“There was a lot going on and I have lots of regrets, but I can’t go back and change anything.”

Source link

kids

‘My father, 75, died without a will’: His ex-wife, fiancée and kids are hiding his financial documents. What can I do?

My father, 75, died without a will. At the time, he was divorced from his fifth wife and had a fiancée. He left behind three children: Me, the oldest at 57, from his first marriage, and a son and daughter, 29 and 32, from his fifth marriage. He was quite well off, being part owner of a business — at least, a “minor” multimillionaire.

However, his fiancée would only give us some of his possessions, and his three cars at the time of his death. She wouldn’t give us any of his legal and financial paperwork. We are pretty sure he didn’t have a will, but we believe he had a life-insurance policy, a 401(k) plan, and other investments. His fiancée swears that she is the beneficiary of his life insurance, but she hasn’t produced any proof.

We have had his mail forwarded to my brother to try and find out who his lawyer is or insurance company is or any paperwork regarding his personal business.

I have several questions:

1. How do we go about finding out if he had life insurance or a will without any paper trail?

2. How do we find out about his checking and savings accounts, and 401(k) without paperwork?

3. We do believe he died intestate and that his assets will have to go through probate court; however, my half brother has taken control of the situation, including having him cremated and sent to him for burial. He gets along great with his sister, but since I’m 25 years older and from the first marriage we were never close, and I feel like they’re “teaming up” with their mother (his most recent ex-wife) to take things from his estate, and not letting me know what’s going on.

My other questions:

4. How do we get to the point of his estate going through probate and how is a third party appointed to oversee that? Can my brother legally just take over? I want to make sure his estate is split evenly between the three of us, and I don’t know how to make that happen when my half brother won’t even communicate with me and my half-sister keeps telling me “he’s handling it.”

5. Also, if he and my sister are listed as beneficiaries on any life insurance policies or 401(k) policy, do I have a legal right to any of it if I’m not listed?

Thank you in advance for your help.

The Eldest Son

Also see: I want to blow the whistle on my former employer’s ‘shady practices,’ but I signed an nondisclosure agreement. Can I break my NDA?

“All of his possessions, everything from his wristwatch to his car and home, should go through probate when an administrator is appointed by the surrogate’s court or county courthouse.”

MarketWatch illustration

Dear Eldest,

Your late father’s fiancée has the most to lose, which is why she is likely using this time to batten down the hatches with an information blackout. All of his possessions, everything from his wristwatch to his car and home, should go through probate when an administrator is appointed by the surrogate’s court or county courthouse. You should be able to apply to be the administrator of your father’s estate. It’s a lot of work, and even includes filing his taxes.

With that said, I can answer your last two questions (No. 4 and 5) first. No, you don’t have any legal right to your father’s life-insurance policy or 401(k) plan, assuming that they do indeed exist and have your siblings (or anyone else, for that matter) listed as beneficiaries. If there are no listed beneficiaries, these accounts would become part of your father’s overall estate, and go through probate with his bank accounts, house, pension and all his other assets.

Your father’s bank account, broker and lawyer should be able to start the fact-finding process. It’s a good lesson for everyone to get their paperwork in order, and leave a copy in a safe deposit box and/or with a trusted lawyer. Assuming your father died intestate — without a will — his fiancée is not a legal heir and, therefore, would walk away with nothing, unless she was a co-owner of his bank account or listed as a beneficiary on his other accounts.

However, any 11th-hour changes to your father’s listed beneficiaries could raise a red flag. Typically, a person must be of sound mind and not under or subject to duress, restraint, fraud or undue influence to sign a will, a power of attorney document, or other legal and financial documents. A person must understand what they are signing, and have testamentary capacity — that is, he would need to know what he was signing and why, and how much was at stake.

After a person is appointed by the court to speak for the estate, you can then identify insurance payments through transactions on his bank account, and file for a change of address for all of your father’s mail, says Hubert Klein, partner and forensic accountant at EisnerAmper. As for your half brother and sister, Klein says, “What authority did he have to rush the process? Was he [or she] appointed the executor or administrator? You need to ask.”

State law controls the probate process. “Many states have this information online on how the process works — who can file paperwork, who can be appointed as the estate representative, and who can effectuate transactions on behalf of the estate,” he says. “Hidden or non-disclosed assets and accounts can be found, but someone has to speak for the estate in order ensure a proper accounting of all the estate’s assets, and that liabilities are documented for the court.”

The probate process is public, the legal equivalent of washing your dirty linen in the front yard; that will leave little room for siblings or ex-wives or fiancées to muddy the waters. In addition to an administrator/executor, you will need a trust and estate attorney to navigate the process. No one has the right to hijack this process, and the sooner you embark on a fact-finding mission with the help of your father’s bank, and the legal wheels start turning, the better.

More from Quentin Fottrell:

My father has dementia and ‘forgave’ my brother’s $200,000 house loan. The nursing-home notary said he was of sound mind. What can we do?

My husband bought our house with an inheritance. I signed a quitclaim. He said I could live there after he dies, but changed his mind. What now?

Low-paying jobs are the economy’s way of saying you should get a better job’: I’ve decided to stop tipping, except at restaurants. Am I wrong?

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter. The Moneyist regrets he cannot reply to questions individually.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Readers write to me with all sorts of dilemmas. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thinking About Saving for Your Kids’ or Grandkids’ College in a 529 Plan? There’s a Big New Perk in 2024 You’ll Definitely Want to Know About.

The end of a year and the beginning of a new year can cause many Americans to focus on the future — and not just on their own future. It’s a time when some look to what’s ahead for their families.

With soaring costs, planning ahead for college is an especially smart move. Thinking about saving for your kids’ or grandkids’ college in a 529 plan? There’s a big new perk in 2024 that you’ll definitely want to know about.

Image source: Getty Images.

Why 529 plans are so popular

Before we get to that new perk, it’s important to understand why 529 plans are so popular. These plans are specifically designed for saving for education expenses. Initially, 529 plans could only be used to cover the costs of college and higher education. Since 2018, though, they can also be used to pay for up to $10,000 in private elementary and high school tuition.

The best thing about 529 plans is that they’re tax-advantaged. You can’t deduct contributions to a 529 plan from your federal income taxes. However, all of the money earned in a 529 plan grows tax-free (at least for federal taxes). Many states also offer tax deductions or credits for contributions.

A beneficiary must be named for each 529 plan. However, the account owner controls the money. It’s also no problem to roll the funds into another 529 plan. This is great for cases when one child decides against attending college. Any money in that child’s 529 plan can be used to fund another child’s education.

One downside to 529 plans, though, is that there’s a limit on how much you can contribute. In 2024, that limit is set at $18,000. There are also maximum aggregate contribution limits that vary by state.

Now they’re even better

But another previous drawback to 529 plans is being eased significantly in 2024. In the past, the accounts could only be used for education-related purposes. The federal government imposed a 10% penalty on any withdrawals that were used for other reasons.

Now, however, unused money from 529 plans can be used for retirement by rolling the funds over to a Roth IRA. This is a major change that makes 529 plans better than ever. The new rule was made possible by the passage of the Secure 2.0 legislation in late 2022.

Granted, there are some restrictions. For one thing, the 529 account must have been open for at least 15 years. No contributions made in the last five years can be rolled over. You’ll still be subject to annual Roth IRA contribution limits as well. There’s also a $35,000 lifetime cap on 529-to-Roth-IRA rollovers.

Since 529 plans were created in 1996, one of the biggest concerns for parents and grandparents was: What happens if the child doesn’t attend college or receives a scholarship that covers their college expenses? That’s no longer as big of a worry.

My mother’s will leaves her house to her two kids and two nieces, but she sold her home. Could these nieces come after us for the money?

My mother’s will states that her home is to be sold and the money divided — with half going to her two children and the other half to her late husband’s nieces. Mom now feels the nieces don’t deserve the money because they never helped or even visited her husband, their uncle.

But she has yet to change her will to reflect those feelings. After a stroke, she moved in with me and sold her house, with the money from the sale going into her savings to pay for her care. My brother and I are on both her bank accounts.

Upon her death, can the nieces demand half of the proceeds from the house sale? What if she’s used the money for her own care? Would we be responsible for covering that amount? Your answer will help me convince mom that it’s time to get the will to reflect her wishes.

Daughter

“Generally, legitimate ‘interested parties’ have the right to challenge a will. They could be relatives and, yes, people who are mentioned in the will.”

MarketWatch illustration

Dear Daughter,

Your mother effectively made her decision when she sold the house and used the proceeds for her care. Her late husband’s nieces are not direct heirs and, if she died without leaving a will, her entire estate would go to her next of kin — her two children, you and your sibling.

However, legitimate “interested parties” have the right to challenge a will. They could be relatives and, yes, people who are mentioned in the will. In an ideal world, executors should keep beneficiaries informed of changes to the will in question. In this case, of course, your mother is very much alive.

Neil V. Carbone, a partner at Farrell Fritz, P.C., quotes a simple adage to sum up your predicament: “As the saying goes, ‘You can’t give what you don’t have,’” he says. Your mother said she would leave her home to four people, but she sold that home during her lifetime.

“The question here is whether the legal doctrine of ‘ademption’ applies,” he says. “In general, when a decedent includes a specific bequest of property under his or her will but no longer owns that property at the time of death, the bequest ‘adeems’ or lapses.”

“In effect, the decedent revoked the gift by disposing of the property during his or her lifetime. Here, because mom sold the house herself, according to the facts presented, the direction in her will to sell it and divide the sale proceeds is rendered ineffective and the bequest adeems.”

But there are exceptions to the doctrine of ademption in New York, he says. “One exception applies when property is sold by the guardian or conservator of an incapacitated person. In that case, the beneficiary would be entitled to receive the traceable proceeds of sale.”

As more people use a durable power of attorney to avoid the expenses related to guardianship, Carbone adds, more cases of wills being challenged in court have arisen seeking to extend this exemption to agents acting under such a power of attorney.

In other words, her husband’s nieces could claim that your mother was not competent at the time of the house sale and that they should therefore receive what they believe is their fair share of the proceeds. That could be a time-consuming and expensive process.

It’s smart to update a will as circumstances and feelings change. While your mother can’t leave what she no longer owns, there could be a loose end or two that might motivate these nieces to take action. Where there’s a will, there’s a relative. You mother should change the will, and keep things simple.

More from Quentin Fottrell:

My mother’s late husband came with baggage — ‘his deadbeat son.’ Is she on the hook for his debts? Can she evict him from her home?

On the day my stepfather died of brain cancer, he changed his trust and left everything to my sister. Do I have any recourse?

My husband and I are in our 70s. We married 3 years ago. He’s leaving his $1.8 million home to a 10-year-old relative. Is that normal?

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter. The Moneyist regrets he cannot reply to questions individually.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Readers write to me with all sorts of dilemmas. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to the Moneyist or posting your dilemmas on the Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Almost half, 43%, of unmarried American adults want to get married in the future, according to a 2022 Harris Poll survey. But only 28% said they want to have a child.

This trend has contributed to the growth of a household configuration popularly referred to as DINKs: “dual income, no kids.”

“This idea and household configuration of dual-income partners living alone without children is on the rise,” according to Misty L. Heggeness, an associate research scientist at the University of Kansas’ Institute for Policy and Social Research. “In 2022, it was around 43% of households, and that’s about a 7% increase from a decade previously.”

More from Personal Finance:

Here’s how to make the most of your workplace health plan in 2024

Even high earners consider themselves ‘not rich yet,’ despite their net worth

Here’s what to expect in 2024 if you want to buy a home, experts say

Almost half, 46%, of adults in the Harris Poll survey who do not have children and do not want to have a child in the future pointed to their personal financial situation as a reason, while 33% noted housing prices as a factor.

“When we advise clients about having children, we honestly don’t even give them the full real details and the real numbers,” said Shannon McLay, founder of The Financial Gym. “It’s one of those things if you see the math of it all, it might make you decide to not have children.”

Besides eliminating expenses such as child care, DINKs can also fully reap the benefits of combining their finances.

“Being able to split our finances, to look at both of our incomes coming in and see how we’re able to handle all of that because we don’t have extra finances with a child or anything like that, it’s much more comfortable,” said Taylor Graves, a 32-year-old project manager in health-care technology who has been living the DINK lifestyle for 10 years. “We get to focus more on the things that we want to do, saving a lot of that money for the future and worry less about the day-to-day finances of the house and our bills.”

Watch the video to find out more about what it’s like to live the DINK lifestyle.

My children have inherited $5 million of stock from their father (whose estate has not yet been dispersed after 11 months) leaving them with a 30% or so loss of value over which they have had no control. Is there any way they could make a choice of which equities they should sell and harvest tax losses? It is their understanding that the 10-year individual retirement account (IRA) withdrawal period is now reduced to nine years which makes it even more taxing. Any help would be appreciated.

I’m sorry to hear about his passing. I’m sure this is already a difficult time for you and your children, and I know that dealing with his unsettled estate and the issue of investment losses don’t make it any easier.

There are potentially a lot of complexities at play here that I am not aware of because I don’t know all the details of the estate, but I’ll try to explain from a big-picture perspective some things that you should be aware of that might help you decide how to move forward from here.

A financial advisor can help you make decisions about handling an inheritance and minimizing taxes.

Speak With the Executor

First, I recommend that you speak with the executor of the estate and discuss any concerns you have. There are several potential issues this may help resolve.

Without knowing anything else about the estate I can’t say if 11 months is a long time to wait for settlement. Simpler estates can be settled more quickly than complex ones, and more complex estates take longer. If you believe, however, that the settlement is being delayed due to inaction or inability on the part of the executor then this needs to be addressed. That’s particularly true if the delay is causing financial harm to your children.

Even if the delay is not due to anything under the executor’s control, knowing which stocks your children would prefer to sell can help inform the executor’s decisions. Only the executor or an appointed court administrator has the authority to sell estate assets.

Inherited IRA Distributions

Let’s also clarify their understanding of the inherited IRA distribution rules. Assuming your children are not minors then, yes, under current law they have 10 years to withdraw any money held within inherited IRAs. Specifically, the money needs to be withdrawn by the end of the tenth year following the year of death of the original account owner.

If their father passed at any point during 2021, they have until Dec. 31, 2031. If he passed away in 2020, they have until Dec. 31, 2030.

Unfortunately, this clock does start at the time of the original account owner’s death regardless of how long it takes to settle the rest of the estate and distribute the assets.

Harvesting Capital Losses

It’s unclear whether the particular stocks in question are held within the IRA or in a different account. That matters when it comes to figuring out the tax ramifications and whether or not harvesting losses is an option.

-

If the stocks are held within the IRA, then capital gains are already shielded from taxation. The other side of that coin is that you also can’t harvest capital losses for a tax benefit. What will matter in this case is simply that when a distribution is received from the IRA it will be taxed as income to the recipient.

-

If the stocks are held within a taxable brokerage account, then it’s a different story. In this case, capital losses can be used to offset capital gains. However, just because the stock’s value has dropped by 30% doesn’t guarantee that there are actually any losses to harvest.

Make sure you check the stock’s basis and understand whether there are any unrealized losses to take.

Estate Taxes

If the stocks are in fact held in a taxable account such that capital losses can be harvested to reduce tax liability, and if there are in fact capital losses to harvest, you still need to consider the best approach for harvesting those losses. If you sell the stocks while they are still held within the estate, then the estate will get the deduction for the capital loss.

That may or may not be the best approach. While estates do have a much higher tax rate than most taxpayers do – running between 18% and 40% – the vast majority of estates are not subject to taxation at all due to the current exemption amount of $12.06 million. It could very well mean that you harvest losses against an estate that doesn’t have a tax liability anyway.

Distribution in Kind

If instead, the estate passes the stock to your children in-kind, meaning the estate doesn’t sell the stock but distributes the actual shares to them, then their basis in the stock is most likely their fair market value on the date their father passed. That would be the case regardless of the amount their father paid for them or what his basis was. This is called a stepped-up basis.

This potentially creates a tax-saving opportunity for your children. If the stock’s value has fallen by 30% since their father passed, then there isn’t anything they can do about that now anyway. If they take distribution in kind, they may be able to sell and harvest the 30% loss, which is what it sounds like they were hoping to do in the first place.

Next Steps

I hope this provides some clarity and helps you think about your next steps. Estates can be very complex and tax rules often hinge on minor details. I strongly encourage you to speak with a team that includes an attorney, tax professional and financial planner who all have the necessary expertise to help you.

Brandon Renfro, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Brandon is not a participant in the SmartAdvisor Match platform.

Investing and Retirement Planning Tips

-

If you have questions specific to your investing and inheritance situation, a financial advisor can help. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

If you have a sizable estate, estate taxes could be hefty. But you can plan ahead for taxes to maximize your loved ones’ inheritances. For example, you can gift portions of your estate in advance to heirs or even set up a trust.

Photo credit: ©iStock.com/PeopleImages, ©iStock.com/Natee Meepian

The post Ask an Advisor: My Kids Inherited $5 Million. How Should They Handle It? appeared first on SmartAsset Blog.

My husband took out a $50K car loan. What about spending money on our kids?

My husband just told me the company he works for is not doing well. He may not get the raise or the bonus he was looking forward to next year. His base pay is $100,000, with a bonus of $20,000 to $30,000. That bonus was earmarked to pay off extensive house repairs completed this year, but it can be paid next year on a 0% interest plan. He tells me not to worry, that he will think of something and will find a new job. He’s really great in this regard — responsible and confident, and he takes care of our family. We have some savings.

What worries me is his habit of spending money. For example, despite my objections, he bought two cars. Both of these car payments have a low interest rate, but he has about $50,000 left to pay off. We have two mortgages: We live in our house and rent out our condo. The rent just about covers the condo’s mortgage and fees, so it’s a wash.

We have different values on certain things. He wants new cars to drive around comfortably in. I would have been happy with a secondhand car that gets us safely from A to B.

“‘He wants new cars to drive around comfortably in. I would have been happy with a secondhand car that gets us safely from A to B.’”

We have two young kids. They’re at the age when we should be sending them to extracurricular classes or camps that they are interested in — science, sports, swimming or gymnastics. My husband is always saying the kids don’t need that, but he also doesn’t spend any time teaching them how to swim or ride a bike or hit a ball. This drives me crazy.

We don’t have a joint account, and I have to ask him to pay for any of the kids’ activities. He did give me a credit card to buy groceries and supplies for the kids. If the activity is not too expensive, I’m allowed to put it on the card.

By this time, I think you can tell that he has a little bit of machismo, which is galling, but at the same time, I also see his love and responsibility toward his family.

“‘He did give me a credit card to buy groceries and supplies for the kids. If the activity is not too expensive, I’m allowed to put it on the card.’”

In the event that he loses his job or doesn’t find a new job with comparable pay, we will have to tighten our belts as a family. We don’t go on vacations and I don’t buy new clothes or bags. My own personal expenditures, excluding food, are about $200 a month.

I could dip into my own savings of about $70,000 to send the kids to aftercare and summer camp, and I could find a job. I’ve tried juggling work and kids before but felt overwhelmed with the constant interruptions and not having enough hours in the day to do a good job at work, cook for my kids, drive them to activities, etc.

What kind of work can I do? Or how I can better allocate my remaining savings of $70,000? I’m thinking of putting $25,000 into a high-yield savings account and another $25,000 into a separate high-yield savings account. Would it be wise to use the remaining $20,000 for my continuing education to get into a financially rewarding field? I’ve already contributed $6,000 to my IRA this year. Should I open a brokerage account and just pay taxes on whatever index funds I buy?

Wife & Mother

“What should you do? Speak up and act up.”

MarketWatch illustration

Dear Wife & Mother,

Your husband likes to hold the purse strings.

For that reason, don’t lock away your savings for a long time. Financial advisers typically recommend brokerage accounts of a five-year period. Keep your options open. In order to have your needs met, you need to clearly articulate them outside of his most recent financial decisions — his car purchases. Write down the five most important things you need. They could be, for instance: 1. Joint decision making. 2. Joint account. 3. Marriage counseling. 4. Further education. 5. Getting a job. Have a five-point plan and, regardless of whether your husband expresses his support, pursue the last two goals on that plan — that is, those that are within your control.

How much of a say should you have with the family finances, and how much financial independence do you want in life? The answer to the first question is 50% — because this is a partnership, and you are not in your husband’s employ — and the answer to the second question is 100%. Your husband believes that he and he alone is entitled to make all the decisions. You can leverage an argument of fairness and the fact that this should be a partnership, but nothing will speak louder than having your own income. You won’t change your husband’s controlling nature overnight, if at all. It’s up to you to institute change for yourself.

“Have a five-point plan and, regardless of whether your husband expresses his support, pursue the goals that are within your control. ”

Keep saving and keep contributing to your IRA, and by all means take advantage of the relatively high interest rates. As I told this letter writer, who had $50,000 to invest, CDs are investment vehicles that attract people who are looking for a safe haven for their cash in an uncertain economic climate. Annual percentage yields typically track the federal-funds rate, which is currently in the range of 5.25% to 5.5%. Financial institutions are competing for business and are offering CD rates hovering at 5% and above, double the top rate seen 12 months ago. High-yield online savings accounts are offering similar rates.

Whatever you say or do, he knows that ultimately he holds all the cards. You have an allowance, you don’t have a joint bank account, and he will spend money on cars and other activities instead of your children’s extracurricular activities as long as he is able to. It’s hard to say whether you are in a happy or unhappy marriage or in a relationship that is brimming with conflict. What is clear: The rules have been set by one party, and you are expected to live by them. Men are the sole breadwinners in 55% of marriages in the U.S., so your situation is not so unusual — although the decision making may be more equitably shared in some of those marriages.

“Even as financial contributions have become more equal in marriages, the way couples divide their time between paid work and home life remains unbalanced,” according to the Pew Research Center. “Women pick up a heavier load when it comes to household chores and caregiving responsibilities, while men spend more time on work and leisure. This is true in egalitarian marriages — where both spouses earn roughly the same amount of money — and in marriages where the wife is the primary earner. The only marriage type where husbands devote more time to caregiving than their wives is one in which the wife is the sole breadwinner.”

“What kind of work should you do? Choose a field that you enjoy. The more you enjoy your work, the easier it will be to spend time doing it.”

What should you do? Speak up and act up. That is, state your feelings about what marriage means to you and what happiness and fairness looks like. It may not change your husband’s opinion or lead him to devote more funds to your children’s activities over his new automobiles, but it’s important to make your voice heard. What kind of work should you do? Choose a field that you enjoy. The more you enjoy your work, the easier it will be to spend time doing it. You won’t feel like you are changing the world every day, but if you are doing a job that brings you satisfaction, and you’re working with people you like, that certainly helps.

Your husband is, at least, open about his own wants and needs and how they may even exist independently from everyone else’s. I’ve received many letters in the same oeuvre as yours, although others have given me more cause for alarm. Among them: the husband who wrote a secret will, the man who absconded and bought a house in another state and the husband who kept his income, savings account and P.O. box a secret from his wife.

Ultimately, you can’t change him. You can only change your own situation, and you have the means to do it. You could seek career advice at your local community college. Remember that change is unlikely to happen overnight. Sometimes, we just have to take one action — however small — that leads to another, and another.

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

My fiancé earns $90K, and racks up credit-card debt. I earn $150K. Should I think twice about getting married?

‘I’ve sacrificed my career’: My husband and I may divorce soon, but he will inherit $1 million. How do I make sure I get half?

My wife and I have a $5 million estate — and no children. She has four nieces and I have one. Should we split our estate 5 ways?

Teaching kids to read: 90-year-old makes ‘an impression that could last forever’

Not all of us will live to be 90. But if we do, will we still be getting out of the house and volunteering? Smiler Haynes, a retired fashion model in Boston who just celebrated her 90th birthday, isn’t letting age slow her down.

“I feel better than the person I helped,” she says about the time she spends teaching reading skills to young people in her community.

“Just giving back is beneficial to me as well as the recipient,” she says. “Being around young people and seeing how you can give positive reinforcement by the things you do feels so rewarding to me.”

The way she sees it, during the five hours a week she spends working with local kids, she gets the chance “to make an impression that could last forever.”

Read: Volunteers cuddle babies in intensive care: ‘To feel their finger curl around yours is an amazing connection.’

Haynes, who has four children, eight grandchildren and 15 great-grandchildren — so far, she adds — says she has always volunteered, even when she worked full time as a model and a show producer.

“My mother always told me that you need to give back to the community,” she says, adding that there’s a quote attributed to Muhammad Ali that she likes: “Service to others is the rent we pay for our rooms here on earth.”

Haynes retired at age 62, when her husband fell ill. He passed away 20 years ago.

Since retiring, she has kept busy working with local charities and with her church, Boston’s historic Charles Street African Methodist Episcopal Church. She has been most involved in literacy and education programs, working with the nonprofit organizations Jumpstart for Young Children and Generations Incorporated, now known as Literations, both of which focus on kids preschool-age and older. After many years of volunteering five hours a day, three days a week, she downshifted to her current five hours a week at age 82.

Read: Where are the retirees? The retiree volunteer rate is depressingly low. Here’s how to change it.

She recommends volunteering to all seniors — for their own sake as well as the sake of those they are helping.

“I would say to others, keeping busy, keeping your mind on something other than what’s on the TV, gives you an opportunity to see how big this world is,” she says. “You’ll see that the problems you think you have are minuscule.”

She adds: “Move your body and you’ll move your mind. Love everybody!”

Read more about retirement and volunteering:

Traveling, volunteering, and — yes — working. Welcome to unretirement.

These much-loved volunteers swoop in to rescue animals in communities struck by disasters

‘We all need purpose when we wake up in the morning’: Finding meaning in retirement leads to happiness and health

How can I give $600K to my kids and ensure they don’t lose it if they divorce?

Dear Quentin,

My three siblings and I inherited a house on a beautiful island from our parents that is worth about $2 million. It is mostly used in the summer. I’m 72, I live abroad, and I don’t get there much. I find the maintenance costs and the joint decision making burdensome, as lovely as the place is. My two children, 41 and 35, are not keen to inherit this property, which could end up being split far too many ways. So I am negotiating with my siblings to buy me out. It would leave me with an inheritance of around $667,000.

I don’t need the money. I have a good pension and my own property, so I would like to use these proceeds to set my children on the property ladder, in effect transmitting to them a portion of their future inheritance when they most need it. They are both renters but are keen to buy, and they are both married or partnered.

My question is how to protect myself and them. If my spouse dies before me, I would want to move back to the U.S., near one child or the other, and this might require a top-up of capital — or else my children might have to provide me with a spare room or two. In addition, I would like to ensure that they could keep this gift for themselves in the event of divorce, without my being too obvious and nasty about it. Is there a co-purchase scenario — or two, since I want to treat them equally — that would make sense?

The Father

Related: Trusts are useful for almost everything in estate planning

Dear Father,

If there is a 50/50 chance that you will return to the U.S., think twice before giving all $667,000 away to your children. Once you’ve given it away, it’s gone for good.

First, the financials. The current estate-tax exemption — the amount of money on which you won’t owe federal estate tax when you die — is now $12.9 million for individuals, up from $12.06 million in 2022. That exemption is $25.84 million for couples, up from $24.12 million the previous year. However, those rates will sunset at the end of 2025. Without congressional action, those exemptions will return to where they were before the 2018 Tax Cuts and Jobs Act, meaning they will be reduced by about half.

An inheritance received by one person in a marriage is generally considered separate property, as is real estate owned by one spouse prior to a marriage. But that can change. Here’s Scenario No. 1: You make a gift of money to your unmarried child, who buys a home before getting married, but your child’s partner contributes to a renovation of the property, thus turning it from separate property into community property. And Scenario No. 2: You give money to your married child, who decides to put it in a joint bank account, thereby making it a shared asset.

You could, as you suggest, purchase property with your children. There are several kinds of co-ownership agreements. Joint tenancy with the right of survivorship means that if one person died, the other owner or owners would inherit their share and the property would not go through probate. With tenants in common, on the other hand, if one of your children died before you, their share would go through probate and be distributed among their heirs. Such decisions should be made with the assistance of a good estate-planning lawyer.

There are measures you can take to keep this money in the sole hands of your children, but there is only so much you can do once you hand it over. Setting up a revocable trust for your children would allow you to dictate how the money is spent and who can access it, and would also keep it out of reach of their respective partners — should that be their wish, too. An irrevocable trust, used if your estate exceeds the lifetime exemption, is more often used by the ultrawealthy (exhibit A: the British royal family) and, from what you say, that does not apply to you.

Remember to review your last will and testament and the rules of any family trusts every five years. There may come a time where you grow close to your children’s partners and wish to include them in your will, when you want to set up trusts for their children. Fair warning: Management of such trusts does not usually come cheap.

Ultimately, there is only so much control you can have over your children — and the money you give them. If you want more control, keep all or a portion of it. And never give away your entire kingdom.

“Ultimately, there is only so much control you can have over your children — and the money you give them,” the Moneyist writes.

MarketWatch illustration

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

I gave my daughter $5,000 for her divorce, but she lashed out when I refused to give her more. When will enough be enough?

‘He wanted nothing to do with me’: I discovered my biological father through Ancestry.com. Am I entitled to a share of his estate?

‘I grew up dirt-poor’: I am 43 and have $2.5 million in stocks and an IRA. Can I retire early?

Should you ‘orange pill’ children? The case for Bitcoin kids books – Cointelegraph Magazine

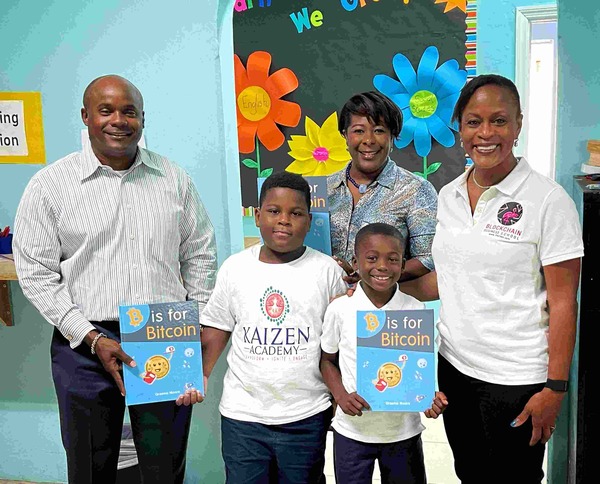

“Any kid who doesn’t learn something about Bitcoin is missing out,” says Bitcoin advocate Ben De Waal.

De Waal explains that his 12-year-old daughter Samantha has already convinced “a couple” of her schoolmates and a teacher to hop on the Bitcoin bandwagon, though she’s not attempting to “orange pill the entire school”… yet.

Thanks to her upbringing in a “Bitcoin family” that has largely abandoned fiat currency, Sam is now a Bitcoin ambassador wunderkind nicknamed The Bitcoin Kid.

De Waal himself discovered Bitcoin “around 2010” and dedicated his life to it around 2016 (sadly, after he deleted 200 Bitcoin!). He’s worked in engineering leadership positions at both Swan Bitcoin and Lightning Labs and explains he first introduced Sam to children’s books about Bitcoin when she was just 10 years old.

Just two years after she read her first Bitcoin book, Sam found herself on the grand stage of BTC Prague 2023 in mid-June, delivering a speech about Bitcoin.

Oh, and she had to follow MicroStrategy’s Michael Saylor’s presentation, too.

Seems like she nailed it, though – she was “the best” speaker at the conference according to Peter McCormack, the host of the incredibly popular podcast What Bitcoin Did.

It’s her second big conference appearance, following a presentation at Adopting Bitcoin in 2022.

Adults shouldn’t feel too bad, though — kids have a natural advantage when it comes to understanding and learning about Bitcoin.

Scott Sibley, co-author of the children’s book Goodnight Bitcoin, believes this is because kids haven’t really latched onto a specific form of currency yet.

“In many ways, it’s easier for kids to learn about Bitcoin because they don’t have the baggage of thinking it’s new or different.”

Goodnight Bitcoin is an origin tale recounting how Satoshi Nakamoto created Bitcoin and sent the first Bitcoin to Hal Finney.

“Goodnight Bitcoin tells the story of Satoshi and Hal as they attempt to create the impossible: a new money called Bitcoin,” Sibley says.

It brings children through various stages of the “Bitcoin story.”

The book touches on the perception that many had toward Bitcoin when it was first introduced, stating that “many monsters thought it was impossible and very funny.”

Also lightly touching on how the Bitcoin network operates, the book explains, “In 2011, Satoshi slipped away to his hidden shelter. But don’t worry, the helpers have kept the Bitcoin network running.”

Another Bitcoin kid’s book author Graeme Moore (B Is for Bitcoin) believes that kids who are exposed to Bitcoin today will find it easier to form their own opinions about it later in life.

“If it’s a thing that’s been around forever since you were born, then you have a lot more confidence in pursuing it as a legitimate endeavor for a number of years,” Moore says.

This is evident with Sam, who has been exposed to Bitcoin throughout her entire life.

She even accidentally orange-pilled her own school teacher.

“Her teacher said to me, ‘Hey, I learned some basics from your daughter, but you know, what is this [Bitcoin], can you tell me more about this?’” De Waal recalls.

Sam is mainly interested in reading allegory books with a hidden message.

Two of her favorite books so far are Bitcoin Money: A Tale of Bitville Discovering Good Money, a story that explores different types of money and helps kids tackle the “Why Bitcoin?” question, and 99 Bitcoins and an Elephant, a tale of a young girl lost in a huge department store that becomes flush with Bitcoin.

De Waal says that while these books “didn’t necessarily” teach her all the fundamentals about Bitcoin, they “firmed up her knowledge and made it clearer.”

What do children learn from Bitcoin kids’ books?

The real question is: Does introducing kids to Bitcoin early via children’s book help create the next generation of Bitcoiners? And is it education or a form of indoctrination?

While there are no guarantees that simply reading books about Bitcoin to children will lead them to grace the stage at BTC Prague, Bitcoiner parents see benefits to be gained from planting the seed early.

The authors that Magazine speak to believe that getting kids familiar with the word “Bitcoin” and teaching them a few basic concepts is a good base of knowledge for further exploration.

Moore explains that brand-new technologies do not “really take off” until they are “accepted as inevitable.”

“There are kids now who were born in 2009, and they’ve never been alive without blockchain,” Moore says. (Samantha is a good example of this).

“Bitcoin has always existed since they were born, so they assume they will always exist until the end of time.”

Moore admits that children will not “learn a ton” about the mechanics of Bitcoin from his book, but there are “some funny rhymes in the book” that introduce larger concepts.

“C is for consensus that the blockchain brings, D is for decentralization of all of the things,” he quotes from B Is for Bitcoin.

Drawing inspiration from Dr. Seuss, his “favorite author ever,” Moore understands how powerful it is to instill certain words and ideas into children from a young age.

He says that diving into all the nitty-gritty technical stuff isn’t really necessary.

“[Kids] don’t have to know how proof-of-work actually works and how the difficulty adjustment makes it secure, and why the blockchain is immutable,” Moore explains.

The book has become a hit within the Bitcoin community, with Moore occasionally waking up to a big order.

“Like a couple of people in Bitcoin, they’ll call me randomly and be like, ‘Hey, I need 20 copies,’ and I’ll be like ‘Cool, that’s awesome.’”

A famous billionaire Bitcoin investor even requested a stack of copies.

“Tim Draper bought 10 copies from me one time,” Moore gleefully recalls.

However, not all believe shoving Bitcoin down children’s throats is a good idea.

Jason Don, author of Rhyming Bitcoin, has a similar belief to Moore on just introducing the broad topic to kids and says it is important to just “open their minds to the possibilities that Bitcoin offers.”

Rhyming Bitcoin has a similar style to Alice in Wonderland and Dr. Seuss’ books, gently easing children down the Bitcoin rabbit hole in a fun and playful way.

While it doesn’t tackle the technical details of “how” Bitcoin was created, it focuses more on the “why.”

The book doesn’t shy away from taking a few playful jabs at fiat currency, proclaiming that “dollars, like rocks, don’t mean much” and gently introducing them to inflation in a passive-aggressive way.

“The Silly State prints dollars, all day and all night. They Keep printing dollars, and prices take flight!” the book declares.

“I just think it’s important that children understand that money isn’t just what the government says it is and that anyone should be free to use whatever money they like.”

Sibley believes that children don’t have the “ability to think fiat is weird yet,” but he’s confident that hearing these stories with an underlying message now will come in handy later in life.

“I have no doubt that as they get older, they will wonder why people had cash, went to banks — no different than people in their 20s and 30s today find writing a check so odd,” he says.

The simple lessons conveyed in these books can serve as a foundation for children to engage in a chinwag with their schoolmates, allowing them to develop their understanding even further.

De Waal says Sam is “pretty good at actually kind of talking about Bitcoin to other kids and explaining… What is Bitcoin? Why does Bitcoin exist?”

“She read the [Bitcoin Money book] to the class, and you know, there were a lot of questions which came out of that, which was great.”

Parents want to ‘orange pill’ their kids during bull markets

Interest in Bitcoin kids’ books is much higher during bull markets than bear markets.

“The sales of Bitcoin kids’ books perfectly track the price of Bitcoin,” says Moore, adding he can forecast his earnings several months in advance just by looking at the price.

“Two to three months after the coin price goes up, there’s more frequent sales, and then when the price goes down, you know there’s a lot less sales,” Moore adds.

It’s not necessarily a lucrative area, though, and authors often do it as a labor of love rather than as a money-making scheme. For example, Don doesn’t have a marketing team and relies on Bitcoiners on Twitter sharing photos of the book to “help grow the book’s audience.”

Sibley explains that the majority of his sales are to people already in the Bitcoin space “that have or are starting families” and sees those embracing alternative approaches to education as a potential audience.

“We anticipate more homeschool families gravitating towards Bitcoin education, but that will take some time.”

Similar to how Bitcoin requires time for mainstream adoption, the books for children are still a fair bit away from topping the charts anytime soon.

One of the most popular Bitcoin kids’ books sold on Amazon is Bitcoin Money: A Tale of Bitville Discovering Good Money by Michael Caras and Marina Yakubivska, which has more than 250 reviews and an average rating of 4.6.

My First Step in Crypto and Bitcoin Investing for Kids and Beginners: Simplified Introduction of Cryptocurrencies for Dummies by Sweet Smart Books and Kelly Rhodes is another hot product for Bitcoiners with 95 reviews and an average rating of 4.2.

But their success is relative: Mainstream kids’ books such as I Love You to the Moon and Back by Amelia Hepworth and Where the Wild Things Are by Maurice Sendak, have 66,074 and 33,920 ratings, respectively.

Read also

Features

The value of a legacy: Hunting down Satoshi’s Bitcoin

Features

How to make a Metaverse: Secrets of the founders

The author’s personal motivations

The motivation behind creating a Bitcoin children’s book for many authors seems to originate from the desire to share their passions and beliefs with their offspring.

It is not uncommon for children’s books that tackle political or ideological concepts to be inspired by a desire from the author to communicate their beliefs to their own children.

For example, Ibram X. Kendi wrote Antiracist Baby to share his views on race and racism with his four-year-old daughter.

He said in an interview with the Los Angeles Times that the idea was to open up the conversation with parents and “little children about racism” before they can even understand it.

“The idea is that when they’re older, they will have heard so much about it, it won’t be anything mysterious or taboo.”

Similar books include A is for Activist by Innosanto Nagara, which explores social justice and promotes LGBT equality through playful illustrations, and Ada Twist, Scientist by Andrea Beaty, which challenges traditional gender roles through witty writing and creative drawings.

While anti-racists, activists and Bitcoiners all see teaching their beliefs to their kids as education, opponents may view it as indoctrination.

DeFi Dad, a popular crypto podcaster and influencer with over 152,000 Twitter followers, tells Magazine he has refrained from exposing his two young children to Bitcoin kids’ books and would be cautious to do so anytime soon.

“As a parent, despite how bullish I am on crypto, I would still be cautious of any ‘Bitcoin kids’ books’ until I read them myself to verify they are objectively educational and not some form of propaganda.”

Even if the books present themselves to be educational, he believes that these books should be “complementary” to children’s education about fiat currencies and not “replace any such books.”

“In the United States, I would bet more than 99% of children are not exposed to any form of education on fiat or basic finance,” he says, adding there was a real “lack of financial literacy” as a result.

De Waal explains that, while he introduced Sam to reading books about Bitcoin and is running a “Bitcoin family,” he is OK if she decides to go her own way too.

“Maybe one day, she’ll come to me and say, ‘Hey, dad, you know, I think Bitcoin is terrible.’ I’ll say, ‘Okay, tell me why,’ you know, ‘Explain to me why, and we’ll discuss this.’ I’m not just going to say, ‘You’re wrong.’”

Explaining a complicated subject

The authors have the best of intentions, however. Moore says that he wrote B Is for Bitcoin with his young niece in mind, wanting to have something special to read to her.

Sibley explains that “as a family with a then infant,” he wanted to expose her to Bitcoin before she could even walk.

“We wanted to be able to make it easier for her to be able to jump down the Bitcoin rabbit hole as early as possible,” he says.

For Don, who isn’t a parent, the motivation behind writing the book was because he found most “so-called entry-level” Bitcoin books too complicated for beginners.

“Bitcoin can be daunting, difficult to explain, and even more difficult to wrap your mind around,” he says.

“One day, I was reading a so-called ‘beginner’ book, and it really wasn’t for beginners. So, I thought, Why not try to create a beautifully illustrated book that would appeal to people of all ages, something to ease people into the rabbit hole and that explains why Bitcoin is so important.”

Despite not having a child of his own to test the book on, he was able to recruit his mate’s kids.

“I was able to send the manuscript and illustrations to a number of friends with children for feedback, which I think proved incredibly helpful,” he says.

The authors opt for self-publishing

Don asserts that while there is a market for children’s books about Bitcoin, publishing houses are hesitant to take the risk. He sent the manuscript and illustrations for Rhyming Bitcoin to a publishing agent he “has a relationship with,” but they questioned how profitable the book would actually be.

“The feedback in terms of marketability wasn’t great. Rather than fight an uphill battle there, I opted for more control through self-publishing.”

Moore also opted for self-publishing, as he was reluctant to “lose massively on sales, on the back end.”

Although he acknowledges the advantage of “getting your $200,000 advance” through traditional publishing, he argues that relying on a publisher means betting “less on yourself” and forfeiting long-term rewards.

He draws a parallel to this arrangement, similar to being an employee rather than owning your own business.

Read also

Features

Blockchain and the world’s growing plastic problem

Features

Year 1602 revisited: Are DAOs the new corporate paradigm?

What has the feedback been like?

Moore says the feedback has been great besides those Bitcoin maxis who weren’t too thrilled about the inclusion of a non-Bitcoin currency.

“So, a few people who just wanted to be Bitcoin strictly, you know, Bitcoin maxis, of course, they weren’t huge fans that E was for Ethereum.”

But overall, the feedback has been positive, with many parents happy they can share their love of Bitcoin with their offspring.

“It’s being able to share something that you love with your kid while teaching them how to read. That’s been the really heart-warming feedback that I want.”

Bitcoin should be introduced to children naturally…

While it may be tempting for Bitcoin maxis to orange pill their child as young as possible, Sibley says it is better to take baby steps when introducing Bitcoin to children.

He says:

“If there are ways you can work in little lessons throughout the day when things are happening, that will probably stick the best.”

Sibley explains that integrating Bitcoin into everyday life, along with reading books, is the best approach.

“There was a service light on in our car that our daughter noticed one day and asked what it was. I explained to her how people have jobs fixing cars and that ours might need something done, but that would cost money. She then asked if we’d pay in Bitcoin, which shows how she is already thinking about transactions for value.”

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He’s also a standup comedian and has been a radio and TV presenter on Triple J, SBS and The Project.