Badgerdao, in partnership with Lido, has unveiled eBTC, an ether-backed synthetic bitcoin token aimed at enhancing the decentralization and capital efficiency of borrowing bitcoin in the decentralized finance (defi) space. Badgerdao and Lido Forge Partnership to Launch eBTC Badgerdao, a decentralized autonomous organization (DAO) committed to integrating bitcoin (BTC) into defi, has announced the launch […]

Badgerdao, in partnership with Lido, has unveiled eBTC, an ether-backed synthetic bitcoin token aimed at enhancing the decentralization and capital efficiency of borrowing bitcoin in the decentralized finance (defi) space. Badgerdao and Lido Forge Partnership to Launch eBTC Badgerdao, a decentralized autonomous organization (DAO) committed to integrating bitcoin (BTC) into defi, has announced the launch […]

Source link

Introduces

Zano Blockchain’s Hard Fork Facilitates Privacy Coin Creation, Introduces Confidential Assets

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

The Zano blockchain’s recently completed Zarcanum hard fork (HF4) will enable users and organizations to create custom tokenized assets that meet their specific needs. These custom tokenized assets or confidential assets, will be untraceable on the Zano blockchain. The team believes that without privacy and security, cryptocurrencies cannot achieve the much-hyped widespread adoption. Hosting Multiple […]

Source link

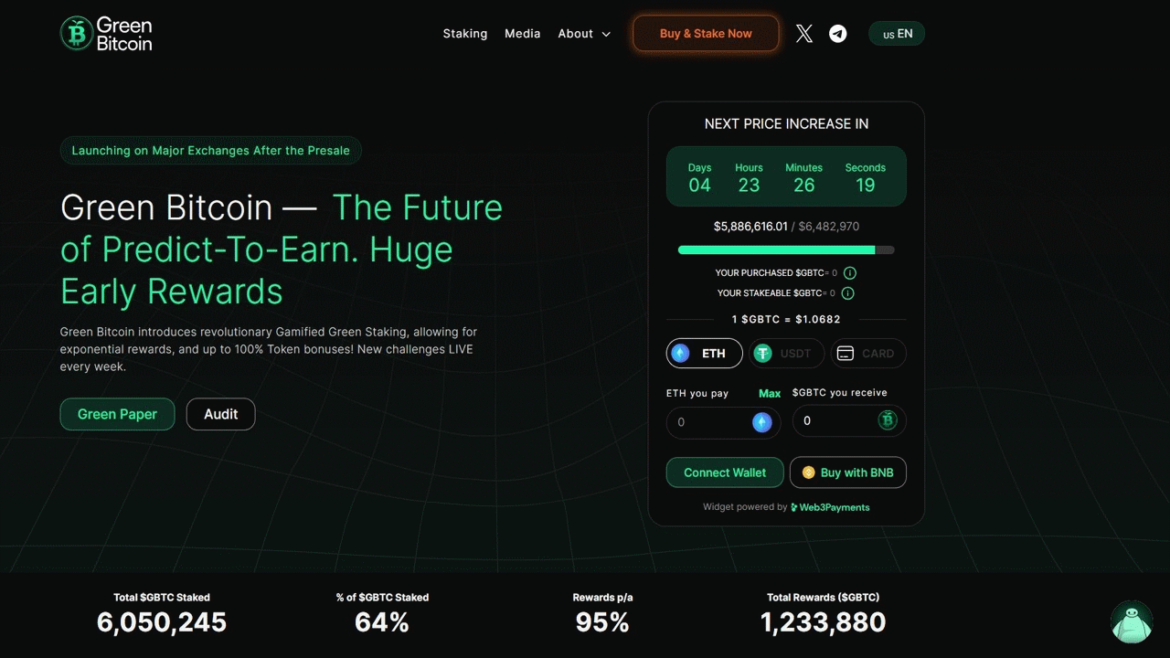

New ICO Green Bitcoin Introduces the Gamified Green Staking and Raises $6M in 2 Weeks

PRESS RELEASE. A new project called Green Bitcoin (GBTC) saw a sudden burst of popularity around the time when the original Bitcoin (BTC) saw its massive price surge. While Bitcoin skyrocketed to an all-time high, Green Bitcoin — currently still in presale — managed to raise $6 million in only two weeks. Green Bitcoin’s presale […]

PRESS RELEASE. A new project called Green Bitcoin (GBTC) saw a sudden burst of popularity around the time when the original Bitcoin (BTC) saw its massive price surge. While Bitcoin skyrocketed to an all-time high, Green Bitcoin — currently still in presale — managed to raise $6 million in only two weeks. Green Bitcoin’s presale […]

Source link

Upland Introduces Token Reward System With ‘Share and Build’ Airdrop Series

Upland, a popular Web3 metaverse and crypto game, unveiled the inaugural chapter of its “Share and Build” airdrop series on Friday. This initiative is designed to reward players with tokens for their participation. Upland’s Airdrop Series Rewards Community Participation At its essence, Upland is a Web3 metaverse platform dedicated to virtual land ownership and fostering […]

Upland, a popular Web3 metaverse and crypto game, unveiled the inaugural chapter of its “Share and Build” airdrop series on Friday. This initiative is designed to reward players with tokens for their participation. Upland’s Airdrop Series Rewards Community Participation At its essence, Upland is a Web3 metaverse platform dedicated to virtual land ownership and fostering […]

Source link

Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows

Grayscale, the issuer of the world’s largest Bitcoin exchange-traded fund (ETF), has applied for a smaller version of its popular Grayscale Bitcoin Trust (GBTC) ETF under the “BTC” ticker, according to a Mar. 12 filing with the US Securities and Exchange Commission (SEC).

Grayscale said:

“This would be net-positive for existing GBTC investors, who would benefit from a lower blended fee with the same exposure to Bitcoin, spanning ownership of shares of both GBTC and BTC.”

If approved, the proposed ETF will debut a cost-effective iteration of its GBTC ETF. It will be seeded through an undisclosed percentage of GBTC, and shareholders of the current GBTC will seamlessly transition to holding shares in both GBTC and BTC, ensuring no taxable implications.

The proposed ETF will be listed on the New York Stock Exchange, operating independently from Grayscale’s GBTC fund.

Why did Grayscale file for a ‘mini’ ETF?

James Seyffart, an ETF analyst at Bloomberg, explained Grayscale’s maneuver as a savvy move to compete against rivals without compromising on fees for its profitable GBTC investment offering.

Besides that, Seyffart pointed out that the new trust could offer GBTC investors tax-free exposure to the flagship digital asset. He said:

“[The Mini ETF] definitely helps out long term GBTC holders — particularly the taxable ones who were sorta stuck with potential capital gains tax hits. Not a full solution. But way more helpful than launching a standalone product from scratch.”

Furthermore, introducing a miniature version could prevent customers from migrating to more cost-effective alternatives.

GBTC, since its inception in January, has witnessed outflows exceeding $11 billion. This trend is primarily attributed to its high fees of 1.5%, notably higher than competitors charging 0.3% or even less.

Eric Balchunas, Bloomberg senior ETF analyst, opined:

“This way, [Grayscale] can keep some of that juicy 1.5% assets while placating a bit of investors with this treat. Also, BTC then gives something competitive for their salespeople to have when talking to advisors who probably find a 1.5% fee an instant dealbreaker.”

The post Grayscale introduces ‘mini’ Bitcoin ETF to alleviate investor tax burdens and curb outflows appeared first on CryptoSlate.

Uniswap Introduces Wallet Extension and Limit Orders, UNI Jumps 83% in 30 Days

Uniswap Labs has unveiled a collection of new features designed to refine the trading journey for users of its decentralized exchange (dex). This collection encompasses the Uniswap browser extension, limit orders for precise trading strategies, and advanced data and insights for making well-informed choices. Uniswap Labs explained on Tuesday that the expansion aims to make […]

Uniswap Labs has unveiled a collection of new features designed to refine the trading journey for users of its decentralized exchange (dex). This collection encompasses the Uniswap browser extension, limit orders for precise trading strategies, and advanced data and insights for making well-informed choices. Uniswap Labs explained on Tuesday that the expansion aims to make […]

Source link

CoinStats introduces AI-driven Exit Strategy feature to maximize crypto profits

Crypto portfolio app CoinStats has unveiled an innovative artificial intelligence (AI)-powered Exit Strategy feature on its platform, empowering traders to optimize their profits effectively, according to a Feb. 2 statement shared with CryptoSlate.

The feature would allow crypto investors to strategically determine the optimal selling price for their cryptocurrency assets within their wallets.

The asset management firm revealed that its premium users can leverage the AI Suggest tool within the Exit Strategy feature to make more nuanced decisions about their crypto portfolios. This tool leverages artificial intelligence to predict the Bull Market Price (BMP) for specific cryptocurrencies, empowering investors with valuable insights for informed decision-making.

“AI-powered analytics are crucial in the volatile and unpredictable field of cryptocurrency, as they provide an additional data-driven approach to securing profits,” the company added.

Exit Strategy tool to be important in upcoming bull market

CoinStats believes the tool would prove useful with the impending crypto bull market catalyzed by the spot Bitcoin exchange-traded funds (ETFs) approval in the U.S.

Several market observers noted that the crypto market would react positively to this development and further predicted that the upcoming BTC halving event would act as another catalyst for the industry.

CoinStats CEO Narek Gevorgyan revealed that he came up with the feature idea because most people hold a surging digital asset “with no idea when they want to sell.” So, the Exit Strategy feature would help these users “set and stick to a selling plan” that would allow them to profit from market rises.

“The biggest mistake I see people making in crypto is not having a plan, they hold a pumping token with no idea when they want to sell. It’s essential to have exact selling prices for your positions, this gave me the idea for a new CoinStats feature,” Gevoryan said.

CoinStats new users will be prompted to integrate the Exit Strategy feature and establish target prices for selling their assets. Once integrated into their profiles, investors can effortlessly review their target prices through the Exit Strategy view, conveniently accessible alongside the portfolio view.

The post CoinStats introduces AI-driven Exit Strategy feature to maximize crypto profits appeared first on CryptoSlate.

Clearpool Introduces Credit Vaults to Provide Blockchain Loan Efficiency for Lenders and Empower Borrowers

Credit Vaults empower borrowers by allowing them to customize loan terms according to their specific requirements. The increased interest rates provided by the solution encourage more lenders to join.

Clearpool, a decentralized finance (DeFi) lending protocol, has introduced a groundbreaking product called Credit Vaults. With this solution, the network aims to optimize lending efficiency and flexibility, bringing private credit efficiency onto the blockchain. This innovative offering allows borrowers to have more control over loan terms while attracting additional lenders with higher interest rates. Ultimately providing the potential to significantly expand Clearpool’s lending ecosystem.

What Are Credit Vaults and How Do They Work?

Credit Vaults are customizable lending pools designed for individual borrowers. It gives them the freedom to modify various parameters, such as interest rates, repayment schedules, pool caps, and know-your-customer (KYC) requirements, to suit their specific needs.

When lenders contribute funds to a Credit Vault, the capital goes directly to the borrower’s wallet in exchange for tokenized pool shares known as cpTokens. These tokens accrue interest in real-time, providing lenders with continuous yields.

The solution offers several advantages, including higher utilization of lent funds compared to Clearpool’s existing Permissionless Pools. With 100% utilization, Credit Vaults achieve approximately 15% higher capital efficiency, resulting in a significant boost of up to 17.6% in potential returns for lenders. Additionally, borrowers can adjust rates based on predefined protocol rules, adding an extra layer of flexibility to their borrowing experience.

New Opportunities for Borrowers and Lenders

Credit Vaults empower borrowers by allowing them to customize loan terms according to their specific requirements. This flexibility opens doors for a wider range of borrowers, from institutions to individuals. For example, trading firms can increase pool caps and rates to attract more liquidity for launching new strategies. Moreover, the solution enables more real-world lending, providing access to DeFi opportunities for secured credit products and non-crypto companies.

The increased interest rates provided by Credit Vaults encourage more lenders to join. This improved capital efficiency leads to higher profits for lenders, creating a beneficial situation for both borrowers and lenders.

Clearpool’s decision to introduce Credit Vaults is driven by the success of its original Permissionless Pools. These pools were the first to offer flexible and liquid private credit lending in the DeFi industry, originating loans worth an impressive $460 million. However, as the demand for more personalized and stable lending opportunities grew, Clearpool recognized the need to develop a new product to meet the evolving needs of borrowers.

Plans for Future Expansion

To expand access and flexibility further, Clearpool plans to launch Credit Vaults on additional blockchain networks. This multi-chain approach will empower more borrowers while diversifying liquidity streams for lenders. As the DeFi network grows and establishes partnerships on different blockchain networks, the protocol is positioned to be a leader in decentralized private credit innovation.

Credit Vaults have already demonstrated their potential by offering a balance between customized lending options for borrowers and attractive returns for lenders. If the adoption of the solution follows the success of Permissionless Pools, it has the potential to revolutionize lending practices in the DeFi industry.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Coinbase Wallet Introduces Shareable Links Option for Local and International Payments to Simplify Money Transfers

Whether transferring money to family abroad or tipping a tour guide on vacation, Coinbase Wallet lets users easily create a personalized link for any payment amount.

Cryptocurrency platform Coinbase aims to make sending money worldwide easier, faster, and more affordable through newly added features. Users can now instantly send funds globally by simply creating a shareable payment link to distribute via messaging apps, social media, or email.

The new feature removes the need to exchange complicated bank details or wait through sluggish traditional wire transfers. With a few taps, people can generate a link to send money to recipients worldwide with virtually no fees for instant access.

Whether transferring money to family abroad or tipping a tour guide on vacation, Coinbase Wallet lets users easily create a personalized link for any payment amount. It’s as simple as sharing a text or email through a messaging app and it is available in over 170 countries and 20 languages for worldwide accessibility.

To illustrate this, suppose you wish to send money or provide a tip to someone who has completed a task for you. This individual could be located far away from you, but with the help of a simple process, you can effortlessly transfer funds without any complexities. All you need to do is generate a link on your Coinbase account, specifying the desired amount to be sent, and then share the link with the recipient through various platforms such as WhatsApp, Telegram, Email, or any other app that supports link sharing. In a recent blog release, the company stated:

“We’ve made it easy to send money anywhere you can share a link, whether it’s through messaging apps like WhatsApp, iMessage, and Telegram, social media platforms like Facebook, Snapchat, TikTok, and Instagram, or even via email.”

Recipients can claim transfers by clicking the link on any platform that supports Coinbase Wallet and utilizing the app. They can download the wallet app itself and instantly create an account in one click to receive funds. However, any money that is unclaimed is automatically returned to the sender after two weeks.

Coinbase Wide Reach Is Also an Advantage

In addition to offering shareable links, Coinbase has been actively expanding user access on a global scale, now supporting fiat transactions in over 130 countries across the world. This widespread availability enables individuals from diverse nations to conveniently and swiftly conduct transfers using its platform.

Coinbase users situated in various countries can also receive funds from multiple cryptocurrency exchanges. Furthermore, they can convert their money into stablecoin USDC without incurring any fees and transfers at no network costs.

The company has also prioritized the development of an optional simplified mode, emphasizing an intuitive user experience to cater to a broader user base. These enhancements to the wallet align with Coinbase’s overarching objectives of facilitating streamlined cross-border money transfers with reduced complexity and fees, while simultaneously broadening access to the ever-evolving cryptocurrency landscape worldwide.

next

Altcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Mantle introduces mETH liquid staking protocol, expanding its Ethereum-based DeFi ecosystem

Mantle, the DAO-led web3 ecosystem, today unveiled its Mantle Liquid Staking Protocol (LSP) as a key addition to the Mantle Ecosystem, offering users a novel way to engage with Ethereum’s proof-of-stake (PoS) validator network, according to a statement shared with CryptoSlate.

The Mantle LSP is a permissionless and non-custodial Ethereum (ETH) liquid staking protocol, functioning on Ethereum L1 and governed by Mantle. It stands as the second core product of the Mantle Ecosystem, following the Mantle Network L2. Mantle posits that the introduction of Mantle Staked Ether (mETH), a value-accumulating receipt token, is a pivotal step in their protocol.

Mantle detailed that the genesis of Mantle LSP began with a proposal in a Mantle forum on July 14, 2023. Following the acceptance of the Mantle Governance Proposal MIP-25, the staking of Mantle Treasury ETH was sanctioned, leading to the phased deployment of Mantle LSP. This process culminated in the protocol’s full operational launch on Dec. 4, transitioning it into a Permissionless Mode.

Mantle LSP distinguishes itself by offering instant and sustainable rewards. Users staking ETH receive mETH, a token embodying their staked value and accumulated rewards, while also unlocking additional yield opportunities within the Mantle Ecosystem. Mantle states that the ETH to mETH exchange rate is deterministically calculated, thus mitigating the impact of stake size on slippage. Furthermore, mETH is available for trade on various exchanges, with its pricing governed by market dynamics.

Mantle emphasizes that their protocol underscores a commitment to user experience, security, and yield optimization. Mantle states its LSP features a streamlined architecture, focusing on the ETH to mETH conversion process on L1, and avoids complexities associated with other PoS tokens and chains. The protocol’s design incorporates robust risk management strategies, including non-custodial core smart contracts and off-chain services that impose strict risk limits. Additionally, Mantle LSP’s security framework involves dividing responsibilities among various roles, ensuring the safeguarding of staked ETH within smart contract addresses.

With the launch of Mantle LSP, Mantle intends to enhance its DeFi offerings by exploring the adoption of mETH across various applications within its ecosystem and beyond. This expansion aims to bolster the utility and efficiency of mETH, contributing significantly to Mantle’s growth in the DeFi space.

The broader Mantle ecosystem, anchored in Ethereum technology, now includes the Mantle Network, an Ethereum layer 2 (L2) solution, Mantle Governance, a decentralized autonomous organization (DAO), and Mantle Treasury, one of the largest on-chain treasuries. The ecosystem is facilitated by the Mantle token (MNT), which serves as a product and governance token.