These 7 steps can give Boeing a path to recovery.

Source link

hard

Zano Blockchain’s Hard Fork Facilitates Privacy Coin Creation, Introduces Confidential Assets

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

Source link

Thianchai Sitthikongsak | Moment | Getty Images

Higher mortgage rates continue to hit demand from both current homeowners and potential homebuyers.

Total mortgage application volume dropped 5.6% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. An additional adjustment was made to account for the Presidents Day holiday.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.04% from 7.06%, with points increasing to 0.67 from 0.66 (including the origination fee) for loans with a 20% down payment. The rate was about a quarter percentage point higher than it was one year ago.

As a result, applications to refinance a home loan were 7% lower than the previous week and were 1% lower than the same week one year ago.

“Higher rates in recent weeks have stalled activity, and last week it dropped more for those seeking FHA and VA refinances,” said Mike Fratantoni, MBA’s chief economist, in a release.

FHA and VA loans are generally used by lower-income borrowers because they have lower down payment requirements.

Applications for a mortgage to purchase a home dropped 5% for the week and were 12% lower than the same week one year ago.

Fratantoni noted, however, that mortgage demand from buyers looking at newly built homes jumped 19% year over year in January.

“This disparity continues to highlight how the lack of existing inventory is the primary constraint to increases in purchase volume. However, mortgage rates above 7% sure don’t help,” he added. Rates were in the 6% range for all of January.

Mortgage rates moved higher again to start this week, according to a separate survey from Mortgage News Daily. The 30-year fixed is now matching the highest level since early December 2023.

“There were no interesting or obvious catalysts for the move, nor would we expect there to be when it comes to the level of volatility seen on almost any day of the past 2 weeks,” wrote Matthew Graham, chief operating officer at Mortgage News Daily.

Don’t miss these stories from CNBC PRO:

Meme coin PEPE navigated a turbulent week, experiencing a 14% price drop but finding solace in rising bullish sentiment and technical indicators pointing towards a potential rebound.

Investor Woes, But Whale Appetite Grows

NewsBTC’s analysis, using data from IntoTheBlock, revealed over 70% of Pepe investors currently sitting on losses, suggesting a challenging week. However, whales saw opportunity in the dip, with Santiment data showing a sharp increase in Pepe holdings by top addresses.

Source: IntoTheBlock

Bullish Buzz Despite Price Slump

Sentiment around Pepe took an interesting turn, defying the price decline. The meme coin’s Weighted Sentiment, tracked since February 1st, witnessed a rise, indicating growing optimism within the community. This positive buzz was further fueled by consistent social media engagement, reflected in high Pepe Volume throughout the week.

PEPEUSD currently trading at $0.00000089589 on the daily chart: TradingView.com

Exchange Activity Signals Caution

While whales accumulated, broader market selling sentiment weighed on Pepe. NewsBTC observed a drop in Exchange Outflow, suggesting investors moving their holdings off exchanges for potential selling. Additionally, a drastic increase in Supply on Exchanges coupled with a decrease in Supply outside of Exchanges painted a picture of potential selling pressure in the near future.

Source: Santiment

Technicals Hint At Reversal

Despite the recent price struggles, Pepe’s daily chart offered some positive signals. The MACD indicator hinted at a potential bullish crossover, suggesting a shift in momentum. The Relative Strength Index (RSI) neared the oversold zone, potentially triggering buying pressure if it enters that territory. The Chaikin Money Flow (CMF) also displayed an uptick, further reinforcing the possibility of a price increase.

Bears are currently attempting to push the price below a crucial support level of $0.0000009. If this level breaks, significant losses could occur, potentially dragging the price down to lows of $0.0000006 seen in September/October 2023, representing a decline of over 30% from current levels.

Source: DEXTools

Community Strength Endures

Despite the market fluctuations, Pepe boasts a strong community presence, with over 154,000 individual holders and active communities on platforms like X (formerly Twitter) and Telegram, exceeding 500,000 followers and 60,000 members respectively.

The outlook for Pepe remains cautiously optimistic. While recent price drops and selling pressure raise concerns, bullish sentiment, technical indicators, and a strong community suggest potential for a reversal.

However, investors should carefully consider both positive and negative factors before making any investment decisions, acknowledging the inherent volatility associated with meme coins.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

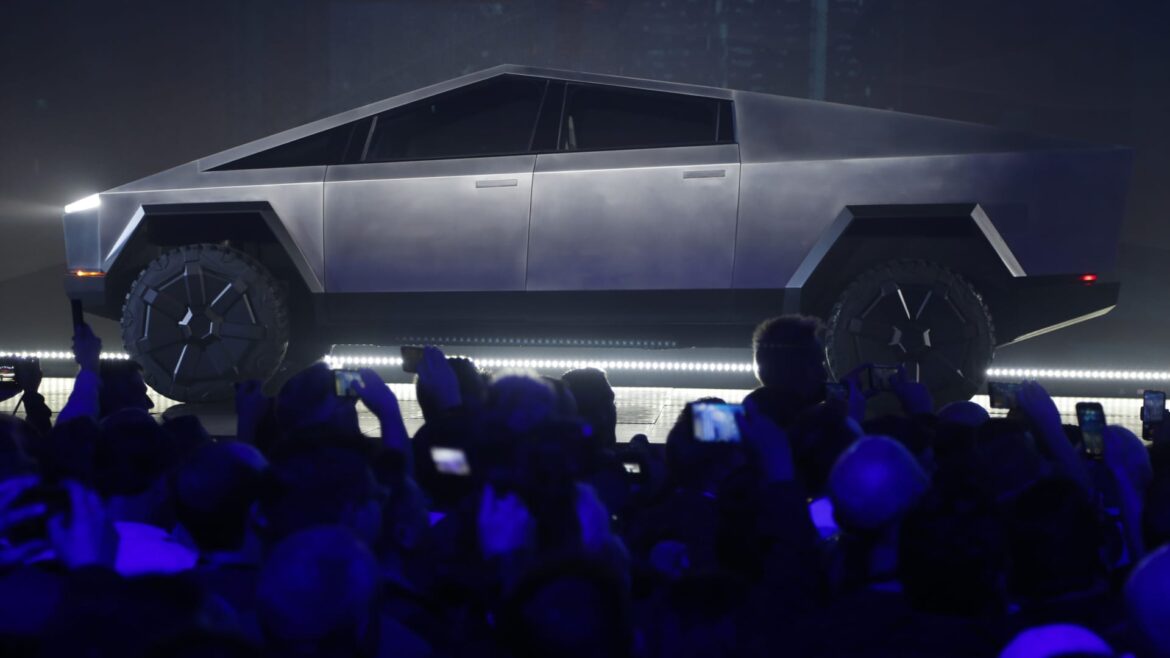

When Tesla unveiled its vision for an electric truck in November 2019, it shocked the world. The Cybertruck, featuring an unconventional design and clad in a custom stainless steel alloy, was equally captivating and divisive. Originally slated for a 2021 release, the company has struggled to get the truck to market, with Musk repeatedly emphasizing how difficult building it has been. Nearly four years later, it’s finally here, with the first deliveries taking place at the end of November.

Now Tesla must contend with scaling production, something that has historically proven difficult for the electric carmaker. And the Cybertruck’s unique design introduces a plethora of new challenges. Chief among them is its use of stainless steel.

“Stainless steel is tough to tool for. It’s tough to work with. And this is in some ways a really giant experiment” says John Voelcker, Contributing Editor for Car and Driver Magazine.

Tesla’s VP of Vehicle Engineering, Lars Moravy, revealed in an interview with Top Gear that Telsa had to invent a manufacturing process called “air bending” which shapes the steel with high air pressure without actually touching the surface. The thickness of the steel and the flat, angular design also contribute to the challenges, especially with regard to mass production.

“Stainless steel…when you cut it, all the mistakes basically show up, when you have a flat plane like that, it’s really hard to hide mistakes,” says Mike Ramsey, VP Team Manager for Automotive and Transportation at Gartner.

In late August, Elon Musk sent an email to Tesla employees stating, “due to the nature of Cybertruck, which is made of bright metal with mostly straight edges, any dimensional variation shows up like a sore thumb” and emphasized that all parts of for the vehicle “need to be designed and built to sub 10 micron accuracy.”

During the company’s third quarter earnings call, Musk tempered expectations for the new vehicle. “I do want to emphasize there will be enormous challenges in reaching volume with the Cybertruck,” and said it will take a year or longer before it is a “significant positive cash flow contributor.”

Watch the video to learn why the Cybertruck is so hard to manufacture and what Tesla is up against as it works to scale production.

This is part one of a three-part series on organized retail crime. The stories will examine the claims retailers make about how theft is affecting their business and the actions companies and policymakers are taking in response to the issue. Be sure to check out parts two and three later this week.

Anti-theft locked merchandise on shelves with customer service button at CVS pharmacy, Queens, New York.

Lindsey Nicholson | Universal Images Group | Getty Images

Retailers have zeroed in on organized retail theft as a top priority, as more and more companies blame crime for lower profits.

But it is difficult for companies to tally just how much stolen goods affect their bottom lines — and even tougher to confirm their claims.

More than a dozen retailers, including Target, Dollar General, Foot Locker and Ulta, called out shrink, or more specifically retail theft, as a reason they cut their profit outlook or reported lower margins when they released earnings in May and June. Those mentions could flare up again as a flurry of retail companies will report financial results starting next week.

Many of them described organized theft as an industrywide problem that’s largely out of their control. Some retailers lumped it in with heavy discounting, soft sales and macroeconomic conditions as other factors that cut into their margins.

While organized theft is a real concern, it is nearly impossible to verify the claims retailers make about it. Companies are not required to disclose their losses from stolen goods, and it’s a difficult metric to accurately count, leaving the industry, investors and policymakers few choices but to rely on their word.

The surge in references to organized retail crime, and the dearth of transparency surrounding the issue, come as the companies’ claims take on a new weight. Retailers and trade associations are increasingly using their positions to influence lawmakers to pass new legislation that benefits them, hurts competitors and could disproportionally affect marginalized people, according to policy experts.

What is shrink, and how do retailers tally it?

Shrink is a retail industry term that refers to lost inventory. It can come from a variety of factors, including shoplifting and vendor fraud, which can be difficult to control. Shrink can also be caused by employee theft, administrative error and inventory damage, which retailers have more power to curb.

Retailers have repeatedly said organized theft drove shrink in recent quarters. But they rarely, if ever, break down how much of the inventory loss is due to crime and how much of a role other causes played.

They also don’t disclose their total losses from shrink and how they have changed over time. That makes it impossible to verify whether the issue has gotten worse and just how much of a bite it has taken from their bottom lines.

Multibillion-dollar companies commonly withhold information that can appear unflattering on earnings calls and press releases. That information can often be found in documents submitted to the U.S. Securities and Exchange Commission, such as quarterly 10-Q reports or annual 10-K filings.

However, companies are not required to disclose losses from shrink unless they’re “exceptionally large” and could be considered material to investors, according to Raphael Duguay, an assistant professor of accounting at Yale University School of Management.

Alongside discounts, promotions and returns, losses from shrink are buried into the “cost of goods sold” and only show up in a retailer’s gross margin, said Duguay.

Retailers are loath to reveal their shrink numbers because they’re often based on estimates and they would have to be “presumptive in their presentation of the numbers,” said Mark Cohen, a professor and director of retail studies at Columbia Business School.

“And they never will be [disclosed] if retailers have their way because they don’t want to have to report that,” said Cohen, who previously served as the CEO of Sears Canada, Bradlees and Lazarus Department Stores. “Retailers will never want to record it unless they were absolutely forced to because it’s a black mark … It makes them look stupid.”

Is retail theft really on the rise? It’s hard to say

When industry executives say that organized theft is rising, many are relying on a study released by the National Retail Federation in September. It found losses from shrink increased to $94.5 billion in 2021 from $90.8 billion in 2020.

In 2021, the largest chunk of losses – 37% – came from external theft, according to the survey.

There is no conclusive data about inventory losses in recent years, including from the first half of this year when multiple companies named it as a growing problem.

The NRF’s study is the best guess the industry can make about how shrink affects companies. But the data, which is anonymized, gathered on the honor system and largely based on estimates, isn’t as clear cut as it appears

Survey respondents were asked to disclose their inventory shrink as a percentage of sales. On average, that number stood at 1.4% in 2021, which is lower than the five-year average of 1.5%, the study says.

Anti-theft locked beauty products with customer service button at Walgreens pharmacy, Queens, New York.

Ucg | Universal Images Group | Getty Images

The NRF arrived at the $94.5 billion in losses by applying that 1.4% average shrink to the total retail sales reported to the U.S. Census Bureau in 2021, according to the study.

However, as retail sales jumped 17.1% from 2020 to 2021, the total hit companies took from shrink would naturally increase as well. Further, the census data used for the study were preliminary at the time it was released. The final retail sales figure was lower, making estimated shrink losses about $600 million less than what the NRF originally reported.

The actual amount that American retailers lost to shrink in 2021 – and how that number has changed over time – isn’t known.

National crime data from the FBI shows the rate of larceny offenses steadily declined between 1985 and 2020, and such crimes overwhelmingly occur in homes rather than stores. However, the FBI’s statistics don’t include data from all law enforcement agencies, and many theft incidents, especially those that happen at retail locations, go unreported.

The tricky business of counting theft

Retailers have always had to contend with shrink, but they have long relied on estimates and educated guesses to determine how an item was lost.

Retailers use sales patterns, inventory trends, historical data and, when available, evidence such as surveillance footage to estimate how merchandise is lost.

“We know what we’ve run up at the register, we know what we put on the shelf. When the anomaly occurs, we can estimate or infer that it represents theft,” Cohen, the Columbia Business School professor, told CNBC.

Target, one of the few retailers to say how much its lost from unaccounted inventory, made headlines in May when it said it was on track to lose more than $1 billion from shrink this year, up from $763 million the previous fiscal year. Target has repeatedly said organized retail theft is fueling its inventory losses. But at the same time, the retailer acknowledged it’s difficult to calculate theft and shrink overall — which raises questions about how accurately it can estimate the effect stolen goods has on its profits.

Locked up merchandise, to prevent theft in Target store, Queens, New York.

Lindsey Nicholson | Universal Images Group | Getty Images

Between 2019 and 2022, the total retail value of the merchandise Target lost to shrink increased by “nearly 100 percent,” the company told CNBC.

“This correlates with a dramatic increase in organized retail crime in our stores and online over that same time period,” Target said.

The trend has worsened so far this year, the company said. It declined to break down all the sources of its shrink, but acknowledged other factors, such as damage and administrative error, have contributed.

To explain how it decided organized retail crime in its stores has worsened, Target pointed to vague trends and data points that don’t conclusively prove the acts are fueling its losses.

The company said it determined retail theft is driving shrink through a number of “signals,” including recent criminal justice reforms, news reports about crime increasing, commentary from other retailers who said they were seeing higher rates of theft and documented upticks in violence and fraud.

For example, acts that Target associates with organized retail crime rings — such as gift card and return fraud — increased by about 50% in its stores between 2021 and 2022, the company said.

Target has also clocked a “marked increase” in theft involving violence or threats over the same time period and in 2023, the company said. In the first five months of 2023, stores have seen a nearly 120% increase in those incidents, the company said.

Sonia Lapinsky, a partner and managing director with AlixPartners’ retail practice, said shrink is an “incredibly complex thing to track and measure” because it can come from many sources at all points in the supply chain, from the factory to the store.

“Not that many retailers are sophisticated enough to track it at all the different points,” said Lapinsky.

Those that have the right systems and technology in place have a better grasp on where their shrink is coming from, but overall the industry is “lagging” behind in those investments, she said.

Foxconn failed India chip effort shows how hard it is for new players

This month, Foxconn pulled out of its joint venture with Vedanta. The two sides “mutually agreed to part ways,” Foxconn said in a statement at the time.

Sopa Images | Lightrocket | Getty Images

Foxconn is best known as the main assembler of Apple’s iPhones. But in last couple of years, the Taiwanese firm has made a push into semiconductors, betting that the rise of technologies like artificial intelligence will boost demand for these chips.

But Foxconn’s semiconductor foray has had a tough start, highlighting the difficulty for new players to enter a market dominated by established firms with huge experience and a highly intricate supply chain.

“The industry presents newcomers with high barriers to entry, mainly high levels of capital intensity and access to coveted intellectual property,” Gabriel Perez, ICT analyst at BMI, a unit at Fitch Group, told CNBC via email.

“Established players such as TSMC, Samsung or Micron count with several decades of R&D (research and development), process engineering and trillions of dollars in investment to reach their current capabilities.”

Why is Foxconn getting into semiconductors?

Foxconn, officially known as Hon Hai Technology Group, is a contract electronics manufacturer that assembles consumer products like iPhones. But in the last two years, it has stepped up its presence in semiconductors.

In May 2021, it formed a joint venture with Yageo Corporation, which makes various types of electronic components. That same year, Foxconn bought a chip plant from Taiwanese chipmaker Macronix.

The biggest ramp-up in effort came last year when Foxconn agreed with Indian metals-to-oil conglomerate Vedanta to set up a semiconductor and display production plant in India as part of a $19.5 billion joint venture.

Read more about tech and crypto from CNBC Pro

Neil Shah, vice president of research at Counterpoint Research, said Foxconn’s push into semiconductors is about diversifying its business, and the company’s decision to launch an electric car unit is part of that plan. Its aim is to become a “one stop shop” for electronics and automotive companies, Shah said.

If Foxconn could assemble electronics and manufacture chips, it would be a very unique and competitive business.

Why India?

Foxconn looked to India for its joint venture with Vedanta because the country’s government is looking to boost its domestic semiconductor industry and bring manufacturing on shore.

“Foxconn’s decision to establish a JV in India responds to two key trends – one of them being the market’s growing role as a consumer electronics manufacturing hub, the second one being India’s ambitions – mirroring other major markets such as the US, the EU and Mainland China – to develop its domestic semiconductor industry through public subsidies and regulatory incentives,” BMI’s Perez said.

What went wrong for Foxconn?

This month, Foxconn pulled out of its joint venture with Vedanta. The two sides “mutually agreed to part ways,” Foxconn said in a statement at the time.

“There was recognition from both sides that the project was not moving fast enough, there were challenging gaps we were not able to smoothly overcome, as well as external issues unrelated to the project,” Foxconn said.

Deadlocked talks with European chipmaker STMicroelectronics, which was the technology partner for the project, was one major reason for the venture’s failure, Reuters reported this month.

Foxconn and Vedanta wanted to license the technology from STMicro and India wanted the firm to have a stake in the joint venture, but the European chipmaker did not, Reuters reported.

It’s hard to break into chipmaking

Foxconn’s hurdles point to a broader issue — it’s hard for newcomers to get into semiconductor manufacturing.

The manufacturing of chips is dominated by one player — Taiwan Semiconductor Manufacturing Company, better known as TSMC — which has a 59% market share in the foundry segment, according to Counterpoint Research.

TSMC doesn’t design its own chips. Instead, it makes these components for other companies like Apple. TSMC has had more than two decades of experience and billions of dollars of investment to get to where it is.

TSMC also relies on a complex supply chain of companies that make critical tools to allow it to manufacture the most advanced chips in the world.

Foxconn and Vedanta’s effort appeared to rely heavily on STMicro, but once the European company bailed, the joint venture was without much expertise in semiconductors.

“Both companies … lacked the core competency of manufacturing a chip,” Counterpoint Research’s Shah said, adding that they were dependent on third-party technology and intellectual property.

Foxconn’s attempts to crack the semiconductor space highlight how difficult it is for a new entrant to do so — even for a $47.9 billion giant.

“The semiconductor market is highly concentrated with few players which have taken more than two decades to evolve to this point,” Shah said, adding that there are high barriers to entry, such as large amounts of investment and specialized labor.

“On an average, it takes more than two decades to be at the level of skill and scale to be a successful semiconductor manufacturing (fab) company.”