IBM Corp. on Tuesday notified employees in its marketing and communications division that it’s making cuts, the latest large tech company to trim its payroll.

Source link

IBM

In 2024, artificial intelligence (AI) continues to play a role in a stock’s success after rising to prominence last year. Plenty of tech companies have trumpeted the use of AI, but many didn’t even exist when International Business Machines (IBM 0.41%) started working on the technology back in the 1950s.

IBM’s deep expertise in this area allowed the company’s AI book of business to double between the third and fourth quarters of last year. This rapid AI growth is one of the reasons why IBM shares jumped to a 52-week high of $197 in January, its highest share price in a decade.

The stock price has pulled back from this high, which may make you wonder whether IBM is a buy now. A closer look into Big Blue can help determine if the company makes a good long-term investment.

AI’s role in IBM’s revenue growth

Despite its long history with AI, IBM didn’t make this technology a central focus of the company until Arvind Krishna became CEO in 2020. Thanks in part to this prioritization of AI, IBM delivered strong financial performance in 2023.

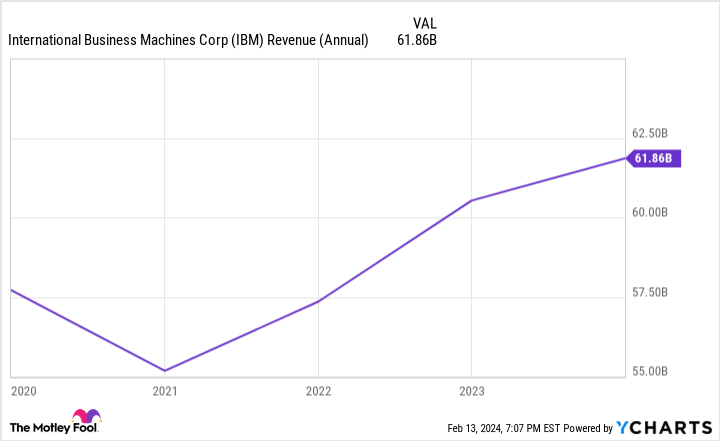

Big Blue ended the fourth quarter with revenue up 4% over 2022, reaching $17.4 billion, as all segments of its business experienced year-over-year sales gains. This propelled IBM to $61.9 billion in full-year revenue.

The company’s 2023 results were the latest in a trend of steadily rising revenue over the past couple of years.

Data by YCharts.

AI was one of the contributing factors to IBM’s sales growth. Krishna noted, “Every client I speak with is asking about how to boost productivity with AI.”

This is where IBM’s consulting division comes into play. Big Blue’s consultants help businesses create an AI strategy and implement the technical components. This consultative capability is a competitive advantage.

Krishna stated, “We are the only provider today that offers both a technology stack… and consulting services for deploying and managing generative AI.”

As a result, Q4 revenue in IBM’s consulting segment was up 6% over 2022, comprising $5 billion of Big Blue’s $17.4 billion in sales for the quarter.

IBM’s success beyond AI

AI isn’t IBM’s only area of success. Its Red Hat cloud computing division enjoyed strong 8% year-over-year revenue growth in Q4, and annual bookings increased 17%. This rise in annual bookings indicates customers plan to spend more on Red Hat’s cloud computing services, suggesting IBM’s Q4 sales success is likely to continue in 2024.

Even IBM’s infrastructure division, which sells hardware such as computer servers, saw year-over-year sales rise 2.7% in Q4 to $4.6 billion. This business segment is sensitive to product cycle swings, and its latest mainframe server, the z16, has been out for seven quarters.

If z16 sales were on the wane, it would be understandable. Instead, the z16 outperformed prior models thanks to innovations such as embedded AI capabilities, as well as cybersecurity capable of protecting from hacks generated by quantum computers. Quantum computing represents the next generation of computing machines, and IBM is developing this technology as well.

Helped by its revenue growth, Big Blue saw 2023 free cash flow (FCF) make a substantial jump to $11.2 billion from $9.3 billion in 2022. FCF indicates the cash profits a company has available for activities such as investing in its business and funding its dividend.

So IBM’s FCF growth is a positive sign for investors, solidifying the company’s ability to continue offering its attractive dividend, currently yielding over 3%.

Big Blue paid out $6 billion in dividends last year, so its 2023 FCF total comfortably covered this expense, allowing the company to increase its dividend for the 28th straight year. IBM expects to deliver a greater amount of FCF, about $12 billion, in 2024.

To buy or not to buy IBM stock?

IBM has a lot going for it right now. It’s doing well across all its business segments. Its revenue growth in 2024 looks encouraging given Q4’s double-digit increase in annual bookings. FCF generation remains strong, enabling Big Blue the flexibility to raise its dividend.

Moreover, the company benefits from the secular trend of AI. The AI market is expected to reach $305.9 billion this year, up from $241.8 billion in 2023, and is forecasted to grow to $738.8 billion by 2030. This serves as a multiyear tailwind for Big Blue.

All of these factors combine to make IBM stock an attractive long-term investment. With the share price not far from its 52-week high, a prudent approach is to use dollar-cost averaging to buy some shares now, then build your position over time whenever the stock dips. And you’ll receive dividend payments as passive income while you continue to build your position over the long term.

Apple, IBM, and Netflix Just Split Their Stocks, but It’s Not What You Think

I subscribe to a plethora of stock market information services. It comes with the job, you know. Earlier this week, several of these tools sent me a whole lot of news announcements, nearly buzzing that phone out of my pocket. I was in for an eye-opening discovery.

A flood of buzzing surprises

According to these unexpected notifications, Netflix (NASDAQ: NFLX) just split its stock. Oh? Maybe they announced it in that game-changing earnings report and nobody noticed? I guess it could happen.

Wait — International Business Machines (NYSE: IBM) did the same thing. Then there’s Bank of America (NYSE: BAC), Apple (NASDAQ: AAPL), and Toyota Motor (NYSE: TM), just to name a few. There’s no way all of these giants could have performed stock splits in unison, like a Gregorian chant of Wall Street accounting tricks, without generating miles and miles of headlines. Besides, I couldn’t find the same stock-split announcements through my usual sources, which focus on the American stock market.

So I looked at the notifications again, zeroing in on the stock tickers. And then it hit me.

These stock splits, all taking place on Wednesday, didn’t actually involve the American stocks. Every single announcement was about each company’s presence on the Argentinian stock market, at the Buenos Aires exchange.

Don’t cry for me, Argentina. If anything, I should cry for you.

Yes, Netflix and Apple really did split their stocks this week, but not because their listings on the NYSE and Nasdaq exchanges were growing too pricey. Most of them may get there soon, and I wouldn’t be terribly surprised to see a normal Netflix split someday soon — but Bank of America’s shares only cost $33 each.

Things look very different on the Buenos Aires exchange, where investors must struggle with Argentina’s incredible hyperinflation. Here, Netflix trades at roughly 14,700 Argentine pesos per share after Wednesday’s 3-for-1 stock split. That’s about $18 at current exchange rates. But things change fast in Argentina. In early December, the same stash of pesos was worth $41. A year ago, it was $79. It’s no wonder that American companies feel the need to adjust their share prices amid this catastrophic exchange-rate trend.

The U.S. dollar’s inflation rate briefly soared to 9.1% in June 2022. It was a painful jump with game-changing effects on business and personal finance in this country, sparking heavy-handed anti-inflation policies from every level of our government.

The Argentine crisis is orders of magnitude worse. December’s prices were 25.5% above November’s and 211% higher on the same year-over-year basis you see most often in American inflation reports.

Argentina is teaching me things about value storage

You might think the prices of American stocks on the Buenos Aires exchange are a low priority in times like these. However, Argentinians with the means and foresight to invest in these stable value stores have a powerful financial tool in their hands. As the peso loses its value, alternatives such as stocks, physical gold, or Bitcoin (CRYPTO: BTC) become incredibly important. Other defensive options include real estate holdings, cars, or bills and coins in foreign currencies such as the dollar.

The total value of Netflix, Toyota, and Apple shares on the Buenos Aires market are always in lockstep with their underlying American counterparts, filtered through the effective currency exchange rates and different number of shares. Tapping into your foreign stock holdings (and other stable assets) can keep food on your table when the pesos in your pocket are turning worthless.

This reminder of the Argentine inflation crisis may not improve my investing strategy by much, but those buzzing notifications opened my eyes to the sheer scale of this monetary disaster. Now I understand why Netflix pointed to the falling peso as a 3% currency-exchange headwind for its top-line growth in the next quarter. And the American situation doesn’t seem likely to mirror the Argentine crisis anytime soon, but a healthy reserve of gold or Bitcoin could be a life-saver if the next local inflation crisis is any worse than the recent one.

These stock splits, initially a curiosity, reveal the profound impact of global economic shifts. They underscore a vital truth for investors: the importance of vigilance in an interconnected world and the wisdom of diversifying beyond the traditional stock market. Diversify, stay alert, and maybe keep some Bitcoin or gold handy for a rainy day — because when it rains on the scale of a national economy, it really pours.

10 stocks we like better than Walmart

When our analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

*Stock Advisor returns as of 1/22/2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Anders Bylund has positions in Bitcoin, International Business Machines, and Netflix. The Motley Fool has positions in and recommends Apple, Bank of America, Bitcoin, and Netflix. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Stock Market Curveball: Apple, IBM, and Netflix Just Split Their Stocks, but It’s Not What You Think was originally published by The Motley Fool

IBM Strengthens Hybrid Cloud and AI Platforms With $2.3 Billion Acquisition

International Business Machines (IBM 0.31%) has a knack for using acquisitions to bolster its growth businesses. The tech giant occasionally goes big, as it did with the $34 billion acquisition of Red Hat in 2019, but most of its acquisitions are smaller.

Most recently, IBM shelled out $4.6 billion for financial and operational IT management and optimization software provider Apptio. Apptio’s products can help IBM’s clients keep cloud spending under control as they modernize their IT infrastructures.

IBM announced on Monday that it’s following up the Apptio acquisition with another significant purchase. The company has agreed to acquire StreamSets and webMethods, two products that comprise what current owner Software AG calls a “super integration platform-as-a-service.” The deal will cost IBM about $2.3 billion and be funded from the company’s available cash on hand.

Solving a thorny problem

Enterprises use a wide variety of software and tools. Often, these tools don’t work nicely together. One solution is to dedicate software engineering resources to building bespoke integrations between tools. This works until it doesn’t. These integrations tend to be fragile, requiring additional resources to fix when something goes wrong.

The picture is complicated further when an enterprise needs to connect both modern cloud applications and legacy software running on its own servers. A cloud-based customer relationship management tool may need access to data squirreled away in an application that’s been running on-premises for decades, for example. Making that connection in a reliable, low-maintenance way is tricky.

An iPaaS, or integration platform as a service, aims to solve this problem. Using an iPaaS, connecting two applications is no longer a software engineering project. If the marketing team wants to automate a workflow, pulling data from multiple places and connecting multiple applications, the iPaaS makes it happen with minimal fuss.

While a standard iPaaS is focused on connecting modern cloud-based applications, the iPaaS platform IBM is acquiring takes it a step further by supporting integrations with legacy software. The platform also helps solve the issue of connecting applications in cases where data residency rules add another layer of complexity.

IBM is all in on hybrid cloud computing. The company helps its clients modernize their IT infrastructures, which usually involves running workloads on multiple public clouds as well as on private clouds. An iPaaS product that seamlessly connects all those workloads is a valuable addition to IBM’s suite of hybrid cloud software products.

This acquisition also boosts IBM’s artificial intelligence (AI) business. StreamSets is all about data ingestion, and IBM will use it to add data ingestion capabilities to its watsonx AI platform.

Focusing on what works

While IBM is seeing some clients pull back on spending in some areas, digital transformation and application modernization are in high demand. IBM’s clients are looking for projects that can deliver cost savings, productivity gains, and efficiency improvements.

The acquisition of StreamSets and webMethods will strengthen IBM’s hybrid cloud and AI platforms. Notably, the platform IBM is acquiring is growing, already profitable, and has significant recurring revenue. Around 50% of IBM’s total revenue was recurring in nature during the third quarter. By 2027, the market for integration software is expected to top $18 billion.

IBM has started to find its groove after a decade-long transformation effort. Revenue should grow by 3% to 5% this year despite an uncertain economy, and free cash flow is set to expand by more than 10% to $10.5 billion. As IBM continues to push its hybrid cloud and AI platforms, the $2.3 billion acquisition of StreamSets and webMethods will make them more compelling for enterprise customers.

Timothy Green has positions in International Business Machines. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Apple, IBM, and Disney: Here are all the companies that have pulled ads on X

Multiple high-profile companies have suspended advertising on X, the company formerly known as Twitter, following Elon Musk’s apparent endorsement of antisemitic conspiracy theories last week.

Musk posted to X, “you have said the actual truth,” in response to a post that claimed Jewish communities support “dialectical hatred against whites.” Musk and X CEO Linda Yaccarino followed the firestorm from Musk’s tweets with posts stating they are against antisemitism.

Over…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

IBM Quantum and Microsoft have formed a coalition to tackle post-quantum cryptography alongside not-for-profit research tank MITRE, United Kingdom-based cryptography firm PQShield, Google sibling company SandboxAQ and the University of Waterloo.

We’re proud to be a part of a new community of cybersecurity organizations to accelerate adoption of post-quantum cryptography in commercial & open-source technologies.

Learn more about the #PQC Coalition.

| #QWC2023 #UWaterloo pic.twitter.com/vXG6CilQVx

— University of Waterloo (@UWaterloo) September 26, 2023

Post-quantum cryptography (PQC) addresses the potential threat posed by quantum computers of the future. Current cryptography schemes rely on mathematical problems to stymie decryption attempts.

Cracking or bypassing such encryption with a classical computer would be nearly impossible. Some experts estimate that it would take a binary computer system roughly 300 trillion years to break a 1,024-bit or 2,048-bit RSA key.

RSA, named for the computer scientists who first discussed it, is largely considered the standard for encryption.

Theoretically speaking, however, a quantum computer with sufficient hardware and architecture should be able to break RSA and similar encryption schemes within a matter of weeks, days or even hours.

According to a press release from MITRE:

“Preparing for a PQC transition includes developing standards for the algorithms; creating secure, reliable, and efficient implementations of those algorithms; and integrating the new post-quantum algorithms into cryptographic libraries and protocols.”

Technologies such as blockchain and cryptocurrency, which rely on mathematical encryption, could be particularly vulnerable to decryption attacks by the theoretical quantum computers of the future. However, it’s currently unclear how long it could be before such threats could come to fruition.

Related: Scientists warn the ‘quantum revolution’ may stagnate economic growth

One study conducted in 2022 determined that it would take a quantum computer with 300 million qubits (a very generalized measure of the potential processing power of a quantum system) to crack the Bitcoin blockchain fast enough to do any damage. By comparison, today’s most advanced quantum computers average a little over 100 qubits.

However, per the architecture described in that paper, it’s possible that more advanced qubit arrangements, chipsets and optimization algorithms could significantly change the calculus involved and drop the theoretical 300-million-qubit requirement exponentially. For this reason, the global technology community is turning to quantum-safe encryption.

The National Institute of Standards and Technology (NIST) chose four proposed post-quantum encryption algorithms in 2022 — CRYSTALS-Kyber, CRYSTALS-Dilithium, SPHINCS+ and Falcon — as candidates for a PQC-safe encryption standard.

On Aug. 24, 2023, NIST announced that three of the algorithms had been accepted for standardization, with the fourth, Falcon, expected to follow suit in 2024.

Now that the algorithms have been accepted and (mostly) standardized, the coalition is set to begin its mission of using the deep knowledge and hands-on experience amassed by its members to ensure key institutions such as government, banking, telecommunications and transportation services are able to transition from current to post-quantum encryption.

Fool.com contributor Parkev Tatevosian reviews IBM‘s (IBM 0.43%) latest earnings results and determines if IBM stock is a buy right now.

*Stock prices used were the afternoon prices of July 19, 2023. The video was published on July 21, 2023.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Here is your Pro Recap of four head-turning deal dispatches you may have missed this week: IBM and Apptio merger rumors, Eli Lilly acquires Dice Therapeutics, Amazon’s iRobot acquisition faces EU antitrust investigation, and Stratasys determines 3D Systems’ offer not a ‘Superior Proposal’ to Desktop Metal agreement.

InvestingPro subscribers got this news first. Never miss another market-moving headline.

IBM to acquire Apptio for $5 billion, says WSJ

IBM (NYSE:IBM) is close to buying cloud-focused software firm Apptio for around $5 billion, per the Wall Street Journal – and the deal could be finalized over the weekend, according to the people familiar with the matter. Neither IBM nor Apptio have commented on the matter.

The acquisition aligns with IBM’s recent trend of software purchases like Turbonomic in 2021 and Red Hat in 2019.

IBM is expected to report Q2 earnings next month, with analysts looking for a slight rise in revenue but a drop in earnings per share to $2.01 from last year’s $2.31

Eli Lilly to acquire Dice Therapeutics for $2.4B

Dice Therapeutics (NASDAQ:DICE) shares jumped more than 37% on Tuesday after Eli Lilly (NYSE:LLY) said it has agreed to acquire the biotech company for $48 per share in cash, an aggregate of approximately $2.4B.

Amazon’s iRobot acquisition to face EU antitrust investigation

Amazon’s (NASDAQ:AMZN) $1.7B acquisition of iRobot (NASDAQ:IRBT) is set to undergo an EU antitrust investigation, Reuters reported on Thursday. According to the sources familiar with the matter, the European Commission is planning to undertake a four-month investigation into the deal after the end of its preliminary review acquisition on July 6. Reuters sources suggest Amazon may yet convince the EU of the deal’s pro-competitive nature, but the odds are high against it.

iRobot shares fell around 15% this week.

Another report on Thursday led to a surge in Ocado (LON:OCDO) share prices by around 43%. The catalyst was rumors of a potential takeover by Amazon. The Times suggested that Amazon, in collaboration with investment banks JP Morgan and Goldman Sachs, could make an offer, valuing Ocado at around £6.6B ($7.67B).

Stratasys says 3D Systems’ offer not a ‘Superior Proposal’ to Desktop Metal agreement

Stratasys (NASDAQ:SSYS) announced that its Board of Directors determined that the May 30 unsolicited non-binding indicative proposal from 3D Systems (NYSE:DDD) to acquire Stratasys does not constitute a “Superior Proposal” and does not provide a basis upon which to enter into discussions with 3D Systems, pursuant to the terms of the merger agreement with Desktop Metal Inc (NYSE:DM).

Stratasys saw a surge in shares prices since the start of the month after it announced it had received an unsolicited cash-and-stock offer from 3D Systems to acquire the company: $7.50 in cash and 1.2507 newly issued 3D Systems shares per ordinary Stratasys share.

Jeffrey Graves, CEO of 3D Systems, voiced his disappointment over Stratasys’ decision, stating that they remain undeterred in the belief that a transaction between 3D Systems and Stratasys on the terms proposed constitutes a ‘Superior Proposal.’

Get ready to supercharge your investment strategy with our exclusive discounts.

Don’t miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, the Summer Sale won’t last forever!

Related Articles

4 big deal reports: IBM to buy out Apptio for $5B, per media reports

PwC Australia to sell government business for A$1, appoint new CEO