Aurora Cannabis Inc. led gains among Canadian cannabis stocks on Wednesday after an industry executive was named president of the Cannabis Council of Canada trade group.

Source link

leads

Solana’s stablecoin supply surges past $3 billion, USDC leads the charge

Stablecoin supply on the layer-1 blockchain network Solana has increased steadily since the beginning of the year, crossing the $3 billion mark during the past week.

Data from the blockchain analytical platform Artemis shows that the stablecoin supply on the network has increased by 55.72% in the last three months to reach $3.12 billion.

Notably, this number pales significantly against the balance on the network in 2022, when more than $6 billion worth of these assets were on the blockchain. However, it plummeted to as low as $1.4 billion during the bear market situation before embarking on the recent upward trend.

Meanwhile, stablecoin transfer volume on Solana surged by 164% to $1.4 trillion, reflecting the significant amount of activity the network has enjoyed.

USDC dominates

A breakdown of stablecoins on Solana shows Circle’s USD Coin’s (USDC) dominance, accounting for 73% of such assets on the network.

For context, Artemis data show that USDC accounted for a significant $63.69 billion of stablecoin transfer volume on April 2, overshadowing USDT’s $812.41 million. EURC completes the top three with less than $100,000 in volume.

USDC’s dominance on Solana can be directly linked to Circle’s launch of its Cross-Chain Transfer Protocol (CCTP) on the network on March 26.

Why Solana stablecoins balance is rising

Stablecoins play a crucial role as an intermediary between traditional fiat currencies and digital assets. An increasing stablecoin supply indicates heightened liquidity and is indicative of increased capital infusion.

Market observers have explained that this upsurge reflects the significant influx of capital into the network, coinciding with the frenzy surrounding memecoins and the expanding DeFi activity within the Solana ecosystem.

Over the past year, the Solana blockchain ecosystem has witnessed notable expansion despite its previous ties to Sam Bankman-Fried, the controversial founder of FTX. This growth has attracted a wave of new users and forged significant partnerships with major global financial entities, including Visa and Shopify.

The post Solana’s stablecoin supply surges past $3 billion, USDC leads the charge appeared first on CryptoSlate.

US Bitcoin ETFs See $85.7M Outflow After 4 Days of Gains; Grayscale’s GBTC Leads the Dip

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

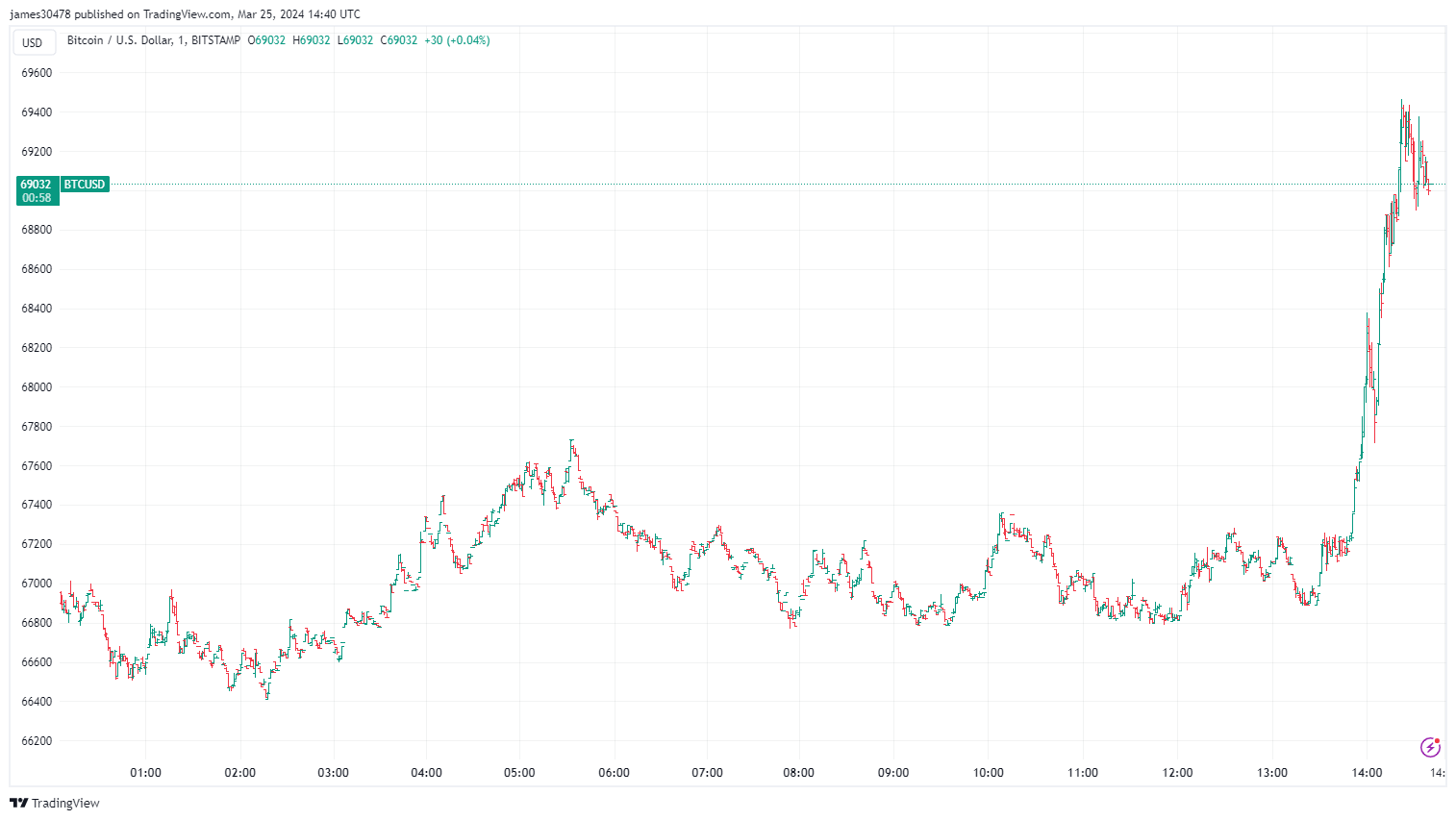

Bitcoin’s price rally above $69,000 leads to widespread market liquidations

Quick Take

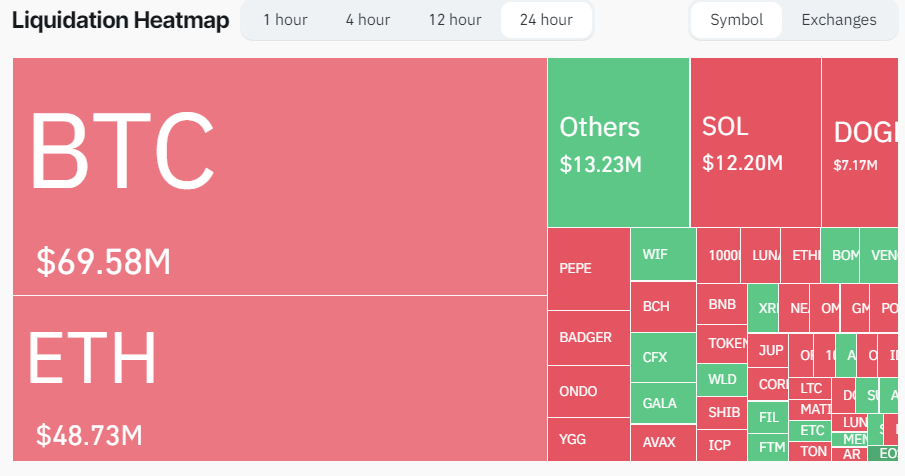

Bitcoin has started the week strong with a push above $69,000—up more than 3% today and marking its highest value since March 16. The move triggered a flood of liquidations in the digital asset ecosystem. These liquidations stem partly from the digital assets strong rally, peaking at an impressive $69,400.

Coinglass data shows that, in the past 24 hours, the ecosystem has seen nearly $200 million in liquidations, with shorts accounting for a predominant portion of the total, around $129 million. The last hour alone witnessed a massive $35 million worth of liquidations, primarily comprising of shorts.

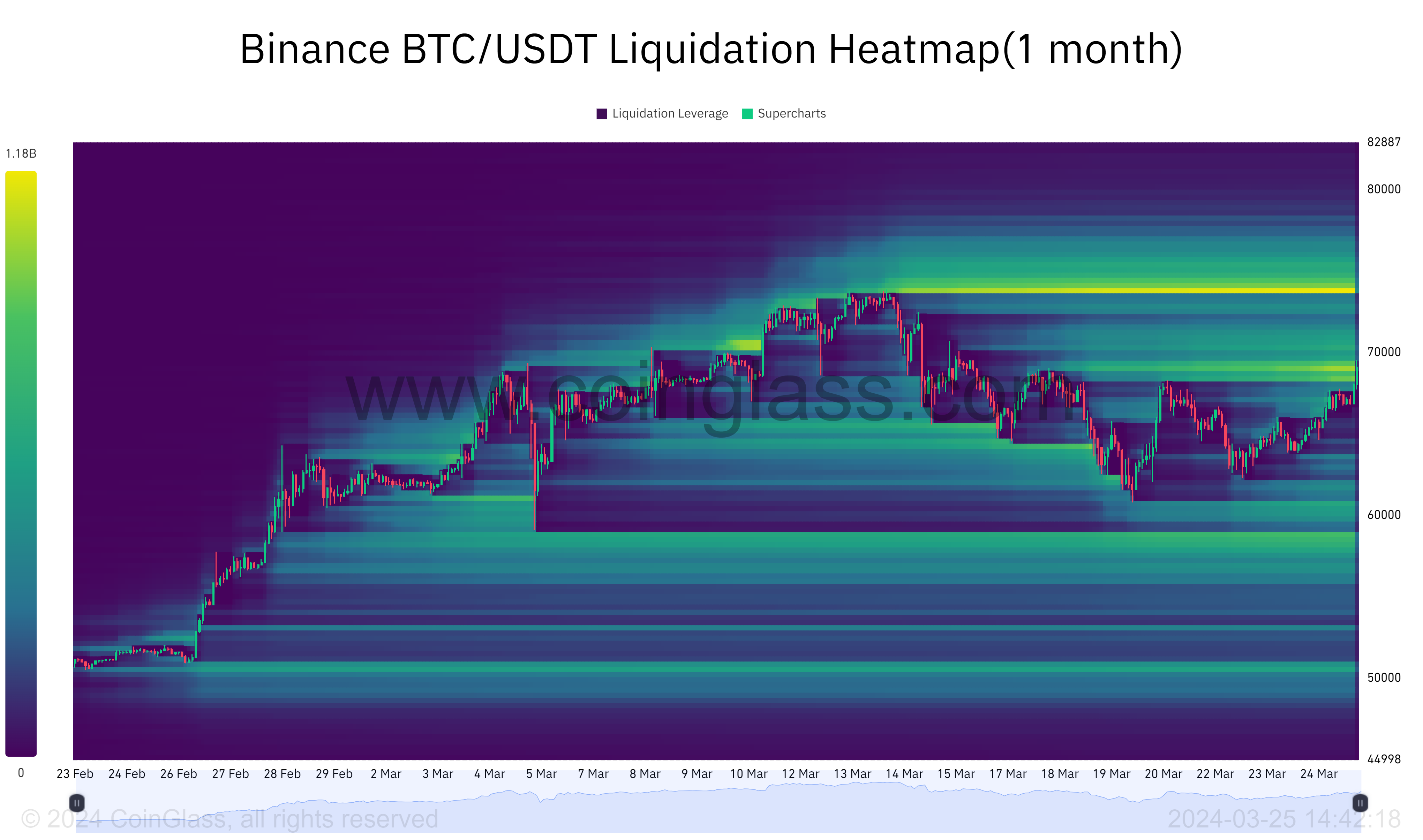

Data from Coinglass indicates a substantial amount of leverage, approximately $1.18 billion, parked just above the $73,000 mark.

The post Bitcoin’s price rally above $69,000 leads to widespread market liquidations appeared first on CryptoSlate.

Genesis and Gemini’s Earn program closure leads to $2 billion settlement offer for affected users

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Quick Take

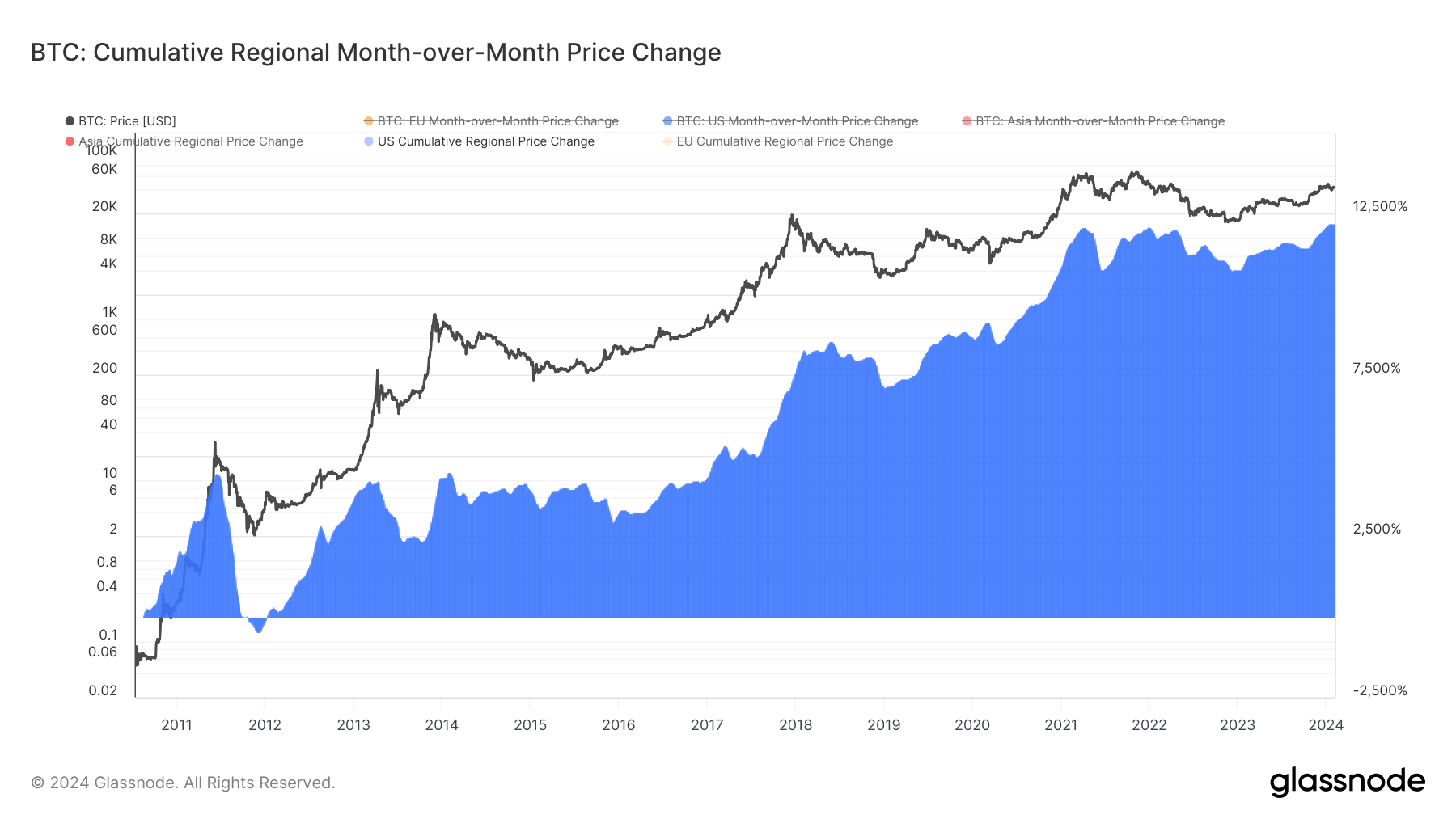

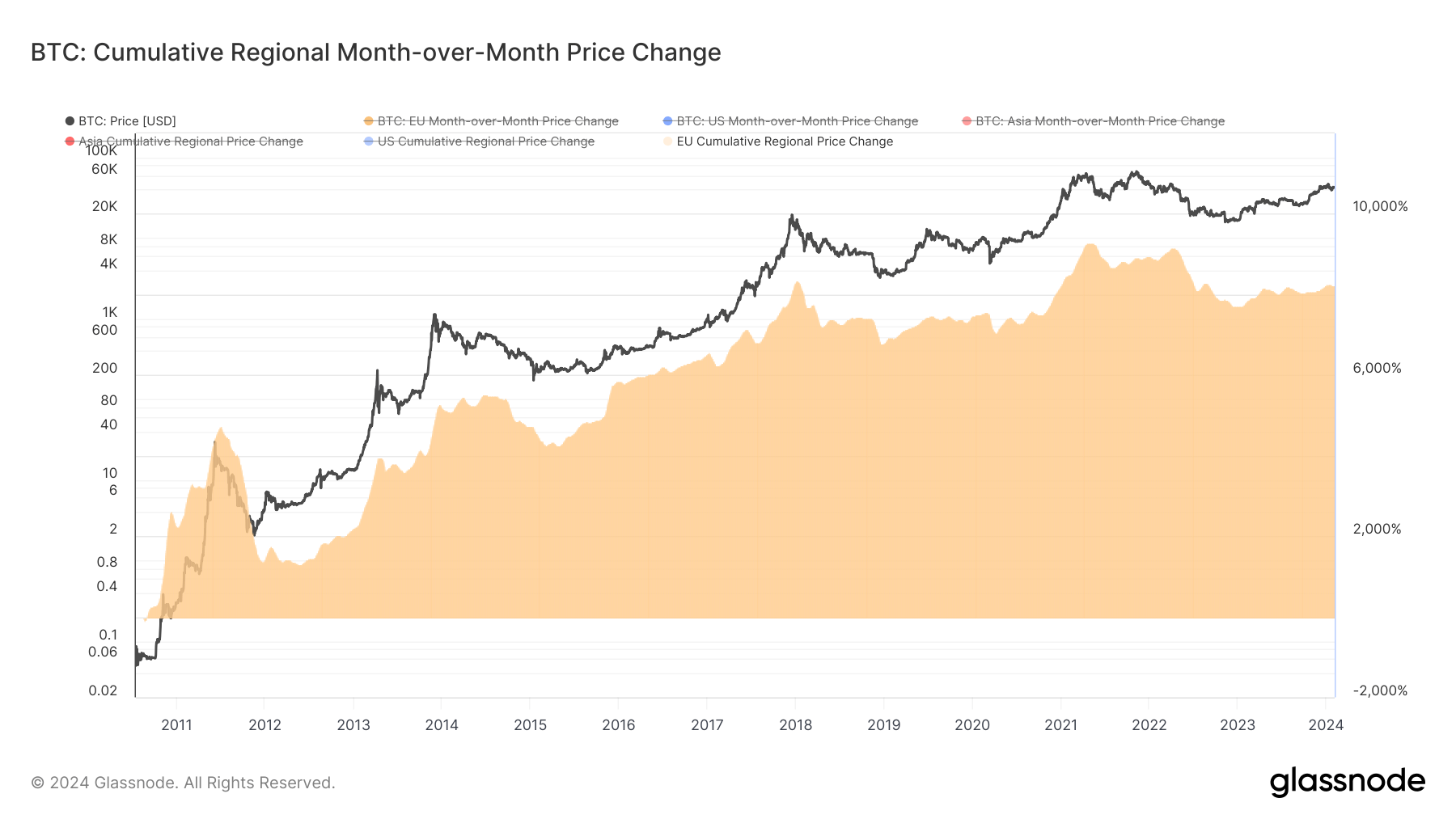

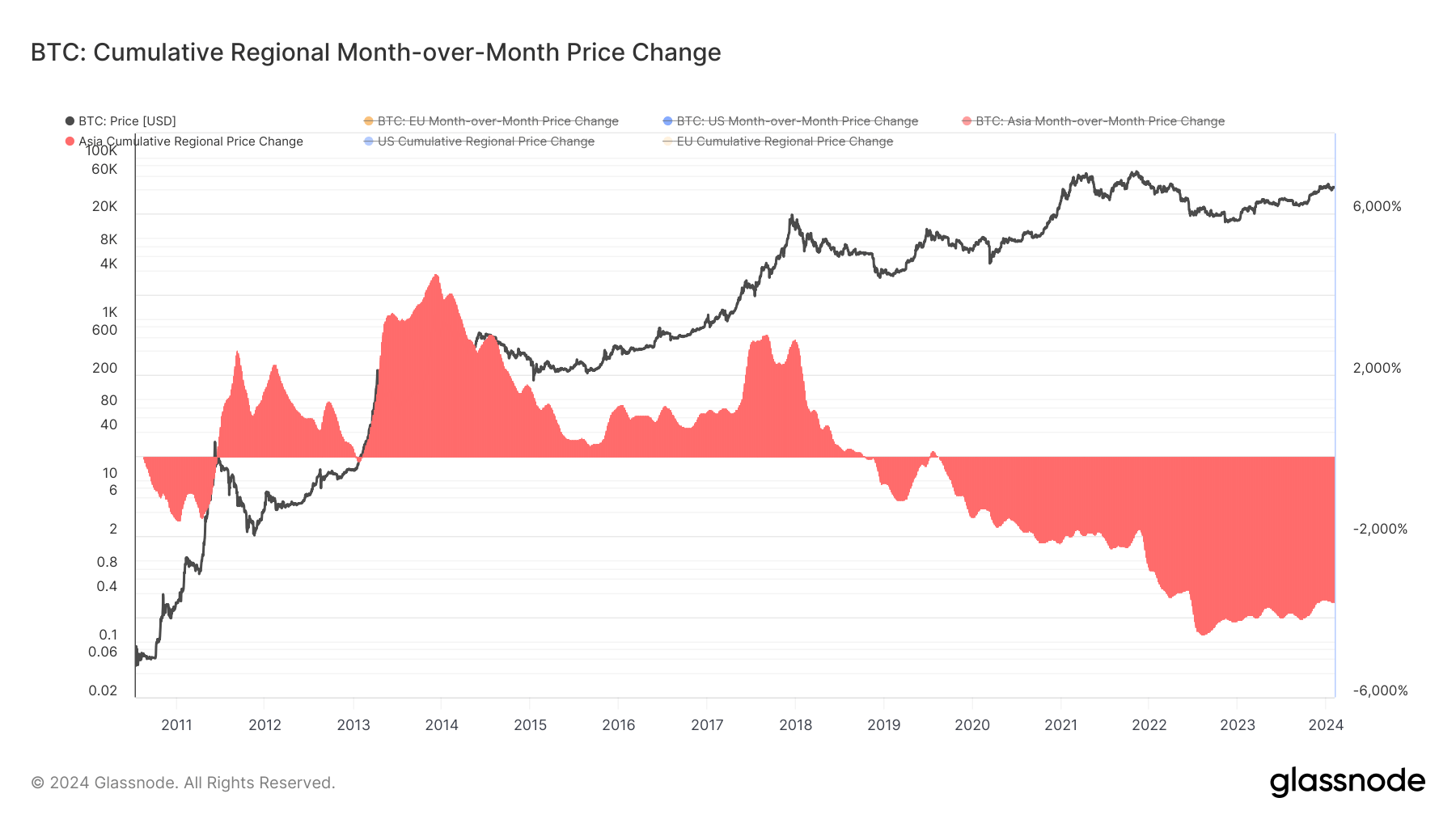

A deep analysis of Bitcoin transactions and their correlation with working hours across major geographical regions reveals a striking disparity in price performance.

Analyzing 8 am to 8 pm Eastern Time, Central European Time, and China Standard Time for the U.S., Europe, and Asia, respectively, allows insights into Bitcoin price change within work hours in each region.

Looking at the month-on-month cumulative price change within each time period reveals notable discrepancies.

The United States, with its bullish stance on Bitcoin, leads the pack with a whopping 12,200% price change. This trend appears to strengthen as Bitcoin’s lifespan prolongs, suggesting an increasing favor towards the digital currency.

The U.S.’s bullish trend can be supported by the recent approval of spot BTC exchange-traded funds (ETFs), which have seen a total net inflow of $1.5 billion.

Despite a similar trajectory, Europe trails slightly, boasting a significant 8,000% price change. Despite falling short compared to the U.S., Europe’s performance demonstrates a steady confidence in Bitcoin’s potential.

However, the narrative differs starkly for Asia. Once bullish, their stance flipped negative in 2019, and the region hasn’t recovered since, with an alarming negative 3,500% price change. Conversely, Asia’s negative performance may be traced back to multiple Bitcoin bans, notably in China, which saw a notable decline in the Bitcoin hash rate in 2021.

The post U.S. leads in Bitcoin price surge as Asia sees decline appeared first on CryptoSlate.

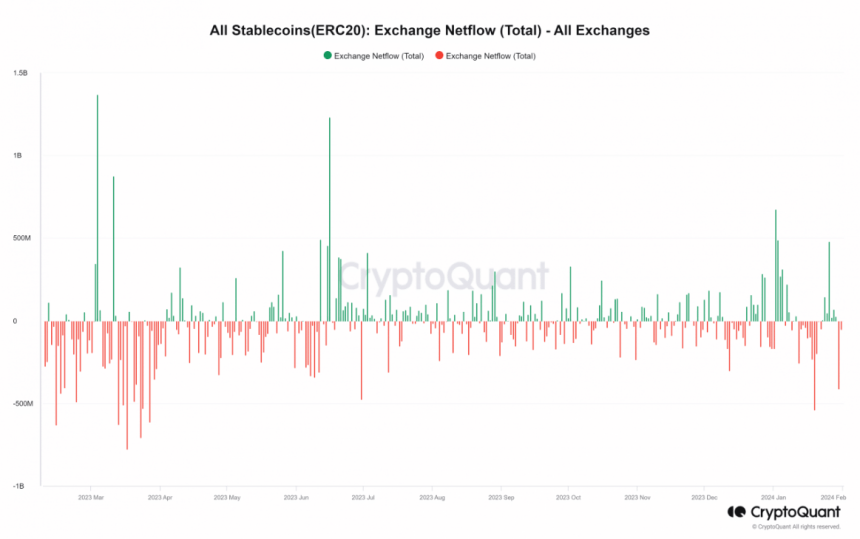

The cryptocurrency industry has witnessed a significant change in the movement of stablecoins, offering valuable observations into the evolving dynamics of the market. Recent data from IntoTheBlock and CryptoQuant has shown a surge in stablecoin inflows into exchanges, reaching record highs in January.

Notable inflows were observed on January 2nd ($478 million), January 3rd ($489 million), and January 26th ($673 million). However, this trend has since reversed, with outflows dominating the market.

On January 30th, there was a substantial outflow of $412 million, marking the second-highest daily outflow recorded in the month, following the $541 million outflow on January 19th.

USDT Leads Stablecoin Rally, But Caution Persists In Crypto Market

An analysis of the 24-hour trading volume of the top stablecoins on CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC) collectively accounted for approximately 90% of the total volume. Tether, in particular, has been dominant in terms of flows, with a 24-hour trading volume exceeding $42 billion, while USDC’s volume stood at around $6 billion.

Taking a closer look at the flow of USDT through CryptoQuant, it was found that there was a substantial inflow of $373 million on January 26th, followed by a prevailing trend of outflows, with over $83.4 million observed at the time of writing.

USDTUSD currently trading at $0.99897 on the daily chart: TradingView.com

Experts suggest that the rise in stablecoin inflows onto exchanges, particularly the $478 million on January 2nd, could indicate traders’ and investors’ readiness to participate in the market or their desire to safeguard their funds during uncertain times.

Conversely, the shift towards outflows may signal caution or preparation for potential market volatility. Additionally, the substantial inflow of stablecoins, especially USDT, could indicate increased buying power and intentions to establish positions in the cryptocurrency space.

Stablecoins Surge, Signal Investor Preparation

The increase in stablecoin inflows onto exchanges can be interpreted in two ways. Firstly, it may indicate that investors and traders are preparing to enter the market. By moving their funds into stablecoins, they can quickly transition into other cryptocurrencies when they perceive favorable opportunities. This suggests a readiness to participate and take advantage of potential market movements.

Secondly, the rise in stablecoin inflows may also reflect a desire to keep funds in a secure manner, particularly during uncertain times. Stablecoins offer stability by being pegged to a specific asset, such as the US dollar, which can be appealing to investors seeking to protect their capital in times of market volatility. This cautious approach can be seen as a way to safeguard funds and mitigate risks in an unpredictable market.

Tether Records Nearly $3 Billion Profit

Meanwhile, Tether announced a “record-breaking” $2.85 billion in quarterly profits as the market capitalization of its main token, USDT, approached $100 billion.

According to a blog post by Tether, the interest gained on the company’s enormous holdings in US Treasury, reverse repo, and money market funds—which support the USDT stablecoin—account for around $1 billion of the earnings in the most recent quarterly attestation report that was released on Wednesday. Everything else was “mainly” due to the growth of Tether’s other assets, like gold and bitcoin (BTC), the stablecoin issuer said.

Featured image from Wccftech, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Trump leads Biden in 7 swing states and is favored on handling the economy: poll

Former President Donald Trump has an advantage over President Joe Biden in the U.S. states that are likely to decide the 2024 White House race, according to a poll released Wednesday.

Trump gets 48% support on average among swing-state voters, compared with 42% for Biden, according to the Bloomberg News-Morning Consult poll that focused on seven battleground states.

The Republican former president’s edge over the Democratic incumbent was biggest in North Carolina, at 10 percentage points, and smallest in Arizona and Pennsylvania, at 3 points, as shown in the chart below.

Bloomberg News/Morning Consult

Some 51% of swing-state voters said they trusted Trump over Biden to handle the U.S. economy, while 33% said Biden would be better, according to the poll.

Related: Investors are thrilled inflation is down. Regular people aren’t so happy. Here’s why.

And see: Here’s why Biden may not get a political lift from strong GDP growth

On immigration, 52% said Trump would be better on the issue, versus 30% who favored Biden.

One bright spot for Biden’s re-election campaign: 53% of voters in the seven battleground states said they would be unwilling to support Trump in the general election if he were found guilty of a crime, and 55% said they wouldn’t back him if he’s sentenced to prison.

Trump faces charges in Washington, D.C., and in Georgia’s Fulton County in election-interference cases and also was indicted last year in a hush-money case and a classified-documents case. The 45th president has denied wrongdoing and argued the prosecutions are politically motivated. Many Republican voters share his views and have rallied around him.

Other January polls for swing states have shown Biden with an edge. The Democratic incumbent got 47% support among Pennsylvania voters compared with Trump’s 39% in a Susquehanna Polling & Research survey, and he got 45% support in a Michigan poll, versus Trump’s 41%.

But Wednesday’s poll jibes with a New York Times/Siena College survey in November that showed Trump leading Biden by between three and 10 points in five of six battleground states.

Nikki Haley remains in the race for the 2024 GOP presidential nomination, but she’s widely viewed as a longshot, so many analysts have moved on to preparing for a Trump-Biden rematch in the general election.

The main U.S. stock gauges

SPX

DJIA

COMP

were mostly retreating Wednesday as traders awaited a Federal Reserve announcement on interest-rate policy.

Now read: Haley says Trump’s new 10% tariff would mean ‘raising taxes on every single American’

And see: Trump takes credit for stocks’ rally, yet there are expectations his Fed would be ‘not just dovish, but weird’

Harvest leads the charge with Hong Kong spot Bitcoin ETF application: Report

Hong Kong has reportedly received its first application for a spot Bitcoin (BTC) exchange-traded fund (ETF) in the city-state.

According to a Jan. 29 Tencent report, Harvest Hong Kong, one of China’s leading fund managers, submitted the first application to the Securities and Futures Commission (SFC) on Jan. 26.

This development is arriving just over a month after Hong Kong’s financial regulators—SFC and the Hong Kong Monetary Authority (HKMA)—revealed their willingness to allow financial institutions to apply for spot ETFs investment products. However, the regulators outlined stringent requirements for the applicants, including strict custodial rules and how the ETF transactions must be conducted through an SFC-licensed crypto platform or authorized financial institutions that comply with HKMA’s regulatory requirements.

Nevertheless, Harvest Hong Kong’s swift application shows the preparedness and interest these products have generated since they were introduced in the U.S. The ETFs would be pivotal in integrating crypto into mainstream finance, and their launch would help capitalize on the region’s burgeoning demand for them.

Expedite approval

Meanwhile, the regulatory authorities in Hong Kong are demonstrating a willingness to expedite the approval process for ETF applications. The ETFs could be listed on the Hong Kong Stock Exchange shortly after the Chinese New Year, scheduled for Feb. 10.

This approach is reminiscent of the U.S. Securities and Exchange Commission (SEC), which approved multiple ETF applications from several financial institutions, including BlackRock and Fidelity, after rejecting such products for over a decade.

Only Harvest Hong Kong has applied with the regulator despite several financial institutions’ expressions of interest in such products. CryptoSlate reported that as many as ten firms, including HashKey, Venture Smart Financial Holdings, Samsung Asset Management, and CSOP Asset Management, are exploring the feasibility of launching spot Bitcoin ETFs in the Asian city.

Bitcoin ETFs have generated much interest and attention globally thanks to their record-breaking entrance into the U.S. market. Within just ten trading days, the ETFs have significantly altered the market as they have amassed a substantial amount of the top cryptocurrency for their fund.

Bearish Bitcoin leads to tumble in crypto stocks, with Coinbase taking a hit

The shares of several U.S.-listed crypto companies experienced substantial declines in their values due to the significant market downturn today, Jan. 23.

Earlier today, Bitcoin’s price retraced more of the gains it made in anticipation of the U.S.-based spot exchange-traded fund (ETF) launches in the U.S. The flagship digital asset dropped below $39,000, marking its lowest value since early December, according to CryptoSlate’s data.

According to Yahoo Finance data, this market movement triggered a 5% decline in crypto exchange Coinbase shares and a 4% dip in business intelligence firm MicroStrategy’s shares during pre-market trading.

JPMorgan analysts downgraded Coinbase’s stock from Neutral to Underweight in response to the crypto market pressure and potential revenue shifts away from Coinbase due to newly launched ETFs.

The analysts explained that the exchange’s stock is valued “on a normalized earnings power at $80/share, suggesting a downside of 35% in its shares.”

Despite a remarkable 2023 performance (COIN +390% vs. SP500 +26%), the analysts foresee challenges for Coinbase this year.

“Cryptocurrency prices are already under pressure; with Bitcoin falling below $40k as of the writing of this note, we see greater potential for cryptocurrency ETF enthusiasm to further deflate, driving with it lower token prices, lower trading volume, and lower ancillary revenue opportunities for firms like Coinbase,” JPMorgan added.

Crypto miners’ stock decline

Bitcoin miners were not immune to the market decline as their stock value also fell.

Marathon Digital Holdings, a Nasdaq-listed bitcoin miner, witnessed a 3.19% pre-market decline, bringing its price to approximately $16.08.

Riot Platforms, another Bitcoin miner, saw a 2.45% decrease to $10.34, while Canada-based miner Hut 8 Corp experienced a 2.05% dip. In addition, CleanSpark recorded a 2.82% decline in pre-market prices.

Julio Moreno, CryptoQuant’s head of research, noted that BTC miners are currently feeling the pain from the flagship digital asset’s lower prices and fees.

“[BTC] prices are down 18% since ETF approval, total daily fees down 87% since mid-December (in BTC terms), and overall daily revenue down 38% also since mid-December (in USD terms),” Moreno explained.