Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Following the downturn in bitcoin’s price on Friday, the hashprice of bitcoin has declined from slightly above $119 per petahash per second to marginally over $116 per PH/s on a daily basis. Should the prices remain low leading up to the forthcoming halving event scheduled for next week, certain mining devices may only be viable […]

Source link

Impact

Telegram Implements Toncoin Payment Integration For Ads, TON Price Sees Impact

Telegram, the renowned messaging platform, recently unveiled a new feature that allows users to promote their channels through advertising. With the launch of this feature, users can now purchase ad space using Toncoins (TON), the native cryptocurrency powered by the TON blockchain.

Telegram Implements TON Blockchain For Ad Payments

Acknowledging the potential for channel owners to generate advertising revenue, Telegram’s announcement highlighted that channels collectively accumulate over 1 trillion views each month.

Realizing this opportunity, Telegram has implemented a revenue-sharing model, enabling channel owners with a minimum of 1000 subscribers to receive 50% of the ad revenue generated from ads displayed on their channels.

The decision to integrate the TON blockchain into this feature was driven by various reasons, as noted in the social media platform’s announcement on Sunday:

We chose the TON Blockchain because it has low fees, high transaction speeds – and holds a record for the number of transactions it can process per second. Anyone can now promote their bot or channel – with budgets as low as a handful of Toncoins. When creating a Telegram ad, you choose the exact channels where you’d like it to appear, so you have full control over their context.

Telegram CEO Pavel Durov had previously emphasized the importance of fast and secure ad payments and withdrawals, expressing that the TON blockchain would be the exclusive platform for these transactions. Durov stated:

To ensure ad payments and withdrawals are fast and secure, we will exclusively use the TON blockchain. Similar to our approach with Telegram usernames on Fragment, we will sell ads and share revenue with channel owners in Toncoin. This will create a virtuous circle, in which content creators will be able to either cash out their Toncoins — or reinvest them in promoting and upgrading their channels.

TON Shows Bullish Momentum

As Telegram unveils these new features and developments that can significantly boost the adoption and usage of the TON token, the cryptocurrency has responded positively.

Over the past 24 hours, TON has surged by more than 5%, reaching a current trading price of $5.30. This surge adds to its impressive 100% price increase over the past 30 days alone.

Notably, the announcement has also caused a substantial increase in the trading volume of TON, which has soared to $234,869,370 in the past 24 hours. This represents a rise of over 74% compared to Sunday’s trading volume, according to CoinGecko data.

Furthermore, the TON token is approaching its all-time high (ATH) mark of $5.69, reached on March 25. With the introduction of these new features in Telegram and the notable increase in trading volume, the token appears to be on the verge of setting a new ATH in the coming days if the demand continues to rise.

However, the token must surpass the significant resistance level of $5.45 for this scenario to unfold. This price level has proven to be a hurdle for the token, as it has attempted three times to break through and consolidate above it to reach a new ATH but has failed. Overcoming this resistance level is crucial before the token can approach new ATH levels.

On the TON/USD 4-hour chart, the support level that could potentially halt a price correction following the recent uptrend is $5.26. This support level acts as a buffer to prevent a significant downward correction in price.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

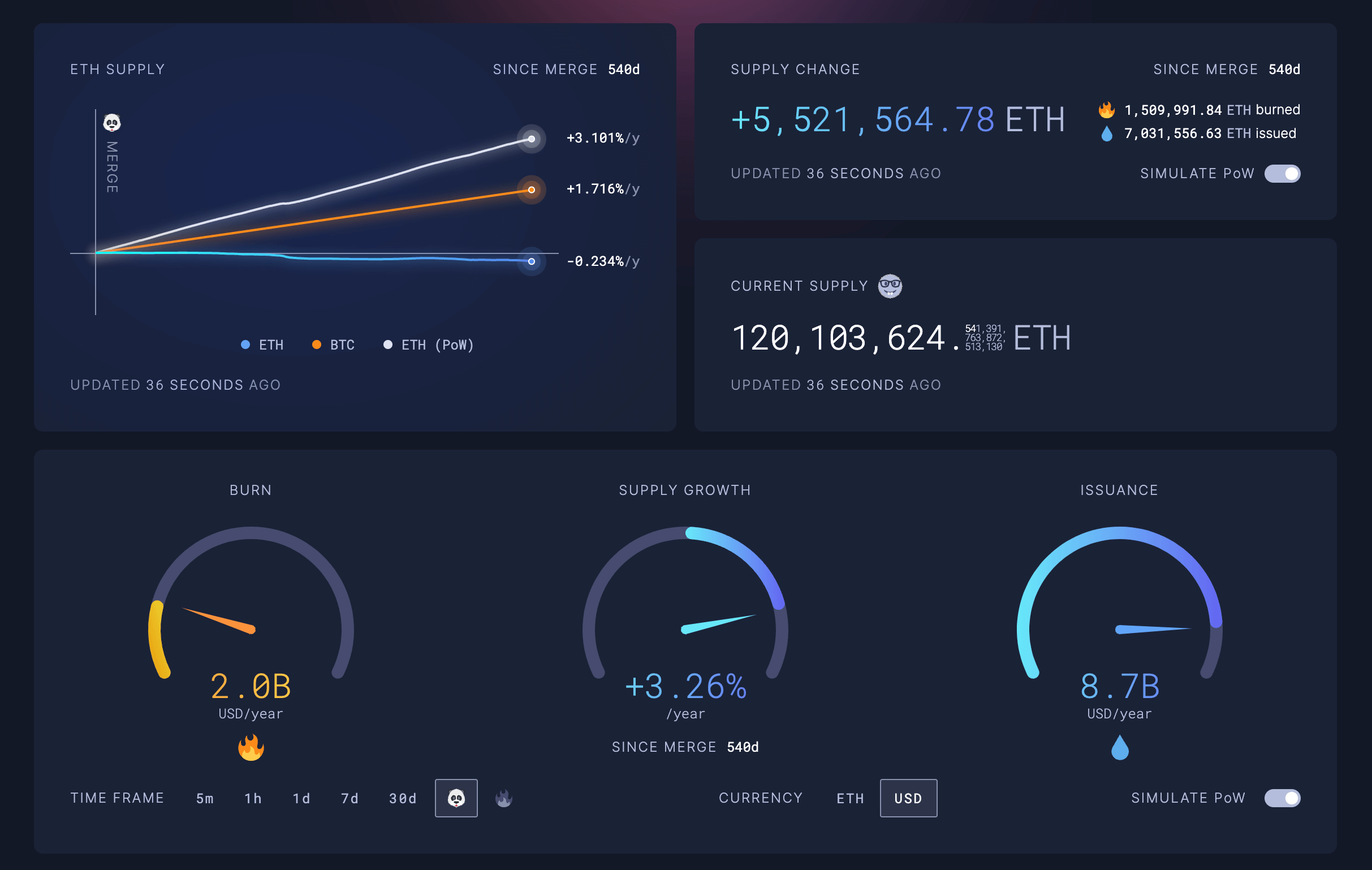

The Ethereum network has seen a reduction of 417,413 ETH in supply since transitioning to a Proof-of-Stake (PoS) consensus mechanism in September 2022, per data from ultrasound.money. In the 540 days since The Merge, 1,509,991 ETH has been burned while the network has issued 1,092,578 new ETH, resulting in a net decrease.

As of press time, the market value of the ETH removed from the supply stands at $1,653,797,635, marking an annual inflation rate of -0.23%.

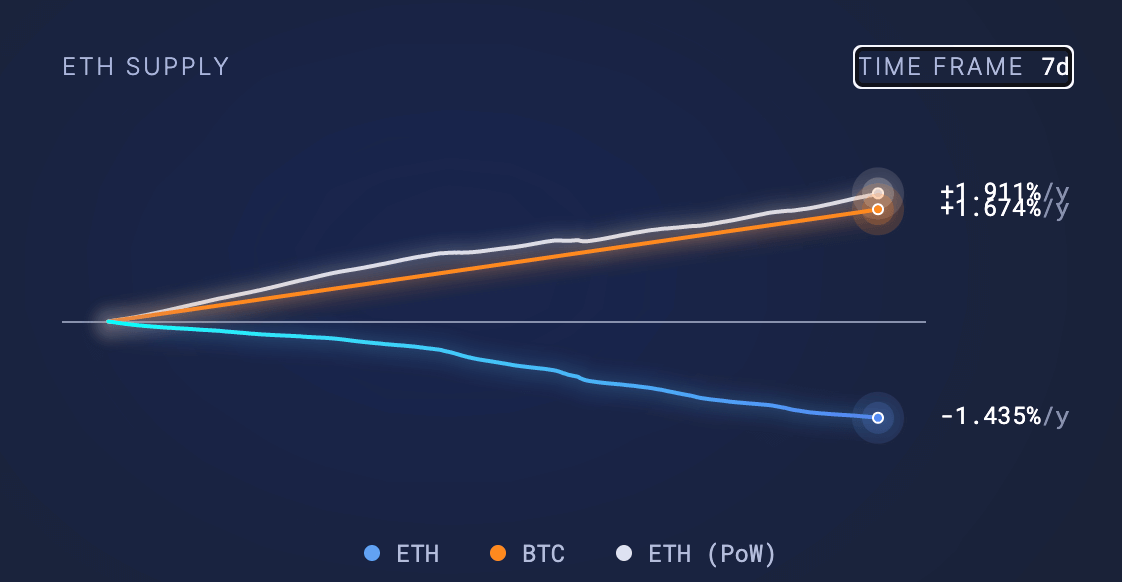

In contrast, Bitcoin’s supply has grown by 1.716% over the same period. This highlights the divergent monetary policies of the two largest cryptocurrencies, as Bitcoin maintains a predictable issuance schedule. At the same time, the balance between staking rewards and transaction fee burning now determines Ethereum’s supply change.

A Proof-of-Work (PoW) simulation on the ultrasound.money dashboard shows Ethereum’s supply would have increased by over 5.5 million ETH during the same period had the network not shifted to PoS. Under the PoW model, the simulation indicates 7,031,556 ETH would have been issued with the same 1.5 million ETH burn rate, leading to a net increase of 5,521,564 ETH since The Merge. The value of the ETH issued under this simulation would amount to $21,865,393,440, representing a theoretical inflation rate of 3.26%.

The stark difference highlights the deflationary impact of Ethereum’s new consensus design compared to its previous mining-based system. The transition to PoS has significantly reduced new ETH issuance, as validators staking ETH now secure the network instead of PoW miners. This shift, combined with the ongoing burn mechanism introduced in EIP-1559, has put downward pressure on Ethereum’s supply growth.

According to the real-time data, Ethereum’s total circulating supply currently stands at 120,103,624 ETH. Meanwhile, the PoW simulation estimates the supply would have reached 125,625,188 ETH if miners were still powering the network under the old model.

The supply reduction since The Merge aligns with the Ethereum community’s vision of making ETH a deflationary asset over time, diverging from Bitcoin’s fixed inflationary schedule. Proponents believe the combination of staking rewards and fee burning will continue to offset new issuance, potentially leading to net negative supply change periods.

Over the past seven days, increasing ETH network fees has facilitated an uptick in deflationary behavior as it rose to -1.435%. Moreover, even under PoW, its inflation rate would have fallen to 1.911% due to the surge in network activity and its correlation with the burn mechanic.

However, critics argue the move to PoS has centralized control of the network in the hands of major staking entities and exchanges. Some warn that the concentration of staked ETH could undermine Ethereum’s decentralization and security guarantees, in contrast to Bitcoin’s more distributed mining network.

As Ethereum continues to evolve under its new PoS regime and Bitcoin maintains its established PoW model, observers will closely watch how their respective supply dynamics and security trade-offs unfold. With Bitcoin’s issuance about to half due to the upcoming halving, its inflation rate will drop to 0.8%, which is within 1% of Ethereum. Bitcoin, however, has a fixed supply and will eventually have an inflation rate of zero. Ethereum’s inflation rate is tied to network activity and the amount burned through network transactions.

Still, the deflationary trend in ETH over the past 540 days offers an early glimpse into the potential future of the two largest cryptocurrencies ahead of the first Bitcoin halving since The Merge. The long-term sustainability and implications for both networks remain to be seen, with Bitcoin currently thriving at a $1.3 trillion market cap and Ethereum next in line at $478 billion.

Mentioned in this article

Latest Alpha Market Report

Bloomberg Strategist Sees Bitcoin as Global Alternative Currency — Warns Stock Market Drawdown Could Impact BTC

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Source link

A hard-landing recession is guaranteed as the full impact of Fed rate hikes have yet to hit the economy, Morgan Stanley’s chief economist says

-

A hard landing is guaranteed for the US, Morgan Stanley’s chief US economist has said.

-

She said the full impacts of the Federal Reserve’s tightening hadn’t been fully felt in the economy.

-

It could take 18 months after the last rate hike to feel the full weight of higher rates.

A hard-landing recession is certain to come for the economy, and high rates are to blame even as markets start positioning for the Federal Reserve to loosen monetary policy this year, says Ellen Zentner, Morgan Stanley’s chief US economist.

Speaking to CNBC on Monday, Zentner responded to Jamie Dimon’s recent comments on the economy, in which the JPMorgan boss warned that the chance of a soft landing was about half of the 70% to 80% odds other forecasters were predicting. He said that was because of several risks still facing the US, including the Fed’s tightening campaign, geopolitical conflict, and interest rates, which central bankers have said could remain higher for longer.

Zentner said she was expecting the US to avoid a recession this year as there was no data to support a soon-to-come downturn. But she warned that a hard landing was unavoidable.

“We will have a hard landing at some point. I guarantee you that. We’re all wondering: When does that come?” she said. “The point that Dimon makes is that there are these cumulative impacts that build over time, and we are in the camp that we haven’t yet seen all of the tightening impacts from monetary policy,” she added, referring to the impact of Fed rate hikes.

Fed officials raised interest rates a whopping 525 basis points in 18 months to tame inflation, a move that’s taken borrowing costs in the economy to their highest level since 2001.

Economists have warned that high interest rates could spark a recession as financial conditions become restrictive and that the full impact of rate hikes probably hasn’t been felt, as they typically take about 18 months to fully work their way through the economy.

Signs of stress are beginning to show in parts of the financial system. Corporate defaults soared last year to their highest level since the pandemic, according to Moody’s Analytics. Bank lending has fallen for three straight quarters, according to Fed data.

Still, signs point to the Fed keeping interest rates elevated as it keeps an eye on inflation. Consumer prices came in hotter than expected last month, with inflation rising 3.1% year-over-year in January.

Zentner predicted that inflation would probably reaccelerate over the first quarter, pointing to the 3.9% growth in core inflation last month. That reacceleration could show up in the next consumer-price-index report, which markets are expecting later this week.

“We do expect inflation reacceleration to be temporary, but that is an open question,” Zentner said, adding that markets might have to consider Fed rate cuts pushed beyond mid-year.

Investors had been pricing in ambitious rate cuts to come in 2024, but many forecasters have dialed back their expectations amid hot inflation data. Markets are now pricing in a 39% chance that the Fed could lower rates by 100 basis points or more by the end of the year, according to the CME FedWatch tool.

Read the original article on Business Insider

Meta Warns Of Zuckerberg’s Death-Defying Lifestyle — ‘There Could Be A Material Adverse Impact On Our Operations’

Meta Platforms Inc., under the leadership of CEO Mark Zuckerberg, flagged an unusual concern to its investors in its latest report filed with the Securities and Exchange Commission (SEC).

The company’s 10-K filing, an exhaustive review of its activities for 2023, for the first time listed the CEO’s penchant for high-adrenaline hobbies as a “risk factor,” hinting at the potential for “serious injury and death.”

Zuckerberg, 39, is known for his adventurous streak, engaging in activities like hydrofoiling and mixed martial arts — passions that come with risks.

Don’t Miss:

During the pandemic, Zuckerberg discovered a new hobby in Brazilian jiu-jitsu, frequently updating his social media with images of his training and toned physique. His efforts in the sport were recognized when he won gold and silver medals at a Brazilian jiu-jitsu tournament in May.

His dedication to these pursuits was underscored last November when he sustained a torn ACL during a mixed martial arts training session, a mishap he shared with his followers on Instagram. The post featured Zuckerberg in a hospital bed, his left leg wrapped and secured in a brace, evidence that his ventures often come at a price.

Zuckerberg’s enthusiasm extends to surfing, an activity that, despite his earnest participation, has drawn playful critique from online communities.

Trending:

Showcasing his zeal for pushing boundaries, Zuckerberg has ventured into aviation, pursuing a pilot’s license. Records from the Federal Aviation Administration reveal that he achieved his student pilot certificate last year, signaling progress in this often dangerous endeavor.

Meta’s recent SEC disclosure points out that Zuckerberg’s array of “high-risk activities,” including combat sports, extreme sports and recreational aviation, pose a unique challenge to the company.

The filing candidly addresses the potential repercussions on Meta’s operations should these pursuits lead to severe consequences for Zuckerberg, emphasizing the critical role he plays within the company. It notes that if the worst happens, “there could be a material adverse impact on our [Meta’s] operations.”

The filing added, “We currently depend on the continued services and performance of our key personnel, including Mark Zuckerberg.”

Meta hasn’t spoken about its decision to add this warning to its most recent 10-K. Just the same, there’s no word on whether Zuckerberg has plans to take a step back from his many thrill-seeking hobbies.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Meta Warns Of Zuckerberg’s Death-Defying Lifestyle — ‘There Could Be A Material Adverse Impact On Our Operations’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Avalanche, the blockchain platform poised for a major event in the month of love, is gearing up for a significant development. As February unfolds, the cryptocurrency market is anticipating the release of nearly $900 million worth of vested tokens from a diverse array of projects. This imminent influx into the market has sparked a wave of concerns among investors who are closely watching the unfolding scenario.

Projects involved in this token release include Avalanche (AVAX), Aptos (APT), The Sandbox (SAND), Optimism (OP), and SUI. Avalanche is strategically targeting strategic partners, team members, and an airdrop to maintain a balance between long-term commitment and potential short-term sell-offs.

Avalanche Braces For Major Token Release

Scheduled for release on February 22, Avalanche is set to unleash 9.5 million tokens valued at approximately $320 million. Similarly, Aptos is gearing up to release 24.8 million tokens worth around $233 million on February 11. The distribution strategy for Aptos aims to ensure market stability while fostering community involvement.

The impending release of these vested tokens has put the crypto community on high alert. Investors and analysts are closely monitoring the developments with a mix of excitement and caution. While anticipation surrounds the token releases, there is also a sense of vigilance as market participants evaluate how the surge in supply might impact project valuations and overall stability.

Avalanche currently trading at $35.76 on the daily chart: TradingView.com

Navigating A Potential Correction Phase: AVAX Price Analysis

Avalanche (AVAX) has recently caught the attention of the market with an impressive price performance, boasting a remarkable 470% increase after breaking through its bear market descending trendline on November 1.

Recent analyses suggest that AVAX is currently facing resistance at a descending trendline from the December high, which could lead to a price rejection and subsequent decrease.

If this correction signifies the commencement of a lasting bull phase for Avalanche, support levels around $20, aligning with the 0.5 to 0.618 Fibonacci retracement levels, may come into play. Following this correction phase, AVAX could potentially embark on a new uptrend, surpassing its all-time high.

Image source: DefiLlama

Meanwhile, AVAX has grown exponentially in the last year, and according to DeFiLlama data, it is now the sixth-largest DeFi chain. An artificial intelligence (AI) based price prediction model has predicted that the AVAX token’s price would soar by more than 500% from its present levels, reaching over $200 by the beginning of 2025.

Previous AVAX Unlock And Its Impact On The Market

It’s crucial to note that AVAX’s previous token unlock on November 23 did not cause significant price fluctuations. However, in the anticipation leading up to the unlock, the price experienced a 16% fall from nearly $23 on November 20 to $19 at the tokens’ release.

This historical precedent underscores the importance of closely monitoring market dynamics during token release events. Market participants should exercise caution and carefully consider the potential impact of these developments on their investment strategies.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ripple Labs, a leading American-based payment firm has locked away a substantial amount of XRP tokens in its escrow wallet as part of its monthly unlock program to help bolster its ecosystem and XRP.

Ripple Takes Back 800 Million XRP

A recent report from on-chain tracker Whale Alert revealed that Ripple took back about 800 million XRP tokens. This is no surprise, as the stated transaction has been a recurring outcome by the payment firm.

The payment firm locked the aforementioned funds after its monthly 1 billion XRP release, which has caught the attention of the crypto space. According to Whale Alert, the firm carried out the transaction in two distinct transfers.

For the first transaction, Ripple locked away 500 million XRP tokens, valued at $253 million at the time of the report. Data from XRPScan shows that the 500 million XRP were initially transferred from “Ripple 23” to “Ripple 11” wallets before they were locked away.

Meanwhile, the second transaction saw 300 million XRP valued at about $151 million being transferred to the company’s escrow wallet. Whale Alert revealed the transaction was carried out by another wallet address identified as “Ripple 10,” according to data from the XRPScan.

The firm has been releasing XRP from its escrow holdings every first day of the month. This process is a component of Ripple’s strategy to regulate the amount of XRP in circulation and uphold stability in the dynamic world of digital assets.

After making up 55% of all XRP supply at first, the escrow accounts now own 40.7% of the supply. This is a result of the progressive unlocking process since it began in December 2017.

As of December 2017, the firm held 55 billion XRP as part of the escrow system initiative, which was mostly implemented on the XRP Ledger (XRPL).

XRP Whales On Dumping Spree

Whale Alert has also detected a substantial dump of XRP on cryptocurrency exchanges (CEXs). Whale Alert reported that over 67 million XRP was observed being moved to Bitso and Bitstamp platforms.

Further data shows that the unknown wallet address r4wf7enWPx…5XgwHh4Rzn transferred 37.9 million XRP to a Bitso-based wallet address. As of the time of transfer, the funds were valued at approximately $19 million.

Later on, 29.7 million XRP was moved to Bitstamp, a Luxemburg-based crypto exchange, in a separate transaction. According to the tracker, the same wallet address carried out the transaction worth about $15 million. This particular wallet address has been carrying out this type of transaction to the CEXs for a while now. It is believed that this might be due to Ripple’s strategic partnership with these centralized exchanges.

The price of XRP is still down by over 2% in the past week, trading at $0.505. Its market capitalization is currently up by 2%, but its trading volume has decreased by over 36% in the past 24 hours.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

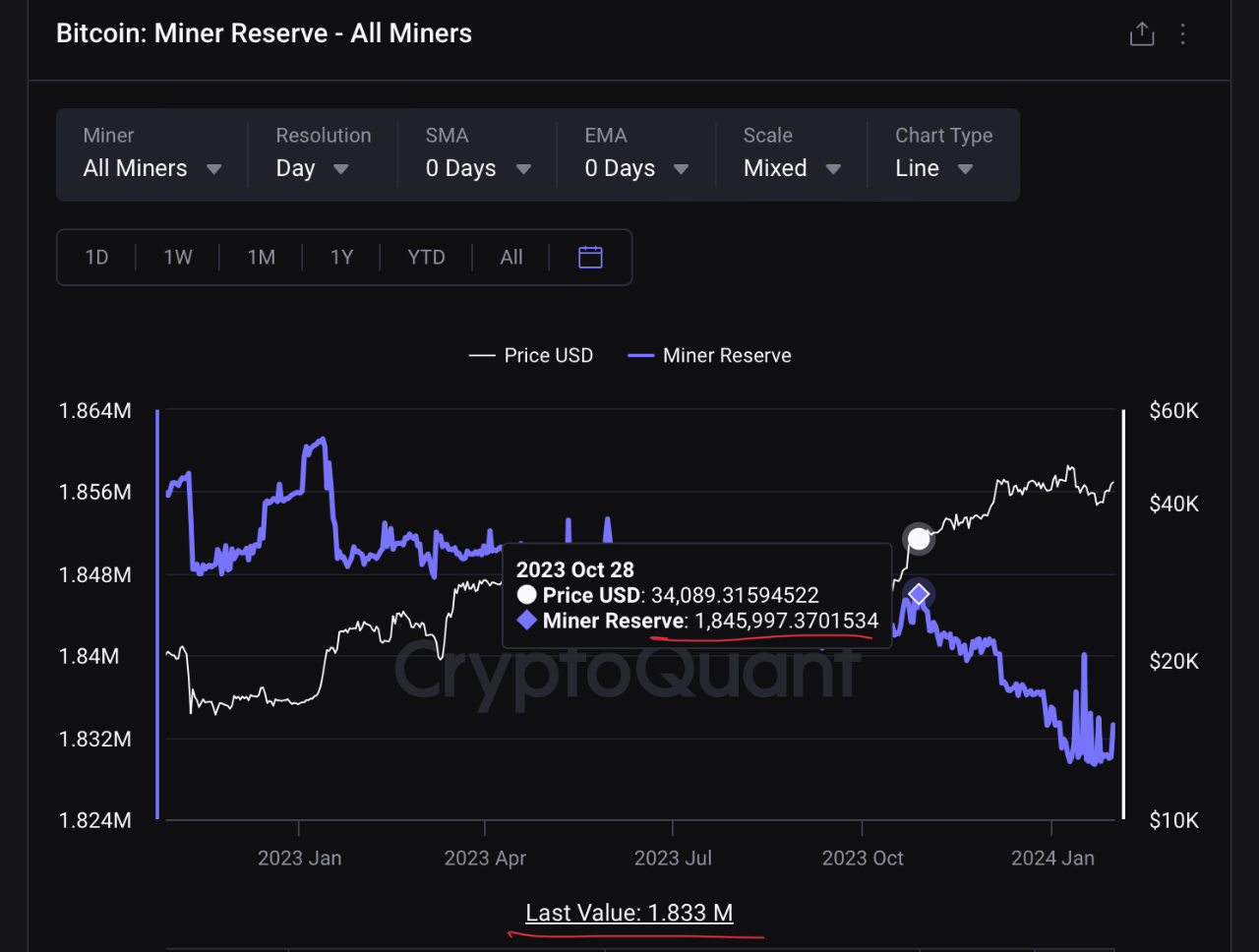

On-chain data shows the Bitcoin miners have been selling recently, but this quant has argued that this selloff shouldn’t have much impact on the market.

Bitcoin Miner Reserve Has Registered A Decline Recently

In a CryptoQuant Quicktake post, an analyst discussed the latest selling pressure that the miners have been putting on the market. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin that the miners combined hold in their wallets right now.

This metric can naturally provide information about the collective behavior of these chain validators. Generally, the miners withdraw their coins from their reserve when they want to sell, so a decline in the indicator can potentially have bearish consequences for the asset.

A rise in the metric, on the other hand, may be bullish for the cryptocurrency’s price as it suggests the miners as a whole are in accumulation mode at the moment.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past year:

The value of the metric seems to have been heading down in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin miner reserve has been on its way down since October, implying that this cohort has withdrawn a net amount of BTC from their wallets during this period.

This latest selloff from the miners has recently been a topic in the community, with many speculating about the possible bearish impact arising from it. The quant has a different opinion on the matter, however.

“The sell-off of Bitcoin reserves by miners, as discussed on X and various portals, is unfounded,” explains the analyst. To back this claim, the quant has pointed out the exact numbers involved here.

Before this selling started, the miner reserve had a value of around 1,84,997 BTC. Following the decline that the indicator has witnessed since then, the miners now hold about 1,833,222 BTC.

This represents a decrease of 12,755 BTC, which, although substantial on its own, doesn’t seem too large in the grand scheme of things, especially considering the size of the miner reserve itself. “The minimal amount of bitcoin sold has negligible impact on the market,” notes the analyst.

The trend in the miner inflows and outflows over the past couple of months | Source: CryptoQuant

The above chart shows the data for the Bitcoin inflows and outflows being made by the miners. There have indeed been outflows taking place recently, which is why there has been talk of a selloff.

At the same time, the inflow transaction volume has also been at significant levels, making up for these outflows. This is the reason for the relatively small net decrease in the total miner reserve.

BTC Price

Bitcoin had recovered beyond the $43,000 mark earlier, but the asset has seen a setback during the past day as it has slipped back towards $42,500.

Looks like the price of the coin has retraced some of its recent recovery | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.