Solana, one of the top proof-of-stake blockchains, has integrated Filecoin, a decentralized file-saving blockchain-based system, to make its block history accessible for third-party apps. According to Filecoin, this will allow Solana to achieve improved redundancy and scalability for part of its data set while leveraging a decentralized solution like Filecoin. Solana to Integrate Filecoin to […]

Solana, one of the top proof-of-stake blockchains, has integrated Filecoin, a decentralized file-saving blockchain-based system, to make its block history accessible for third-party apps. According to Filecoin, this will allow Solana to achieve improved redundancy and scalability for part of its data set while leveraging a decentralized solution like Filecoin. Solana to Integrate Filecoin to […]

Source link

historic

With bitcoin’s value rising past the $51,000 mark, numerous long-dormant bitcoin hoards have begun to mobilize unspent transaction outputs (UTXOs) that have remained untouched for an extended period. Although instances involving ‘sleeping bitcoins’ from the years 2009, 2010, and 2011 are considerably scarce, there’s been a noticeable resurgence of older coin batches from 2012, 2013, […]

With bitcoin’s value rising past the $51,000 mark, numerous long-dormant bitcoin hoards have begun to mobilize unspent transaction outputs (UTXOs) that have remained untouched for an extended period. Although instances involving ‘sleeping bitcoins’ from the years 2009, 2010, and 2011 are considerably scarce, there’s been a noticeable resurgence of older coin batches from 2012, 2013, […]

Source link

Renowned macroeconomist Henrik Zeberg has set the financial world abuzz with a stark prognosis on X (formerly Twitter), forecasting a dramatic surge in the Bitcoin price to a peak of $115,000 to $150,000. However, this meteoric rise is predicted to find an abrupt end, caused by a devastating macroeconomic downturn, one that Zeberg anticipates will be the most severe since the 1929 crash.

Why A Recession Will Hit The US In 2024/2025

At the core of Zeberg’s argument are seven reasons. Zeberg asserts, “Our Business Cycle has flashed a recession signal in 2023. Leading Indicators have crashed under our Equilibrium Line. In 80 years of data, the recession Signal from our Model has NEVER been wrong. No false signals – ever!” This model, with its unwavering accuracy over eight decades, forms the bedrock of his grim forecast.

Zeberg also delves into the significance of yield inversion, a well-documented precursor to economic downturns. Despite the signal’s dismissal by analysts in 2023 due to impatience, Zeberg emphasizes its historical reliability, noting, “From the bottom of the Yield Inversion, we normally see 12-15 months before a recession sets in. This signal is very much alive!” His remarks underscore a widespread underestimation of this critical indicator.

The economist further examines the trajectory of US industrial production, drawing alarming parallels to the period just before the 2007-08 financial crisis. He observes a similar pattern of divergence and warns of a strong impending drop in industrial production, signaling the onset of a recession.

Zeberg’s analysis extends to the housing market, where he highlights the plummeting NAHB index as a significant warning sign. “The bigger the decline in NAHB – the larger the rise in Unemployment,” he states, pointing to the direct relationship between housing market distress and the broader economy. This situation is exacerbated by rising interest rates, which lead to reduced consumer spending and, consequently, an economic downturn.

Moreover, personal interest payments are another cornerstone of Zeberg’s argument. He notes the historical pattern where increases in market rates burden consumers with higher mortgage and debt payments, ultimately leading to recessions. “Every rise in rates over the years has caused a recession, as consumers need to pull back on their Consumption,” Zeberg cautions, highlighting the lag inherent in the economic business cycle.

Housing affordability, or the lack thereof, is also a critical component of his analysis. With affordability plummeting below levels seen before the financial crisis, Zeberg paints a grim picture of the near future, where a deteriorating unemployment situation could lead to widespread defaults and a housing market collapse.

Lastly, Zeberg points to the bloated inventory levels of retailers and companies worldwide. He describes this as a hangover from the demand hype of 2021-22, driven by stimulus funds that have since dried up. This mismatch between supply and anticipated demand, he suggests, is a ticking time bomb for the economy.

Bitcoin: A Mirage Before The Storm

In the midst of this dire economic forecast, Zeberg casts a unique spotlight on Bitcoin. He predicts a fleeting period of euphoria for the cryptocurrency, with its value skyrocketing to an all-time high, potentially reaching between $115,000 and $150,000. He also provocatively states, “@Peter Schiff: See you at BTC = 100X 1 ounce of Gold.”

See you at BTC = 100X 1 ounce of Gold

— Henrik Zeberg (@HenrikZeberg) January 17, 2024

However, Zeberg cautions that this surge is part of a broader misleading narrative. “The Soft Landing Narrative is what will dominate into the top in #Equities #Crypto #BTC,” he elaborates. This narrative, according to him, is a mirage that will mislead economists and analysts as they try to rationalize the ‘blow off top,’ a phenomenon they failed to forecast.

The reality, as Zeberg sees it, is starkly different: “Stock Market and Crypto will SOAR into early 2024. Euphoria will develop. Everybody will get onto the wrong side of the boat – just as Equity and Crypto Markets put in a major top. Recession sets in a few months later in 2024.”

In conclusion, Zeberg’s analysis foresees a major recession, one that he believes is inevitable and imminent. “The Titanic has already hit the Iceberg – and it will sink,” he starkly notes, dismissing any interventions from the Fed or any administration as futile.

The question is how Bitcoin might behave in a recession, something the cryptocurrency has not experienced since its inception in 2009. Will BTC become a safe haven, or will it follow the fate of equities, as Zeberg predicts?

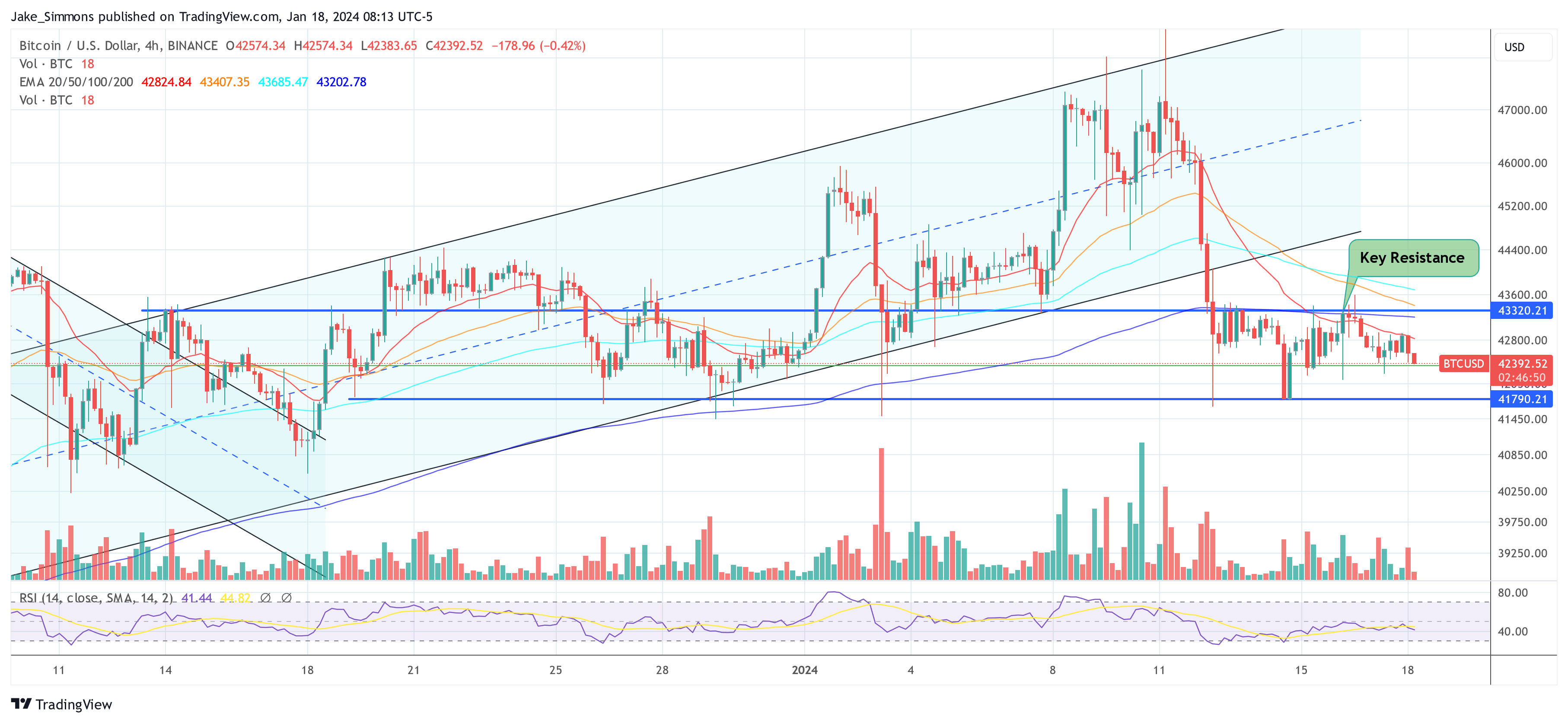

At press time, the Bitcoin price continued its sideways trend, trading at $42,392.

Featured image from DALL·E , chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin futures margined in BTC hit historic lows as cash options prevail

Quick Take

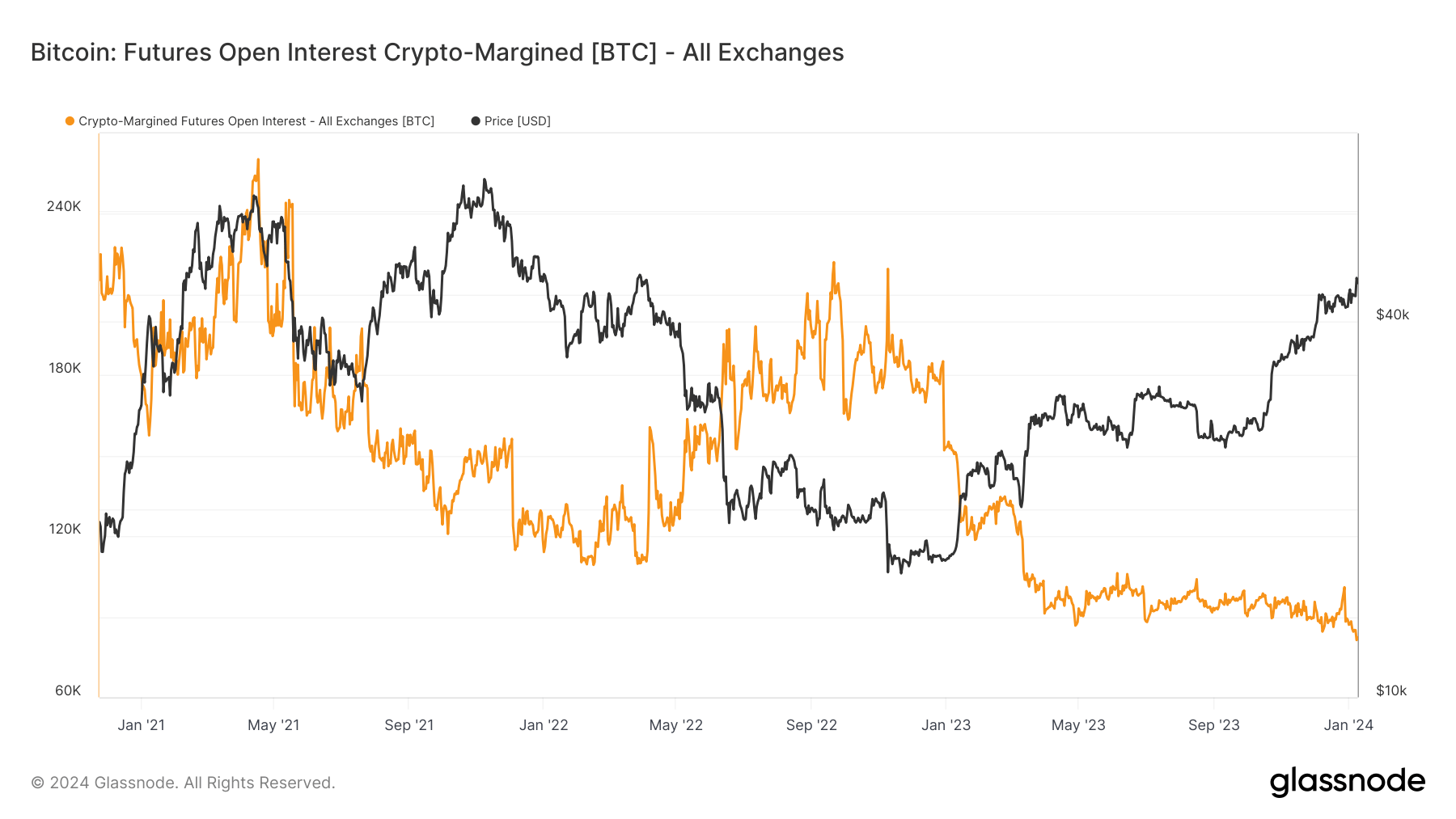

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX’s holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

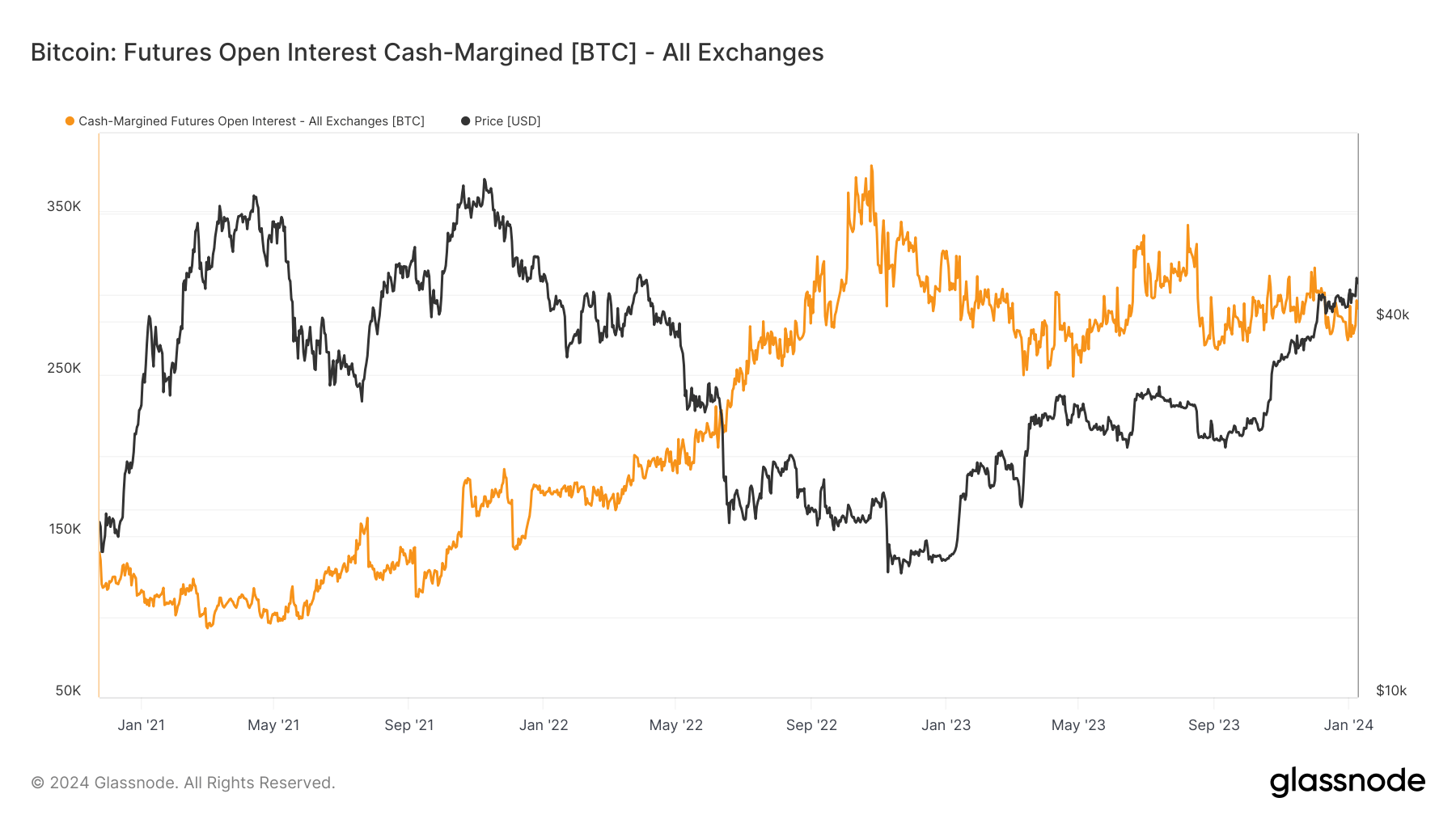

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin’s shift from volatile futures to more stable cash margins could signal reduced market volatility.

The post Bitcoin futures margined in BTC hit historic lows as cash options prevail appeared first on CryptoSlate.

Bitcoin continues its winning streak, marking a potentially historic fourth month

Quick Take

As per Coinglass data, Bitcoin appears to be carving a path of consistent gains, eyeing its fourth successive month of profitability. Breaking down the numbers, Bitcoin demonstrated a weekly profitability streak of eight, a record unseen in recent years. The last quarter of 2023 witnessed a steady climb, with September logging a 3.91% gain, October a substantial 28.52%, November 8.81%, and December so far with a healthy 12.07%.

Interestingly, this isn’t Bitcoin’s first series of consecutive profitable months in 2023. The digital asset had previously delivered a solid performance from January to April. Taking a stroll down memory lane to the bull run of 2020 to 2021, Bitcoin outdid itself with six unbroken months of gains from October 2020 to March 2021, a record for the digital asset. In comparison, 2017 and 2019 saw five back-to-back profitable months.

Looking forward, Bitcoin must maintain three months of profitability in the first quarter for a record-breaking attempt. With the prospect of an ETF and an impending halving, the stage is set for possible disruption.

The post Bitcoin continues its winning streak, marking a potentially historic fourth month appeared first on CryptoSlate.

Lumen Technologies Inc. shares sold off sharply in the wake of earnings, but the telecommunication company’s chief executive has been buying.

CEO Kate Johnson scooped up 1 million Lumen shares

LUMN,

Thursday at an average price of 97 cents, spending $970,000 on the purchase, according to a filing with the Securities and Exchange Commission released Friday.

Johnson’s buying spree came on the heels of a historic selloff in Lumen shares Wednesday, as the stock fell 32.9% to 98 cents and clinched its largest single-day percentage decline on record. Shares touched as low as 78 cents in Thursday’s session, the day of Johnson’s purchasing, though they ended that session at $1.06 and then moved higher Friday as well, to close the week at $1.12.

After buying the latest batch of stock, Johnson now owns over 5.1 million Lumen shares directly, according to Friday’s filing.

“Kate’s decision to purchase shares speaks to her confidence in the long-term potential of Lumen and her commitment to our success,” a Lumen spokesperson said in a statement.

Johnson took over as Lumen’s CEO about a year ago and has been tasked with steering a turnaround for the company, which provides networking, cloud storage and more. Shares have tumbled 81% over the past year and 91% over the past two years.

The company, once known as CenturyLink, announced a new credit agreement earlier this week and disclosed that it planned to scale back fiber investments and headcount.

Analysts still aren’t sold on the company’s attempt at a transition.

“Although we like the improved liquidity position and effort to invest and return to growth at Lumen, we expect continued pressure on fundamentals in 2023 and 2024 due to multiple years of under-investing in the Enterprise asset base and rising competition from fiber overbuilders, [fixed-wireless access], and cable to pressure mass-market revenue at the same time as Lumen has scaled back on its build,” JPMorgan’s Philip Cusick wrote Wednesday.

He rates the stock at underweight, saying that he’s “skeptical on shares as revenue declines continue, leverage inches higher, and the company attempts to execute an unproven and very capital-intensive strategy.”

MoffettNathanson’s Nick Del Deo was similarly cautious in light of revenue pressures seen again in the latest quarter. “Net net, it’s the top line that strikes us as most important: Absent better top-line performance, it’s hard to make the rest of the model work,” he wrote late Tuesday, while sticking with his sell rating and $1 target.

IRS will pursue 1,600 millionaires who owe back taxes — promises ‘sweeping and historic changes’

The Internal Revenue Service is going after hedge funds, large law firms, partnerships and more millionaires as its compliance clampdown continues, the tax agency’s commissioner said.

One year after Congress approved billions in extra funding for the IRS to improve operations and revive high-end tax enforcement that flagged during the past decade, the agency is now getting specific about where it’s planning to make sure it’s collecting all taxes due.

The IRS is also refining its methods for spotting enforcement targets: by using artificial intelligence, in certain cases.

The IRS has its eyes on approximately 1,600 millionaires who owe at least $250,000 apiece in tax debt. All together, they owe “hundreds of millions of dollars,” Werfel said. The agency said in July that it’s already collected $38 million in back taxes from 175 millionaire taxpayers.

“These are sweeping and historic changes that will alter the landscape of our compliance work,” IRS Commissioner Danny Werfel told reporters Thursday evening.

“‘These are sweeping and historic changes that will alter the landscape of our compliance work.’”

— IRS Commissioner Danny Werfel

Audit rates by the increasingly short-staffed and cash-strapped IRS have been dropping in recent years for all income levels, but particularly for extremely rich taxpayers.

There’s a range of estimates on the gap between taxes owed and actually paid. In 2021, Werfel’s predecessor Charles Rettig said it could be as large as $1 trillion each year because the tax agency didn’t have the resources to dig into many complex returns.

The IRS’s latest announcement is the agency’s latest attempt to narrow that gap.

There will also be a fresh batch of audits for 75 large partnerships, Werfel said. These entities include hedge funds, real-estate investment partnerships, publicly-traded partnerships and large law firms.

The organizations – each averaging $10 billion in assets – will be told of the audits in the coming weeks, Werfel said.

These types of audits are complicated, and even after examination an audit can result in no change for the tax bill. IRS officials are betting these reviews will reap extra tax revenue after using artificial intelligence to spot suspicious patterns and trends.

“IRS will renew efforts to audit hedge funds, real-estate investment partnerships, publicly-traded partnerships and large law firms.”

The IRS doesn’t know how much it could collect from these partnerships and the process could be lengthy and litigious, Werfel said. “But we absolutely believe this is the right thing to do to make sure there is tax fairness,” he said.

Starting next month, the IRS will also mail out letters to around 500 partnerships that are worth at least $10 million. The IRS has questions about their balance sheets and if the agency isn’t satisfied with answers, more audits may follow.

The IRS is also stepping up scrutiny for taxpayers with cryptocurrency holdings and foreign bank accounts, Werfel said.

The Inflation Reduction Act, which was enacted in August 2022, included $80 billion to upgrade staffing and raise the number of audits for businesses and rich taxpayers. The money will not be used to increase enforcement on households making under $400,000, Biden administration officials said.

In wrangling to raise the debt ceiling earlier this year, the White House agreed with Republican negotiators to redirect $20 billion of that $80 billion.

Friday’s enforcement announcements are concrete next steps for an agency that’s eager to show how it’s planning to use the money to upgrade — especially as negotiations continue over its annual base budget.

The audits require staff with the skills to sift through complex returns. But the IRS still has a long way to go to have the people ready for the task, a recent watchdog report showed.

The agency’s Large Business and International Division had a net loss of 82 revenue agents during fiscal year 2023, when 97 departing agents exceeded 15 new hires, according to a report from the Treasury Inspector General for Tax Administration.

In the agency’s Small Business/Self-Employed Division, there was a net loss of 186 revenue agents, the report said this week.

The IRS aims to get back to a 90,000 full-time-employee headcount, which it hasn’t been at in more than a decade, Werfel noted.

The first hiring burst included 5,000 customer-service assistants, and extra audit staff is the next step, Werfel said. Meanwhile, he said the agency is also shifting staff to higher-end audits while the hiring effort continues.

“We have more work to do in hiring exam personnel. On that front, it’s going to be a very busy fall for us,” he said.

The tech industry was abuzz in 2020 when Nvidia announced its ambitious plan to acquire Arm Holdings from SoftBank for a staggering $40 billion before its planned IPO.

British semiconductor and software design company Arm Holdings plc recently revealed that multiple technology giants, including Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL), and Nvidia Corp (NASDAQ: NVDA), are interested in purchasing up to $735 million in its shares as it eyes an Initial Public Offering (IPO).

Tech Giants Show Massive Interest in Arm Holdings IPO

While these investments are not certain, their mere consideration highlights Arm’s enormous position in changing the technology world, with its designs powering processors in data center servers, consumer devices, and industrial products.

The impending IPO of Arm Holdings is attracting more attention and intrigue than ever before. Along with Apple, Google’s Alphabet, and Nvidia, a host of semiconductor industry leaders and innovative firms have also expressed an eagerness to invest in Arm.

Notably, Intel Corp (NASDAQ: INTC), Samsung Electronics Co Ltd (KRX: 005930), and Taiwan Semiconductor Manufacturing Co Ltd (TPE: 2330) have joined the race, along with Advanced Micro Devices Inc (NASDAQ: AMD), MediaTek Inc (TPE: 2454), Cadence Design Systems Inc (NASDAQ: CDNS), and Synopsys Inc (NASDAQ: SNPS).

As a result, Arm’s IPO, if successful, could lead to a market capitalization of $52 billion and inject nearly $5 billion in fresh capital into the company. This diversified group of investors emphasizes Arm’s critical role in the semiconductor and technology ecosystem.

Meanwhile, the tech IPO landscape has experienced a noticeable slowdown over the past two years, primarily due to the impact of rising interest rates, which has made investors more cautious about betting on high-growth, high-risk companies.

However, Arm stands out as an exception. Its unique trajectory, from its proposed IPO in London and New York to its acquisition sets it apart from the typical tech IPO narrative.

Nvidia Corp’s Unwavering Backing in Arm

The tech industry was abuzz in 2020 when Nvidia announced its ambitious plan to acquire Arm Holdings from SoftBank for a staggering $40 billion before its planned IPO. However, regulatory hurdles in both the United States and the United Kingdom led to the abandonment of this acquisition in 2022.

Yet, Nvidia’s interest in Arm remains unwavering, and it is evident that the two companies continue to see a promising future together, even if it’s not in the form of a direct merger. Nvidia’s co-founder and CEO, Jensen Huang, has been an enthusiastic advocate for Arm during Arm’s current IPO roadshow.

In a prerecorded video presentation, Huang lavishly praised Arm. He referred to Arm as an “extraordinary company” and highlighted the platform’s value, franchise, and world-class management team. His words resonated with the tech community, emphasizing that Arm’s significance goes far beyond its potential as a merger partner.

Nvidia’s collaboration with Arm extends beyond rhetoric. The company is actively working with Arm on the development of a new cloud data center ecosystem. Historically, Intel’s x86 architecture has been the dominant force in data center servers. However, with Arm’s energy-efficient designs and Nvidia’s computational prowess, this partnership could usher in a new era for data center technology.

The collaboration aligns with the industry’s growing emphasis on energy efficiency, performance, and scalability. Arm’s architecture has already made significant dominance in data center servers, and Nvidia’s involvement could accelerate this trend.

next

Business News, IPO News, Market News, News, Stocks

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Crypto markets are booming after historic XRP ruling; BTC and ETH both break critical barriers at 31k and 2k

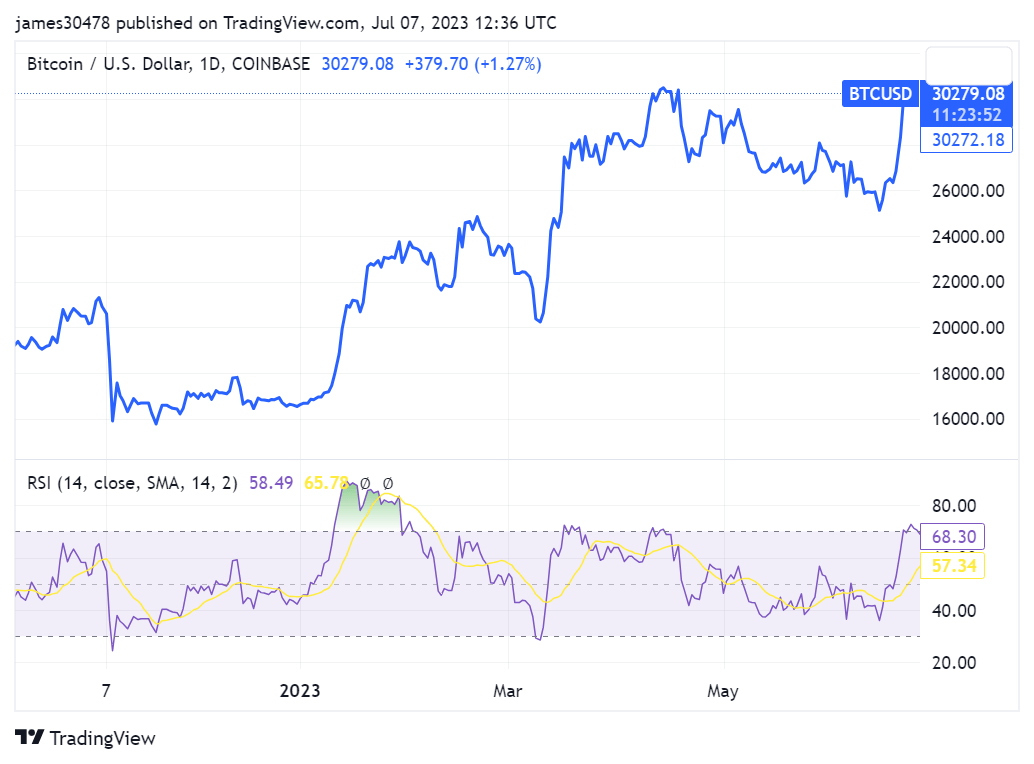

Bitcoin and the rest of the cryptocurrency market saw significant gains after Ripple secured a victory against securities regulators on July 13.

As of 8:30 p.m. UTC, Bitcoin (BTC) had gained 4.3% over 24 hours, achieving a $31,594.31 market value and a $613.8 billion market cap. That change represents more than a one-year high, as the asset has not seen comparable prices since June 2022.

Ethereum (ETH), meanwhile, gained 6.9% over 24 hours for a market cap of $239.8 billion. Its price briefly surpassed $2,000.

Those gains were likely influenced by the outcome of a legal case between Ripple and the U.S. Securities and Exchange Commission in which courts ruled that Ripple’s XRP sales are not securities. XRP itself gained 73% over 24 hours to reach a $42.6 billion market cap, making it the 4th largest cryptocurrency at present.

At least two major crypto exchanges — Coinbase and Gemini — have decided to list or are considering listing XRP following Ripple’s legal victory. Those decisions could further support the price of the XRP token.

Three coins named in unrelated SEC cases against Coinbase and Binance are also among the biggest gainers today: Cardano (ADA) rose 19.5%, Solana (SOL) rose 17.3%, and Polygon (MATIC) rose 17.8%. Those gains are perhaps due to more general optimism that is possible for crypto companies to win cases against regulators.

Various other assets have also seen gains. Stellar (XLM), which has early ties to Ripple but is otherwise an independent project, saw gains of 62.4%. The entire crypto market has gained 6.5% over 24 hours for a total market capitalization of $1.3 trillion.

Liquidations reach $236 million

Meanwhile, the crypto market saw $238.37 million in liquidations over a 24-hour period. That total includes $52.01 million of long liquidations and $186.36 million of short liquidations. About 66,800 traders were liquidated in total.

Three assets saw the most liquidations. Bitcoin saw $55.67 million in liquidations, Ethereum saw $37.81 million in liquidations, and XRP saw $47.97 million in liquidations.

Binance was responsible for $85.88 million in liquidations, while OKX was similarly responsible for $68.74 million in liquidations. Together, those two exchanges were responsible for about two-thirds of all liquidations across the cryptocurrency market.

Various other exchanges, including Bybit, Huobi, and CoinEX, were responsible for the remainder of those liquidations, as shown below:

The events of the day represent rare positive news amidst the crypto industry’s latest bear market. Though the broader implications of the Ripple case are still unclear, the latest developments seem to have generated optimism among cryptocurrency investors.

Quick Take

Data from Zerohedge on U.S. data

- June nonfarm payrolls 209K, Exp. 230K, Last 339K

- Unemployment rate 3.6 %, Exp. 3.6%, Last 3.7%

- Average hourly earnings 0.4%, Exp. 0.3%, Last 0.4%

- Average weekly hours all workers 34.4, Exp. 34.3, Last 34.3

- Bitcoin up 1.3%, $30,300

The post Unemployment rate stays at historic lows, Bitcoin jumps 1.5% appeared first on CryptoSlate.