Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Ripple CEO Brad Garlinghouse believes that the U.S. Securities and Exchange Commission (SEC) will approve spot exchange-traded funds (ETFs) based on crypto tokens other than bitcoin. “I think it’s inevitable that there’ll be multiple ETFs around different tokens,” he stressed, noting that Ripple would welcome an XRP ETF. “In my opinion, it makes these markets […]

Source link

Idea

Let’s face it: America has a drinking problem. As in too many of us consume way too much alcohol and pay the price in terms of our health, our careers and our relationships.

And yet I am skeptical about Dry January.

By now, I’m sure you know all about this challenge of going alcohol-free during the first month of the year. Chances are you may be attempting it yourself. In a 2023 study, a remarkable 41% of Americans surveyed by the polling platform CivicScience said they were likely to do Dry January.

For the record, if you feel you need to cut back on your drinking, Dry January is probably not a bad idea, according to addiction experts I consulted. It might be a very good idea, in fact.

Lest we forget the seriousness of the disease of addiction: Each year, roughly 140,000 Americans die of alcohol-related causes, according to the National Institute on Alcohol Abuse and Alcoholism. And 16.1 million of us report having drunk heavily in the past month. Those are scary numbers indeed.

But Dry January has its limitations — and risks.

Begin with the most critical element: If you have a major drinking problem, it can be dangerous and even deadly to go cold turkey on your own, experts advise. That’s because you may suffer from major withdrawal symptoms, from heart palpitations to headaches, and the need for medical supervision during detoxification can be essential.

Beyond that, there’s a mental-health component. People often self-medicate with alcohol, using it to help with their depression, anxiety or any number of other conditions. Remove the booze and the person might be physically healthier, but those underlying emotional problems remain and need to be addressed. In effect, Dry January can’t be done in a vacuum.

Or as Cheryl Brown Merriwether, executive director of the Orlando-based International Center for Addiction and Recovery Education (ICARE), told me: “Alcohol-use disorder is a disease, and it needs to be treated as a disease.”

“If you have a serious drinking problem, it can be dangerous and even deadly to go cold turkey on your own, experts advise. ”

What about those of us who drink but don’t necessarily suffer from a true disorder: Would January stand to benefit us?

It depends, experts advise. Certainly, it can offer some short-term benefits, such as weight loss and improved sleep. And it may create greater awareness of our drinking patterns, so that we emerge from Dry January with a commitment to better manage our alcohol consumption during the rest of the year.

But there’s a rub. While there’s some evidence that those who give up booze at the beginning of the year may end up drinking less down the road, some experts worry that Dry January can lead to Overindulgence February. Or, at the very least, it won’t really prompt long-term change.

Such is the real challenge that drinking can present, explained Lisa Ferguson, a recovering alcoholic who helps run Right Path House, a group of sober houses in Connecticut.

“You may well have the rebound effect,” Ferguson told me. “It happens all the time.”

My questioning of Dry January goes deeper than that, however. I can’t help but wonder if what started as a well-intentioned movement has become reduced to a fad — something people do because it’s trendy and suits the tenor of the times.

In the process, a lot of these people seem more than eager to broadcast their month-long sojourn into sobriety, almost as if they’ve turned what could be a worthwhile health-minded goal into a form of virtue signaling. Or, for whatever reason, they have the desire to share with the world the details of their drinking — or not drinking, as it were.

Francine Cohen, a veteran food- and beverage-industry consultant, put it thusly: “Sometimes I go to a bar or restaurant and order an alcoholic beverage. Sometimes I choose water or another option. But never do I feel any obligation to explain myself.”

Cohen raises another point — that so many of the nonalcoholic beverages that have flooded store shelves in the last few years miss the mark. As someone who writes a fair bit about wine, beer and spirits, I concur: The faux booze rarely equals the real deal flavorwise. I’d rather have a Coke and call it a day.

“People seem eager to broadcast their month-long sojourn into sobriety, almost as if they’ve turned what could be a worthwhile goal into a form of virtue signaling. ”

Still, people are buying the stuff: NielsenIQ reports the nonalcohol segment grew by $121 million in the past year to reach $510 million in sales. Heck, there’s now an alcohol-free version of White Claw, the popular hard-seltzer brand.

Last I checked, booze-free hard seltzer is something we’ve been drinking for ages. It’s called — duh! — seltzer. The White Claw team nevertheless says this new formulation hits the spot.

It “looks, tastes, and feels completely different from anything out there,” said Kevin Brady, vice president of marketing for Mark Anthony Brands Inc., the Chicago-based company behind White Claw.

No matter how tasty it might prove, let’s be honest with ourselves: A great glass of wine, a sip of quality whiskey, a thirst-quenching beer — these are things we treasure in life. Yes, we must guard against alcohol misuse. But if we can keep our drinking fully in check, must we feel pressured to give it up, even for a month?

Donald Hensrud, a Mayo Clinic physician and associate professor of nutrition and preventive medicine at the clinic’s medical school, doesn’t disagree with me. While he’s quick to note that recent research has started to debunk the idea that drinking alcohol can be healthy, he nevertheless recognizes the pleasure that glass of vino can bring.

“There is enjoyment and relaxation,” he told me, though he did reiterate the need to keep things within sensible medical bounds.

And here’s another thought: If you really want to forgo the booze, why does it have to be in January? We all know how difficult it is to stick to our New Year’s resolutions.

For that matter, why does it have to be about a month of sobriety? Peter Vernig, vice president of mental-health services at the Recovery Centers of America, suggests there are other ways to cut back — not just for a month, but in general — that might be more helpful in terms of rethinking our consumption of alcohol.

“You could reduce the amount you drink in a single setting. You could reduce the number of days you drink in a week,” Vernig said.

I’ve been drinking less myself in the past year, largely because I’ve been trying to lose weight and I view alcohol as the quintessence of empty calories. And yet I see no reason to do Dry January because I continue to enjoy that occasional sip — in moderation. If others feel there’s something to be gained from 31 days of booze-free living, good for them, I say.

But the caveats and cautions still apply.

Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is

Steve Ballmer, once an assistant to Bill Gates at Microsoft, is now ranking just a few spots away from his former boss on the list of the world’s richest people. According to Bloomberg, Ballmer’s net worth soared to $117 billion in October 2023, placing him as the fifth-richest globally, just $5 billion short of Gates’ wealth. Gates has donated a substantial part of his fortune to charity since leaving Microsoft.

According to Forbes’ real-time billionaires list on Nov.8, 2023, Steve Ballmer’s net worth has recently decreased to $108.7 billion, with Bill Gates maintaining a narrow lead at $113.9 billion.

Don’t Miss:

Despite a dip reported by Forbes, Ballmer’s net worth surge earlier in the year positioned him alongside esteemed billionaires such as Elon Musk, Bernard Arnault and Jeff Bezos. He ranks just after tech giants Larry Page and Mark Zuckerberg in wealth. Among these titans of industry, Ballmer stands out as the sole individual in the top 10 who isn’t a company founder.

His journey began at Harvard University, where he crossed paths with Gates. After graduating in 1977, Ballmer joined Microsoft as its 24th employee. Starting as a business manager, he climbed the ranks to become president and later CEO, taking the reins from Gates himself.

Even after stepping down as CEO and purchasing the Los Angeles Clippers in 2014, Ballmer’s fortunes are still heavily invested in Microsoft, where he holds about a 4% stake. Microsoft’s stock has surged, particularly in 2023, thanks to an AI-driven boost in the tech sector, greatly benefiting Ballmer’s financial portfolio.

Trending: Until 2016 it was illegal for retail investors to invest in high-growth startups. Thanks to changes in federal law, this Kevin O’Leary-backed startup lets you become a venture capitalist with $100.

The strength of Ballmer’s wealth is significantly tied to Microsoft’s performance, with the company’s expansion into AI and cloud services boosting its market value and his personal net worth. His 4% stake in Microsoft is a testament to his enduring confidence in the company he helped elevate.

The opportunity to invest in promising AI or tech startups is accessible to anyone, not just wealthy investors. Take Kliken, for instance, which leverages GPT AI technology to offer small businesses top-tier digital marketing services at a significantly reduced cost, and it’s possible to invest in this potential with as little as $200.

Ballmer’s ownership of the Los Angeles Clippers adds a substantial non-tech asset to his portfolio. The Clippers’ valuation, combined with the NBA’s profitable broadcasting agreements, bolsters his financial standing.

In contrast, Bill Gates has shifted focus towards philanthropy and invested billions in health, education and climate change initiatives through his foundation. This philanthropic approach has redistributed a portion of Gates’ wealth, differing from Ballmer’s investment strategy.

While market changes and economic trends can affect the net worth of the world’s richest, Ballmer’s diversified investments and Microsoft’s ongoing success provide him with a stable position in the upper echelons of global wealth, showcasing the vast potential for growth among the tech elite.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

This article Bill Gates’ Former Assistant Is Now One Of The Richest People In The World And Could Even Surpass Him In Net Worth — But You Probably Have No Idea Who He Is originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

Bitcoin (BTC) is about to test hodlers with a “mid cycle lull” before starting a bull run in late 2024, a new BTC price model states.

According to its creator, popular analyst CryptoCon, the “November 28th Cycles Theory” demands the BTC price all-time high in 2025.

Countdown to BTC price “bull run launch”

Amid debate over the nature of the current Bitcoin four-year price cycle, CryptoCon believes that all may be simpler than many imagine when it comes to how BTC/USD behaves at a given time.

Unveiling the “November 28th” chart on X (formerly Twitter), he delineated the date as a key pivot point in the year, along with a three-week period on either side.

“Using 4-year time cycles against my Theory, produces Bitcoins exact behavior in time since its inception. Cycles are centered around the date of the first halving Nov 28th,” he explained.

“Bitcoin price action began at the first bottom October 8th, 2010. This is where cycle curves peak, every 4 years. Tops and bottoms come +/- 21 days from Nov 28th at their appropriate times on the curve. Tops on the upswing, bottoms on the pinnacle.”

The chart describes November 28 as the date Bitcoin sees a “bull run launch” every four years. The last was in 2020 when BTC/USD broke beyond its prior all-time high (ATH) to hit its current $69,000 record a year later.

The next point of interest is thus November 2024. Until then, BTC price action will spend its time in a “mid cycle lull.”

“After Bitcoin bottoms, price makes an early first cycle move (orange) and enters into a mid-cycle lull,” CryptoCon continued.

“This is the longest part of the cycle, where Bitcoin spends time around the median price (half of previous ATH), until the curve bottoms.”

He added that Bitcoin had “almost certainly” seen its early top, referencing the $31,800 local highs from July.

A Bitcoin “bull market fakeout”

As Cointelegraph reported, opinions on where BTC price action will go into the 2024 block subsidy halving differ.

Related: Bitcoin halving can take BTC price to $148K by July 2025 — Pantera Capital

Some argue that modest gains will be all that hodlers will see before the event, scheduled for April next year.

In an interview with Cointelegraph this week, Filbfilb, co-founder of trading suite DecenTrader, nonetheless delivered a $46,000 target for the halving, with $35,000 slated for year-end.

In his latest newsletter published on Sept. 5, meanwhile, CryptoCon summarized 2023 BTC price behavior as a “bull market fakeout.”

“This makes it appear as if the bull market has begun with the trigger of many signals, but then at some point, price fails to continue,” he wrote.

“This is the most convincing example we’ve seen of this yet. Personally, I think there is still some time to go for that and I am patiently awaiting its completion.”

BTC/USD traded at $26,200 at the time of writing on Sept. 8, per data from Cointelegraph Markets Pro and TradingView.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

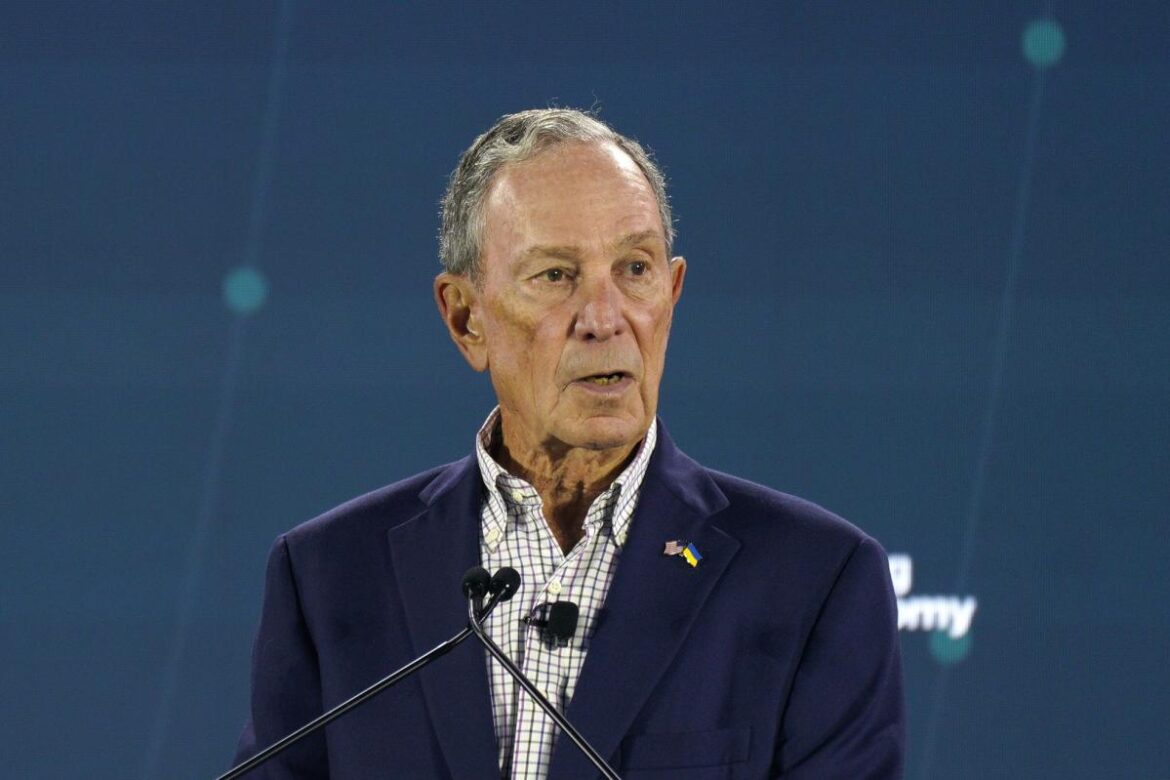

Michael Bloomberg made a radical decision to ax his entire board of directors. Was that a good idea?

Good morning,

Michael Bloomberg wasn’t known for board refreshments until last week—when he fired every single director.

News of the move came in a memo to staff in which the 81-year-old founder and majority owner of Bloomberg, the global financial data and media giant, also announced a new CEO and a new president at the firm. Vlad Kliatchko, Bloomberg’s chief product officer, and Jean-Paul Zammitt, the company’s chief commercial officer, were promoted to the top two jobs respectively. Neither man is replacing anyone, since the company didn’t have a sitting CEO or president. The founder, who holds no title but is reportedly very much in charge of his eponymous firm, also made his own position clear, writing: “I’m not going anywhere.”

Bloomberg’s new board of directors will be headed by Mark Carney, the former governor of the Bank of England, but no other incoming members were mentioned. In the memo, he thanked his directors for their decades of service, but mentioned it was “time to build on what they did and get the next generation into place.”

Corporate governance experts say Bloomberg’s move to ax the entire board is nearly unprecedented. Sure, Elon Musk fired the entire Twitter board when he purchased the social media platform (he became the sole director), but he was taking the firm private at the time. And while it’s possible that CEOs or founders of small private companies might take dramatic measures to rebuild a board, staggered refreshments are more common, especially at a company the size of Bloomberg, a titan of the finance industry with revenues of $12 billion a year, according to the Financial Times.

Heidi Roizen, partner at the venture capital firm Threshold Ventures, calls Bloomberg’s extreme board refreshment a “bold maneuver” and adds that it’s risky. It can be challenging to onboard even a few directors at once, she says. “Boards have their own cultures. They have their own institutional knowledge. Imagine on a sports team, if you suddenly changed out half your players, you lose a lot of that connective tissue,” Roizen says.

In Bloomberg’s case, media reporters and insiders have suggested that the leadership reshuffling is linked to the founder’s plan to eventually exit the company and turn it over to a philanthropic trust. In such a situation, forming a high-profile board is a smart idea, says Shawn Panson, U.S. private company services leader for PwC. “The next family generation or the next leader may not have that same sort of brand or presence [as the founder],” he says, and a high-powered board would influence how the company is seen “and who wants to do business with them.”

Succession aside, both Panson and Roizen say that such a sudden boardroom change would also allow a company to catch up on a few key trends in current private board practices—the tendency to favor shorter tenures (most of Bloomberg’s directors had tenures of 20 years or more), and the chance to recruit directors with a greater diversity of in-demand expertise, including IT and cybersecurity, talent management and human resources, M&A, and sustainability. The all-in-one-go method also means that no one board member is singled out when they’re let go, Roizen notes. “It could be an easier conversation to have,” she says. Bloomberg did not respond to Fortune’s queries about the new board.

Ted Bililies, a partner and managing director at AlixPartners who works with boards and CEOs, also points out that letting go of a full board means a company can “reset with a fresh, clean slate, a clean history,” which “can give the founder quite a great deal of power.”

However, he cautions that any CEO who wants to try this needs to think about building a new governance scaffolding with explicit rules: “You have to make sure that your governance procedures and even your role descriptions—what does it mean to be a board member—those requirements are very explicitly stated, because so much has been done over the decades implicitly.”

Lila MacLellan

lila.maclellan@fortune.com

@lilamaclellan

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Want more for your money? These 9 savings accounts have rates of 5.00% APY (and higher)

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home

In the wake of a massive exploit, the price of the Curve (CRV) token has declined drastically, recording double-digit losses in the last day. This has led to what some would call an opportunity to buy cheap coins and Matrixport and Bitdeer founder Jihan Wu is one of the believers.

A Good Time To Buy Curve (CRV)?

Jihan Wu recently tweeted that he bought the CRV dip. According to Wu, he remains a strong believer in the token because of its future applications.

Wu’s tweet comes at a time when Decentralized Finance (DeFi) platform Curve DAO’s native token CRV has been down by more than 12% in the last 24 hours. This dip came following an exploit in some of Curve’s stablecoin pools.

The exploit on the protocol reportedly occurred due to a bug in the Vyper programming language, which is used to power part of the DEX’s ecosystem.

Despite this occurrence, Wu believes that this is a good time to invest in the CRV tokens as these tokens will play a significant role in the coming RWA (Real World Assets) wave in reference to the tokenization of physical assets.

“In the coming RWA wave, $crv is one of the most important infrastructures. I have BTFD. NFA,” the founder said in the tweet.

Without a doubt, the tokenized industry is growing and boasts immense potential. Last year, a World Economic Forum survey projected the tokenized assets industry to account for almost 10% of the global GDP by 2027.

The tokenization of real-world assets will involve bringing physical assets like houses, arts, and precious metals on-chain. This will undoubtedly provide easier access and promote fractional ownership of these assets.

CRV price declines over 14% following exploit | Source: CRVUSD on Tradingview.com

As Wu has highlighted, DeFi protocols like Curve and tokens like CRV will play an integral role in facilitating transactions involving the transfer and trade of these tokenized assets.

DeFi Security Remains A Stumbling Block

The several exploits on DeFi protocols continue to remain a huge problem in the DeFi ecosystem and something which many consider a stumbling block to the wider adoption of DEXs over CEXs by many crypto users. Recently, Curve Finance’s Omnipool platform, Conic Finance, suffered an exploit that resulted in the hacker stealing over $3 million in Ether.

A report from Web3 portfolio app De.Fi found that over $204 million was lost to hacks and exploits in the DeFi ecosystem in Q2 of 2023 alone. The number of incidents (117) in Q2 this year translated to an “almost 7 times” increase in comparison with Q2 of 2022 (17 incidents).

According to the report, over $665 million have been lost to such exploits this year. And these breaches further highlight the need for DeFi protocols to implement enhanced security mechanisms on their platforms.

Featured image from The Coin Republic, chart from Tradingview.com