Aurora Cannabis Inc. led gains among Canadian cannabis stocks on Wednesday after an industry executive was named president of the Cannabis Council of Canada trade group.

Source link

Group

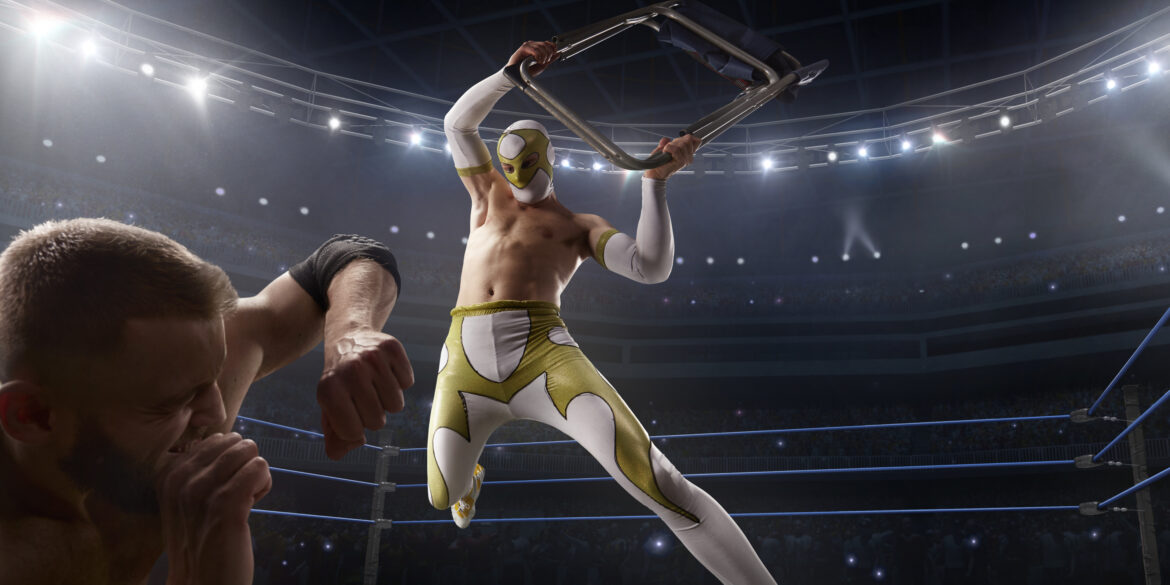

Shares of TKO Group Holdings (TKO 7.84%) jumped 7.5% on Wednesday after the parent company of Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE) reached a settlement for two outstanding class action lawsuits against the company.

A small price to pay for TKO Group

In a Securities and Exchange Commission (SEC) filing this afternoon, TKO Group says it reached an agreement to settle all claims related to two class action lawsuits in exchange for $335 million in tax-deductible periodic payments over a predetermined (but still undisclosed) period of time.

Over 1,200 fighters were represented by the lawsuits, which were brought by two former fighters alleging that UFC used a monopoly over the mixed martial arts (MMA) market to suppress fighters’ wages. If the $335 million payment seems steep, know it could have been worse; the two suits were initially seeking total damages ranging from $894 million to $1.6 billion.

What’s next for TKO Group investors?

The agreement isn’t a done deal yet; TKO Group still needs to submit a long-form agreement for the court’s approval.

But in a tweet following the news, the Mixed Martial Arts Fighters Association also said it was “pleased with the settlement and will disclose more” through additional court filings in the next 45 to 60 days.

In the end, while TKO Group would have likely preferred to win the cases outright, this settlement effectively removes the threat of an even larger court judgment hanging over the company. With shares down around 20% over the past year, it’s no surprise to see the stock rebounding in response today.

$200B Financial Group Cetera Approves 4 Spot Bitcoin ETFs on Its Platform

Cetera Financial Group, a platform with $475 billion in assets under administration and $190 billion in assets under management, has approved four U.S. spot bitcoin exchange-traded funds (ETFs) for use in brokerage accounts on its platform. “We are prudently embracing bitcoin ETFs and we prioritized developing this important guidance to help our financial professionals implement […]

Cetera Financial Group, a platform with $475 billion in assets under administration and $190 billion in assets under management, has approved four U.S. spot bitcoin exchange-traded funds (ETFs) for use in brokerage accounts on its platform. “We are prudently embracing bitcoin ETFs and we prioritized developing this important guidance to help our financial professionals implement […]

Source link

Email Shows Digital Currency Group and Gemini Explored Merger Before Genesis Bankruptcy

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

Source link

Group 1 Automotive cutting 10% of U.K. jobs on losses in its used-car sales

Group 1 Automotive Inc. said Wednesday it will reduce its U.K. workforce by 10% or roughly 358 people as the latest company to cut jobs to reduce costs in the face of an uncertain economy.

Group 1 also warned it expects losses on used-vehicle wholesale sales in the U.K. to continue into the current quarter, which ended March 31.

The Houston-based auto dealership and collision-repair company also fell short of analyst estimates for fourth-quarter profit as costs rose, but it posted a slight beat on revenue.

Group 1’s stock

GPI,

rose 2% to $282.29 on Tuesday. It was not trading in the premarket on Wednesday. The stock has fallen by 7.4% so far in 2024, compared to a 3.3% rise by the S&P 500

SPX.

While Group 1’s U.S. operations have executed well in an “evolving” market, its U.K. unit experienced challenges with used vehicles, said Chief Executive Daryl Kenningham.

Group 1 said it recognizes that “we have some work ahead of us to bring our costs back in-line with recent trends.”

Based on 3,487 U.K. jobs disclosed in its annual report, Group 1

GPI,

will reduce its head count by about 348 people out of a total companywide head count of 15,491 employees. Out of that total, the auto dealer and collision repair specialist employs 12,004 workers in the U.S.

A company spokesperson did not immediately reply to a query on an exact head-count-reduction figure.

The company’s fourth-quarter profit fell by 30.3% to $106.2 million, or $7.87 a share, from $152.4 million, or $10.76 a share, in the year-ago quarter.

Adjusted earnings in the latest quarter were $9.50 a share, below the FactSet consensus estimate of $10.44 a share.

Revenue rose 10% to $4.48 billion, ahead of the analyst estimate of $4.41 a share.

While new-vehicle units rose by 14.8%, margins fell due to higher selling, general and administrative expenses (SG&A).

SG&A as a percentage of gross profit increased 7.5% in the U.K., driven by higher expenses and lower margins on both used and new cars, the company said.

“Our U.K. operations began a rebalancing of our used vehicle inventory in response to market changes, which generated losses on used vehicle wholesale sales in the current quarter, which are expected to continue into the quarterly period ended March 31,” the company said.

WWE founder Vince McMahon resigns from TKO Group after being accused of sexual assault and trafficking in new lawsuit

Vince McMahon attends a press conference to announce that WWE Wrestlemania 29 will be held at MetLife Stadium in 2013 at MetLife Stadium on February 16, 2012 in East Rutherford, New Jersey.

Michael N. Todaro | Getty Images

Vince McMahon, executive chairman of the board of TKO Group Holdings and founder of wrestling giant WWE, has resigned his positions at both companies, according to a WWE memo obtained by CNBC and confirmed by the company.

“Vince McMahon has tendered his resignation from his positions as TKO Executive Chairman and on the TKO Board of Directors. He will no longer have a role with TKO Group Holdings or WWE,” said Nick Khan, president of the WWE.

The announcement came in the wake of allegations made public Thursday, of sexual assault and sex trafficking, against McMahon.

McMahon has denied the allegations. But he said in a statement late Friday that, “out of respect for the WWE Universe, the extraordinary TKO business and its board members and shareholders, partners and constituents, and all of the employees and Superstars who helped make WWE into the global leader it is today, I have decided to resign from my executive chairmanship and the TKO board of directors, effective immediately.”

The latest allegations against McMahon were in a lawsuit filed by Janel Grant — who alleges McMahon directed her to have sex with a WWE “superstar” and other men. Grant’s suit seeks to void a nondisclosure agreement Grant said she reached with McMahon in early 2022.

Grant’s suit in U.S. District Court in Connecticut says the billionaire McMahon agreed to pay her $3 million as part of that deal, but ended up only paying her $1 million in exchange for her silence about his conduct.

In addition to McMahon, 78, the complaint names as defendants WWE and John Laurinaitis, the company’s former head of talent relations and general manager.

The complaint comes six months after federal law enforcement agents executed a search warrant on McMahon and served him with a grand jury subpoena as part of an investigation into McMahon’s payment of millions of dollars to multiple women, among them Grant, after allegations of sexual misconduct.

McMahon, who resigned from WWE leadership posts in mid-2022 amid an internal company investigation, only to return as its leader in early 2023, last March paid WWE $17.4 million to cover costs of a probe of those payouts by a law firm retained by the company.

BEIJNG, CHINA – NOVEMBER 13: Illuminated skyscrapers stand at the central business district at sunset on November 13, 2023 in Beijing, China. (Photo by Gao Zehong/VCG via Getty Images)

Vcg | Visual China Group | Getty Images

The chief executive of the Institute of International Finance warned Tuesday that policymakers need to swiftly address record levels of global debt, describing the brewing crisis as a “huge fiscal problem.”

IIF CEO Tim Adams sounded the alarm on rising levels of debt while speaking to CNBC’s Silvia Amaro at the World Economic Forum in Davos, Switzerland.

His comments come at a time when the issue has largely been overshadowed at the WEF’s annual meeting, which runs through to Friday, with the rise of artificial intelligence and conflicts in the Middle East and Ukraine high on the forum’s agenda.

“We have a debt problem globally. We have the highest levels of debt in a nonwar period in modern history and it’s at the corporate, household, sovereign, sub-sovereign [levels],” Adams said.

“We have a huge fiscal problem everywhere, including the U.S. We’re running [a] deficit at 7% of GDP. We need sobriety and we need to focus on how we are going to get our fiscal house in order,” he added.

The global banking industry’s premier trade group said late last year that worldwide debt climbed to a record of $307.4 trillion in the third quarter of 2023, with a substantial increase in both high-income countries and emerging markets.

The IIF said it expected global debt to reach $310 trillion by the end of 2023, warning that elections in more than 50 countries and regions this year could usher in a shift toward populism that brings with it still-higher debt levels.

“I worry about geopolitics every day,” Adams said. “I think this will be a challenging year.”

Asked whether high levels of global public debt mattered at a time when major central banks are poised to cut interest rates, Adams replied: “It matters because of demographics. We have aging populations in so many parts of the world, from China to across Europe to the U.S. and Japan.”

“We need to build that capacity and deal with that huge debt overhang going forward. And this is in peacetime, so the question is how to do we do this quickly and in an intelligent fashion. But we all need to focus on the fiscal imbalances.”

SANA’A, YEMEN – DECEMBER 03: Members of the Houthi-run Military Special Forces guard during a funeral procession of Houthi fighters at Al-Sha’ab Mosque on December 03, 2023 in Sana’a, Yemen. (Photo by Mohammed Hamoud/Getty Images)

Mohammed Hamoud | Getty Images News | Getty Images

U.S. and U.K. forces have carried out airstrikes against Houthi rebel targets in Yemen in response to repeated attacks by the Iranian-backed group on ships in the Red Sea.

The U.S. Air Force on Thursday launched strikes on over 60 targets at 16 Houthi militant locations, including missile launch sites, production facilities and radar systems, according to the U.S. Central Command.

It said more than 100 precision-guided munitions were used in the strikes, which reportedly killed at least five people and wounded six.

“U.S. military forces — together with the United Kingdom and with support from Australia, Bahrain, Canada, and the Netherlands — successfully conducted strikes against a number of targets in Yemen used by Houthi rebels to endanger freedom of navigation in one of the world’s most vital waterways,” President Joe Biden said.

The strikes come after the Houthis defied a warning to stop targeting international maritime vessels in the Red Sea, which has wreaked havoc on global trade.

Who are the Houthis of Yemen?

The Houthis, officially known as Ansar Allah or “Supporters of God,” are a militia group named after their founder, Hussein Badr Eddin al-Houthi.

Formed in the early 1990s, the Houthi movement seeks to promote the rights of the Zaydi branch of Shiite Islam and rose to prominence as Arab Spring protests swept the region in 2011.

Three years later, the Houthis took over Yemen’s capital of Sanaa and seized control over much of the north of the country. It prompted a broader conflict with Saudi Arabia, Iran’s regional foe, which has since culminated in a situation in Yemen that the U.N. has described as “the largest humanitarian crisis in the world.”

SANA’A, YEMEN – DECEMBER 02: Yemenis recently militarily trained by the Houthi movement holding up their guns and Palestinian flag chant slogans during an armed popular parade held in Al-Sabeen Square to get ready to go and fight Israel in the Gaza Strip, on December 02, 2023 in Sana’a, Yemen. Thousands of Yemenis recently recruited by the Houthi military forces participated in an armed popular parade held to express readiness for heading to the Gaza Strip and fighting with Palestinians against Israel in response to Israel’s war resumption in Gaza. (Photo by Mohammed Hamoud/Getty Images)

Mohammed Hamoud | Getty Images News | Getty Images

Human Rights Watch says the Houthis have carried out “widespread violations of international humanitarian law and civilian harm” since taking over Yemen’s capital in 2014.

“The Houthis still have not taken responsibility for the civilian harm that they have caused to those living in Yemen,” Michael Page, Middle East and North Africa deputy director at Human Rights Watch, said in a statement on Dec. 13.

“Rather than carrying out new war crimes, they should focus on achieving a durable peace in their country,” he added.

The Houthis, which oppose the U.S. and Israeli influence in the Middle East, is not internationally recognized as the government of Yemen but it does control large parts of the country. This includes the Bab el-Mandeb Strait, a crucial maritime chokepoint that connects the Red Sea with the Gulf of Aden.

Yemeni officials have repeatedly said that Iran and the militant group Hezbollah have provided military and financial support to the Houthis, a charge that Iranian and Hezbollah officials have denied.

What next for the Red Sea crisis?

The Houthis have vowed to continue its attacks in the Red Sea following U.S. and U.K. strikes against Yemen, claiming that the U.S. and U.K. will pay a “heavy price.”

“We affirm that there is absolutely no justification for this aggression against Yemen, as there was no threat to international navigation in the Red and Arabian Seas, and the targeting was and will continue to affect Israeli ships or those heading to the ports of occupied Palestine,” Mohammed Abdulsalam, Houthi negotiator and spokesperson, said via Telegram, according to a Google translation.

Houthi attacks on ships traversing in the Red Sea began late last year, drawing international condemnation. The militants claim their attacks in the Red Sea are in response to the ongoing war in the Gaza Strip.

Global markets have been spooked by the escalating tensions that threaten to spread into the broader Middle East region.

A ship transits the Suez Canal towards the Red Sea on January 10, 2024 in Ismailia, Egypt.

Sayed Hassan | Getty Images

The U.S. says nearly 15% of global seaborne trade passes through the Red Sea, including 12% of seaborne-traded oil and 8% of the world’s liquified natural gas trade.

“Everything and nothing has changed overnight with the retaliation from U.S. and allied forces in response to the aggression that we have seen over the past two months now,” Peter Sands, chief analyst at air and ocean freight rate benchmarking platform Xeneta, told CNBC’s “Street Signs Europe” on Friday.

“The tension is still massive in the region. Uncertainty is a huge part of the planning for global supply chains right now,” Sands said.

“I think every shipper should expect still extended transit times [and] much higher freight rates,” he added.

— CNBC’s Joanna Tan & Ruxandra Iordache contributed to this report.

EOS Network Ventures Awards NoahArk Tech Group $2.4M to Advance DeFi on EOS

With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

EOS Network Ventures (ENV), the primary steward of the EOS network, has announced a major grant to accelerate DeFi adoption. $2.4 million has been invested by ENV into NoahArk Tech Group to allow decentralized applications on EOS to flourish.

The product of a joint enterprise between Defibox Technology and Hong Kong Noah Technology, NoahArk Tech Group is intent on growing the EOS ecosystem with a particular focus on DeFi. Decentralized finance has been slow to take off on EOS compared to other chains, but over the last 12 months, EOS Network Ventures has been making up for lost time.

More DEX, More DeFi

A good decentralized exchange is the foundation of all DeFi activity. Build it and everything else – lending platforms, liquid staking, perps, prediction markets – will follow. Ethereum has Uniswap. Avalanche has TraderJoe. Now EOS is determined to create some major DeFi protocols of its own which is why ENV has made such a considerable investment in NoahArk.

Funds will be directed at Defibox.io and Noahark.io, two of the leading DeFi platforms on EOS EVM. The EOS EVM, which runs in tandem with the main EOS chain, is ideally suited to decentralized finance thanks to its Ethereum compatibility. This makes it easier for users to bridge ERC20 tokens from other EVM chains. It also makes it easier for Solidity devs to create applications on EOS EVM or to port existing ones.

Bringing Deep Liquidity to EOS

For DeFi to be widely utilized on any network, several properties are desirable. Firstly, liquidity needs to be deep enough for users to trade with size. DEXes that can absorb large market orders without buckling will ensure that prices don’t get significantly out of sync with the rest of the market any time a whale enters the game.

The second property required for DeFi to flourish is good tooling and protocols that allow crypto assets to be used to full effect. Defibox and Noahark have already provided a foundation for economic activity to take place on the EOS EVM. Both platforms support swaps, lending, and flexible EOS staking. With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

As NoahArk Tech Group CEO Eason explains:

“This investment from EOS Network Ventures, coupled with the reorganization of Defibox.io and Noahark.io, marks a transformative phase for the EOS DeFi ecosystem. In this new phase, the EOS EVM will significantly enhance our operational capabilities, making it easier for established products and developers to participate and enabling the fluid movement of various assets through cross-chain bridges.”

This calls for a combination of the right tech and the right talk. In other words, messaging needs to accompany the infrastructure improvements, so that users are aware of what they can do on EOS EVM and how this compares to other EVM chains.

Or as ENV’s Yves La Rose puts it:

“This move is more than just financial support; it’s a commitment to driving growth and new developments in DeFi. We see NoahArk Tech Group as a key player in enhancing decentralized exchanges and our strategic vision is to support the creation of more interconnected and user-friendly DeFi services, benefiting the entire sector.”

What’s good for NoahArk Tech Group should prove good for EOS users in 2024.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.