The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

The latest bitcoin derivatives data indicates a continued climb in bitcoin futures open interest, hitting all-time peaks. Over the last day, statistics reveal an open interest of $32.30 billion across fourteen distinct bitcoin futures markets. Soaring Open Interest in BTC Futures Signals Growing Derivatives Market Friday, March 8, 2024, marked a notable day when BTC […]

Source link

interest

Egypt Devalues Currency, Raises Interest Rates to Fulfill Key IMF Aid Requirement

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

Source link

Jerome Powell says ‘the housing market is in a very challenging situation right now’ and interest rate cuts alone won’t solve a long-running inventory crisis

The housing market has a problem—millions of them. The country is short between 3.5 and 5.5 million housing units, according to various estimates. The roots of the shortage go back to the aftermath of the Global Financial Crisis, when cautious developers were hesitant to invest in new construction and set a precedent of undersupply that’s continued to now. Jerome Powell.

On Thursday, the Federal Reserve chair testified to the Senate Banking Committee against the backdrop of his recent decision not to cut interest rates, the big question investors and homebuyers are asking. Potential rate cuts have given investors hope about some much-needed relief for the housing market, which has struggled to cope with soaring mortgage and refinancing rates, but Powell testified that the housing market’s real problems run much deeper—and it will take more than just monetary policy to fix them.

“The housing market is in a very challenging situation right now,” Powell said on Capitol Hill on Thursday. “Problems associated with low rate mortgage [lock-in] and high [mortgage] rates and all that, those will abate as the economy normalizes and as rates normalize,” he said, referring to the mismatch between something approaching 90% of homeowners with mortgage rates below 6% and the current market offering above 7%. “But we’ll still be left with a housing market nationally, where there is a housing shortage.”

‘There are a ton of things happening’

Powell explained the current problems facing homebuyers and sellers to the committee: “You have a shortage of homes available for sale because many people are living in homes with a very low mortgage rate and can’t afford to refinance, so they’re not moving, which means the supply of regular existing homes that are for sale is historically low and a very low transaction rate,” Powell said. “That actually pushes up the prices of other existing homes, and also of new homes, because there’s just not enough supply.”

But it’s a bigger issue than buyers and sellers being locked in, he said. “There are a ton of things happening … because of higher rates, and those in the short-term are weighing on the housing market … it’s more difficult [for builders] to get people [labor] and materials,” Powell said. “But as [mortgage] rates come down, and that all goes through the economy, we’re still going to be back to a place where we don’t have enough housing.”

The pandemic only made things worse. High inflation has made materials and labor costs far pricier, and ballooning mortgage rates have pumped the brakes on an already-slow sector. National Association of Realtors data showed that there were only 3.2 months of available housing supply as of the end of last year, about half as much as there should be in a balanced market.

Markets expect the Fed to announce rate cuts this year—but while that will offer some short-term relief, it won’t solve the housing market’s deep–set supply problems.

Powell noted that restrictive zoning laws play an important role in limiting new construction. He also pointed out that rising mortgage rates have discouraged longtime homeowners who locked in lower rates from moving, which has limited the number of existing homes on the market and left new homebuyers struggling to find affordable options.

Powell’s threading a tricky needle—the housing market is a big driver of the domestic economy, and overstressing it by keeping interest rates high for too long could threaten the rest of the economy. On the other hand, cutting rates too soon—or too quickly—in line with the industry’s demands could undermine the Fed’s yearslong attempts to stick a soft landing and keep inflation under control.

“Housing activity accounts for nearly 16% of GDP according to NAHB estimates,” wrote a group of housing industry trade organizations in a letter to Powell last fall. “We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

This story was originally featured on Fortune.com

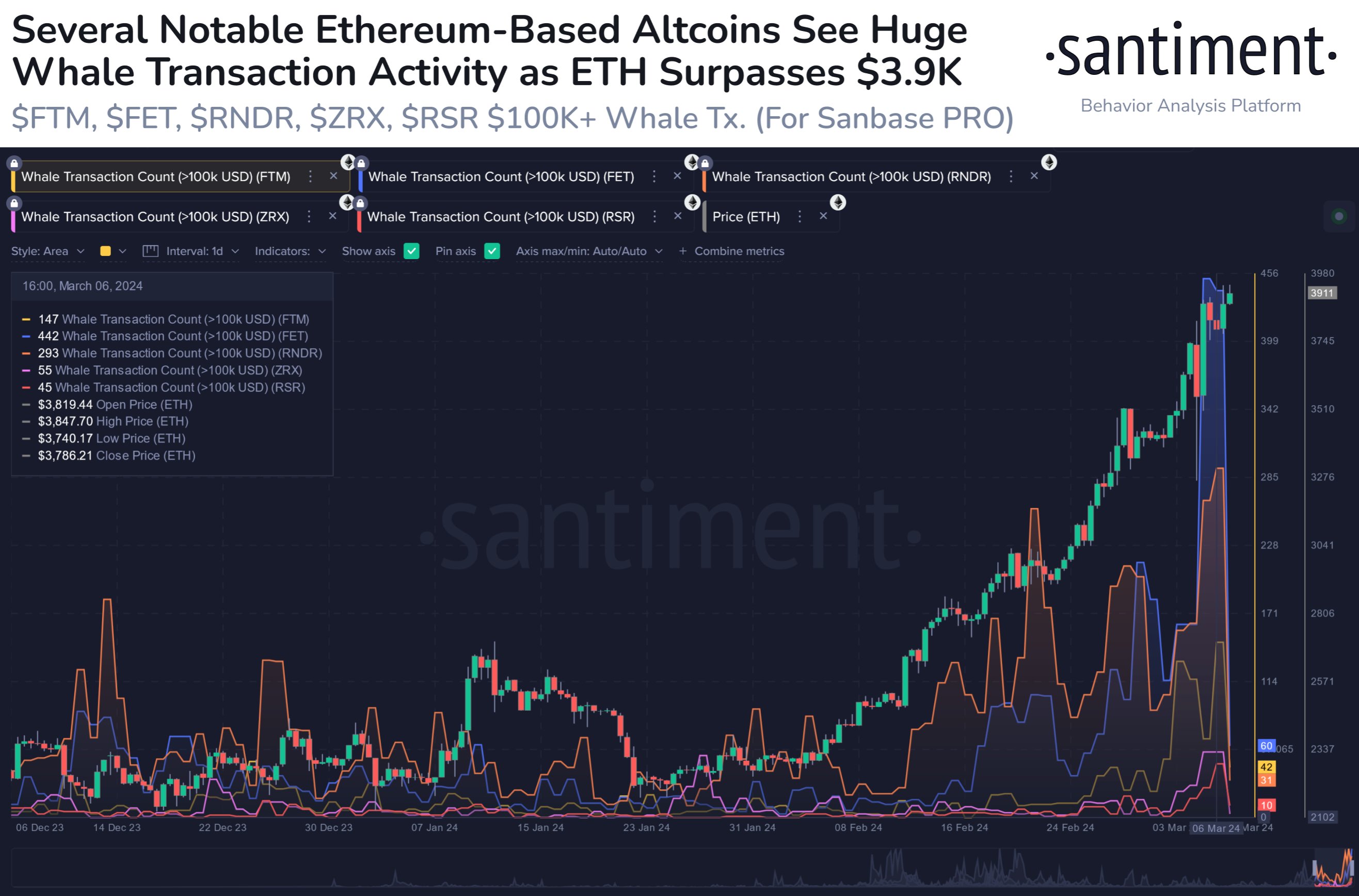

Here are the Ethereum-based altcoins that are currently witnessing a high amount of activity from the whales, according to on-chain data.

These Ethereum Altcoins Are Seeing High Whale Transactions Right Now

In a new post on X, the on-chain analytics firm Santiment has discussed how several Ethereum-based altcoins have been seeing notable whale activity recently.

The indicator of relevance here is the “whale transaction count,” which keeps track of the total number of transfers taking place on the network for a given cryptocurrency that is valued at $100,000 or more.

Generally, only the whales are capable of moving such large amounts in single transactions, so transfers carrying this much value are assumed to involve these humongous entities.

When the value of this metric is high, it means that the whales are making a large amount of moves on the network right now. Such a trend implies these large investors have a high interest in the asset currently.

On the other hand, low values suggest the cryptocurrency may have a lack of whale interest behind it, as there are barely any large transactions occurring on the chain.

Now, here is a chart that shows the trend in the whale transaction count for a few different Ethereum-based altcoins over the past few months:

The value of the metric seems to have been high for all of these assets recently | Source: Santiment on X

As displayed in the above graph, the whale transaction count has recently seen a sharp surge for these five altcoins: Fantom (FTM), Fetch.ai (FET), Render (RNDR), 0x Protocol (ZRX), and Reserve Rights (RSR).

“Ethereum’s market value is up to $3,920 and the #2 cap ranked market price ratio vs. Bitcoin is +9.5% in the past 3 days,” Santiment notes. “When these kinds of price dominance flips occur, we often see profits quickly redistribute, and whales becoming very active in ERC20-based altcoins.”

The alts in question here have all recently registered at least three-month highs in their whale activity. From the chart, it’s visible that Fetch.ai has observed the largest spike out of these assets.

Render leads in second place, while Fantom has followed after it in third. The prices of all three of these altcoins have registered rapid increases, with FTM coming out as the winner so far, with more than 67% in profits over the past week.

Thus, it would appear that the recent whale activity likely corresponded to buying pressure in these alts. It should be noted, however, that even if the whale transaction count remains high in the near future, it doesn’t necessarily have to lead to a bullish outcome.

The indicator merely counts the number of all whale-sized transactions and doesn’t contain any information about whether they are being made for buying or selling.

All that the whale transaction count can say about these altcoins is that, should whale activity remain high, their prices would be probable to witness volatile action, but its direction could go either way.

ETH Price

Ethereum has managed to outperform Bitcoin in the past week, as the second-largest coin has seen an increase of around 15% that has now taken its price beyond the $3,900 level.

Looks like the price of the coin has been going up in recent days | Source: ETHUSD on TradingView

Featured image from Yilei (Jerry) Bao on Unsplash.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Thianchai Sitthikongsak | Moment | Getty Images

Higher mortgage rates continue to hit demand from both current homeowners and potential homebuyers.

Total mortgage application volume dropped 5.6% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. An additional adjustment was made to account for the Presidents Day holiday.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.04% from 7.06%, with points increasing to 0.67 from 0.66 (including the origination fee) for loans with a 20% down payment. The rate was about a quarter percentage point higher than it was one year ago.

As a result, applications to refinance a home loan were 7% lower than the previous week and were 1% lower than the same week one year ago.

“Higher rates in recent weeks have stalled activity, and last week it dropped more for those seeking FHA and VA refinances,” said Mike Fratantoni, MBA’s chief economist, in a release.

FHA and VA loans are generally used by lower-income borrowers because they have lower down payment requirements.

Applications for a mortgage to purchase a home dropped 5% for the week and were 12% lower than the same week one year ago.

Fratantoni noted, however, that mortgage demand from buyers looking at newly built homes jumped 19% year over year in January.

“This disparity continues to highlight how the lack of existing inventory is the primary constraint to increases in purchase volume. However, mortgage rates above 7% sure don’t help,” he added. Rates were in the 6% range for all of January.

Mortgage rates moved higher again to start this week, according to a separate survey from Mortgage News Daily. The 30-year fixed is now matching the highest level since early December 2023.

“There were no interesting or obvious catalysts for the move, nor would we expect there to be when it comes to the level of volatility seen on almost any day of the past 2 weeks,” wrote Matthew Graham, chief operating officer at Mortgage News Daily.

Don’t miss these stories from CNBC PRO:

Bitcoin Futures’ Open Interest Reaches Lifetime High, Surpassing 2021 Bull Run

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Bitcoin’s value has been on an impressive rise over the past month, and by the start of the week, the leading digital currency surpassed the $57,000 range for the first time since Nov. 2021. This upward trend in value has stimulated bitcoin-based derivatives, causing open interest in bitcoin futures to hit an unprecedented level, exceeding […]

Source link

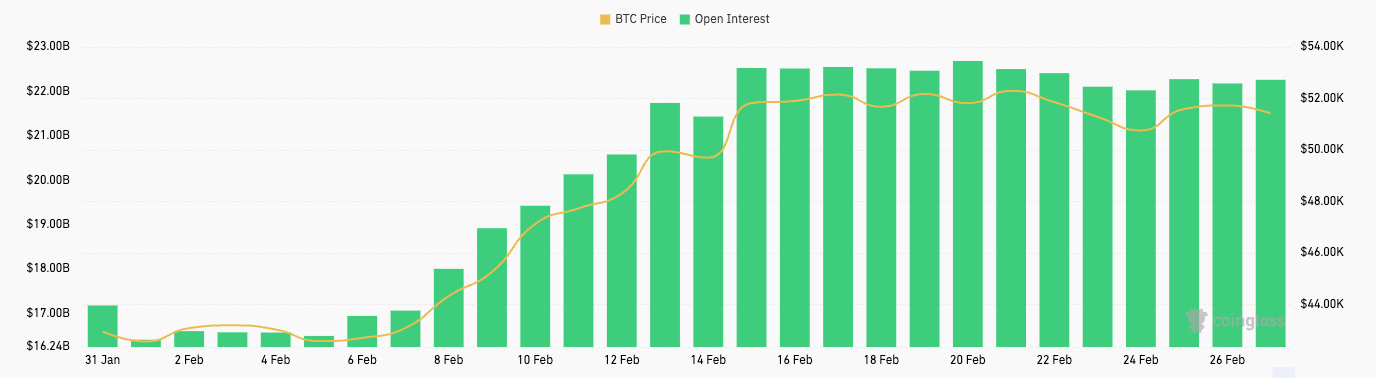

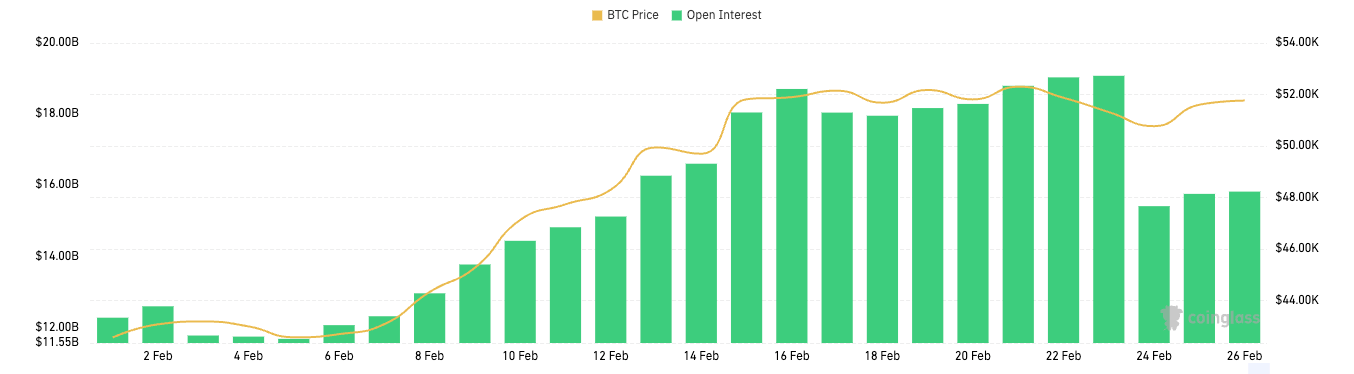

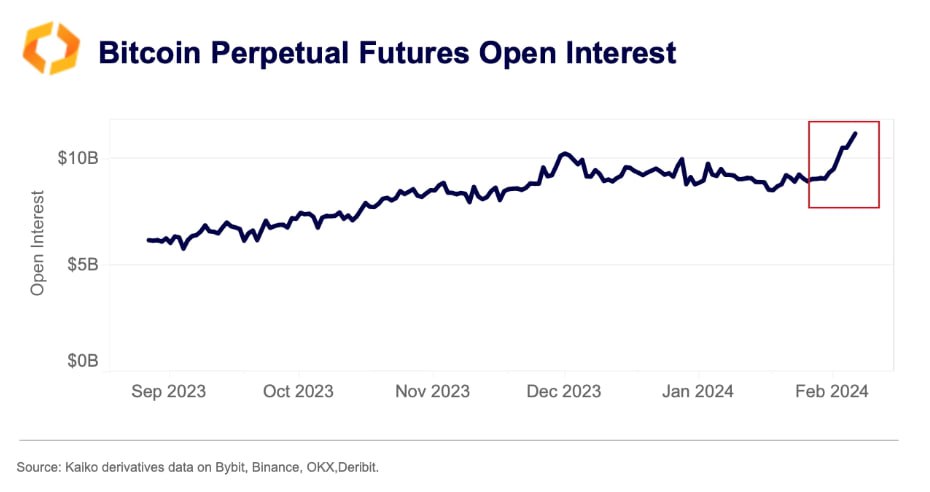

Open interest, the total number of outstanding derivative contracts that have not been settled, is an important metric for gauging market health and sentiment. An increase in open interest means new money entering the market, showing heightened trading activity and interest in Bitcoin. Conversely, a decline suggests closing positions, potentially indicating a change in market sentiment or a consolidation phase. Monitoring these trends is important for understanding the liquidity, volatility, and future price expectations in the market.

In a bullish market, an increase in open interest often correlates with rising prices, suggesting that new money is betting on further price appreciation. This scenario typically reflects a strong market sentiment and investor confidence in Bitcoin’s upward trajectory. On the other hand, in a bearish context, growing open interest might indicate that investors are hedging against expected price declines, revealing a more cautious or negative market outlook.

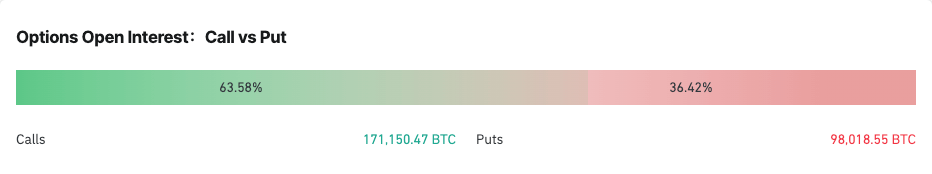

Furthermore, the balance between call and put options within the open interest provides deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many investors expecting price rises, whereas a majority of puts can indicate bearish expectations.

February saw a significant increase in open interest for Bitcoin futures and options.

From Feb. 1 to Feb. 20, Bitcoin futures open interest grew from $16.41 billion to $22.69 billion. This substantial rise suggests that traders were increasingly entering into futures contracts, anticipating higher volatility or making directional bets on Bitcoin’s price. Interestingly, this period aligns with a notable increase in Bitcoin’s price, from $42,560 to $52,303, suggesting a bullish sentiment among futures traders. The slight decrease in open interest by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s price to $51,716, could indicate some traders taking profits or closing positions in anticipation of a consolidation phase or to reduce exposure ahead of potential volatility.

Similarly, Bitcoin options open interest saw a dramatic increase from $12.27 billion at the beginning of February to a peak of $19.08 billion by Feb.23 before dialing back to $15.82 billion towards the month’s end. Options provide the holder the right, but not the obligation, to buy (call option) or sell (put option) Bitcoin at a specified price, offering more complex strategies for traders to express bullish or bearish views or to hedge existing positions. The initial spike in options open interest reflects a robust engagement from investors, leveraging options for directional bets on Bitcoin’s price and protective measures against potential downturns.

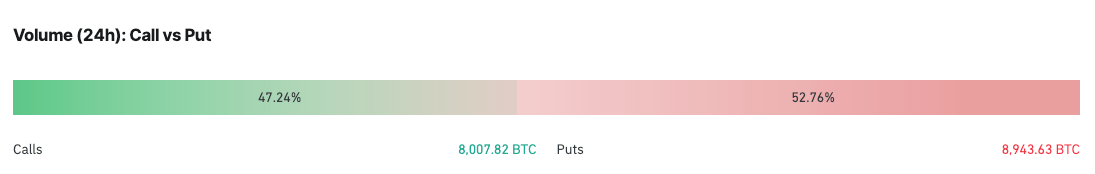

The ratio between calls and puts for Bitcoin options provides a deeper insight into market sentiment and potential expectations for Bitcoin’s price direction. The distribution between calls and puts is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising prices and puts on falling prices.

As of Feb. 26, the open interest in Bitcoin options was skewed towards calls, comprising 63.76% of the total, compared to 36.24% for puts. This distribution reinforces the bullish sentiment observed through the increase in options open interest earlier in the month. A predominance of calls in the open interest suggests that a significant portion of market participants were expecting Bitcoin’s price to continue rising or were utilizing calls to hedge against other positions.

However, the 24-hour volume tells a slightly different story, with calls accounting for 47.24% and puts for 52.76%. Compared to the overall open interest, this shift towards puts in the daily trading volume might indicate a short-term increase in caution among traders. It suggests that within the last 24 hours, there was a noticeable pick-up in defensive strategies or bearish bets.

The immediate implication for Bitcoin’s price is a potential increase in volatility. The bullish sentiment, as evidenced by the growing open interest and high proportion of calls, supports a continued positive outlook among many market participants. However, the recent uptick in puts volume may signal upcoming price fluctuations as traders adjust their positions in anticipation of or in response to new information or market trends.

Considering these, the market appears to be at a crossroads, with a strong bullish sentiment tempered by short-term caution. This scenario often precedes periods of heightened volatility as conflicting expectations play out through trading activities.

Chainlink Open Interest Sitting At Record Levels, What This Means For Price

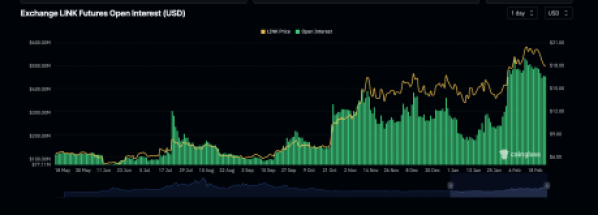

Chainlink has seen its open interest spike significantly in the month of February, so much so that it has reached new all-time highs. This trend has not waned despite the decline in the price of the cryptocurrency, which could paint a rather bullish picture for the LINK price going forward.

Chainlink Open Interest Crosses $450 Million

The Chainlink open interest ended the month of January on a high note and carried this trend into the month of February. A major jump was seen between January 31 and February 3 when the open interest went from below $250 million to more than $320 million.

In the days following this, the open interest continued to rise, and eventually hit a peak of $533 million. This was significant because it was not just the highest point for the year but it is the highest that the open interest has ever been for the asset.

Source: Coinglass

As expected, the price would quickly rise to keep up with the open interest as investors continued to place their bets on the price. There has been a retracement in the open interest. However, Chainlink has continued to maintain more than $450 million in open interest since February 12.

Currently, Coinglass data shows that the Chainlink open interest is $456 million as of February 23, continuing to maintain a high level. Given this, it might be prudent to look at how the LINK price has reacted in the past when open interest remained elevated.

Historical Performance Of The LINK Price

While the Chainlink open interest is at record levels, there have been times in the past where the open interest had been elevated for a period of time like it is now. So, how the price reacted during those periods could provide a pointer for how it might perform now.

The last time that the open interest was this elevated for a long period of time was back in October-November 2023 when open interest more than doubled. It would maintain this elevated level for almost a month, but at the end of it, the LINK price would react positively and saw a price surge from $11 to $15, which was a 36% increase in price.

If this scenario were to repeat now, then a 36% increase would send the LINK price to $24. This is not particularly hard to believe, given that the LINK price had topped out at $52 in the last bull market. So, such a move would still leave it 50% below its all-time high levels.

On the flip side of this, the open interest levels could also taper off, as was seen in November 2023. This could see the LINK open interest lose its hold on the $450 million that it maintained in February and fall toward $400 million before recovering again.

LINK price shows strength at $17.9 | Source: LINKUSD on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

SEC Inspector General investigating crypto conflicts of interest within federal agency

The US Security and Exchange Commission’s (SEC) Office of Inspector General (OIG) is investigating cryptocurrency-related financial conflicts of interest identified by the accountability group Empower Oversight.

In a Feb. 15 statement, Empower Oversight disclosed that the SEC’s division was in the “final stages of completing” an open investigation into matters relating to the failures of the SEC’s Ethics Office and a former official, William Hinman.

Hinman is accused of participating in matters where he held a financial stake, notably delivering a contentious speech asserting that specific digital assets, such as Ethereum, were not subject to SEC regulation as securities.

Critics within the Ripple XRP community contend that Hinman’s speech unfairly favored Ethereum, potentially giving it an edge over other digital assets in the market.

Empower Oversight emphasized its concerns by presenting documentation indicating that key figures from Ethereum, including co-founders Joseph Lubin and Vitalik Buterin, were involved in drafting the infamous speech.

In addition, the watchdog group also declared that Hinman “blatantly disregarded” instructions not to meet with specific individuals while working at the SEC, such as his former employer, Simpson Thacher, a member of the Ethereum Enterprise Alliance (EEA.)

“When Hinman departed the SEC in December 2020, he returned to Simpson Thacher as a partner. That same month the SEC sued Ripple, alleging XRP was an unregistered security,” Tristan Leavitt, president of Empower Oversight wrote.

This matter was officially brought to the attention of the OIG in May 2022.

Threatens Lawsuit

Empower Oversight has threatened the financial regulator with a lawsuit if it fails to provide information regarding its investigations by Feb. 23.

The group noted that the SEC has failed to provide information about the case since it filed a Freedom of Information Act (FOIA) in May 2023.

Leavitt said:

“The silver lining is that now we know one reason for the stonewalling is that there actually is an active inquiry by the inspector general, which is almost done. However, whether the OIG report thoroughly addresses all the issues we raised remains to be seen because we don’t know the exact scope of the inquiry. The SEC’s OIG needs to get this right and help prevent similar conflicts of interest from undermining public faith in the SEC’s work in the future.”

Bitcoin Open Interest Surges To A 2-Year High, BTC Breaks Above $51,000

Bitcoin’s open interest has surged past $11 billion for the first time in over two years. This uptick comes when the world’s most valuable coin surges, recently easing past $51,000, the highest level since December 2021.

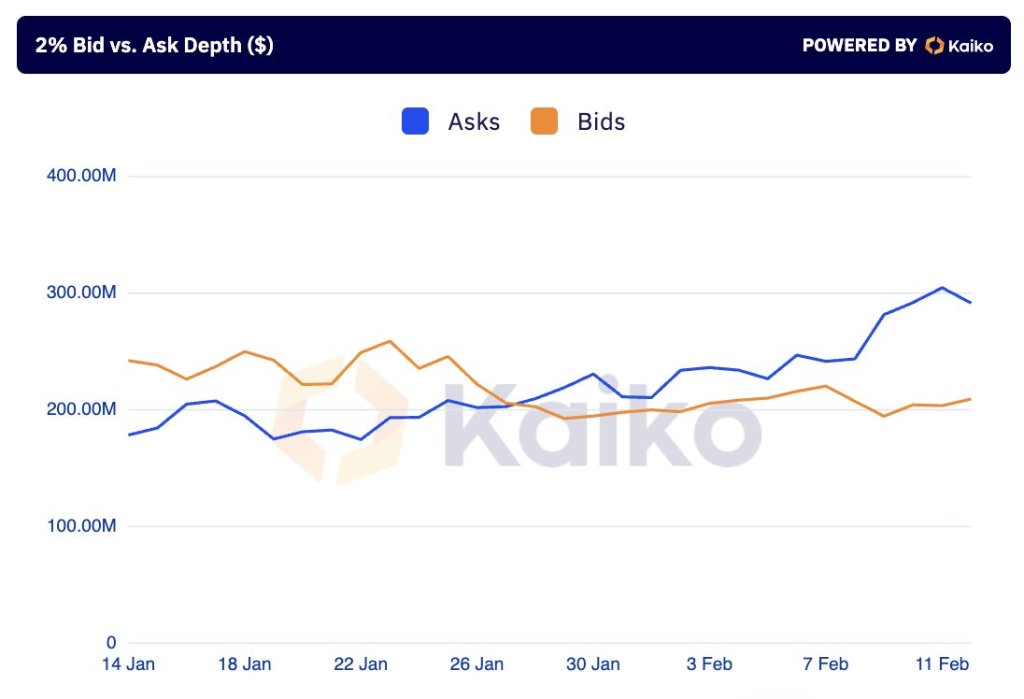

Surging Open Interest And Order Book Imbalance

According to Kaiko, a leading crypto analytics provider, this upswing in open interest comes at a critical time for the coin. When prices zoomed past $48,000 on February 11, there was an order book imbalance. Then, Kaiko observed there were $100 million more bids than asks.

Technically, whenever there is an order book imbalance with more bids than asks, it suggests that buyers are more willing and enthusiastic to purchase at spot rates than sellers are willing to liquidate. Following this imbalance, prices shot higher the following days, breaking above the $50,000 psychological number to over $51,500 when writing on February 14.

Surging open interest, especially as the market trends higher, is bullish. It means that more people are willing to participate in the market, hopeful of riding the trend. Subsequently, their participation translates to a more liquid market, charging the upside momentum.

Bitcoin is racing higher at the back of strong inflows into spot Bitcoin exchange-traded funds (ETFs). Over the past few weeks, spot Bitcoin ETF issuers have been rapidly accumulating the coin. The largest so far is BlackRock’s IBIT, owning over 70,000 BTC.

As a result, prices are edging higher, reflecting the high demand pinned directly to institutional participation. This positive sentiment and expectations of even more price gains, translating to higher open interest, is despite the continued liquidation of the Grayscale Bitcoin Trust (GBTC). Following court approval, GBTC is converted into an ETF, joining others like Fidelity, who also offer a similar product.

Genesis Looking To Sell GBTC; Will Bitcoin Rally In March?

Even with the high optimism, a potential cloud hangs over the Bitcoin market. Genesis, a crypto lender under bankruptcy protection, wants the court to allow them to sell over $1.4 billion of GBTC.

If the court green-lights this move, BTC could have more liquidation pressure, possibly unwinding recent gains. So far, the FTX estate sold their GBTC, estimated to be worth over $1 billion, coinciding with Bitcoin dropping to as low as $39,500 in January.

Besides these Bitcoin-specific events, the market is closely watching how the monetary policy scene in the United States will evolve in the next few weeks. The United States Federal Reserve is expected to slash rates in March, a potentially beneficial move for BTC.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.