“There was a lot going on and I have lots of regrets, but I can’t go back and change anything.”

Source link

Judge

UK Judge Freezes Craig Wright’s Assets Worth $7M Amid Satoshi Nakamoto Identity Dispute

After Judge James Mellor in the U.K. rendered his decision in the notable lawsuit initiated by the Crypto Open Patent Alliance (COPA) against Craig Wright, he concluded that Wright did not embody the persona of the pseudonymous Satoshi Nakamoto. Subsequently, Mellor enforced a worldwide injunction on Wright’s holdings, freezing assets valued at £6.7 million (approximately […]

After Judge James Mellor in the U.K. rendered his decision in the notable lawsuit initiated by the Crypto Open Patent Alliance (COPA) against Craig Wright, he concluded that Wright did not embody the persona of the pseudonymous Satoshi Nakamoto. Subsequently, Mellor enforced a worldwide injunction on Wright’s holdings, freezing assets valued at £6.7 million (approximately […]

Source link

TRON DAO Reveals Exciting Updates to Sponsor and Judge List for HackaTRON Season 6

Geneva, Switzerland, March 28, 2024 – HackaTRON Season 6, co-hosted between TRON DAO, HTX DAO, BitTorrent Chain, and JustLend DAO, introduces an exciting lineup of new sponsors, partners, and judges.

Showcasing HackaTRON Sponsors

Diamond Sponsors:

Ankr: Specializing in decentralized infrastructure services for DApp development, Ankr supports the seamless integration and deployment of blockchain applications.

ChainGPT: Platform that merges the power of AI with blockchain to significantly enhance Web3’s accessibility and efficiency. Contributing to the discerning panel of judges, ChainGPT introduces:

Ilan Rakhmanov, Founder & CEO: A visionary entrepreneur with a knack for blending coding, compliance, and business to guide ChainGPT’s strategic direction.

Sharon Sciammas, CMO: Armed with vast tech marketing knowledge, Sharon aims to broaden the event’s impact and participant engagement.

Max Martinez, Advisor: With his expertise in AI, FinTech, Blockchain, and Web3, Max offers invaluable insights into product strategy and innovation.

AI-Tech Solidius: A champion of eco-friendly computing and a marketplace linking AI and blockchain, emphasizing sustainable tech development. Joining the judge lineup from AI-Tech Solidius are:

Paul Farhi, Founder & CEO: Leading with a vision for integrating AI within blockchain, driving the future of decentralized technologies.

Talha Tayyab, Marketing Manager: Brings strategic marketing insights to highlight innovative solutions and engage the global community.

Adrian Stoica, Founder and Head of Technology and Development: Offers a deep tech perspective to evaluate the technical robustness of projects.

Platinum Sponsor:

Kima: A decentralized protocol for blockchain-based money transfers, enabling interchain transactions and accessibility for any user across any blockchain. It promotes an innovative approach to liquidity management and transaction assurance, ensuring seamless and secure transfers every time.

Gold Sponsor:

GT-Protocol: As our Gold Sponsor, GT-Protocol revolutionizes DeFi with its suite of decentralized tools aimed at enhancing efficiency and transparency. Embracing the core values of open finance, GT-Protocol brings to the judge’s table:

Balaban Vladyslav, Co-founder: A fervent blockchain advocate, investor, entrepreneur, futurist, and the driving force behind GT Protocol’s innovative vision.

Celebrating Strategic Partnerships and Industry Experts

HackaTRON Season 6’s innovation and integrity are amplified by the diverse expertise of our partners and their distinguished judges:

Huawei Cloud: Represented by Bian Wenchao, who is spearheading the charge towards a vibrant Web3 ecosystem.

Blockchain.com: Matt Arney, leading business development, brings a dynamic approach to fostering startup growth within the blockchain space.

ChainSecurity: Pietro Carta, a Blockchain Security Engineer known for identifying and mitigating critical vulnerabilities in blockchain infrastructures.

ChainAnalysis: Pablo Navarro, Technical PMM & Developer Marketing, combines his Web3 experience with offensive security to enhance blockchain safety.

Nansen: Edward Wilson, Social Media Manager, offering insights into on-chain data and DeFi from a user experience perspective.

Into The Block: Nicolas Contasti, Head of Sales & Business Development, shares his rich experience from transforming today’s financial services industry through blockchain and crypto innovations.

CryptoQuant: Ben Sizelove, Senior Data Consultant, represents CryptoQuant’s commitment to providing top-notch on-chain and market data analytics.

CryptoRank: Sergei Zubakov, a chief analyst with deep expertise in the DeFi sector, adds a layer of analytical prowess to the event.

Arkham: Alexander Lerangis, Head of Business Development, focuses on leading Arkham’s partnerships, branding, and growth initiatives.

Unprecedented Prize Pool and Community Engagement

With up to $650,000* in prizes, including $500,000 in TRX, TRON network’s native utility token, and $150,000 in energy, which can be used to subsidize transactions and smart contract interactions on the TRON network. HackaTRON Season 6 invites developers to demonstrate their skills and contribute to the ecosystem’s growth. View HackaTRON Season 6 for more details.

*All prizes are issued in TRX or TRON network Energy, not USD, restrictions applied. All contest rules can be viewed here:

About TRON DAO

TRON DAO is a community-governed DAO dedicated to accelerating the decentralization of the internet via blockchain technology and dApps.

Founded in September 2017 by H.E. Justin Sun, the TRON network has continued to deliver impressive achievements since MainNet launch in May 2018. July 2018 also marked the ecosystem integration of BitTorrent, a pioneer in decentralized Web3 services boasting over 100 million monthly active users. The TRON network has gained incredible traction in recent years. As of March 2023, it has over 217.61 million total user accounts on the blockchain, more than 7.27 billion total transactions, and over $25.91 billion in total value locked (TVL), as reported on TRONSCAN.

In addition, TRON hosts the largest circulating supply of USD Tether (USDT) stablecoin across the globe, overtaking USDT on Ethereum since April 2021. The TRON network completed full decentralization in December 2021 and is now a community-governed DAO. Most recently in October 2022, TRON was designated as the national blockchain for the Commonwealth of Dominica, which marks the first time a major public blockchain partnered with a sovereign nation to develop its national blockchain infrastructure. On top of the government’s endorsement to issue Dominica Coin (“DMC”), a blockchain-based fan token to help promote Dominica’s global fanfare, seven existing TRON-based tokens – TRX, BTT, NFT, JST, USDD, USDT, TUSD, have been granted statutory status as authorized digital currency and medium of exchange in the country.

TRONNetwork | TRONDAO | Twitter | YouTube | Telegram | Discord | Reddit | GitHub | Medium | Forum

Media Contact

Hayward Wong

press@tron.network

The post TRON DAO Reveals Exciting Updates to Sponsor and Judge List for HackaTRON Season 6 appeared first on CryptoSlate.

SEC Asks Judge to Fine Ripple $2 Billion in XRP Case — Ripple CEO Says ‘There Is Absolutely No Precedent for This’

The U.S. Securities and Exchange Commission (SEC) is seeking nearly $2 billion in fines from Ripple Labs in the ongoing XRP lawsuit. “There is absolutely no precedent for this,” exclaimed Ripple’s CEO regarding the $2 billion fine. “We will continue to expose the SEC for what they are when we respond to this.” SEC Wants […]

The U.S. Securities and Exchange Commission (SEC) is seeking nearly $2 billion in fines from Ripple Labs in the ongoing XRP lawsuit. “There is absolutely no precedent for this,” exclaimed Ripple’s CEO regarding the $2 billion fine. “We will continue to expose the SEC for what they are when we respond to this.” SEC Wants […]

Source link

US Judge Backs SEC: Trading of Certain Cryptocurrencies on Secondary Markets Are Securities Transactions

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

Source link

Ripple must provide financial statements at SEC’s request, judge rules

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

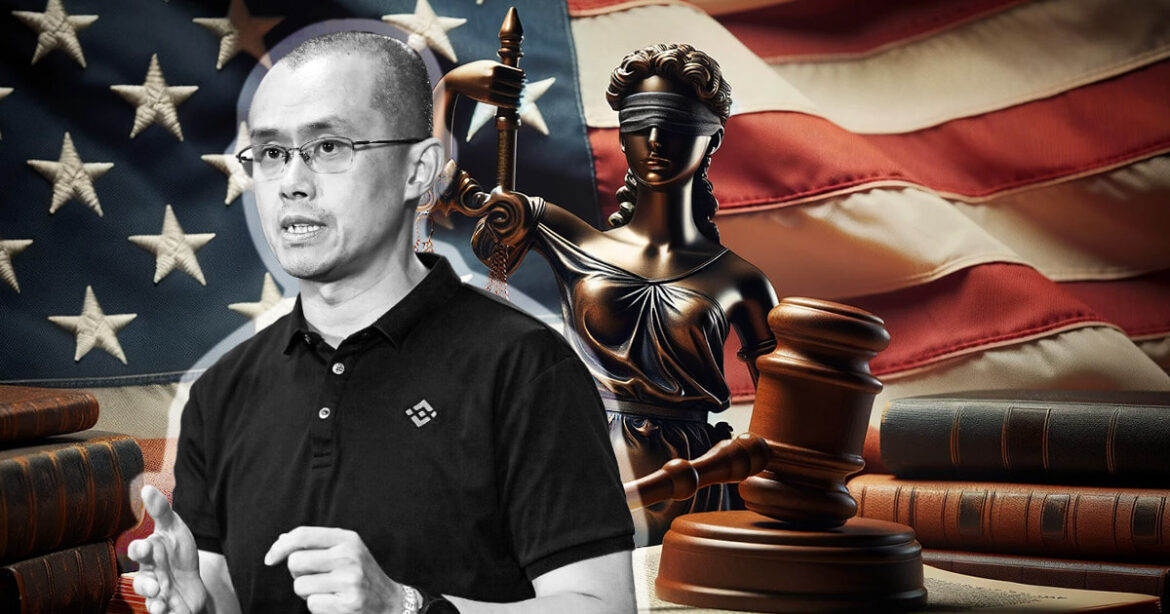

A U.S. District Court has once again denied Binance founder Changpeng ‘CZ’ Zhao’s request to travel internationally in a sealed order, Bloomberg News reported.

CZ, who is currently facing sentencing in the U.S. for criminal charges, had filed a motion seeking permission to visit the UAE, where his family resides. The motion was rejected by Judge Richard Jones of the Western District of Washington on Dec. 29.

It is the second instance where CZ’s travel request has been blocked. The primary concern raised by prosecutors is the potential flight risk posed by CZ, who is worth billions and a citizen of the UAE, which does not have an extradition treaty with the U.S.

The decision comes despite CZ’s efforts to present arguments against the restriction. The details of the arguments against the travel ban remain sealed in the court’s ruling.

Awaiting sentencing

CZ, who has been a pivotal figure in the cryptocurrency and blockchain industry through his leadership of Binance, pleaded guilty last month to a violation of the Bank Secrecy Act. Following his plea, he was released on a substantial personal recognizance bond of $175 million, accompanied by various financial conditions.

Founded in 2017, Binance rapidly emerged as a significant player in the crypto space, known for its extensive range of cryptocurrencies and competitive fees. CZ, a Chinese-Canadian business executive with a robust background in software development and trading systems, has been instrumental in the company’s meteoric rise and influence in the industry.

The exchange’s rapid growth meant it sometimes cut corners and did not have robust compliance measures in place, which allowed some illicit actors to misuse the platform for money laundering and illegal transactions. These lapses eventually attracted regulatory attention, with concerns about money laundering and the lack of stringent know-your-customer (KYC) processes.

Regulatory control

CZ’s legal challenges come amid a broader regulatory effort to establish control over the cryptocurrency market, historically characterized by its lack of regulation. This effort includes enforcing stringent AML and KYC protocols, which have become focal points for governments worldwide, particularly in the U.S.

The case against Zhao and Binance highlights the tension between the decentralized nature of cryptocurrencies and the regulatory frameworks of global financial systems. The outcome of Zhao’s legal proceedings is seen as pivotal, with potential implications for the operational and regulatory future of cryptocurrency exchanges globally.

CZ’s case represents a clash between the traditionally unregulated nature of cryptocurrencies and the established regulatory frameworks of global financial systems. It also raises questions about the future of decentralized finance (DeFi) and the balance between innovation in the crypto space and regulatory compliance.

Moreover, CZ’s situation reflects the cultural and economic challenges faced by international business executives operating in emerging technological sectors, especially in areas like DeFi, where innovation frequently outpaces regulation.

Celsius faces hurdle as judge hints at new vote for Bitcoin mining shift

Celsius Network, a cryptocurrency lending platform, might need to secure a fresh vote from creditors for its planned shift to a Bitcoin mining venture, suggested a U.S. bankruptcy judge in a recent court session.

The crypto lender provided details on Nov. 30, of its plan to only mine Bitcoin (BTC) once it emerges from bankruptcy, a scaled-down business that reflects guidance from regulators.

According to a report, Judge Martin Glenn, responsible for Celsius Network’s Chapter 11 proceedings, voiced displeasure on Nov. 30 regarding the abrupt change, emphasizing his repeated advisories to Celsius about the importance of reaching an agreement with the Securities and Exchange Commission.

Judge Glenn reportedly highlighted that the proposed transformation into a Bitcoin mining business deviates significantly from the deal creditors initially voted on, potentially encountering considerable resistance from creditors.

Celsius recently announced a scaled-back post-bankruptcy strategy, narrowing its focus to Bitcoin mining due to the U.S. Securities and Exchange Commission’s skepticism about its original business plans. While the SEC didn’t outright object to Celsius’ bankruptcy plan, the company stated that the agency was reluctant to endorse crypto lending and staking, activities it had previously disapproved of.

Celsius attorney Chris Koenig reportedly contended during the Nov. 30 hearing that the court-approved bankruptcy plan allowed the company the flexibility to shift to a mining-exclusive business. According to Koenig, a new vote isn’t necessary as the revised deal is equally beneficial for creditors.

As per the report, two customers, proceeding without legal representation, expressed dissent toward the agreement in the court documents, contending that Celsius should undergo complete liquidation instead.

Related: Celsius grants access to withdrawals for eligible crypto holders

Celsius filed for Chapter 11 protection in July 2022, one of several crypto lenders to go bankrupt following the industry’s rapid growth during the COVID-19 pandemic. The updated Celsius plan releases $225 million in cryptocurrency assets from the control of external investors, known as the Fahrenheit consortium, as outlined by Koenig.

Under the new proposal, Celsius creditors are projected to receive a 67% recovery, surpassing the 61.2% under the previous Fahrenheit arrangement, according to court records. During the preceding bid, the post-bankruptcy Bitcoin mining venture for Celsius will be overseen by US Bitcoin Corp, a participant in the consortium alongside Arrington Capital.

Magazine: Crypto’s ‘pro-rioter’ glitch artist stirs controversy — Patrick Amadon, NFT Creator

As part of the agreement, Voyager will be “permanently restrained and enjoined” from marketing or providing products or services related to digital assets.

On Tuesday, November 28, the federal judge approved an order requiring crypto lending firm Voyager Digital and its affiliates to pay $1.65 billion in monetary relief to the United States Federal Trade Commission (FTC).

In a November 28 filing in US District Court for the Southern District of New York, Judge Gregory Woods ordered Voyager to pay $1.65 billion following a settlement between the lending firm and the FTC announced in October.

As part of the agreement, Voyager will be “permanently restrained and enjoined” from marketing or providing products or services related to digital assets.

Judge Woods stated that the recently approved order is unlikely to significantly impact proceedings in the bankruptcy court. Voyager sought Chapter 11 protection in July 2022, revealing liabilities ranging from $1 billion to $10 billion. In May, the court greenlit a plan enabling Voyager users to receive an initial 35.72% of their claims from the lending firm.

As part of the settlement, entities linked to Voyager need to collaborate with FTC officials, participating in hearings, trials, and discovery processes. Voyager must also provide compliance reports after a year, subject to monitoring by the commission.

In October, both the US Commodity Futures Trading Commission (CFTC) and the FTC filed simultaneous lawsuits against former Voyager CEO Stephen Ehrlich, alleging misleading statements about the use and safety of customer funds. Ehrlich, at the time, also contended that Voyager’s team had consistently communicated and collaborated closely with regulators, largely refuting the allegations.

Furthermore, in a separate case in July, the FTC ordered crypto lending company Celsius to pay $4.7 billion in fees, accusing the co-founders of misappropriating user assets and providing misleading information to investors about the platform’s services. Former Celsius CEO Alex Mashinsky, arrested by US officials, remains free on bail until his trial, scheduled to commence in September 2024.

DCG Ends $620 Million Lawsuit with Genesis

In another development, Digital Currency Group (DCG) has reached a new repayment agreement with its bankrupt subsidiary, Genesis Global Holdco LLC, as part of a resolution to a lawsuit seeking approximately $620 million from DCG.

During a Tuesday hearing, Genesis lawyer Sean O’Neal stated that the deal is expected to provide the bankrupt cryptocurrency lender with around $200 million in value over the next few weeks. The agreement stipulates that DCG must fulfill outstanding payments by April 2024, and in the event of a default, Genesis retains the right to pursue the collection of any unpaid amount, according to court documents.

The proposed agreement aims to settle a lawsuit initiated by Genesis in September, seeking to recover outstanding loans from its parent company. Despite DCG making payments to Genesis since the lawsuit’s filing, court documents indicate that, as of Nov. 28, DCG still owes its subsidiary $324.5 million.

Genesis has expressed that the agreement will prevent lengthy and costly litigation with its parent company, ensuring that the bankrupt crypto lender receives partial repayment of its owed amount. However, O’Neal clarified that the deal does not address other disputes between Genesis and DCG related to the resolution of Genesis’s bankruptcy.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Judge rules against tribes in fight over Nevada lithium mine they say is near sacred massacre site

RENO, Nev. (AP) — A federal judge in Nevada has dealt another legal setback to Native American tribes trying to halt construction of one of the biggest lithium mines in the world.

U.S. District Judge Miranda Du granted the government’s motion to dismiss their claims the mine is being built illegally near the sacred site of an 1865 massacre along the Nevada-Oregon line.

But she said in last week’s order the three tribes suing the Bureau of Land Management deserve another chance to amend their complaint to try to prove the agency failed to adequately consult with them as required by the National Historic Preservation Act.

“Given that the court has now twice agreed with federal defendants (and) plaintiffs did not vary their argument … the court is skeptical that plaintiffs could successfully amend it. But skeptical does not mean futile,” Du wrote Nov. 9.

She also noted part of their case is still pending on appeal at the 9th U.S Circuit Court of Appeals, which indicated last month it likely will hear oral arguments in February as construction continues at Lithium Nevada’s mine at Thacker Pass about 230 miles (370 kilometers) northeast of Reno.

Du said in an earlier ruling the tribes had failed to prove the project site is where more than two dozen of their ancestors were killed by the U.S. Cavalry Sept. 12, 1865.

Her new ruling is the latest in a series that have turned back legal challenges to the mine on a variety of fronts, including environmentalists’ claims it would violate the 1872 Mining Law and destroy key habitat for sage grouse, cutthroat trout and pronghorn antelope.

All have argued the bureau violated numerous laws in a rush to approve the mine to help meet sky-rocketing demand for lithium used in the manufacture of batteries for electric vehicles.

Lithium Nevada officials said the $2.3 billion project remains on schedule to begin production in late 2026. They say it’s essential to carrying out President Joe Biden’s clean energy agenda aimed at combating climate change by reducing dependence on fossil fuels.

“We’ve dedicated more than a decade to community engagement and hard work in order to get this project right, and the courts have again validated the efforts by Lithium Americas and the administrative agencies,” company spokesman Tim Crowley said in an email to The Associated Press.

Du agreed with the government’s argument that the consultation is ongoing and therefore not ripe for legal challenge.

The tribes argued it had to be completed before construction began.

“If agencies are left to define when consultation is ongoing and when consultation is finished … then agencies will hold consultation open forever — even as construction destroys the very objects of consultation — so that agencies can never be sued,” the tribal lawyers wrote in recent briefs filed with the 9th Circuit.

Will Falk, representing the Reno-Sparks Indian Colony and Summit Lake Paiute Tribe, said they’re still considering whether to amend the complaint by the Dec. 9 deadline Du set, or focus on the appeal.

“Despite this project being billed as `green,’ it perpetrates the same harm to Native peoples that mines always have,” Falk told AP. “While climate change is a very real, existential threat, if government agencies are allowed to rush through permitting processes to fast-track destructing mining projects like the one at Thacker Pass, more of the natural world and more Native American culture will be destroyed.”

The Paiutes call Thacker Pass “Pee hee mu’huh,” which means “rotten moon.” They describe in oral histories how Paiute hunters returned home in 1865 to find the “elders, women, and children” slain and “unburied and rotting.”

The Oregon-based Burns Paiute Tribe joined the Nevada tribes in the appeal. They say BLM’s consultation efforts with the tribes “were rife with withheld information, misrepresentations, and downright lies.”