“It could be something to remember him by, as they were close.”

Source link

late

In this video, I will talk about two beaten-down stocks that are down 78% from their all-time highs and down 40% and 60% in the past five years.

*Stock prices used were from the trading day of April 5, 2024. The video was published on April 8, 2024.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Neil Rozenbaum has positions in PayPal. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends Alibaba Group and recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy. Neil is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

2 Growth Stocks Down 78% to Buy Before It’s Too Late was originally published by The Motley Fool

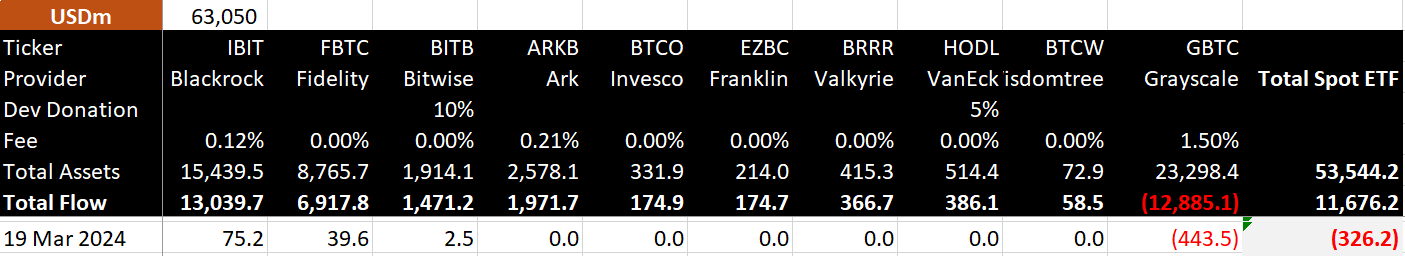

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.

The post First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow appeared first on CryptoSlate.

Alphabet (GOOGL -0.95%) (GOOG -1.22%) stock has run like wildfire over the past year, riding the recovery of tech stocks, the rebound of digital advertising, and the accelerating adoption of artificial intelligence (AI). Share prices of the search leader gained 52% during the past 12 months, nearly double the 27% gains of the S&P 500.

Investor confidence is on the upswing, fueled by the company’s improving financial results, which suggests that the advertising market — which represents the lion’s share of Alphabet’s revenue — will continue to gain ground.

Investors who sat out the recent rally are left asking themselves the quintessential investing question: Is a pullback coming, or should they buy Alphabet before the stock runs even higher? Let’s see what the evidence suggests.

Image source: Getty Images.

Multiple growth drivers on the horizon

Despite the bruising downturn of 2022 and the stock’s recent run higher, there are still reasons to be optimistic. Google remains the worldwide search leader, with more than 91% of the market, according to data compiled by web traffic analytics provider StatCounter. This is the funnel that drives the digital advertising that provides nearly all of Alphabet’s revenue. The company garnered an estimated 39% of worldwide digital ad revenue last year, according to online data provider Statista.

Furthermore, digital ad spending is expected to spike in 2024, increasing 13% year over year, according to data compiled by Insider Intelligence. As the global leader, Alphabet is best positioned to ride that secular tailwind higher.

The recovery in ad spending is already showing up in Alphabet’s results. In the fourth quarter, Alphabet’s revenue increased 13% year over year to $86.3 billion, accelerating from a 1% increase in the year-ago quarter. This suggests the advertising market is finally making a comeback, which could ultimately push Alphabet’s stock higher.

That’s not the only potential catalyst that could drive gains for the company.

The move to the cloud, a foundational part of the digital transformation, could also provide a boost. In the fourth quarter, Google Cloud remained the world’s third-largest cloud infrastructure provider, with 10% of the market, trailing Amazon Web Services and Microsoft Azure, which controlled 31% and 26%, respectively, according to market analytics company Canalys.

The role of cloud infrastructure services in providing generative AI to users has also been a hot topic, and Google Cloud is at the forefront of the conversation.

Its Vertex AI service offers everything users need to get AI up and running, including 130 prebuilt foundation models to choose from. Users can also accelerate the development process to “build, deploy, and scale AI-powered applications,” according to the company.

The most recent addition to its portfolio of products is Google Gemini, the company’s “largest and most capable AI model.” The system was designed to understand and incorporate information from a multitude of sources, including audio, video, text, images, and even computer code. Tests suggest its premiere model, Ultra, “exceeds current state-of-the-art results on 30 of the 32 widely used academic benchmarks” used to assess AI performance.

How to approach Alphabet stock now

Alphabet is currently selling for roughly 24 times trailing earnings, a discount compared to the price-to-earnings (P/E) ratio of nearly 28 for the S&P 500.

Furthermore, it’s difficult to quantify the impact of generative AI. As the opportunity continues to unfold, Alphabet could be among the principal beneficiaries of this secular tailwind.

As noted above, there are several growth drivers that could fuel an ongoing rally for Alphabet stock in the coming months and years. Given the opportunities ahead and its strong history of growth, I’d suggest now is the time to buy Alphabet stock while it’s still on sale.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

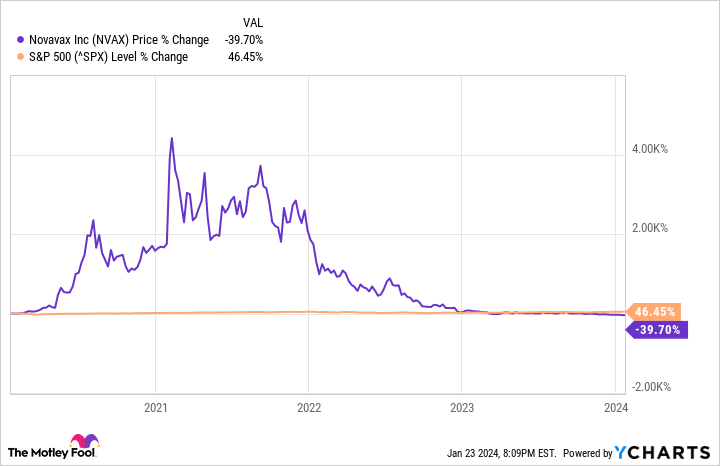

A few years ago, biotech company Novavax (NVAX -0.98%) looked like a promising stock. It emerged as a leader in the development of a COVID-19 vaccine, which sent its share price through the roof.

However, there have been a lot of negative developments for Novavax since then, and as a result, the biotech has given up all of its gains. Is there any hope for Novavax? If the company can improve its situation, investors who get in on the stock now could earn outsized returns.

Let’s find out whether Novavax is likely to pull off a comeback or whether the best the company has to offer is in the rear-view mirror.

What does the COVID-19 market look like?

Novavax’s sales for 2023 declined substantially compared to 2022. For the full fiscal year, the company expects total revenue of between $900 million and $1.1 billion. It reported revenue of about $2 billion in 2022, which means at the midpoint, its 2023 top line will be cut in half compared to the previous fiscal year. There is little reason to think Novavax will perform much better in 2024.

Thankfully, we are no longer in an emergency, and there is less need for COVID-19 vaccines. To be clear, many people will still choose to get inoculated. After all, the coronavirus can still lead to severe disease, complications, and death, especially for those patients with other underlying conditions. However, this market isn’t nearly as attractive as in the earlier pandemic years. And whatever is left of it won’t be dominated by Novavax.

Other companies, namely Moderna and the team of Pfizer and BioNTech, have consistently dominated this space over Novavax. They entered the market first and generated tens of billions in revenue from their products. Where does that leave Novavax? While its coronavirus vaccine is approved in multiple countries, it seems doubtful that it can generate enough revenue and profits from this market alone to turn things around.

So, Novavax will have to launch other products to get back in the good graces of investors.

Novavax looks trapped

For a biotech company the size of Novavax — its current market capitalization is just over $500 million — it isn’t a tragedy to have just one product on the market that generates little revenue. Some similarly sized clinical-stage peers look somewhat promising.

The secret is to have exciting pipeline candidates in late-stage studies and the funds to push these programs through the final clinical and regulatory hurdles — and Novavax seems to be lacking in both categories.

First, the company has two non-coronavirus candidates in the pipeline (this does not include a malaria vaccine that uses Novavax’s proprietary technology and is authorized in some countries). That’s not a bad number, but they are both still in phase 2 clinical trials. The first is a vaccine for the flu, while the second is a combined COVID/flu vaccine.

Both could be relatively successful, especially the second one. Making one trip and getting one shot to get inoculated against the coronavirus and the flu beats having to get one shot for each. Novavax hopes to start a phase 3 study for this combined vaccine candidate this year. However, neither one of these products will hit the market until 2026 at best. A lot can happen between now and then to prevent them from ever seeing the light of day, outside the lab anyway.

They could run into clinical or regulatory problems, or Novavax could encounter funding issues. Speaking of which, the biotech ended the third quarter of 2023 with $666 million in cash, equivalents, and restricted cash, compared to $518 million as of the end of the second quarter. Novavax was able to increase its cash balance thanks to a sale of common stock.

Of note, Novavax started 2023 by telling investors that it was at risk of running out of money and going out of business. The company has since implemented cost-cutting strategies. Still, with an uncertain COVID-19 vaccine market and no biotech with deep pockets as a partner, the company’s financial situation hardly inspires confidence.

With all that going on, can Novavax bounce back? Maybe it can, but no one — at least nobody without an incredibly high-risk tolerance — should bet on it. In my view, the biotech doesn’t have much to offer investors. The best likely is in the rear-view mirror for Novavax.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends BioNTech Se and Moderna. The Motley Fool has a disclosure policy.

Drive-through beverage business Dutch Bros (BROS 0.27%) has notched some impressive feats. For instance, its debut as a public company back in 2021 saw its stock shoot past its IPO price of $23 per share to close around $37.

But while the stock rose even higher in the ensuing months, it eventually returned to earth, hitting a 52-week low of $22.67 last September. Since then, however, the stock price jumped back up as the company delivered record revenue in its third quarter.

With the share price increase, is it now too late to buy Dutch Bros stock? To answer that question, it’s necessary to dig into the business in more detail. Understanding the factors contributing to the company’s success can help assess if Dutch Bros makes a good long-term investment.

A key factor in the revenue growth of Dutch Bros

Dutch Bros made a name for itself selling hand-crafted coffee using a drive-through format that emphasized speed of service. This approach proved popular, as evidenced by the company’s rapid expansion.

At the end of 2023, the number of Dutch Bros stores stood at 831. That’s up from 2022’s 671 shops. And for 2024, the company plans to open between 150 to 165 new stores.

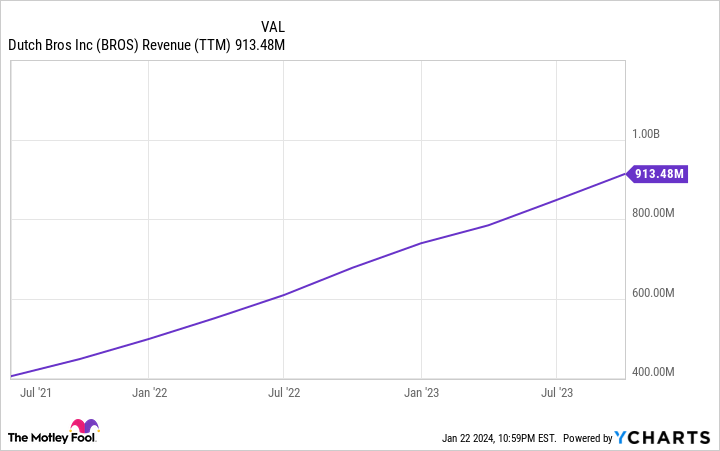

As Dutch Bros expanded, so has its revenue. Sales have been on an upward trajectory since its IPO.

Data by YCharts.

In the third quarter, revenue rose an impressive 33% to $264.5 million compared to $198.6 million in 2022. And for full year 2023, Dutch Bros expects to reach at least $950 million in sales, up from $739 million in 2022.

The company’s revenue growth is poised to continue for some time thanks to its expansion plans. Dutch Bros is targeting to reach 4,000 stores over the next ten to fifteen years.

If it achieves this goal, Dutch Bros will notch another amazing accomplishment. And the company has plenty of runway to do this. Through the end of Q3, Dutch Bros had stores in just 16 states, mostly in the western U.S. Also, it’s not in some major markets, such as New York and Chicago.

Other Dutch Bros factors to consider

But if Dutch Bros relied only on store expansion for revenue growth, that wouldn’t speak to its ability to establish successful shops. So its growth in same store sales is a key performance metric. This reflects the year-over-year change in the revenue of stores open at least 15 months.

You want to see this metric remain a positive number, although it can go up or down from year to year depending on various factors, such as whether Dutch Bros opens stores near existing locations. The company might do that if a particular area experiences increased customer demand. For Q3, the company’s same store sales achieved 4% growth compared to the prior year’s 1.7%.

The company also turned a corner with profitability in 2023. Through three quarters, Dutch Bros achieved net income of $13.7 million. That’s a substantial improvement over the $16.4 million net loss incurred in the initial three quarters of 2022, and demonstrates Dutch Bros can expand locations profitably.

However, one key unknown enters the picture in 2024. Dutch Bros is now under new leadership as Christine Barone became CEO at the start of this year. The first quarterly results under her tenure are months away, so it’ll take time before investors can assess her ability to maintain or improve the company’s current success.

But she recognized that about 63% of transactions are from members of the company’s loyalty program. As a result, she’s embracing promotions to keep these repeat customers coming back, and reaching new clientele through increased use of advertising. These are promising signs, especially if the efforts can grow the company’s same store sales.

Deciding on Dutch Bros stock

In terms of whether it’s too late to capture upside with Dutch Bros shares, consider the stock is well off its 52-week high of $41.44, and even below the nearly $37 closing price on the day of its IPO, at the time of this writing. In addition, the average price target for the stock among Wall Street analysts is $34.33.

Given these factors, and assuming new CEO Christine Barone can continue the company’s current success, it’s not too late to buy Dutch Bros stock.

Add to this the beverage purveyor’s successful revenue growth to date, its profitability, and its impressive store expansion plans spanning many years, and Dutch Bros stock looks like a solid long-term investment.

Realty Income (O 0.71%) has trademarked the nickname “The Monthly Dividend Company.” One big takeaway from this choice is that the real estate investment trust (REIT) is heavily focused on consistently paying dividends to shareholders. If that sounds like a company you’d like to own, there’s still time to buy it even though the stock has rallied of late.

What does Realty Income do?

Before getting into a valuation discussion, it is important to understand Realty Income’s business. It is a property-owning REIT, but it uses a net-lease approach. Net leases require tenants to pay most property-level operations costs. That protects the REIT from inflation to a large degree. And while virtually all of Realty Income’s properties are single tenant, making any individual property a high risk, across a large portfolio the net-lease approach is fairly low risk. Realty Income owns over 13,200 properties.

Image source: Getty Images.

It is, in fact, the largest player in the net-lease space. To put a number on that, its market cap is roughly $42 billion, making Realty Income more than twice the size of its next-largest competitor. Size comes with advantages, including the ability to spread costs over a larger revenue base, greater access to capital markets, and the ability to take on larger deals. Although being so large also makes it harder to move the needle on the top and bottom lines, Realty Income is a differentiated company in the net-lease space.

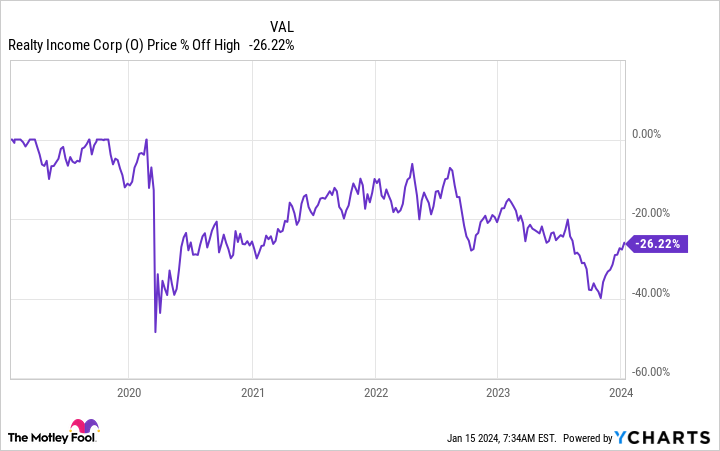

Realty Income’s stock has fallen hard

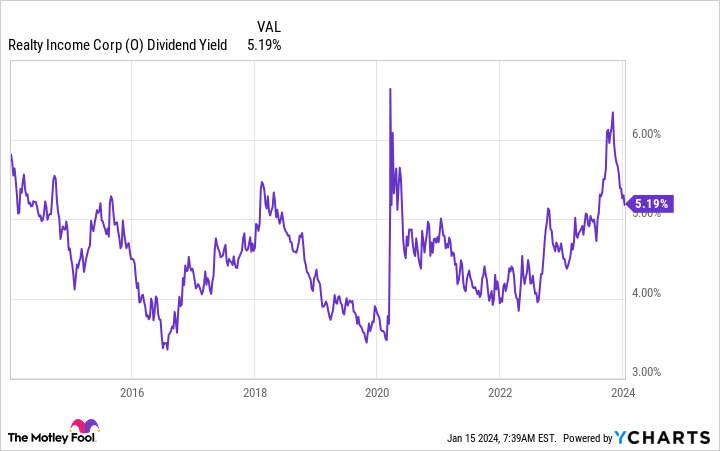

That said, Realty Income’s share price has fallen roughly 25% since hitting a recent peak in 2020. There are a host of reasons for this. The one that has lingered longest is probably interest rates. Rising rates are a headwind for real estate companies because they increase the cost of capital. Although property markets eventually adjust to higher rates, it can take some time.

Also, higher rates make income alternatives more attractive. For example, Realty Income’s 5.2% dividend yield is only a touch higher than what might be available from a high-yield CD. Although there’s a huge benefit in Realty Income’s 29-year streak of annual dividend increases, owning a CD would allow investors to avoid the risk of owning a stock.

But it is important to recognize that the stock decline has pushed Realty Income’s yield up toward the highest levels of the past decade. So for long-term dividend investors, it is probably an attractive investment choice.

O Dividend Yield data by YCharts

Not as great an option, but Realty Income is still attractive

There’s a caveat here, however, when you look at Realty Income’s stock over the short term. The stock is up around 15% over the past three months or so. That’s largely driven by investors believing that the interest rate increases the Federal Reserve has made are at an end. Regardless of why, however, the opportunity to buy Realty Income just isn’t as good as it was a few months ago.

That’s a simple fact, highlighting that the yield, while high, is not the highest it’s been over the past decade. So buying Realty Income today is more like buying a great company at a good price rather than buying a great company at a great price. If you missed the peak yield, don’t assume that the buying opportunity is over. It is hard to complain too much about a 5%-plus yield at a time when the S&P 500 index is only offering 1.4% yield and the average REIT yield is 3.9%. So what if the opportunity isn’t as good as it was? Realty Income still looks like an attractive dividend stock.

You didn’t completely miss the boat

Wall Street is warming up to Realty Income again after dumping the stock as interest rates rose. It isn’t as attractively valued today as it was just a few months ago, using yield as a rough gauge of valuation. But it is still attractively priced when you look over a longer time period and relative to other income options. If you are trying to build a portfolio filled with reliable dividend stocks, it should still be on your buy list.

I’m 65 Years Old With $750k in an IRA. I’m Taking Social Security – Is It Too Late for a Roth Conversion?

If you’re 65 years old and collecting Social Security, you may wonder if it’s too late to convert your $750,000 traditional IRA into a Roth IRA. The short answer is no – there are no legal restrictions to Roth conversion based on age or income. Practically, however, the decision involves carefully weighing tax implications, healthcare costs, estate planning and more. Spreading conversions over multiple years often makes the most financial sense for larger IRAs. Guidance from a financial advisor can help you weigh the costs of a Roth conversion in your circumstances.

Roth Conversion Basics

A Roth IRA conversion involves moving funds from a traditional, pre-tax IRA into an after-tax Roth IRA account. You pay income tax on the money that gets converted now, but future withdrawals in retirement come out tax-free.

Plus, traditional IRAs are subject to required minimum distributions (RMDs) starting at age 73. This can lead to higher taxes in retirement as RMD income, which is treated as ordinary taxable income, can push retirees into higher tax brackets. But RMD rules don’t apply to Roth IRAs and Roth 401(k)s, so you can leave the money in the account or withdraw it any time you need it without owing any taxes on your contributions (you may owe income taxes on investment earnings if you withdraw them less than five years after making your initial contribution).

If you need additional help navigating the rules surrounding Roth IRAs, consider speaking with a financial advisor.

Why Timing Your Roth Conversion Matters

The sooner you convert funds from your traditional pre-tax IRA to a Roth account, the more years of tax-free growth you’ll enjoy in your Roth account. And you’ll be able to withdraw those Roth funds without owing any taxes.

But you will have to pay taxes on the conversion, which is no small consideration when it comes to timing. Converting a large IRA can require you to pay the top marginal tax rate of 37% on most or even all of the entire conversion amount, depending on your other income, deductions and additional factors.

If you convert it gradually, however, you can spread the income bump out over several years and avoid subjecting it to the top marginal tax rate. This can help reduce the tax owed each year and overall.

It’s also important to consider when you’ll need to withdraw funds from your Roth IRA. Funds can’t be withdrawn without penalty within five years of the conversion. And, if you convert your IRA to a Roth gradually over time, those conversions each retrigger the five-year rule for that portion of the money.

Meeting with a financial advisor can provide clarity on complex moves like Roth conversions.

Converting a $750k IRA

A major concern in converting a $750,000 IRA balance at once would be the significant tax bill that would accompany such a transaction. Completely a Roth conversion of that size would push the person into the 37% marginal tax bracket.

If you’re a single filer and your Social Security income isn’t high enough to be taxed, adding $750,000 to your current income could trigger about $238,000 in extra taxes, using the 2023 tax brackets. Going slowly with $75,000 converted per year over 10 years reduces the tax hit each year by keeping your taxable income in the 22% bracket.

Here’s how those scenarios might play out, assuming you are a single filer and your Social Security income is less than $25,000 so escapes taxation:

Scenario 1: Converting $750,000 All at Once

-

Size of Roth conversion: $750,000

-

Tax bracket: 37%

-

Total Federal income tax owed: $237,831

This option leaves you with a massive tax bill but around $512,000 in your new Roth IRA, which you’ll eventually be able to withdraw tax-free.

Scenario 2: Annual $75,000 Conversions Over 10 Years

-

Size of Roth conversion: $75,000 (x10)

-

Tax bracket: 22%

-

Total Federal income tax owed: $88,000 over 10 years

Keep in mind that funds left in your IRA will continue to grow while you’re executing these annual conversions, so the IRA likely won’t be empty by the time you have to start taking RMDs. However, the RMDs you’ll have to take by then will be much smaller so won’t incur nearly as much taxation compared to leaving the money in a traditional IRA.

A third option is to leave the money unconverted in your IRA and start taking RMDs once you turn 73, paying taxes on them as you go. However, this could leave you paying higher taxes in retirement until your death. But if you need more help taking stock of your different options, this free matching tool can pair you with a fiduciary advisor.

Making the Call

You may not find that one course of action is clearly superior. Factors to consider when deciding if and how much Roth conversion makes sense:

-

Compare current vs. future income tax rates

-

Account for RMDs and estate plans

-

Weigh healthcare and other senior costs

-

Assess tax impact on heirs

-

Model multi-year scenarios

Strategic partial Roth conversions tailored to your situation may provide the most tax advantages for people with large IRA balances.

One major limitation to Roth conversions is that they cannot be reversed. If tax rates decline later or you need converted funds sooner, you could regret having locked in taxes now at a higher rate. Inheritance plans may also change. Do a thorough multi-year analysis before committing to convert.

Run your own Roth conversion scenarios first or enlist the help of a financial advisor to help you make these important calculations.

Bottom Line

At 65 or any age, while parts of your retirement finances remain unsettled, limiting Roth conversions to small chunks spread over years offers flexibility. This balances immediate tax costs against future tax savings for you and your heirs. As with most money moves in retirement, prudently assessing your multi-year tax picture first is key.

Retirement Planning Tips

-

Instead of guessing if converting your IRA makes sense, talk to a financial advisor who can crunch the numbers. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep in mind that there are income limitations for contributing to a Roth IRA. In 2024, the IRS doesn’t permit single filers with an adjusted gross income (AGI) above $87,000 and married couples who file jointly with an AGI above $240,000. However, backdoor Roth IRAs can help high earners legally circumvent these income limits.

Photo credit: ©iStock.com/zimmytws, ©iStock.com/Panupong Piewkleng, ©iStock.com/kate_sept2004

The post I’m 65 Years Old With $750k in an IRA. I’m Taking Social Security – Is It Too Late for a Roth Conversion? appeared first on SmartReads by SmartAsset.