“Do I just have to ‘bite the bullet’ and pay the taxes?”

Source link

IRA

Roth IRAs are one of the most coveted accounts on the retirement scene for several reasons. For starters, you contribute after-tax dollars to the account so that you can enjoy tax-free income during retirement. Since you’re not required to withdraw money from the account during your lifetime, the money can keep growing, and you can pass it on to your heirs.

But you’ll want to jump on the benefits of a Roth IRA as soon as possible. Once your income jumps over the threshold, you won’t be able to make direct contributions to the account. So if you’re ready to unlock the power of a Roth IRA, here are three perks you don’t want to miss in 2024.

Image source: Getty Images.

1. Take advantage of the highest contribution limits ever

If you qualify to make direct contributions to a Roth IRA in 2024, you’ll be able to take advantage of the biggest contribution limits we’ve ever seen. This year, you can funnel up to $7,000 into a Roth IRA, provided your income sits below the threshold. And if you’re 50 or older, you can stash away as much as $8,000 as long as you plan to earn at least that much this year. These contribution limits jumped $500 over the cap for 2023.

Let’s say you qualified to contribute $8,000 every year. Within 13 years, you would be able to build a six-figure portfolio. Most likely, you’ll be able to hit six figures much faster if you invest in assets that generate superior returns. The more money you contribute to a Roth IRA, the more money you’ll have available to invest.

2. Invest in your favorite assets

If you’re working full-time, your employer probably offers some type of retirement plan, like a 401(k). For 2024, you can contribute up to $23,000 to the account, and your employer might even chip in a 401(k) match. But your 401(k) investment options are typically limited to a few investments, like index funds and target date funds.

Your Roth IRA offers more flexibility and freedom. You own and manage the account, so you’ll be able to decide what investments you can add to your portfolio. You could pump up your Roth IRA with a wide variety of traditional assets, including:

You could even look into a self-directed Roth IRA and gain access to more exotic assets, such as real estate, businesses, and digital currencies, that can supersize your returns. But you’ll want to make sure you understand the risks associated with these investments before you dive in.

3. Snag a Saver’s Credit

Contributions to a Roth IRA won’t lead to an up-front tax deduction, since they are made with after-tax dollars. But you may be eligible for a Saver’s Credit if your income isn’t too high. The IRS rewards low-and-moderate income retirement savers with a credit worth up to $2,000 ($1,000 if filing single) for making contributions to a qualified retirement account like a Roth IRA. Keep in mind that the Saver’s Credit is nonrefundable, so you won’t end up with a tax refund if your credit exceeds your tax bill.

This table shows whether you’re in the running for the Saver’s Credit. Your credit may be worth 10%, 20%, or 50% of your eligible retirement contributions, depending on your adjusted gross income and filing status.

|

Amount of Your Tax Credit Based on Income and Filing Status for 2024 |

Married Filing Jointly (AGI) |

Head of Household (AGI) |

All Other Filers (AGI) |

|---|---|---|---|

|

50% of your contribution |

$0 to $46,000 |

$0 to $34,500 |

$0 to $23,000 |

|

20% of your contribution |

$46,001 to $50,000 |

$34,501 to $37,500 |

$23,001 to $25,000 |

|

10% of your contribution |

$50,001 to $76,500 |

$37,501 to $57,375 |

$25,001 to $38,250 |

|

0% of your contribution |

Over $76,500 |

Over $57,375 |

Over $38,250 |

Data source: IRS.

If you qualify to make contributions to a Roth IRA and it makes sense for your portfolio, you want to do your research now so you can start taking advantage of the benefits. You may qualify for benefits right now, such as the Saver’s Credit, or position yourself to get more tax-free income during retirement.

I’m 60 With $1.2 Million in an IRA. Should I Convert $120,000 Per Year to a Roth to Avoid RMDs?

If you’re 60 years old with $1.2 million saved for retirement in a traditional IRA, you may be starting to think about required minimum distributions (RMDs) and the hefty annual tax bill they can create once you turn 73. Converting a portion of your IRA to a Roth IRA each year can help you reduce or avoid RMDs and take control of your tax bill – but also comes at a cost. Discuss your Roth IRA conversion questions with a financial advisor to determine if this strategy aligns with your broader financial plan.

RMD Rules: The Basics

Once you turn 73, the IRS requires that you start taking annual distributions called required minimum distributions (RMDs) from traditional IRAs, 401(k)s and similar tax-deferred accounts. RMDs are calculated by dividing your account balance by your life expectancy factor, a value that is set by the IRS based on your age.

RMD withdrawals are treated as ordinary income. With a large IRA balance, the size of the mandatory RMDs could easily push someone into a higher tax bracket and result in a higher tax bill. Remember, a financial advisor can be a valuable resource when it comes to planning for RMDs.

Roth Conversions

Roth IRAs, unlike traditional IRAs and 401(k)s, aren’t subject to RMD rules. So by converting your IRA to a Roth, you could avoid having to pay extra income taxes from mandatory IRA withdrawals in retirement. The catch is that you have to pay income taxes on the amount you convert at your ordinary income rate when you convert it. This can lead to a massive tax bill if you were to convert a $1.2 million IRA to a Roth all at once.

Instead, gradually converting your traditional IRA to a Roth IRA allows you to control when you pay taxes. Rather than unspecified mandatory RMD withdrawals, you choose when to take taxable Roth conversions. Roth withdrawals in retirement are then tax-free, provided you wait five years to withdraw those assets.

Keep in mind that the five-year period applies to each conversion. If you were to convert a portion of your IRA in 2024, 2025 and 2026, you’d have to wait until 2029, 2030 and 2031, respectively, to withdraw each group of funds tax-free.

If you need additional help navigating the rules surrounding Roth conversions, use this tool to match with a financial advisor.

A Roth Conversion Example

Assuming your investments grow at 5% each year for 13 years, your $1.2 million IRA could be worth around $2.3 million by the time you reach age 73. By that time, your first RMD would be approximately $87,000 based on the IRS life expectancy factor. Assuming you’re collecting $80,000 annually in taxable income from pensions and Social Security, adding an extra $87,000 would push you from the 22% bracket into the 24% bracket. (This assumes that the current tax brackets remain in place after 2025 when key provisions of the Tax Cut and Jobs Act sunset.)

But with 13 years of $120,000 Roth conversions already completed, the IRA balance requiring RMDs could be reduced to around $42,000 by age 73. Your first RMD would be just under $1,600. This would likely not push you into a higher bracket and save you thousands in annual taxes during retirement compared to taking the full $87,000 distribution without any prior Roth conversions.

The key is to not convert your entire IRA to a Roth immediately, but rather take an incremental approach. By limiting Roth conversions to a certain amount, you can control and potentially reduce your tax liability. Spreading conversions over time allows taxpayers to fill up their current bracket without exceeding it. By staying in lower brackets, more money is shielded from future taxes than paying the IRS immediately at today’s rates.

But you don’t have to do it all alone. A financial advisor can help you plan out your Roth conversion strategy and manage your taxes in retirement.

Roth Conversion Limitations

No matter how you do it, Roth conversions trigger taxes. Without sufficient non-retirement savings or other sources of income, investors may struggle to pay conversion taxes or be forced to sell investments at a loss. Optimal timing and tax planning are also challenging. Tax rates and laws can change frequently, making it hard to predict brackets decades in advance. Income fluctuations from bonuses, dividends or retirement plan withdrawals also complicate projections.

Converting too little defeats the purpose of avoiding higher future RMD taxes. But converting too much could push you into higher brackets now or reduce your flexibility if tax rates decline. Balancing present and future tax minimization is tricky with many uncertainties at play over long time horizons.

Additional factors may also come into play. Deductions that reduce taxable income, state taxes, fluctuating investment returns and income from other sources such as part-time work are all potentially important variables that need to be considered to craft the optimal strategy for Roth conversion. If you need additional help navigating these factors, consider working with a financial advisor.

Bottom Line

Roth IRA conversions let investors take control of the timing of their tax liability. By paying taxes now at known rates through incremental conversions, overall lifetime taxes can be reduced compared to unpredictable mandatory RMD withdrawals decades into the future. But Roth conversions come at a cost today, require non-retirement funds to pay taxes, and involve considerable analysis and some guesswork to optimize.

Retirement Planning Tips

-

A financial advisor can help develop Roth IRA conversion strategies. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Knowing how much money you’ll need to retire and whether you’re on track to hit that target is vital when you’re planning for your golden years. SmartAsset’s retirement calculator can help you estimate how much you may have in savings when the time comes for you to retire.

Photo credit: ©iStock.com/monkeybusinessimages, ©iStock.com/designer491, ©iStock.com/designer491

The post I’m 60 With $1.2 Million in an IRA. Should I Convert $120,000 Per Year to a Roth to Avoid RMDs? appeared first on SmartReads by SmartAsset.

IRAs are one of the most popular retirement accounts for good reason. They’re open to anyone who earns income during the year, and they give you the freedom to invest in just about anything. You can also choose when you’d like to pay taxes on your funds.

But IRAs have one big drawback: You can only put up to $7,000 here in 2024, or $8,000 if you’re 50 or older. That’s a far cry from the $23,000 ($30,500 for those 50-plus) workers can save in a 401(k).

This might be discouraging if you’re saving exclusively in an IRA, especially since many Americans believe they’ll need to amass close to $2 million for retirement. But don’t worry. If you’re saving diligently, it’s possible to wind up with a lot of money in your IRA.

Image source: Getty Images.

Can you save $1 million or more in an IRA?

Saving $1 million or more might sound difficult when the IRA contribution limit is just $7,000 this year, but there are two key things to remember here.

First, IRA contribution limits rise over time. So just because you’re limited to $7,000 now doesn’t mean that ceiling will be there forever. And once you turn 50, you’ll also be eligible to make catch-up contributions.

Second, you’ll be investing your IRA funds for the future, and your earnings will likely make up the bulk of your retirement funds, assuming you’ve invested wisely and avoided early withdrawals. So it’s possible to reach $1 million or more without actually saving $1 million of your own money.

If you set aside $7,000 in your IRA every year for 40 years, your account would contain $280,000 in personal contributions. But if you invested it all and your investments earned a 10% average annual rate of return during that time, your final balance would be $1.07 million. And again, this doesn’t account for catch-up contributions or changes to the IRA annual contribution limits.

So becoming an IRA millionaire is certainly possible, but whether it’s realistic for you depends on your income, your expenses, and how long you have until retirement. If you’re 60 with no retirement savings, you probably won’t reach millionaire status, although there are still some things you may be able to do to ensure a more comfortable retirement.

Don’t limit yourself to just an IRA

An IRA can be a great place to put your retirement savings, but it’s not always the best choice. Consider all your options before deciding where to invest your funds so you can get the greatest value out of them.

If you qualify for an employer match, for example, it’s best to put your money in your 401(k) first until you’ve claimed the entire match. Then you can switch back to your IRA if you prefer. And if you max that out, you can return to your 401(k) for the rest of the year.

Or if you don’t have access to a workplace retirement plan, you could put a chunk of your savings in a health savings account (HSA), assuming you qualify. You can technically use this cash at any age for medical expenses, but it’s also a great place to stash retirement savings. Some HSA providers even enable you to invest your funds.

If your issue is a lack of funds rather than a lack of access to retirement plans, your road will be more difficult. You might be able to save intermittently in an IRA using year-end bonuses or tax refunds. But you may also have to think about other ways to bring in cash, like working part-time through retirement or delaying retirement longer than you originally intended.

Don’t forget that you’ll probably have some Social Security to rely on too. It’s best to come up with a claiming strategy so you can estimate how much you’ll get from the program. This will help you figure out how much you need to save on your own for retirement.

It’s OK if you eventually outgrow your current retirement plan. The best plans change with you over time. Review which retirement accounts you’re using and how much you’re contributing annually, and do the best you can from where you’re at now.

If you’re taking a required minimum distribution from an IRA, 401(k) or other tax-deferred account and don’t need the money to cover living expenses, where should you stash that unneeded cash?

Investors now need to start taking RMDs at age 73 or, if they were born after 1960, at age 75. Depending on the balances of your accounts, that distribution can be a sizable amount of money, perhaps more than you need to live on. One option is to reinvest that money, and a Roth IRA would seem to be a perfect choice: withdrawals from Roth accounts are tax-free – including all gains on your investments – and you’ll never need to take any of those pesky RMDs during your lifetime.

There’s just one catch: You can’t directly convert your RMDs to a Roth. But for some people, there is a potential workaround. For 2024, you can contribute up to $7,000 plus another $1,000 if you’re at least 50 years old – if you have enough earned income.

Get matched with a financial advisor to discuss your own retirement strategy.

What is – and isn’t – ‘earned income’

The IRS defines earned income as money you get for working, such as wages, commissions, bonuses, tips and honorariums for speaking, writing or taking part in a conference or convention. Income generated by self-employment also counts. Income that doesn’t qualify includes taxable pension payments, interest income, dividends, rental income, alimony and withdrawals from Roth IRAs or other nontaxable retirement accounts, along with annuities, welfare benefits, unemployment compensation, worker’s compensation payments and your Social Security income.

Another restriction on Roth contributions is the income limit. Once your modified adjusted gross income (MAGI) hits $146,000 for a single filer or $230,000 for joint filers, your maximum Roth contribution starts phasing out up to $161,000 (single filers) or $240,000 (joint filers). After that, you’re no longer eligible to contribute.

You also need to remember that you need to wait five tax years after your first contribution to any Roth account before you can make withdrawals. Heirs who inherit your Roth will need to withdraw the entire balance within 10 years.

Consider speaking with a financial advisor to develop a tax-efficient retirement strategy.

Other options on RMDs

If you don’t qualify to make a Roth contribution, you still have options to eliminate, reduce or delay your RMDs.

Roth conversion: You can convert your IRA to a Roth account, once you’ve taken your RMD for the year. You’ll pay taxes on the amount you convert, so one tactic is to convert the maximum amount available without pushing yourself into a higher tax bracket. Each Roth conversion carries its own five-year rule.

Charitable contribution: You can use a Qualified Charitable Distribution to donate some or all of your RMD to a charity recognized by the IRS and you won’t be taxed on the donated amount. To qualify, the money must be transferred directly from your IRA to the charity.

Keep working: Your 401(k) account with your current employer isn’t subject to RMDs if you’re still on the payroll. One tactic is to roll 401(k)s from previous employers into your current plan so that they won’t be subject to RMDs. Once you stop working, however, RMDs are required.

Be careful: The punishment for failing to take an RMD during the required time period is a hefty one – up to 50% of the missed RMD amount.

A financial advisor can help you navigate the particular risks and tradeoffs in your situation.

Pay attention to all your taxes

Structuring your retirement withdrawals to reduce your tax bite means looking at all your sources of income, including retirement accounts, RMDs, Social Security benefits, pensions and taxable investment income. For some people, withdrawing money from an IRA early in retirement can reduce the size of their eventual RMDs. If they also delay collecting their Social Security benefits, their benefit amount to increase by 8% each year until they reach 70 years old. Also, be sure to coordinate taxes, withdrawals and RMDs between spouses, and remember that a younger spouse’s RMDs won’t need to be taken until they reach age 73 or 75.

Other common retirement tax moves include investing in tax-free bonds, moving to a state with no income tax or estate tax, harvesting tax losses in taxable investment accounts and holding any taxable assets long enough to qualify for lower long-term capital gains tax rates.

To learn more about retirement planning and how to work toward your goals, talk to a financial advisor for free.

Bottom line

How to manage your RMDs – and all the other many tax questions that can arise in retirement – can be complicated. Take the time to estimate your retirement taxes before you start collecting pensions, Social Security and taking withdrawals from retirement accounts.

Tips

-

Balancing taxes and retirement income – and figuring out how to minimize taxes in retirement – is a crucial issue. A knowledgeable financial advisor can help you decide how to structure and coordinate these payments over the span of your retirement.

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

-

Make sure you’re protecting your cash reserves from inflation by securing them in an account that generates a competitive interest rate. Leaving cash in a checking account or low-yield savings account can stifle your purchasing power over time.

Photo credit: ©iStock.com/skynesher

The post Can I Use My RMDs to Transfer Money Into My Roth IRA? appeared first on SmartReads by SmartAsset.

A 401(k) is the most common retirement account, but it’s far from the only type of retirement account available. Another common account is an IRA. Unlike a 401(k), an IRA isn’t tied to an employer and must be opened independently, similar to a bank or brokerage account.

There are two main types of IRAs: traditional and Roth. Both have unique benefits and can play a critical role in your retirement savings and investment strategy.

It’s natural to want to boost your IRA balance as much as possible to prepare for retirement, and many people set their eyes on the million-dollar mark. And while that’s a great goal, people should keep a few things in mind.

Image source: Getty Images.

1. IRAs have low contribution limits compared to other retirement accounts

IRAs have many great aspects. They’re free, allow you to invest in virtually any stock or exchange-traded fund (ETF) you want, and have flexible early withdrawal rules that can be beneficial for life events like buying a house or paying for higher education expenses.

That said, one downside to an IRA is the relatively low contribution limit. The most you can contribute to an IRA in 2024 (both traditional and Roth combined) is $7,000. If you’re 50 or older, you can add an additional $1,000 catch-up contribution, bringing the limit to $8,000.

IRA contribution limits are far lower than a 401(k), which allows you to contribute $23,000 ($30,500 if you’re 50 or older). This is important to keep in mind when aiming to become an IRA millionaire.

2. Compound earnings is the greatest gift on your side

Because of IRAs’ relatively low contribution limits, the key to hitting the million-dollar mark will rely heavily on time. Time is one of the greatest forces in investing, mainly because it fuels compound earnings. Compound earnings occur when the returns you earn from investments begins to generate returns of their own.

For example, imagine you invest $1,000 and earn a 10% return, or $100. If you reinvest the $100 and receive 10% again, you’re now earning a return on $1,100, receiving $110. If you reinvest the $110, the 10% is now on $1,210. It’s a rewarding cycle that can take relatively small investments and turn them into big gains.

For compound earnings to work its magic, though, it needs as much time as possible. The more time, the more the compounding effect grows. Without compound earnings, it’d take someone over 142 years to hit $1 million by saving $7,000 annually and 125 years by saving $8,000 annually.

3. You’ll need at least a couple of decades on your side to make it happen

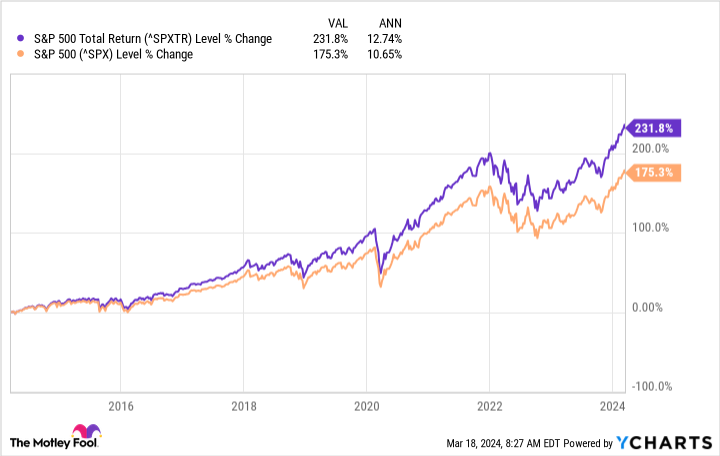

Those aiming to become IRA millionaires should be prepared for the journey to take at least a couple of decades, and that’s on the lower side of things. For perspective, the S&P 500 (^GSPC -0.31%) — which is the stock market’s primary benchmark — has averaged around 10% annual returns since its inception. In the past decade, it has averaged 12.7% total returns, so we’ll round that up to 13% for our example.

Assuming the IRA contribution limit remains at $7,000, and you invest that amount while averaging 13% annual returns, it will take you close to 25 years to cross the million-dollar threshold. If you started at 50 and contributed $8,000 the whole time, it’d still take you close to 24 years.

It’s important to note that past results don’t guarantee future performance, and returns can vary widely — especially over decades. You could average 10% annual returns over those years, or you could average 15%. Nobody can say for certain.

That’s why the main focus should be on starting as early as possible and prioritizing maxing out your IRAs each year. I always recommend that people contribute enough to their 401(k) to get the maximum employer match and then focus on using any additional money to fund their IRAs.

Once your IRA is maxed out for the year, return and add additional contributions to your 401(k) if you choose. That strategy gives you the best of both worlds.

I’m 52. Should I invest in a Roth IRA or index funds like the Dow and Nasdaq?

Dear MarketWatch,

I spent five years as a teacher in Missouri, which made me eligible for a tiny pension (under $400 per month).

Teaching didn’t work out for me, and since I will never be able to return to the profession and increase my pension, I decided to cash in my pension and reallocate the funds to something that would pay more.

I paid down some debt and then invested $6,500 — the maximum allowable amount — into a Roth IRA. I’m 52 but don’t plan to retire for at least another 20 years.

Once I’m done with my taxes, I am not certain whether I should put the remaining funds in the IRA or invest them in index funds like the Dow or Nasdaq. What is your advice?

Related: I’m 73, retired and take my RMDs. But what happens if I become incapacitated and miss them for several years?

Dear Reader,

I’m going to answer your question with a question. Why choose one over the other when you can have both? Index funds are a popular choice for investors with IRAs, so there’s no reason why you couldn’t add them to your Roth IRA’s portfolio.

For those who may be unaware, and as the name suggests, index funds use indexes, such as the S&P 500

SPX,

Dow Jones Industrial Average

DJIA,

Nasdaq Composite,

COMP,

or many others, as benchmarks. They’re particularly useful for long-term investing, which makes them a good choice when your retirement is a couple of decades away.

When you have your retirement investing plans on the radar, but aren’t sure where to start, look at target-date funds. Managers link these portfolio funds to specific years for retirement — say, 2030 or 2055. If your retirement is 20 years away, you could look at a target-date fund for 2045. (Keep an eye on fees, also called expense ratios.)

I am not a financial planner — specifically, not your financial planner — so I do not provide specific investment advice. Any funds I mention here are simply to illustrate and explain how they work and what to look for.

Target-date funds

Back to the target-date fund. If you look at Vanguard Target Retirement Fund 2045, VTIVX you will see under “holdings” that half of that fund is invested in Vanguard’s Total Stock Market Index Fund VSMPX, another 33% is in Vanguard’s Total International Stock Index Fund VGTSX, 10% is in the company’s bond-market index fund VTBIX, 4% is in Vanguard’s international bond index fund VTILX, and 1% is in liquidity. Take it a step further, using the total stock-market index fund as an example, you’ll see the top 10 holdings include Apple,

AAPL,

Microsoft,

MSFT,

Amazon,

AMZN,

and NVIDIA.

NVDA,

Vanguard is far from the only company that offers target-date funds or index funds. Other big names include Fidelity, Blackrock

BLK,

T. Rowe Price

TROW,

Schwab

SCHW,

and American Funds . You can make a day of searching their options and comparing holdings.

Another option you have is to invest in a traditional IRA right now if you’re in a higher tax bracket than you expect to be in the future (though not including assumptions about tax brackets when they sunset in 2025). As your tax liabilities drop, you can convert some of those funds into your Roth account. Having a Roth IRA is a great tool for retirement savings, and diversifying your investments and your taxability will make any option you have in the future even more powerful.

Have a question about your own retirement savings? Email us at HelpMeRetire@marketwatch.com

I Have $500k in an IRA and Will Receive $2,000 Monthly From Social Security. Can I Retire at 67?

Half a million dollars might sound like a lot of money, but if you’re approaching retirement, is it enough?

If you have $500,000 in a pre-tax IRA and expect $2,000 per month from Social Security, you may have enough money to retire at age 67. A half million dollars is a relatively modest nest egg, but it can still generate a comfortable income depending on your standard of living. Here’s what to think about as you plan for retirement around these figures.

A financial advisor can help you build a comprehensive plan for retirement. Match with a fiduciary advisor today.

How Health and Longevity Affect Retirement Options

First of all, make sure to consider your health and longevity. Are you planning to retire at age 67 for health reasons or will you be healthy enough to continue working, if you need to?

As you hit your late 60s and 70s, your health may become more unpredictable. Even if you’re still in good health, your workday may become more tiring as time goes on. You may not be able to continue working after 67, regardless of finances. So while it’s worth considering whether you can continue to work beyond age 67, it’s also critical to think about how long your $500,000 may last in the event that you need to call it a career at 67. A financial advisor can help you decide when the right time is to retire.

Income and Social Security

The next question is how much money your portfolio will generate.

“Lower net worth situations typically imply less room for error,” Bryan M. Kuderna, founder of the Kuderna Financial Team told SmartAsset. “There’s always a lot to consider, but… removing variables to simplify the math means $500,000 over a 20-year hypothetical retirement equals $25,000 annual spend down.”

That’s the starting point: $4,000 per month in cash withdrawals and Social Security income.

While half a million dollars seems like a lot of money, it’s a rather modest retirement savings. A lot of your income will depend on how you invest this money and structure your withdrawals. For example, as Kuderna notes, you could keep everything in cash and withdraw about $2,000 per month for 20 years.

On the other hand, say you invest your entire portfolio in bonds. On average, modern corporate bonds tend to return about 4% per year. By doing so, you could reduce your withdrawals slightly and live indefinitely on about $3,666 per month in Social Security and interest payments. Or, if you’re willing to draw down on the principal, you could generate $4,800 per month over 20 years in combined benefits and withdrawals.

A lifetime annuity could generate a little more, giving you a combined income of about $5,300 per month in Social Security and retirement payments. The difference here is that it would last indefinitely, with no risk of exhausting the principal. And if you need help picking investments for your retirement accounts and want advice on annuities, consider speaking with a financial advisor.

Your Spending in Retirement

Spending is a key component of retirement planning.

Depending on how you manage your money, you can probably expect an annual income between $48,000 (at roughly $4,000 per month) and $63,000 (at roughly $5,300 per month). More is possible if you invest for more aggressive returns, but that will mean taking on more risk.

Whether this income will be enough money is largely dependent on your spending.

Now, one of the green flags here is your Social Security income. A $2,000 monthly benefit at full retirement age means that you likely earned around $70,000 per year in your working life – not far off from what your combined retirement income.

But there are three major things to consider here.

First, taxes will take a bite out of this income. Your IRA is a pre-tax portfolio, so withdrawals are taxed as regular income, not capital gains. The IRS will tax you based on the tax bracket you’re in when you make your withdrawals.

Second, you must plan for inflation. While your Social Security benefits will be indexed for inflation – meaning they typically increase on an annual basis – cash and fixed-income assets such as the bonds and annuities discussed above are not. You may need to invest in assets that will provide a growth element to your portfolio and help you outpace inflation.

Finally, you may have to choose a more aggressive withdrawal rate, which could expose you to longevity risk – the possibility of outliving your money. Adhering to the standard 4% rule would mean withdrawing just $1,666 per month from your IRA in your first year of retirement and that may not be enough to meet your spending needs. An approach that generates about $3,000 per month in IRA income will get you closer to your likely pre-retirement income, but it will mean withdrawing 7.2% of your portfolio in year 1 of retirement, which is quite high. A financial advisor can help you figure out how much money you can afford to withdraw from your IRA.

Bottom Line

Can you afford to retire? It depends entirely on how your portfolio is invested and your goals.

IRA Management Tips

-

Building an IRA requires more planning than a 401(k), which is typically managed by a professional on your behalf. Here are a few tips and strategies for making the most of your IRA.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Luke Chan, ©iStock.com/GetUpStudio, ©iStock.com/Ridofranz

The post I Have $500k in an IRA and Will Receive $2,000 Monthly From Social Security. Can I Retire at 67? appeared first on SmartReads by SmartAsset.

Can I Retire At 62 With A $1 Million Roth IRA, $22,172 Annual Pension And $1,827 Monthly Social Security?

Retirement planning is an intricate process that requires understanding and integrating various income sources. Imagine the following financial scenario: You have a $1 million Roth individual retirement account (IRA), an annual state or local pension averaging $22,172 and a Social Security benefit that amounts to $1,827 per month. Will this be enough to retire at age 62?

Don’t Miss:

Retirement Income Sources

Roth IRA: A Roth IRA is notable for tax-free growth and withdrawals. A $1 million balance in a Roth IRA is a substantial retirement asset.

Pension: The median annual pension benefit in the U.S. is about $22,172 for state or local pensions. This provides a steady income stream in retirement.

Social Security: The average monthly Social Security retirement benefit as of January 2023 is $1,827. But starting benefits at 62 permanently reduces the amount.

Total Monthly Income Breakdown:

Roth IRA: Using the 4% withdrawal rule, a $1 million Roth IRA would yield approximately $40,000 annually or $3,333 per month.

Pension: The average annual state or local pension of $22,172 translates to about $1,848 per month.

Social Security: The average monthly Social Security benefit is $1,827.

Combining these sources, the total estimated monthly income would be approximately $7,008 ($3,333 from Roth IRA + $1,848 from pension + $1,827 from Social Security).

Trending: The average American couple has saved this much money for retirement — How do you compare?

Average Monthly Expenses

For retirees 65 or older, the average monthly spending is $4,345. In this scenario, your hypothetical estimated monthly income of $7,008 surpasses the average monthly expenses of $4,345 for retirees.

A 65-year-old retiring in 2023 can expect to spend an average of $157,500 on healthcare and medical expenses throughout retirement, according to Fidelity Investments’ 2023 Retiree Health Care Cost Estimate. This figure is crucial, as healthcare often represents a significant portion of a retiree’s budget.

Remember, these are averages and estimates. Individual circumstances, such as lifestyle choices, health conditions and unexpected expenses, can greatly impact actual needs.

Considerations for Retirement at 62:

Living expenses and lifestyle: A detailed understanding of expected living expenses is crucial. Lifestyle choices greatly impact the required income in retirement.

Inflation and market risks: Inflation affects the purchasing power of savings, and market volatility can impact Roth IRA investment returns.

Healthcare costs: If retiring before age 65, consider the gap in Medicare coverage and the need for private health insurance.

Longevity: Planning for a longer retirement is essential because of increasing life expectancies.

Strategies for a Comfortable Retirement:

Financial planning: Consulting with a financial adviser is recommended to develop a personalized retirement plan.

Investment strategy: A diversified investment approach within the Roth IRA can help balance growth and risk.

Supplemental income: Consider part-time work or monetizing hobbies for additional income.

Retiring at 62 with a $1 million Roth IRA, an average pension and Social Security benefits can be a viable option, provided that it is backed by careful planning and consideration of personal financial needs and goals. A holistic approach to retirement planning, encompassing all income sources and lifestyle considerations, is key to ensuring a secure and fulfilling retirement.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Can I Retire At 62 With A $1 Million Roth IRA, $22,172 Annual Pension And $1,827 Monthly Social Security? originally appeared on Benzinga.com

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I’m 65 Years Old With $750k in an IRA. I’m Taking Social Security – Is It Too Late for a Roth Conversion?

If you’re 65 years old and collecting Social Security, you may wonder if it’s too late to convert your $750,000 traditional IRA into a Roth IRA. The short answer is no – there are no legal restrictions to Roth conversion based on age or income. Practically, however, the decision involves carefully weighing tax implications, healthcare costs, estate planning and more. Spreading conversions over multiple years often makes the most financial sense for larger IRAs. Guidance from a financial advisor can help you weigh the costs of a Roth conversion in your circumstances.

Roth Conversion Basics

A Roth IRA conversion involves moving funds from a traditional, pre-tax IRA into an after-tax Roth IRA account. You pay income tax on the money that gets converted now, but future withdrawals in retirement come out tax-free.

Plus, traditional IRAs are subject to required minimum distributions (RMDs) starting at age 73. This can lead to higher taxes in retirement as RMD income, which is treated as ordinary taxable income, can push retirees into higher tax brackets. But RMD rules don’t apply to Roth IRAs and Roth 401(k)s, so you can leave the money in the account or withdraw it any time you need it without owing any taxes on your contributions (you may owe income taxes on investment earnings if you withdraw them less than five years after making your initial contribution).

If you need additional help navigating the rules surrounding Roth IRAs, consider speaking with a financial advisor.

Why Timing Your Roth Conversion Matters

The sooner you convert funds from your traditional pre-tax IRA to a Roth account, the more years of tax-free growth you’ll enjoy in your Roth account. And you’ll be able to withdraw those Roth funds without owing any taxes.

But you will have to pay taxes on the conversion, which is no small consideration when it comes to timing. Converting a large IRA can require you to pay the top marginal tax rate of 37% on most or even all of the entire conversion amount, depending on your other income, deductions and additional factors.

If you convert it gradually, however, you can spread the income bump out over several years and avoid subjecting it to the top marginal tax rate. This can help reduce the tax owed each year and overall.

It’s also important to consider when you’ll need to withdraw funds from your Roth IRA. Funds can’t be withdrawn without penalty within five years of the conversion. And, if you convert your IRA to a Roth gradually over time, those conversions each retrigger the five-year rule for that portion of the money.

Meeting with a financial advisor can provide clarity on complex moves like Roth conversions.

Converting a $750k IRA

A major concern in converting a $750,000 IRA balance at once would be the significant tax bill that would accompany such a transaction. Completely a Roth conversion of that size would push the person into the 37% marginal tax bracket.

If you’re a single filer and your Social Security income isn’t high enough to be taxed, adding $750,000 to your current income could trigger about $238,000 in extra taxes, using the 2023 tax brackets. Going slowly with $75,000 converted per year over 10 years reduces the tax hit each year by keeping your taxable income in the 22% bracket.

Here’s how those scenarios might play out, assuming you are a single filer and your Social Security income is less than $25,000 so escapes taxation:

Scenario 1: Converting $750,000 All at Once

-

Size of Roth conversion: $750,000

-

Tax bracket: 37%

-

Total Federal income tax owed: $237,831

This option leaves you with a massive tax bill but around $512,000 in your new Roth IRA, which you’ll eventually be able to withdraw tax-free.

Scenario 2: Annual $75,000 Conversions Over 10 Years

-

Size of Roth conversion: $75,000 (x10)

-

Tax bracket: 22%

-

Total Federal income tax owed: $88,000 over 10 years

Keep in mind that funds left in your IRA will continue to grow while you’re executing these annual conversions, so the IRA likely won’t be empty by the time you have to start taking RMDs. However, the RMDs you’ll have to take by then will be much smaller so won’t incur nearly as much taxation compared to leaving the money in a traditional IRA.

A third option is to leave the money unconverted in your IRA and start taking RMDs once you turn 73, paying taxes on them as you go. However, this could leave you paying higher taxes in retirement until your death. But if you need more help taking stock of your different options, this free matching tool can pair you with a fiduciary advisor.

Making the Call

You may not find that one course of action is clearly superior. Factors to consider when deciding if and how much Roth conversion makes sense:

-

Compare current vs. future income tax rates

-

Account for RMDs and estate plans

-

Weigh healthcare and other senior costs

-

Assess tax impact on heirs

-

Model multi-year scenarios

Strategic partial Roth conversions tailored to your situation may provide the most tax advantages for people with large IRA balances.

One major limitation to Roth conversions is that they cannot be reversed. If tax rates decline later or you need converted funds sooner, you could regret having locked in taxes now at a higher rate. Inheritance plans may also change. Do a thorough multi-year analysis before committing to convert.

Run your own Roth conversion scenarios first or enlist the help of a financial advisor to help you make these important calculations.

Bottom Line

At 65 or any age, while parts of your retirement finances remain unsettled, limiting Roth conversions to small chunks spread over years offers flexibility. This balances immediate tax costs against future tax savings for you and your heirs. As with most money moves in retirement, prudently assessing your multi-year tax picture first is key.

Retirement Planning Tips

-

Instead of guessing if converting your IRA makes sense, talk to a financial advisor who can crunch the numbers. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep in mind that there are income limitations for contributing to a Roth IRA. In 2024, the IRS doesn’t permit single filers with an adjusted gross income (AGI) above $87,000 and married couples who file jointly with an AGI above $240,000. However, backdoor Roth IRAs can help high earners legally circumvent these income limits.

Photo credit: ©iStock.com/zimmytws, ©iStock.com/Panupong Piewkleng, ©iStock.com/kate_sept2004

The post I’m 65 Years Old With $750k in an IRA. I’m Taking Social Security – Is It Too Late for a Roth Conversion? appeared first on SmartReads by SmartAsset.