JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

JPMorgan has warned of a downside risk in crypto markets, citing subdued crypto venture capital flows. The global investment bank’s analysts also remain cautious about the U.S. Securities and Exchange Commission (SEC) greenlighting spot ethereum exchange-traded funds (ETFs) in May. Crypto Market’s Downside Risk Warning Global investment banking giant JPMorgan published a report on Thursday, […]

Source link

JPMorgan

Bitcoin Troubles Far From Over As More Carnage Looms, JPMorgan Analysts

Despite optimism about Bitcoin’s future trajectory heading into the Bitcoin Halving, analysts at JPMorgan have raised concerns that things may not go according to everyone’s expectations. They believe that a storm still lies ahead for the flagship crypto token before any massive move to the upside.

Further Bitcoin Pullbacks Are To Be Expected

According to a Bloomberg report, JPMorgan strategists have warned that Bitcoin could still experience further pullbacks following its recent decline. They alluded to the recent net outflows recorded by the Spot Bitcoin ETFs, which underscored the current bearish sentiment in the Bitcoin ecosystem.

These strategists, led by Nikolaos Nikolaos Panigirtzoglou, also highlighted the sustained open interest in CME Bitcoin futures as another bearish signal for Bitcoin’s price. They further argue that Bitcoin “still looks overbought” and expect further price dips leading up to the Halving event in mid-April.

Meanwhile, these JPMorgan analysts emphasized the decline in net inflows into Spot ETFs, noting that this proves that a sustained one-way net inflow is not possible. Therefore, they expect investors in these funds to keep taking profits heading into the Bitcoin Halving. This wave of profit-taking is also more likely, considering that Bitcoin “still looks overbought despite the past week’s correction.” they claimed.

This recent research note by JPMorgan further reaffirms their bearish sentiment towards Bitcoin’s price despite the flagship crypto exceeding expectations. Last month, the bank predicted that Bitcoin could drop to as low as $42,000 after April as “Bitcoin-halving-induced euphoria subsides.”

Naeem Aslam, chief investment officer at Zaye Capital Markets, also echoed JPMoragn’s sentiments when he suggested that Bitcoin’s recent rally didn’t show enough strength. Aslam believes Bitcoin could fall below $50,000 if the Halving event “fails to really keep the momentum going.”

What Could Happen After The Halving Event

Crypto trader and analyst Rekt Capital recently provided insights into what could happen after the Havling event while elaborating on the four phases of Bitcoin Halving. According to him, there is usually a re-accumulation period after the Halving, which could last for up to five months.

During this period, he noted that many investors get “shaken out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the Halving.” Rekt Capital added that this time could be different since it is the first time this re-accumulation could develop around the new all-time high (ATH) area.

Therefore, he believes this “Re-Accumulation Range may simply take the shape of a regular sideways range and may not last very long before additional uptrend continuation.”

BTC price struggles to establish support | Source: BTCUSD on Tradingview.com

Featured image from Crypto News, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Mega Whale Resurfaces, JPMorgan Expects BTC Price to Drop, Bitcoin Cash Soars 40%, and More — Week in Review

A significant bitcoin “mega whale” moved 3,000 vintage bitcoins from 2010 as BTC peaked at $69,210. JPMorgan predicted a post-halving drop in bitcoin’s price to $42,000, citing current euphoria levels. Meanwhile, bitcoin cash experienced a 40% surge in anticipation of its halving event and a major 2024 upgrade. Additionally, rumors circulated about a Qatari billionaire’s […]

A significant bitcoin “mega whale” moved 3,000 vintage bitcoins from 2010 as BTC peaked at $69,210. JPMorgan predicted a post-halving drop in bitcoin’s price to $42,000, citing current euphoria levels. Meanwhile, bitcoin cash experienced a 40% surge in anticipation of its halving event and a major 2024 upgrade. Additionally, rumors circulated about a Qatari billionaire’s […]

Source link

JPMorgan CEO Jamie Dimon Says Artificial Intelligence (AI) “Can Do Things That the Human Mind Simply Cannot Do.” 1 Stock to Buy if He’s Right.

In an interview last week, JPMorgan Chase CEO Jamie Dimon waded into the debate regarding the advent of artificial intelligence (AI) and the potential applications of this groundbreaking technology. While some market watchers suggest there’s simply too much hype around these next-generation algorithms, Dimon disagrees.

“When we had the internet bubble the first time around … that was hype. This is not hype. It’s real,” Dimon told CNBC’s Leslie Picker in an interview. He went even further, arguing that AI will eventually “be used in almost every job” and could even cure cancer, “because it can do things the human mind simply cannot do.”

Image source: Getty Images.

One AI stock to buy if Dimon is right

One company that’s been at the cutting edge of AI for more than two decades is Palantir Technologies (PLTR 1.15%). The company was initially envisioned as a way to dig through public and intelligence databases to make needed connections that would help detect potential terrorism and stop those responsible before they could mount an attack.

However, Palantir soon discovered that the same AI-powered data analytics — if let loose on enterprise data — could provide actionable intelligence that companies can use to gain an edge. Palantir’s software can be customized for a variety of use cases, providing data analysis and visualization, detecting patterns in the data that might be missed by humans, and helping businesses make data-driven decisions.

The results are telling. In the fourth quarter, Palantir’s revenue grew 20% year over year to $608 million, driven by U.S. commercial revenue that grew 70%. The company also logged its fifth consecutive quarter of generally accepted accounting principles (GAAP) profitability.

Most recently, Palantir developed its Artificial Intelligence Platform (AIP), a generative AI tool that integrates with Palantir’s existing systems, providing feature-rich AI-powered functions in a system that “can be up and running in as little as a few hours,” according to the company. As a result, Palantir’s product pipeline is more robust than ever.

That highlights why Palantir is the one stock to buy as the adoption of generative AI gains steam.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Palantir Technologies. The Motley Fool has positions in and recommends JPMorgan Chase and Palantir Technologies. The Motley Fool has a disclosure policy.

JPMorgan has cautioned investors that the price of bitcoin could fall to $42,000 after the halving event in April. The global investment bank’s analysts explained that $42K is the level they “envisage bitcoin prices drifting towards once bitcoin-halving-induced euphoria subsides after April.” The bank also recently stated that the bitcoin halving and the next major […]

JPMorgan has cautioned investors that the price of bitcoin could fall to $42,000 after the halving event in April. The global investment bank’s analysts explained that $42K is the level they “envisage bitcoin prices drifting towards once bitcoin-halving-induced euphoria subsides after April.” The bank also recently stated that the bitcoin halving and the next major […]

Source link

JPMorgan Says Bitcoin Halving and Ethereum Upgrade ‘Are Largely Priced In’

JPMorgan Chase has discussed three main catalysts driving crypto prices over the coming months. The global investment bank’s analysts believe that the Bitcoin halving event and the next major upgrade of the Ethereum network are largely priced in. JPMorgan on Catalysts Affecting Crypto Prices Global investment bank JPMorgan Chase has provided its insights into three […]

JPMorgan Chase has discussed three main catalysts driving crypto prices over the coming months. The global investment bank’s analysts believe that the Bitcoin halving event and the next major upgrade of the Ethereum network are largely priced in. JPMorgan on Catalysts Affecting Crypto Prices Global investment bank JPMorgan Chase has provided its insights into three […]

Source link

Bitcoin ETFs Boosts Coinbase (COIN) Shares As JPMorgan Upgrades Rating

The recent Bitcoin rally, propelling its price to the $52,000 level, has positively impacted the stock of US-based cryptocurrency exchange Coinbase (COIN). After experiencing a notable dip to $115 at the start of February, Coinbase’s stock rose to $172 on Thursday, following a significant upgrade by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

According to a Bloomberg report, JPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As Bitcoin traded higher, Coinbase shares gained as much as 7.8% following the upgrade. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to shift his rating back to neutral.

This change in stance comes after Worthington’s January downgrade, where he predicted a potential deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

However, contrary to his previous forecast, Bitcoin ETFs have been successful in terms of trading measures, and the price of Bitcoin has surged beyond $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining but improving activity levels and Coinbase’s earnings power as we look to 1Q24.

Coinbase’s stock experienced an 8% dip at the beginning of the year, following an impressive 400% surge in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations being roughly evenly split.

Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is scheduled to be released after the market closes on Thursday.

Worthington emphasized that Coinbase’s business is closely tied to token prices, with its core revenue being transaction-based. As the value of tokens increases and trading activity gains momentum, fees based on the value traded are expected to drive higher trading volumes, ultimately contributing to improved revenue for Coinbase.

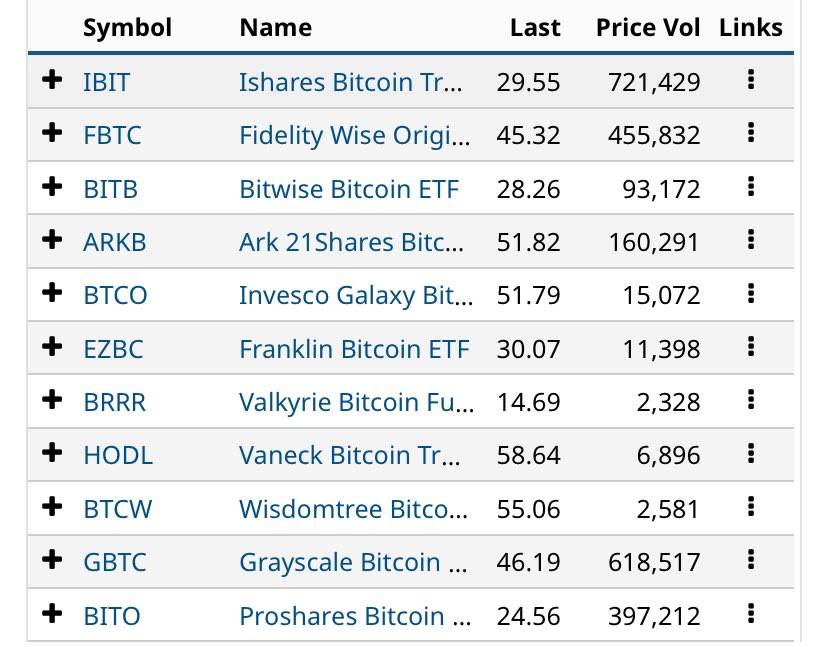

Bitcoin ETFs Witness Significant Trading Volume

On February 14th, the trading volume of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in volume.

Grayscale’s Bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity’s FBTC secured the third spot with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The nine ETFs’ total trading volume amounted to approximately $1.5 billion. Notably, the largest ETFs experienced higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, before the trading session, GBTC sent less than half of the Bitcoin it sent to Coinbase the previous day. Despite this decrease, GBTC’s total trading volume was 50% higher.

As the demand for Bitcoin continues to surge, ETFs play a crucial role in facilitating institutional and retail investors’ participation in the cryptocurrency market. The increased trading volume of Bitcoin ETFs highlights investors’ growing interest and confidence in digital assets.

Currently, Bitcoin is trading at $51,900 and encountering a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’

The scale of derivatives held by major banks like JPMorgan Chase & Co., Citibank and Goldman Sachs, amounting to $203 trillion, has raised concerns about the potential risks these positions might pose to the global economy. The third-quarter Quarterly Report on Bank Trading and Derivatives Activities, published by the Office of the Comptroller of Currency, provides a comprehensive dive into this issue.

This figure surpasses the world’s gross domestic product (GDP) by roughly double, highlighting the enormity of the market.

JPMorgan Chase, in particular, is noted for its substantial exposure to derivatives risk, topping the list with roughly $58 trillion in derivatives. The mounting scale of derivatives owned by banks raises several questions and concerns among regulators and investors.

Don’t Miss:

The 15-digit number has recently drawn speculation among retail investors on social media platforms like Reddit and TikTok. But as recently as March 9, 2023, Congress held a hearing on managing volatility in global commodity derivatives markets.

A derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index or interest rate. Derivatives can be used to offset risks in the future or used as leverage to increase gains or losses.

But it’s unlikely the banks are the ones holding these derivatives. Rather, many of the top banks act as market makers for entities buying and selling derivatives.

While these banks have large derivative positions on their balance sheets, the notional value is a fraction of the total derivatives market. This is because there are typically two sides to every trade: a short and a long. Because each side has a bullish and bearish position, the total size of the derivatives market doesn’t necessarily correlate to risk.

Trending: Copy and paste Mark Cuban’s startup investment strategy according to his colorful portfolio.

According to the Federal Reserve, the total long exposure for financial derivatives for hedge funds, for example, has remained largely unchanged since being tracked in 2012. There was a large spike between 2017 and 2018, but as the total derivatives market size increased, the notional value slowly approached 0. Hedge funds have a total long exposure of about $1 trillion.

The banks likely don’t hold exposure to most of these individual positions. They are market makers for these transactions and largely facilitate the transactions between parties. Those parties often use the derivatives market to manage risk by hedging their bets or using swaps to limit future exposure.

This isn’t to say there isn’t significant market exposure to derivatives. By all metrics, the use of derivatives is increasing. Between the first quarter of 2022 and the third quarter of 2023, the notional amounts of derivatives increased by about $10 trillion. If an entity mismanages its risks and becomes too exposed to derivatives, there could be risks associated with those trades. But regulatory measures like the Dodd-Frank Act and higher capital requirements imposed by the Federal Reserve are regularly used to mitigate such risks.

A larger concern is the lack of reporting and availability of data surrounding the derivatives market. For example, a recent BIS article highlighted the growing trillions in missing debt created by certain derivatives. Forex swaps, forwards and currency swaps create debts that don’t appear on balance sheets and most debt statistics. Swaps such as these are an underlying common denominator for many financial crises and shocks to the system, causing entities to fail or creating funding squeezes. These off-sheet debts are estimated to be at a staggering $97 trillion globally across all currencies and growing fast.

The lack of reporting for these debts makes it difficult to predict future recessions and make policy regulating derivatives.

The $203 trillion in derivatives held by major banks underscores a complex financial landscape where the interplay of risk management and market speculation is pivotal. While banks often act as intermediaries rather than principal holders, the sheer size of these positions raises questions about systemic risk and market stability.

Regulatory frameworks and reporting standards, although improved, still face challenges in fully capturing the nuances of the derivatives market. The need for enhanced transparency and oversight in the sector remains critical, particularly in light of the growing off-balance-sheet debts that continue to elude conventional monitoring mechanisms.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Is $203 Trillion In Derivatives Held By Goldman Sachs, JPMorgan And Other Top Banks Causing an ‘Everything Bubble?’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.