The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

The over-the-counter (OTC) institutional cryptocurrency market saw a dramatic increase in spot transaction volume in the first half of 2024. A recent report by Finery Markets reveals a 95% year-over-year growth, highlighting a significant rise in institutional engagement. Institutional Interest Drives Massive Growth in Crypto’s Over-the-Counter Industry The Finery Markets team analyzed data from two […]

Source link

interest

A New York Community Bank stands in Brooklyn on February 08, 2024 in New York City.

Spencer Platt | Getty Images

New York Community Bank, the regional lender that needed a $1 billion-plus lifeline last month, is offering the country’s highest interest rate for a savings account.

NYCB raised the annual percentage yield offered via its online arm, My Banking Direct, to 5.55%, higher than any other bank’s widely available account, according to Ken Tumin, an analyst who tracks rates for his website DepositAccounts.

The standout rate could be a sign that NYCB is facing funding pressure, Tumin said.

“It looks like they’re trying really hard to attract deposits,” Tumin said. “My Banking Direct has been around for a long time, more than 10 years, so them having an aggressive rate could be a sign of neediness” for funding.

NYCB’s woes began in January, when it said it was preparing for far greater losses on commercial real estate loans than analysts had expected. That set off a downward spiral in its stock price, downgrades from rating agencies and multiple management changes. The bank announced a capital injection from investors led by former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital on March 6.

In the month before the rescue was announced, NYCB shed 7% of its deposits, falling to $77.2 billion by March 5, the bank said in a presentation.

Nothing ‘crazy’

During a conference call held after the capital raise, analysts asked how NYCB managed to retain so much of its deposits during the tumultuous period.

“We didn’t do anything crazy relative to deposit pricing,” NYCB chairman Sandro DiNello replied. “We didn’t go out and offer 6% CDs or something like that in order to make the numbers look good, if that’s what you’re concerned with.”

NYCB didn’t return a call for comment on its funding strategy.

Joseph Otting, a former comptroller of the currency, took over as the bank’s CEO on April 1, about a week before the rate increase.

Despite the turnaround plan, shares of NYCB still trade for under $4 apiece and are off more than 68% year to date.

Forced to pay up

Other banks offering rates higher than 5% right now tend to be newer or smaller players than NYCB, according to Tumin.

Among established banks, the average high-yield savings rate is about 4.4%, and several of them (including American Express, Goldman Sachs and Ally) have dropped rates in the past month, he said. The NYCB rate also tops accounts listed on NerdWallet and Bankrate.

Customer deposits at My Banking Direct are insured by the FDIC up to the standard $250,000.

Over the past two years, savings account rates have broadly been on the rise.

Since the regional banking crisis consumed Silicon Valley Bank and First Republic last year, smaller players have been forced to pay higher rates for deposits compared to giants like JPMorgan Chase in order to compete, said Matt Stucky, chief portfolio manager for equities at Northwestern Mutual.

“When a bank has to go out and advertise a much higher rate, it’s typically because they have a deposit problem,” Stucky said. “It’s not hard for customers to switch banks anymore.”

Bitcoin Futures Open Interest Hits Record $37.55 Billion With CME Leading the Pack

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

On Friday, March 29, 2024, the combined open interest in bitcoin futures reached a new all-time peak of $37.55 billion. This uptick occurs amid buoyant bitcoin markets and a growing attraction from institutional investors. Bitcoin Futures Open Interest Reaches Unprecedented $37.55 Billion Since the close of 2023, interest in bitcoin (BTC) derivatives has escalated, reaching […]

Source link

Ethereum has, for the most part, established a foothold above the $3,500 price level throughout the week as investors continue to anticipate a return to the $4,000 mark. Interestingly, the optimism has seen the open interest of Ethereum surging to new highs. The surge in open interest, although a bullish sentiment indicator, can also serve as a bearish signal of an impending change in market trend.

Ultimately, this metric added to the current dynamics of the Ethereum ecosystem, including regulatory uncertainty and scalability concerns hinting at a complicated price trajectory for the price of Ethereum.

Ethereum Open Interest Reaches New High

Open interest is an efficient method for tracking the total number of open positions in a particular contract. Recent market dynamics and institutional investor interest have seen the total open interest in Ethereum futures surging above records set in the 2021 bull market phase.

According to data from Coinglass, the open interest on Ethereum futures, which has been on a surge since February 5, recently set a new high of $14.11 billion on March 15. This wasn’t particularly surprising, as a strong buying momentum from the bulls in the prior days saw the price of Ethereum surging past the $4,000 mark for the first time in two years.

However, Ethereum has since reversed from the $4,000 price level and is currently trading below $3,600. On the other hand, the total open interest on Ethereum contracts has maintained around its all-time high level, which allowed it to cross over $14.10 billion again on March 28. The open interest weighted average also went up to 0.0462%, indicating an increase in the demand for leveraged ETH long positions.

The majority ($4.55 billion) in the Ethereum futures market were registered on cryptocurrency exchange Binance. Bybit and OKX came in second and third, with $2.39 billion and $1.94 billion respectively. Interestingly, CME’s Ether futures also surged to $1.3 billion. At the time of writing, the CME’s Ether futures now sit at $1.31 billion, reiterating the committed bullishness among institutional investors.

What’s Next For ETH?

Ethereum has been trading flat since the beginning of the week and is currently on a 0.78% gain in the past seven days. All eyes are now on reports of the SEC looking into Ethereum’s security status, the industry awaits an official ruling similar to the one that was handed down in the XRP case that will finally provide clarity to the regulatory landscape.

At the same time, investors continue to await the SEC’s decision regarding the applications of Spot Ethereum exchange-traded fund (ETF) in the US. According to a Bloomberg senior analyst, the likelihood of approval is only 25%.

ETH price drops to $3,500 | Source: SHIBUSD on Tradingview.com

Featured image from Money, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

New Research Paper Sheds Light on Alleged Conflicts of Interest in FTX’s Chapter 11 Filing

A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

A recent research paper on SSRN by legal scholars scrutinizes the ethical quandaries and potential conflicts of interest surrounding Sullivan & Cromwell LLP’s involvement in FTX’s Chapter 11 bankruptcy filing. Study Highlights Legal Ethics From FTX Bankruptcy Proceedings The SSRN research paper entitled “Conflicting Public and Private Interests in Chapter 11” meticulously explores the controversial […]

Source link

The Dogecoin open interest rose to a new all-time high earlier in March, and while there has been a small retracement, the open interest has continued to maintain very high record levels since then. Given this continuous high level, it could point to where the price of the meme coin is headed next using historical data.

Dogecoin Open Interest Maintains High Level

Open interest is a measure of the total number of futures or options contracts of a particular coin in the market at a give time. It can help to tell how much money is flowing into that particular asset, thereby revealing if there a high or love interest in the asset.

On Dogecoin’s part, its total open interest has been rising over the last few months, especially as the crypto market recovered, as shown by data from Coinglass. A natural consequence of this was that the price was also climbing at the same time as the open interest and thus, there is a high correlation between open interest and price.

The DOGE open interest hit a new all-time high of $1.47 billion on March 5, and the meme coin has not looked back since. Despite a small decline in the following days, the open interest is rising once again, reaching $.144 billion on March 14 and taking the price with it.

While the rise in open interest does point to a lot of bullishness in the market, historical performance during times like these also calls for caution. Taking a look at what happened the previous times that the Dogecoin open interest hit new all-time highs could give an idea of where the price is headed next.

Where Can DOGE Go From Here?

Over the years, there have been various points at which the Dogecoin open interest has reached new all-time highs and a trend has emerged, in a manner of speaking. Looking as far back as 2021 when the open interest hit ATHs multiple time, this trend plays out similarly.

A sustained rise until a new all-time high is reached, with the price rising along, and then followed by a crash in open interest, as well as price. This was the case in September 2021 when the open interest reached a new all-time high and then again in November 2021 when it clocked another ATH.

Moving forward, the same trend is seen in October 2021 when the DOGE open rose close to its previous all-time high, but ended the same way as the previous ones – with a crash. These crashes almost always affect the DOGE price as well, causing it to drop to the levels before the surge in open interest.

If this pattern holds this time around, then a crash might be ahead for the Dogecoin open interest and the DOGE price by extension. A likely scenario is a 20% drop that could send the DOGE price back toward $0.15 before the crypto market picks up steam once again.

DOGE bulls hold up price | Source: DOGEUSDT on Tradingview.com

Featured image from Decrypt, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin setting a new all-time high and breaking above $72,000 is a significant milestone for the market. Riding the wave of increased institutional interest in spot Bitcoin ETFs, it smashed through the $68,000 ceiling established in November 2021 after a brief correction to $59,000 and seems to be gearing up for more gains this week.

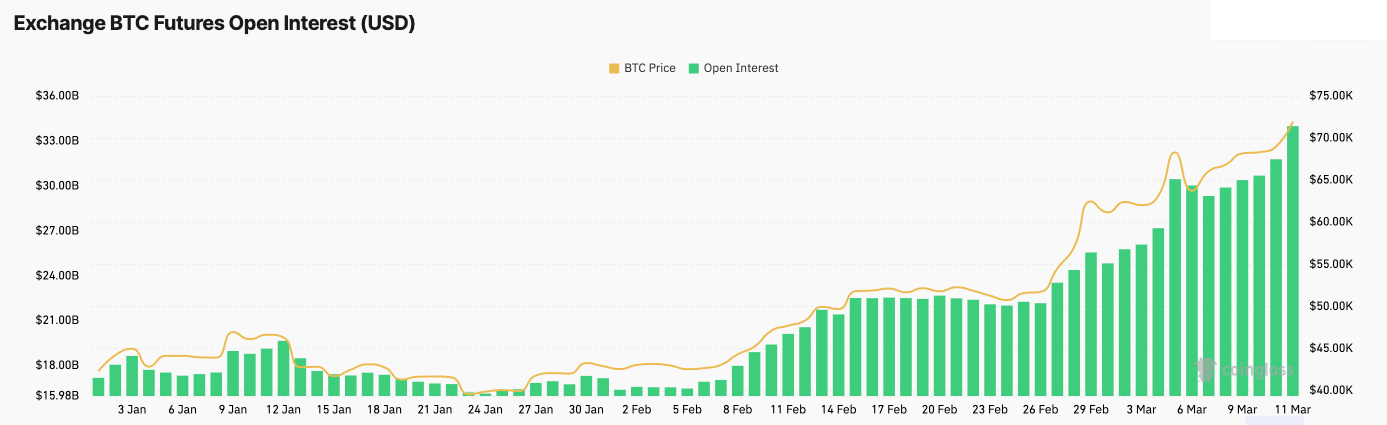

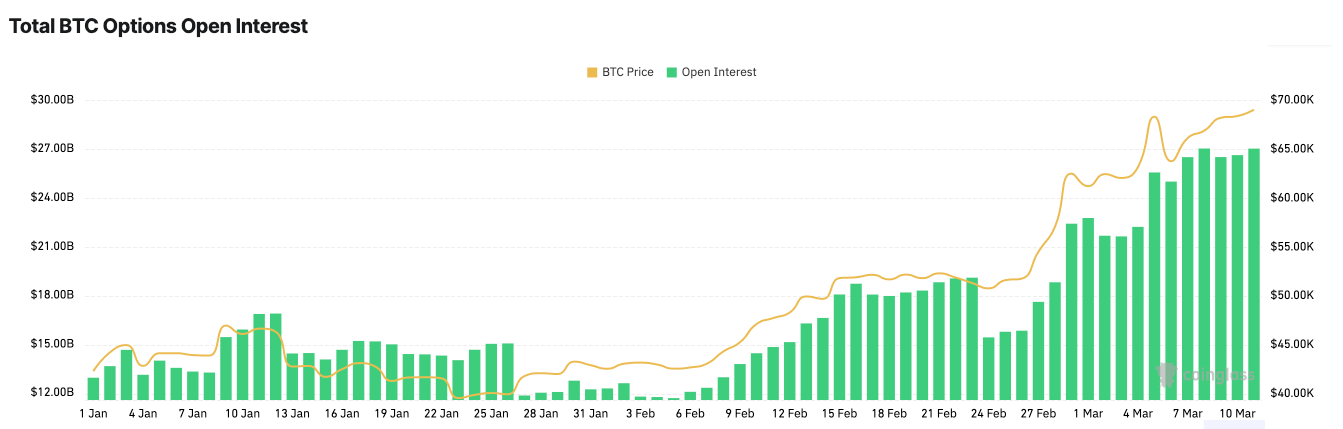

This week, the potential for more volatility is seen in the derivatives market, which peaked as Bitcoin touched $71,400. Since the beginning of the year, Bitcoin futures and options markets have seen unprecedented growth, with open interest reaching new highs on Mar. 11. Analyzing open interest is crucial for understanding market health and trader expectations. While spikes in open interest always follow price volatility, the intensity of the spikes can be a telling sign of just how leveraged the market is.

Futures open interest reached its all-time high of $33.48 billion in the early hours of Mar. 11 — almost double the $17.20 billion it posted on Jan. 1.

Options open interest reached their all-time high on Mar. 8 with $27.02 billion. A foothold seems to have been established at above $27 billion, with open interest remaining stable at $27.01 by Mar. 11. This is a significant increase from the $12.93 billion in open interest at the beginning of the year.

The growth in open interest shows a rapidly increasing appetite for derivatives. Futures and options provide traders with sophisticated strategies that allow them to hedge their positions and speculate on price movements.

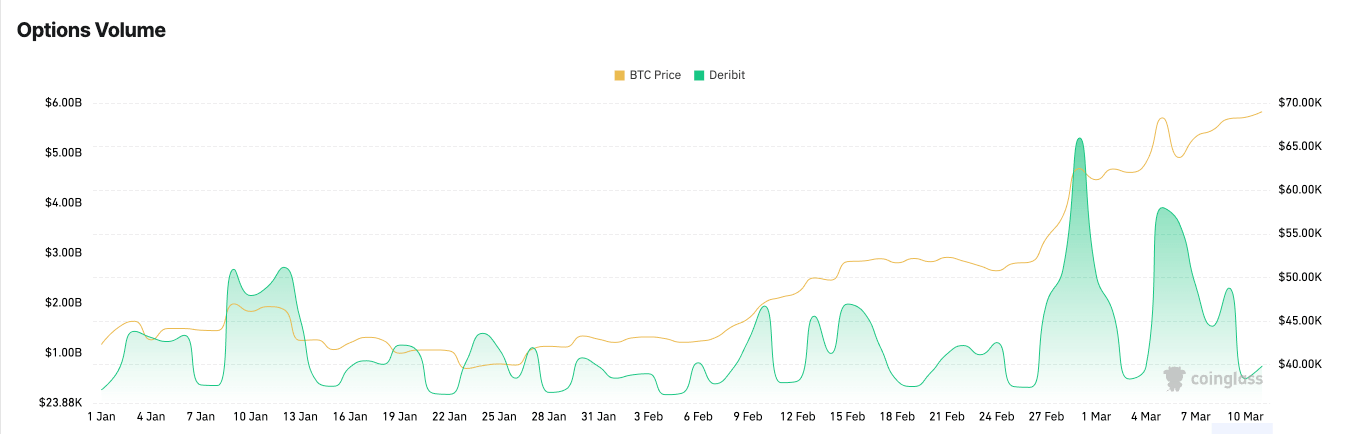

The dominance of call options, with open interest and volume percentages consistently favoring calls over puts (61.66% vs. 38.34% for open interest and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that most of the market is speculating on further price increases.

Significant spikes in options volume on Deribit around key dates show the derivative market’s reactive nature to Bitcoin’s price movements. Data from CoinGlass showed notable spikes in volume on Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of intense price volatility.

Bitcoin breaking through important resistance levels played a pivotal role in this spike. Each resistance point crossed market new heights of market optimism and triggered increased trading activity as the market adjusted its positions to capitalize on the bullish momentum or protect against a potential downturn.

The rapid rise in interest in derivatives has led to the convergence of open interest in futures and options. While futures and options OI are yet to reach parity, the difference between the two is currently unprecedently low. Historically, futures open interest has been significantly higher than that of options, as futures provide a direct mechanism for hedging and speculation without the complexity of options strategies.

However, Bitcoin’s performance this year seems to have attracted many advanced traders looking for more versatile trading strategies than futures. Options are considered more sophisticated trading instruments, allowing traders to hedge their positions, speculate on price movements with limited downside risk, and generate income through strategies such as covered calls and protective puts. As investors become more knowledgeable and confident in using options, the demand for these instruments increases, leading to a rise in open interest.

Moreover, the current market conditions—high volatility and record prices—make options particularly appealing. Options can provide leverage similar to futures but with the added advantage of predetermined buyer risk. In a rapidly appreciating market, options allow investors to speculate on continued growth or protect against a potential downturn without committing as much capital as required for a futures position.

The balancing of open interest in futures and options also suggests that the market is at a crossroads, with investors divided in their outlook. While some may view the current price levels as sustainable and indicative of further growth, others might see it as overextended, warranting caution and using options for risk management.

The implications for future price movements are twofold. On the one hand, the robust derivatives activity indicates a healthy market with deep liquidity and sophisticated participants, potentially supporting further price increases. On the other hand, the high degree of leverage drastically increases the risks of market corrections — with tens of billions worth of derivatives on the line, even smaller drawdowns have the potential to turn into massive volatility.

The post Open interest reaches all-time high as Bitcoin touches $72k appeared first on CryptoSlate.