Quick Take

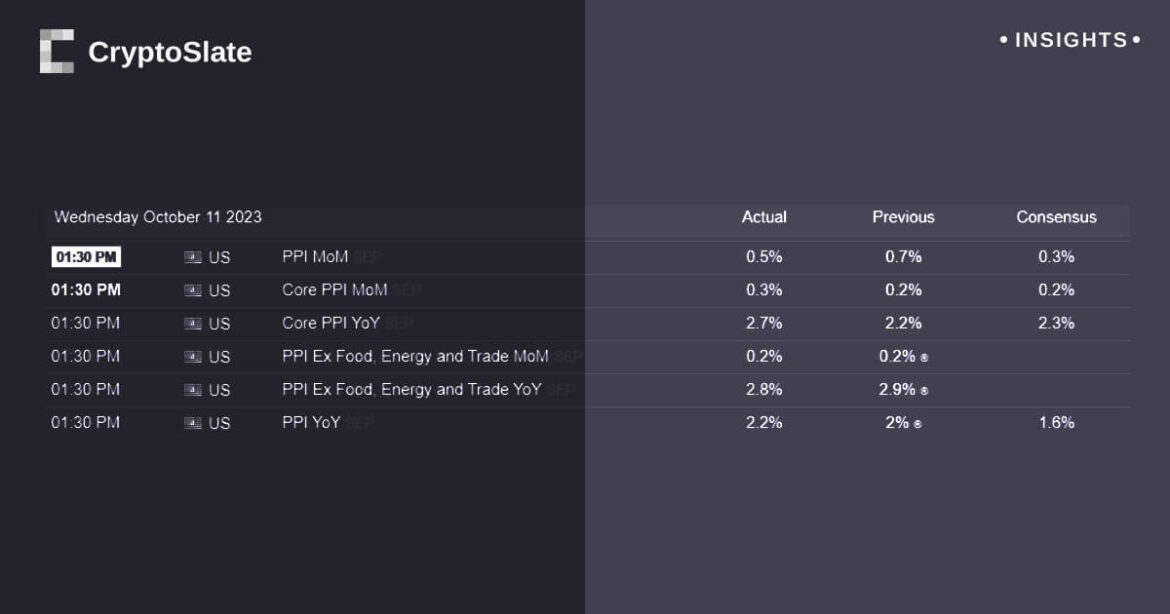

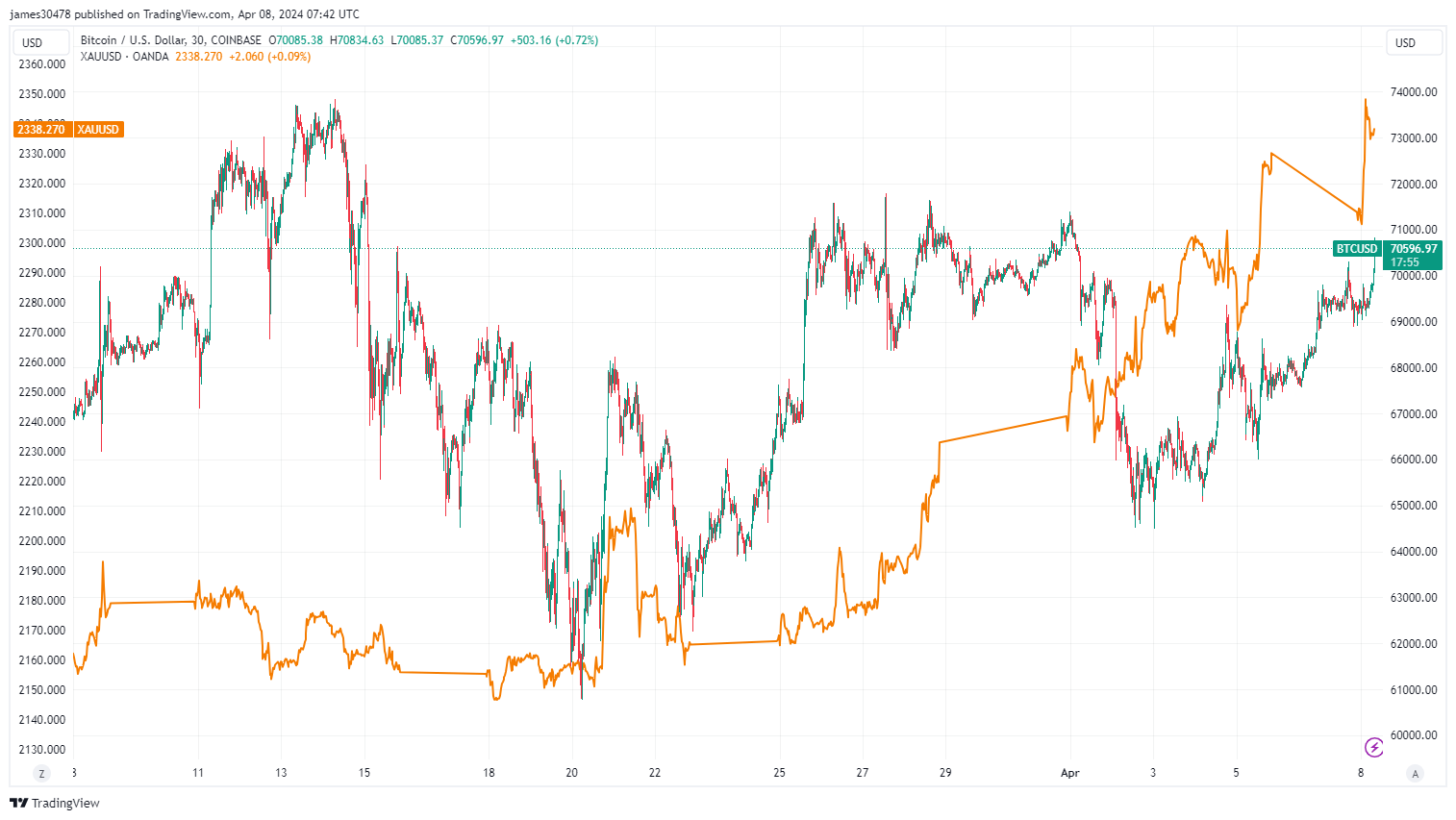

In the midst of economic uncertainty, Bitcoin continues to dance around the crucial $70,000 level, demonstrating its resilience despite the DXY index steadily climbing towards 106 and US yields on the rise. As investors seek safe-haven assets, many are looking to gold for guidance, hoping that Bitcoin, often referred to as “digital gold,” will follow suit.

Despite a slight dip at the beginning of April, Bitcoin’s dominance in the digital asset market remains strong, currently at 54.6%, just below the cycle highs of 55.2%. This growth in dominance, up 6% year-to-date, indicates that investors, on aggregate, are favoring Bitcoin over other digital assets.

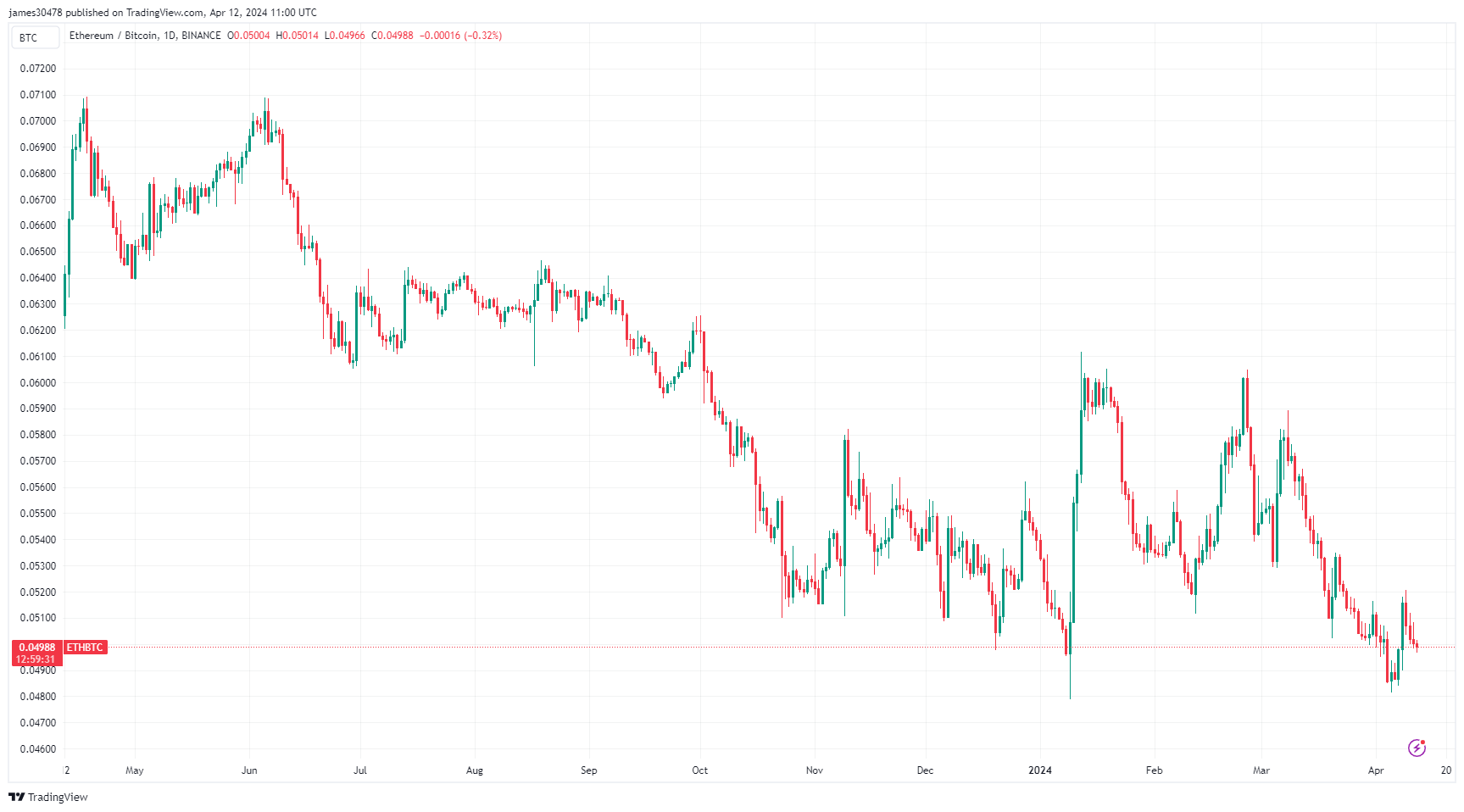

Another noteworthy trend is the ETH/BTC ratio, which remains below the critical 0.05 threshold, suggesting that Bitcoin is outperforming Ethereum. The ETH/BTC ratio has declined by 6% year-to-date and 20% over the past year. As the DXY index continues to surge, market observers are keeping a close eye on Bitcoin and gold, anticipating that they may continue to hold their ground or even follow the upward trend, providing a potential hedge against economic instability.

The post Bitcoin holds steady against economic headwinds, outshining Ethereum appeared first on CryptoSlate.

In the last week, 23 cryptocurrencies experienced notable gains against the U.S. dollar, with flare (FLR) and uniswap (UNI) leading the charge. Concurrently, dymension (DYM) and helium (HNT) saw significant declines over the same period. FLR and UNI Lead Gains in a Diverse Week for Cryptos, Despite DYM and HNT Setbacks As of now, the […]

In the last week, 23 cryptocurrencies experienced notable gains against the U.S. dollar, with flare (FLR) and uniswap (UNI) leading the charge. Concurrently, dymension (DYM) and helium (HNT) saw significant declines over the same period. FLR and UNI Lead Gains in a Diverse Week for Cryptos, Despite DYM and HNT Setbacks As of now, the […]