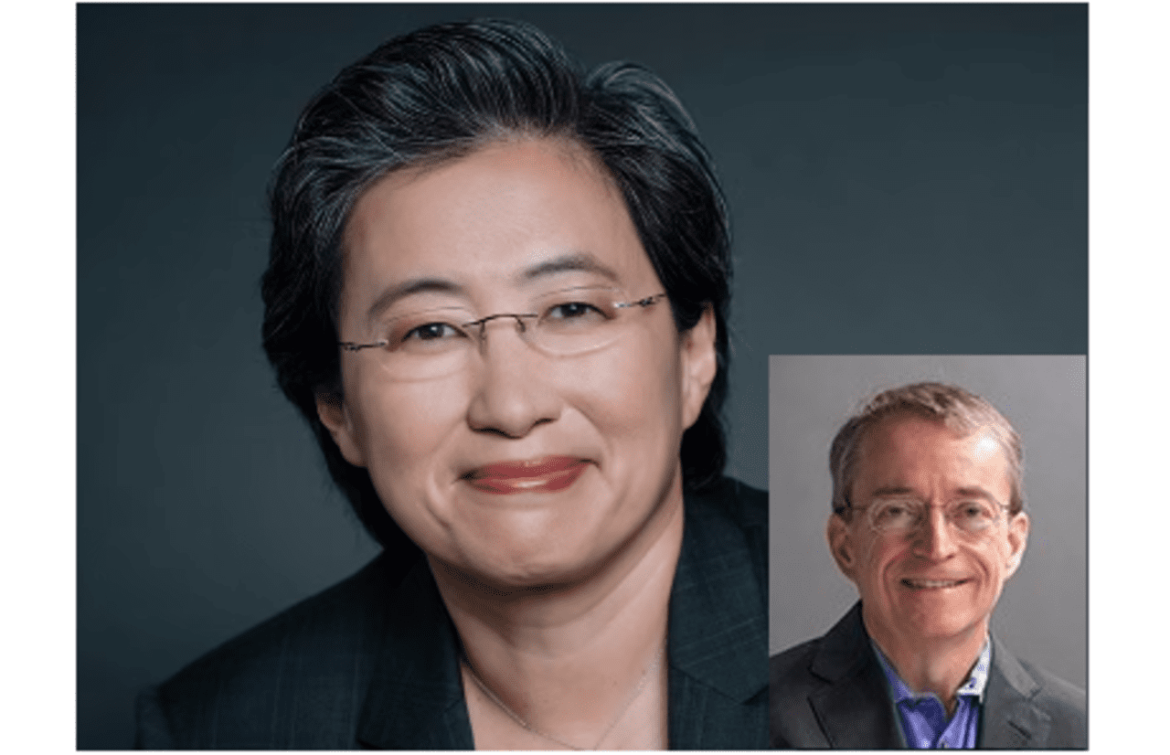

Intel Chief Executive Pat Gelsinger got a big bump in compensation in 2023, but it still amounted to just over half what Lisa Su made as CEO of rival Advanced Micro Devices.

Source link

Intel

China blocks use of Intel and AMD chips in government computers, FT reports

(Reuters) -China has introduced guidelines to phase out U.S. microprocessors from Intel and AMD from government personal computers and servers, the Financial Times reported on Sunday.

The procurement guidance also seeks to sideline Microsoft’s Windows operating system and foreign-made database software in favour of domestic options, the report said.

Government agencies above the township level have been told to include criteria requiring “safe and reliable” processors and operating systems when making purchases, the newspaper said.

China’s industry ministry in late December issued a statement with three separate lists of CPUs, operating systems and centralised database deemed “safe and reliable” for three years after the publication date, all from Chinese companies, Reuters checks showed.

The State Council Information Office, which handles media queries for the council, China’s cabinet, did not immediately respond to a faxed request for comment.

Intel and AMD did not immediately respond to Reuters request for comment.

The U.S. has been aiming to boost domestic semiconductor output and reduce reliance on China and Taiwan with the Biden administration’s 2022 CHIPS and Science Act.

It is designed to bolster U.S. semiconductors and contains financial aid for domestic production with subsidies for production of advanced chips.

(Reporting by Akanksha Khushi in Bengaluru; Editing by Christian Schmollinger, William Mallard and Lincoln Feast.)

Opinion: OpenAI’s Sam Altman has plans for AI that could mean big money for Intel

“Many companies, including giants Nvidia and Qualcomm, will likely partner with Intel for packaging and/or wafer capacity, and this seems to be going somewhat unnoticed.”

I’m bullish on Intel for three main reasons: the leadership of Chief Executive Pat Gelsinger, the company’s strong ecosystem and Intel’s

INTC,

ambitious foundry business — which has perhaps found the perfect moment to become the most important driver of Intel’s future.

Open AI CEO Sam Altman drew widespread attention recently when he appealed for up to $7 trillion to develop silicon-chip manufacturing capacity that can power artificial intelligence. The unprecedented scope of this vision, equal to more than 20% of U.S. GDP, captured the imagination of the world. Here was the person who brought AI to the masses saying that the chip industry currently lacks what it will take to support the development of fabs, data centers and infrastructure.

At first, Altman’s $7 trillion price tag seemed absurd to me, just based on its size, but the more I considered it, the more I came to see the investment required to build chips that will be 10x, 100x or even 1,000x as powerful by the end of this decade. It’s going to take massive investment, and while it’s provocative to think Altman will want to go at it alone, it is perhaps more interesting to think of which partners Altman will want to bring with him.

Chipmaker for the West

Intel aims to be the chip manufacturer for the West, while Altman wants to reimagine the global supply chain and industry for AI chips. Perhaps it is time to ask if its mere coincidence that Altman, Microsoft

MSFT,

CEO Satya Nadella, U.S. Secretary of Commerce Gina Raimondo, and a host of global semiconductor business leaders from the likes of Arm Holdings

ARM,

Broadcom

AVGO,

Synopsys

SNPS,

Cadence Design Systems

CDNS,

Ansys

ANSS,

and others will converge on Wednesday at Intel’s foundry event in San Jose, Calif.

Intel will be providing an important set of updates on its foundry strategy. While Intel’s foundry business has been one of its biggest bright spots over the past few quarters, including a 63% jump in its fiscal fourth quarter, it still feels like this is an underappreciated asset within the Intel portfolio — especially given that Taiwan Semiconductor Manufacturing Co.

TSM,

runs an operating margin of ~40%.

Much focus has been given to whether Intel can get traction with its own AI graphics processing unit and silicon. So the fact that many companies, including giants Nvidia

NVDA,

and Qualcomm

QCOM,

will likely partner with Intel for packaging and/or wafer capacity seems to be going somewhat unnoticed.

Read: Intel stock is not valued even close to its competition

My take: It is far from coincidence, and based upon the mere scale of AI, there is a desperate need for expanded capacity and advanced foundry capabilities in the U.S. and other western geographies like Europe and Israel. Consider this week a coming-out party for Intel, for those that haven’t been following this closely.

I recently spoke with Gelsinger in advance of Wednesday’s Intel event. While he wouldn’t comment directly on what Altman or Raimondo would be speaking on, the Intel CEO did allude to the incredible scale of AI and the orders of magnitude of performance and power management that would be required over the next decade. To me, it’s clear there is a perfect opportunity here for Intel, government policymakers and Altman to collaborate on meeting the need for AI semiconductors. Intel makes for both a willing and ideal partner.

The technology industry, and more specifically the semiconductor industry, and U.S. policy leaders see the immense value in a strong U.S.-based foundry for leading-edge and AI chips. Intel is the only company that has stepped up to do this for the West. Taiwan Semiconductor certainly has a massive role to play, but to build out capacity for AI chips in the future, the moment is all Intel.

Daniel Newman is CEO and chief analyst at The Futurum Group, which provides or has provided research, analysis, advising or consulting to Intel, ServiceNow, NVIDIA, Microsoft, Amazon, IBM, Oracle and other technology companies. Neither he nor the firm have any positions in any of the other companies cited. Follow Newman on X @danielnewmanUV.

More: Three stocks of AI ‘enablers’ to consider as Nvidia sets up another possible surprise

Also read: 3 ways a ‘Magnificent Seven’ stock-market bubble could burst

Intel (INTC 1.91%) hasn’t been the world’s greatest stock to own. Over the past decade, Intel’s total return (which includes dividend payments) was about 140%. While that may not seem terrible, the Nasdaq-100‘s total return is about 465% over that same time frame.

That’s significant underperformance, and it occurred because Intel has fallen behind on technology. However, Intel may be able to turn it around thanks to a new machine it bought.

So, if Intel can return to the top, could it become the next Nvidia and skyrocket higher? Let’s find out.

Intel has fallen behind other semiconductor companies

The machine that Intel just purchased is a high NA EUV lithography machine made by ASML. Lithography machines allow chipmakers to etch the microscopic patterns on a chip. The distance between these traces determines the size of the chip node. Currently, 3 nanometer (nm) chips are the world’s smallest and are only produced by Taiwan Semiconductor and Samsung.

Intel doesn’t have 3nm or 5nm chip technology. Instead, the best it has is 7nm. This difference puts its products at a significant disadvantage compared to competitors’ products that use these more powerful chips.

But Intel’s latest purchase of this high NA EUV lithography machine will allow Intel to produce 2nm chips and return to prominence in the semiconductor space.

However, the effect may not be as big as expected.

Intel is competing with many companies, but primarily Taiwan semiconductors, on this front. Taiwan Semiconductor is a contract chip manufacturer that makes the chips that Intel’s competitors (like AMD) use. Taiwan Semiconductor even makes some 3nm chips for Intel because it cannot do so.

The relationships are deep within this industry, and if Intel can get its 2nm chips out before others, it may not be enough to supplant itself as king of the semiconductor world. However, this return to prominence may be enough to kick-start momentum in the stock.

The stock isn’t that much cheaper than its peers

Valuing Intel’s stock is difficult from the trailing earnings perspective, as it had a few quarters with negative earnings in 2023.

But, if we value the stock using forward earnings, we can better understand how the market views Intel.

INTC PE Ratio (Forward) data by YCharts

At 31 times earnings, Intel’s stock isn’t that cheap. But that isn’t the full picture. Over the past few years, Intel’s profit margins have fallen off a cliff.

INTC Profit Margin data by YCharts

If Intel can recover to a 25% profit margin and maintain the revenue it generated in 2023, $54.2 billion, it would produce profits of $13.6 billion. Dividing its market cap by this figure yields an optimized price-to-earnings ratio of 13.

So, if Intel can return to this level, then the stock looks pretty cheap. But does that mean it could turn into the next Nvidia? I’d say no. Taiwan Semiconductor trades at 19 times forward earnings, so even if Intel improved its margin to previous levels, it doesn’t have that far to go before it would be valued the same as Taiwan Semiconductor.

Intel has a lot to prove, and the stock is already assuming success in revitalizing the company. That’s far from certain, making me want to invest in Taiwan Semiconductor rather than Intel.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

A wave of strong earnings from big tech players proves once again beating the quarter is only as good as your guidance — or lack of it.

Intel

INTC,

beat expectations in its most recent earnings report, but provided guidance that was well-short of expectations. The stock sold off as investors tried to understand why the guidance was so soft. With all the hype over artificial intelligence and improvement in operations at Intel, why wasn’t the company’s result more robust, and the guidance more optimistic?

There were some obvious reasons. One is that Mobileye Global

MBLY,

saw its forecast get slashed, and the stock got pummeled. Intel’s significant investment and position in Mobileye certainly impacted its own guidance. Plus, both network and internet-of-things spending has declined.

While those reasons were noted by investors and analysts, make no mistake, the data-center business is where the alarm bells went off. The growth this quarter was OK, but meanwhile rival Nvidia

NVDA,

is expanding its margin at a breakneck pace, surpassing revenue records and effectively being declared the undisputed champion of AI infrastructure. Intel’s lack of a more optimistic, positive outlook for its data-center solutions built around AI was met with absolute disdain.

“Intel can grow into an AI leader and take customers from Nvidia and AMD”

Against these challenges, is there a bull case for Intel or has it missed the mark on AI?

Let’s start with AI: 2023 was the year of the graphics-processing unit (GPU), and the undisputed, unquestioned winner was Nvidia. With AI training in demand and the largest cloud providers all investing big on infrastructure to support AI, Nvidia was the only option. Some estimate that Nvidia’s market share of the GPU is as high as 98%, which actually looks Intel-esque from its most successful years when AMD

AMD,

was on the ropes and Intel enjoyed almost a complete monopoly in both the data center and the PC.

Read: Is it a bubble? ‘Magnificent 7’ market cap equals the GDP of 11 major cities.

AI on your PC

But the data center isn’t the only place where AI is going to play a role. A new generation of personal computers is being developed with the intent of creating a brand new supercycle. Many analysts, including myself, expect these to hit the market in the second half of 2024. These PCs will run large-language models that enable data to stay private on the device and be used for generative AI applications without having to interact with the cloud — delivering less latency, more security, and efficiency and putting AI at the fingertips of PC users, much like we’ve become accustomed to with our mobile devices.

The other question is whether the AI market is really that mature, and the answer is: of course, not. These are early days for AI. While the training infrastructure that saw Nvidia stock go parabolic in 2023 was certainly exciting, 2024 will see a focus on implementation. This will be much more about AI inference and applications that are able to combine both generative AI and more traditional machine-learning tactics and techniques to maximize the value of data, whether for consumer applications or enterprise apps.

Intel sits in an excellent position around AI because the company still commands around 75% of the data-center computing market and about the same percentage of the PC market. With the company likely a couple of years out from having a GPU that can compete with what Nvidia and AMD are building, Intel could grow into the AI market and look to take a double-digit percent market share from Nvidia.

Reasons for optimism

Here are specific reasons supporting the bull case for Intel, and the stock’s low valuation, plus the market conditions and the growing need for computing of all types sit well for the company’s long-term prospects.

1. CEO Pat Gelsinger, who has brought back a confidence, a spirit, and a leadership style that bodes well for Intel. He’s made hard decisions; moving the company away from its less-profitable businesses and focusing on strategic alignments as well as mobile. At the same time, he’s worked diligently to make Intel the national fab for the United States — in other words, Intel makes its own chips, and is also aiming to use its facilities to make other companies’ chips too.

2. Long-standing relationships with the channel. This is twofold. First, the channel is highly dependent on Intel from both a design distribution and implementation standpoint. Intel has been one of the most successful companies in terms of building strategic marketing, co-op, and MDF programs that have made partners codependent on Intel to deliver products and margin to the business that is required to be successful.

So long as Intel can deliver competitive products, there is a slow-to-change situation that will remain intact for the time being that I do not see being completely disrupted. Given the company is more on track than it’s been in a long time, the company ceded massive market share to AMD and Nvidia through operational deficiencies and a lack of presence in critical markets. But it seems that over the next few years, most of these items will be course-corrected.

Lastly, and my personal favorite bull case for Intel, is its growing foundry business. Yes, there are reports of delays in multi-year fab construction, but I think those delays are to be expected.

Intel has embraced the opportunity to be the United States and the West’s national foundry. Effectively, of course, the company is committed to its integrated manufacturing strategy. But it is also being looked at by more fabless chip designers here in the U.S. for both nationalistic and strategic reasons to provide supply, and the company has successfully expanded to more than being a process foundry but also a packaging foundry, which has propelled that part of the business to record revenues over the past few quarters.

With uncertainty around China and the need for more supply-chain diversity, there is no other bet for a company that can deliver AI chips partnering with Marvell Technology, Nvidia, Qualcomm, AMD, and others than Intel — not to mention demand for non-AI chips that largely caused the shortage of 2021 and 2022.

It’s easy to make the bear case for Intel, and there are analysts that will never see a positive for the company. I also could argue every one of these points from the other side. But having said that, there is a bull case. Intel stock is not valued even close to its competition. And the company does still have a really substantial market share and deep ties in its channel that are hard to break. At the very least, this calls for optimism.

Daniel Newman is the CEO and chief analyst at The Futurum Group, which provides or has provided research, analysis, advising or consulting to ServiceNow, Intel, NVIDIA, Microsoft, Amazon, IBM, AMD and other technology companies. Neither he nor the firm have any positions in any of the companies cited in this article. Follow him on X @danielnewmanUV.

More:

Nvidia is ‘clear beneficiary’ of Meta’s AI spending rush. Its stock is climbing.

Apple just did something unusual. Can it help the stock amid growth woes?

Opinion: Intel has big plans for AI-capable PCs, but that may take time to catch on

Suddenly, Everyone Hates Intel Stock (NASDAQ:INTC) Again, but You Shouldn’t

It seems like everyone and their uncle hate Intel (NASDAQ:INTC) today. This is a sign of how fickle the market can be, but I encourage you to look at the big picture and make your own decisions. When the dust settles in a while, I expect the market to appreciate Intel again, and for the long term, I am bullish on INTC stock.

Intel is a chipmaker that, unlike some of the company’s competitors, actually manufactures its own microchips. Having a foundry business is risky, no doubt, but it’s what sets Intel apart.

Today’s INTC stock dumpage is a textbook example of how investor sentiment can turn on a dime. In just a year’s time, Intel has gone from doghouse to darling and back. Don’t be frustrated at the market’s wild mood swings, though, since irrational behavior leads to volatility, and volatility leads to opportunity.

The Good News That No One is Talking About

INTC stock is down 12% today, even though there are multiple positive news items to report. In effect, the market is so hyper-focused on Intel’s quarterly report and forward guidance that it’s completely overlooking some important developments concerning Intel.

First of all, Intel just celebrated the opening of the company’s factory in Rio Rancho, New Mexico. According to Keyvan Esfarjani, Intel executive vice president and chief global operations officer, this represents the “opening of Intel’s first high-volume semiconductor operations and the only U.S. factory producing the world’s most advanced packaging solutions at scale.”

Furthermore, Intel announced a collaboration with Taiwan-based United Microelectronics Corporation (NYSE:UMC) to develop a “12-nanometer semiconductor process platform to address high-growth markets such as mobile, communication infrastructure and networking.” It’s interesting that Intel is partnering with a Taiwanese foundry business like United Microelectronics Corporation.

With this Taiwan-based partnership, could Intel and UMC be poised to steal significant market share from Taiwan Semiconductor (NYSE:TSM)? It’s a question that ought to be considered, but hardly anyone’s thinking about it today.

The Market Can’t Tolerate Cautious Guidance

To be blunt, the market is so spoiled that it won’t tolerate anything but a full-on beat-and-raise anymore. Sometimes, there’s a beat-and-raise, but the earnings beat and/or the guidance raise isn’t high enough to impress investors. It’s a strange phenomenon – but again, irrationality leads to opportunity.

With its results for the fourth quarter of Fiscal Year 2023, Intel definitely achieved the “beat” part of the beat-and-raise formula. Intel CEO Pat Gelsinger had every right to boast, saying, “We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance.”

Here’s the rundown. Intel’s quarterly revenue grew by 10% year-over-year to $15.4 billion, beating analysts’ consensus expectations by $230 million. Moreover, Wall Street called for Intel to post Fiscal Q4-2023 earnings of $0.45 per share, but the company actually earned $0.54 per share.

After INTC doubled from $24 and change to $50, you might assume that Intel’s Street-beating quarterly results would send the share price higher. Yet, Intel didn’t deliver the “raise” part of the beat-and-raise combo that people expect nowadays.

Specifically, Intel provided a current-quarter revenue guidance range of $12.2 billion to $13.2 billion, while analysts’ consensus forecast called for $14.2 billion in revenue. In addition, whereas Wall Street forecast adjusted Fiscal Q1-2024 earnings of $0.32 per share, Intel’s management only guided for $0.13 per share.

In light of this, a number of analysts have turned cautious on INTC stock. Two examples are Bernstein’s Stacy Rasgon and Stifel Nicolaus’s Ruben Roy, who recently published Hold/Neutral ratings on Intel shares. Furthermore, Rasgon’s $42 price target and Roy’s $45 price target aren’t particularly optimistic.

Think about it – Intel stock would have to go practically nowhere for the next 12 months in order to land at those price targets. Yet, the company’s results demonstrate that Intel is capable of surpassing Wall Street’s financial estimates. Now that the current-quarter expectations are quite low, don’t be too surprised if there’s another earnings beat coming — though I can’t guarantee a beat-and-raise, which everybody seems to demand now.

Is Intel Stock a Buy, According to Analysts?

On TipRanks, INTC comes in as a Hold based on seven Buys, 24 Holds, and four Sell ratings assigned by analysts in the past three months. The average Intel stock price target is $46.38, implying 6.5% upside potential.

Conclusion: Should You Consider Intel Stock?

Intel set the bar low for the current quarter. Investors reacted badly to this, but that’s how opportunities arise. All of this could just be a setup for another earnings beat and more optimistic guidance in a few months.

It’s difficult to envision a good outcome when the market’s sentiment is so negative about Intel. Bear in mind, though, that investors favored Intel just a few days ago. They’ll come to appreciate Intel again, I predict, so I feel that it’s smart to consider INTC stock while it’s trading at a reduced price.

Intel CEO on stock price sell-off after earnings: It’s an overreaction

Intel CEO Pat Gelsinger’s message to investors dumping the stock after a tepid first quarter outlook: Stay the course — the turnaround that gained steam in 2023 hasn’t stalled.

“It’s an overreaction,” Gelsinger said on Yahoo Finance Live of the sharp market reaction on Friday to Intel’s disappointing first quarter guidance the night before.

Shares of the chip giant plunged 11% — with the stock a top trending ticker on Yahoo Finance — as Intel said it would see near-term sales and profit challenges in areas such as its data center and Mobileye businesses.

Gelsinger believes those issues will abate in the second quarter as Intel unleashes a host of new chips to support AI workloads and hardware.

Wall Street isn’t so sure.

“The main reason they guided so poorly was their ‘growth businesses’ are not growing, and in fact, they’re contracting,” Citi analyst Christopher Danely told Yahoo Finance Live.

Gelsinger said that Intel expects to see 40 million shipments of AI PCs in 2024, and all of the company’s planned chip launches for the year remain on track.

Intel recently showcased a range of AI-focused products and services. On display was Gaudi3, an artificial intelligence chip for generative AI software that will become available later this year.

The company has also unveiled its Core Ultra processor, which will target the aforementioned emerging AI PC market.

Gelsinger added he has a line of sight into $10 billion in orders for Intel’s new foundry business. The business is set up to be a consistent money-maker for Intel beginning in 2025, contends Gelsinger.

Despite the green shoots in the quarter, Wall Street is largely sticking with the view Intel is a show-me investment story.

“Overall, we are seeing continued solid execution by the team, compute fundamentals continue gradually improving, and although we continue to be impressed by the current execution, the next 12 months will be the most difficult for the team as they will be launching two datacenter products and two major client products over three new manufacturing technology nodes,” said JPMorgan analyst Harlan Sur in a client note reviewed by Yahoo Finance.

Sur reiterated an Underweight rating on Intel’s stock with a $37 price target, about 16% lower than current levels.

The earnings rundown

-

Net Sales: +10% year over year to $15.4 billion vs. estimate of $15.11 billion

-

Client Computing Sales: $8.84 billion vs. estimate of $8.42 billion

-

Data Center & AI Sales: $4 billion vs. $4.08 billion

-

Network & Edge Sales: $1.47 billion vs. $1.55 billion

-

Mobileye Sales: $637 million vs. $627.2 million

-

Intel Foundry Sales: $291 million vs. $342.5 million

-

-

Adjusted Gross Margin: 48.8% vs. 46.5% estimate

-

Adjusted EPS: $0.54 ($0.15 a year ago) vs. estimate of $0.44

What else caught our attention: Weak first quarter guidance

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on Twitter/X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market.

Read the latest financial and business news from Yahoo Finance

Intel Unveils New AI Chips to Rival Nvidia’s Dominance in AI Industry, INTC Stock Up 1%

Dubbed Gaudi3, Intel intends to attract generative AI companies like OpenAI away from Nvidia and bolster its stock market performance.

Intel Corp (NASDAQ: INTC) stock closed Thursday trading at $45.18, up 1.37 percent from the day’s opening price. Although Intel has been on a winning streak since the calendar flipped in January, the company is not satisfied with the performance as its rival Nvidia Corp (NASDAQ: NVDA) has more than tripled its valuation year-to-date. As a result, Intel has unveiled new products to compete with Nvidia and other peers in the generative Artificial Intelligence (AI).

During the Intel AI Everywhere launch event in New York on Thursday, the company’s Chief Executive Executive Officer (CEO) Patrick Gelsinger announced several AI-focused chips that will hit the market next year. Among the chips unveiled was the Gaudi3, which will compete directly with Nvidia’s H100.

Worth noting that Intel has been developing and improving the Gaudi chips since 2019 after it successfully acquired Habana Labs. As a result, the company is confident more AI software projects will tap into the Gaudi3 to enhance faster and more secure products.

“We’ve been seeing the excitement with generative AI, the star of the show for 2023,” Gelsinger noted during the event.

Intel Unveils New PC and Laptop Chips Focused on AI

In addition to the Gaudi3, Intel also unveiled several other products to be used in PC and laptop development in a bid to support seamless AI software programs. Notably, Intel announced the Core Ultra chipset that is designed for laptops and PCs. The tech company also announced the new fifth-generation Xeon server chipset. Worth noting that both the Core Ultra and fifth-generation Xenon chipsets encompass a specialized AI unit dubbed NPU, which is meant to help generative AI programs run faster and smoothly.

“We think the AI PC will be the star of the show for the upcoming year,” Gelsinger added.

Worth noting that Intel’s Core Ultra chipset introduces robust gaming capabilities to enable mass adoption of web3 metaverse gaming protocols among other immersive games. Although Intel did not reveal the pricing of the new chipset products, the company highlighted that the fifth-generation Xeon processor will play a crucial role in large organizations that use cloud computing. Additionally, Intel noted that the fifth-generation Xeon processor can be deployed in AI model training as it is less power-hungry.

Market Outlook

With the new Intel’s AI-focused processors expected to hit the market by 2024, experts project exponential growth in subsequent quarters. Meanwhile, the $187 billion valued tech company has received an average rating of Hold from 42 ratings. During the third quarter earnings report, Intel reported a revenue of $14.2 billion, down 8 percent YoY. During the fourth quarter, the company expects to report a revenue range of between $14.6 billion and $15.6 billion. Moreover, the ongoing organizational change to focus on AI developments will significantly improve the final output and revenue generation.

next

Artificial Intelligence, Business News, Market News, News, Stocks

You have successfully joined our subscriber list.

Opinion: How Microsoft’s new chip for AI could disrupt Nvidia, AMD and Intel

Microsoft earlier this week took the wraps off one of the more important reveals in the chip market in a long time. Microsoft MSFT now has both a custom-designed AI processing chip and a custom Arm-based CPU to add its growing stable of products to help it vertically integrate its services and solutions.

The star of the show is the new Azure Maia 100 AI accelerator chip. This chip is built for both training and inference (creating the models and then utilizing them for work) and has been collaborated on with OpenAI, the AI…

Intel cheers foundry wins, AI traction, and its stock is roaring after earnings

Intel Corp. shares were popping nearly 8% in Thursday’s extended session after the chip maker delivered a rosy forecast, while talking up new customers for its foundry business and traction related to artificial intelligence.

For the fourth quarter, Intel

INTC,

anticipates $14.6 billion to $15.6 billion in revenue, whereas analysts were looking for $14.4 billion. The company is also modeling 44 cents in adjusted earnings per share, while the FactSet consensus was for 33 cents.

“While the industry has seen some wallet share shifts between CPU and accelerators over the last several quarters, as well as some inventory burn in the server market, we see signs of normalization as we enter Q4,” Chief Executive Pat Gelsinger said on the earnings call.

Gelsinger expressed confidence about Intel’s positioning — and the future of central processing units — as AI becomes more dominant in the technology world.

“Training of these large models is interesting, but the deployment of those models, the inferencing use of those models is what we believe is truly spectacular for the future,” he said. “And…some of that will run on the accelerators, but a huge amount of that is going to run, right, on Xeons.”

He also shared that Intel now has three customers for its 18A foundry process technology that have made commitments. The company previously disclosed one customer made prepayments, but Gelsinger added Thursday that Intel has two other customers.

“The other thing that we saw this quarter, which was a little bit unexpected, was this huge surge in interest for AI customers and Intel’s advanced packaging technology,” he said.

Intel is in the midst of a big push to build a foundry business through which it would manufacture chips for other companies, though not all on Wall Street are sold yet on the move.

The company also delivered an upbeat third-quarter report, easily clearing Wall Street’s bar on profit and topping expectations on revenue as well.

The company reported net income of $297 million, or 7 cents a share, compared with $1.0 billion, or 25 cents a share, in the year-earlier period. On an adjusted basis, Intel earned 41 cents a share, down from 59 cents a share a year prior, while analysts were looking for 22 cents a share.

Revenue dropped to $14.2 billion from $15.3 billion, while the FactSet consensus called for $13.6 billion.

The company saw revenue from its personal-computer segment, known as client-computing, drop 3% to $7.9 billion, whereas analysts were looking for $7.3 billion. Data-center and AI revenue fell 10% to $3.8 billion, narrowly missing the FactSet consensus, which was $3.9 billion.

Intel recorded a 45.8% adjusted gross margin, compared with 39.8% in the second quarter. The company’s forecast had been for about 43%.

Intel shares have climbed 24% so far this year, as the Dow Jones Industrial Average

DJIA

has lost about 1%.