An index tracking the strength of the U.S. dollar against a basket of rivals touched its highest level since mid-November on Tuesday, adding to the headwinds facing U.S. stocks.

Source link

June

Bitcoin Miner Reserves Drop To June 2021 Levels, What This Means For Price

Bitcoin miner reserves can often be a tell for where the market could be headed next due to their large holdings. These reserves going up or down can pinpoint how miners are looking at the market, and a drop in their reserves can be bad for the BTC price.

Miners Reserves Drop By 14,000 BTC

Bitcoin miners, who are responsible for confirming transactions on the blockchain and keeping the network safe, seem to be turning toward selling rather than accumulating. According to a CryptoQuant report, these miner reserves have seen a notable drop since 2024 began.

Their holdings dropped by 14,000 BTC in less than two months, suggesting that these miners have been selling some of their stash. Going by an average price of $43,000 since January 2024, this means that Bitcoin miners have sold over $600 million worth of BTC so far. As a result of this, miner reserves are currently sitting at 1.8 million BTC, which is the lowest level since June 2021.

Bitcoin miners selling their coins are not new because they often need to sometimes sell to keep their operations running. The most notable costs include electricity, as well as mining machines. However, it does not change the fact that their selling can have an adverse effect on the price of BTC.

This time around, though, miners seem to be selling for an additional reason, which Matthew Sigel, who’s head of digital asset research at VanEck, has identified to be for purposes of bolstering their balance sheets.

Bitcoin Miners Getting Ready For The Halving

The next Bitcoin halving is expected to happen sometime in April 2024, and the block rewards are expected to fall to 3.125 BTC. Naturally, these miners are getting ready for this drop in rewards, as identified by Matthew Sigel.

“Miners have begun to sell more of their coins to bolster balance sheets and fund growth capex ahead of tougher times for margins when block rewards are halved in April. After the halving, scale will matter even more.”

Nevertheless, as selling has ramped up, so has buying as Spot Bitcoin ETF issuers scramble to accumulate BTC for their customers. According to this NewsbTC report, Spot Bitcoin ETF issuers now hold more than 657,000 BTC, worth more than $28 billion at current prices.

At the time of writing, the BTC price is trending at $42,933, after being beaten back from the $43,000 resistance. The crypto’s fluctuations at this level suggest that $43,000 is the target to beat if it is to continue its uptrend.

BTC price struggles below $43,000 | Source: BTCUSD on Tradingview.com

Featured image from Forbes India, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Japan’s exports rose in June led by strong growth in car shipments, data released by the Ministry of Finance showed Thursday.

Exports rose 1.5% on year, the 28th straight month of increase, with car shipments growing 49.7%.

Economists surveyed by data provider FactSet had expected a 2.2% increase in exports.

Exports to the EU and the U.S. led the growth among regional destinations, rising 15% and 11.7%, respectively. The rise was driven by shipments of products like cars and construction and mining machinery.

However, lower shipments of products such as steel led to a decline in exports to China and Asia, which fell 11% and 8.4%, respectively.

Imports fell 12.9%, mainly due to lower demand for products such as coal, crude oil and liquefied natural gas.

As food prices rise in June, analysts warn of a ‘tipping point’ for Americans

Food prices grew at a slower pace in June, but economists remain concerned that prices will reach a level where consumers will make dramatic changes in their behavior.

Food prices rose 3% in June compared to a year ago, according to the latest data from the Bureau of Labor Statistics. After a year of price hikes, consumers continued to see food prices rise, but at a slower rate.

Grocery prices were 5.7% higher in June compared to a year ago, and dining out was 7.7% more expensive. That’s significantly lower than the 13.5% peak inflation for grocery prices last August and the 8.8% peak inflation for dining out.

“Overall, there continues to be a similar narrative of extended upward pressure on food prices as we try to discern whether this stress has led to a tipping point where consumers are struggling to buy the foods that they want,” said Jayson Lusk, the head and distinguished professor of Agricultural Economics at Purdue University.

Reported food insecurity across households of different income levels reached 17% in June, the highest level since March 2022, according to the monthly Consumer Food Insights Report from Purdue University. Although it didn’t deviate too much from the normal range — food insecurity hovered at 14% two months ago — Lusk said the increase is concerning given the amount of pressure on more financially vulnerable consumers.

“Reported food insecurity across households of different income levels reached 17% in June, the highest level since March 2022, according to Purdue University. ”

The pandemic-era expansion of the Supplemental Nutrition Assistance Program ended in March, meaning SNAP recipients are now receiving $90 less on average every month, according to the Center on Budget and Policy Priorities, a progressive policy think tank based in Washington, D.C.

The recent rise in food insecurity could be a lag from households adjusting to the policy change, Lusk said. On average, consumers are spending about $120 per week on groceries and $70 per week on dining out or takeout, the report found.

Middle-income households earning $50,000 to $100,000 a year and low-income households earning less than $50,000 a year cut weekly spending on groceries and dining out by about $10 a week, Purdue found. The average weekly grocery expenditure for low-income households was $103 in June; for middle-income households, it was $118. Households earning more than $100,000 a year spent $141 a week on groceries in June.

****Around 47% of low-income households — those earning less than $50,000 a year — said they relied on SNAP benefits in May, up from roughly 40% in February, according to a recent Morning Consult report.*****

For low-income households, rising food insecurity is often coupled with juggling bills such as utilities and rent, which has also led to rising eviction rates in recent months, according to Propel, an app that aims to help low-income Americans improve their financial health. Propel surveys SNAP users on insecurity around food, finance and their housing situation.

Nearly half of the survey respondents said they cannot afford the food they want. “We were unable to pay bills because we had to buy food. We’re about to lose our home,” a South Carolina user named Anna told the Propel survey.

The share of surveyed households that paid their utilities late rose 11% from May to June, and only 27% of respondents paid their utility bills on time and in full, according to Propel’s June survey.

By Howard Schneider

WASHINGTON (Reuters) -A year after U.S. inflation peaked and touched off an aggressive turn in monetary policy, Federal Reserve officials may be opening a more encouraging chapter in their policy discussion with the first of what analysts expect to be a run of data showing key price measures in steady decline.

The U.S. Labor Department on Wednesday reported the consumer price index rose at an annual rate of 3% in June, below economists’ expectations in a Reuters poll and the lowest reading since March 2021. It marked a material leg down in a figure that had clocked in at 4% in May and had topped 9% in June 2022, which was the highest in four decades.

A separate measure of underlying inflation, stripped of items like energy and food that are tied to world commodity markets, eased to 4.8% from 5.3% in May, with the drop being the largest in more than three years.

It may be just the start of what economists are beginning to frame as a more durable “disinflation” as the impact of the U.S. central bank’s policy tightening over the last year begins to show itself in slower hiring and weaker demand.

There were outright price declines in many goods in June, only a modest increase in food costs, and evidence that the pace of price hikes was slowing in the service sector, an area of the economy Fed officials have worried would be difficult to budge.

Omair Sharif, president of Inflation Insights, noted that prices had barely increased at all last month for services outside of housing and energy, and he expected continued weakness.

That could help lower overall inflation when the next CPI report is released on Aug. 10, with the details in Wednesday’s report suggesting “downside risks” to any forecast of July’s inflation rate.

The June report is the “first of what we anticipate will become a trend toward closer-to-target levels of inflation,” said Rick Rieder, chief investment officer of global fixed income at BlackRock. “We should see these types of numbers over the coming months ahead across domestic inflation prints.”

Lael Brainard, a former Fed vice chair who is now the director of the White House’s National Economic Council, touted the CPI release as evidence that the country was winning its inflation fight without heavy pain in the labor market.

“The economy is defying predictions that inflation wouldn’t fall absent significant job destruction,” Brainard said at an event held by the Economic Club of New York. “Just today we saw new and encouraging evidence that the economy is on the path to moderate inflation accompanied by a resilient jobs market.”

A month of good inflation news, however, is unlikely to dissuade the Fed from raising its benchmark overnight interest rate by another quarter of a percentage point to the 5.25%-5.50% range at its July 25-26 policy meeting. Investors on Wednesday still put more than a 90% probability on such a move.

Indeed, at least one Fed official on Wednesday stuck to policymakers’ prevailing hawkish mantra that inflation is still too high.

While not specifically addressing the CPI report, Richmond Fed President Thomas Barkin told a Maryland business group that he still felt inflation had “been stubbornly persistent.”

“No matter how you cut it, inflation has been too high,” he said, adding that he agreed that overall demand was beginning to slow, but he wanted to be “convinced” by incoming data that it would translate into lower inflation.

The Fed has a 2% inflation target measured against the separate personal consumption expenditures price index, and a closely watched version of it, also stripped of volatile food and energy prices, has been lodged at around 4.6% since December.

U.S. central bank officials have said they need to see steady declines in that data to be comfortable that inflation is under control and on a sustainable path back to the 2% target.

‘FINAL INNINGS’

But the latest CPI data could undercut arguments for yet another rate increase beyond the July meeting.

“Today’s report is consistent with our view that Fed tightening is in its final innings,” economists from Goldman Sachs wrote, with a quarter-percentage-point hike expected in July “followed by unchanged policy for the remainder of the year.”

Recent data have been somewhat ambiguous – slowing overall job growth, for example, coupled with still strong wage increases that some officials worry could feed future inflation; an improved mood in recent small business surveys offering evidence of economic resilience, but a boost as well in the share of business owners planning to raise prices.

But, importantly, public expectations about inflation have remained under control. A study released this week from the Cleveland Fed’s Center for Inflation Research found the long-term inflation outlook was “anchored near the Federal Reserve’s 2% target,” a finding generally shared by Fed policymakers who consider any move higher in public inflation expectations a warning that inflation itself may accelerate.

The calendar is also turning in the Fed’s favor, with some of the worst inflation readings falling from the calculations of annual price increases, and recent, weaker data on rental costs set to become more prominent in the numbers.

Fed officials, blindsided by the persistence of inflation they initially thought would dissipate on its own, have been reluctant to bank on good news continuing. Far from declaring victory over inflation, they’ve focused on the risks that it might resurge, worried over its stubbornness, and have been more likely than not to pencil in higher interest rates if there was any doubt.

The June data may change the tone.

In comments this week, prior to the release of the CPI data, Atlanta Fed President Raphael Bostic said he felt the central bank now “had momentum” in its inflation fight and, in his view, won’t have to raise rates again.

“The underlying data is actually telling a very positive story,” Bostic said.

(Reporting by Howard Schneider;Additional reporting by Michael S. Derby and Ann Saphir;Editing by Dan Burns and Paul Simao)

1 Growth Stock Down 88% to Buy Right Now

1 FAANG Stock That’s a Surefire Buy in July and 1 to Avoid Like the Plague

My 3 Favorite Ultra-High-Yield Dividend Stocks to Buy Right Now

Warren Buffett Is Losing Almost $16 Billion, Combined, on 4 Brand-Name Stocks

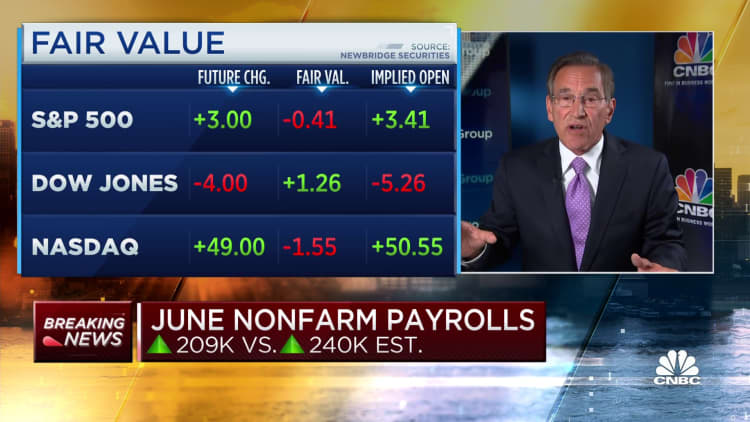

The June jobs report showed signs that the U.S. labor market may be losing steam after surprisingly strong growth earlier this year, but some categories still saw big jumps in employment last month.

The biggest area for growth was health care and social assistance, with 65,200 jobs added, according to data from the Labor Department. That category expanded by more than 70,000 new positions when education is included, as some economists do.

The category was powered by 18,000 job adds in individual and family services and 15,000 in hospitals.

The other star category was government, which added 60,000 jobs. That sector has seen growth accelerate this year but is still below its pre-Covid pandemic employment level, according to the Labor Department.

The strength in those categories is a reason why more than half of the jobs added in June went to women, Betsey Stevenson, a University of Michigan professor and former Labor Department chief economist, said Friday on CNBC’s “Squawk Box.”

“It tells us about where the jobs are coming from. They’re coming from the kinds of industries that women tend to work in, like health care, education services and government,” Stevenson said.

Another strong area of the labor market was construction, which added 23,000 jobs for the second straight month. The sector has proved resilient even as higher interest rates have hurt the purchasing power of prospective homebuyers.

Several sectors shed jobs in June, and they suggest that companies are still adjusting to the shift in U.S. consumer spending away from goods and toward services. Retail trade and transportation and warehousing lost about 18,000 jobs combined.

Clarification: This story has been updated to clarify that hospitals added 15,000 jobs.

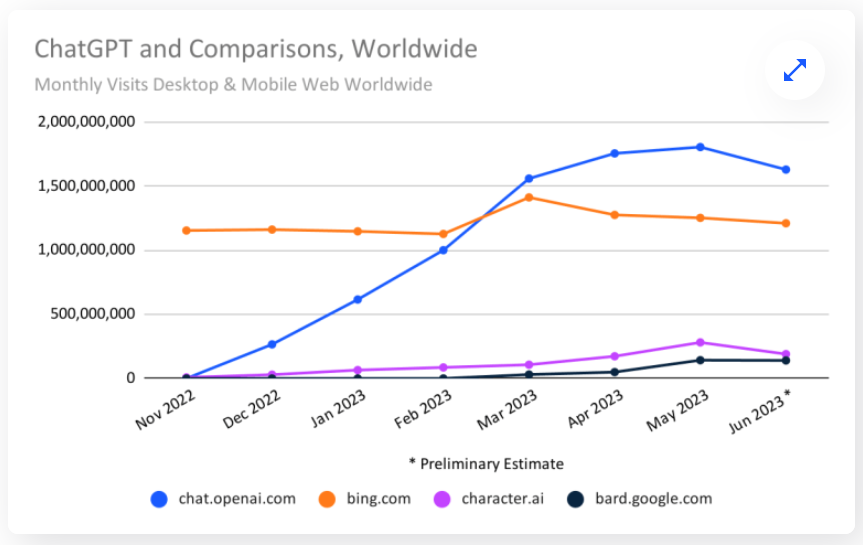

Worldwide traffic for the popular artificial intelligence (AI) chatbot ChatGPT has experienced a decline from May to June, suggesting a decline in interest in the AI assistant tool developed by OpenAI.

According to data estimates from the traffic analytics site Similarweb, desktop and mobile web traffic for ChatGPT dropped by 9.7% in June. In addition, the site’s unique visitors and the amount of time users spend on the site have also declined by 5.7% and 8.5%, respectively. In the United States, the recorded month-on-month decline in the website’s traffic was 10.3%.

Despite the decline in traffic, the website is still ahead of Google’s Bard, Microsoft’s Bing and Character AI, another popular AI-powered chatbot.

As the data was released, some argued that the drop might be due to the tools’ users being students who are currently on their summer break, as well as the AI chatbot’s novelty starting to wear off.

Related: OpenAI pauses ChatGPT’s Bing feature, as users were jumping paywalls

On the other hand, a community member disputed the reasons behind the drop, as it did not include the traffic taken from the AI chatbot’s recently-released iOS application. According to the Twitter user, there could simply be a “change in how ChatGPT is accessed.”

On May 18, OpenAI officially launched ChatGPT’s mobile application for iOS. The firm initially rolled out the app in the United States and promised to expand the release to other countries in the following weeks.

Meanwhile, Lighting Labs, the development firm behind the Bitcoin Lightning Network, has announced tools for AI to send and receive Bitcoin (BTC) on its layer-2 solution. The firm released the toolkit with the aim of helping make payments faster, cheaper and easier for developers working on AI-focused projects.

Magazine: AI Eye: AI travel booking hilariously bad, 3 weird uses for ChatGPT, crypto plugins

Bitcoin miners cash in on June price surge, selling thousands of BTC

Bitcoin (BTC) miners sold a significant amount of their mined Bitcoin in June to fund their operations, according to Glassnode data analyzed by CryptoSlate.

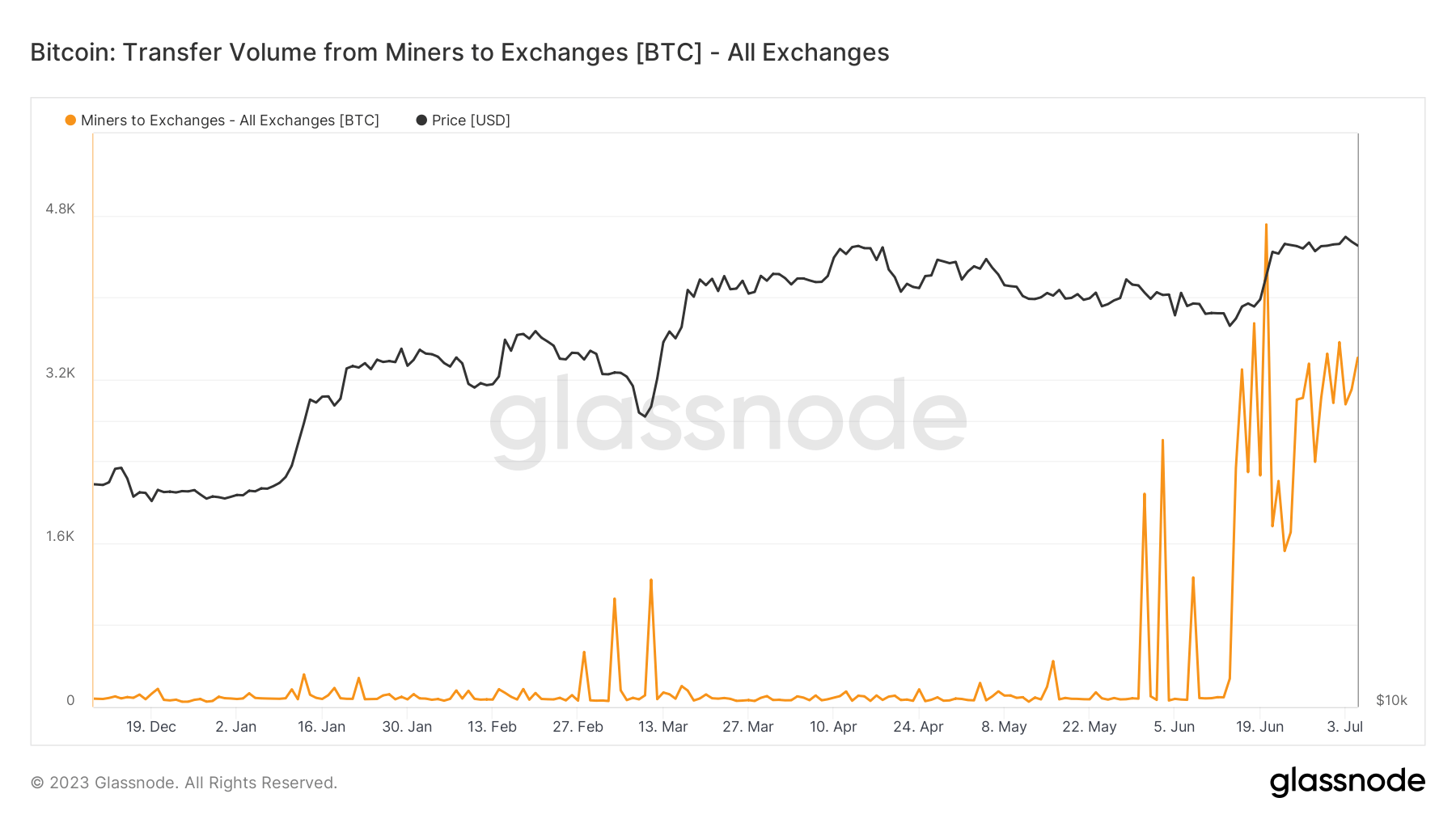

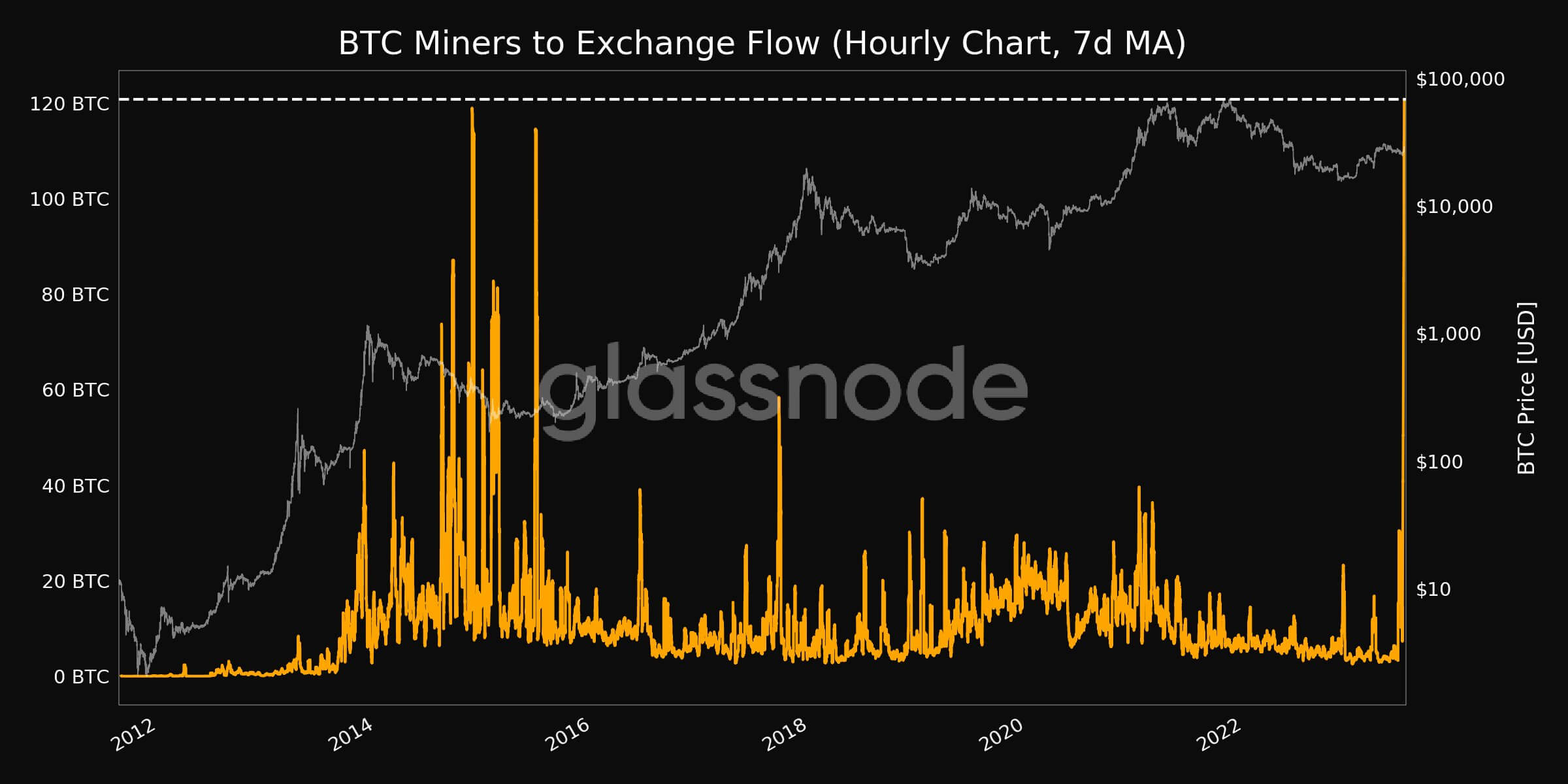

According to the chart below, miners’ exchange flow peaked at 4,710 BTC on June 20—the highest rate of the past five years. Other days of the month also saw significant spikes, averaging over 2000 BTC to exchanges.

Glassnode stated that the seven days moving average hourly flow from miners to exchange reached as high as 120.77 BTC, one of the highest levels since 2015.

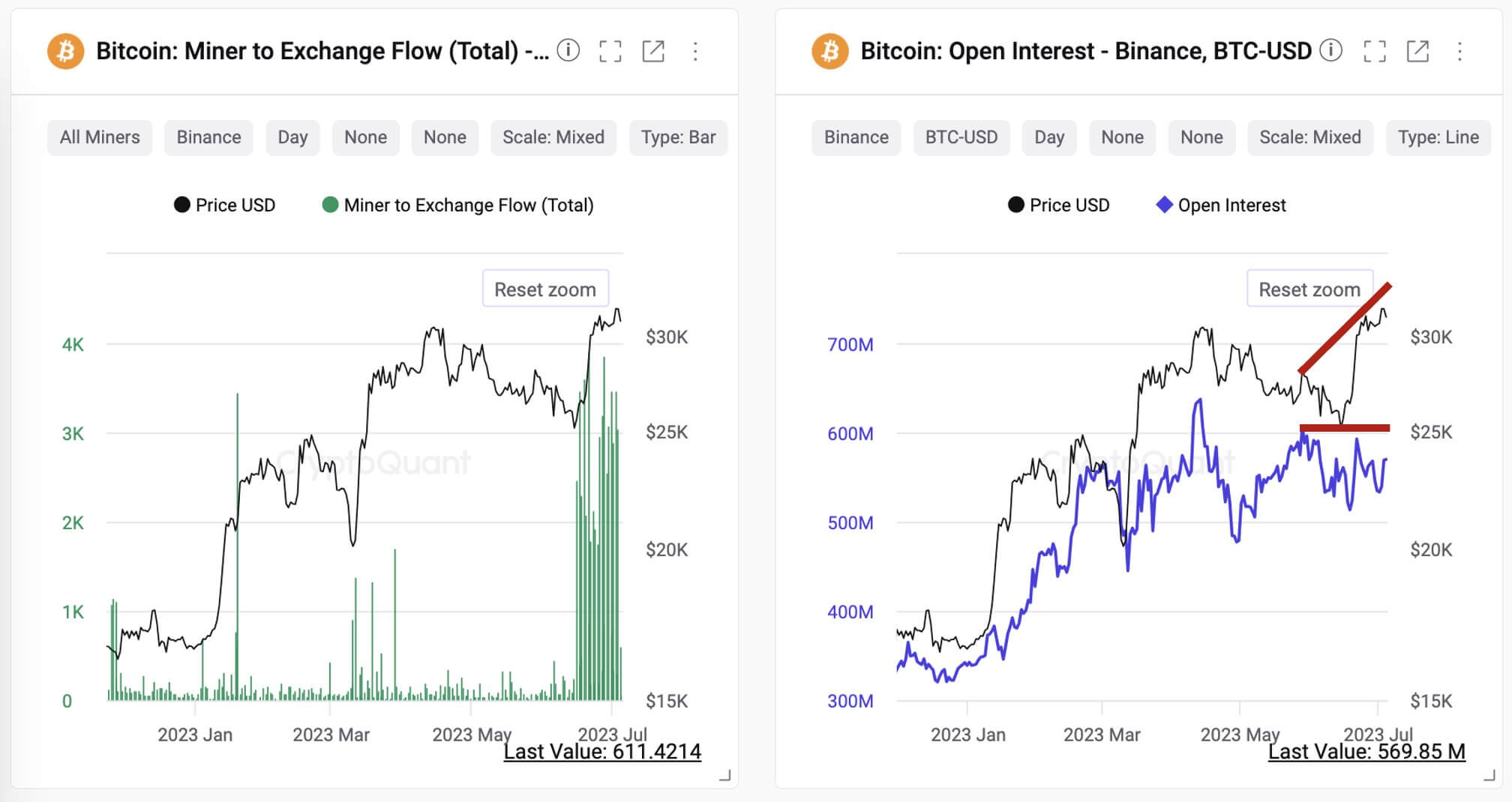

On July 4, CryptoQuant CEO Ki Young Ju said miners sent over 54,000 BTC to Binance in the past three weeks. Ju pointed out that there was “no significant change in BTC-USD open interest, suggesting less likelihood of filling collaterals to punt new long positions.”

Ju added:

“Spot selling seems more likely.”

In their recently released operational updates, Bitcoin miners Marathon Digital, Cleanspark, and Hut 8 confirmed these transactions.

In a July 6 press statement, Marathon Digital said it sold 700 BTC, representing 71.5%, of its mined 979 BTC in June for an undisclosed sum. Its rival, Hut 8, sold 217 BTC—100% of the Bitcoin it produced in May and 70 Bitcoin produced in June—for $7.9 million.

Meanwhile, Cleanspark sold 84% of the 491 BTC it mined in June for $11.2 million, according to a July 3 statement.

These trading activities suggest miners wanted to capitalize on BTC’s recent price surge to secure profits. In June, BTC mostly traded above $25,000, peaking at $31,268 after several traditional financial institutions, including BlackRock and others, filed for Bitcoin ETFs.

The post Bitcoin miners cash in on June price surge, selling thousands of BTC appeared first on CryptoSlate.