Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Welcome to Latam Insights, a compendium of Latin America’s most relevant crypto and economic news during the last week. In this issue: President Bukele states El Salvador will not sell its bitcoin, Bitcoin ETFs land in Brazil and Peru, and Argentine President Javier Milei aims to criminalize central bank money issuance. El Salvador Won’t Sell […]

Source link

land

Sam Bankman-Fried defense team fails to land a blow as he takes stand

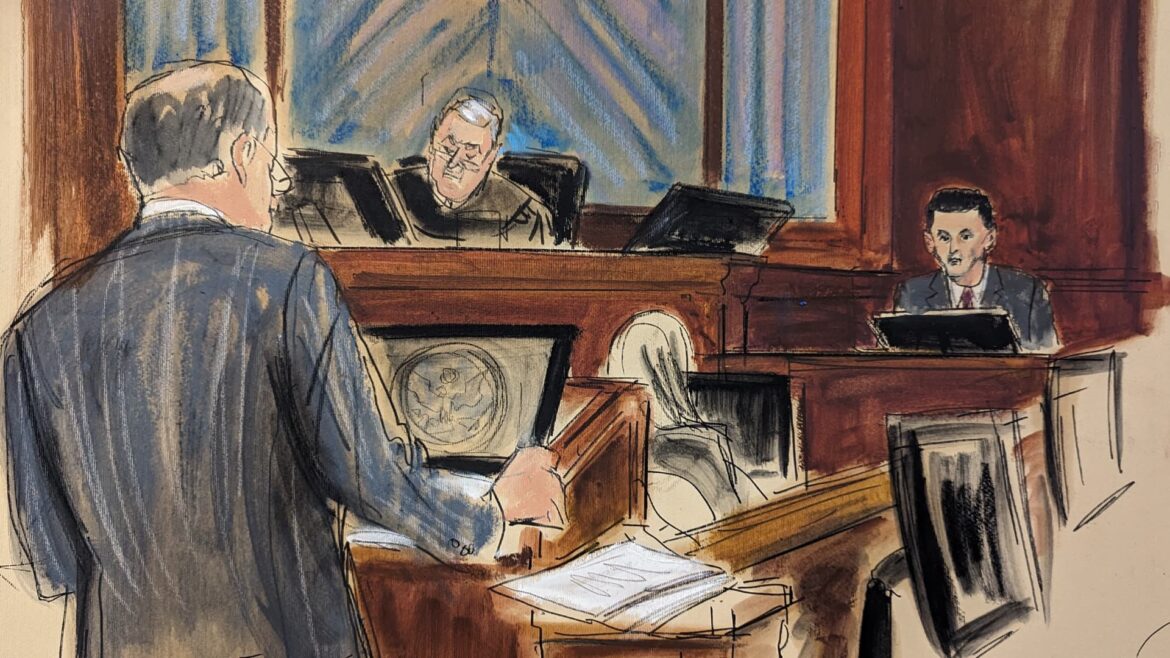

Courtroom sketch showing Sam Bankman Fried questioned by his attorney Mark Cohen. Judge Lewis Kaplan on the bench

Artist: Elizabeth Williams

Sam Bankman-Fried took the stand in a New York courtroom on Thursday, as he and his defense team auditioned their best legal material for U.S. District Judge Lewis Kaplan.

The former crypto billionaire had originally been scheduled to testify before the jury, but the judge sent jurors home early to consider whether some aspects of Bankman-Fried’s planned testimony, related to legal advice he got while running FTX, would be admissible in court.

In a sort of mini-hearing within the trial, defense attorney Mark Cohen guided Bankman-Fried through a series of questions designed to showcase the defense’s strongest arguments of his innocence, including suggesting that he relied on FTX’s former chief regulatory officer and in-house attorney, Dan Friedberg, to guide some actions that the government claims are illegal.

Bankman-Fried faces seven criminal counts, including wire fraud, securities fraud and money laundering, that could land him in prison for more than 100 years if he is convicted at his trial in Manhattan federal court. Bankman-Fried, the son of two Stanford legal scholars, has pleaded not guilty in the case.

“Before the trial, I was convinced that SBF was headed to near-certain conviction on serious felony counts, and it was apparent to me that his defense team had not come up with anything that could derail that result,” said Renato Mariotti, a former prosecutor in the U.S. Justice Department’s Securities & Commodities Fraud Section and now a trial partner in Chicago with Bryan Cave Leighton Paisner.

“Nothing that has occurred during the trial has changed my view. The evidence of his guilt appears to be overwhelming,” added Mariotti.

In the last four weeks of trial, multiple members of the C-suite at crypto exchange FTX, and its sister hedge fund Alameda Research, have all singled out Bankman-Fried as the mastermind behind the scenes. Several of these witnesses have themselves pleaded guilty to multiple charges, including Bankman-Fried’s ex-girlfriend Caroline Ellison, who faces a maximum sentence of 110 years for crimes committed while she was the CEO of Alameda.

Prosecutors have also entered evidence to corroborate witness accounts, including encrypted Signal messages and other internal documents that appear to show Bankman-Fried orchestrating the spending of FTX customer money.

The defense’s case — which is comprised of Bankman-Fried’s upcoming testimony along with that of two witnesses who both wrapped in just over an hour on Thursday morning — hinges on whether the jury believes the defendant when he takes the stand.

“He has always been convinced that he’s the smartest guy in the room and that he can talk his way out of any problem,” continued Mariotti.

“But the biggest problem with SBF’s testimony will be SBF himself. Given that the core issue will be intent to defraud, SBF should be portraying himself as clueless, inattentive, and in over his head. But for years he had portrayed himself as a visionary genius, and I don’t expect that to change on the stand,” he said.

Defense struggles to land a blow

Judge Kaplan previously ruled that Bankman-Fried’s lawyers could not make a so-called advice of counsel argument in their opening remarks since it might risk prejudicing the jury. On Thursday, Kaplan sent the jury home early to reconsider in a closed-door session whether to allow this line of testimony.

Under questioning led by Cohen, Bankman-Fried appeared to place much of the criminal blame on FTX’s chief regulatory officer, Friedberg, as well as outside counsel Fenwick & West, which advised the crypto exchange. Bankman-Fried spoke about Friedberg’s active involvement in everything from the company-wide auto deletion policy on messaging apps like Signal, to the creation of Alameda’s North Dimension bank account, where billions of dollars worth of FTX customer money was funneled.

The former FTX chief also said that the hundreds of millions of dollars in personal loans to himself and other founders of the platform were structured through promissory notes drafted by his in-house legal team and discussed in concert with his general counsel and Friedberg. Having the blessing of his legal counsel was something that SBF said he “took comfort in.”

While taking the stand offers Bankman-Fried the opportunity to tell his side of the story to jurors, it also opens the door for federal prosecutors to go for the jugular in cross-examination. Following damning testimony from Bankman-Fried’s closest ex-confidantes and top deputies, defense attorneys for the FTX founder have failed to flip the narrative in cross-examining key witnesses or to undermine the most troubling allegations regarding their client.

Indeed, Bankman-Fried’s practice run on Thursday was tough to watch. While he came across as direct and credible in his direct examination, the grilling by prosecutors was aggressive and effective. At multiple points, the judge appeared exasperated by Bankman-Fried’s responses, once saying that the defendant had an “interesting way of answering questions.”

The defendant’s demeanor flipped 180 degrees when U.S. assistant attorney Danielle Sassoon began her questioning. He swiveled back and forth in his chair, nervously shook a piece of paper he held in his hands, repeatedly grabbed for his water bottle before responding, and skirted a lot of questions by saying he couldn’t recall what had happened.

Judge Kaplan interjected at one point, telling the defendant to “listen to the question and answer the question directly.”

On Friday morning, we’ll get a ruling from the judge on what’s admissible from the defense’s wish list of topics – as well as Bankman-Fried’s debut before the jury from the stand.

“Given that he appears headed for defeat, taking the stand can be a ‘Hail Mary’ of sorts,” said Mariotti.

“SBF will be hamstrung by his many prior statements, which could be used to impeach him. It will be difficult for SBF to weave his testimony around those prior statements.”

This week’s testimony is just the latest example of the defense team’s struggle to land a blow in the criminal fraud case.

Prosecutors spent four weeks of the trial walking former leaders of FTX and Alameda Research through specific actions taken by their boss that resulted in clients losing billions of dollars late last year.

In trying to poke holes in witness accounts, Bankman-Fried’s lawyers have repeatedly jumped around, unable to maintain a consistent timeline or coherent argument, while also opening the door for witnesses to offer additional testimony in furtherance of what they’d previously told the jury.

The scattershot approach is potentially troubling for Bankman-Fried, who’s counting on his defense attorneys to keep him out of prison in what could be a life sentence if convicted. The central claim the defense has been unable to knock down is that Bankman-Fried knowingly used billions of dollars in FTX customer funds to pay for his lavish lifestyle, to make political donations and, most dramatically, to cover a gaping hole in Alameda’s books following the cratering of cryptocurrency prices last year.

Cohen, a co-founder of the New York law firm Cohen & Gresser, is being joined at trial by Christian Everdell, a member of the firm’s white collar defense team. Cohen, a graduate of the University of Michigan Law School, started his firm 21 years ago and previously served as an assistant U.S. attorney for the Eastern District of New York. Everdell started at Cohen & Gresser in 2017 after almost a decade working as a prosecutor for the Southern District of New York.

— CNBC’s Dawn Giel contributed to this report.

McDonald’s Hong Kong has picked The Sandbox to build its first Web3 experience, McNuggets Land, a virtual world dedicated to celebrating Chicken McNuggets’ 40th anniversary.

The experience takes users to a virtual store with a hidden factory and a tour through the history of the chicken snack, allowing gamers to play and complete quests to win rewards, such as The Sandbox (SAND) utility token, which is used to purchase virtual goods and customize avatars on the platform.

Hong Kong users can also win 365-day free Chicken McNuggets coupons for redemption at the chain’s restaurants. To join the virtual world, users only need an email address.

Metaverse experiences have emerged as a tool for brand-building strategies in the past few years, allowing companies to gamify products and services, as well as establish online loyalty programs.

Sebastien Borget, co-founder and chief operating officer of The Sandbox, noted in a statement shared with Cointelegraph that the partnership with McDonald’s takes The Sandbox to “a new level” and brings it “closer to realizing the ultimate goal of mass adoption of the metaverse.”

The giant fast food chain has chosen Web3 tools to engage customers in the past. In 2021, for instance, McDonald’s China released a set of 188 nonfungible tokens to celebrate its 31st anniversary in the local market.

McDonald’s isn’t the first global brand to embrace the virtual world through collaborations with The Sandbox. The Web3 firm has partnered with nearly 400 companies, including Warner Music Group, Ubisoft, Gucci and Adidas, as well as Snoop Dogg, The Smurfs, Care Bears, The Walking Dead and Atari.

“The launch of self-publishing now allows our partners to realize the true potential and monetise their brand in the metaverse by making their customer experience available to everyone, all the time,” said Borget about the recently released feature that allows brands to launch experiences directly on the platform’s map.

Magazine: 4 out of 10 NFT sales are fake: Learn to spot the signs of wash trading

Ethereum users have been given another way to create nonfungible tokens (NFTs) and other digital assets on the blockchain with the launch of a new protocol.

Launched on June 17, the protocol, dubbed “Ethscriptions,” is a nod to the Bitcoin (BTC) Ordinals protocol — where assets are known as “inscriptions.”

Ethscriptions was developed by music website Genius.com co-founder Tom Lehman, who uses the pseudonym Middlemarch on Twitter. Lehman declared the project a “huge success” in a series of tweets on June 17 and noted nearly 30,000 Ethscriptions had been created within the first 18 hours of the protocol going live.

With almost 30k Ethscriptions in

Thank you for seeing the massive potential here!I am on Ethscriptions 24/7, but I need your help!

DM @proroketh to join our protocol Twitter chat. Ideas, bug reports, NO alpha, NO trading, NERDS ONLY! pic.twitter.com/udKdsVT0L8

— Middlemarch (@dumbnamenumbers) June 17, 2023

According to Lehman, Ethscriptions assets utilize Ethereum “calldata” — the data within a smart contract — to allow for a “cheaper” and “more decentralized” minting process compared to conventional smart contract-based methods.

Users are currently limited to image-only inscriptions, but Lehman says the protocol will allow for different file types to be uploaded in the future. Currently, users are able to “ethscribe” any image as long as it’s less than 96 kilobytes in size.

Lehman’s debut project on the Ethscriptions protocol, dubbed “Ethereum Punks,” witnessed a considerably positive response from the community, with all 10,000 assets being claimed near-instantaneously.

Introducing Ethscriptions: a new way of creating and sharing digital artifacts on Ethereum using transaction calldata.https://t.co/XfQ7RdtblD

ALSO: Introducing Ethereum Punks. Because why should all non-contract Punk collecting happen on Bitcoin?https://t.co/d3Ycwbdc2Z…

— Middlemarch (@dumbnamenumbers) June 16, 2023

Lehman added the project’s launch garnered so much user activity that the API interface for the official Ethscriptions website temporarily crashed.

Related: Bitcoin Ordinals to bridge Ethereum NFTs with the launch of BRC-721E

Due to pre-existing infrastructure that allows for the creation of NFTs and other digital assets on the Ethereum network, it’s unclear if Ethscriptions will witness the same level of popularity as Bitcoin Ordinals has.

In less than six months, the total number of Ordinals inscribed on Bitcoin surged from zero to 10 million. The enormous surge in activity was driven in large part by users embracing the novelty of being able to mint assets, which later included entirely new tokens — by way of the BRC-20 token standard — on the Bitcoin network.

NFT Creator: ‘Holy shit, I’ve seen that!’ — Coldie’s Snoop Dogg, Vitalik and McAfee NFTs