Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Source link

highs

Super Micro Computer Stock Is Down 19% From 52-Week Highs: Here’s Why That’s Great News for Investors

Super Micro Computer (SMCI -1.30%) stock has been pulling back in recent sessions after the company revealed the pricing of its common stock offering, which would dilute existing shareholders. As it turns out, shares of the high-flying server manufacturer are down 19% from their 52-week high, which it hit on March 8.

Savvy investors looking to invest in a top artificial intelligence (AI) stock right now should consider capitalizing on Supermicro’s drop by buying it hand over fist. Here’s why.

Supermicro investors should focus on the bigger picture

Super Micro Computer is offering 2 million shares of its common stock for $875 per share. Moreover, underwriter Goldman Sachs has a 30-day option to purchase an additional 300,000 shares as a part of this offering.

The fact that this announcement came at a time when each Supermicro share was trading at just over $1,000 seems to have dented investor confidence. The company priced the sale at a discount, and the market was quick to press the panic button.

However, a look at the bigger picture will tell us that this is a smart move by Super Micro Computer management because the company aims to raise $1.75 billion in gross proceeds through this exercise. Management adds that the proceeds will be deployed for supporting “its operations, including for purchase of inventory and other working capital needs, manufacturing capacity expansion and increased R&D [research and development] investments.”

The company’s focus on expanding its manufacturing capacity is the right thing to do considering the booming demand for its server solutions that are used for deploying AI chips. On its fiscal 2024 second-quarter earnings conference call, Supermicro pointed out that the utilization rate of its production facilities in the U.S., Taiwan, and the Netherlands was 65%. Management also added that its remaining production capacity was quickly filling up.

Supermicro, therefore, needed to bring new production facilities online to cater to the fast-growing AI server market. Not surprisingly, CEO Charles Liang pointed out on the call:

To address this immediate capacity challenge, we are adding two new production facilities and warehouses near our Silicon Valley HQ, which will be operating in a few months. The new Malaysia facility will focus on expanding our building blocks with lower costs and increased volume, while other new sites will support our annual revenue capacity above $25 billion.

Supermicro is on track to generate $14.5 billion in revenue this fiscal year at the midpoint of its guidance range. That would be more than double the $7.1 billion in revenue it generated in fiscal 2023. Now that the company has already built up a revenue capacity of $25 billion, it would need to bring more capacity online, given how fast the market for AI servers has been growing.

According to Global Market Insights, the AI server market was worth an estimated $38 billion in 2023. By 2032, this market is expected to generate a whopping $177 billion in revenue, for a compound annual growth rate of 18% during the forecast period. Supermicro’s share of AI servers has been improving since it has been growing at a much faster pace than this market.

Considering the lucrative end-market opportunity on offer in the long run, it would make sense for the company to grab a bigger share of this space. This probably explains why management has decided to capitalize on the stock’s terrific surge this year and go for a stock offering to raise more capital. Additionally, Supermicro’s pullback means investors can now buy it at a relatively cheaper valuation.

Another reason to buy the stock following the pullback

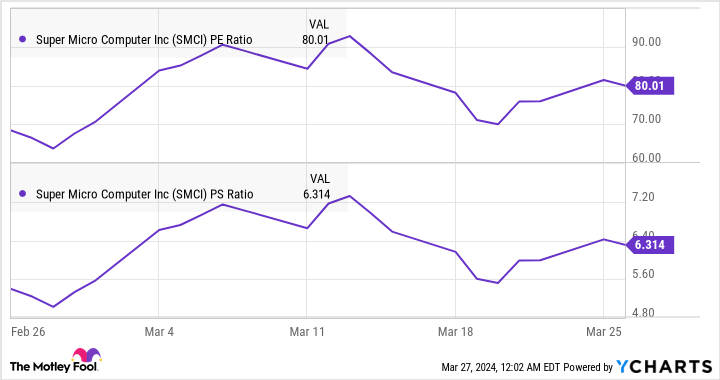

Supermicro’s earnings and sales multiples have retreated of late.

SMCI PE Ratio data by YCharts.

The stock was trading at more than 90 times earnings at one point this month, while its sales multiple stood at almost 7.5. Some might argue that Supermicro is still expensive as far as its earnings multiple is concerned. However, buying the stock right now is a no-brainer.

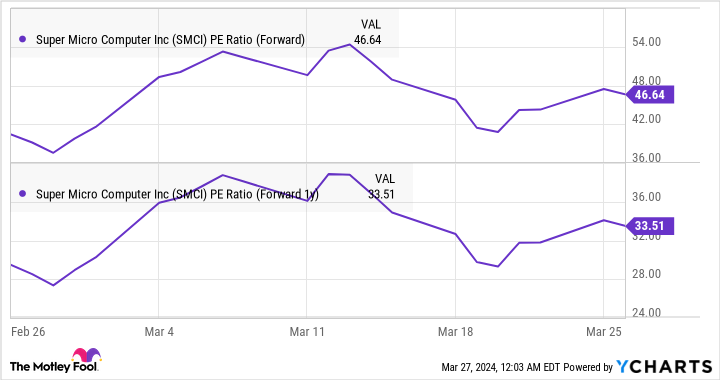

SMCI PE Ratio (Forward) data by YCharts.

Supermicro’s forward earnings multiples are significantly lower than the trailing price-to-earnings ratio because of the massive bottom-line growth that the company is predicted to deliver. Analysts expect Supermicro’s earnings to increase a solid 86% in fiscal 2024, followed by a 40% jump in fiscal 2025 to $30.83 per share.

Now that Supermicro is looking to boost capacity through its common stock offering, there’s a good chance it will be able to boost its manufacturing levels and deliver stronger growth, considering the market in which it operates. That’s why savvy investors should consider buying this tech stock as it could regain momentum quickly.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Bitcoin Market Cap Hints at Potential Price Surge After Retesting 2021 Highs

A crypto analyst on X is confident that Bitcoin has bottomed and is poised for major gains in the sessions ahead. Interestingly, the bullish outlook hinges on the Bitcoin market cap retesting all-time highs at press time.

Will BTC Rally? Market Dynamics Changing

So far, the Bitcoin price is around 2021 highs in USD terms but recently broke all-time highs, peaking at around $73,800. This fluctuation is also reflected in its market cap. It currently stands at $1.25 trillion, down 5% in the past 24 hours.

Notably, it is at the same price level as in 2021, when Bitcoin prices peaked, recording new all-time highs.

While optimism abounds and the trader expects more sharp price expansions in the days ahead, it is not immediately clear whether the coin will rip higher, aligning with this forecast. Bitcoin is volatile and has remained so despite changing market dynamics.

At the same time, unlike in the past, Bitcoin prices are driven not only by retail forces but by institutions. These institutions are regulated by the United States Securities and Exchange Commission (SEC), which also approved the spot Bitcoin exchange-traded fund (ETF).

This Bitcoin derivative product has been the primary driving force in the past ten weeks. This is from looking at how prices have evolved since its approval in mid-January 2024.

However, since BlackRock and Fidelity are regulated by the United States SEC, unlike retailers, they cannot act as they wish. Considering the millions and billions of dollars at play, their comments or assessments on the coin, now and in the future, can greatly impact sentiment.

Sentiment Is Dented, BTC Facing Headwinds

Sentiment has been dented when writing. Even with the United States Federal Reserve (Fed) ‘s decision to hold rates at 5.5%, the highest in 2023, lifting prices, there has been no solid follow-through in price action. The coin remains steady below $70,000.

Whether prices will rally over the weekend remains to be seen. However, for now, there are some headwinds to consider.

First, there has been a slowdown in inflows to spot BTC ETFs. At the same time, outflows from the Grayscale Bitcoin Trust (GBTC) have increased. Second, after rallying sharply from October 2023, a cool-off before halving might see the coin trend lower.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Dogecoin open interest rose to a new all-time high earlier in March, and while there has been a small retracement, the open interest has continued to maintain very high record levels since then. Given this continuous high level, it could point to where the price of the meme coin is headed next using historical data.

Dogecoin Open Interest Maintains High Level

Open interest is a measure of the total number of futures or options contracts of a particular coin in the market at a give time. It can help to tell how much money is flowing into that particular asset, thereby revealing if there a high or love interest in the asset.

On Dogecoin’s part, its total open interest has been rising over the last few months, especially as the crypto market recovered, as shown by data from Coinglass. A natural consequence of this was that the price was also climbing at the same time as the open interest and thus, there is a high correlation between open interest and price.

The DOGE open interest hit a new all-time high of $1.47 billion on March 5, and the meme coin has not looked back since. Despite a small decline in the following days, the open interest is rising once again, reaching $.144 billion on March 14 and taking the price with it.

While the rise in open interest does point to a lot of bullishness in the market, historical performance during times like these also calls for caution. Taking a look at what happened the previous times that the Dogecoin open interest hit new all-time highs could give an idea of where the price is headed next.

Where Can DOGE Go From Here?

Over the years, there have been various points at which the Dogecoin open interest has reached new all-time highs and a trend has emerged, in a manner of speaking. Looking as far back as 2021 when the open interest hit ATHs multiple time, this trend plays out similarly.

A sustained rise until a new all-time high is reached, with the price rising along, and then followed by a crash in open interest, as well as price. This was the case in September 2021 when the open interest reached a new all-time high and then again in November 2021 when it clocked another ATH.

Moving forward, the same trend is seen in October 2021 when the DOGE open rose close to its previous all-time high, but ended the same way as the previous ones – with a crash. These crashes almost always affect the DOGE price as well, causing it to drop to the levels before the surge in open interest.

If this pattern holds this time around, then a crash might be ahead for the Dogecoin open interest and the DOGE price by extension. A likely scenario is a 20% drop that could send the DOGE price back toward $0.15 before the crypto market picks up steam once again.

DOGE bulls hold up price | Source: DOGEUSDT on Tradingview.com

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

As Bitcoin Hits New Highs, Nasdaq-Listed Miners Face Unexpected Declines

Despite bitcoin reaching another all-time peak on Monday, publicly traded mining stocks commenced the day with percentage declines. Stock linked to companies such as Marathon, Cleanspark, Riot, and various others have diminished in value compared to the U.S. dollar, even as bitcoin celebrates fresh price milestones. Mining Stocks Tumble on Nasdaq Nasdaq-listed bitcoin (BTC) miners […]

Despite bitcoin reaching another all-time peak on Monday, publicly traded mining stocks commenced the day with percentage declines. Stock linked to companies such as Marathon, Cleanspark, Riot, and various others have diminished in value compared to the U.S. dollar, even as bitcoin celebrates fresh price milestones. Mining Stocks Tumble on Nasdaq Nasdaq-listed bitcoin (BTC) miners […]

Source link

The S&P 500 is at its highest level ever, but that doesn’t mean that there aren’t any bargains to be found in the market. In fact, both I and colleague Tyler Crowe recently bought some stocks that look like incredible values for long-term investors, and in this video, we’ll tell you all about them.

*Stock prices used were the afternoon prices of Feb. 22, 2024. The video was published on Feb. 23, 2024.

Matt Frankel has positions in PayPal. Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy. Matthew Frankel is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

Filecoin surges to new highs fueled by pivotal Solana deal and AI sector growth

Filecoin has surged to a new yearly high amid significant development within its ecosystem.

The decentralized storage protocol’s FIL token price soared to a yearly peak of $8.43 but has slightly corrected to $7.92 as of press time, according to CryptoSlate data.

Notably, FIL is the only digital asset among the top 25 cryptocurrencies by market capitalization that saw a green candle in the last 24 hours, up more than 7% during the reporting period.

Over the past 30 days, FIL has grown by more than 63.61% and by 15% on the year-to-date metric. Despite this growth, Filecoin remains down about 96.54% from its all-time high of $236.965 in April 2021.

Why is Filecoin’s value rising?

FIL’s price performance can be attributed to several reasons, including recent developments within its ecosystem and the current artificial intelligence (AI) narrative pervading the broader market.

During the past week, Filecoin announced a significant partnership with the leading blockchain network, Solana.

According to the announcement, the collaboration would allow infrastructure providers, explorers, indexers, and anyone needing historical access to have seamless access to Solana’s block history.

“By leveraging Filecoin’s decentralized storage capabilities, Solana can achieve data redundancy, scalability, and enhanced security while staying true to its decentralized ethos,” it added.

Besides that, market observers have highlighted the current AI narrative as another reason for FIL’s bullish price performance.

Recent reports revealed that AI-linked tokens have rapidly gained after OpenAI announced its AI-powered video generation service, Sora. In addition, Nvidia’s recent earning report showed a massive demand for generative AI.

Considering this, Arthur Hayes, the co-founder of the BitMEX exchange, said, “All things AI-related [will] levitate.” According to him, this would push FIL’s price to $100.

Furthermore, a recent report from the protocol highlighted increased accessibility and demand for its products in the previous year. Notably, the protocol onboarded over 1,800 new large dataset clients and more than 180 clients to Singularity alone.