Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Bitcoin’s ascent beyond the $51,000 mark has propelled the Crypto Fear and Greed Index (CFGI) into the “greed” territory, registering a notable 74 out of 100. Just a day earlier, the CFGI soared to an impressive peak of 79, denoting “extreme greed” and marking its highest point since 2021. Crypto Fear and Greed Index Score […]

Source link

index

Markets count on consumer-price index to fall below 3% for first time since 2021

Tuesday has the potential to bring investors something they haven’t seen in almost three years: A U.S. inflation rate based on the consumer-price index that looks more like 2%.

In the run-up to January’s CPI data, stocks finished near a record close, with the S&P 500 index

SPX

ending above 5,000 on Monday — helped by growing confidence that inflation is improving. Treasury yields ended little changed, following a steep climb over the past few weeks that’s been driven by stronger-than-expected U.S. economic data.

Economists now expect an annual headline CPI rate of 2.9% for January, which would be the lowest level since March 2021 and down from 3.4% in December. Any upside surprise in Tuesday’s report that shows inflation remaining unexpectedly sticky, however, is likely to shake up the bond market the most, according to analysts.

Read: The first big inflation report of 2024 is coming out. Here’s what the CPI is likely to show.

Tuesday’s data is likely to “just confirm what the market already knows: that inflation is falling,” said Adam Turnquist, chief technical strategist for LPL Financial in Green Bay, Wis. “Anything outside of that is going to lead to some volatility on a short-term basis, but it’s also not going to detract from investors’ confidence on inflation.”

“Stocks should do well if inflation is in line or below expectations and, in the event that it isn’t, investors might be willing to withhold judgment by focusing on individual components of the report that are expected to fall, like shelter,” Turnquist said via phone. “Fixed income will be moving the most if inflation comes in hotter than expected, following a string of upside surprises to the economy. If you throw in a high inflation print, that’s going to add to the upside we’ve seen in terms of yields. And the dollar is highly correlated to the 10-year rate.”

On Monday, 2 –

BX:TMUBMUSD02Y

and 10-year Treasury rates

BX:TMUBMUSD10Y

settled not far from their highest levels since mid-December. Yields had finished Friday with their biggest weekly advances since the period that ended on Jan. 19, after minor revisions were made to past CPI reports.

The ICE U.S. Dollar Index

DXY

has advanced roughly 1.9% for the year. Meanwhile, stocks ended mixed, with the S&P 500 losing an earlier gain to finish lower at 5,021.84 while the Dow Jones Industrial Average closed up by 125.69 points, or 0.3%.

“Stocks are pricing in a baseline expectation that inflation is largely improving, and it’s now more about monetary policy and when — not if — the Fed is going to cut rates and by how much,” Turnquist said. “The inflation hysteria around these prints has deteriorated.”

The annual headline rate of CPI reached a peak of 9.1% in June 2022 and has since steadily fallen, holding around 3% for seven straight months. While Federal Reserve policymakers prefer to rely on another gauge known as the PCE and the core readings that exclude food and energy, officials also pay attention to annual headline CPI because of its ability to affect household expectations.

See also: Why Americans Are So Down on a Strong Economy

“Anything under 3% offers some sort of assurance,” said strategist Will Compernolle at FHN Financial in New York. “But I think tomorrow won’t give as much as definitive clarity on inflation as the markets hope for.”

“January was full of disruptions, with weather and illness. Consumer spending patterns changed and companies couldn’t operate at full capacity. How those two ingredients combine, I’m not sure,” Compernolle said via phone. “But with lower demand, inflation could look cooler, on net, and January’s data may not be representative of the longer-term trajectory on inflation.”

The report “will probably be seen as ‘good enough,’ and might provide a sense of relief that inflation is not moving any faster,” he said on Monday.

I’m 52. Should I invest in a Roth IRA or index funds like the Dow and Nasdaq?

Dear MarketWatch,

I spent five years as a teacher in Missouri, which made me eligible for a tiny pension (under $400 per month).

Teaching didn’t work out for me, and since I will never be able to return to the profession and increase my pension, I decided to cash in my pension and reallocate the funds to something that would pay more.

I paid down some debt and then invested $6,500 — the maximum allowable amount — into a Roth IRA. I’m 52 but don’t plan to retire for at least another 20 years.

Once I’m done with my taxes, I am not certain whether I should put the remaining funds in the IRA or invest them in index funds like the Dow or Nasdaq. What is your advice?

Related: I’m 73, retired and take my RMDs. But what happens if I become incapacitated and miss them for several years?

Dear Reader,

I’m going to answer your question with a question. Why choose one over the other when you can have both? Index funds are a popular choice for investors with IRAs, so there’s no reason why you couldn’t add them to your Roth IRA’s portfolio.

For those who may be unaware, and as the name suggests, index funds use indexes, such as the S&P 500

SPX,

Dow Jones Industrial Average

DJIA,

Nasdaq Composite,

COMP,

or many others, as benchmarks. They’re particularly useful for long-term investing, which makes them a good choice when your retirement is a couple of decades away.

When you have your retirement investing plans on the radar, but aren’t sure where to start, look at target-date funds. Managers link these portfolio funds to specific years for retirement — say, 2030 or 2055. If your retirement is 20 years away, you could look at a target-date fund for 2045. (Keep an eye on fees, also called expense ratios.)

I am not a financial planner — specifically, not your financial planner — so I do not provide specific investment advice. Any funds I mention here are simply to illustrate and explain how they work and what to look for.

Target-date funds

Back to the target-date fund. If you look at Vanguard Target Retirement Fund 2045, VTIVX you will see under “holdings” that half of that fund is invested in Vanguard’s Total Stock Market Index Fund VSMPX, another 33% is in Vanguard’s Total International Stock Index Fund VGTSX, 10% is in the company’s bond-market index fund VTBIX, 4% is in Vanguard’s international bond index fund VTILX, and 1% is in liquidity. Take it a step further, using the total stock-market index fund as an example, you’ll see the top 10 holdings include Apple,

AAPL,

Microsoft,

MSFT,

Amazon,

AMZN,

and NVIDIA.

NVDA,

Vanguard is far from the only company that offers target-date funds or index funds. Other big names include Fidelity, Blackrock

BLK,

T. Rowe Price

TROW,

Schwab

SCHW,

and American Funds . You can make a day of searching their options and comparing holdings.

Another option you have is to invest in a traditional IRA right now if you’re in a higher tax bracket than you expect to be in the future (though not including assumptions about tax brackets when they sunset in 2025). As your tax liabilities drop, you can convert some of those funds into your Roth account. Having a Roth IRA is a great tool for retirement savings, and diversifying your investments and your taxability will make any option you have in the future even more powerful.

Have a question about your own retirement savings? Email us at HelpMeRetire@marketwatch.com

Want to Invest $1,000 in the “Magnificent Seven?” Invest This Amount in an S&P 500 Index Fund

In 2023, The performance of the “Magnificent Seven” stocks added more than $5 trillion in value to the S&P 500.

Bank of America analyst Michael Hartnett came up with the term Magnificent Seven to describe seven massive tech-focused companies — Apple, Microsoft, Alphabet, Amazon, Meta Platforms , Nvidia, and Tesla.

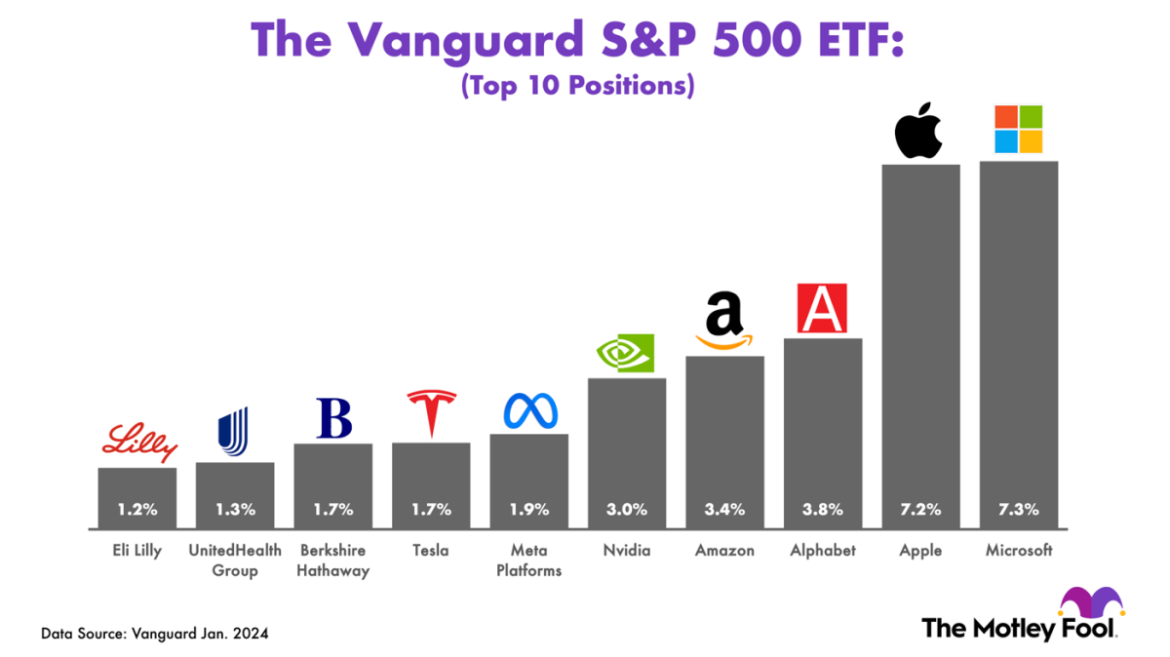

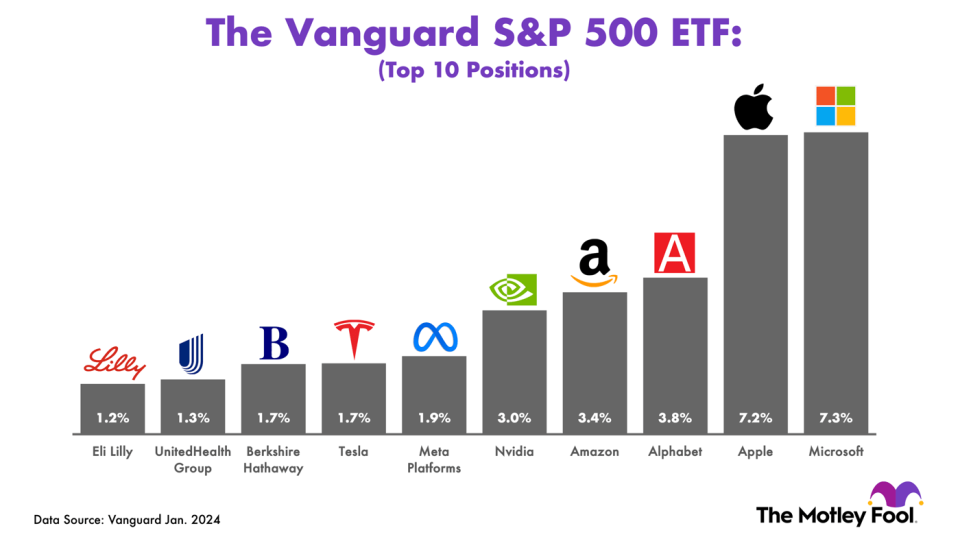

It’s not hard to gain exposure to the Magnificent Seven given how valuable these companies have become. In fact, by investing $3,525 in an exchange-traded fund (ETF) mimicking the performance of the S&P 500, you are effectively putting $1,000 in the Magnificent Seven and $2,525 in the rest of the market, since the Magnificent Seven stocks account for 28.37% of the total value of the S&P 500.

Let’s discuss some top S&P 500 index funds to consider, why the market has become less diversified, and steps you can take to ensure you’re getting the allocation needed to match your risk tolerance, passive income needs, and investing goals.

Image source: Getty Images.

Top S&P 500-related index funds

There are many quality S&P 500 index funds to choose from. Three of the biggest are the Vanguard S&P 500 ETF (VOO -0.06%), the SPDR S&P 500 ETF Trust (SPY -0.13%), and BlackRock’s iShares Core S&P 500 ETF (IVV -0.10%). Here’s a look at how each has performed over the last five years.

As you can see, the difference in performance is negligible. The expense ratios are also similar. The Vanguard and BlackRock index funds have a mere 0.03% expense ratio, while the SPDR S&P 500 ETF Trust has a slightly higher 0.09% expense ratio. The difference doesn’t really matter. $10,000 invested in the SPDR S&P 500 ETF Trust will incur a $9 fee compared to $3 for the other funds. So the decision should come down to which service you prefer, or maybe you have other money invested with one of these platforms and want to house everything under the same roof.

Changing tides

The good news is that getting sizable, diversified, and low-cost exposure to the Magnificent Seven is easier than ever. But the mixed news, depending on your perspective, is that the market is far less diversified than in years past.

As mentioned earlier, the Magnificent Seven stocks make up 28.37% of the S&P 500. Adding 13 more tech-focused companies — Broadcom, Adobe, Salesforce, Advanced Micro Devices, Netflix, Cisco, Intel, Oracle, Intuit, Qualcomm, ServiceNow, IBM, and Texas Instruments — brings the total concentration to 35.8% in those 20 companies alone.

Branching outside the tech sector, 10.9% of the S&P 500 is in 10 stodgy and stable companies that I like to call the “Terrific 10,” which are Berkshire Hathaway, Eli Lilly, JPMorgan Chase, UnitedHealth Group, Visa, Johnson & Johnson, ExxonMobil, Home Depot, Mastercard, and Procter & Gamble. All told, 46.7% of the value of the S&P 500 is in these 30 companies. Or put another way, nearly half of the S&P 500’s performance is dictated by just 6% of the stocks in the index.

This concentration isn’t necessarily a bad thing. After all, the main reason why the S&P 500 has done so well over the last 15 years is due to these companies, especially the value creation of the Magnificent Seven.

Some folks may argue that many of these companies are too expensive and can’t possibly get bigger. And there’s merit to that. But it would be a mistake to ignore these companies’ advantages over the competition.

For example, Apple, Microsoft, Alphabet, and Meta Platforms generate a ton of free cash flow. They can afford to make mistakes, take risks, buy smaller companies, and repurchase their own stock if it sells off. A smaller company has a much harder time pulling those levers.

The greatest advantage of a smaller company is that it has more flexibility to make changes and more freedom to innovate. You may want to leave room in your portfolio to get creative and have fun by investing in individual stocks or hidden gems.

Combine an S&P 500 index fund with other investments

No matter what you decide to do, it’s important to understand the composition of an S&P 500 index fund before you buy it. If you’re unsure which Magnificent Seven stock to buy, an S&P 500 index fund is a low-cost way to get exposure to all of the Magnificent Seven companies.

The S&P 500 isn’t a good source of passive income, considering the stocks in it yield an average of just 1.4%. The yield is lower now than in the past because many of the largest S&P 500 components don’t pay dividends and because the S&P 500 has appreciated in value so much recently.

The good news is there are plenty of pockets of the market with high-yield opportunities. If you are risk-averse or looking to generate more passive income, mixing in some quality dividend stocks with an S&P 500 index fund can be a great way to gain exposure to large-cap growth while ensuring you don’t miss out on income plays.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Berkshire Hathaway, Cisco Systems, Home Depot, Intuit, JPMorgan Chase, Mastercard, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Qualcomm, Salesforce, ServiceNow, Tesla, Texas Instruments, Vanguard S&P 500 ETF, and Visa. The Motley Fool recommends Broadcom, Intel, International Business Machines, Johnson & Johnson, and UnitedHealth Group and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $370 calls on Mastercard, long January 2025 $45 calls on Intel, short February 2024 $47 calls on Intel, and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The Nasdaq Composite (NASDAQINDEX: ^IXIC) rebounded in spectacular fashion last year. After nosediving 33% in 2022 (its worst performance since the Great Recession), the index soared 43% in 2023. Given its tech-focused composition, the excitement surrounding generative artificial intelligence (AI) was a substantial tailwind, and ongoing innovation in the space could propel the Nasdaq higher in the future.

Meanwhile, the broad-based S&P 500 was less than a percentage point from reaching a new record high last week, an event that will signal the onset of a new bull market. The S&P 500 is considered a benchmark for the entire U.S. stock market, and it returned an average of 186% during each of the last nine bull markets.

Now factor in the fact that the Nasdaq has historically compounded much more quickly than the S&P 500. The technology-centric index doubled the performance of the S&P 500 over the last three decades, and that outperformance could be magnified during the next bull market.

Taking all this together, now might be an excellent time to buy an index fund that tracks the Nasdaq Composite, and the Fidelity Nasdaq Composite ETF (NASDAQ: ONEQ) does just that.

Here’s why this index ETF is a great long-term investment option right now.

The Fidelity Nasdaq Composite ETF tracks innovative tech companies

The Fidelity Nasdaq Composite ETF tracks about 1,000 U.S. growth stocks, most of which come from the technology, consumer discretionary, and communications services sectors. The index fund allows investors to spread capital across a range of innovative companies well positioned to benefit from trends like artificial intelligence, cloud computing, and electric vehicles, as well as nascent but potentially explosive technologies like robotaxis.

The top 10 holdings in the Fidelity Nasdaq Composite ETF are:

-

Apple: 12.3%

-

Microsoft: 11.5%

-

Alphabet: 6.7%

-

Amazon: 6.4%

-

Nvidia: 5.1%

-

Tesla: 3.3%

-

Meta Platforms: 3.2%

-

Broadcom: 2.2%

-

Costco Wholesale: 1.2%

-

Adobe: 1.1%

This Fidelity ETF soared 298% over the last decade, compounding at 14.8% annually. Better yet, the index fund skyrocketed 1,000% over the last 15 years, compounding at 17.3% annually. Returns of that nature may be unsustainable over a multidecade horizon, so I will assume future growth of 12% annually to introduce a margin of safety.

At that pace, $300 invested monthly (about $70 weekly) in the index fund would grow into $66,600 in one decade, $273,400 in two decades, and $915,600 in three decades.

Of course, some investors may not have $300 per month, and others may want to contribute more. The chart below shows how different monthly contribution amounts would grow over time, assuming 12% annual returns.

|

Holding Period |

$200 Per Month |

$400 Per Month |

$600 Per Month |

|---|---|---|---|

|

10 Years |

$44,400 |

$88,800 |

$133,200 |

|

20 Years |

$182,200 |

$364,500 |

$546,700 |

|

30 Years |

$610,400 |

$1.2 million |

$1.8 million |

Note: The chart assumes a 12% annual return. Dollar totals are rounded to the nearest $100.

The Fidelity Nasdaq Composite ETF is a great option for risk-tolerant investors

The secret to making money in the stock market is patience and some tolerance for risk. As discussed in the previous section, relatively small amounts of money invested regularly in the Fidelity Nasdaq Composite ETF can potentially compound into tremendous sums and even million-dollar fortunes over time. And realizing those gains requires next to no work from the investor. Index funds also reduce concentration risk by spreading capital across a broad group of stocks.

That said, the Fidelity Nasdaq Composite ETF is heavily concentrated in technology stocks. Indeed, nearly 50% of its weighted exposure comes from that single sector. That concentration has historically been a blessing and a curse. The technology sector has handily outperformed every other market sector over the last decade, so the index fund has performed well. But technology stocks have also been very volatile at times, so the index fund has been volatile, too.

Here is the bottom line: History says the Fidelity Nasdaq Composite ETF will likely be a volatile investment in the future. But history also says the index fund will outperform the S&P 500 during the next bull market, creating tremendous wealth for patient investors. With a below-average expense ratio of 0.21% — meaning annual fees on a $10,000 portfolio would total just $21 — this index fund is a great option for growth-focused investors comfortable with market turbulence.

Should you invest $1,000 in Fidelity Commonwealth Trust-Fidelity Nasdaq Composite Index ETF right now?

Before you buy stock in Fidelity Commonwealth Trust-Fidelity Nasdaq Composite Index ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fidelity Commonwealth Trust-Fidelity Nasdaq Composite Index ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Adobe, Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

A Bull Market Is Coming: 1 Magnificent Index Fund Could Turn $300 Per Week Into $915,600 was originally published by The Motley Fool

Warren Buffett Recommends This Surefire Index Fund. It Could Turn $400 Per Month Into $847,800

Warren Buffett is one of the most famous figures in the financial world. His knack for picking stocks has made him a billionaire several times over, and it has created astonishing wealth for other investors. Shares of Berkshire Hathaway have doubled the annual return of the S&P 500 since Buffett took control in 1965.

Not surprisingly, investors often seek stock market advice from Buffett, but readers may be surprised to learn Buffett has consistently offered the same advice, as he reminded attendees at Berkshire’s annual meeting in 2021: “I recommend the S&P 500 index fund, and have for a long, long time to people.”

Here’s how Buffett’s suggestion could turn $400 per month into $847,800 for patient investors.

The Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (NYSEMKT: VOO) measures the performance of 500 U.S. companies that include value stocks and growth stocks from all 11 market sectors. Its constituents cover 80% of the domestic equities market and more than 50% of the global equities market.

In short, the index fund lets investors spread money across many of the most influential businesses in the world. That includes enterprise software leader Microsoft, consumer electronics giant Apple, digital advertising leader Alphabet, cloud computing leader Amazon, and artificial intelligence chipmaker Nvidia.

The following chart shows the top 10 positions in the Vanguard S&P 500 ETF as of Jan. 1, 2024.

Buffett believes the average person cannot pick stocks — not because people lack the mental capacity but rather because identifying good stocks requires a level of patience and dedication to which most people are unwilling to commit.

In lieu of individual stocks, Buffett sees an S&P 500 index fund as the best option for the average person because it provides exposure to a “cross-section of businesses that in aggregate are bound to do well.” Indeed, the S&P 500 has been a consistent moneymaker for patient investors.

The S&P 500 has been a surefire investment over long periods

The S&P 500 has been a profitable investment over every rolling 20-year period since its inception in 1957, and its precursor was a profitable investment over every rolling 20-year period since its inception in 1926.

Moreover, the S&P 500 increased 1,720% over the past three decades, compounding at 10.14% annually. At that pace, $400 invested monthly would be worth $80,500 in one decade, $292,000 in two decades, and $847,800 in three decades.

Some investors may not have $400 per month to invest, and others may wish to save more. Assuming an annual return of 10.14%, the following chart explores how different monthly contribution amounts would grow over time.

|

Holding Period |

$200 Per Month |

$600 Per Month |

$800 Per Month |

|---|---|---|---|

|

10 years |

$40,300 |

$120,800 |

$161,100 |

|

20 years |

$146,000 |

$438,100 |

$584,200 |

|

30 years |

$423,900 |

$1.2 million |

$1.6 million |

Data source: author. Dollar totals have been rounded to the nearest $100.

Investors can diversify their portfolios with an S&P 500 index fund

I’ve already mentioned that Buffett doesn’t believe the average person can pick stocks, but investors shouldn’t be discouraged. Anyone willing to do the requisite research should feel comfortable buying individual stocks, particularly in combination with an S&P 500 index fund.

Identifying good investments requires an understanding of individual companies and the industries in which they operate. Building that knowledge takes time, and very few people have enough time to regularly research every stock market sector, so investors can use an S&P 500 index fund to supplement their knowledge gaps and diversify their portfolios.

To be clear, diversification is not essential to making money in the stock market, but it does mitigate the risk inherent to a concentrated portfolio. I find that very compelling. I keep a large portion of my portfolio in individual stocks, many of which come from the technology sector, and I keep the rest in the Vanguard S&P 500 ETF.

I like that strategy for two reasons. First, if my individual stocks outperform the S&P 500, then my entire portfolio will beat the market. Second, if my individual stocks underperform the S&P 500, my portfolio will still perform reasonably well because the S&P 500 has returned 10.14% annually over the last 30 years.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

Warren Buffett Recommends This Surefire Index Fund. It Could Turn $400 Per Month Into $847,800 was originally published by The Motley Fool

The Russell 2000 Index has soared, but you might be better off looking elsewhere for quality small-cap stocks

The Russell 2000 Index soared 12% in December, which might reflect investors’ exuberance about the state of the U.S. economy — it appears the Federal Reserve has won its battle against inflation.

But if you are looking to broaden your exposure to the stock market beyond the large-cap S&P 500

,

buying shares of a fund that tracks the Russell 2000 Index

might not be the best way to do it. This is because the Russell 2000 isn’t selective — it is made up of the smallest 2,000 companies by market capitalization in the Russell 300 Index

,

which itself is designed to capture about 98% of the U.S. public equity market.

A better choice might be the S&P Small Cap 600 Index

because S&P Global requires companies to show four consecutive quarters of profitability to be initially included in the index, among other criteria.

Below is a screen of analysts’ favorite stocks among the S&P Small Cap 600, along with another for the Russell 2000.

Watch for a “head fake”

Much of the small-cap buying in December might have resulted from covering of short positions by hedge-fund managers. This idea is backed by the timing of trading activity immediately following the Federal Open Market Committee’s announcement on Dec. 13 that it wouldn’t change its interest-rate policy, according to MacroTourist blogger Kevin Muir. The Fed’s economic projections released the same day also indicate three cuts to the federal-funds rate in 2024.

Heading into the end of the year, a fund manager who had shorted small-caps, and then was surprised by the Fed’s interest-rate projections, might have scrambled to buy stocks it had shorted to close-out the positions and hopefully lock in gains, or limit losses.

That buying activity and resulting pop in small-cap prices could set up a typical “head fake” for investors as the new year begins, according to Muir.

The long-term case for quality

Looking at data for companies’ most recently reported fiscal quarters, 58% of the Russell 2000 reported positive earnings per share, according to data provided by FactSet. In other words, hundreds of these companies were losing money. These might include promising companies facing “binary events,” such as make-or-break drug trials in the biotechnology industry.

In comparison, 78% of companies among the S&P Small Cap 600 were profitable, and 93% of the S&P 500 were in the black.

Here are long-term performance figures for exchange-traded funds that track all three indexes:

| ETF | Ticker | 2023 | 3 years | 5 years | 10 years | 15 years | 20 years |

| iShares Russell 2000 ETF | 17% | 7% | 61% | 99% | 428% | 365% | |

| iShares Core S&P Small Cap ETF | 16% | 25% | 69% | 129% | 540% | 515% | |

| SPDR S&P 500 ETF Trust | 26% | 34% | 108% | 210% | 629% | 527% | |

| Source: FactSet | |||||||

An approach tracking the S&P Small Cap 600 has outperformed the Russell 2000 for all periods, with margins widening as you go further back.

Brett Arends: You own the wrong small-cap fund. How to get into a better one.

Looking ahead for quality… or not

For the first screen, we began with the S&P Small Cap 600 and narrowed the list to 385 companies covered by at least five analysts polled by FactSet. Then we cut the list to 92 companies with “buy” or equivalent ratings among at least 75% of the covering analysts.

Here are the 20 remaining stocks among the S&P Small Cap 600 with the highest 12-month upside potential indicated by analysts’ consensus price targets:

| Company | Ticker | Share “buy” ratings | Dec. 29 price | Consensus price target | Implied 12-month upside potential |

| Vir Biotechnology Inc. | VIR | 88% | $10.06 | $32.00 | 218% |

| Arcus Biosciences Inc. | RCUS | 82% | $19.10 | $41.00 | 115% |

| Xencor Inc. | XNCR | 92% | $21.23 | $39.83 | 88% |

| Dynavax Technologies Corp. | DVAX | 100% | $13.98 | $24.80 | 77% |

| ModivCare Inc. | MODV | 100% | $43.99 | $75.50 | 72% |

| Xperi Inc | XPER | 80% | $11.02 | $18.20 | 65% |

| Thryv Holdings Inc. | THRY | 100% | $20.35 | $32.75 | 61% |

| Ligand Pharmaceuticals Inc. | LGND | 100% | $71.42 | $114.80 | 61% |

| Green Plains Inc. | GPRE | 80% | $25.22 | $40.30 | 60% |

| Patterson-UTI Energy Inc. | PTEN | 75% | $10.80 | $17.00 | 57% |

| Ironwood Pharmaceuticals Inc. Class A | IRWD | 83% | $11.44 | $17.83 | 56% |

| Catalyst Pharmaceuticals Inc. | CPRX | 100% | $16.81 | $26.20 | 56% |

| Payoneer Global Inc. | PAYO | 100% | $5.21 | $8.00 | 54% |

| Helix Energy Solutions Group Inc. | HLX | 83% | $10.28 | $15.00 | 46% |

| Arlo Technologies Inc. | ARLO | 100% | $9.52 | $13.80 | 45% |

| Pacira Biosciences Inc. | PCRX | 100% | $33.74 | $48.40 | 43% |

| Privia Health Group Inc. | PRVA | 100% | $23.03 | $32.53 | 41% |

| Semtech Corp. | SMTC | 92% | $21.91 | $30.90 | 41% |

| Talos Energy Inc. | TALO | 78% | $14.23 | $20.00 | 41% |

| Digi International Inc. | DGII | 100% | $26.00 | $36.14 | 39% |

| Source: FactSet | |||||

Any stock screen should only be considered a starting point. You should do your own research to form your own opinion before making any investment. one way to begin is by clicking on the tickers for more about each company.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Moving on to the Russell 2000, when we narrowed this group to stocks covered by at least five analysts polled by FactSet, we were left with 936 companies. Among these, 355 have “buy” or equivalent ratings among at least 75% of the covering analysts.

Among those 355 stocks in the Russell 2000, these 20 have the highest implied upside over the next year, based on consensus price targets:

| Company | Ticker | Share “buy” ratings | Dec. 29 price | Consensus price target | Implied 12-month upside potential |

| Karyopharm Therapeutics Inc. | KPTI | 75% | $0.87 | $6.00 | 594% |

| Rallybio Corp. | RLYB | 100% | $2.39 | $16.50 | 590% |

| Vor Biopharma Inc. | VOR | 100% | $2.25 | $15.44 | 586% |

| Tenaya Therapeutics Inc. | TNYA | 100% | $3.24 | $19.14 | 491% |

| Compass Therapeutics Inc. | CMPX | 86% | $1.56 | $9.17 | 488% |

| Vigil Neuroscience Inc. | VIGL | 88% | $3.38 | $18.75 | 455% |

| Trevi Therapeutics Inc. | TRVI | 100% | $1.34 | $7.33 | 447% |

| Inozyme Pharma Inc. | INZY | 100% | $4.26 | $21.00 | 393% |

| Gritstone bio Inc. | GRTS | 100% | $2.04 | $10.00 | 390% |

| Actinium Pharmaceuticals Inc. | ATNM | 83% | $5.08 | $23.36 | 360% |

| Lineage Cell Therapeutics Inc. | LCTX | 86% | $1.09 | $4.83 | 343% |

| Century Therapeutics Inc. | IPSC | 86% | $3.32 | $14.67 | 342% |

| Acrivon Therapeutics Inc. | ACRV | 100% | $4.92 | $21.13 | 329% |

| Avidity Biosciences Inc. | RNA | 100% | $9.05 | $37.50 | 314% |

| Longboard Pharmaceuticals Inc. | LBPH | 100% | $6.03 | $24.17 | 301% |

| Omega Therapeutics Inc. | OMGA | 100% | $3.01 | $12.00 | 299% |

| Allogene Therapeutics Inc. | ALLO | 82% | $3.21 | $12.79 | 298% |

| X4 Pharmaceuticals Inc. | XFOR | 86% | $0.84 | $3.26 | 289% |

| Caribou Biosciences Inc. | CRBU | 89% | $5.73 | $22.25 | 288% |

| Stoke Therapeutics Inc. | STOK | 78% | $5.26 | $19.33 | 268% |

| Source: FactSet | |||||

That’s right — this Russell 2000 list is all biotech. And in case you are wondering if any companies are on both lists, the answer is no.

Don’t miss: 11 dividend stocks with high yields expected to be well supported in 2024 per strict criteria

Coinbase (COIN) Stock Could Indicate Index Play for TradFi Institutions Looking for Crypto Exposure

The analyst said TradFi institutions trying to get into crypto, but are unsure how to begin, may use Coinbase stock to enter.

According to the co-founder of research firm Reflexivity Research Will Clemente, shares of major cryptocurrency exchange Coinbase Global Inc (NASDAQ: COIN) could serve as an indicator for the crypto sector. Clemente says Coinbase shares could be an “index play” for traditional finance (TradFi) firms looking for a way into the industry.

Clemente offered his opinion while speaking on an X (formerly Twitter) Space hosted by Bitcoin bull and tech investor Anthony Pompliano. The Reflexivity Research exec said:

“I think TradFi will probably view COIN as kind of an index play on crypto because they have so many different kinds of verticals now…Someone might come in the space and say, ” I bought some Bitcoin. I don’t really know which of these other assets to pick. Coinbase feels like a pretty safe kind of index style play.”

A Bitwise exec also shares this optimism and generally bullish sentiment. Speaking on the same Space, crypto asset manager Bitwise’s Chief Investment Officer Matt Hougan said he believes that Coinbase “is executing better than any financial services company in America”.

Hougan also seemed to review an earlier Bitwise forecast that Coinbase will double its revenue in 2024. On the Space, he said:

“I almost wonder if their revenues doubling will be too low. So we have a lot of conviction in that.”

MarketWatch data shows that Coinbase stock has recorded more than 374% in year-to-date (YTD) gains, beating out Bitcoin’s (BTC) 163% and Ether’s (ETH) 94%. The stock has also gained nearly 126% in 3 months, 54% in 1 month, and a healthy 9.37% in the last 5 days.

Coinbase Stock Supported by Multiple Updates

Several Coinbase updates that may be contributing to the stock’s rise in recent times. For instance, Coinbase is continuing its expansion in Europe and recently received a virtual asset provider (VASP) license from regulators in France. The license allows Coinbase to provide trading, custody, and related services to users in France who may transact using legal tender or other cryptocurrencies.

Another update is Project Diamond, a platform designed for institutions to tokenize and trade real-world assets. Backed by Coinbase, Project Diamond is powered by the exchange’s Base layer-2 scaling solution to deliver a robust and compliant platform to improve mass crypto and blockchain adoption.

Despite these and many more, Coinbase is still at loggerheads with the United States Securities and Exchange Commission (SEC). Last week, the SEC rejected Coinbase’s request for crypto rules, seemingly elongating the battle between both entities. In July last year, Coinbase asked the SEC for new rules on crypto assets that qualify as securities. Unfortunately, SEC Chair Gary Gensler recently announced a refusal for multiple reasons.

Firstly, Gensler pointed out that the current securities laws are robust enough to cover the crypto securities markets. He also added that the timing for rulemaking is wrong and that the SEC is still seeking comments on crypto rules. Lastly, Gensler suggested that rulemaking should be at the SEC’s discretion.

Interestingly, SEC Commissioners Hester M. Peirce and Mark T. Uyeda published a statement disagreeing with the agency’s decision. While the statement respects the SEC’s discretion on rulemaking, it notes that Coinbase’s petition raises specific issues around new technologies. The Commissioners state that these issues should be thoroughly addressed via concept releases, requests for comments, and public roundtables.

next

Market News, News, Stocks

You have successfully joined our subscriber list.

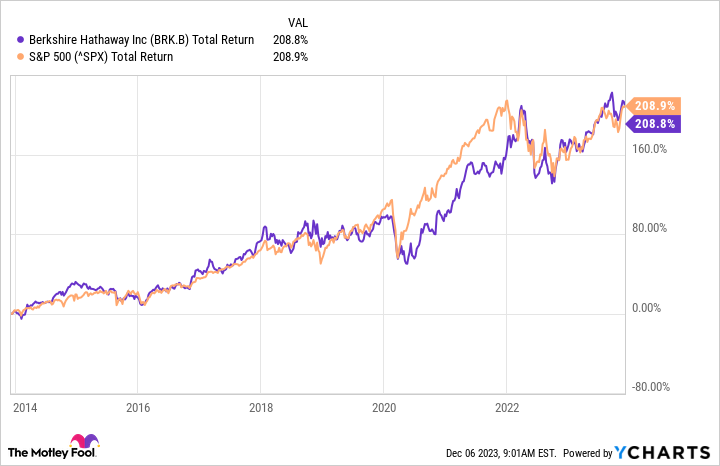

Berkshire Hathaway CEO (BRK.A -0.18%) (BRK.B -0.33%) Warren Buffett has a well-earned reputation as one of the world’s best business pickers. From 1965 to 2022, Buffett’s business acumen helped Berkshire’s shares deliver an astounding compound annual return of 19.8%.

If you bought a fund tracking the benchmark S&P 500 and reinvested the dividends over this period, you’d still only end up with an average compound annual return of 9.9%. That’s a testament to Buffett’s uncanny skill as an investor.

Nonetheless, the Oracle of Omaha himself has often said that most investors should simply buy a low-cost index fund that tracks the S&P 500 and call it a day. In Berkshire’s 2013 annual letter, for instance, he specifically recommended the Vanguard 500 Index Fund (VOO 0.47%) for its low fees and nearly identical performance to its benchmark index.

Image Source: Getty Images.

Should investors heed Buffett’s advice or is Berkshire stock still a better growth vehicle than this popular indexed exchange-traded fund (ETF)? Let’s dig deeper to find out.

Berkshire’s investing thesis is changing with age

Berkshire is a diversified conglomerate that has investments in various sectors, such as insurance and energy, technology, and consumer goods, as well as large holdings of U.S. treasuries, U.S. and foreign equities, and a lot of cash. Its stock is designed to withstand both unforeseen economic shocks and normal economic downturns that occur in business cycles.

However, Berkshire does face some unique challenges due to its girth. The company has struggled to find attractive opportunities that can move the needle for its massive portfolio since the turn of the century. As a result, its stock has lagged behind the market at times over this period.

Buffett and analysts alike have acknowledged this reality and pointed to the company’s size as a limiting factor. This is a key reason Apple has become the dominant position in Berkshire’s stock portfolio in recent years, as it’s one of the few growth companies that can match its scale.

Over the last 10 years, Berkshire stock hasn’t been able to produce higher returns on capital than the S&P 500 because of its size problem and its lack of a dividend. Dividend payments allow investors to amplify capital gains over time through the power of compounding. Buffett’s holding company has also underperformed the VOO over the past five years by nearly 15%, and most analysts expect this trend to continue for the foreseeable future.

BRK.B Total Return Level data by YCharts.

Better buy

At this stage in its history, Berkshire is more of a defensive play against market volatility, rather than a top-notch capital-appreciation vehicle. During short periods, the conglomerate’s shares will likely do better than the broader markets because of its safety factor. It should also consistently generate positive net returns over the long term, which isn’t an easy thing to do.

However, most investors would be smart to follow Buffett’s advice and go with the VOO as a low-cost and tax-efficient way to grow capital over long periods. Still, Berkshire’s stock could play an important role in a well-diversified portfolio as a hedge against economic and geopolitical risks, as well as other black-swan-type events.

George Budwell has positions in Apple and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Consumer Price Index (CPI) Report Expected to Provide Some Guidance as to Potential Bitcoin Rally

Bitcoin bulls may be hoping that the expected CPI report may present some respite for BTC, which has struggled to maintain momentum.

The general financial market is anticipating the Consumer Price Index (CPI) today to put some figures in perspective regarding the state of the economy. In addition to economic indicators, the content of the expected CPI will hopefully provide bulls with information that may pump Bitcoin.

Bitcoin and the CPI

For a few weeks, the market witnessed an interesting rally that saw the price of Bitcoin climb almost 40%. However, the king coin has failed to hold up the rally and is struggling to maintain the momentum. According to CoinMarketCap, Bitcoin is trading at $36,436, after gaining 4.43% in the last 7 days but losing more than 2% in 24 hours.

Economists currently predict that monthly headline CPI, which was 0.4% in September, dropped to 0.1% in October. The predicted year-over-year (YoY) CPI is also expected to crash from 3.7% to 3.3%. For core CPI, which does not include food and energy prices, the figure is expected to remain unchanged from September at 0.3%. This reflects a flat YoY figure of 4.1%.

The last CPI report showed a 0.4% monthly and 3.7% YoY increase in the prices of goods and services. The report also indicated a 0.6% increase in shelter, 0.3% for medical care services, and 0.7% for transportation services. Furthermore, the Labor Department recorded a 0.3% increase in the prices of new vehicles.

Unfortunately, the figures are still not at the Federal Reserve’s target of 2%. This may suggest that the country’s apex bank is not yet done with its interest rate hikes. Nonetheless, the Fed has said it is not waiting until inflation hits 2% before stopping the rate hikes. A reduction in interest rates might benefit Bitcoin if the market becomes more palatable. However, the CPI could show disappointing figures, which could plunge Bitcoin further.

Bitcoin May Crash Before Spot ETF Approval

Longtime Bitcoin critic Peter Schiff has signaled a Bitcoin crash before the United States Securities and Exchange Commission (SEC) approves one of the spot Bitcoin ETF proposals currently under scrutiny. Nonetheless, a user debunked the Euro Pacific Capital Inc CEO and chief global strategist’s signaling, pointing out that Schiff predicted Bitcoin would crash to $750 in 2018, when the king coin was below $3,800.

On the other hand, there is no shortage of bullish Bitcoin predictions. Upbeat forecasts have been pouring for Bitcoin, especially as the market quietly awaits the asset’s halving event expected in April next year. For instance, international asset manager AllianceBernstein Holding LP believes Bitcoin could rise to $150,000 by 2025. According to the firm, the two major catalysts are the expected approval of a spot Bitcoin ETF, and the halving. Bernstein analyst Gautam Chhugani also states that up to 10% of Bitcoin’s circulating supply will enter the ETF market.

Bernstein also believes the SEC will likely approve a spot Bitcoin ETF by January 10.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.