The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

institutional

Ethereum Outperforms Bitcoin As Institutional Investors Clamor For ETH Exposure

Reports have revealed that institutional investors are shifting their focus to Ethereum, displaying a preference compared to the largest cryptocurrency, Bitcoin. Despite Bitcoin’s recent rally to over $55,000, Ethereum’s unique features and potential developmental capabilities continue to capture institutional players’ interest.

Institutions Favor Ethereum Over Bitcoin

On February 24, cryptocurrency exchange, Bybit, published a research report on its users’ asset allocation. The research examined investors’ hodling and trading behaviours, covering the period from July 2023 to January 2024. Bybit’s report also provided valuable insights into investors’ asset allocation across cryptocurrencies such as altcoins, stablecoins and meme coins, shedding light on the specific coins users are currently bullish or bearish on.

According to the research report, Ethereum has unexpectedly emerged as the primary cryptocurrency choice for institutional investors. The report revealed that “institutions are betting big on Ethereum,” allocating more of their funds to ETH compared to BTC.

Bybit has disclosed that the recent rise in interest in Ethereum began in September 2023, when ETH was still trading around $2,000. Subsequently, Ethereum’s market sentiment became more bullish, experiencing a surge in investor interest to about 40% by January 2024. The crypto exchange has confirmed that, as of January 31, ETH has become the single largest cryptocurrency held by institutions.

Bybit’s report also revealed that institutional investors’ interest in Bitcoin began to wane following the United States Securities and Exchange Commission (SEC) approval of Spot Bitcoin ETFs on January 10, 2024. At the time, Bitcoin had experienced massive selling pressures, resulting in investors trimming their BTC holdings to favour other cryptocurrencies.

The excessive allocation of Ethereum is reportedly attributed to investors anticipating a favourable outcome from Ethereum’s upcoming Decun Upgrade, slated to launch in March 2024.

Notably, Bybit has disclosed that it is still being determined if the recent shift to Ethereum is a short-term manoeuvre or a more prolonged move. However, the approaching Bitcoin halving in April potentially adds a layer of bearish risks, as projections indicate Bitcoin’s significant rise in value to new all-time highs during the halving phase.

ETH price rises to $3,230 | Source: ETHUSD on Tradingview.com

Retail Investors Think Otherwise

Bybit’s research report also examines the asset allocation trend for retail investors on the cryptocurrency exchange. The report revealed that retail investors are significantly more bullish on Bitcoin than Ethereum, allocating more funds into BTC than ETH despite Ethereum’s recent surge in value.

Over the past week, Ethereum has experienced a substantial hike in its price, jumping over 7% and outpacing Bitcoin, suggesting a potential for a more extensive upward trajectory. At the time of writing, Ethereum is trading at $3,227, reflecting a 4.05% increase in the last 24 hours, according to CoinMarketCap.

While Ethereum’s massive rally has successfully elevated the sentiment among institutional investors, retail investors remain less swayed, opting to hold onto or incorporate additional Bitcoin into their diversified portfolio of digital assets.

Featured image from Cointribune, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Spot Bitcoin ETFs have lived up to the hype, as these funds have ramped up institutional adoption of the flagship cryptocurrency, Bitcoin. This is further evident in a recent analysis that captured how much Bitcoin BlackRock and other issuers amassed in this week alone.

Spot Bitcoin ETF Issuers Purchased Over 19,908 BTC This Week

Data from the on-chain analytics platform Lookonchain shows that the Spot Bitcoin ETF issuers combined to purchase over 19,908 BTC ($860 million) this week. Meanwhile, it is worth mentioning that Lookonchain’s data didn’t capture WisdomTree’s BTC purchases in its analysis, suggesting that the figure could be way higher when the asset manager’s purchases are also factored in.

Further data obtained from Arkham Intelligence provided insights into how much Bitcoin Wisdom Tree obtained for its Bitcoin fund this week. 74 BTC is shown to have gone into the asset manager’s wallet address for its Spot Bitcoin ETF. The addition of these crypto tokens means that all Spot Bitcoin ETF issuers combined to purchase almost 20,000 BTC this week alone.

Interestingly, Bitcoin ETFs were recently reported to hold 3.3% of Bitcoin’s circulating supply, underscoring their success since launching. Data from Lookonchain shows that these ETFs currently hold over 657,000 BTC (excluding WisdomTree).

Matt Hougan, Bitwise’s Chief Investment Officer (CIO), also revealed how these funds have seen flows of $1.7 billion after their first 14 trading days. This is more impressive as he made a comparison to Gold ETFs, which saw $1.3 billion in a similar time frame. In another X post, he mentioned how these Spot Bitcoin ETFs have taken $700 million in net inflows this week alone.

BTC price recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock Finally Trumps Grayscale

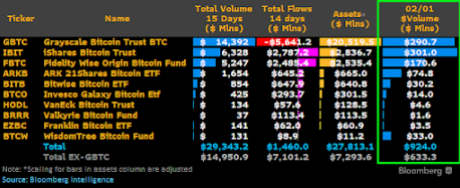

Bloomberg analyst James Seyffart mentioned in an X post that BlackRock’s IBIT looks to have become the first ETF to trade more than Grayscale’s GBTC in a single day. Before now, Grayscale had continued to record the most daily trading volume, although IBIT had come close on a couple of occasions.

From the data that Seyffart shared, IBIT looks to have recorded $301 million in trading volume on February 1, while GBTC saw $290 in trading volume. However, he further stated that the total trading on the day “was kind of a dud,” with all Spot Bitcoin ETFs combined recording $924 million in trading volume.

Interestingly, that happened to be the first day that the daily volume for Spot Bitcoin ETFs was under $1 billion. The Bloomberg analyst didn’t, however, give any opinion as to what could have caused this relatively sub-par performance.

Featured image from U.S. Global Investors, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Zero-Knowledge infrastructure can secure ‘trillions’ in institutional money in 2024: Interview Polygon Labs

In an exclusive interview with Colin Butler, Global Head of Institutional Capital at Polygon Labs, Butler brings a unique and informed perspective to the table, discussing various pivotal aspects shaping the future of blockchain and cryptocurrency. This interview explores the impact of traditional financial instruments like ETFs on the crypto market, the significant strides made in institutional DeFi in 2023, the evolving role of tokenization in institutional adoption, and Polygon’s strategic position in this rapidly changing landscape. His answers offer a comprehensive look at the current state and future prospects of blockchain technology in the institutional domain, highlighting both the challenges and opportunities that lie ahead.

Butler highlights 2024 as a critical year for institutional adoption of tokenization. He emphasizes the maturity of the underlying infrastructure, capable of supporting immense financial values. The focus is on the significant improvement in security, particularly with Zero-Knowledge technology, which is crucial for traditional finance (TradFi) institutions to engage with blockchain and cryptocurrencies. The integration of ETFs and similar products is expected to significantly enhance trust and legitimacy in cryptocurrencies. Butler foresees a broader investor base, increased market stability, and reduced volatility driven by deeper involvement from traditional financial institutions.

He discusses the challenges and future of tokenization. He mentions the need for institutions to improve infrastructure and supply to meet the growing demand. He predicts rapid growth in areas like tokenized funds and structured products, with physical assets like real estate and art being slower due to inherent challenges.

Butler is uniquely positioned to comment on the institutional perception of DeFi, as the below interview highlights.

You’ve mentioned that big institutions are now tokenizing real-world assets and the implications of on-chain assets becoming institutional in the form of ETFs. Can you elaborate on how this trend might evolve in 2024?

I see 2024 being an extreme inflection point for the institutional adoption of tokenization. The underlying infrastructure is now in a state capable of securely supporting the billions, if not trillions, of dollars worth of value that traditional financial institutions bring with them.

Security has been the blocker to date; you only have to look at the broader crypto and DeFi ecosystems to see the impact of security defects and the potential for significant monetary losses as a result. However, with the implementation of Zero-Knowledge technology, a level of security is in place that even the most hesitant of TradFi proponents can get on board with.

What impact do you foresee ETFs and similar products having on the broader crypto market and investor confidence?

As TradFi deepens its crypto involvement, we’ll witness a substantial increase in overall trust and legitimacy of cryptocurrencies as an asset class. Crypto products will appeal to a broader range of investors, including those who have been previously skeptical. With increased confidence and more consistent investment flows will come greater market stability and a reduction in the volatility characteristic of the crypto markets to date.

You predicted that 2023 would be a pivotal year for institutional decentralized finance (DeFi). What developments have you seen this year that reinforce or challenge this prediction?

2023 was a year of clear progress. We saw the launch of Clearpool’s institutional borrowing platform, allowing lenders to set their own stablecoin loan terms. JPMorgan’s deposit tokens suggest a growing interest from traditional financial institutions in blockchain solutions, though within a regulated framework.

The integration between legacy financial systems and blockchain is a complex one. There has been major advancement and interest, certainly, but also a recognition of the remaining hurdles, particularly around regulation. BlackRock’s embrace of Bitcoin and cautious stance with DeFi epitomizes the institutional desire for clarity amidst regulatory complexities.

How do you think the progress made in 2023 will shape the institutional DeFi landscape in 2024?

With the massive improvements brought by layer-2 networks and ZK technology, we’ve seen the Ethereum network successfully update to a more efficient and cost-effective infrastructure that can make DeFi protocols accessible and appealing to institutional users.

In 2024, I think we’ll see a shift in the user base of DeFi from primarily retail to more institutional participants, driven by the development of more sophisticated financial tools like derivatives. Furthermore, the entry of large entities like BlackRock into DeFi will pave the way for new standards and frameworks that make DeFi a clear win for traditional finance more broadly.

Considering your belief in tokenization as a world-changing phenomenon, what do you think are the key drivers for its widespread adoption by institutions?

I think the institutions building these products need to go out and sell them. You can lay out all of the benefits: 24/7 trading, access to vehicles and assets for which you had no prior access etc. But does this create an order of magnitude better solution that people can clearly see like in front of them? It’s tough to say.

Until now the infrastructure hasn’t existed for the technology to be accessible by the average person, as a result, demand has been low. While the benefits for tokenization are undeniable, the supply and infrastructure has to exist for widespread adoption. That’s the challenge we face as an industry. We’re small in every leg of the stool: infrastructure, supply, and demand. We need institutions to continue to grow their infrastructure and, in time, demand will grow in tandem with supply.

How do you see tokenization evolving in the next year, especially in terms of new asset classes or innovative use cases?

In 2024, I see tokenization growing rapidly in some areas but slowly in others.

Tokenized funds will continue to grow over the next three to six months. Next I see structured products, such as currencies, being tokenized more regularly and private credit will come soon after. These are the most logical use cases for tokenization and because they’re digital the transition on-chain should be fairly smooth.

Bonds and equities are likely to come next. But the last to be tokenized is going to be physical assets like gold, real estate, art, wine, etc. While these physical assets have heaps to gain, due to them not being digital, the transition will take a lot longer. There are a lot of challenges we face to tokenize physical assets, some of which may never be solved.

As the Global Head of Institutional Capital at Polygon Labs, how do you see the platform fitting into and influencing the institutional adoption of blockchain technology?

If you’re an institutional investor you want two things: high liquidity and security. The Polygon networks give you both.

Investors can tap into the entire Ethereum ecosystem through the Polygon networks, providing access to high liquidity. And, the development and adoption of zero-knowledge tech in the Polygon network will increase the security of transactions.

I believe that due to these two factors, institutional investors will be looking towards the Polygon protocols, more often than not, when looking to invest in blockchain technology.

Can you share any insights or case studies where Polygon has been instrumental for institutions in adopting blockchain?

This year Hamilton Lane, one of the leading global investment funds, started allowing individual investors to access their $2.1 billion flagship fund through tokenization on the Polygon PoS network. This reduced the minimum investment required from $5 million to just $20,000. This collaboration between Hamilton Lane and Securitize went so well that they later started offering a new fund with a $10,000 minimum investment.

But this isn’t one case study in isolation, South Korea’s largest financial group, Mirae Asset Securities, also trusts the Polygon network for their adoption of Web3 technologies.

While ABN AMRO became the first Dutch bank to register a green bond on the blockchain, using the Polygon network. And, JPMorgan used the Polygon PoS network as part of the Singapore CBDC project.

The Polygon protocols are playing an instrumental role in institutional adoption of blockchain technology by providing infrastructure that can handle the flow of billions of dollars.

Given your role in educating the institutional investment community about blockchain, what are the key areas of focus or common misconceptions you address?

There’s a common misconception that blockchain and cryptocurrency, particularly Bitcoin, are synonymous. But blockchain encompasses much more than just cryptocurrencies. It’s a foundational technology that offers tokenization, smart contracts, and a wide array of applications.

The transparency offered by public blockchains is a significant feature, often underestimated in their ability to provide real-time visibility into transactions and analyze the risk of each platform’s transactions as they occur. Contrary to popular belief, the incidence of illicit activities in these businesses is minimal, as shown by the analysis of transaction inflows into mainstream exchanges.

Another common misconception is that blockchains are inherently limited by low transaction speeds and scalability issues. Scaling solutions like the Polygon networks for Ethereum are crucial developments in making blockchain technology more viable for widespread institutional use.”

How do you approach the challenge of balancing technical depth with approachability in these educational efforts?

I think it’s important to explain things in as simple terms as possible. Although blockchain emerged thanks to several impressive technological innovations, notably advanced cryptography, it’s important to draw analogies with familiar examples and portray blockchain as an evolution of existing financial systems rather than a radical departure.

For instance, smart contracts can be likened to automated versions of self-executing contractual clauses much like an escrow service in traditional finance, but with automation and predefined rules. Fundamentally, a blockchain is a digital ledger, similar to accounting ledgers in traditional banking, but more advanced and transparent. This ledger records transactions securely, akin to how banks record financial transactions, but with increased transaction speed, and enhanced transparency. The most important aspect of blockchain education is to show how it enhances and improves upon current processes. It didn’t emerge out of nowhere. It came about to solve some of the limitations faced by traditional finance.

Connect with Colin Butler

Is Cardano The Next Solana? Institutional Investors Clamor For ADA Exposure

Crypto asset investment products started the year on a positive note, with Cardano making a comeback despite going on a price decline last week. According to the latest digital asset fund flow from CoinShares, crypto products saw total inflows of $151 million in the first week of 2024.

Unsurprisingly, a larger part of this inflow went into Bitcoin, with Ethereum closely following behind. However, Cardano products also picked up steam during the week, attracting notable inflows compared to other altcoins.

Cardano Attracting Institutional Altcoin Investors

Institutional investors poured a notable $3.7 million into Cardano-based investment products last week, far greater than its average in 2023. Aside from Ethereum, which received a $29.6 million net inflow, Cardano saw the most inflow among altcoins, followed by Avalanche with $2 million.

Litecoin and XRP also saw modest inflows of $1.3 million and $0.9 million respectively, while multi-asset products received a net inflow of $5.4 million.

It would seem most of the attention Solana received in 2023 was diverted into Cardano in the week. According to previous weekly reports, Solana frequently saw the most weekly inflow in the last quarter of 2023, even surpassing Bitcoin and Ethereum at some point.

However, it would seem this sentiment failed to show itself in the first week of the year, as data from CoinShares showed Solana registered a net flow of $5.3 million. Similarly, Short Bitcoin products saw a net outflow of $1 million, pushing its total outflows over the last nine weeks to $7 million.

As stated earlier, Bitcoin received the most inflows. Bitcoin started the year with a weekly net inflow of $113 million, and inflows over the last nine weeks representing 3.2% of assets under management. Blockchain equities have also had a good start to the year, seeing US$24m inflows over the last week.

In terms of geographical location, the US saw the most activity. Exchanges in the country saw a weekly net inflow of $83 billion, representing 55% of the total inflow. Germany and Switzerland followed with $32.5 million and $24.9 respectively, representing 21% and 17% of the total inflow.

ADA price at $0.59 | Source: ADAUSD on Tradingview.com

What’s Next For ADA?

The report from Coinshares attributes the inflow to proponents of spot Bitcoin ETFs who continue to push a bullish sentiment for the cryptocurrency pending approval in the US. Now that these ETFs have been approved, it is up to the market to determine what they bring to the table.

Cardano has also largely benefited from a steady growth in its ecosystem, development activity, and in DeFi. At the time of writing, Cardano (ADA) is trading at $0.5926. The crypto has outperformed most large market cap altcoins in the past 24 hours and is up by 15.55% in the timeframe. According to various predictions, Cardano (ADA) is set for a surge in 2024 with one analyst forecasting a price target of $6.

Featured image from CriptoNoticias, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin CME futures and Coinbase show renewed premiums as institutional interest spikes

Quick Take

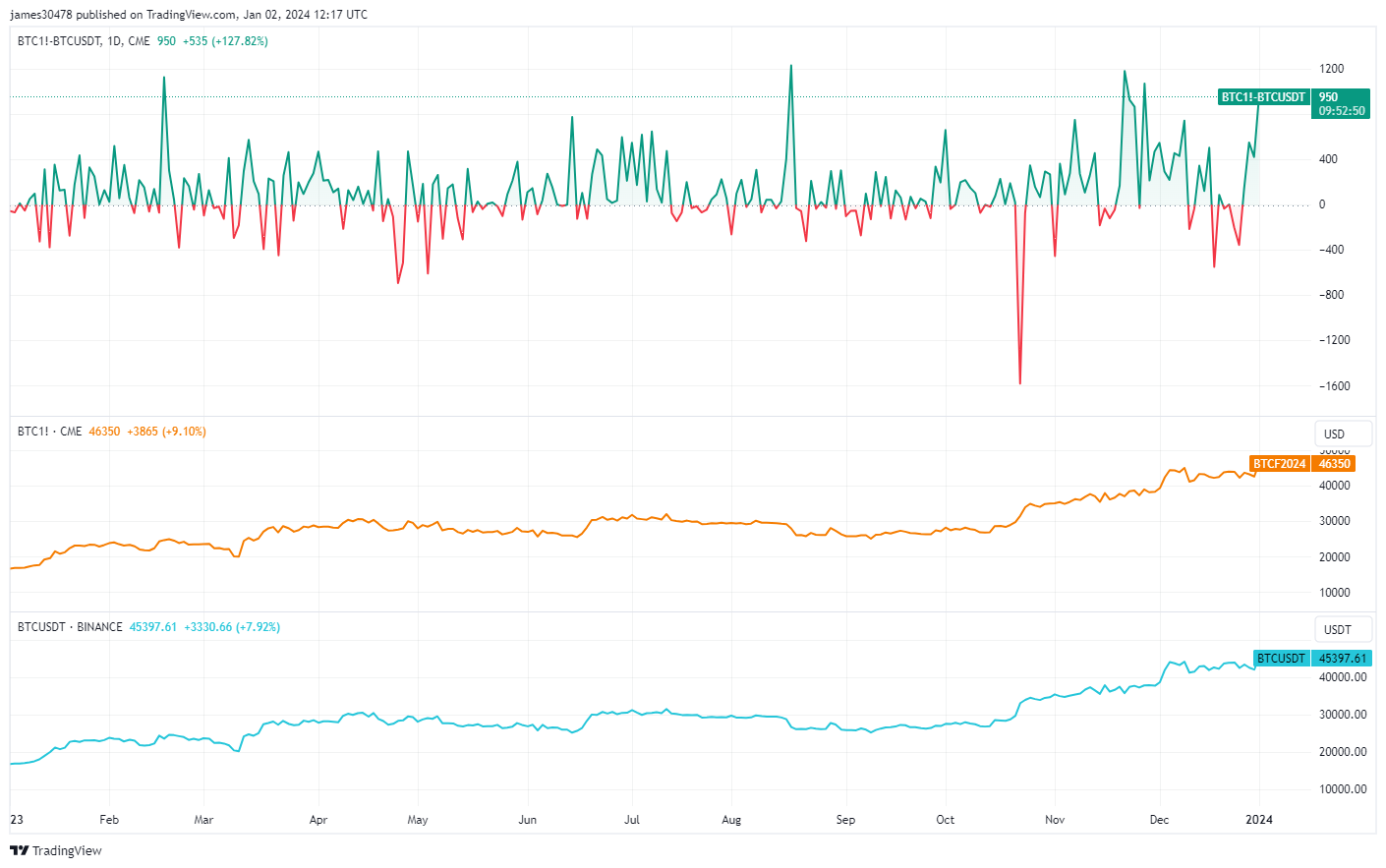

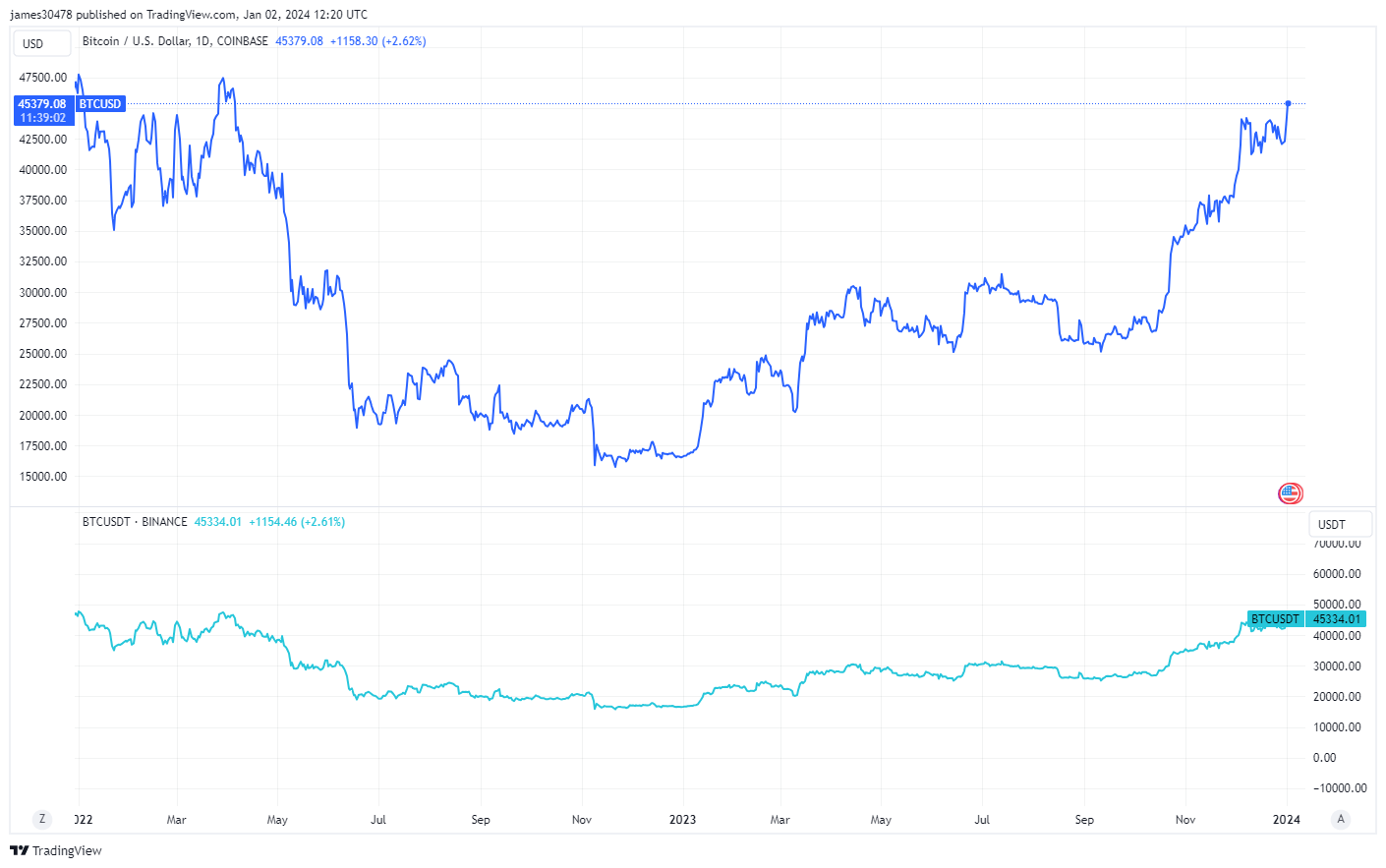

A notable development ensues as Bitcoin enters 2024 with the reappearance of premiums on both Chicago Mercantile Exchange (CME) futures and Coinbase. Data analysis reveals a discernible price discrepancy between CME’s Bitcoin futures, trading approximately at $46,400, and Binance’s BTCUSDT pair, exchanging hands at about $45,300. This almost $1,000 variance emerges as the fifth-largest differential observed in the past year.

Further, the Coinbase premium, too, has made a comeback. The BTCUSD pair on Coinbase is seen trading for $45,400, in contrast to the BTCUSDT pair, set at $45,300. This evolving landscape indicates a resurgence in institutional interest, primarily from the United States, coinciding with the potential approval of a Bitcoin spot Exchange-Traded Fund (ETF).

While the dynamics of this resurgence are multifaceted, it is clear that the potential approval of the spot ETF may have a major role in this shift.

The post Bitcoin CME futures and Coinbase show renewed premiums as institutional interest spikes appeared first on CryptoSlate.

Institutional Investors Increase Bitcoin Appetite Ahead Of Spot ETF, Report Shows

A report by K33 research analysts has provided insight into how much institutional investors’ appetite for Bitcoin has increased ahead of a potential approval of a Spot BTC ETF. The research firm emphasized a particular indicator to drive home their point and provided further insight into what the future holds if these ETFs get approved.

The Derivatives Market: An Indicator Of Institutional Interest In Bitcoin

In the report written by K33’s Senior Analyst Vetle Lunde and Head of Research Anders Helseth, they noted that the derivatives market was important as it can be used to gauge institutional traders’ interest in Bitcoin. In line with this, they touched on how there has been a significant increase in open interest in the Chicago Mercantile Exchange (CME) derivatives market.

The K33 report specifically noted that the CME’s open interest has grown by over 3,4000 BTC over the past week. Meanwhile, CME’s open interest remains near all-time highs of 110,000 BTC. The increased activity on the CME has resulted from these traders’ desire to gain exposure to Bitcoin ahead of the “imminent ETF verdict.”

With a potential approval on the horizon, it is believed that many traders are looking to make as much profit as they can from this bullish event. Meanwhile, others have genuinely become bullish on the flagship cryptocurrency and want to gain exposure to it in any way they can. The CME is arguably the most accessible means to gain exposure to Bitcoin for this class of investors.

Notably, the K33 analysts highlighted how the open interest in the CME exchange had picked up the pace back in October. Coincidentally or not, this happened to be when Bitcoin and the broader crypto market picked up steam, as many believed that the Spot Bitcoin ETF rumors were the reason for the rally.

BTC price at $42,851 | Source: BTCUSD on Tradingview.com

CME To Lose Market Share Once ETFs Get Approved

NewsBTC had in November reported how CME had overtaken Binance in Bitcoin futures. Data from Coinglass also shows that the CME is still well ahead in terms of Bitcoin futures open interest. However, that could change soon enough as the K33 report touched on the possibility of open interest in CME collapsing once these Spot Bitcoin ETFs get approved.

An approval can cause selling pressure on CME as these institutional investors might look to take profit while others will be looking to transfer their capital to the Spot ETFs. K33 elaborated on the latter. The report noted that futures-based ETFs currently account for 46% of the CME’s open interest.

Considering that futures and Spot ETFs will be in direct competition, they expect the latter to become the more favorable option. As such, these K33 analysts foresee a decline in the open interest, which these futures ETFs account for. They project that many institutional investors will look to rotate a substantial portion of their capital to the Spot ETFs.

At the time of writing, Bitcoin is trading at around $42,800, down in the last 24 hours, according to data from CoinMarketCap.

Featured image from RIS Media, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Valour XRP ETP Set To Begin Trading, Can Institutional Inflows Drive Price To $10?

The XRP price may be gearing towards a bullish momentum with the potential release of multiple ETPs and the anticipated launch of Valour’s XRP ETP into the European markets next month.

Valour XRP ETP To Enter European Markets

Valour, a publicly traded company backed by DeFi Technologies, a crypto-based software organization, has announced a new XRP Exchange Traded Product (ETP). In a press release published on Wednesday, DeFi Technologies disclosed the launch of Valour’s XRP ETP in December 2023.

A popular YouTuber, Zack Rector has stated in a recent YouTube video that the token is positioned to take advantage of a large flow of liquidity driven by the initiation of multiple XRP ETPs.

Including Valour’s ETP, there have been many other ETPs launched by industry-leading crypto companies. 21 Shares, a Swiss financial institution, is one of the prominent companies that issued its XRP ETP (AXRP) in 2019. Since its launch, AXRP has recorded approximately $49 million in assets under its control and the ETP earns a year-to-date return of +69%.

Rector disclosed that the growing number of ETPs could trigger significant institutional inflows that could push the adoption of the token and possibly drive its price upwards. Furthermore, the integration of an XRP ETP has the potential to significantly advance the ecosystem by enhancing liquidity and improving accessibility for retail and institutional investors.

ETP Influence On The Price

The announcement of Valour’s XRP ETP comes as a positive development for the community and the broader crypto space. Various crypto investors have expressed their optimism about the significant impacts these ETPs could have on the XRP market.

Just as the news of Spot Bitcoin ETF applications propelled Bitcoin’s price above $37,000, institutional flows from Valour’s XRP ETP could drive the token’s price to $10.

The ETP issued by 21 Shares Ripple is a prime example of how XRP ETPs have performed in the past. After being traded 447 times on the market, this particular ETP generated $5 million in revenue.

Valour’s upcoming ETP has become a focal point for investors seeking strategic investment opportunities. Crypto investors are closely monitoring the market to assess the potential gains that may follow the ETP’s debut.

The anticipated launch of Ripple’s IPO and the final resolution of the lawsuit between Ripple and the United States Securities and Exchange Commission (SEC) are also major events that could help drive the price of the token to higher levels.

Token price falls tot $0.619 | Source: XRPUSD On Tradingview.com

Featured image from Analytics Insight, chart from Tradingview.com

OKX joins Komainu and CoinShares for institutional segregated asset trading

Crypto exchange OKX has partnered with custody provider Komainu and asset manager CoinShares to facilitate round-the-clock trading of segregated assets to push institutional adoption of digital assets forward.

According to OKX, CoinShares will trade on the OKX exchange, while Komainu, a third-party custody provider, holds the collateral assets. This is done to mitigate counterparty risks, such as the other party failing to fulfill its part of the deal in a trading transaction.

According to Sebastian Widmann, head of strategy at Komainu, this is a necessary step to attract institutions to adopt digital assets, as it mirrors traditional financial market infrastructure. “By acting as independent, trusted and regulated third-party custodians for collateral assets, we give our clients additional assurances throughout their trading lifecycle,” Widmann said in a statement.

Lennix Lai, the chief commercial officer at OKX, believes that the new development addresses one of the remaining hurdles for institutional traders, counterparty risks. He explained:

“Secure custody solutions are live. Regulatory frameworks are taking shape. Exchange liquidity is deepening alongside the development of the trading ecosystem. However, counterparty risk is a big remaining hurdle for institutional traders.”

According to Lai, this protection reinforces the trust and confidence of institutional traders and creates a more reliable landscape for them to transact in digital assets. In a previous interview with Cointelegraph, Lai stated it’s important to raise compliance standards to bring in more traditional finance investors within the crypto space.

Related: Brad Garlinghouse jabs at maximalists: ‘It will be a multichain world’

Meanwhile, Lewis Fellas, head of hedge fund solutions at CoinShares, said the partnership creates a “legally robust mechanism” for the mutual management of assets. According to Fellas, the partnership also demonstrates the company’s expertise in “negotiating complex tripartite agreements that cover collateral, security and legal risks,” which are important for institutional investors.

Magazine: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

The Chicago Mercantile Exchange (CME) has recently clinched the title of the largest Bitcoin futures exchange by open interest, overtaking the renowned crypto exchange, Binance.

Data from Coinglass reveals that CME’s open positions have reached roughly $4.04 billion across 108,900 Bitcoin contracts, accounting for 24.22% of the entire Bitcoin futures market.

Open interest in the context of futures trading refers to the total number of outstanding derivative contracts, such as futures, that have not yet been settled. This metric is crucial as it indicates the market’s liquidity level and trading activity.

For BTC futures, it represents the total value of all positions yet to be closed, offering insights into market sentiment and investor behavior. The rise of CME to the top position signifies a notable shift in the market dynamics, indicating a growing preference among institutional investors for regulated derivatives products.

Institutional Appetite For BTC And Implications For SEC Spot ETF Approvals

Binance, once the leader in BTC futures open interest, now trails CME with $3.90 billion in open interest, comprising 23.37% of the total market. This change underscores a significant trend: institutional investors increasingly favor Bitcoin as an investment vehicle, as evidenced by entities like MicroStrategy.

This enterprise software company, known for its substantial Bitcoin holdings, recently acquired an additional 155 BTC for $5.3 million. With Bitcoin’s current trading price above $37,000, MicroStrategy’s investment boasts roughly $1.1 billion in paper profits, underscoring the asset’s appeal to corporate investors.

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR

— Michael Saylor⚡️ (@saylor) November 1, 2023

The overtaking of Binance by CME in Bitcoin futures open interest has captured market participants’ attention and raised crucial questions among regulatory observers.

Notably, Bloomberg Intelligence ETF research analyst James Seyffart, echoing sentiments from Will Clemente, has speculated on whether CME’s growing Bitcoin futures open interest might address the US Securities and Exchange Commission’s (SEC) concerns about market depth and potential manipulation in Bitcoin markets.

Okay this is interesting… Does this constitute ‘market of significant size’ now? haha

— James Seyffart (@JSeyff) November 9, 2023

This shift in market leadership from a crypto exchange like Binance to a traditional and regulated derivatives marketplace like CME could signal a maturing BTC market. Such a development might influence the SEC’s stance on approving spot Bitcoin ETFs.

Bitcoin Latest Price Action

While CME is overthrowing Binance regarding Bitcoin’s open interest, the crypto asset has recently reclaimed its $37,000 zone in the past hours after retracing slightly below that price mark following the quick spike on Thursday.

Notably, BTC currently trades for $37,350 at the time of writing, up by 2.1% in the past 24 hours and nearly 10% over the past 7 days.

Featured image from Unsplash, Chart from TradingView