In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

Source link

highlights

Riot Platforms Highlights Risks Associated With Upcoming Bitcoin Halving Event in Annual Report

In its latest annual report, Riot Platforms, the publicly-listed bitcoin mining firm, outlines several significant risks that could impact its operations, including troubles in the broader crypto economy, potential decreases in onchain transaction fees, and the anticipated bitcoin halving event in April 2024. The company emphasizes the halving event’s potential to reduce mining rewards as […]

In its latest annual report, Riot Platforms, the publicly-listed bitcoin mining firm, outlines several significant risks that could impact its operations, including troubles in the broader crypto economy, potential decreases in onchain transaction fees, and the anticipated bitcoin halving event in April 2024. The company emphasizes the halving event’s potential to reduce mining rewards as […]

Source link

The crypto market is currently abuzz with discussions on Bitcoin (BTC), as it teeters on the brink of reaching the $50,000 threshold. This is fueled by the fast-approaching halving as well as a “bullish divergence” observed over the past week, with Bitcoin breaking past the $48,000 mark.

Analyst Analysis On Bitcoin

Michaël van de Poppe, a prominent figure in the realm of crypto analysis, recently shared insights on the bullish divergence. Van de Poppe pointed out the notable weekly candle that propelled Bitcoin’s value beyond $48,000, signaling a potential challenge at the $50,000 resistance level in the near term.

#Bitcoin looking at the resistance.

Massive weekly candle, through which Bitcoin is back above $48,000.

I’m personally interested what price will do around $50,000 in the upcoming 1-2 weeks. pic.twitter.com/6I927U20pg

— Michaël van de Poppe (@CryptoMichNL) February 12, 2024

Further echoing this challenge, IntoTheBlock highlighted a key obstacle Bitcoin faces on its path to $50,000 in the latest post. The firm identified a crucial resistance level, noting that over 800,000 addresses have purchased nearly 270,000 BTC at an average price of $48,491.

Currently, at a loss, these holders may exert selling pressure as Bitcoin approaches its break-even point, potentially impacting its ascent to the coveted $50,000 mark.

Bitcoin has set its sights on $50k!

To get there, there is one important resistance level left. Over 800k addresses acquired nearly 270k $BTC at an average price of $48,491. These addresses are currently in the red and might provide sell pressure as they break even on their… pic.twitter.com/nEw4tP8wUc— IntoTheBlock (@intotheblock) February 12, 2024

Over the past week alone, Bitcoin’s value has increased by more than 10%, igniting discussions among crypto enthusiasts and experts regarding its future trajectory. This bullish momentum and the impending halving event reinforce optimistic stances within the crypto sphere about Bitcoin’s value proposition.

Bullish Outlook On BTC And Market Sentiment

Amid this bullish phase, several crypto analysts and market observers have put forward their forecasts regarding Bitcoin’s potential price movement shortly. Crypto Rover, another analyst with a significant following, suggested that surpassing the $48,500 resistance and reaching the 0.618 Fibonacci level could set Bitcoin on a path to the “official trend reversal to a bull market.”

Once #Bitcoin breaks the $48,500 mark, better said, the 0.618 Fibonacci level,

that will mark the official trend reversal to a bull market. I’m keeping a close eye on this level! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

Furthermore, data from IntoTheBlock indicates a positive trend regarding Bitcoin address profitability. Currently, 91% of Bitcoin addresses are profitable, with the total number of addresses in profit at 46.87 million, accounting for 90.53% of all addresses.

This is contrasted with 3.44 million addresses that are still at a loss. IntoTheBlock’s analysis also reveals that most addresses that purchased BTC within the $40,919.92 to $55,413.77 range are now profitable, underscoring a bullish sentiment among Bitcoin holders.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Michael van de Poppe, a prominent crypto analyst, recently outlined three key factors that could herald a bullish phase for Ethereum, the second-largest crypto by market capitalization. One crucial factor he identifies is Bitcoin’s current behavior.

The analyst pointed out that as the market leader, Bitcoin’s recent signs of bottoming out tend to precede altcoin rallies, hinting at a potential upswing for Ethereum. Moreover, Van de Poppe highlights the growing anticipation surrounding spot Ethereum exchange-traded funds (ETFs).

According to Van de Poppe, the increasing buzz about these spot ETFs is a significant catalyst that could drive Ethereum’s value over the coming weeks.

Additionally, Ethereum is on the cusp of rolling out critical network upgrades. These updates, aimed at reducing transaction costs by up to 90%, are expected to improve the network’s efficiency and scalability significantly.

The momentum towards $ETH is probably going to come in the next few weeks.

Arguments:

– #Bitcoin bottoming out is a trigger for altcoins to make a new run.

– Ethereum Spot ETF hype.

– Ethereum launching new upgrades to reduce 90% of the costs. pic.twitter.com/N8bDi52F8M— Michaël van de Poppe (@CryptoMichNL) January 25, 2024

Latest Update On Ethereum Deacon Upgrade

Regarding updates, Ethereum’s development team is making strides with the upcoming Dencun upgrade, a significant “hard fork” that aims to enhance the blockchain’s efficiency.

Tim Beiko, a core Ethereum developer, updated the community earlier today on the progress. Dencun, which incorporates “proto-danksharding,” is set to reduce transaction costs on layer 2 solutions, making Ethereum more accessible and affordable for users.

According to the developer, the upgrade is scheduled to activate on the Sepolia testnet on January 30 and the Holesky testnet on February 7, with mainnet implementation following if these tests succeed.

More testnet blobs on the way .oO

Dencun will activate on Sepolia Jan 30, and on Holesky Feb 7. If running a node on either network, now’s the time to update it!

Assuming both of these go smoothly, mainnet is next ✅

— timbeiko.eth ☀️ (@TimBeiko) January 25, 2024

Brighter Future Ahead

Despite these positive developments, Ethereum’s market performance mirrors the overall bearish sentiment in the crypto market, led by Bitcoin. ETH has seen a 13.7% decline in the past week, currently trading at $2,216.

However, analysts like Van de Poppe urge caution, particularly regarding the impact of the Bitcoin spot ETF. While there may be short-term selling pressure, Van de Poppe remains optimistic about the long-term prospects.

The analyst suggests that the influx of new capital from diverse market participants could propel Bitcoin, and by extension, Ethereum, to new heights.

The markets need to be more accurate with the impact of the ETF.

There’s some selling pressure in the short term, but in the long term, a massive amount of new money flows into the markets from new participants.

As a result, #Bitcoin might push higher this cycle than we think.

— Michaël van de Poppe (@CryptoMichNL) January 25, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Solana has been on a downward trend over the past week, following a surge from multi-year low levels. The token suffered when its biggest promoter, crypto exchange FTX, fell, but the ecosystem continued to thrive, leading to the high timeframe recovery.

As of this writing, Solana’s native token SOL trades at $87 with a 2% profit over the past 24 hours. Over the previous seven days, the cryptocurrency records a 12% correction.

Rising Stars In The Solana Landscape

According to a report from Coingecko, the Solana network is witnessing a resurgence fueled by its recovery in the cryptocurrency market, notable reductions in network outages, and a series of positive developments.

This rejuvenation has drawn the attention of investors and developers and led to a surge in the adoption of existing projects within its ecosystem. Specific projects stand out among these, poised to shape the future of decentralized finance (DeFi) and non-fungible tokens (NFTs) on Solana, Coingecko claims.

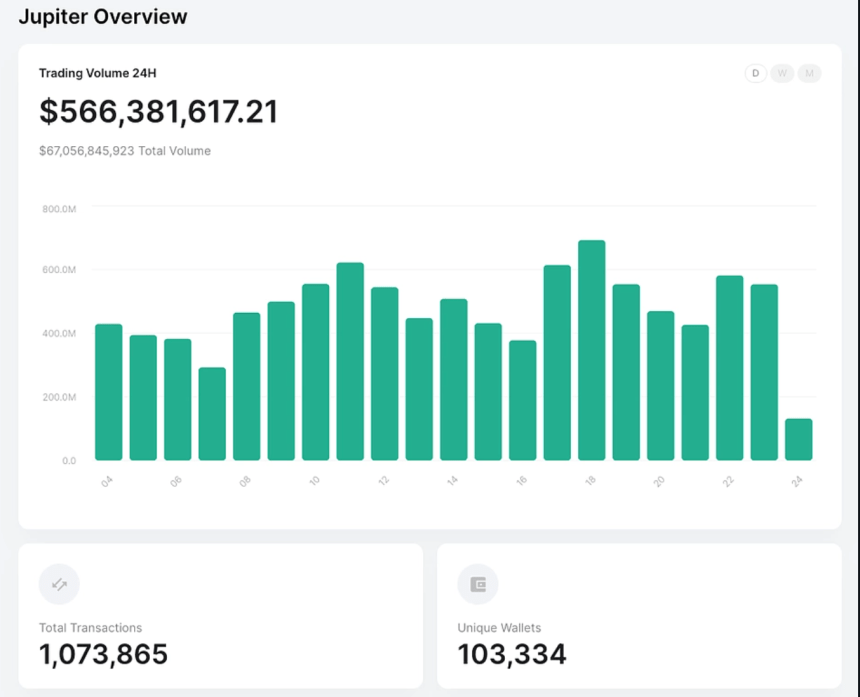

Decentralized exchanges (DEXs) such as Jupiter, Orca, and Drift are at the forefront of Solana’s innovation. Jupiter is “transforming” the landscape with its limit-order decentralized swap services, offering a DEX aggregator to ensure users get the optimal price offers.

The chart below shows that its daily trading volume, involving around 90,000 unique wallets, has reached an average of $400 million.

Orca, another DEX, has a concentrated liquidity feature, Whirlpools, which enhances returns for liquidity providers and reduces slippage for traders. With a total value of approximately $185 million, Orca’s community-driven governance model is another selling point to attract new users in the coming months.

Drift is a decentralized perpetual trading platform, allowing traders to engage with up to 20x leverage. It integrates a series of features, including a money market for decentralized lending, offering additional passive income opportunities through staking and market maker rewards.

Furthermore, Solend, Marginfi, and Kamino are making strides on the lending front. Solend, a prominent money market, enables users to lend and borrow crypto assets, with over $165 million locked in its smart contracts.

Marginfi, boasting over $345 million in tokens locked, enhances the lending experience with advanced risk management technologies.

Kamino, another lending platform, manages over $242 million in assets. It offers liquidity through CLMM-based lending vaults, allowing users to deploy tokens in yield-bearing programs.

Emerging Projects: Helium And Render Network

In addition to these platforms, the report identified projects that could benefit from the surge of interest in Solana over the long run.

These include Marinade Finance and Jito. Marinade Finance, with over $1 billion in assets, offers maximized returns through liquid staking and immediate unstaking options. Jito, enhancing staking yields via MEV rewards, boasts about 6.7 million SOL staked across its platform.

In the world of NFTs, collections like Mad Lads and Tensorians are gaining popularity. Mad Lads, a unique collection of 10,000 artworks, reached a new all-time high in floor price, reflecting the increasing interest in Solana-based NFTs.

According to the report, Helium and Render Network are two emerging projects within the Solana ecosystem worth watching. Helium, a decentralized connectivity service provider, utilizes Solana’s blockchain to remit and administer its internet services. Its multi-token system incentivizes hotspot owners and fosters the expansion of decentralized internet facilities.

Render Network, expanding to Solana in 2023, offers GPU rendering services for creators. By renting out excess GPU power, artists can produce high-resolution graphics with the Render token (RNDR) as the network’s remittance token.

The Solana ecosystem, marked by innovation and rapid growth, solidifies its position in the smart contract blockchain space. Its diverse projects, from DEXs and lending protocols to staking solutions and NFT collections, showcase the network’s dynamic and burgeoning landscape. With the SOL token climbing the ranks, Solana’s ecosystem is poised for continued expansion and success in the years ahead.

Cover image from Unsplash, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Data highlights Bitcoin’s potential path to $40K amid global economic turbulence

Bitcoin (BTC) has been trading within a narrow 4.5% range over the past two weeks, indicating a level of consolidation around the $34,700 mark.

Despite the stagnant prices, the 24.2% gains since Oct. 7 instill confidence, driven by the impending effects of the 2024 halving and the potential approval of a spot Bitcoin exchange-traded fund (ETF) in the United States.

Investors worry about the bearish global economic outlook

Bears expect further macroeconomic data supporting a global economic contraction as the U.S. Federal Reserve holds its interest rate above 5.25% in order to curb inflation. For instance, on Nov. 6, Chinese exports shrank 6.4% from a year earlier in October. Furthermore, Germany reported October industrial production down 1.4% versus the prior month on Nov. 7.

The weaker global economic activity has led to WTI oil prices dipping below $78 for the first time since late July, despite the potential for supply cuts from major oil producers. U.S. Federal Reserve Bank of Minneapolis President Neel Kashkari’s remarks on Nov. 6 set a bearish tone, prompting a “flight-to-quality” response.

Kashkari stated:

“We haven’t completely solved the inflation problem. We still have more work ahead of us to get it done.”

Investors have sought refuge in U.S. Treasurys, resulting in the 10-year note yield dropping to 4.55%, its lowest level in six weeks. Curiously, the S&P 500 stock market index has reached 4,383 points, its highest level in nearly seven weeks, defying expectations during a global economic slowdown.

This phenomenon can be attributed to the fact that the firms within the S&P 500 collectively hold $2.6 trillion in cash and equivalents, offering some protection as interest rates remain high. Despite increasing exposure to major tech companies, the stock market provides both scarcity and dividend yield, aligning with investor preferences during times of uncertainty.

Meanwhile, Bitcoin’s futures open interest has reached its highest level since April 2022, standing at $16.3 billion. This milestone gains even more significance as the Chicago Mercantile Exchange solidifies its position as the second-largest market for BTC derivatives.

Healthy demand for Bitcoin options and futures

The recent use of Bitcoin futures and options has made media headlines. The demand for leverage is likely fueled by what investors believe are the two most bullish catalysts for 2024: the potential for a spot BTC ETF and the Bitcoin halving.

One way to gauge market health is by examining the Bitcoin futures premium, which measures the difference between two-month futures contracts and the current spot price. In a robust market, the annualized premium, also known as the basis rate, should typically fall within the 5%–10% range.

Notice how this indicator has reached its highest level in over a year, at 11%. This indicates a strong demand for Bitcoin futures primarily driven by leveraged long positions. If the opposite were true, with investors heavily betting on Bitcoin’s price decline, the premium would have remained at 5% or lower.

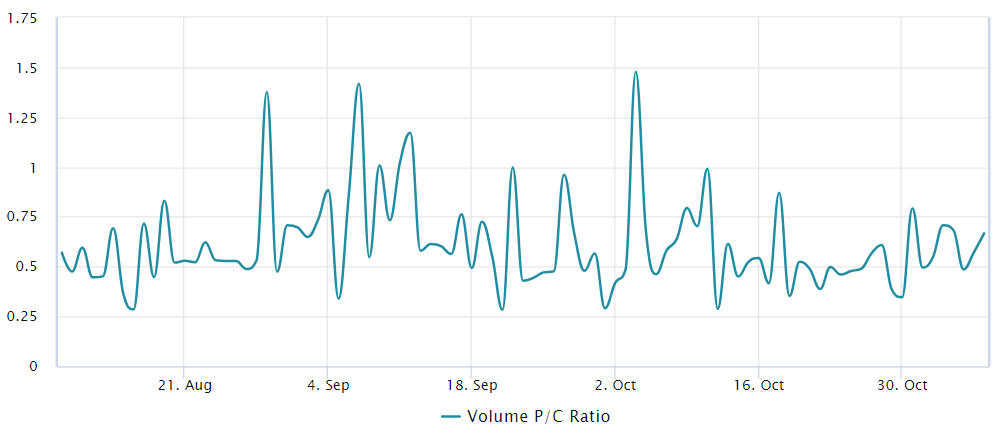

Another piece of evidence can be derived from the Bitcoin options markets, comparing the demand between call (buy) and put (sell) options. While this analysis doesn’t encompass more intricate strategies, it offers a broad context for understanding investor sentiment.

Related: Bitcoin Ordinals see resurgence from Binance listing

Over the past week, this indicator has averaged 0.60, reflecting a 40% bias favoring call (buy) options. Interestingly, Bitcoin options open interest has seen a 51% increase over the past 30 days, reaching $15.6 billion, and this growth has also been driven by bullish instruments, as indicated by the put-to-call volume data.

As Bitcoin’s price reaches its highest level in 18 months, some degree of skepticism and hedging might be expected. However, the current conditions in the derivatives market reveal healthy growth with no signs of excessive optimism, aligning with the bullish outlook targeting prices of $40,000 and higher by year-end.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Bittrex bypasses US clients amid regulatory haze, CEO highlights global scope

Bittrex Global CEO Oliver Linch noted that market participants are increasingly wary of the United States because of the regulatory uncertainty surrounding the crypto industry in the country, according to an Aug. 16 statement shared with CryptoSlate.

Bittrex steers clear of US users

Linch stated that his exchange made substantial investments to ensure it does not accept U.S. customers because of the regulatory environment.

Since the beginning of the year, U.S. financial regulators have increased their scrutiny of the crypto industry, with the SEC and CFTC filing legal actions against several crypto-related firms for federal law violations.

The financial watchdogs have filed legal actions against several crypto-related firms over violations of federal laws. Concurrently, a jurisdictional dispute is brewing between the two agencies, further complicating the oversight of this burgeoning sector.

These uncertainties have led to increased calls for the U.S. Congress to introduce legislation that adequately addresses the regulatory vacuum in the industry. However, SEC chairman Gary Gensler has maintained that current laws adequately govern the space.

To circumvent the issues, the CEO revealed that Bittrex Global was regulated in two leading jurisdictions, Liechtenstein and Bermuda, and advised investors looking to do business with a non-U.S. regulated digital assets exchange to consider his firm.

On Bittrex, SEC case

Bittrex U.S. subsidiary filed for bankruptcy in May after the SEC alleged that the crypto exchange operated as an unregistered national securities exchange, broker, and clearing agency, among other allegations.

Last week, the SEC reached a $24 million settlement with Bittrex and its former CEO, William Shihara. The exchange did not admit nor deny any of the SEC’s allegations brought against it.

CEO Linch expressed satisfaction at the firm’s quick settlement with the SEC. He said the quick closure of the case would give the firm an opportunity to build a future “as a regulated, mature, and sophisticated part of the wider financial ecosystem.”

Meanwhile, the press statement clarified that the bankrupt U.S. subsidiary paid the settlement, not its international arm, Bittrex Global.

The post Bittrex bypasses US clients amid regulatory haze, CEO highlights global scope appeared first on CryptoSlate.

The recent court ruling in the Ripple Labs and SEC case has prompted Bank of America to reiterate its differentiation between the trading of blockchain-native crypto tokens and tokenized traditional assets.

The legal battle between Ripple Labs Inc and the United States Securities and Exchange Commission (SEC) has been closely watched by the crypto community, and a recent court ruling has added further complexity to an already contentious issue.

Bank of America Corp (NYSE: BAC) emphasizes in a recent report that the ruling falls short of providing clarity on broader regulatory concerns and fails to establish a clear precedent for other tokens.

Ripple vs SEC: Uncertainty in the Ruling

While the court ruled partially in favor of Ripple by stating that XRP sales through exchanges and algorithms did not constitute investment contracts, it also found that institutional sales of XRP tokens violated federal securities laws. This mixed decision creates ambiguity in how other cryptocurrencies may be affected by similar regulatory scrutiny.

The Bank of America research report acknowledges that the implications of the court’s ruling are not straightforward to determine due to Ripple’s XRP offerings’ uniqueness. This uniqueness makes it difficult to apply the court’s ruling to other digital assets with different use cases and functionalities.

Notably, Ripple’s XRP has been acknowledged as a trailblazing digital currency that serves a specific purpose within the Ripple network. Unlike many other cryptocurrencies, XRP functions as a bridge currency, allowing for quick and low-cost cross-border transactions.

This utility-focused use case distinguishes XRP from typical investment-focused cryptocurrencies such as Bitcoin and Ethereum. The unique characteristics of XRP have attracted the interest of financial organizations looking to streamline their cross-border payment procedures.

To promote healthy growth and mainstream adoption of digital assets, the report stresses the importance of clear and comprehensive regulatory guidelines. A well-defined regulatory framework will instill investor confidence and provide market participants with a transparent understanding of the rules governing the crypto industry.

Remarkably, Analysts Alkesh Shah and Andrew Moss highlight that the court’s decision was significantly influenced by an initial unregistered offering and sale of XRP to institutional investors. They noted that this early sale to institutional investors laid the foundation for a secondary market for XRP, which subsequently included programmatic sales on digital asset exchanges.

Bank of America’s Distinction in Crypto Regulation

The recent court ruling in the Ripple Labs and SEC case has prompted Bank of America to reiterate its differentiation between the trading of blockchain-native crypto tokens and tokenized traditional assets.

While the bank noted that regulations for blockchain-native tokens are still being established, the trading of tokenized traditional assets, such as Exchange-Traded Funds (ETFs), repos, and gold, already adheres to well-established rules, with trading volumes reaching trillions of dollars.

Rival broker Needham, on the other hand, sees the court’s decision as a favorable step for crypto exchange Coinbase Global Inc (NASDAQ: COIN) in its ongoing case with the SEC. Needham emphasized that the ruling will reduce regulatory pressure on the company.

next

Altcoin News, Blockchain News, Cryptocurrency news, News, XRP News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Ripple welcomes MiCA regulation as US lawsuit highlights lack of clarity

Cryptocurrency payments service provider Ripple continues to see global adoption of its payment services despite a long-winded legal battle with the United States Securities and Exchange Commission (SEC) over its XRP (XRP) token.

In a wide-ranging interview with Cointelegraph at Money 20/20 in Amsterdam, Sendi Young, Ripple’s managing director for Europe and the United Kingdom, unpacked the firm’s growing remit worldwide, despite ongoing regulatory scrutiny in the United States.

Cryptocurrency exchanges and businesses have clashed with U.S. regulators over the past year, with a lack of regulatory clarity threatening to stifle innovation and adoption of blockchain-based services, systems, and cryptocurrencies.

Meanwhile, the European Union is well on its way to instituting a set of requirements and standards for the cryptocurrency industry across the continent after the long-awaited Markets in Crypto-Assets (MiCA) legislation was signed into law on May 31.

The divergence of regulatory perspectives in the U.S. and Europe is wide, Young told Cointelegraph, highlighting Ripple’s business growth outside of the U.S., which is in part due to progressive regulatory oversight in different markets:

“That lawsuit is very isolated to U.S. regulations or the lack of clarity and certainty thereof. It almost accentuates the kind of environment that we have in Europe and the United Kingdom.”

Young added that Ripple continues to foster private-public partnerships, and open dialogue with regulators and policymakers, with both parties educating each other as the industry develops:

“It does enable business to grow and innovation to happen. I would say we’re very fortunate in this sort of U.K., Europe environment, which is setting standards globally.”

Related: SEC is killing innovation in the United States — 1inch co-founder

In a European context, Young believes the MiCA regulatory framework will facilitate a “level playing field” that fosters healthy competition and innovation in the cryptocurrency space, while driving adoption among traditional finance players.

“I think that’s where we’ve seen much bigger mainstream take up and the real benefits of crypto’s utility being realized. Without clear regulation, that is impossible. I see that as the first step in getting more mainstream adoption.”

Young highlighted Ripple’s expanding basket of services aimed at plugging into an increasingly interconnected financial ecosystem. This is in part facilitated by crucial fiat on-ramps and off-ramps, as well as the development of central bank digital currencies (CBDCs) and stablecoins:

“It’s really a number of different currencies and CBDCs. They’re all going to be coexisting, and that kind of ability to interoperate, to go in and out, is going to be very important.”

Ripple’s ongoing lawsuit with the SEC took an interesting turn in June 2023, as eagerly awaited documents relating to a speech from former SEC corporate finance division director Bill Hinman highlighted contradictory viewpoints on classifying cryptocurrencies as securities.

Magazine: Peter McCormack’s Real Bedford Football Club puts Bitcoin on the map