B2Broker is a premier provider of liquidity solutions, white-label platforms, CRM systems and advanced trading mechanisms. Founded in 2014, B2Broker has consistently added new features and tools to its expansive liquidity and white-label offerings. With the contribution of B2Broker’s sibling companies – B2BinPay, B2Core and B2Trader, the group delivers a comprehensive suite of B2B brokerage […]

B2Broker is a premier provider of liquidity solutions, white-label platforms, CRM systems and advanced trading mechanisms. Founded in 2014, B2Broker has consistently added new features and tools to its expansive liquidity and white-label offerings. With the contribution of B2Broker’s sibling companies – B2BinPay, B2Core and B2Trader, the group delivers a comprehensive suite of B2B brokerage […]

Source link

John

Trading Guru John Bollinger Forecasts Bitcoin Breakout, $50,000 On The Horizon?

John Bollinger, a legendary Bitcoin (BTC) trader known for creating the Bollinger Bands strategy, has recently shared an optimistic view on Bitcoin’s future.

Bitcoin Poised For Further Surge?

In a post on X, John suggest that Bitcoin’s price is likely to “break higher” from its current levels. This prediction is based on his analysis using the Bollinger Bands chart, a popular technical analysis tool he developed. For context, Bollinger Bands are a type of statistical chart characterizing the prices and volatility of an asset over time.

They consist of a set of three lines: the middle line typically represents the simple moving average of the asset’s price, and the other two lines are plotted at a standard deviation above and below the average. This tool helps traders to assess market conditions and potential price movements.

I think it breaks higher. $btc

— John Bollinger (@bbands) January 4, 2024

Bollinger’s prediction using this methodology indicates a positive outlook for Bitcoin, especially significant in light of the recent market turbulence.

Bitcoin’s Recovery And $50,000 Price Target

So far, Bitcoin’s journey in the crypto market has been marked by resilience, as evidenced by its recovery from a notably down turn in the market that resulted in the asset to trade in the $40,000 region.

Currently trading above the $43,000 mark, Bitcoin has shown a 3% growth in the past 7 days. This rebound is particularly noteworthy following a bearish report from Matrixport concerning a rejection of spot Bitcoin exchange traded funds (ETFs) by the US Securities and Exchange Commission (SEC).

Joining Bollinger in bullish predictions is Dan Gambardello, another well-respected analyst in the crypto space. Gambardello has projected an upward breakout for Bitcoin, potentially leading the digital currency to reach the $50,000 mark in the short-term and $60,000 in the long term.

This projection is tied to the anticipation of a spot Bitcoin ETF approval, which could serve as a significant catalyst for Bitcoin’s price movement. Gambardello explains that this upward trend would represent a historical breakthrough for Bitcoin, especially in terms of breaking through the lower highs of its Fibonacci level.

Bitcoin ETF Ticking Time Bomb! Approval Could Trigger Historic Crypto Rally!

Intro 00:00

Big Grayscale news 1:10

Bitcoin ETF final stretch 2:30

BTC price pressure building 3:15

$50k Bitcoin target 5:10

BTC attempting something it’s never done 6:30

Bitcoin dominance and altcoins… pic.twitter.com/uZZ2YrblCO— Dan Gambardello (@cryptorecruitr) January 4, 2024

Notably, it is evident that the predictions from both Bollinger and Gambardello hinge significantly on the US SEC decision regarding the approval of a spot Bitcoin ETF. While optimism prevails, Gambardello has also cautioned that a rejection could lead to a decline in Bitcoin’s price, potentially dropping below $40,000 to find support around $37,000.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

John Chambers expects an AI bubble with many failures, ‘but it is worth the bet’

Silicon Valley legend John Chambers is sold on artificial intelligence, but he sees choppy times in its near future.

“Going into 2024, it will be the decade of AI in front of us, which will dwarf the size of the internet and cloud eras combined,” Chambers, who runs venture fund JC2, said in an interview Monday.

“Is it a bubble? Yeah. There are too many players, and the majority of [AI companies] will fail, but it is worth the bet,” Chambers warned. All 20 of his startups have an AI strategy, he added.

Indeed, the AI innovation wave is sweeping the U.S. and the rest of the world, allowing places like West Virginia and India to “play at a different level,” Chambers said.

Before, “if you weren’t in Silicon Valley or New York or maybe Austin, you could not participate,” he said. “West Virginia is now the No. 3 state in the U.S. in terms of percentage growth for the number of startups.”

“In India, pre-[Prime Minister Narenda] Modi, it was the slowest-moving democracy,” Chambers said. “Now, it is the most innovative in the world and most optimistic. It will become the No. 1 GDP country in the world within 30 to 40 years.”

In what has become an annual tradition for the former longtime Cisco Systems Inc.

CSCO,

chief executive, Chambers dusted off his crystal ball and made his usual bold predictions for the year ahead in tech.

What he sees is a rebounding stock market — “I’m more optimistic than in two years for a soft landing and a reasonably good year,” he said — and increased M&A activity leading to a resurgence in initial public offerings after a long rough patch. Accelerating it all is AI, which he deems transformative and essential for the survival of Fortune 500 companies, most of which he believes will fade away in a couple decades regardless.

The pressure is on, in an escalating digital arms race that entered a new phase with a groundbreaking product last week. Alphabet Inc.’s

GOOGL,

GOOG,

Google unfurled Gemini as the company’s “largest and most capable AI model” — one designed to supercharge everything from Google’s consumer apps to Android smartphones.

Read more: Gemini, Google’s long-awaited answer to ChatGPT, is an overnight hit

Though he foresees staggering innovation from Gemini with a major impact on the AI playing field, C3.ai Inc.

AI,

CEO Tom Siebel contends it’s anyone’s race to win. “It could be OpenAI, Anthropic, Google or someone else. It will take three to four years to shake out,” he said in an interview last week. The billionaire pointed to the success of companies like Microsoft Corp.

MSFT,

Intel Corp.

INTC,

Amazon.com Inc.

AMZN,

and others that “came out of nowhere” to become dominant vendors in their respective fields.

Chambers agrees it is a “completely wide-open competition,” but Apple Inc.

AAPL,

Google, Microsoft and Amazon could “crush competition” in their zeal to sew up the market.

Rakesh Malhotra, a former Microsoft executive who is co-founder of consulting firm Nuvalence, believes Apple will “crash the AI party” with a “flood of AI-first products.” He believes Apple, which makes its own chips and is a leader in privacy and data, will incorporate AI capabilities into the iPhone after rivals establish the AI market.

“Your entire life is on your phone, and they (Apple) vow to protect your data,” Malhotra said in an interview.

There will be bumps in the road, Chambers acknowledged, ranging from legislation to government oversight as Big Tech scrambles to dominate AI.

European Union policymakers agreed Friday on the AI Act, comprehensive regulation for artificial intelligence that makes the E.U. the first governing body to pass AI legislation of its kind. It covers AI’s riskiest uses by companies and governments, including those for law enforcement and the operation of crucial services like water and energy.

Vijay Balasubramaniyan, co-founder and CEO of Pindrop, a cybersecurity firm funded by Chambers’s VC firm, was among those who attended an AI forum hosted last week by Sen. Chuck Schumer, the New York Democrat. The top concern at the meeting was deepfakes, or misleading video clips created in AI that are being used to influence commerce, social media and online communications.

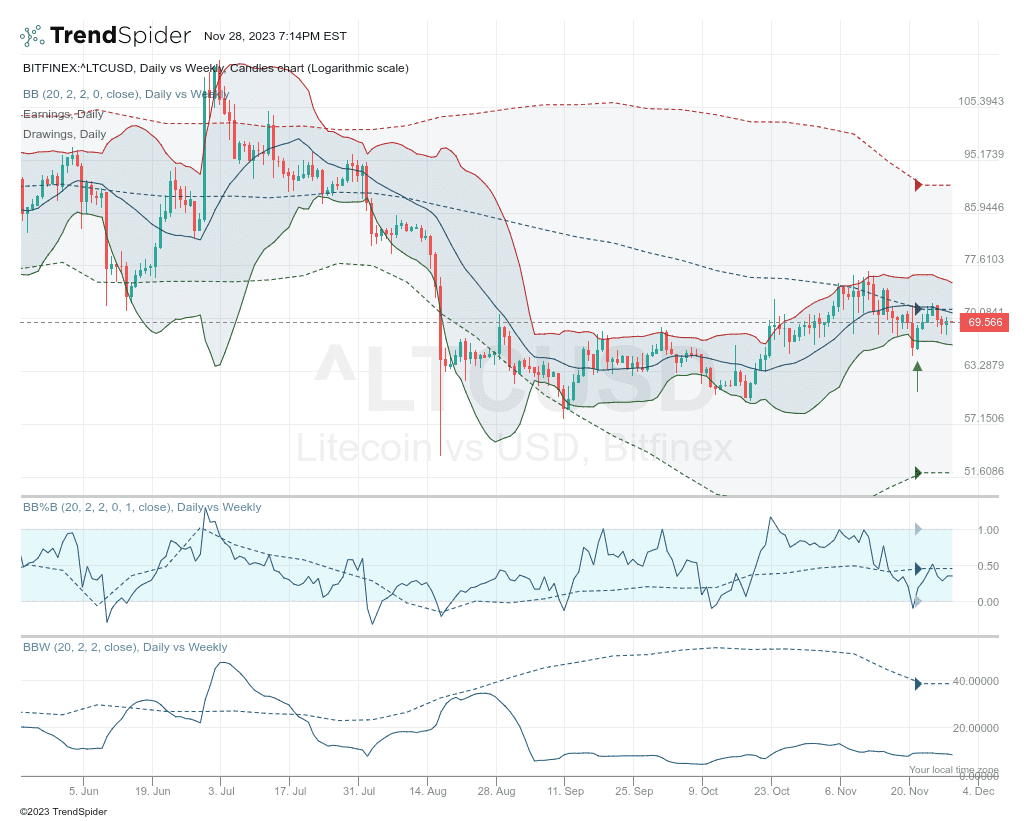

In his latest analysis, legendary trader John Bollinger has expressed concerns over Litecoin’s performance, particularly in comparison to Bitcoin. Bollinger, known for developing the popular technical analysis tool Bollinger Bands, highlighted a worrying pattern in the Litecoin market.

He remarked, “I was asked for an analysis of LTCBTC. The thing that concerns me the most is its underperformance vs Bitcoin. From a price perspective the controlling LTCUSD feature is the 2 bar reversal at the lower Bollinger Band which is typically considered a bearish signal by traders.”

Bollinger’s Bearish Litecoin Prediction Explained

The chart of the LTC/USD pair provided by Bollinger on November 28, 2023, shows Litecoin’s price action in relation to its Bollinger Bands on both a daily and weekly scale. The price is currently hovering around $69.566, which is significantly lower than the upper Bollinger Band, suggesting a lack of bullish momentum.

The Bands form by plotting a range of standard deviations above and below a simple moving average, commonly enveloping the price action. In this chart, the daily vs. weekly candles chart shows that the LTC/USD price is struggling beneath the midpoint of these bands, which is a bearish indication. The price currently near $69.566 is substantially below the upper band level of around $90, which represents a potential resistance level.

The Bollinger Bands (BB) on the chart are set with a 20-period moving average with a 2 standard deviation range. Bollinger’s analysis points to a ‘2 bar reversal’ pattern at the lower band. This pattern emerges when a bar reaches a high above the preceding bar but then closes below the close of that same previous bar, hinting at a possible reversal from the uptrend. Such a pattern took place near the lower band, indicating that any effort to drive the price higher meets with resistance, and the prevailing selling pressure is taking hold.

The Bollinger %B indicator is also crucial here as it compares the price of Litecoin to the range defined by the Bollinger Bands. A %B value below 0.5 indicates that Litecoin’s price sits nearer to the lower band than to the upper band, potentially signaling weakness. The chart shows the indicator failing to cross the 0.5 level after a plunge toward 0, signifying that the price frequently touches or falls below the lower band.

LTC Price Under Pressure

The Bollinger Band Width (BBW) serves as another indicator, measuring volatility by assessing the Bollinger Bands’ width. A narrowing of the Bands, as seen in the latter part of the chart, suggests a decrease in volatility and often precedes a significant price movement. In this context, the BBW’s narrowing on the Litecoin chart might indicate that the market is tensing, possibly gearing up for an impending breakout or breakdown.

When Bollinger mentions Litecoin’s underperformance relative to Bitcoin, it’s important to note that Bitcoin often leads the crypto market trend. If Litecoin is not keeping up with Bitcoin’s movements, it could suggest a lack of confidence or interest from traders in altcoins (as the current rise in Bitcoin dominance shows) and Litecoin specifically.

In summary, Bollinger’s technical analysis indicates that Litecoin is in a precarious position. The price action at the lower Bollinger Band, the bearish ‘2 bar reversal’ pattern, the sub-0.5 Bollinger %B values, and the narrowing BBW all suggest that Litecoin may continue to see downward pressure in the near term.

At press time, Litecoin traded at $70.05. The 1-day chart of LTC/USD shows that the altcoin fell below the key support of the 0.236 Fibonacci retracement level at $69.98 two days ago. A retest is currently taking place, a daily close above this is of utmost importance for the Litecoin price.

Featured image from Unsplash / Kanchanara, chart from TradingView.com

SafeMoon CEO John Karony’s bail postponed while courts assess level of flight risk

According to court documents dated Nov. 9, a judge has partially granted U.S. prosecutors’ request to counter the bail of John Karony, the CEO of crypto platform SafeMoon.

A filing from New York prosecutors indicates that a Utah magistrate judge, Daphne A. Oberg, issued Karony’s release order on Nov. 8. Karony’s bail included a $500,000 bond plus conditions of house arrest and restrictions on financial activities.

However, Prosecutors for the Eastern District of New York said the Utah judge did not consider Karony’s finances and his ability to flee. Specifically, they said that Karony had millions of dollars of assets that the court was not aware of, including a Utah home currently being sold for $1.5 million, various expensive items, and money in an unnamed company.

The Nov. 9 filing states that Karony’s release order will be stayed (paused) until the matter is resolved. That filing is signed by District Judge LaShann DeArcy Hall for the Eastern District of New York, where Karony’s criminal case is proceeding.

The order does not revoke Karony’s bail in its entirety, require Karony to remain in custody until trial or require Karony to be transferred to the Eastern District of New York.

The government added that Karony has strong ties outside of the U.S. and asserted that there are no conditions that could ensure that he continues to appear.

Prosecutors noted that Karony has “shown a desire to remain abroad” since working on SafeMoon. Specifically, they said that Karony took twelve trips to Europe in just over two years. Most recently, they said, Karony was outside of the U.S. for five months before returning on Oct. 27. He planned to stay in the U.S. for just weeks.

Prosecutors filed charges this month

The U.S. Attorney’s Office for the Eastern District of New York alleged on Nov. 1 that Karony and other SafeMoon executives had committed securities fraud, conspiracy to commit wire fraud, and money laundering conspiracy.

The agency said that Karony and other executives had manipulated SafeMoon (SFM) prices and misappropriated millions of dollars locked in SafeMoon liquidity pools. The executives spent those funds on luxury vehicles, real estate, and personal investments.

The U.S. Securities and Exchange Commission, which filed parallel charges, suggested that executives had appropriated $200 million from their project in total.

John Grisham, George R.R. Martin, other prominent authors sue OpenAI

Sam Altman, CEO of ChatGPT maker OpenAI, arrives for a bipartisan Artificial Intelligence Insight Forum for all U.S. senators hosted by Senate Majority Leader Chuck Schumer at the U.S. Capitol in Washington, D.C., Sept. 13, 2023.

Craig Hudson | Reuters

A group of prominent U.S. authors, including Jonathan Franzen, John Grisham, George R.R. Martin and Jodi Picoult, has sued OpenAI over alleged copyright infringement in using their work to train ChatGPT.

The lawsuit, filed by the Authors Guild in Manhattan federal court on Tuesday, alleges that OpenAI “copied Plaintiffs’ works wholesale, without permission or consideration … then fed Plaintiffs’ copyrighted works into their ‘large language models’ or ‘LLMs,’ algorithms designed to output human-seeming text responses to users’ prompts and queries.”

The proposed class-action lawsuit is one of a handful of recent legal actions against companies behind popular generative artificial intelligence tools, including large language models and image-generation models. In July, two authors filed a similar lawsuit against OpenAI, alleging that their books were used to train the company’s chatbot without their consent.

Getty Images sued Stability AI in February, alleging that the company behind the viral text-to-image generator copied 12 million of Getty’s images for training data. In January, Stability AI, Midjourney and DeviantArt were hit with a class-action lawsuit over copyright claims in their AI image generators.

Microsoft, GitHub and OpenAI are involved in a proposed class-action lawsuit, filed in November, which alleges that the companies scraped licensed code to train their code generators. There are several other generative AI-related lawsuits currently out there.

“These algorithms are at the heart of Defendants’ massive commercial enterprise,” the Authors Guild’s filing states. “And at the heart of these algorithms is systematic theft on a mass scale.”