With new listings hitting the market, the spring home-buying season is poised to be much brisker than it was a year ago. But one real-estate exec isn’t ready to call it a recovery just yet.

Source link

holding

Cardano (ADA) is attempting a fresh increase from the $0.4720 zone. ADA could start a fresh rally if there is a close above the $0.5350 resistance.

- ADA price is moving higher above the $0.500 zone.

- The price is trading above $0.512 and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance near $0.510 on the 4-hour chart of the ADA/USD pair (data source from Kraken).

- The pair could accelerate higher if there is a clear move above $0.535 and $0.550.

Cardano Price Eyes Fresh Increase

After forming a base above the $0.4720 level, Cardano started a fresh increase. ADA price was able to climb above the $0.485 and $0.500 resistance levels to move into a positive zone, like Bitcoin and Ethereum.

There was a break above a key bearish trend line with resistance near $0.510 on the 4-hour chart of the ADA/USD pair. The bulls pushed the pair above the $0.520 resistance zone. However, the bears are now active near the $0.535 resistance zone.

ADA price is now trading above $0.512 and the 100 simple moving average (4 hours). It is also above the 23.6% Fib retracement level of the recent increase from the $0.4718 swing low to the $0.5354 high.

Source: ADAUSD on TradingView.com

On the upside, immediate resistance is near the $0.535 zone. The first resistance is near $0.545 and $0.550. The next key resistance might be $0.565. If there is a close above the $0.565 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.600 region. Any more gains might call for a move toward $0.620.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.535 resistance level, it could start a fresh decline. Immediate support on the downside is near the $0.520 level.

The next major support is near the $0.5040 level or the 50% Fib retracement level of the recent increase from the $0.4718 swing low to the $0.5354 high. A downside break below the $0.5040 level could open the doors for a test of $0.485. The next major support is near the $0.4720 level.

Technical Indicators

4 hours MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for ADA/USD is now above the 50 level.

Major Support Levels – $0.520, $0.5040, and $0.4720.

Major Resistance Levels – $0.5350, $0.550, and $0.600.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 Beaten-Down Dividend Stock to Avoid in 2024, and 1 to Consider Buying and Holding Forever

Buying dividend stocks that have seen better days can be a great way to ensure you’re exposed to the possibility of gain from a turnaround. It’s also a great way to get a higher yield on your shares than you would otherwise, and that can add up to make for a big benefit over time.

But not every recently tarnished dividend stock is a smart purchase. In fact, many will burn your money and dash your hopes for passive income. So here’s one example of a dangerous dividend stock to avoid, and one that’s a solid choice for a long-term hold.

Avoid Medical Properties Trust

Shares of Medical Properties Trust (NYSE: MPW), a healthcare real estate investment trust (REIT), are down by 76% in the last three years. That’s a big part of the reason its forward dividend yield is upwards of 27%. Critically, this isn’t a stock to buy on the dip to capture its outsized yield. It’s one to examine as a lesson for what to look out for and avoid.

In a nutshell, Medical Properties Trust buys and rents out healthcare facilities to its tenants, some of whom it invests in. There are many things that can go wrong with that process.

If it uses too much debt while buying properties, the costs of servicing the interest payments can become unsustainably high relative to its income. Its debt load is currently in excess of $10 billion, or 122% of its equity. In 2026, it’ll need to repay close to $3 billion in debt; it has only $340 million in cash on hand now, and its trailing-12-month net losses are $33 million.

If its tenants encounter problems, they may struggle to pay rent on time. One of its largest tenants, Steward Healthcare, which is responsible for approximately 20% of the REIT’s revenue as of Q3, is chronically unable to pay its full monthly rent, and is behind on its payments to the tune of $50 million. The company plans to write off hundreds of millions of its rent receivables in its Q4 earnings report. That’s a bad sign.

Finally, if it can’t generate enough cash to pay out to investors, it’ll need to slash the dividend again. In 2023, it cut its payment considerably, but more could be on the way. There isn’t any hope in sight, either. With tightly constrained resources and little in the way of surging demand for hospital floor space, this business may not recover from its downward spiral. Don’t buy this stock.

Consider buying Pfizer

Pfizer‘s (NYSE: PFE) story is somewhat the opposite of Medical Properties Trust. Its stock soared due to its development and sale of the Comirnaty vaccination and Paxlovid antiviral pill for preventing and treating coronavirus infections. But the company’s temporarily-bloated top line is deflating from its peak of just over $100 billion in 2022.

In essence, Pfizer became a victim of its own success, and when the scramble for tools to fight the pandemic became less intense, it was all but guaranteed to struggle growing.

Pfizer’s forward yield is now 6.1%, and its coronavirus windfall is eroding rapidly. Nonetheless, its trailing-12-month sales of $68.5 billion are still much higher than its pre-pandemic haul of $40.9 billion in 2019. Management has a plan to increase that sum by quite a bit by scaling up its competition in oncology over the next six years and beyond.

The first stage of the plan is already in motion. Pfizer recently purchased Seagen, a biotech developing antibody-drug conjugate (ADC) medicines for various cancers, and it aims to acquire additional companies while also upscaling the output of its pipeline by spending more on research and development.

Scaling up will mean increasing its opportunities to grow in the long term. It already has a whopping 31 programs in phase 3 clinical trials, with another 34 in phase 2, so investors can have confidence that the company has a strong roadmap to deliver its dividend for at least the next six to eight years, and likely beyond.

Though its payout ratio is relatively high at the moment, at 89% of its annual earnings, returning to growth will ameliorate the situation and give Pfizer more headroom to hike its payment once again. Especially for investors who are willing to buy the stock now when it’s down and hold it for a long time (during which it’ll be able to deliver a steady stream of cash), Pfizer’s shares are an opportunity that’s ripe for the taking.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

1 Beaten-Down Dividend Stock to Avoid in 2024, and 1 to Consider Buying and Holding Forever was originally published by The Motley Fool

Ethereum Price is Primed For a Correction And Only 1 Thing is Holding it Back

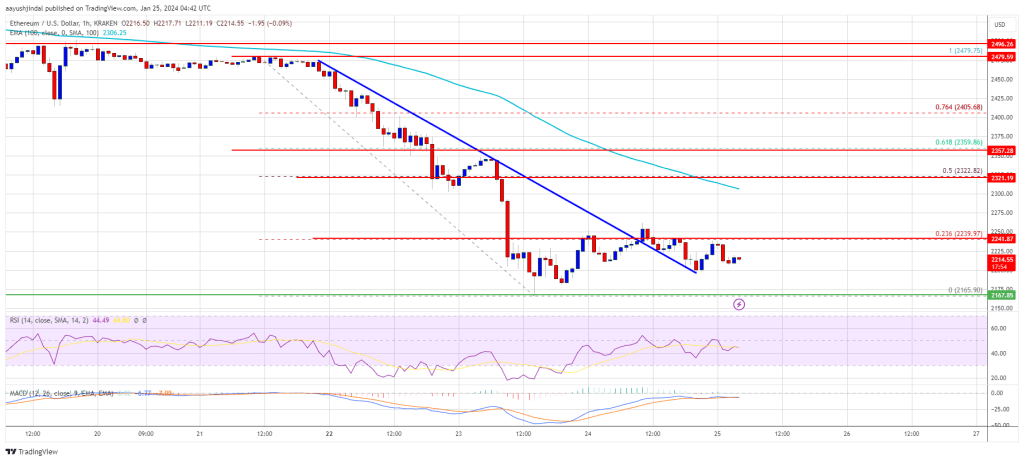

Ethereum price is attempting an upside correction from the $2,150 support. ETH could gain pace if it clears the $2,240 resistance zone.

- Ethereum started an upside correction from the $2,165 zone.

- The price is trading below $2,240 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance near $2,235 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair might start a steady increase if it clears the $2,240 resistance zone.

Ethereum Price Holds Support

Ethereum price extended its decline below the $2,240 support zone. ETH spiked below $2,200 before the bulls appeared near the $2,165 level. The price formed a short-term base and started an upside correction like Bitcoin.

There was a move above the $2,200 resistance level. Besides, there was a break above a connecting bearish trend line with resistance near $2,235 on the hourly chart of ETH/USD. However, the bears are active near the $2,240 resistance. They defended the 23.6% Fib retracement level of the downward move from the $2,480 swing high to the $2,165 low.

Ethereum is now trading below $2,240 and the 100-hourly Simple Moving Average. On the upside, the price is facing resistance near the $2,240 level.

The next hurdle could be $2,300 or the 100-hourly Simple Moving Average, above which the price might rise and test the 50% Fib retracement level of the downward move from the $2,480 swing high to the $2,165 low at $2,320. The next major resistance is now near $2,360.

Source: ETHUSD on TradingView.com

A clear move above the $2,360 level might start a decent increase. In the stated case, the price could rise toward the $2,420 level. Any more gains might send the price toward the $2,500 zone.

Another Drop in ETH?

If Ethereum fails to clear the $2,240 resistance, it could start another decline. Initial support on the downside is near the $2,200 level.

The next key support could be the $2,165 zone. A downside break below the $2,165 support might start another substantial decline. In the stated case, Ether could test the $2,080 support. Any more losses might send the price toward the $2,000 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $2,165

Major Resistance Level – $2,240

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Near a 52-Week Low, This Dividend Stock Is Worth Buying in December and Holding Well Beyond 2024

Dominion Energy (D 1.02%) is up 24.1% from its 52-week low — which sounds like a lot until you realize the stock is still down 17.9% over the last year and 36.8% over the last five years compared to impressive gains in the S&P 500.

Still, the comeback is a big move in a short period of time from a stodgy, reliable, dividend-paying utility. But Dominion has been anything but that — cutting its dividend in late 2020 and only slightly raising it since then.

So how could a company that has disappointed investors through capital losses and lower dividend income be a good investment? The answer lies not in where Dominion Energy has been but in where it is going. Here’s why the future looks promising for this utility stock.

Image source: Getty Images.

Twists and turns

For the last four years, Dominion has been on an asset-selling spree. In September, Enbridge announced a $14 billion acquisition (including debt) of three natural gas utilities from Dominion Energy. A few months prior, Dominion sold its remaining 50% non-controlling interest in Cove Point LNG to Berkshire Hathaway Energy (BHE). In 2020, Dominion sold $9.7 billion in energy transmission assets to BHE.

The idea behind the asset sales was to make the company less reliant on volatile fossil fuel industries and transition toward renewables and regulated utility functions. The problem is that Dominion didn’t do a good job communicating its intentions to investors, leaving them to connect the dots to try to figure out what the new company would look like once the dust settled.

To be fair, Dominion did a good job of setting clear emissions reduction goals. The company had spent years transitioning from coal to natural gas and was now transitioning from gas to renewables. There was little doubt about the company’s multidecade plan, but plenty of question marks surrounded the short and medium terms.

A turnaround in the making

Dominion’s Q3 2023 earnings presentation clarified what investors can expect from the business for the rest of the year, in 2024, and even in 2025.

Its estimated 2023 earnings are $2.10, giving the company a 23 price-to-earnings (P/E) ratio. Factoring in $0.80 per share in adjustments — namely $0.50 from interest expense savings from pending asset sales — would bring 2023 earnings to $2.90 — giving Dominion an adjusted P/E ratio of 16.6. That’s a much more realistic valuation for a low-growth utility business.

The earnings presentation also provided insight into Coastal Virginia Offshore Wind (CVOW) — Dominion’s utility-scale wind energy megaproject. The company wants to find a noncontrolling equity financing partner by the end of 2023 or early 2024 to take some of the burden off of the project’s cost. Dominion expects to reach $3 billion on total project investment by year-end compared to a total current capital budget of $9.8 billion. Construction is expected to be completed by the end of 2026.

The project is decently efficient as far as offshore wind goes, with an estimated levelized cost of electricity of $77 per megawatt-hour (MWh). For context, the International Renewable Energy Agency estimates that 2022 levelized cost of electricity for offshore wind was $81 per MWh compared to $33 for onshore wind, $49 for solar PV, and $61 for hydropower.

On Oct. 31, the Biden administration approved the 2.6 GW project, which is currently the largest approved offshore wind project in the U.S. It’s even more massive when put into the context of the administration’s 2030 goal of 30 GW of installed offshore wind capacity — meaning CVOW alone would make up about 9% of the 2030 goal.

CVOW is expensive, but landing a partner and completing the project on time will reduce the financial burden while giving Dominion a cleaner source of electricity for its customers.

A reliable dividend

Dominion reassured investors that it is “100% committed to its current dividend” and is targeting a payout ratio in the 60% range over time. That’s a healthy target that allows earnings to support dividend payments without making the dividend too straining on the business.

Dominion is likely years away from a dividend raise. As mentioned, its forecast 2023 adjusted earnings per share are $2.90, while its dividend sits at $2.67 per year. The current payout ratio on adjusted earnings is 92%. So earnings are going to have to increase by quite a bit before it can justify a raise. In the meantime, the existing dividend appears safe, and that’s good enough, considering the stock yields 5.4%.

Dominion is worth buying now

Dominion deserved to fall, given its murky outlook. But now, Dominion is on track to look like a much better company.

The valuation could look reasonable very soon. The dividend is solid and has room to grow once earnings improve. And the utility is becoming safer and more dependent on clean energy, which is the right long-term move even if Dominion mishandled some of the steps to getting there.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

When investors think of athletic apparel brand names, Nike is often the first that comes to mind. And rightfully so. After all, it’s the single biggest name in the business, having dominated the market since the 1980s.

For investors, though, everything is relative. While being big certainly has its advantages, sometimes it’s the smaller, newer names in an industry offering up the better growth opportunities.

That’s the crux of the bull case for high-end sports apparel name On Holding (ONON -3.71%) right now. It’s only a fraction of the size of Nike (and may never be as big), and its relatively small size and tighter focus on one sliver of the athletic apparel market position the company for much faster growth.

Here’s a look at the three reasons you might want to buy the stock sooner rathan than later.

1. There’s room for a new premium brand name in athletic apparel

Although Switzerland-based On Holding makes a range of apparel, footwear is by far its biggest business. On’s competitive edge, however, is quality. Its customers pay a premium for its running, hiking, tennis, and lifestyle shoes, but they get a premium product for their money.

That’s not to suggest Nike’s products are of subpar quality. But again, the marketplace is changing. Millennials and Gen Z consumers in particular love On Holding’s shoes for their utility as a status symbol and their amazing functionality and comfort.

This demand is apt to grow. Analysts with TD Cowen note that these two age groups already enjoy $165 billion in annual purchasing power in the United States alone. They’re also set to inherit tens of trillions of dollars of wealth over the course of the next couple decades. Moreover, as soon as 2028, Gen Z and millennials will collectively make up 68% of the U.S. population, versus only 45% now. That’s one heck of a tailwind brewing.

2. On Holding’s incredible growth outlook is actually credible

On Holding has plans … big plans. In fact, they’re so big they’re almost unbelievable. The company expects to double this year’s expected revenue of $2.1 billion by 2026 with a 26% compound annual growth rate. Meanwhile, it wants to push its gross margin above 60% and widen its EBITDA margin from around 17% now to more than 18%. Most young companies like this one need to spend heavily at this stage of their existence, which eats away at profitability.

Just bear in mind that On is already growing quickly enough and cost-effectively enough to achieve its targets. Sales through the first three quarters of 2023 were up more than 57% year over year, and EBITDA nearly doubled during that time.

And On Holding is generating this growth exactly where it needs to — its direct-to-consumer business and its online efforts in particular. Direct-to-consumer market research outfit ESW reports one-fifth of millennials say they’re going to make more online purchases of footwear and apparel this year than they did in 2022 (and they were already spending a lot online). When the category is switched to luxury goods, nearly one-third of millennials said they planned to make more online purchases in 2023.

These data nuggets offer just a glimpse into how the marketplace is evolving as the digitally native demographics grow up.

3. Both Wall Street and insiders are bullish on the company

Last but not least, On Holding’s employees and founders own roughly one-third of the company as well.

Bear in mind some of these shares are likely being offered in lieu of larger paychecks. Young up-and-coming companies often lack the cash to attract top candidates, whereas it’s relatively easy to issue shares and pay these employees with stock.

Regardless, the high insider ownership aligns management’s interests with those of other shareholders.

As for Wall Street, of the 19 research analysts covering the stock, 14 of them deem it a strong buy. The analysts’ average price target of $36.09 points to a nearly 30% gain for the stock in the near term.

These aren’t usually core elements of a bull case for owning a stock; past and projected results should be an investor’s top criteria when investing. On Holding isn’t your usual prospective investment though. It’s a young company and an even younger stock. It’s still developing its stride as a public company, but the strong analyst recommendations and significant insider ownership certainly boost the overall story.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

On Holding Stock Stumbles Despite Earnings Beat and Raised 2023 Guidance

Shares of On Holding (ONON 8.46%), the parent company of the innovative Swiss athletic shoemaker On Running, tumbled 3.4% on Tuesday, following the release of its third-quarter 2023 report.

The slight pullback is likely attributable to some investors taking profits. After all, shares have surged 49.2% this year through Tuesday. The pullback was not a reflection of the company’s earnings report, as it was strong: The quarter’s revenue and earnings both sprinted by Wall Street’s estimates, and management raised its full-year 2023 revenue guidance.

On Holding’s key numbers

| Metric | Q3 2022 | Q3 2023 | Change |

|---|---|---|---|

| Revenue | 328.0 million CHF | 480.5 million CHF | 47% |

| Operating income | 40.7 million CHF | 57.8 million CHF | 42% |

| Net income | 20.6 million CHF | 58.7 million CHF | 185% |

| Adjusted net income | 22.3 million CHF | 65.5 million CHF | 194% |

| Earnings per share (EPS) | 0.06 CHF | 0.18 CHF | 200% |

| Adjusted EPS | 0.07 CHF | 0.20 CHF | 186% |

Data source: On Holding. CHF = Swiss franc. 1 CHF = $1.0922 at the end of Q3, per The Wall Street Journal‘s exchange rate data.

The revenue growth percentage above understates how well the company actually performed. On a constant currency basis, its sales jumped approximately 58% year over year.

On a U.S. dollar basis, On Holding’s quarterly revenue and adjusted EPS were about $525 million and $0.22, respectively. Wall Street was looking for adjusted EPS of $0.17 on revenue of $508 million. So, On Holding exceeded both expectations.

Gross margin increased to 59.9% from 57.1% in the year-ago period. This is a great gross margin for the industry. For context, athletic shoe and sportswear giant Nike‘s gross margin for its quarter ended Aug. 31 was 44.2%.

For the first three quarters of the year, On Holding generated cash of 110.7 million CHF running its business, compared to using 157.1 million CHF in the year-ago period. The company ended the quarter with cash and equivalents of 432 million CHF, down 12% from the year-ago period.

What happened with On Holding in the quarter?

- Direct-to-consumer (DTC) sales increased 55% to 164.7 million CHF.

- Wholesale sales rose 43% to 315.7 million CHF.

- Sales by region: Europe, Middle East, and Africa (EMEA) up 20% to 144 million CHF; Americas up 61% to 294.9 million CHF; and Asia-Pacific up 72% to 41.6 million CHF.

- Sales by product category: Shoes up 47% to 456.9 CHF; apparel up 32% to 20.1 million CHF; and accessories up 84% to 3.5 million CHF.

What management had to say

Here’s Co-CEO and CFO Martin Hoffmann’s statement in the earnings release:

The third quarter has not only been the seventh consecutive record top-line quarter, but also our most successful quarter in history across numerous measures. We are extremely grateful for the hard work that our team is putting behind our joint mission. The brand momentum for On’s footwear, apparel and accessories continues to convert into high sales growth across all channels. We are planning to add less additional wholesale doors in the future and to focus on our existing wholesale partners and our own DTC channels, E-com[merce] and own retail. With the increased outlook for the full year 2023 and our recently announced Dream On vision for 2026, we are heading into the holiday season with a lot of confidence and are very excited for the road ahead.

Annual guidance raised

Management increased full-year 2023 revenue guidance to 1.79 billion CHF, up from its prior outlook of 1.76 billion CHF. The new guidance implies annual growth of more than 46%. Moreover, it now expects 2023 gross margin of at least 59%, up from its prior outlook of 58.5%.

In short, On Holding turned in a robust quarter and signs point to its continued strong top- and bottom-line growth.

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

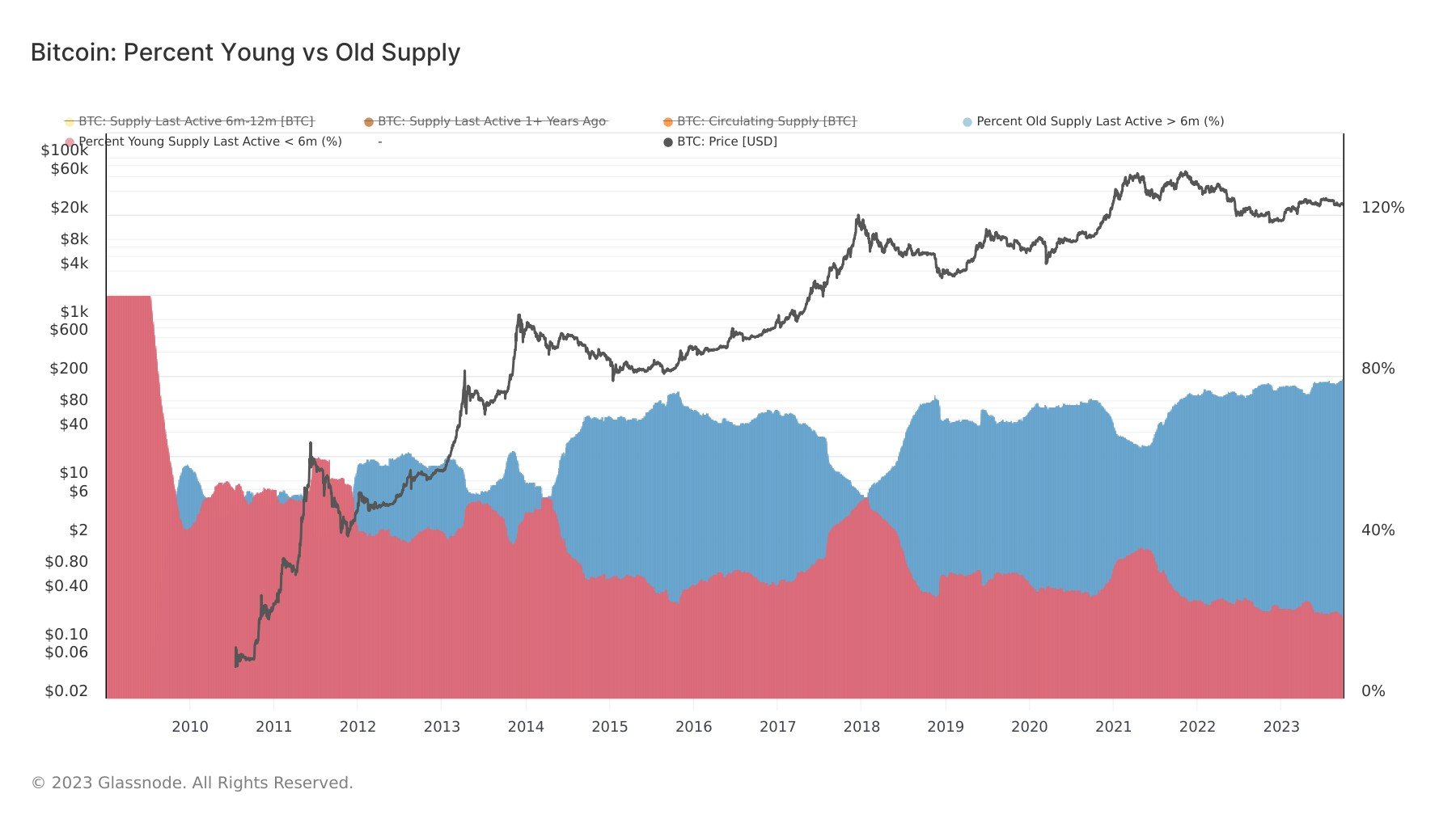

First-ever 80/20 investor split in Bitcoin market shines a spotlight on long-term holding

Quick Take

For the first time in its history, Bitcoin has seen an 80/20 split in its circulating supply. The data reveals that approximately 80% of the Bitcoin supply is currently held by investors who have retained their holdings for six months or longer. This indicates a shift in investor behavior towards long-term holding, and potentially, a belief in the cryptocurrency’s future value growth.

On the other hand, the remaining 20% of the supply has been transacted within the last six months, reflecting the actions of more short-term, possibly speculative, traders. This division, visualized through contrasting colors, illustrates the differing strategies within the Bitcoin market and the balance between patience and swift action.

The post First-ever 80/20 investor split in Bitcoin market shines a spotlight on long-term holding appeared first on CryptoSlate.

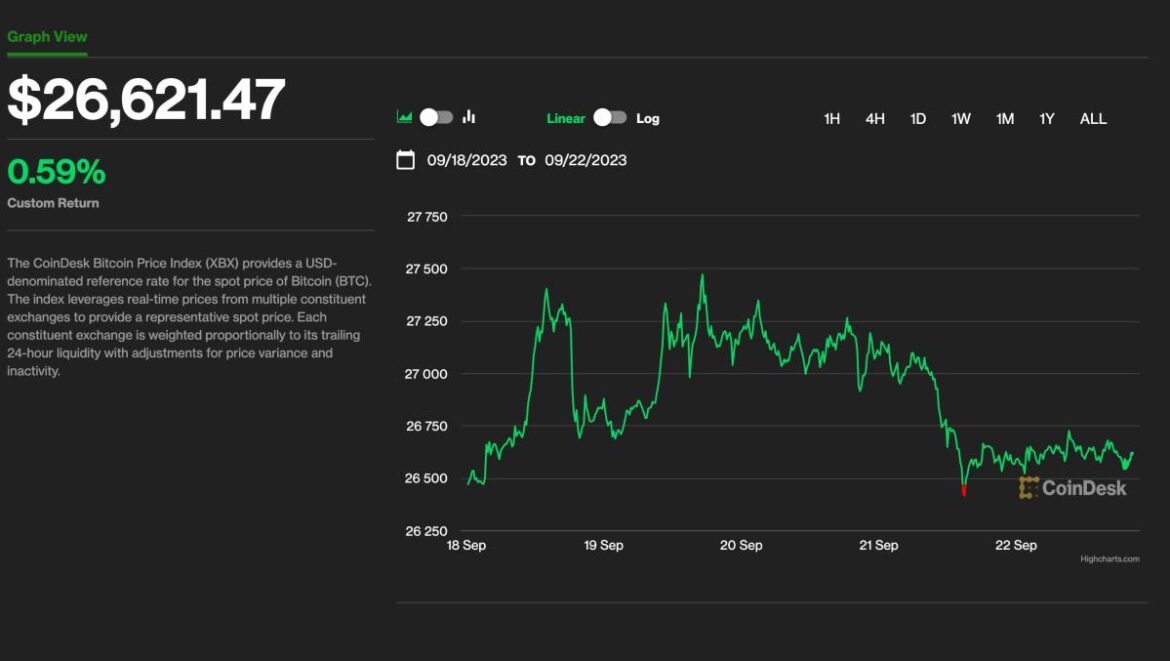

Bitcoin Holding Above $26K Is ‘Remarkable’ as Equities Take a Hit. What’s Next for BTC’s Price?

Bitcoin (BTC) has held firmly above the $26,000 level this week despite sharp sell-offs in equity markets and the surging U.S. dollar – a victory of sorts given the bearish signals those other moves could’ve portended.

The largest crypto asset by market capitalization changed hands Friday afternoon at around $26,500, slightly up 0.3% since the start of the week.

Meanwhile, the benchmark for U.S. stocks, the S&P 500, and the tech-heavy Nasdaq Composite Index plunged 2.7% and 3.2%, respectively.

IntoTheBlock said in a report that the steady price action was “remarkable” in light of the stock market taking a hit. The analytics firm noted among the potential reasons behind the stability that BTC’s correlation with the Dollar Index (DXY) hit zero, meaning there’s no relationship at all between them.

The number of long-term holders – HODLers in crypto slang – are near an all-time high, IntoTheBlock said, which could be a sign that they are refusing to sell before a potential approval of a spot BTC exchange-traded fund in the U.S.

“Historically, these long-term investors have helped sustain price during bear markets and take profits as new all-time highs are set in bull markets,” the report said.

“This trend appears to signal a bullish cycle for bitcoin may be approaching,” it added. “Though it’s unclear how long bitcoin’s outperformance will last in a worsening macro environment, on-chain data shows that its long-term investors continue to accumulate regardless.”

Resistance above $27,000

BTC climbed to as high as $27,400 ahead of the Federal Reserve meeting on Wednesday, but turned lower “witnessing strong selling pressure,” Rachel Lin, CEO of derivatives decentralized exchange SynFutures, noted in an email.

“Both the 200-weekly moving average and the 200-daily moving average are in the 27,800 level, likely acting as strong resistance in the coming week,” she said, adding that the range between $26,000 and $26,500 acts as a support for prices.

In the options market, $24,000 puts and $35,000 call options have the largest open interest, according to Lin.

“This suggests the market still believes BTC will stay in that range for the foreseeable future,” she said.