Veteran trader Peter Brandt has warned that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler should not be trusted. He stressed that Gensler “has a long history of not looking out for the interests of investors.” Brandt further emphasized that the SEC chairman “was instrumental in the bankruptcy” of a major company and was […]

Veteran trader Peter Brandt has warned that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler should not be trusted. He stressed that Gensler “has a long history of not looking out for the interests of investors.” Brandt further emphasized that the SEC chairman “was instrumental in the bankruptcy” of a major company and was […]

Source link

History

In this podcast, Motley Fool host Mary Long caught up with Motley Fool analyst Jason Moser for a conversation about the publicly traded companies associated with the Super Bowl to dig into whether any are worth an investor’s attention.

Mary also interviewed Dave Schwartz, ombuds at the University of Nevada, Las Vegas, and a student of gambling history.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. To get started investing, check out our quick-start guide to investing in stocks. A full transcript follows the video.

10 stocks we like better than Walmart

When our analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

See the 10 stocks

*Stock Advisor returns as of 2/12/2024

This video was recorded on Feb. 10, 2024.

Dave Schwartz: Traditionally, the NFL thought that gambling was terrible, Las Vegas was even worse at gambling. Even now that reason because we’re having gambling scandals, and cheating scandals in the past in football and baseball and other sports, professional amateur so it makes sense if people want [inaudible]. But they continue to have this policy long after gambling had become more mainstream within the United States. Long after we have casinos all across the country, they continue to have this. It’s interesting that as the national prohibition on the spread of sports gambling fell, the league’s policy changed.

Mary Long: I’m Mary Long, and that’s Dave Schwartz. Ombuds at the University of Nevada, Las Vegas, and a student of gambling history. I caught up with Schwartz for a look at the history of sports betting and what it means today. But first, I talk with Jason Moser about four publicly traded companies with ties to the Super Bowl to see if any of them are worth investors attention. Tomorrow at the Kansas City Chiefs face off against the San Francisco 49ers in Las Vegas, Nevada. It’s a Super Bowl and you know what they say, if you can’t go to the Super Bowl, make your own Super Bowl so that’s what we’ve done. Jason, excited to be here with you.

Jason Moser: Happy to be here, Mary. Thanks for the invite.

Mary Long: We’ve got four stocks, each representing a different element of Sunday’s Super Bowl game. We’re going to talk through each of these teams, and at the end, I’ll ask you, which stock is the winner in your mind. Let the games begin. In one corner, we’re repping the San Francisco 49ers we’ve got United Airlines. United is the presenting sponsor of the 49ers. It’s also the official airline for both teams. But for our purposes, we’re going to put United solely with San Francisco. The airline industry uses some metrics that might be unfamiliar to investors who are newer to the industry or just exploring it. How do you grade airline stocks and where on that scale would you put United?

Jason Moser: Well, so in grading airline stocks, I will say first and foremost, I’ve just never been an investor in airlines personally. To me, it’s not the most attractive long term type holding. The capital requirements, the constant fuel hedging, it’s certainly an industry where size does matter. But whenever I hear about investing in airlines, it just takes me back to that Warren Buffett quote from 2007. He wrote in the Berkshire Letter. He said, ”If a far sighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orval down.” Obviously, he’s kidding and he even had a little bit of a turnaround there and tried some airline investments as well. It didn’t work out so great. But when you look at the data from this industry, the data I found, and compiled by airlines for America, since 1978, there’s been over 100 bankruptcy filings in the airlines industry. They’ve not all resulted in liquidation, but this is just an industry rife with bankruptcies and that’s obviously, not a good thing. But like I said, size does matter. You look really too I think, the big players in the space as the ones that probably stand the best chance. United absolutely stands out in that way. As far as metrics, I think one that stands out to mean the load factor, that’s something that ultimately measures the percentage of available seating capacity that’s been filled with passengers. Higher means that an airline has sold most of its available seats, and so I think that can give you an idea, at least to the health and consistency of any given airline. But it’s absolutely a difficult space to invest in.

Mary Long: There’s a difficult aspect of the space because the bankruptcy like you mentioned, just massive upfront costs. But also more recently we’ve seen shorter-term issues also plague the industry. I feel you can’t talk about airlines today without talking about many issues, not least of which is Boeing‘s chaos that’s happening. How is that in particular affecting United’s operations?

Jason Moser: Well, with United, the short answer is it’s a big deal. United has plenty of exposure to this particular plane. If you go back to the earnings call recently, they noted as of Saturday January 6, the MAX 9 aircraft had been grounded, and they noted a call. They’re the largest operator of the Boeing MAX 9 and that represents approximately 8% of their capacity from the first quarter. Clearly, that’s something that matters a lot for United. That speaks to I think, one of the short term challenges that they’ve been witnessing. It’s absolutely playing out in their guidance looking toward 2024. They’re spending in particular, they’re expecting reduction in orders and deliveries from Boeing all the way out into 2025. That ultimately requires them to go in there and rework their fleet plan and exactly how they’re going to manage this. One of those near term headwinds that is absolutely going to impact United more so than others, something investors definitely want to keep in mind.

Mary Long: Playing on behalf of Kansas City, we’ve got the official soup sponsor of the Chiefs none other than the Campbell Soup Company, Ticker CPB. Despite the name, it’s not just soup that Campbell sells. They also own Pepperidge Farm of Goldfish Fame, Pop Secret popcorn, Cape Cod potato chips, lots of snacks basically. Campbell’s breaks down their revenue into two different segments, meals and beverages as one and then snacks as another. That snack segment has accounted for an operating profit of 640 million in fiscal 2023. That’s 42% of its total profits, even in the age of Ozempic are snacks big business?

Jason Moser: Absolutely, they’re a big business. We love snacks. We all love our snacks. Whether it’s sweet, salty, a mix of the two, snacks are very big business and it’s absolutely been a driver for Campbell. If you look at the data, at their statistic data actually, says that revenue for the US snack food market is set to hit $114 billion here in 2024. It’s expected to grow annually, close to 4% through 2028. That’s not mind bending growth, but it is pretty reliable and pretty steady. Then when you look at another, I think shining snack example out there in the market, like Pepsi. Pepsi I think is a great example of a company that has benefited through the years by building out their snack side. Just to put that in context, their free to lay business went from $15.8 billion in revenue in 2017 to $23.3 billion in 2022. Talking about going to the numbers because they tell the tale, Mary. I think those numbers tell us a lot.

Mary Long: Over the past 10 years, you look at Campbell’s stock price and it hasn’t moved too much. There’s ups and downs, but it’s leveled out over time. Neither has its operating income. What needs to happen for Campbell to not just beat its competitors in this fool bowl that we’re playing today, but in the market?

Jason Moser: It’s going to be difficult I think that what we’re seeing with Campbell is that they are trying to really hone their portfolio of offerings for where the future of food is going ultimately. Part of that is in packaged foods. I think part of that is we’re going to see some acquisitions from this company going forward as well though, they just acquired Sovos Brands which gives them Rao’s. I think that’s how you pronounce it Rao’s, the pasta sauce in a number of other ancillary brands and prepared meals. That’s where they see a lot of opportunity there. But you’re right, the growth, this company’s lobbed up, it’s nothing to write home about. It’s not been a winning stock for investors just based on returns. Ultimately, when organic growth runs dry, when the company has trouble just growing on its own, then they start leaning on some of those acquisitions in that consolidation. I understand that strategy, but acquisitions do come with their share of risk.

Jason Moser: It’s going to take a number of different efforts I think for this to ultimately be a market beating stock going forward.

Mary Long: Growth is not the story here but Campbell has a decent defensive line we might say. Stock pays a 3.44% dividend. That dividend has been around for several decades and with few exceptions has increased relatively regularly. Does that make this a more compelling case for a portfolio?

Jason Moser: I think it certainly makes for a better argument in holding the stock. I think anytime you’re getting a 3% or better yield on a dividend-paying stock, that’s a good thing. That’s a healthy yield and we like to see that. Now if we look at the total return for this company over time, over the last 10 years a total return for Campbell shareholders has been close to 50% versus the markets 180% or so. This is clearly a company that has lagged the market significantly. Again I think dividends are great. I want them, I’m getting older and I’m moving more of my portfolio over toward income bearing investments there but this doesn’t really look like the best income idea out there. It’s not a dividend aristocrat, it’s not a dividend king, it’s not to say it can’t be one day but those are the companies I think we want to look more toward when we’re looking for really reliable dividend payers. Those companies that have grown their dividends annually for at least 25 consecutive years or if you’re a king status and that 50 years, that really tells you that dividend is a priority and once those companies achieve that status they really do everything in their power to not relinquish it because investors really do care about it.

Mary Long: Playing on behalf of Las Vegas and Allegiant Stadium we’ve got Allegiant Travel which is not your typical airline it seeks to be an integrated travel company. In addition to running Allegiant Airlines, the company officially opened Sunseeker Resort in Florida in mid December of last year. They’ve also acquired a golf course management software company called Teesnap. They’re looking to launch a family gaming center that has laser tag, go carts, bowling, you name it. We talked about airlines already. Seems like that’s a hectic enough, expensive enough business to be a part of. Why take on even more? Is that something that differentiates Allegiant or does it diversify it?

Jason Moser: It could be maybe a little bit of both. I think it absolutely differentiates it. Because you and I were talking before we started recording and that was one of the things with Allegiant that makes it stand out, it’s not just one of those discount airlines, it’s more, and that could potentially be a good thing. Now it absolutely could run that risk of diversification. Just trying to do too many things and not really doing anything well. But I think it’s compelling. It makes me want to look at Allegiant a little bit more closely because when you consider the size of the travel and experience market, all together they really are focusing on not just the travel but the experience and entertainment side of it as well. That can be very powerful assuming that they do it well. The company IPO back in 2006, it’s still a true small cap; one-and-a-half billion dollar market capitalization. It is not a company that has grown by leaps and bounds but it does seem like they’re taking these steps in order to try to be able to grow here in the coming years. Time will tell whether that actually works or not but listen, I respect the effort.

Mary Long: Allegiant has pulled a bit of a Disney in the past year. Former CEO Maury Gallagher is now CEO once more. He replaced John Redmond this past fall after Redmond had been in the spot for less than a year. Redmond resigned. We don’t really know why, but Gallagher had been with the company for a while. He’s been a majority owner and board member of Allegiant since 2001. Basically brought Allegiant from being one plane to a fleet of over 100. He’s played a role in several low-cost airlines. Unlike other airlines, Allegiant’s stock peaked mid-pandemic in 2021 but today it’s still off about 70% from those highs. Is Gallagher’s returned the beginning of a turnaround story?

Jason Moser: Well, I hope. It seems like that’s the guy that could probably make it happen given his track record. Bringing an airline out of bankruptcy and obviously, we talked about that earlier with United. Bankruptcy was just a common word in this space. But that also can present opportunities and it seems like Mr. Gallagher is certainly trying to take advantage of that opportunity. Looking through their most recent earnings call, they seem very optimistic with the strategy. They are getting some headwinds in regard to pilot negotiation issues behind them and I think that’ll be a load off of the business. Right now today, 75% of their roots don’t have any direct competition at all so they do stand out a little bit in that way. I think that’s one of the things that’s most interesting about this company is they know what they are and what they’re trying to be. They’re not out there trying to compete in those big cities and networks where all of the money is. They’re really trying to do their own thing. They said in the call I thought this was a pretty interesting way to put it. He said, “We’ve created our own private swim lane and are proud to be in it.” They really are a company focused on their identity doing things their way and focusing on that particular market opportunity. Hey, listen, I like that.

Mary Long: If you’re not at Allegiant Stadium to watch the game, you’re probably watching the Super Bowl on a screen in which case you’ve got Paramount Plus to thank. The streaming business is not awesome if you’re not Netflix, where does Paramount Plus fit into that picture?

Jason Moser: Well, if you look back at their earnings call in November of last year Paramount Plus the streaming offering crossed 63 million subscribers. I was actually surprised to see that number that high. This is not a company that I have followed very closely because like you said streaming sucks unless you’re Netflix. [laughs] I think that really speaks to a lot of things Netflix did right early on in their efforts there. But Paramount Plus 63 million subscribers they deliver 38% direct to consumer revenue growth. They were able to increase prices a little bit. That’s all very encouraging. Now it all does come at a cost. That content just continues to get more and more expensive. To me I think this is just a space that is going to witness a lot of consolidation in the coming quarters in years. If I’m a betting man, I think that Paramount probably ends up being a part of something bigger there but there’s no doubt they have a portfolio of content that a lot of viewers really place a lot of value in because 63 million subscribers, that has nothing to seize that.

Mary Long: Consolidation seems like that will be a likely story for Paramount moving forward or even earlier this week news broke that media mogul, Byron Allen, who owns the Weather channel among other local TV stations made a $14.3 billion offer to acquire Paramount Global. Allen’s deal offers shareholders a 50% premium on the current share price. If you are a shareholder, are you praying that the deal goes through or are you holding out and hoping for a realistic larger growth story beyond being bought?

Jason Moser: I personally would be hoping for an acquisition just get out of this thing and go for. Now I don’t own Paramount shares and I don’t think that I will. But for me again just streaming in particular, it is just a very difficult space in speaking to that consolidation theme, I mean, it is. We’re just seeing it all over the place. Paramount Plus even recently, they incorporated showtime into that offering so like with the price points there you had you could do Paramount Plus essential which is just six dollars a month or if you want to do Paramount Plus plus Showtime that’s essentially double the cost. But even just there’s a little consolidation going on even in their own universe. Then we saw also this recent announcement just the other day ESPN, Fox and Warner Brothers Discovery teaming up for a new sports streaming service and Disney trying to figure out exactly how to move forward with that ESPN strategy. To me Netflix has taught us a lot. They taught us that the economics of streaming are really difficult and that being early to the game for them made a really big difference. Now it feels when a new streaming service is announced people get a little bit more fed up with the whole thing. Remember we’ve talked about Zoom exhaustion before. That’s totally a thing and I think there’s a similar dynamic that’s now playing out with all of these streaming services so they have to be very thoughtful in the new services they announce and how exactly how much they’re going to be charging for them because consumers are getting close to having had enough.

Mary Long: Jason, we’ve talked airlines, we’ve talked soup and snacks. We’ve talked integrated travel and streaming. Which of these teams has your bet to win Fool Bowl 2024?

Jason Moser: Well, if you look at the track record of all four, none of these four has really lit the world on fire so to speak. Let’s assume Paramount is going to ultimately be acquired. I think that that’s more than likely a given. Even if it weren’t going to be acquired, to me I think actually I’d like to learn a little bit more about Allegiant. I still don’t have much of a desire to invest in a pure play airline but to me with Allegiant, this is more a travel company and entertainment company which could be a little bit more compelling. I like that they know their customer, they seem to be laser-focused on that particular opportunity as opposed to doing other things that they may not really be able to compete so effectively on. I don’t know, I’m going to be keeping my eye on Allegiant here.

Mary Long: Unlike the Super Bowl we won’t know who wins out tonight or tomorrow but well, we’ll keep our eyes posted on what happens in the long term.

Jason Moser: But we’ll revisit it next Super Bowl.

Mary Long: Bingo. For Fool Bowl 2024. That’s hard to say. I did not do myself a favor with that one.

Mary Long: Up next is my conversation with Dave Schwartz, Ombuds at the University of Nevada, Las Vegas, and a student of gambling history. I wanted to talk to you because our relationship with the nation as gambling has changed a lot in recent years. Before the ’80s, you could really only bet in two places, Nevada and Atlantic City. Today, sports betting is legal in 38 states plus DC, and we all walk around with virtual casinos in our pockets. How did gambling go from being mostly illegal and mostly stigmatized to mostly everywhere?

Dave Schwartz: It has been an interesting process and a lot of it was driven by money. I guess not surprising because it’s gambling. Basically casino style gambling for many years was only legal in Nevada, New Jersey, rolled the dice in it, legalized it in ’76. It started in ’78 and other states and the federal government saw this be used to make some money that could help. Atlantic City, it was for urban redevelopment. Tribal gaming, of course, was also recognized and came along in the ’80s and ’90s and a lot of states legalized gambling. Most of the idea was, look, people are going to be doing this anyway, but if we legalize it, we can gain some benefit from it.

Mary Long: I want to hone in on one organization’s role in this changing relationship with gambling in particular, Super Bowl Sunday is coming up. The NFL used to pretty strongly oppose not just sports betting, but Las Vegas in particular. In 2003, the Las Vegas Convention and Visitors Authority attempted to buy air time for a Super Bowl commercial. They were flat out denied. There’s been like this firewall of sorts between the league and Las Vegas this year. The Super Bowl is in Las Vegas. How did the NFL in particular come to embrace Sin City?

Dave Schwartz: I have a feeling that three quarters of a billion dollars in public funding really helped change that relationship. That, of course, is what was guaranteed for the stadium, it was built for the Raiders when they moved here. Traditionally, the NFL thought that gambling was terrible. Las Vegas was even worse than gambling. Not without reason, because there had been gambling scandals and cheating scandals in the past in football and baseball and other sports, professional and amateur so makes sense. They wanted to keep it a arm’s length. But they continue to have this policy long after gambling had become more mainstream in the United States. Long after we casinos all across the country, they continue to have this. It’s interesting that as the national prohibition on the spread of sports gambling fell, the league’s policy changed and they seem to be much more gambling friendly.

Mary Long: How did the NFL’s relationship with sports betting and their embrace of that compared to the pace at which other sports leagues embraced it?

Dave Schwartz: NFL seemed to be a little bit behind you had MBA was probably one of the more proactive ones, but in general, most of the other sports started to embrace it once after 2018, when the Supreme Court struck down the Professional Amateur Sports Protection Act. More states started to legalize it. It became more mainstream in the other sports. I want to say jump on the bandwagon, but became a lot friendlier toward it.

Mary Long: In 2018, Americans wagered 4.6 billion dollar on sports betting. 2023 they bet $104 billion. How much of that growth comes from previously illegal wagering that’s now been brought into the public light or is that just all new money coming into this?

Dave Schwartz: That’s a really good question and you’ve got to imagine that a lot of it was the previously illegal gambling they came in. You also have as there’s advertising for it and it’s more mainstream and it’s more accessible, it becomes less stigmatized, so it’s easier for people to bet, so they’ll get into it a little bit more. I think it’s probably a combination of both, where they’re maybe taking some of the business away from the illegal gambling, but also maybe people are learning more about it for the first time.

Mary Long: It seems safe to bet too that that number of dollars wagered each year will only grow more in the future. As we enter into an era when gambling maybe becomes a larger part of everyday life. We talked about like mini casinos in your pocket. Are there lessons from history that we as a society should keep in mind?

Dave Schwartz: There’s certainly some lessons. I think number one, people have gambled throughout all of human history. Some societies have been a little bit more on the prohibition aside, where they don’t allow legal gambling. But pretty much if you look at the history of humanity, somebody was gambling somewhere. It seems like that’s a universal impulse. What makes it interesting is the way people gamble change. We’re no longer betting, back in Egyptian times, people betting a game that was a lot like Backgammon. That’s not such a big deal. Now we’ve got craps and Blackjack and especially slot machines. Slot machines is another great thing. If we went back to 1850 and said people are going to be gambling in machines, they would say, how could that be? That’s a big deal now. Basically, gambling tends to evolve as the technology evolves. It’s interesting if you look back, going all the way back to history, you have the shift to groundstone technology from flakes stone technology, back in the stone age, you start seeing cubicle dice which are polished instead of the animal bone dice. You have the rise of block printing and you see the proliferation of playing cards. In the 19th century you have the telegraph being used and what’s one of the things that people use it for, to gamble by sending horse racing results across the country. If you look at every technological change, it seems like people have found a way to make it about gambling. I’m not surprised we’re still doing that.

Mary Long: There are a lot of threads, I think, between this trend, the rise of sports betting, and social media and like this need for constant stimulation, but also maybe an inclination, particularly among young people, toward financial nihilism. You want to shoot your shot, you want to get rich quick, you want to beat the house. I think that, that fascination with chance is like very natural and very human. But in your research, do we tend to see increased interest in gambling at times of social, cultural, economic discontent? Or is it just a constant throughout any type of period in history?

Dave Schwartz: It definitely ebbs and flows. For example, in Western Europe, you saw a real boom in gambling from about 1,500, 1,600 to about 1,800 as there was a lot of changes going on. You had a lot more cash and money economies developing things like that. You also have the rise of things like insurance, which originally was considered a form of gambling. Basically, you take out insurance on a ship. You’re betting that your ship is going to sink. That was one of the first areas of insurance. You also have the rise of joint stock companies splitting the risk, things like that. You also have the rise of the theory of probability, where you can even do that. We see that boom. Then in the 19th century, it declines. That’s when you have a rising middle class. You’ve got what the historians call the market economy misses Max Weber’s Protestant work ethic where he work hard, save money. Gambling is subversive to that because you can go from rich to poor overnight. There’s a crackdown against gambling and pretty much United States, at least, which is where I studied most of my history. There’s a shift from a more subsistence style economy to more market style economy. More people are getting pulled into that. There’s a lot more speculation and a lot more importance for discipline people working hard, saving their money. You see a turn against gamble. Then getting into the 20th century, people are still gambling and there’s the idea that hey, wait, we can actually use this to fund some stuff for the government which means we don’t have to raise taxes and that’s one thing. I don’t know if any politicians are ever, ever yet popular for raising taxes that ever gets maybe I don’t know. It’s very popular because hey, we can raise money without raising taxes and let people that. I think that’s how that’s played out in the past.

Mary Long: As always, people in the program may have interest in the stocks you talk about and the Motley Fool may have formal recommendations for or against. So don’t buy or sell stocks based solely on what you hear. I’m Mary Long. Thanks for listening. Enjoy the game tomorrow if you’re watching and whether you are or not, we’ll still have an episode here for you. See you then.

Byron Allen, founder, chairman and CEO of the Allen Media Group, speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022.

Patrick T. Fallon | AFP | Getty Images

Byron Allen, the media mogul offering $14 billion for Paramount Global, told CNBC on Wednesday that he has the money to finance a deal, despite skepticism around his deal-making.

“We have more than enough capital available to us. The real challenge is certainty of close,” Allen said.

“This deal lives or dies at the [Federal Communications Commission],” he added.

Allen, the founder and CEO of a media group that owns dozens of television networks across the U.S., offered $30 billion for all of Paramount’s outstanding shares, including debt and equity.

The Allen Media Group said in a statement the offer “is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued.”

Allen has a long history of making offers on major media assets. But bidding doesn’t mean buying.

His recent media buyout offers have failed to materialize into sales. The Wall Street Journal reported Wednesday that Allen last year offered $18.5 billion for Paramount, and was rejected.

Allen told CNBC he hasn’t received a response from Paramount to his most recent offer.

Shari Redstone, who controls Paramount through her company National Amusements, has been open to deal-making in recent months in an effort to either merge or sell the company that’s home to brands such as CBS, Showtime, Nickelodeon and its namesake movie studio.

CNBC reported last week that David Ellison’s Skydance Media and its backers were exploring a deal to take Paramount Pictures or the entire media company private.

In December, CNBC also reported Paramount had entered preliminary talks with Warner Bros. Discovery to merge the two media giants in a deal that could have faced regulatory hurdles.

Allen’s bid for Paramount is the most ambitious of the deals the media mogul has tried to complete. Here are some of his recent deal attempts:

- In December, Allen renewed an attempt to buy Paramount-owned Black Entertainment Television and VH1 for a combined $3.5 billion.

- In November, Bloomberg reported, he was weighing a bid to buy television stations from E.W. Scripps.

- In September, Allen made an offer to buy ABC and several other networks from Disney for $10 billion after Disney CEO Bob Iger opened the door to selling the company’s linear TV assets.

- In 2022, he explored a bid to buy the National Football League’s Washington Commanders.

- In March 2020, he offered $8.5 billion to buy television stations owner Tegna.

Allen told CNBC via phone Wednesday that he lost out on several deals because ownership changed course on wanting to sell. He highlighted his acquisition of The Weather Channel in 2018 for a reported $300 million and broadly defended his track record, invoking baseball Hall of Famer Babe Ruth.

“Let’s talk about Babe Ruth. Does he go down as one of the greatest baseball players of all time? And he struck out half the time,” Allen said. In actuality, Ruth struck out 1,300 times in 8,399 at bats — a 15% strikeout rate.

Allen’s bids for linear TV assets come as the media landscape shifts away from traditional TV toward streaming. Almost all the major media companies have launched services to compete with streaming giant Netflix.

Paramount reported in its third-quarter earnings report that its streaming platform, Paramount+, increased its subscriber count to 63 million. However, Paramount’s direct-to-consumer products have failed to turn a profit like Netflix has. The division reported adjusted losses of $238 million for the third quarter.

Paramount will release its fourth-quarter earnings Feb. 28.

Allen told CNBC he wants to buy Paramount for its linear networks, what he says is the most challenging part of the company.

“These are still great businesses if you know how to manage them properly,” Allen said.

Shares of Paramount were up almost 7% Wednesday and have risen more than 35% in the past three months as talks of a deal have ramped up. However, the stock is more than 40% off its 52-week high of $25.93 a share reached in February 2023.

— CNBC’s Alex Sherman and Julia Boorstin contributed to this report.

Don’t miss these stories from CNBC PRO:

History Says That Costco Stock Is Overvalued. What Does That Mean for Investors in 2024?

For shoppers looking for good deals, Costco Wholesale (COST 0.17%) is a dream come true. The warehouse club retailer sells all sorts of things at extremely attractive prices, from rotisserie chickens to hot dogs to $250 Disney gift cards for $224.99. It’s ironic, therefore, that this retail chain known for bargains has a stock that’s anything but a bargain.

In the business world, businesses (whether public or private) are bought and sold largely based on their future financials. For example, for a business with $10,000 in annual profits, someone might buy a stake in the company based on the idea that the business will eventually post profits of $50,000. Or for a business with $1 million in annual revenue, someone might buy in on an assumption the company will soon report $1.5 million in revenue. There’s a lot more that goes into it, but you get the idea. Investors are willing to pay a premium to get in on the future potential of the company.

When buying a business though, investors should also be concerned about recouping their cash and eventually making money on their investment. Therefore, it’s important to not overpay up front.

Investing great Warren Buffett encourages people to think about the stock market in the same way. In his 1987 letter to Berkshire Hathaway‘s shareholders, he wrote that when he and business partner Charlie Munger bought stocks, “We approach the transaction as if we were buying into a private business.”

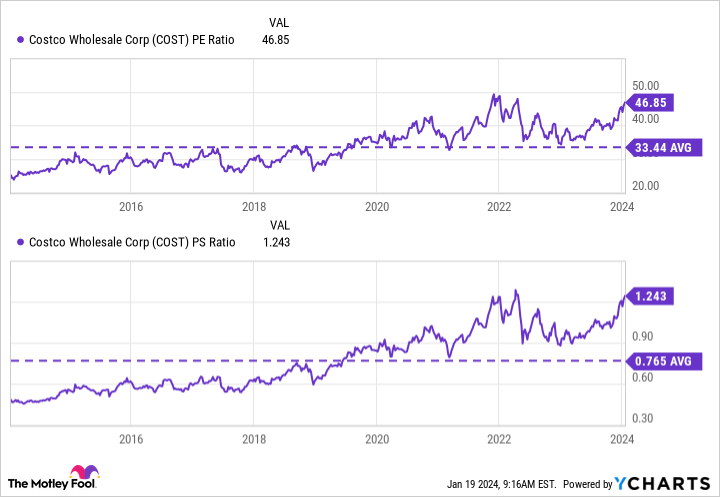

Applying this concept to Costco stock should give investors pause. From a profit perspective, Costco stock trades at a price-to-earnings (P/E) ratio of 47. That valuation is double the average P/E ratio of the S&P 500, which currently sits at 23. It essentially means investors think Costco is worth buying at twice the price of an average stock.

Perhaps some would object to the comparison. After all, Costco is a very high-quality business (as I’ll explain) and consequently should have an above-average valuation. That may be true. However, looking at the history of Costco’s P/E ratio and its price-to-sales (P/S) ratio, investors can plainly see that its valuation has recently skyrocketed well above what’s been considered normal in the past.

COST PE Ratio data by YCharts.

Compared to most other stocks, Costco stock is expensive. And even compared to where it has traded in the past, it’s pricey. This being the case, what should investors do now?

Here’s what investors should do

Costco stock is expensive, and for this reason, I believe it’s likely to underperform the market in 2024. However, ignoring Costco entirely could be a mistake. There are only so many high-quality businesses in the world, and I believe Costco qualifies as one of them. The company generates hundreds of billions of dollars in sales with a low profit margin. But it earns 73% of its profits from membership fees.

Costco has over $6.5 billion in trailing-12-month net income, and nearly three-quarters of that came from membership fees. Right now, its members are renewing at a 93% rate. Investors will struggle to find many other businesses with such a high retention rate.

Investors shouldn’t ignore a high-quality business like this. But they should likely wait for a better price before buying its shares. And that’s the encouraging thing: Costco’s stock price has dropped by 10% or more nearly once a year for the last decade, so a more reasonable valuation is likely coming at some point soon.

Given that, if you’re a Costco shareholder, it might seem like a sensible strategy to sell your shares now while they are carrying an unusual premium and repurchase them later for a lower price. But that’s likely a bad plan.

To succeed over the long term in investing, it’s important to hold on to your winners. Yes, I believe Costco stock is overvalued and will likely underperform in the coming year. But the business is still set up for long-term success, and there’s no way to know for sure when its next pullback will actually happen — some stocks trade at expensive levels for much longer than one would expect.

If a Costco shareholder tried to execute a timely sell and then guess when to make the subsequent buy, they’d risk selling a winner prematurely. They might also mistime the window for repurchasing shares. Attempts at market-timing moves like this can be devastating to one’s overall long-term portfolio returns.

It might sound like I’m talking out of both sides of my mouth, but I’d assert that it’s reasonable to approach Costco stock differently depending on whether or not one already owns shares. For those who don’t own this stock, it’s reasonable to wait for a more attractive price. For those who do own shares, the smart course of action is to hold on to this long-term winner.

It goes back to something that Charlie Munger used to say: “The first rule of compounding is to never interrupt it unnecessarily.” He might not have been thinking about Costco stock specifically when he first said it. But then again, he was a Costco shareholder. And just before he passed, he said, “I’m never going to sell a share.”

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Costco Wholesale, and Walt Disney. The Motley Fool has a disclosure policy.

Maker DAO’s MKR has been a dominant force in real-world asset (RWA) transactions within decentralized finance (DeFi), boasting a daily average of $94.5 million in RWA-related transactions in the second week of January. Despite this impressive transaction volume, there are underlying challenges that investors need to consider.

Maker Transaction Volume Dominance

MKR stands out with its substantial RWA transaction volume, signaling ongoing activity and interest in the MakerDAO ecosystem amid market volatility. This is a positive indicator for the protocol.

MakerDAO’s strategic move towards tokenized T-Bills has proven successful, contributing over half of the protocol’s fee revenue. This diversification provides a potential growth engine, offering a positive aspect amid other challenges.

$MKR leads transaction volume amongst RWA protocol tokens, reaching a daily average volume of $94.5M during the second week of January.

🔗 pic.twitter.com/DxqTjCuaon— IntoTheBlock (@intotheblock) January 18, 2024

The Concern: Decline In RWA Activity

However, the overall picture for RWA on MakerDAO is not entirely positive. The total value locked (TVL) in RWA has dropped by 33% since October, raising concerns about waning investor interest in real-world asset integration on the platform.

MKR market cap currently at $1.8 billion. Chart: TradingView.com

Investor sentiment mirrors the decline in TVL, with a substantial $871 million withdrawn from Maker’s RWA offerings in the past three months. This suggests potential concerns about specific RWA deals or broader market volatility.

Despite positive sentiment and demand for MKR, questions arise about the sustainability of this momentum if the RWA decline persists. The future of MKR as the RWA leader is uncertain, and the potential ripple effects remain a key consideration.

MKR 24-hour price action. Source: Coingecko

Revival Or Paradigm Shift?

The capital flight may be a temporary setback or indicative of a broader shift in investor preferences towards different RWA platforms or asset classes. Time will reveal whether MakerDAO can regain investor confidence and revive its RWA sector.

MKR was trading at $2,015 at the time of publication, based on CoinMarketCap data. The demand for the altcoin has increased as the year has progressed, with the majority of the attitude being favorable.

The challenges and opportunities of RWAs in DeFi are encapsulated in MakerDAO’s story. While high transaction volume and innovative T-Bill offerings show promise, the significant decline in RWA inflows raises questions about the protocol’s long-term sustainability.

The success of RWAs on MakerDAO and in DeFi as a whole hinges on finding the right balance between innovation, risk management, and building trust with investors. MakerDAO faces the challenge of rewriting the RWA narrative or potentially losing its prominence in the evolving landscape of real-world assets in DeFi.

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

S&P 500 closes at a new record high. Here’s what history says could happen next.

The S&P 500 on Friday posted its first record close in more than two years, while also setting a new intraday record after wobbling in a narrow trading range for almost a month.

Most Read from MarketWatch

The large-cap benchmark S&P 500 index SPX finished at 4,839.81 on Friday, surpassing the prior record close of 4,796.56 set on Jan. 3, 2022. The index also traded as high as 4,842.07, topping its intraday record of 4,818.62 set on Jan. 4, 2022, according to FactSet data.

The move came amid a choppy start to the year for stocks that analysts have attributed to a renewed rise in Treasury yields and uncertainty over a March interest-rate cut by the Federal Reserve.

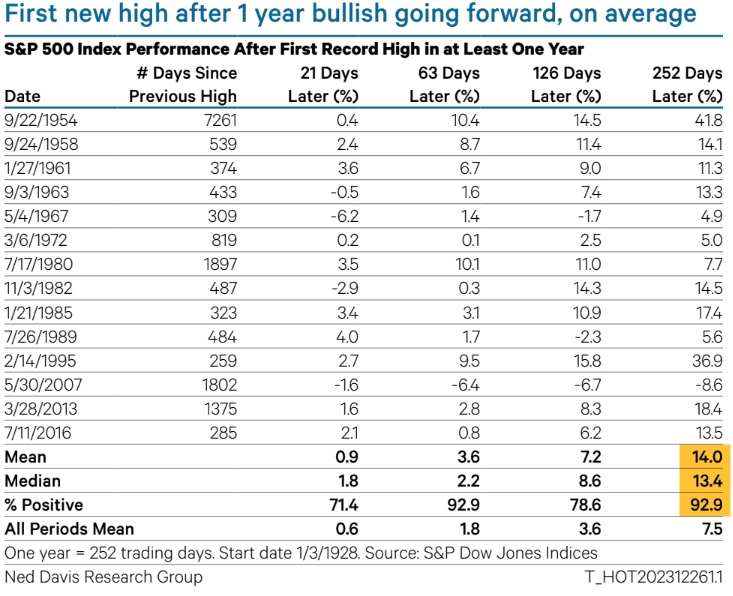

Friday’s move also broke a streak of 512 trading days without a fresh record closing high for the S&P 500, ending the longest such stretch since the 1,375 trading-day streak from October 2007 to March 2013, according to Dow Jones Market Data (see table below).

U.S. stocks opened the new year on a downward trend, pulling back from near-record highs as solid economic data and pushback from Federal Reserve officials against market expectations of aggressive rate cuts maintained a cloud of uncertainty over the path of monetary policy in 2024, while driving the longer-term Treasury yields to their highest levels since December.

The S&P 500 index remained in a short-term trading range which had been in place since mid-December. The range was bound by the intraday level of around 4,700 on the downside and the intraday level of a little above 4,800 on the upside for the past month, but the S&P 500 never scored a close above the record-high of 4,796.56 over that period, according to FactSet data.

“It’s normal for stocks to be stuck in a trading range when you’re trying to approach a record high, because you’d expect to have some resistance,” said Steve Sosnick, chief strategist at Interactive Brokers.

However, stocks posted a solid recovery Thursday as an upbeat 2024 outlook by chip maker Taiwan Semiconductor Manufacturing Co. TSM drove an outperformance from megacap technology stocks that saw the S&P 500 and the Nasdaq Composite COMP erase all their 2024 losses.

Sosnick said record highs for the S&P 500 will “bring more people into the market,” as the optimism on artificial intelligence and the fourth-quarter earnings outweighs the notion that the Fed may not cut rates as quickly as market participants expect.

“Traders are very good at shifting their focus to whatever narrative suits them best at the moment,” he told MarketWatch in a phone interview on Friday. “It’s a normal thing for people to want to buy when they see market prices breaking out, and then they jump in.”

Mark Arbeter, president of Arbeter Investments LLC, said he hasn’t seen any short-term technical damage to the major indexes as “they are all working on bearish daily momentum divergences” from extreme overbought territory at the end of 2023, when the stock-market sentiment “was rip roaringly bullish.”

But he also saw technical evidence continue to mount for “some type of pullback or correction” with some major indexes at, or near their all-time highs. “There are plenty of more obscure indicators that do not line up for the bulls,” Arbeter said in a Thursday client note.

For example, the VIX term structure, which compares one-month futures VX.1 on the Cboe Volatility Index VIX to the three-month VIX futures VXJ24 and shows expectations of future implied volatility of the S&P 500, is in backwardation.

That means futures traders are pricing in lower near-term volatility suggesting there is complacency in the market that often leads to trouble, Arbeter wrote. “At times, this indicator can be early but is pretty accurate in seeing trouble ahead,” he said.

Meanwhile, historical data shows that a return to record territory after a gap of at least a year has led to positive returns a year later , noted strategists Ed Clissold and London Stockton of Ned Davis Research.

“Did the rally to new highs leave the market overbought and in need of a correction? Or was it a breakout to a new up leg? History sides with the latter,” wrote Clissold and Stockton, in a December client note.

U.S. stocks soared on Friday with the Dow Jones Industrial Average DJIA up nearly 400 points, or 1.1%, closing at a record high of 37,863.80, its second of the year, while the Nasdaq Composite advanced 1.7%. For the week, the S&P 500 jumped 1.2%, while the Dow industrials rose 0.7% and the Nasdaq Composite surged 2.3%, according to FactSet data.

—William Watts contributed.

Most Read from MarketWatch

AMC CEO sends Taylor Swift ‘eternal gratitude’ as concert film makes history

AMC Entertainment Holdings Inc. CEO Adam Aron has expressed the movie-theater chain’s “eternal gratitude” to Taylor Swift as the singer-songwriter’s concert film breaks another record.

Variety reported Sunday that “Taylor Swift: The Eras Tour” has earned more than $261.6 million globally, making it the highest-grossing concert and documentary film in history, surpassing “Michael Jackson’s This Is It.”

“Now at $261.6 million globally, AMC’s first ever released film, TAYLOR SWIFT | THE ERAS TOUR just became the highest grossing concert film & highest grossing documentary film of all time,” Aron tweeted Sunday. “AMC sends our congratulations and eternal gratitude to Taylor Swift for being so remarkable.”

Related: AMC still riding a ‘Taylor Swift: The Eras Tour’ wave

AMC shares

AMC,

which recently hit record lows, have edged lower this week. The movie-theater chain and original meme-stock darling’s stock is down 85% in the past 52 weeks, compared with the S&P 500’s

SPX

gain of 20.9%.

In addition to showing “Taylor Swift: The Eras Tour” in its theaters, AMC is also the theatrical distributor for the movie. AMC Theatres Distribution, along with subdistribution partners Variance Films, Trafalgar Releasing, Cinepolis and Cineplex Inc.

CPXGF,

CGX,

clinched deals with movie-theater operators representing more than 8,500 venues globally to show the film, according to AMC.

“Taylor Swift: The Eras Tour” was breaking records even before its scheduled release on Oct. 13, prompting more showings to be added. On Oct. 11, Swift tweeted that early access showings would be held on Oct. 12, citing “unprecedented demand” for the movie.

Related: AMC shares rise as ‘Taylor Swift: The Eras Tour’ sets another record

The movie shattered the record for the biggest global opening weekend for a concert film, racking up $128 million in box-office returns, according to Comscore. Imax Corp.

IMAX,

announced that “Taylor Swift: The Eras Tour” had a $13 million global box-office debut, making it the largest Imax opening of a concert or a documentary film by a musical artist.

History Says the Nasdaq Will Soar in 2024: 1 Artificial Intelligence (AI) Growth Stock to Buy Before It Does

There’s no denying the challenges investors faced in 2022, which was one of the most difficult years in decades. After shedding more than 35% in 2022, the Nasdaq Composite has come roaring back, rising 43% in 2023 as of this writing. Things have clearly taken a turn for the better.

Yet history tells us the rally is likely to continue. Going back more than 50 years, the year following a market rebound has generated additional gains of 19%, on average, for the tech-heavy index.

Most market watchers agree a major catalyst for this year’s recovery was the advent of the next stage of artificial intelligence (AI). Unlike previous advances, a broad cross-section of businesses can now benefit from the productivity gains yielded by this technology. One company that’s already reaping the rewards of its AI expertise is Palantir Technologies (PLTR -1.19%). The accelerating adoption of AI plays right to the company’s strengths, representing a compelling opportunity for investors.

Image source: Getty Images.

Decades of real-world experience

While AI has taken the spotlight this year, it has been slowly gaining ground for years. Likewise, Palantir has only been publicly traded since Sept. 2020, but the company has been around since 2003 when PayPal co-founder Peter Thiel launched it on the heels of the 9/11 terrorist attacks.

Thiel developed tools that could be applied to the dated computer systems of U.S. law enforcement and intelligence agencies to detect patterns hidden deep within mounds of data, unearthing actionable intelligence and thus increasing the likelihood of preventing future attacks. Palantir’s system thus became very valuable to the U.S. government and its allies.

Perhaps as importantly for investors, this groundbreaking technology has had important implications for business and enterprise as well. Palantir developed a companion system to focus on business analytics and data-mining services to provide the same actionable intelligence that made it so valuable for government agencies.

The next generation of AI

The debut of ChatGPT in late 2022 unleashed a tidal wave of interest in generative AI. These AI models have the ability to create original content, generate summaries and presentations from existing data, draft and revise computer code, and more, all of which promises significant productivity gains. Businesses of all stripes are scrambling to share in the windfall, and because of its vast experience in the field, Palantir has been able to quickly pivot to meet the growing demand.

To be clear, while the opportunity AI represents is vast, no one knows for sure how big it will get. Two conservative estimates come courtesy of analysts at Morgan Stanley and Goldman Sachs, which suggest the opportunity will be worth $6 trillion and $7 trillion, respectively, by 2030. Cathie Wood of Ark Investment Management is much more bullish, estimating that AI software will generate $14 trillion in spending by the end of the decade.

With an opportunity of that magnitude, Palantir could parlay the demand for generative AI into significant new revenue streams.

The numbers tell the tale

Palantir’s recent results highlight its progress. For the third quarter, revenue grew 17% year over year to $558 million, fueled by commercial revenue growth of 23%, which outpaced government revenue’s 12% increase. That performance resulted in earnings per share (EPS) of $0.03, up from a loss of $0.06 per share in the prior-year quarter.

Most importantly, Palantir generated its fourth consecutive quarter of GAAP profitability, which management called “the most significant profit in the company’s 20-year history.” Management also pointed out that Palantir is now “eligible for inclusion in the S&P 500,” a development that could drive the stock even higher in 2024.

Helping fuel the results is the accelerating demand for Palantir’s Artificial Intelligence Platform (AIP), which it released in the second quarter. The AIP helps businesses layer generative AI capabilities on top of existing systems. Management revealed that “demand for AIP is unlike anything we have seen in the past 20 years,” which should soon begin driving its results.

A compelling opportunity

The excitement surrounding AI has fueled a significant run for Palantir in 2023 as the stock is already up 171% year to date

However, the combination of Palantir’s increasing profitability and growing demand for its AI expertise still paints a compelling picture for long-term investors who want to tap into the AI revolution.

Danny Vena has positions in Palantir Technologies and PayPal and has the following options: long January 2024 $95 calls on PayPal. The Motley Fool has positions in and recommends Goldman Sachs Group, Palantir Technologies, and PayPal. The Motley Fool recommends the following options: short December 2023 $67.50 puts on PayPal. The Motley Fool has a disclosure policy.

The S&P 500 Is Poised to Do Something It’s Only Done 3 Times Ever. Here’s What History Says It Could Mean for Stocks in 2024.

Investors should enjoy especially happy holidays this year. Barring a stunning late December collapse, the stock market will deliver hefty gains in 2023.

The big question now is: Can the momentum continue into the new year? For those who look to the past to try to discern what might happen in the future, there could be an intriguing answer to that question. The S&P 500 is poised to do something it’s only done three times ever. Here’s what history says it could mean for stocks in 2024.

Image source: Getty Images.

A rare occurrence for the S&P 500

Standard Statistics Company, which later merged with Poor’s Publishing to form Standard & Poor’s (now S&P Global (SPGI 0.50%)), first created a stock market index of U.S. companies back in the 1920s. However, the S&P 500 in its current form with 500 companies dates back to 1957.

During its 66-year history, the S&P 500 has delivered positive annual gains roughly 70% of the time. Down years aren’t unusual, but positive years are much more common. What is rare, though, is for the S&P 500 to experience a large decline in one year followed by a huge gain in the following year.

From 1957 through 2022, the S&P 500 fell by 15% or more five times. The index rebounded by 15% or more in the following year only three times. The most recent example was in 2008 and 2009 with the stock market crash and subsequent comeback. Now, this rare occurrence appears to be about to happen again. The S&P plunged 19% in 2022 but is set to finish 2023 up more than 20%.

Even if we look at the indexes that were predecessors to the modern S&P 500, such steep declines followed by significant bounces are infrequent. There have been only five previous times since the 1920s when the S&P 500 and its previous versions fell by 15% or more, then rose by 15% or more in the next year.

Historical precedents

So has the S&P 500 been like a yo-yo in the past — falling, rising, then falling again? Nope. Let’s look at how the index has performed in the year following a big rebound.

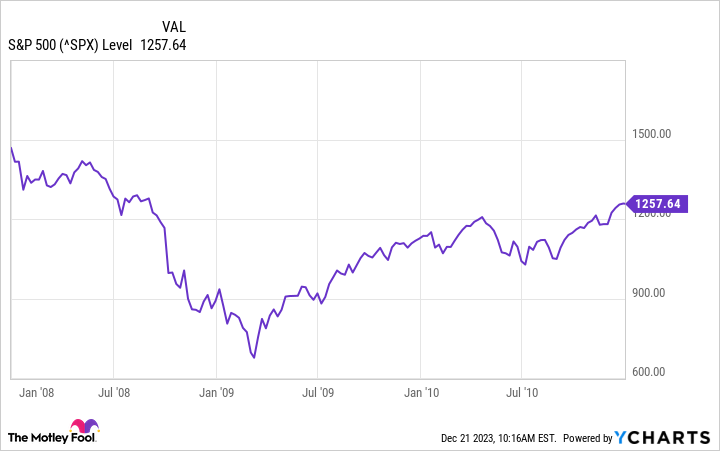

In 2008, the S&P 500 plunged over 38% with markets roiled by the financial crisis. The next year, it bounced back by more than 23%. That momentum continued, albeit at a moderated pace, in 2010 with the S&P rising nearly 13%.

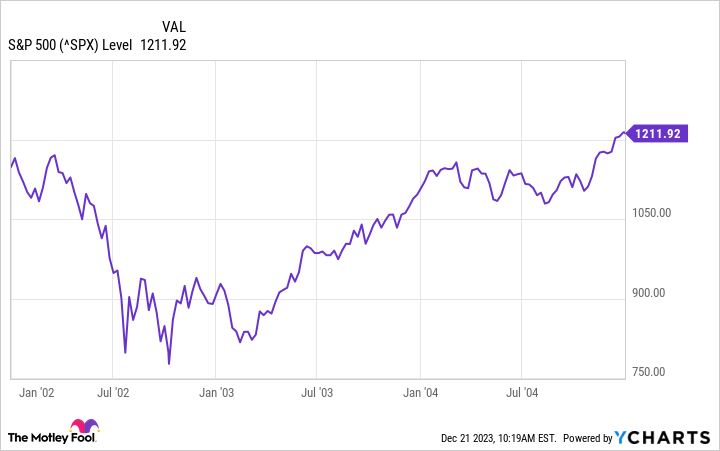

It was a similar story early in the 21st century. The S&P 500 fell 23% in 2002 in the continued aftermath of the dot-com bubble bursting. In 2003, the index roared back with a 26% jump. The S&P rose more in 2004, but with a smaller gain of close to 9%.

The same pattern emerged during the 1970s. In 1974, the S&P 500 plummeted nearly 30%. It rebounded by almost 32% in the next year. The index then rose another 19% in 1976 — a strong but smaller gain.

If history is a guide, we could see the same thing happen in 2024. The S&P 500 could continue its positive momentum in the new year but deliver a performance that isn’t as impressive as that of 2023.

Will stocks really jump again in 2024?

Unfortunately, there’s no guarantee that history will repeat itself. From a statistical standpoint, the trends from the past are virtually meaningless because of the low sample size.

Granted, some Wall Street analysts think that the S&P 500 will rise, but at a more modest rate, next year. For example, Bank of America (BAC 0.69%) analysts set a target price for the index of 5,000, reflecting an increase of nearly 6% from its current level. Goldman Sachs (GS 0.02%) expects the S&P 500 to hit 5,100 next year, a gain of nearly 8%. No one knows for sure what the stock market will do over the next year, though.

The good news is that long-term investors don’t have to be concerned about it. Over a long period, the S&P 500 almost always goes up. As Warren Buffett once stated: “In aggregate, American business has done wonderfully over time and will continue to do so (though, most assuredly, in unpredictable fits and starts).” Whatever happens in 2024, the long-term outlook for the stock market should be bright.

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global. The Motley Fool has a disclosure policy.

History Says This Is the Best Way to Invest With Stocks at All-Time Highs

2023 has been a momentous year for the stock market. The Dow Jones Industrial Average (^DJI -0.05%) reached new all-time highs in mid-December. The S&P 500 is within spitting distance of its own record level, and the Nasdaq Composite isn’t far off.

If you’ve remained invested in the stock market throughout the past few years, then 2023 has provided more proof of what history has said countless times before: After bear markets and other significant market downturns, stocks have always recovered and rewarded long-term investors. But for many who lost confidence in stocks during 2022’s bear market, 2023 has been frustrating, because it has shown how selling stocks at their lows can ultimately prove counterproductive.

Regardless of whether you have a stock-heavy portfolio or are just now thinking about investing in stocks, a look back at the past can reveal a lot about what the best strategy is when stocks are at all-time highs. It’s not complicated, and many long-term investors will find that they don’t have to change a thing about what they’re doing in order to remain successful well into the future.

Image source: Getty Images.

What bull market history has to say

When you look back at past bull markets, you can see that on many occasions, stocks continue to gain ground even after they’ve made big moves to return to all-time highs. After the financial crisis in 2008 and 2009, it took the S&P 500 until March 2013 to surpass its old high from 2007 and hit new record levels. Some investors suggested that after such an impressive recovery, it would be smart to take some money off the table.

Yet what happened after that was a nearly seven-year run of success, with the S&P continuing to rise and set records consistently on dozens of occasions between that first new all-time high and early 2020. By the end, the index had more than doubled from its record close in March 2013.

The same thing happened after the lightning bear market at the beginning of the COVID-19 pandemic. After plunging in February and March 2020, markets recovered quickly, and the S&P returned to record levels that August. Again, some felt it prudent to reduce stock exposure at that point, yet the S&P climbed another 40% between August 2020 and January 2022 before the most recent bear market began.

Admittedly, there have been occasions when stocks recovered to record levels just to fall again. After the tech bubble burst in 2000 through 2002, it took the market seven years to reach new records. Yet the S&P only rose another few percent before the financial crisis took hold.

The right strategy for right now

With history as background, there are several things to consider with markets at all-time highs. The right way to approach things right now depends a lot on your particular situation.

If you still have a long time horizon before you’ll need the money that you’re investing, then there’s little reason to pay attention to the ups and downs of the market. Keep saving and consistently invest more into stocks, and you’ll benefit from what have historically been superior returns.

If it took all your discipline to avoid selling stocks at 2022’s bear market lows, then pat yourself on the back for having outlasted the downturn. However, look critically at your asset allocation. Did you overestimate your ability to weather a severe bear market? If so, consider a more conservative investing approach. That doesn’t mean selling all your stocks right away, but it could mean shifting a percentage out of the market into other asset classes like bonds and cash.

Similarly, if you’re retired and have been spending down your cash cushion in order to avoid having to sell stocks at lows, then now’s a good time to consider replenishing your cash reserves. Again, you don’t necessarily want to sell a huge amount right now, but taking steps to give yourself the balance you want is essential for the success of your long-term strategy.

On the other hand, if you’ve been out of the market, you might think now’s the worst time to invest. Yet the smart move is still to make some stock purchases, perhaps through a dollar-cost averaging strategy that ensures all of your money won’t go in at the absolute top if a market downturn is on the way.

A final thing to consider

Lastly, bear in mind that just because the Dow Jones and other indexes are at or near all-time highs, many individual stocks remain far below their record levels. Indeed, it’s the very fact that many stocks are still playing catch-up at the end of a bear market that often keeps driving market indexes higher.

All-time highs are exciting, but they shouldn’t have a huge impact on your investing. By keeping an even keel and not letting headlines affect you too much, you’ll be in a better position to reap the true rewards that await those with a long-term investing mindset.