Surging Treasury yields and rising oil prices are calling the tune across markets right now.

Source link

Heres

Here’s Why Vanguard’s Largest Growth Fund Keeps Outperforming the S&P 500 and the Nasdaq Composite

We’re only one quarter into 2024 and already the Nasdaq Composite and S&P 500 are up over 9% year to date. But Vanguard’s largest growth-focused exchange-traded fund (ETF) is up even more.

Here’s why the Vanguard Growth ETF (VUG -0.24%) continues to outperform the major indexes while achieving diversification, why the ETF could continue to outperform, and whether it is worth buying now.

Image source: Getty Images.

Built to let winners run

The Vanguard Growth ETF targets the largest U.S.-based growth stocks no matter the industry or exchange they trade on. This is a different approach than the S&P 500 — which tracks the 500 largest U.S.-based companies by market cap (although there are a few other qualifications) or the Nasdaq Composite, which covers the largest companies on the Nasdaq Stock Market, but not the New York Stock Exchange.

Although the Nasdaq typically includes younger, more growth-focused companies, the New York Stock Exchange has some high-powered growth stocks that you wouldn’t get if you bought a Nasdaq ETF, like drug maker Eli Lilly. Or Visa and Mastercard, which have consistently outperformed the broader financial sector.

The inherent structure of the Vanguard Growth ETF means that it should outperform the Nasdaq Composite and S&P 500 if large-cap growth is leading the market, which is precisely what has been happening in 2023, 2024, and for most of the last five years.

|

Security |

YTD Total Return |

1-Year Total Return |

3-Year Total Return |

5-Year Total Return |

|---|---|---|---|---|

|

Vanguard Growth ETF |

11.2% |

44.1% |

39.9% |

131.7% |

|

Nasdaq Composite |

9.3% |

39.7% |

39.9% |

123.8% |

|

S&P 500 |

9.8% |

33.5% |

29.3% |

102.8% |

Data source: YCharts. YTD = year to date.

A “Magnificent” concentration

Over 50% of the Vanguard Growth ETF is weighted in the “Magnificent Seven” stocks — a term coined by Bank of America analyst Michael Hartnett to describe seven large, tech-focused companies. The ETF has a far higher concentration in the Magnificent Seven than the SPDR S&P 500 ETF or even the Invesco QQQ, which mirrors the performance of the Nasdaq-100. The Nasdaq-100 covers the 100 largest non-financial companies listed on the exchange.

|

Security |

Microsoft |

Apple |

Nvidia |

Amazon |

Alphabet |

Meta Platforms |

Tesla |

|---|---|---|---|---|---|---|---|

|

Vanguard Growth ETF |

12.8% |

11.2% |

7.8% |

6.9% |

6.3% |

4.5% |

2.3% |

|

Invesco QQQ |

8.8% |

7.4% |

6.6% |

5.2% |

4.9% |

4.9% |

2.3% |

|

SPDR S&P 500 ETF |

7.2% |

5.7% |

5.4% |

3.8% |

3.7% |

2.5% |

1.1% |

Data sources: Vanguard, Invesco, State Street Global Advisers.

The higher weightings in outperforming stocks like Microsoft, Nvidia, and Amazon offset the underperformance of higher-weighed stocks like Apple, Alphabet, and Tesla. As mentioned earlier, the Vanguard Growth ETF has more flexibility regarding what stocks it can include, allowing it to take advantage of growth across different pockets of the market.

You get what you wish for

The biggest drawback of the Vanguard Growth ETF is its valuation. The price-to-earnings (P/E) ratio is a sky-high 41.6 compared to 36.3 for the Invesco QQQ and 26.2 for the SPDR S&P 500 ETF. An expensive valuation is what you get with heavy concentration in premium-priced stocks — like most of the Magnificent Seven. However, P/E based on trailing-12-month earnings only tells part of the story.

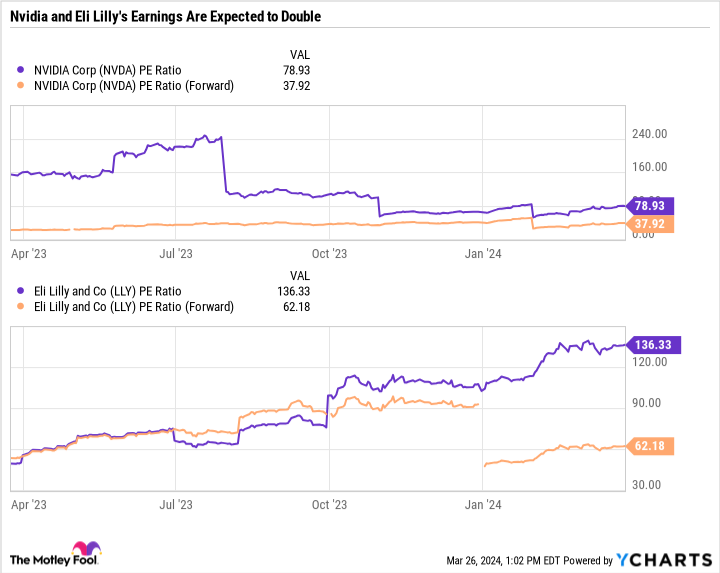

Nvidia and Eli Lilly, which collectively make up a whopping 10.4% of the Vanguard Growth ETF, have very high P/E ratios. But analyst consensus estimates forecast their earnings to more than double over the next 12 months — which is why their forward P/E ratios are less than half current P/E ratios.

NVDA PE Ratio data by YCharts

The valuations of Nvidia and Ely Lilly are a good lesson in why a growth-focused ETF can look so expensive in the short term but is actually more reasonable if earnings deliver. Granted, there’s a lot of uncertainty when it comes to banking on forward earnings. These are just projections, and a lot can go wrong within and outside of a company’s control.

A good option if it fits your investment objectives

The Vanguard Growth ETF gives growth investors the complete package of diversification and high weightings in the market’s top growth stocks. At a mere 0.04% expense ratio, a $1,000 investment in the fund would incur just $0.40 in annual fees.

The ETF just made a new all-time high and is more expensive than it used to be. But investors shouldn’t be approaching growth ETFs or growth stocks in general based on their past earnings, but on what the investment could deliver in the future.

The ETF will probably continue to be more volatile than the S&P 500. But it’s worth considering if you want to invest in growth but don’t know where to start or are just looking for a simple way to add to your growth holdings without incurring high fees from more expensive financial products.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Bank of America, Mastercard, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard, long January 2026 $395 calls on Microsoft, short January 2025 $380 calls on Mastercard, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Crypto Analyst Predicts 600%-1000% Return For XRP, Here’s The Target

A cryptocurrency analyst has predicted a massive price surge for XRP, anticipating the cryptocurrency to witness a more than 600% increase. Despite its historically sluggish growth, XRP has begun to gather momentum, showing potential to experience major price growth during the 2024 bull run.

Price Projected To Soar Above $5

A crypto analyst identified as Egrag Crypto has taken to X (formerly Twitter) to predict an exponential price surge for XRP. According to Egrag Crypto XRP is “guaranteed” to experience a 600% to 1000% increase to new all-time highs around $5.5.

Basing his predictions on XRP’s historical data from 2017, the analyst shared a chart illustrating XRP’s price movements over the years. He delved into the cryptocurrency’s minimum and shortest price pumps observed when the 21 Exponential Moving Average (EMA) crosses the 55 Moving Average (MA).

The crypto expert disclosed that in 2017, the altcoin witnessed a significant price surge of approximately 902.85%, driving its price to $0.0646 at the time. Around 2021, the cryptocurrency recorded another pump, surging by about 585.29% to trade above the $1 price mark.

Following historical trends, XRP is anticipated to undergo a substantial surge of 585.20%, reaching a price level of about $3.26 in 2024. The analyst has revealed that if XRP manages to achieve a 900% or 585% price pump, it could potentially rise even further to $5.5 or $4, respectively.

On the flip side, Egrag Crypto has disclosed that if XRP fails to achieve an all-time high of $5 to $10 during the 2024 bull cycle, the cryptocurrency may not experience a bullish surge until the next bull run. Despite this, the analyst has remained confident in XRP’s potential to attain triple-digit gains and reach new all-time highs soon.

When Will XRP Witness A $5.5 Price Surge?

When asked by a crypto community member about the timeline for the price of XRP to potentially rise to $5.5, Egrag Crypto boldly affirmed that the window of uptick lies between April and July 2024. He urged the XRP army to brace themselves for this potentially bullish period, emphasizing a strong belief for XRP to surge to unprecedented heights.

Despite its recent price drops, the sentiment surrounding XRP has remained positive, with many crypto analysts predicting bullish price movements for the cryptocurrency. At the time of writing, XRP is trading around $0.61, reflecting a decline of 1.77% over the last 24 hours and 3.93% over the past week, according to CoinMarketCap.

While the cryptocurrency has successfully crossed resistance levels above $0.5, it is still a long way from surpassing its all-time high of $3.84 recorded in 2018.

Token price trending at $0.62 | Source: XRPUSDT on Tradingview.com

Featured image from Bitcoin News, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Super Micro Computer Stock Is Down 19% From 52-Week Highs: Here’s Why That’s Great News for Investors

Super Micro Computer (SMCI -1.30%) stock has been pulling back in recent sessions after the company revealed the pricing of its common stock offering, which would dilute existing shareholders. As it turns out, shares of the high-flying server manufacturer are down 19% from their 52-week high, which it hit on March 8.

Savvy investors looking to invest in a top artificial intelligence (AI) stock right now should consider capitalizing on Supermicro’s drop by buying it hand over fist. Here’s why.

Supermicro investors should focus on the bigger picture

Super Micro Computer is offering 2 million shares of its common stock for $875 per share. Moreover, underwriter Goldman Sachs has a 30-day option to purchase an additional 300,000 shares as a part of this offering.

The fact that this announcement came at a time when each Supermicro share was trading at just over $1,000 seems to have dented investor confidence. The company priced the sale at a discount, and the market was quick to press the panic button.

However, a look at the bigger picture will tell us that this is a smart move by Super Micro Computer management because the company aims to raise $1.75 billion in gross proceeds through this exercise. Management adds that the proceeds will be deployed for supporting “its operations, including for purchase of inventory and other working capital needs, manufacturing capacity expansion and increased R&D [research and development] investments.”

The company’s focus on expanding its manufacturing capacity is the right thing to do considering the booming demand for its server solutions that are used for deploying AI chips. On its fiscal 2024 second-quarter earnings conference call, Supermicro pointed out that the utilization rate of its production facilities in the U.S., Taiwan, and the Netherlands was 65%. Management also added that its remaining production capacity was quickly filling up.

Supermicro, therefore, needed to bring new production facilities online to cater to the fast-growing AI server market. Not surprisingly, CEO Charles Liang pointed out on the call:

To address this immediate capacity challenge, we are adding two new production facilities and warehouses near our Silicon Valley HQ, which will be operating in a few months. The new Malaysia facility will focus on expanding our building blocks with lower costs and increased volume, while other new sites will support our annual revenue capacity above $25 billion.

Supermicro is on track to generate $14.5 billion in revenue this fiscal year at the midpoint of its guidance range. That would be more than double the $7.1 billion in revenue it generated in fiscal 2023. Now that the company has already built up a revenue capacity of $25 billion, it would need to bring more capacity online, given how fast the market for AI servers has been growing.

According to Global Market Insights, the AI server market was worth an estimated $38 billion in 2023. By 2032, this market is expected to generate a whopping $177 billion in revenue, for a compound annual growth rate of 18% during the forecast period. Supermicro’s share of AI servers has been improving since it has been growing at a much faster pace than this market.

Considering the lucrative end-market opportunity on offer in the long run, it would make sense for the company to grab a bigger share of this space. This probably explains why management has decided to capitalize on the stock’s terrific surge this year and go for a stock offering to raise more capital. Additionally, Supermicro’s pullback means investors can now buy it at a relatively cheaper valuation.

Another reason to buy the stock following the pullback

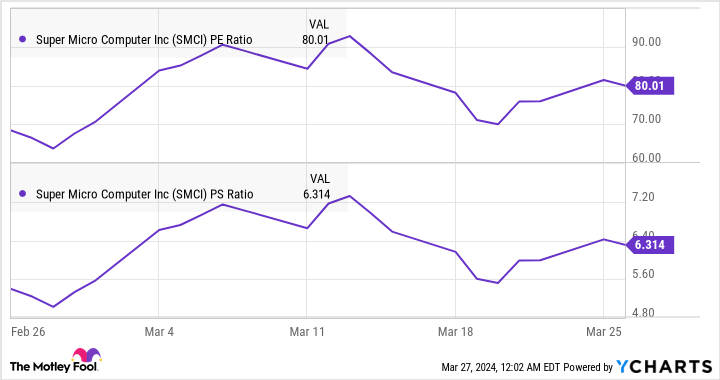

Supermicro’s earnings and sales multiples have retreated of late.

SMCI PE Ratio data by YCharts.

The stock was trading at more than 90 times earnings at one point this month, while its sales multiple stood at almost 7.5. Some might argue that Supermicro is still expensive as far as its earnings multiple is concerned. However, buying the stock right now is a no-brainer.

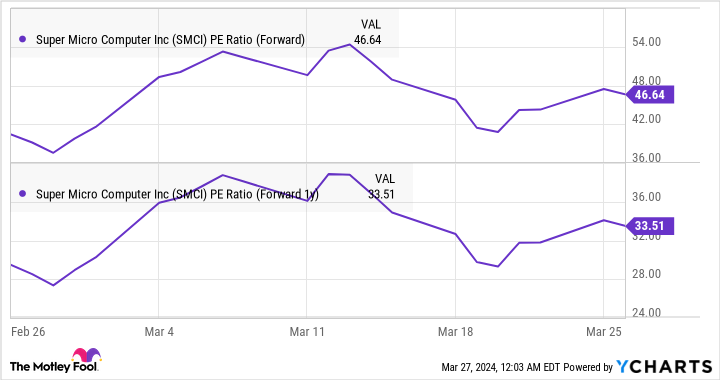

SMCI PE Ratio (Forward) data by YCharts.

Supermicro’s forward earnings multiples are significantly lower than the trailing price-to-earnings ratio because of the massive bottom-line growth that the company is predicted to deliver. Analysts expect Supermicro’s earnings to increase a solid 86% in fiscal 2024, followed by a 40% jump in fiscal 2025 to $30.83 per share.

Now that Supermicro is looking to boost capacity through its common stock offering, there’s a good chance it will be able to boost its manufacturing levels and deliver stronger growth, considering the market in which it operates. That’s why savvy investors should consider buying this tech stock as it could regain momentum quickly.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Leading the downturn today, Fantom (FTM) contributes to the 2% drop in the crypto market after weeks of growth.

Fantom is one of those altcoins that followed the broader momentum of the market. The latest market data shows that the token is down 10% in the past 24 hours, but is still on the green in the bi-weekly timeframe at 14%. However, Fantom has a trick up its sleeve to curb this brewing bearishness potentially.

Fantom CEO Michael Kong Unveils Sonic Launch

Sonic is the brand-new technology that the Fantom has been developing in the past 2 years. According to their latest blog post, Sonic was able to surpass the network’s 200 transactions per second metric. Although 200 TPS was already impressive compared to Ethereum’s 12 TPS, the network was quickly congested, and user experience deteriorated.

Kong said in the blog post:

“Sonic will be used to create a new best-in-class shared sequencer for L1 and L2 chains, capable of processing over 180 million daily transactions with real, sub-second confirmation times, and serve as the foundation to relaunch Fantom as an entirely new community-centric brand.”

This brand-new tech will cover all parts of the Fantom network, from bridging to a stablecoin launch, Sonic has it all.

Sonic Labs will also gain a slice of the pie as the foundation ultimately adds grant programs alongside the network upgrades.

Bitcoin is now trading at $70.396. Chart: TradingView

“We will continue to significantly scale and accelerate our Sonic Labs grant program for developers who build unique and valuable applications and public goods in categories including gaming, DeFi, social media, streaming, and now distributed AI,” Kong added.

This will significantly increase the size of Fantom’s user base, boosting investor confidence, and giving more room for developers to innovate.

Furthermore, the advancements brought forth by Sonic Labs in covering all aspects of the Fantom network, from bridging to the launch of a stablecoin, are poised to have a notable impact on Fantom’s market dynamics.

By streamlining processes, enhancing interoperability, and introducing new functionalities, these developments are likely to enhance the network’s attractiveness to investors and users alike.

We are thrilled to announce the first of many angel investors that have joined our round!

Sam Kazemian (@samkazemian ) is the founder of @FraxFinance ✦, one of the largest DeFi protocols with over $1.6bn in assets such as sfrxETH and the FRAX stablecoin.

🌐 Frax is committed… pic.twitter.com/zSL1XFNHYR

— Fantom Foundation (@FantomFDN) March 27, 2024

The Fantom Foundation X account announced today that Frax Finance Founder Sam Kazemain is the first angel investor for Sonic, stating that Frax will deploy natively issued assets on Sonic on its eventual launch.

Short-Term Gains Slashed In Favor Of The Long-Term

Meanwhile, the bears have completely taken over the FTM market in the short to medium term. Investors in FTM could only hope that the broader market downturn will reverse in the coming weeks.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Fifth Largest Bitcoin Whale Moves $6 Billion In BTC, Here’s The Destination

The crypto community’s attention has been drawn to a Bitcoin whale who recently moved a huge portion of their BTC holdings across different wallets. This action has sparked the curiosity of those in the community about the reason for these transactions.

Bitcoin Whale Moves $6 Billion In BTC

Blockchain analysis platform Arkham Intelligence first brought this occurrence to the community’s attention when it mentioned in an X (formerly Twitter) post that the Bitcoin address (37XuVSE) had moved over $6 billion in BTC to three new addresses.

As part of the transactions, $5.03 billion worth of BTC was sent to one of these addresses (bc1q8yj), while the two other addresses (bc1q6m5 and bc1q592) received $561.46 million and $488.40 million worth of BTC respectively. Arkham added that one of the wallets (bc1q592) has since then proceeded to transfer the received funds to another wallet.

Notably, the wallet which moved $6 billion in BTC was before now the fifth richest Bitcoin address having held over 94,500 BTC in its wallet. As of now, it still holds 1.31 BTC in the wallet in question. Interestingly, before now, this address was dormant as it had not moved any of this BTC which it received since 2019.

Transactions of such magnitude are always sure to cause a stir in the crypto community, considering the impact such whales can have on the market. Usually, a move like this can cause community members to speculate that the whale may be looking to offload their tokens and take profits. However, the fact that these transactions weren’t made to exchange-linked wallets has quelled such speculations.

Another BTC Whale On The Rise

Bitcoinist recently reported on BlackRock’s Bitcoin wallet, which has continued to accumulate Bitcoin at an astonishing rate due to the impressive demand for its iShares Bitcoin Trust (IBIT). Despite just launching this ETF in mid-January 2024, BlackRock now holds 243,126 BTC for the fund.

BlackRock’s BTC holdings has seen it rise to becoming one of the largest corporate BTC holders, only behind centralized exchanges Binance, Bitfinex, and Coinbase and fellow Bitcoin ETF issuer Grayscale. A sustained demand for the IBIT ETF could however see BlackRock surpass these entities at some point.

That is also something that could reflect positively on Bitcoin’s price seeing as how instituitional demand for the flagship crypto has helped propel it to new highs.

At the time of writing, Bitcoin is trading at around $70,500, up in the last 24 hours according to data from CoinMarketCap.

BTC price recovers above $71,000 | Source: BTCUSD on Tradingview.com

Featured image from Forbes, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Here’s How to Tell If You Qualify for Spousal Social Security Benefits

Social Security offers a vital financial safety net and a cornerstone in the foundation for a secure future for millions of Americans. What happens, though, if your employment history doesn’t support those plans?

If your spouse is eligible to receive retirement benefits, you may qualify for spousal benefits. You’ll need to check the rules and regulations from the Social Security Administration (SSA) to determine if you meet the requirements but can begin your research with the following summary of the major ways you can qualify for spousal benefits.

Image source: Getty Images.

Meeting the basic requirements

The good news is that you don’t necessarily need your own work history to receive spousal benefits. Ways to qualify include reaching age 62 or caring for a qualified disabled child under age 16. The child also must be eligible for benefits on your spouse’s Social Security record.

You also may be able to make a claim on an ex-spouse’s work record if you’re 62 or older, were married at least 10 years, divorced for at least two, and currently unmarried.

Some other caveats and what you can expect

There are a few additional factors to keep in mind. First, if you remarry after you become eligible for divorced spousal benefits, you’ll lose those benefits. (But you can reapply if you later become single again.) In any case, the amount of your spousal benefit will depend on your spouse’s earnings history and when you start collecting benefits.

Generally, you can receive up to 50% of your spouse’s full retirement benefit. However, if you start receiving benefits before your full retirement age, your benefit will be permanently reduced. The SSA offers an online tool for estimating your potential spousal benefit.

Develop your plan strategically

Knowing these eligibility requirements can help you and your spouse plan your retirement strategy. If you’re the lower earner in the marriage, you may want to delay taking your own retirement benefits until you reach your full retirement age to maximize your potential spousal benefit.

You can estimate your retirement benefit and investigate various claiming situations, including spousal benefits, using the SSA’s online benefits planner. The planner also is a good aid for understanding some of the complexities involved in making educated decisions about your retirement income.

Maximizing your income, together or not

Spousal benefits can be a significant source of income for retirees. By understanding the eligibility requirements and how different claiming strategies can affect your benefit amount, you and your spouse can work together to maximize your retirement income. The same goes for your ex-spouse.

For more detailed information on spousal benefits and claiming strategies, visit the Social Security Administration’s website. Consulting with a financial planning advisor who understands both Social Security and how your benefits will fit in with the eggs already in your nest is also a good idea.