Grayscale Investments has removed cardano from its Digital Large Cap Fund. The crypto fund now holds bitcoin, ethereum, solana, XRP, and avalanche. The crypto asset manager also adjusted the holdings of its Smart Contract Platform Ex-Ethereum Fund. Cardano Removed From Grayscale’s Large Cap Fund Grayscale Investments, the world’s largest crypto asset manager, announced Thursday that […]

Grayscale Investments has removed cardano from its Digital Large Cap Fund. The crypto fund now holds bitcoin, ethereum, solana, XRP, and avalanche. The crypto asset manager also adjusted the holdings of its Smart Contract Platform Ex-Ethereum Fund. Cardano Removed From Grayscale’s Large Cap Fund Grayscale Investments, the world’s largest crypto asset manager, announced Thursday that […]

Source link

Large

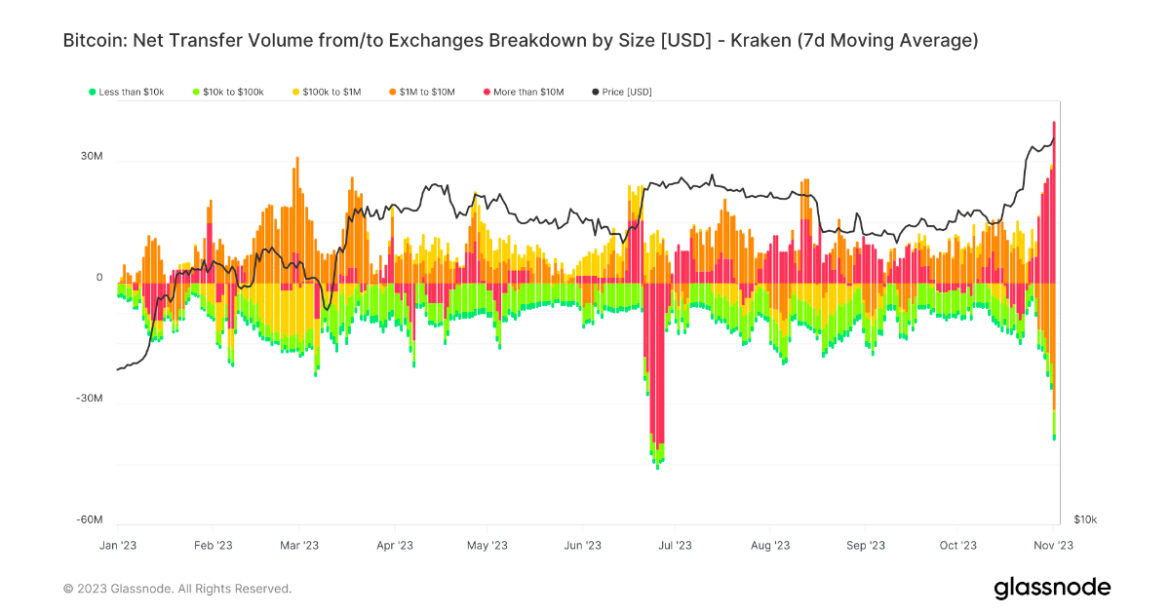

Record-high inflows and outflows noticed on Kraken, large investors in play

Quick Take

Recent data analysis by CryptoSlate brought to light an unusual pattern of massive inflows and outflows on cryptocurrency exchanges. Notably, Kraken, one of the prominent crypto exchanges, has been at the heart of this trend with significant movements of digital assets in recent weeks.

On Nov. 1, Kraken experienced the third largest outflow this year, with approximately $75 million leaving the exchange. In a fascinating deviation, this departure was accompanied by the second largest inflow of the year – a hefty sum reaching nearly $100 million.

The inflow was primarily driven by large investors, often dubbed ‘whales,’ while the outflows were characterized by transactions ranging from $1 million to slightly less than $ 10 million.

The recent week has highlighted a distinct divergence in the transaction patterns on Kraken. Specifically, we observe inflows of Bitcoin exceeding $10 million arriving at the exchanges, while the outflows are predominantly transactions of less than $10 million leaving the exchanges.

Similarly, last week, Crypto.com saw its most significant influx in a year, reinforcing the unprecedented surge of capital mobility on crypto exchanges.

The post Record-high inflows and outflows noticed on Kraken, large investors in play appeared first on CryptoSlate.

These 13%-Plus-Yielding Stocks Pay Large Monthly Dividends; Analysts Say ‘Buy’

Dividend investing has always been popular, and for good reason. Dividend stocks offer a wide range of advantages for return-minded investors, but two of the most significant are a reliable income stream and an inflation-beating yield. Taken together, these advantages can form the base of a truly sound portfolio.

The majority of dividend stocks pay out on a quarterly basis, but turning towards those with a monthly payment schedule allows investors to better plan their income streams to meet their needs. When it comes to yields, they are still calculated based on the annualized rate of the dividend, so even a small monthly payment, multiplied by 12, can result in a high annual yield.

But not all dividend stocks are created equal, and some offer better opportunities than others. This is where Wall Street’s analysts come into play.

Diving into the TipRanks database, we have homed in on two monthly-payment dividend stocks that not only boast a market-beating dividend yield of at least 13% but also qualify as ‘Strong Buys’ according to the analyst consensus. Let’s take a closer look.

Dynex Capital (DX)

We’ll start with Dynex Capital, a real estate investment trust company that focuses on mortgage loans and securities. Dynex allocates its resources to both agency and non-agency mortgage-backed security (MBS) instruments and also has exposure to the commercial MBS market. The company’s portfolio also contains a sizable portion of mortgage loans, including both securitized single-family residential and commercial mortgages dating back to the ’90s.

Dynex adheres to several simple strategic points in building its portfolio. The company is committed to capital preservation and disciplined allocation of that capital, using risk management techniques to maintain long-term returns. Furthermore, the company has always been committed to maintaining the dividend as a healthy component of those returns. Finally, and of key importance to dividend investors, Dynex keeps its sights set on maintaining stable and acceptable returns over the long term.

In the last quarter reported, 2Q23, Dynex’s bottom line came in with a net income per diluted share of 96 cents. This EPS exceeded expectations by $1.25 and compared favorably to the 81-cent EPS loss reported for 1Q23. Additionally, Dynex reported $561.5 million in ‘cash and unencumbered assets’ available at the end of Q2, with $300.1 million in cash, representing a 7.5% increase from Q1.

The company’s combination of a positive net income and solid cash assets on hand fully covered the monthly dividend payment, which was last declared in August at 13 cents per common share and paid on September 1. The dividend annualizes to $1.56 per share, providing an attractive yield of 13%.

Covering the stock for BTIG, analyst Eric Hagen points out the company’s solid return profile – and the fact that the dividends are fully covered by income and assets.

“Our expectation [is] for DX’s dividend to remain stable at these spread levels, or even a little wider, followed by the opportunity to capture some capital appreciation (book value upside) when mortgages eventually tighten versus interest rates. Having strong conviction for spreads to tighten is admittedly a moving target (tethered mostly to realizing lower interest rate volatility), although we expect stock valuation could improve quickly when that visibility comes into better focus… We think the real value being captured along the way is managing and preserving a very healthy and transparent liquidity position, which we expect to remain in excess of $400 million, or more than half its capital base,” Hagen opined.

Hagen uses these comments to support his Buy rating on DX stock, and his $15 price target points toward an upside potential of ~26% in the coming months. Adding in the dividend, and the total return on this stock is a solid 39% for the year ahead. (To watch Hagen’s track record, click here)

Overall, all three of the recent analyst reviews on Dynex are positive, making the Strong Buy consensus rating unanimous. The shares are selling for $11.94 and their $14.33 average price target implies a 20% one-year upside. (See DX stock forecast)

Ellington Financial (EFC)

The next high-yield dividend stock we’ll look at is Ellington Financial, another mortgage REIT. This firm works in the acquisition and management of financial assets, with particular attention to such mortgage-related assets as MBSs and equity investments in commercial and residential mortgage loans. The company reported having $9.4 billion in total assets under management as of June 30 of this year.

The AUM is only part of Ellington’s story. The firm reported a solid balance sheet in its release of the 2Q23 financial results, the last such results reported. Total assets on the balance sheets came to $14.3 billion, $194.6 million in cash and another $343.3 million in other unencumbered assets. At the end of the quarter, the company had a book value per common share of $14.70; it’s important to note that this book value is down approximately 35 cents per common share from the December 2022 and March 2023 readings.

In a metric of special importance to dividend investors, Ellington reported adjusted distributable earnings of 38 cents per common share for Q2. While profitable, this was 5 cents per share lower than had been expected. Despite the miss on earnings, Ellington has maintained its monthly dividend payment at 15 cents per common share, or 45 cents per share quarterly. The annualized dividend payment, of $1.80 per common share, yields 14.4% at current share prices.

Analyst Crispin Love, covering Ellington for Piper Sandler, points out that the firm is taking steps to diversify its portfolio and expand into new territory. He writes of the company’s interests going forward, “A key catalyst for Ellington over the next several quarters could be loan acquisition opportunities to buy both performing and non-performing loans. We believe Ellington could be a bidder for the Signature CRE loans as the company has the expertise and the purchases would be consistent with the company’s history (especially following the Great Financial Crisis). On recent earnings calls, management commented that it would be interested in participating in the FDIC loan sales assuming that the transactions would be accretive to EFC. In addition to potentially participating in FDIC loan sales, EFC has been vocal about a desire to buy CRE loans from banks.”

It’s clear from his Overweight (i.e. Buy) rating, and his $15 price target, that Love does see Ellington’s potential acquisitions as accretive. His price target implies a 20% upside potential on the one-year time horizon. Add in the dividend yield, and the stock’s total yield on the one-year time frame climbs as high as 33%. (To watch Love’s track record, click here)

Overall, there are 5 recent analyst reviews on record for Ellington, and their 4 to 1 breakdown favoring Buy over Hold gives the stock a Strong Buy consensus rating. The shares are priced at $12.47 and have an average price target of $14.50, suggesting a 16% one-year upside. (See EFC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Large bitcoin (BTC) investors – “whales” in crypto terms – seemed undeterred by the recent weakness in price and substantially increased their holdings.

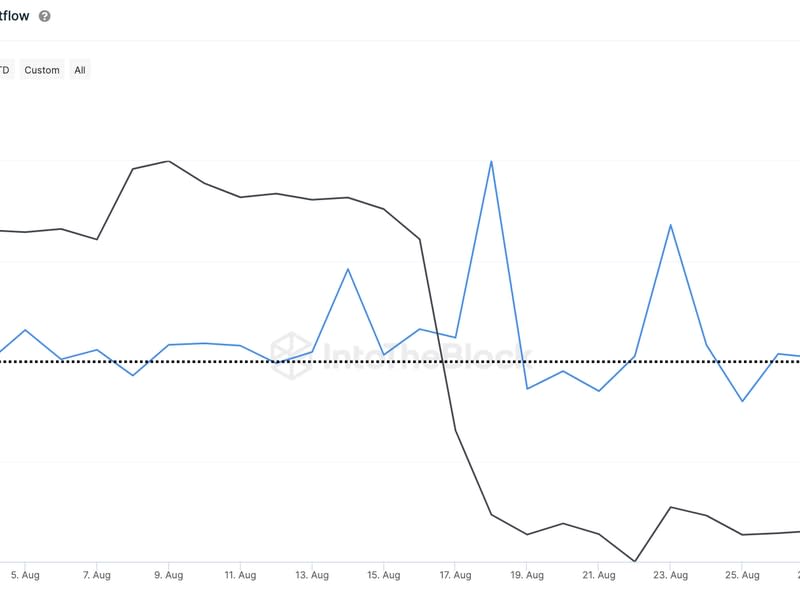

Data by crypto analytics firm IntoTheBlock shows that addresses holding at least 0.1% of the bitcoin supply – worth more than $500 million – increased their stash by a total of $1.5 billion in the last two weeks of August.

The increase occurred while inflows into centralized exchanges were near zero, suggesting that “there is organic buying demand rather than just funds moving to exchange addresses,” Lucas Outumuro, head of research at IntoTheBlock, wrote in a report.

Whales are entities who control large amounts of a digital asset. Their purchases and sales can have a sizable impact on markets, thus crypto watchers closely follow their behavior to anticipate market movements.

The purchases happened during a period when BTC’s price sunk to a two-month low, temporarily lifted by an important court decision in Grayscale’s campaign to list a spot bitcoin exchange-traded fund in the U.S.

Large holders first loaded up after Aug. 17, when BTC plunged more than 10% to below $26,000, its lowest price since June, IntoTheBlock data shows.

They also increased holdings earlier this week following asset manager Grayscale’s court victory over the U.S. Securities and Exchange Commission (SEC). A federal appeals court ordered the agency to vacate and review its denial to convert the $14 billion Grayscale Bitcoin Trust into a more-desirable spot bitcoin ETF.

Analysts interpreted the court’s decision as a key advance towards listing the first spot BTC ETF in the U.S., making the largest cryptocurrency more accessible for a new class of investors.

Still, BTC has erased all gains from the brief rally ignited by the Grayscale ruling and slid back below $26,000 on Friday.

Despite the weak price action, the accumulation suggests that “institutional investors are getting optimistic in bitcoin as ETF decisions approach,” Outumuro said.

In recent years, the world of artificial intelligence (AI) has been revolutionized by the advent of large language models. These models, such as OpenAI’s GPT-3, have showcased the immense potential of AI in understanding and generating human-like text. This article will delve into what exactly large language models are and how to deploy them for various applications.

Understanding large language models

Large language models are a class of artificial intelligence models that have been trained on vast amounts of text data to understand, generate and manipulate human language.

These models utilize deep learning techniques, specifically a type of neural network called a transformer, to process and learn patterns from text data. The result is a model capable of comprehending context, semantics and syntax in human language, allowing it to generate coherent and contextually relevant text.

OpenAI’s GPT-3 (Generative Pre-trained Transformer 3) is one of the most prominent examples of a large language model. With 175 billion parameters (learnable weights), GPT-3 can perform a wide range of tasks, from language translation and text generation to code completion and conversation.

Related: What is prompt engineering and how does it work

In addition to prompting LLMs, many developers are now also experimenting with fine-tuning. I describe in The Batch how to choose from the growing menu of options for building applications with LLMs: Prompting, few-shot, fine-tuning, pre-training. https://t.co/NgPg0snzNt

— Andrew Ng (@AndrewYNg) August 17, 2023

Deploying large language models

Deploying a large language model involves making it accessible to users, whether through web applications, chatbots or other interfaces. Here’s a step-by-step guide on how to deploy a large language model:

- Select a framework: Choose a programming framework suitable for deploying large language models. Common choices include TensorFlow, PyTorch and Hugging Face Transformers library.

- Prepare the model: If programmers use a pre-trained model like GPT-3, they must ensure that they have access to the model’s parameters and weights. For other models, they might need to fine-tune them on specific tasks.

- Set up an interface: Decide how users will interact with the model. This could be through a web interface, a chatbot or a command-line tool.

- Application programming interface (API) integration (for pre-trained models): When using a pre-trained model like GPT-3, users can interact with it using API calls. OpenAI provides API documentation and guidelines for integrating its models into applications.

- Implement user input handling: Design the code to accept user inputs and pass them to the model. The model generates responses based on the input and its context.

- Post-process output: Depending on the task, users might need to post-process the model’s output to make it more coherent or user-friendly.

- Scalability and performance: Consider the scalability of the deployment. Large language models can be resource-intensive, so make sure that the infrastructure can handle concurrent requests.

- User experience: Design a user-friendly interface that guides users in interacting with the model effectively. This is crucial for a positive user experience.

- Security and privacy: Implement security measures to protect user data and prevent misuse of the model. Encryption, access controls and data anonymization should be considered.

- Testing and optimization: Thoroughly test the deployment to identify and fix any bugs or issues. Optimize the model’s performance for speed and accuracy.

- Monitoring and maintenance: Set up monitoring tools to keep track of the model’s performance and usage. Regularly update and maintain the model to ensure it stays up-to-date and functional.

Applications of large language models

The versatility of large language models enables their deployment in various applications:

- Chatbots and virtual assistants: Large language models can power intelligent chatbots and virtual assistants that engage in natural language conversations with users.

- Content generation: They can create high-quality articles, product descriptions, marketing copy and more.

- Code generation: Large language models can assist developers by generating code snippets, completing code and providing programming-related explanations.

- Language translation: These models can be fine-tuned for specific languages and used for translation tasks.

- Content summarization: Large language models can automatically summarize long articles or documents.

- Personalized recommendations: They can provide personalized recommendations based on user preferences and behavior.

Related: How to learn Python with ChatGPT

ChatGPT can explain a JavaScript code in plain English. It “understood” the code was computing the pixel differences between a previous and next frame. Really good to start blog posts from code snippets! This function is used in @screenrunapp to detect mouse positions in a video pic.twitter.com/a44r7z5Qoy

— Laurent Denoue (@ldenoue) January 28, 2023

Careful deployment of large language models is the key to success

Large language models represent a groundbreaking advancement in artificial intelligence, bringing human-like language understanding and generation capabilities to machines.

Deploying these models requires careful planning, coding and consideration of user experience and security. Venturing into the world of large language models will open the potential to transform a wide range of industries and applications, enhancing interactions between humans and machines in unprecedented ways.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

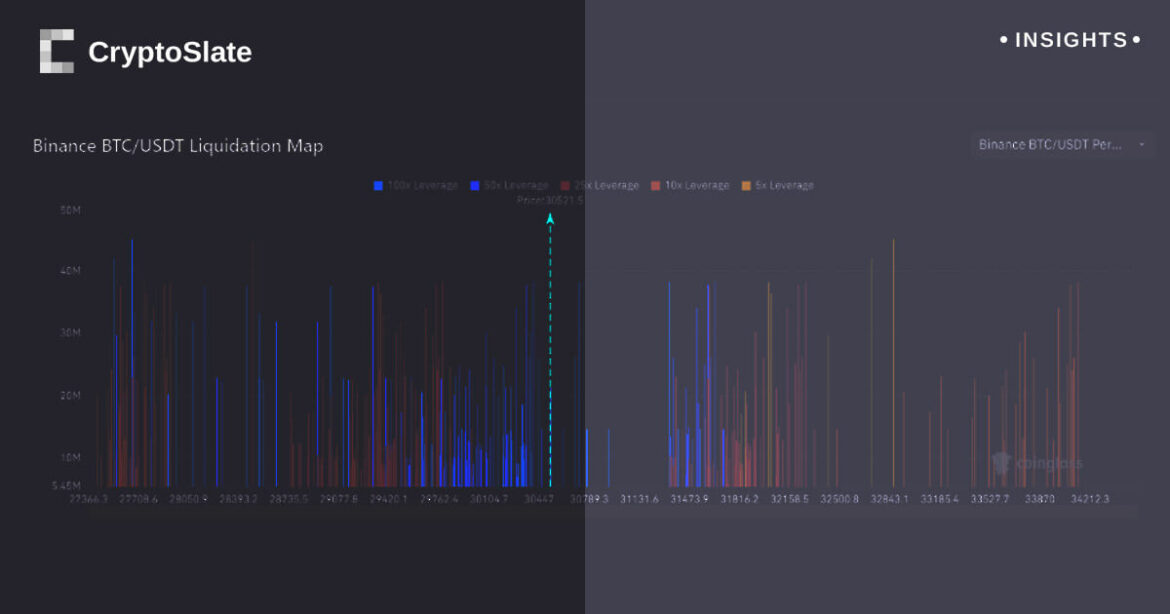

Quick Take

The use of a liquidation map as a tool for understanding investor leverage has been effectively demonstrated by Coinglass. This approach involves plotting liquidation levels in correlation with Bitcoin’s price.

There’s a substantial grouping of potential liquidations that stands out just below the $30,000 benchmark, stretching as low as $29,000. What’s especially remarkable about these liquidation levels is the intense level of leverage used, which could be as high as 50 to 100 times.

When we divert our attention above the $30,000 level, we find a marked scarcity of liquidation points until we hit $31,400. It is important to clarify that this data corresponds to the BTC/USDT pair on the Binance platform.

The post Large cluster of leveraged Bitcoin bets at risk of liquidation appeared first on CryptoSlate.