Jerome Powell just revealed a hidden reason why inflation is staying high: The economy is increasingly uninsurable

Source link

hidden

When it comes to claiming Social Security, you get the flexibility to choose a filing age that works for you. That choice may be based on factors such as your health, your work status, your retirement goals, and the amount of money you have in savings.

You can sign up for Social Security at any age starting at 62. But you’re not entitled to your full monthly benefit based on your lifetime earnings until full retirement age (FRA) arrives. That age is 66, 67, or somewhere in between, depending on the year you were born.

Image source: Getty Images.

There’s also the option to delay your Social Security claim past FRA. For each year you do, up until age 70, your monthly benefit gets an 8% boost — and a permanent one at that.

Filing for Social Security at age 70 could make your retirement much less financially stressful. After all, if you’re getting more money on a monthly basis, it gives you more freedom to spend on different expenses. But there’s a less obvious benefit to claiming Social Security at age 70 that you should also know about.

You might end up with a boosted nest egg, too

If you’re waiting until age 70 to file for Social Security, it may mean that you’re pushing yourself to keep working until those benefits start hitting your bank account. And a few extra years of work could do a lot of great things for your retirement savings.

For one thing, you may be in a position to keep funding your IRA or 401(k) plan while you’re working later in life. So those additional contributions could build nicely on your existing balance. But leaving your nest egg alone for a few extra years could also result in a lot more money.

Let’s imagine that your FRA for Social Security is 67, and that you have $500,000 socked away in savings. Let’s also assume that at that point, you’ve shifted the investments in your portfolio to more conservative ones so that your retirement plan is giving you a 6% annual return, which is well below the stock market’s average.

Even if you don’t manage to add another dollar to your IRA or 401(k), if you leave your account untouched until age 70, your $500,000 balance will grow into over $595,000. That’s a huge difference.

Patience can really pay off

Not everyone is in a position to delay Social Security until age 70. If you’re no longer able to hold down a job, then waiting that long may not be feasible. And if your health is in notably poor shape, then you actually really shouldn’t delay your filing until age 70, as that might mean ending up with less money from Social Security on a lifetime basis.

But otherwise, do consider the upside of claiming Social Security at age 70. Not only might you enjoy a boosted monthly benefit for life, but you might also end up with an even larger nest egg that lasts longer in retirement.

1 Hidden Stock That Could Benefit From the Chip Manufacturing Boom — Is It a Buy Now?

There is buzz surrounding all sorts of semiconductor businesses. The world woke up to the need for more chip manufacturing during the pandemic’s height, and governments are now pouring tens of billions of dollars into bolstering their supply chains as a result.

One company that could be a big beneficiary is Entegris (ENTG -1.27%), a top supplier of materials and manufacturing processes for tech — including the chip industry. Entegris is actually one of the 30 stocks in the iShares Semiconductor ETF.

The stock has been in rally mode this year. It’s up nearly 50% as of this writing as Entegris manages the integration of its big $5.7 billion acquisition of peer CMC Materials, completed the summer of 2022. Is Entegris a buy now?

Squeezing synergies from a giant chemicals specialist

Entegris’ tie-up with CMC Materials created a giant in specialty chemicals, materials, and handling (like trays and boxes for transporting silicon wafers and chips and related semiconductor equipment) for high tech.

Manufacturing chips and computing systems is a complex process involving hundreds of steps and dozens of chemicals (besides the silicon chips are made of), and with parts needing to be transported in bulk to various locations spanning multiple continents. Entegris is deeply integrated into the global supply chain.

This is just the type of diversified industrial products company that could benefit from things like the U.S. CHIPS Act, European Chips Act, and related semiconductor manufacturing funding taking place elsewhere, like Taiwan, Japan, and China.

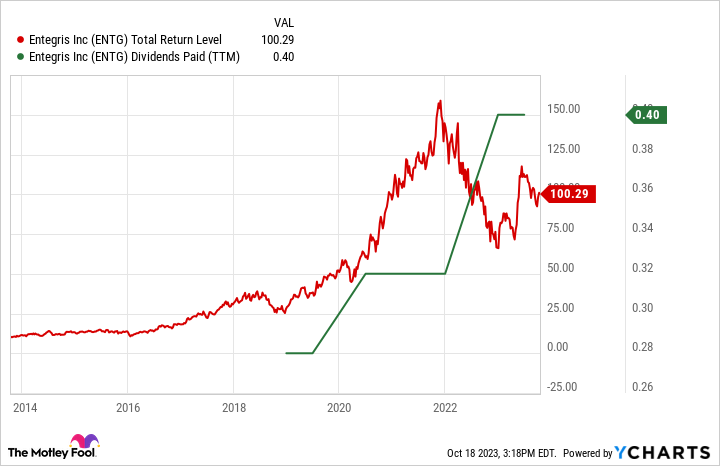

Entegris has been a solid long-term stock, increasing more than 900% in the last 10-year stretch, and shelling out a rising dividend since initiating a quarterly payout in 2017.

Data by YCharts.

However, a key to Entegris’ long-term success going forward will be realizing synergies from its operation following the takeover of CMC.

In the last year, operating profit margins have contracted from well over 20% to at times just a single-digit percentage, and free cash flow has dipped into the red (negative $68 million in the last reported 12-month stretch). Long-term debt sat at nearly $5.5 billion, and cash and short-term investments at just $566 million, at the end of June 2023.

Such is how it often goes when big mergers and acquisitions take place.

A long-term value in the making?

The work toward paying down debt and streamlining operations is well underway. This year, Entegris offloaded multiple segments it deemed non-strategic to its focus on tech manufacturing, including the recent $700 million sale of its “electronics chemicals” business to Japan’s Fujifilm Holdings in early October. That cash will go toward paying down debt, a good thing given that the U.S. Federal Reserve is poised to keep interest rates higher for longer.

As for free cash flow, besides whittling down redundant expenses, Entegris will also be working through elevated capital expenditures as it expands into key areas in support of its chip fab partners.

For example, Entegris recently broke ground on a new manufacturing facility in Colorado Springs, Colorado. The facility is near chip company fabs and design centers operated by Analog Devices, Broadcom, Microchip Technology, and others. As that project winds down in early 2025, free cash flow should jump higher.

At this point in its transformation, it’s difficult to stick a fair value on Entegris. The stock’s valuation using trailing 12-month earnings and free cash flow isn’t meaningful, and insight into the newly merged company’s profitability in 2024 and beyond is limited.

Shares currently trade for about 27 times analysts’ expectations for 2024 earnings per share, but take that with a grain of salt. Management will need to prove it can pay down debt and boost profit margins again after full integration of CMC Materials, as well as that recent sale to Fujifilm.

For now, I’m content to watch Entegris from the sidelines while its future earnings power becomes more clear. However, the company has a solid track record of market outperformance, and could return to its long-term winning streak.

Entegris is on my watchlist as semiconductor and computing technology manufacturing gets a big boost from federal governments all over the world in the next few years.

(Bloomberg) — The relentless selloff in Chinese stocks has made the market the worst performer in the world over the past three years. And that is exactly the reason some funds are looking to unearth pockets of value.

Most Read from Bloomberg

They see a contrarian signal in the extreme pessimism toward Chinese assets in recent months amid an economic slowdown, unpredictable government crackdowns and rolling property woes. Global funds as a whole have slashed their China stock positioning to the lowest since October, which to some means more room for potential buying.

“China has a growth problem today, but not a systemic crisis,” said John Lin, Singapore-based chief investment officer for China equities at AllianceBernstein, which oversees $694 billion globally. “The way you make money is you have to go company by company. There’s a lot of nice cashflow companies, nice dividend-yield companies that are still under-appreciated.”

The MSCI China Index has tumbled 55% from a high set in February 2021, while a gauge of mainland firms traded in Hong Kong has slumped 50% and is the worst performer of 92 global indexes compiled by Bloomberg over the past three years.

One of the major drivers of the downtrend has been selling by global funds. After making net purchases earlier this year, offshore money managers offloaded a record $12 billion of mainland shares in August via trading links with Hong Kong, and have sold another $3.2 billion this month.

That bearish positioning opens up the prospect of a rebound, while signs of stabilization in parts of the economy mean it makes sense to look for value now, bulls say.

A Shares

AllianceBernstein’s Lin says he favors firms in China’s local share market, which is primarily traded by domestic investors.

“We like A shares because they are more domestic oriented, and therefore are less susceptible to capital flows based on geopolitical tensions,” he said. “You can find a lot of interesting stocks that have their own idiosyncratic dynamics.”

Some of the most attractive firms are industrial-cyclical stocks such as bus-makers and diesel-engine makers that export to places like Asean, central Asia and Middle East, and also have a presence in the domestic market so they will participate in the eventual local economic recovery, he said.

Health Care

For Amundi SA, China’s health-care stocks are where it sees value.

Medical shares have been beaten down amid an anti-corruption clampdown but the sector has probably already reached a bottom with all the bad news in the price, said Nicholas McConway, head of Asia ex-Japan equities at Europe’s largest money manager in London.

McConway is focusing on companies that are self-funded with robust drug pipelines. The prospect that global central banks are nearing an end to interest-rate hikes may also favor these companies as they can take years to turn profitable so tend to perform better in a lower-rate environment, he said.

Pharma

Guinness Global Investors favors pharmaceutical names that are transitioning from generic drugs to developing new products themselves or acquiring them through mergers and acquisitions.

Examples include CSPC Pharmaceutical Group Ltd., Sino Biopharmaceutical Ltd. and China Medical System Holdings Ltd., said Sharukh Malik, a fund manager at Guinness Global in London who has spent the last eight years investing in Asian stocks.

“We estimate that for these three companies, valuations are now low enough that investors are paying nothing for the cashflows from future growth capex,” he said. “If we think these companies will eventually successfully make novel drugs themselves, the risk reward ratio is very favorable for us.”

Tech Giants

Some of the largest firms in the beaten-up technology sector now look attractive, according to Mondrian Investment Partners, which manages $45.6 billion in assets.

Tech has seen some of the biggest losses over the past three years due to a government crackdown after authorities blocked a planned $37 billion initial public offering by Ant Group in late 2020. The sector was a relative bright spot in second-quarter earnings, which has led to analyst estimate upgrades.

Mondrian Investment has been adding to positions in e-commerce giant Alibaba Group Holding Ltd. as its stock price failed to capture the potential payouts that will be distributed to shareholders during its six-way split, said Ginny Chong, head of Chinese equities in London with over 20 years of experience in emerging markets.

She has also been also adding shares of Tencent Holdings Ltd., and sees Baidu Inc. as undervalued.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Security platforms warn about hidden phishing and wallet drainer links

With millions of dollars worth of assets being lost to phishing attacks after signing malicious permissions, the threat of losing crypto assets to questionable links is very real. When these are paired with platforms that allow hidden links, users are subjected to a different kind of risk.

On Sept. 4, Web3 security provider Pocket Universe shared how scammers are able to hide wallet drainer links in any text on the instant messaging platform Discord. While some users report that the feature has only been enabled for Discord users recently, the ability to embed links in any text has been available on many different social platforms for a while now.

Scammers can now hide links in any discord text ☠️

Watch out for hidden wallet drainer links

e.g. pic.twitter.com/mgqG18sOF9— Pocket Universe (@PocketUniverseZ) September 4, 2023

Cointelegraph reached out to several cybersecurity professionals to learn more about how users can protect themselves from such attempts and how platforms can improve their security so that users are not subjected to such attacks.

Christian Seifert, who works as a researcher in residence at Web3 security firm Forta Network, said that this type of attack has been the bread and butter of hackers since the internet was created. He explained:

“Whatever a platform creates, there will be a hacker ready to find a way to hack it. Hyperlinks with text are a feature supported as part of HTML and have been a source for phishing attacks since the early days of the internet.”

According to Seifert, security requires an in-depth defense approach. “Both platforms and users need to work towards protecting themselves,” he said. From the user’s side, the security professional highlighted that there are plugins that they can use to protect themselves from such scams.

When it comes to Discord, Seifert pointed out that the platform does provide information on the true destination of the URL after the user clicks on it. However, the platform also allows users to “trust” a domain going forward. This can be abused by scammers, according to Seifert. He explained:

“Imagine a domain like foo.bar, which the user trusted. A scammer can craft a potentially malicious link that performs some action on this domain, such as an ‘oauth’ request to the scammer, like foo.bar/oauth/scammer-account.”

The cybersecurity professional said that an issue with the platform’s current implementation is that links and text can be deceptive and misaligned with users’ expectations. “If a text link clearly resembles a domain or URL and it is mismatched to the true destination URL, Discord should disallow such links,” he added.

Related: Exploits, hacks and scams stole almost $1B in 2023: Report

Meanwhile, Hugh Brooks, director of security operations at the blockchain security firm CertiK, echoed some of Seifert’s sentiments. According to Brooks, users and platforms have a collective responsibility to watch out for malicious actors. He explained that it’s essential for platforms to continually review and refine their security features and for users to stay vigilant and educated.

For users, Brooks said that they should be proactive and cautious when it comes to links, especially when being asked for signatures and permissions. The executive urged users to verify the authenticity of the site address before giving it access to crypto wallets. Brooks shared:

“A good practice is to cross-check web addresses with recognized phishing warning lists. PhishTank, Google Safe Browsing and OpenPhish are valuable resources here, along with browser extensions like HTTPS Everywhere and ad blockers like uBlock.”

Brooks explained that these tools can alert users in real time whenever they are about to visit known phishing or malicious websites. “Furthermore, by simply hovering over a URL link, the actual web address will be displayed, allowing users to confirm its legitimacy before engaging further,” he added.

On the platform’s side, the cybersecurity professional said that there are measures that can be implemented, such as being able to only receive messages from trusted contacts. Brooks said that a good example of this is Meta’s “Facebook Protect,” which lets users have heightened security features for their accounts.

“As the saying goes, the only constant is change. Platforms owe it to their users and to their continued relevance to make security a priority. This involves not only updating security measures but also fostering a culture of vigilance and awareness among users,” he added.

Magazine: Should crypto projects ever negotiate with hackers? Probably