Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Grayscale has revealed the submission of an S-1 form to the U.S. Securities and Exchange Commission (SEC) for the launch of a new, smaller version of its popular Grayscale Bitcoin Trust (GBTC). This initiative is designed to provide shareholders with exposure to bitcoin, reduced fees and potential tax benefits. Grayscale Unveils Bitcoin Mini Trust With […]

Source link

launch

Rivian‘s (RIVN 2.28%) biggest challenge right now is cash. The company’s cash burn is unsustainable while building out R2 and R3 capacity, which is why management announced reduced capital expenditures in Georgia.

But that’s not good news either because it likely doesn’t get the company to profitability. Travis Hoium digs into what we know now in the video below.

*Stock prices used were end-of-day prices of March 7, 2024. The video was published on March 7, 2024.

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link, they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.

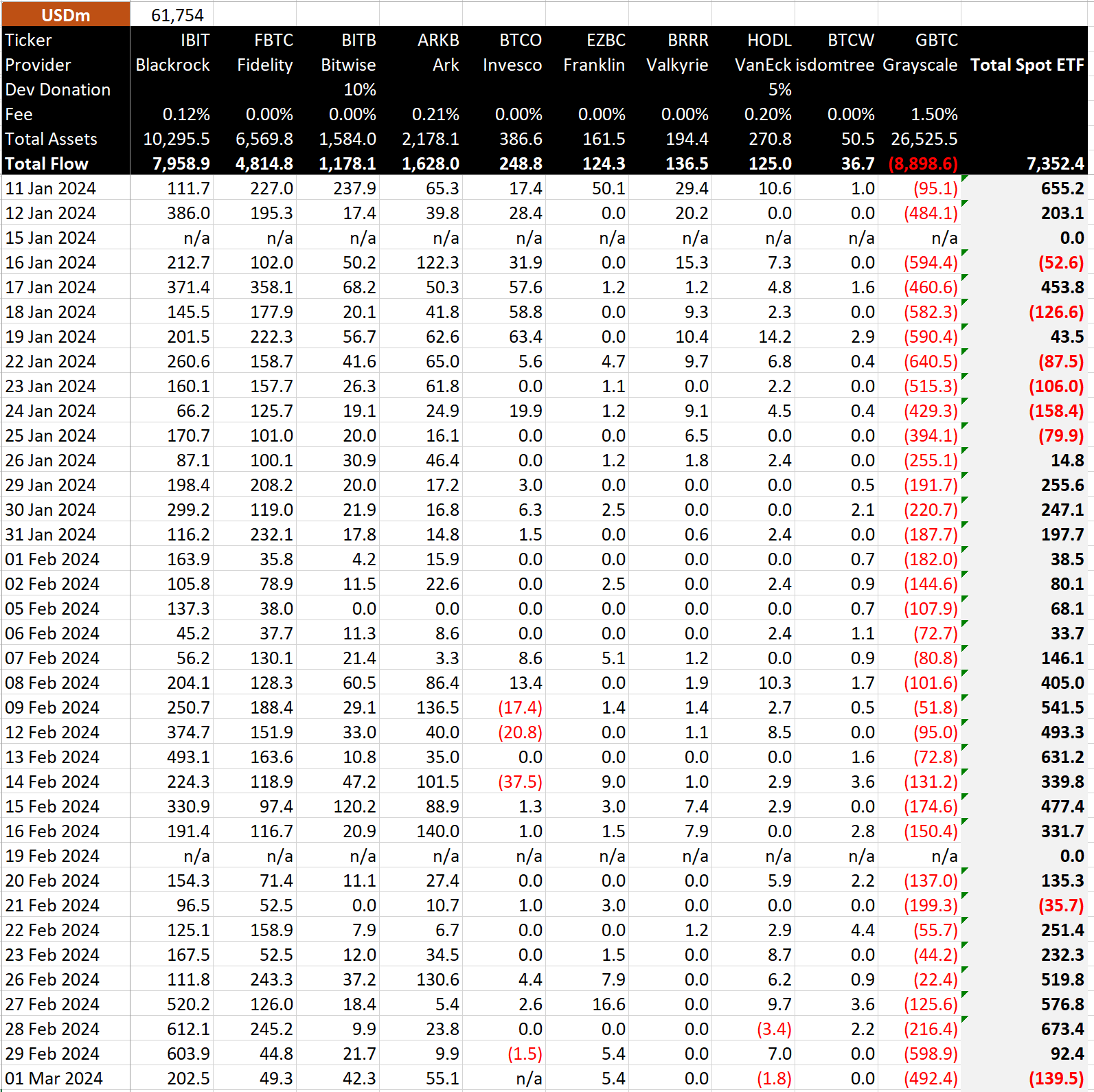

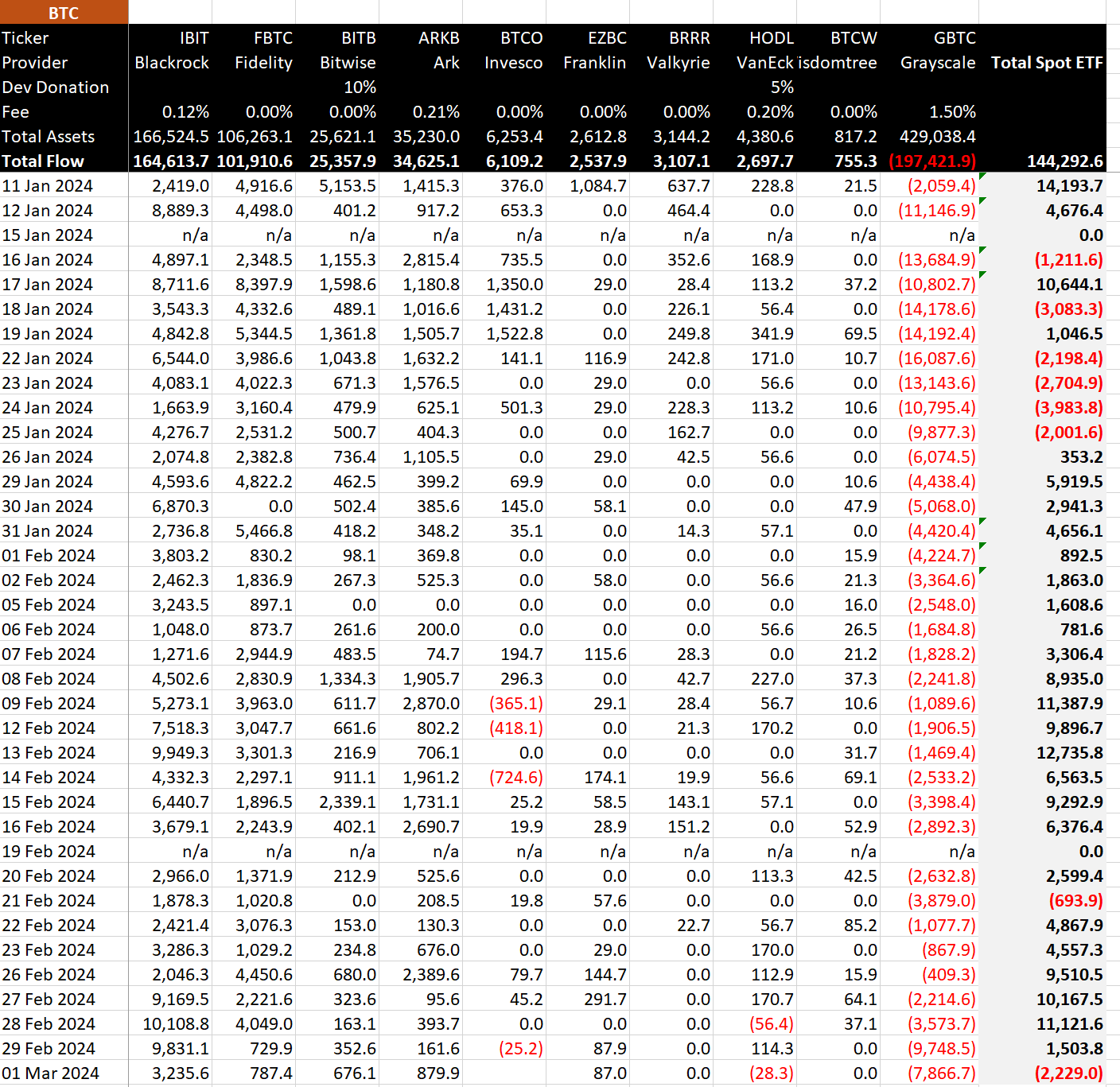

GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows

Quick Take

Data from BitMEX shows March began with the first total outflow since Feb. 21. The day saw an outflow of $140 million, significantly impacted by a massive $492 million outflow from the Grayscale Bitcoin Trust (GBTC), marking one of the largest single-day outflows.

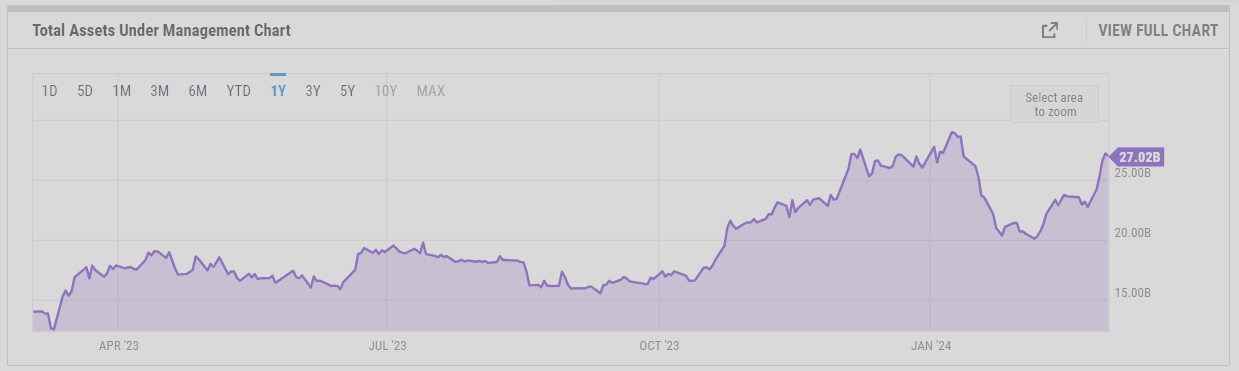

According to BitMEX data, the Grayscale Bitcoin Trust (GBTC) has experienced outflows totaling $8.9 billion. Despite this significant outflow, the assets under management (AUM) of GBTC only decreased by $1.6 billion, moving from $28.6 billion to $27 billion, as reported by ycharts.

This relatively small decrease in AUM, in the face of large outflows, can be attributed to the increase in Bitcoin’s price, which rose from $49,000 to $65,000 since the ETF was launched on Jan. 11.

Despite these outflows, GBTC maintains a strong market presence with a 55% share, though down from 100% two months ago, as noted by ETF Store President Nate Geraci.

Furthermore, GBTC’s annual fee revenue stands at a significant $398 million, dwarfing the $53 million from the nine new ETFs, not including fee waivers, according to Geraci.

Meanwhile, BlackRock’s IBIT saw much quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their total net inflow to $8 billion, roughly equivalent to holding 165,000 Bitcoin, according to BitMEX.

BitMEX has noted that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its data for Mar. 1.

The post GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows appeared first on CryptoSlate.

Hot Airdrop: Social-Fi Project CharityDAO About to Launch Airdrop Event

PRESS RELEASE. According to community volunteers, CharityDAO will launch a large-scale airdrop event on February 29th. It is estimated that 76 million CHD tokens will be distributed to participating users. The current method of interaction is not yet known. This is another popular Social-Fi project announcing an airdrop following friend.tech’s high-profile announcement last week. Benefiting […]

PRESS RELEASE. According to community volunteers, CharityDAO will launch a large-scale airdrop event on February 29th. It is estimated that 76 million CHD tokens will be distributed to participating users. The current method of interaction is not yet known. This is another popular Social-Fi project announcing an airdrop following friend.tech’s high-profile announcement last week. Benefiting […]

Source link

Revolut to launch new crypto exchange amidst reports of listing Solana’s BONK memecoin

UK-based digital bank Revolut is preparing to introduce more extensive crypto exchange services, according to a report from Coindesk on Feb. 16.

That report cites an email to a UK customer describing a “new crypto exchange, built with advanced traders in mind.” The email also promises that the exchange will feature “deeper analytical tools and lower fees” than Revolut’s main app.

Reportedly, the fees are set between 0% and 0.09%, and limit orders will not include a cost. It is unclear whether those rates apply to upcoming or current services, as those numbers appear to describe Revolut’s contemporary maker and taker fees.

Another page suggests that Revolut charges a single fixed fee for crypto conversions between 0.99% and 1.99%, depending on the plan.

The latest development marks growth in Revolut’s crypto services following earlier reductions. Revolut reduced UK business access to crypto services in December 2023 and suspended US access to crypto services in August 2023 due to regulatory developments in both jurisdictions.

Revolut may list Solana’s BONK memecoin

There is also speculation that Revolut will list Solana-based memecoin BONK as part of a partnership, which will involve running a $1.2 million “learn and earn” campaign.

The news is supported by a recent proposal by the BONK community that describes a partnership with “one of the biggest European fintech” firms without naming Revolut specifically. However, the proposal also describes the partner firm serving 38 million customers in over 50 countries, which applies to Revolut.

It is unclear whether the expected BONK partnership will extend to Revolut’s current crypto services or is restricted to its upcoming advanced exchange.

BONK saw a significant surge in value in December 2023, setting a new all-time high. However, the memecoin has lost most of the gains since and is now down 62% from its ATH on Dec. 15.

BONK has been criticized for its highly centralized supply and the lack of a whitepaper. Nevertheless, it has gained listings on popular exchanges such as Binance and Coinbase.

The post Revolut to launch new crypto exchange amidst reports of listing Solana’s BONK memecoin appeared first on CryptoSlate.

Uniswap, one of the world’s largest decentralized exchanges (DEX), is poised for significant growth with the upcoming launch of its V4 upgrade. This anticipated update will introduce custom Automated Market Maker (AMM) functionality directly on top of Uniswap, eliminating the need for separate AMM designs.

In addition, Uniswap’s governance token, UNI, has seen notable growth, with a 6.8% increase in the last 24 hours and an 8% increase in the previous 30 days, bringing the UNI token to $7.318.

However, while these developments favor the exchange and investors, decentralized finance (DeFi) researcher DeFi Ignas has raised concerns regarding the launch and its potential impact on critical features.

The Ultimate DeFi Liquidity Solution With Uniswap V4?

According to DeFi Ignas’ latest analysis on X (formerly Twitter), Uniswap V4 represents a significant transformation from a protocol to a platform. Like the Apple Store’s impact on the iPhone, Uniswap V4 will consolidate all pools into a single framework, reducing creation costs by 99% and enabling more cost-effective multi-pool swaps.

The introduction of the “Hooks” system is particularly noteworthy. These hooks act as plugins or extensions, allowing for customized code execution during crucial events within a pool.

The 13 available hooks enable various functionalities, including on-chain limit orders, time-weighted average market making, liquidity depositing into lending protocols, auto compound liquidity provider (LP) fees, and know-your-customer (KYC) integration.

Introducing hooks leads DeFi Ignas to believe that the launch of Uniswap V4 will allow developers to experiment and launch their protocols while leveraging Uniswap’s liquidity.

According to the researcher, this has the potential to attract even more liquidity from other decentralized exchanges and establish Uniswap as the dominant liquidity layer for all DeFi activities, from trading to lending.

Yet, while unified liquidity may benefit users by increasing market efficiency, it raises concerns about potential market concentration and stifling of competition.

UNI Token Gains Momentum

Uniswap’s V4 liquidity sourcing could concentrate liquidity within the platform, potentially making it the go-to liquidity layer for DeFi. According to DeFi Ignas, this dominance, coupled with Uniswap’s operating license that prohibits forking until 2027, raises questions about market competition and the potential impact on decentralized finance.

In addition, reports suggest that Uniswap Labs has sent takedown notices to gateways of the InterPlanetary File System (IPFS) – a decentralized and distributed protocol designed to facilitate the storage and sharing of files on a peer-to-peer network – adding another layer of concern about decentralized access and censorship resistance.

Regarding the potential upside of Uniswap V4 acting as a catalyst for the exchange’s token, the research went on to suggest that while UNI’s value “accrual” for retail investors has been relatively modest, the introduction of Uniswap V4 and its hooks opens up new possibilities.

In this sense, DeFi Ignas believes the UNI token could function as a platform/ecosystem token, benefiting from third-party decentralized applications (dApps) developed using Uniswap’s hooks, expanding the token’s use cases and potentially attracting more investors.

Additionally, there is speculation that Uniswap may solidify its dominance and liquidity by launching its chain, potentially as a layer-two (L2) solution, which could further boost the valuation of the UNI token.

As the upgrade deadline for Uniswap approaches, the impact of the exchange’s upgrade on the UNI token remains uncertain. However, there has been a noticeable growth in the token’s value over the past few weeks.

After reaching a 17-month high of $8.260 in January, the token experienced a correction but has since broken out of that pattern. As the upgrade deadline draws near, it is yet to be determined whether the token can consolidate its gains and regain previous levels.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Prometheum’s Ethereum Custodial Launch Puts SEC’s ETH Classification In The Spotlight

Prometheum, an “alternative” trading platform for crypto “securities” assets, has recently announced the launch of its custodial services for Ethereum (ETH). This move has significant implications for the legal status of the second-largest cryptocurrency by market capitalization.

Fortune Magazine reported that the company’s strategy is to compel regulators, particularly the Securities and Exchange Commission (SEC), to recognize Ethereum as a security.

SEC Pressured To Settle Ethereum Legal Status

Per the report, Prometheum, based in New York, has positioned itself as a compliant player in the crypto industry by claiming to have discovered a path to operate within existing laws.

The company received regulatory approval in 2021 to operate as an alternative trading platform for securities. It gained further attention when it obtained a special-purpose broker-dealer license from the Financial Industry Regulatory Authority (FINRA).

The license allows them to operate as a broker-dealer in “digital asset securities,” a designation no other firm has achieved. This has prompted crypto companies and even members of the US Congress to call for investigations into the firm’s activities.

Previously, the SEC refrained from definitively classifying Ethereum as a security despite declaring several other cryptocurrencies as such.

Prometheum aligns with the SEC’s assessment that most cryptocurrencies are securities and argues that Ethereum can be listed as a security under an exemption called Rule 144, typically used for trading restricted stocks.

The embattled company claims it can use blockchain data to determine whether the assets have been circulating for over a year, a crucial factor in claiming the exemption.

What’s interesting is that Prometheum’s custodial services for Ethereum could potentially force the SEC to determine Ethereum’s legal status. The company’s registered status with FINRA and the SEC, prominently displayed on its website, adds weight to its claim.

Legal experts and academics speculated that the SEC may be forced to rule on Ethereum’s classification due to Prometheum’s custodial launch. This decision could have far-reaching consequences for the crypto industry, challenging the industry’s argument that cryptocurrencies cannot operate under existing securities laws.

Backlash Mounts As Prometheum Shakes Up Crypto Regulations

SEC Chair Gary Gensler, who has intensified enforcement efforts following the collapse of FTX, has emphasized the sufficiency of existing rules while filing lawsuits against exchanges for failing to register with the agency.

Prometheum’s approach contrasts with other crypto exchanges like Coinbase, which argue that the existing rules are outdated. Prometheum’s strategy has drawn criticism from the crypto industry and Republican lawmakers who accuse Gensler of supporting the firm to advance his regulatory agenda.

Overall, Prometheum’s introduction of Ethereum custodial services has thrust the debate over Ethereum’s legal classification into the spotlight.

This move could compel the SEC to decide whether Ethereum should be classified as a security, challenging the crypto industry’s argument for new laws.

While the success of Prometheum’s approach is still uncertain, it remains to be seen how subsequent SEC administrations will respond and whether institutional investors will be attracted to Prometheum’s compliant approach.

Currently, ETH is trading at $2,428, reflecting a marginal 0.5% price increase in the last 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Disney, Fox and Warner Bros. team up to launch new sports streaming service

Walt Disney Co.’s ESPN, Fox Corp. and Warner Bros. Discovery Inc. are teaming to create a joint sports streaming service.

The as-yet unnamed service, which could be available as early as the fall and offer a sort of Hulu model for sports, comes amid an explosion in sports-streaming rights and audiences.

The service would essentially be a skinny bundle of the companies’ linear channels, including ESPN, ESPN2, ESPNU, SECN, ACCN, ESPNEWS, ABC, Fox, FS1, FS2, BTN, TNT, TBS, truTV, as well as the ESPN+ streaming service.

“The launch of this new streaming sports service is a significant moment for Disney

DIS,

and ESPN, a major win for sports fans, and an important step forward for the media business,” Disney Chief Executive Bob Iger said in a statement late Tuesday. “This means the full suite of ESPN channels will be available to consumers alongside the sports programming of other industry leaders as part of a differentiated sports-centric service.”

Added Warner Bros.

WBD,

CEO David Zaslav: “This new sports service exemplifies our ability as an industry to drive innovation and provide consumers with more choice, enjoyment and value and we’re thrilled to deliver it to sports fans.”

Each company will own one-third of the platform, according to Disney, in a deal reminiscent of the original Hulu, which started off as a joint venture between ABC, Fox and NBCUniversal.

The service will have a new brand with an independent management team, and will be available to bundle with Disney+, Hulu and Max subscriptions.

“We’re pumped,” Fox

FOX,

CEO Lachlan Murdoch said. “We believe the service will provide passionate fans outside of the traditional bundle an array of amazing sports content all in one place.”

More details, including pricing, will be announced later.

Prominently missing from the deal are Comcast Corp.

CMCSA,

which owns NBCUniversal and its sports lineup that includes NFL football and the Olympics, and Paramount Global

PARA,

which owns CBS — which carries the NFL and college football, among other sports.

The new service will showcase thousands of high-profile sporting events and include all four major sports leagues — the NFL, NBA, MLB and NHL — as well as college football and basketball, golf, tennis, cycling, soccer and UFC.

Shares of Disney slipped 1% in extended trading Tuesday, while Fox shares jumped 5% and WBD gained 3%.

Mike Murphy contributed to this report.

The United States, through the Energy Information Administration (EIA), will start collecting data about cryptocurrency miners’ energy consumption rate within the nation starting next week.

On Jan. 31, the EIA revealed its intention to initiate a provisional survey targeting commercial cryptocurrency miners. This survey was authorized by the Office of Management and Budget (OMB) as an emergency data collection request, signifying the urgency of obtaining this information.

To get the approval, EIA wrote that Bitcoin price increases have incentivized more crypto mining activity, increasing electricity consumption.

“The combined effects of increased cryptomining and stressed electricity systems create heightened uncertainty in electric power markets, which could result in demand peaks that affect system operations and consumer prices,” EIA claimed.

In tandem with the survey, the EIA will actively seek public input on the energy usage data collection process from the cryptocurrency mining sector.

EIA Administrator Joe DeCarolis emphasized that the survey aims to shed light on the broader implications of cryptocurrency mining activities in the United States.

Furthermore, DeCarolis outlined the EIA’s focus on understanding how the energy demand associated with cryptocurrency mining is evolving. The agency aims to pinpoint geographical areas experiencing significant growth in this sector and quantify the electricity sources fueling this demand.

Crypto mining in the U.S.

Mining activities have attracted significant attention from regulators and lawmakers alike for their electricity-sapping operations and impact on power grids and carbon emissions.

Over the past years, the U.S. has emerged as a major mining hub following China’s ban on such operations in 2021. The Cambridge Centre for Alternative Finance (CCAF) data showed that the country contributed an average monthly hashrate share of more than 37% as of January 2022.

Notably, skeptics point to the top cryptocurrency energy usage’s negative impact on the environment as a stick against mining activities. However, industry experts have suggested that BTC mining activities can actively contribute to the stability and efficiency of power systems.

The post US to launch survey on cryptocurrency miners’ energy consumption appeared first on CryptoSlate.

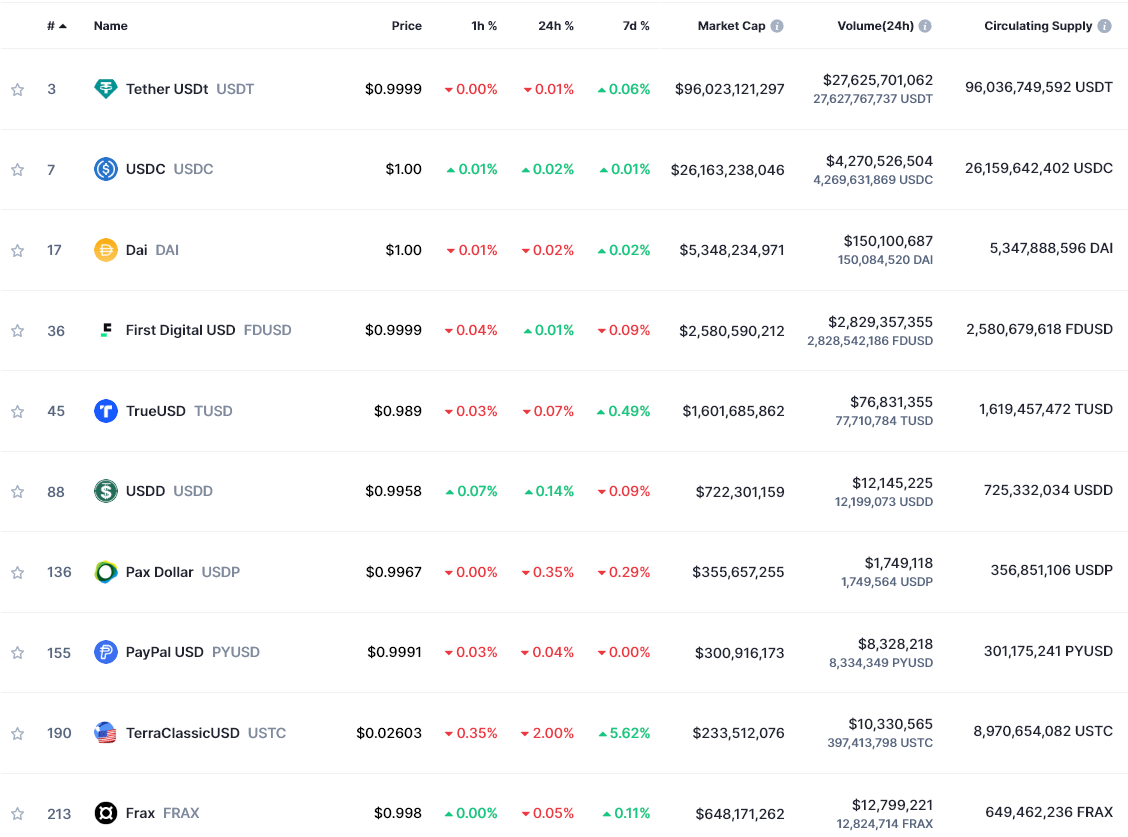

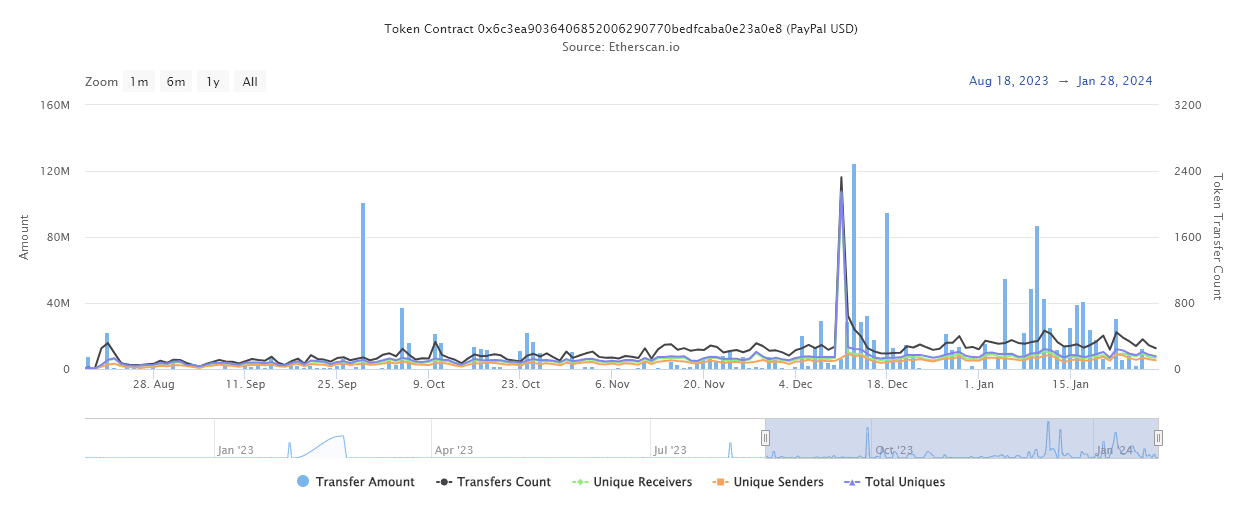

PayPal’s entrance into the stablecoin market on Aug. 7, 2023, was welcomed by many in the industry, with Circle CEO Jeremy Allaire stating that competition from PayPal was ‘great to have.’

The news of the launch led to a modest 4% rise in the price of Bitcoin, and within days, exchanges were offering low-fee promotional opportunities for traders willing to utilize PayPal’s PYUSD. Before the end of August, Coinbase, Kraken, and HTX had listed the stablecoin, adding Venmo support just a month later.

Five months after its launch, PYUSD has now claimed the number eight position by market cap in the global stablecoin charts, having captured the $300 million mark around Jan. 22. However, PYUSD drops to eleventh overall when ordered by volume, with just $10 million in 24-hour trade volume. This puts it only slightly ahead of UST Classic, which, with a price 98% off its originally intended $1 peg, traded just $500,000 less over the past day.

Still, PayPal’s PYUSD climb to $300 million in value locked in five months is impressive. In addition to an increase in market cap, the token has seen steady on-chain activity, with a modest 200 – 400 transactions per day.

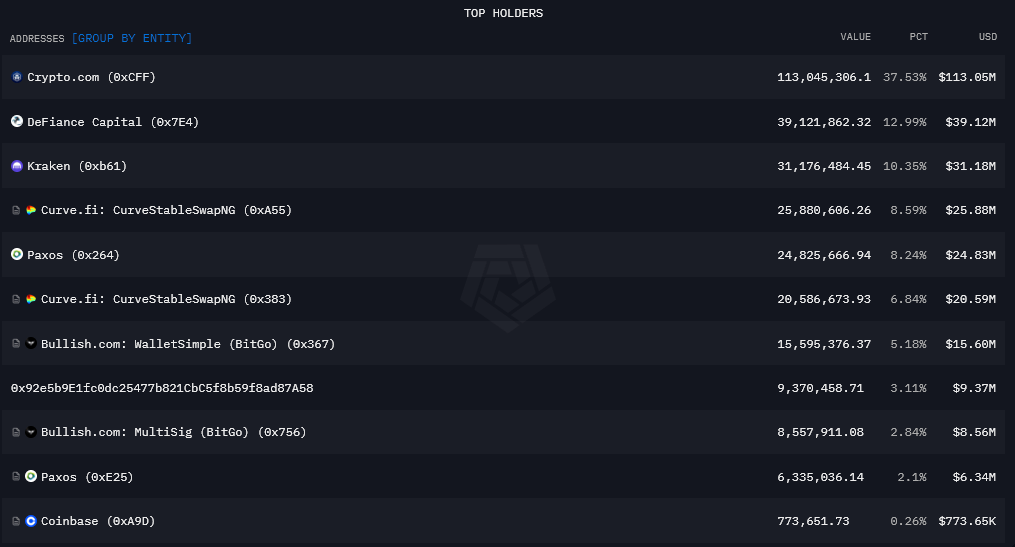

However, PYUSD has yet to break into the DeFi landscape in any meaningful way, as the below table and diagram highlight. The majority of the PYUSD liquidity sits on centralized exchanges, with Crypto.com being the largest single holder of the token at $113 million, just over one-third of the total market cap.

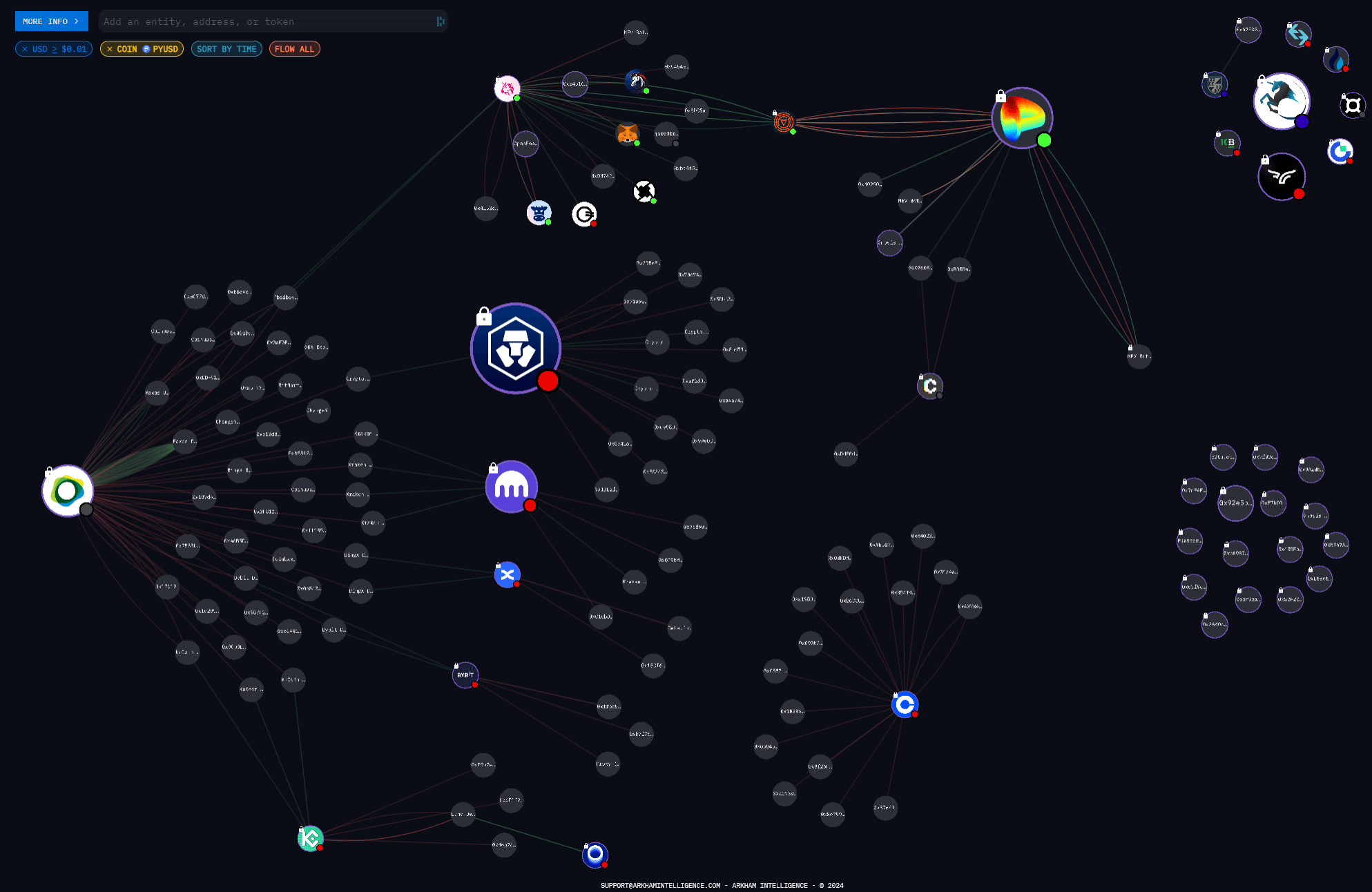

The visualization below depicts the transactions between major entities exclusively for PYUSD. Entities with more substantial PYUSD holdings are shown larger than those with smaller amounts. The entities with no logos on the far right are unknown wallets holding above $30,000. The logos in the top right depict business entity tokens, likely treasury holdings.

Interestingly, there are several connections between PYUSD issuer Paxos, Uniswap, and Curve. Yet, these entities do not then link into the major exchanges, suggesting the DeFi and CEX ecosystems for PYUSD are wholly separate.

While PayPal was subpoenaed by the SEC when PYUSD had half the current market cap, it was reported to have complied with requests, and little has been heard on the matter since. The announcement of the filing marked the local low for PayPal’s stock price also, with it rallying 24% since November.

Further, PayPal Ventures has recently started using the PYUSD stablecoin as a mechanism for strategic investments, using it for a stake in the institutional crypto platform Mesh. Amman Bhasin, Partner at PayPal Ventures, commented,

“As the world of financial services undergoes rapid transformation, we believe that user ownership and portability of assets will become a critical building block of product innovation, with crypto serving as the first beachhead where this is possible.”

Thus, while PYUSD still has some way to go to catch behemoths such as Circle and Tether, the debutant and web2 disruptor is certainly in the process of cementing its position in the industry.