The U.S. central bank should stay the course and avoid prematurely celebrating the end of inflation above 2%.

Source link

leave

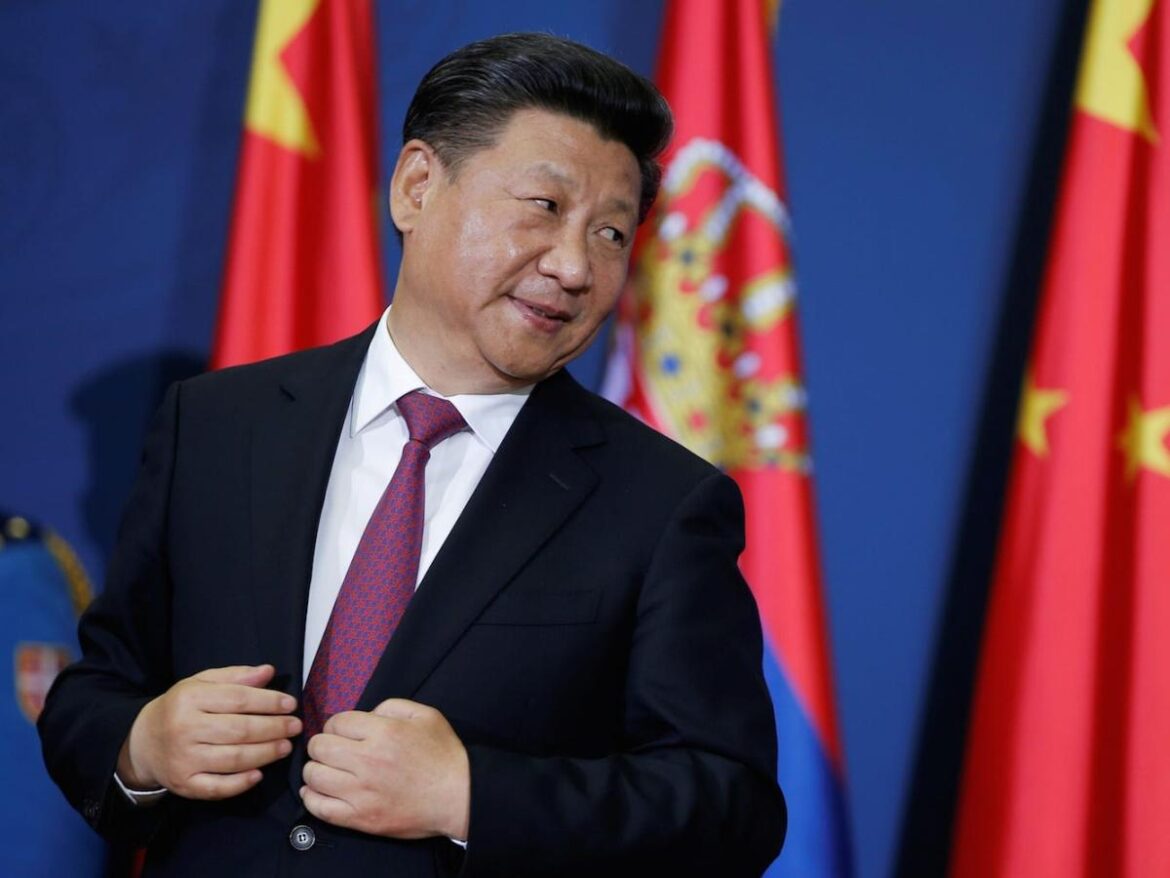

China’s market crash could be the last straw for many foreign investors who leave permanently, think tank says

-

China’s crashing stock market could be the breaking point for foreign investors, Atlantic Council’s Jeremy Mark said.

-

The market will become more volatile as remaining investors focus on fast profits.

-

The country needs to respond to its property crisis to trigger a stable market recovery.

The decline of China’s stock market may have scarred it for the long-term, as foreign investors likely aren’t coming back, the Atlantic Council wrote on Friday.

On domestic and US indexes, Chinese firms have collectively suffered a $7 trillion hit since early 2021. The fallout could be the final breaking point for offshore traders, who are already hastening to exit amid souring outlooks on the country’s economy, Senior Fellow Jeremy Mark said.

With few reasons to jump back in, China will become the focus of investors betting on fast profits instead of stable growth.

“Investing in China likely will become the domain of foreign bargain hunters and hedge funds, some of whom already are actively trading in the market,” Mark wrote, later adding: “The fund managers who remain could end up contributing to the volatile swings in fortune that are everyday life in China’s markets.”

Beijing has responded to the financial stress in recent weeks, issuing a slew of measures meant to dampen the sharp decline. These include state-backed purchases, as well as restricted access to offshore markets and curbs on short-selling.

Although this flurry of efforts has triggered a rally this week in Chinese indexes, a more forceful recovery will depend on Beijing’s handling of broader crises, Mark noted.

China’s property market is the leading concern, considering the sector accounts for around a quarter of the nation’s GDP. Once a rapidly growing industry, its dependence on high leverage has resulted in a massive default wave, with real estate giants forced to liquidate.

Foreign investors have been disenchanted by Beijing’s slow response, while the government’s 2020 crackdown on the tech sector provided another incentive to move out of Chinese markets, Marks noted.

The stock exodus has largely been led by passive funds, as well as investors focused on long-term growth. Net foreign inflows last year reached only $6.1 billion, the lowest level since 2017.

It’s had a direct impact on China’s startup scene, with the country’s IPO market drying up as new companies search for cash.

“Even if the economy and property market bottom out in 2024, there are worrying signals about the government’s intentions for stock investors. Over the past few months, there have been various pronouncements directed at financial markets that suggest less tolerance for business as usual,” Marks said.

Read the original article on Business Insider

I want my son to inherit my $1.2 million house. Should I leave it to my second husband in my will? He promised to pass it on.

My husband and I signed a prenuptial agreement before we married. This is my second marriage, his first. He has no children. I have one child who was an adult when we married so there was no need for my current husband to adopt him. My husband and I live in a home that I purchased and maintain with my separate property.

I have been careful to pay for all mortgage and maintenance costs myself to make sure there is no question that this is my separate property. After I die, my trust directs that my husband gets the house — currently worth a net $1.2 million after deducting the outstanding mortgage from its market value — and my child gets the rest of my assets, which are around $1.2 million.

My husband will also get monthly payments from my pension as a survivor and beneficiary, which will more than cover the monthly mortgage payments. So my husband would, in effect, be paying the mortgage from funds that I provide even after my death. I would like the house to be given back to my son after my husband passes.

Not a blood relative

He is, after all, my son’s stepfather, but he is not a blood relative. Would the house be considered an inheritance? If my son were to sell the house, would it have a step-up in cost basis just as it would if I had left the house to him directly? Or would my husband leaving the house to my son be akin to a stranger bequeathing the house to him?

I know I can rewrite my trust to give my husband use of the house while he is alive and then have it pass to my son upon his death, but that forces my husband to live in the house until his death. He may wish to move elsewhere after he retires. What I wish to avoid is his leaving the house to a spouse he marries after my passing.

If I rewrite my trust to allow my husband to live in the home until his death at which time it passes to my son, what are his options and what happens to the house if he chooses to go live in another state? Can he rent out the house to provide him with an income to pay for housing wherever he goes? I suppose I could stipulate this in my trust.

I would appreciate any advice you have on this matter.

Also see: My brother lives in our parents’ home, which we’ll inherit 50/50. I want to keep it in the family for my children. How do I protect my interests?

“Trusts and wills cannot be all things to all people.”

MarketWatch illustration

Dear Wife & Mother,

Alas, you are trying to be too many things to too many people. Set out your goals with your estate planning in order of priority. You will have to make some kind of compromise along the way and, from what you say in your letter, your son is your No. 1 priority from an inheritance viewpoint, even though you wish to make sure your husband has a roof over his head.

You are going to great pains to ensure that your $1.2 million home is not commingled with your marital assets — in the event that you divorced — and yet still plan to leave it to your second husband in your will. Ultimately, you want your son to inherit your entire estate, while ensuring that your second husband lives a financially independent life after you’re gone.

In order to do that, you have to cut yourself some slack. Situations change, relationships crumble, people marry and those spouses often come with their own power and influence. Your husband and son could fall out. He or a new spouse could fall on hard times and need money for long-term care or medical expenses. That house could become a lucrative source of income.

Trusts and wills cannot be all things to all people. Allow your husband to live in your home for the remainder of his life as a tenant for life, making sure to specify that he must take care of the property taxes and upkeep of the property. But you are asking for trouble by allowing your husband to have his cake and eat it — by allowing him to live in the house and sell it.

So what if you did leave your house to your husband — with the hope/promise that he would keep his word and leave it to your son after he dies? Stepchildren are not ordinarily regarded as legal heirs under the law, unless they are formally adopted, or included in beneficiary designations, trusts, gifts or a last will and testament. Check with a tax lawyer in your state.

Step-up in basis

But who qualifies for a step-up in basis complicated. “An heir does not have to be a biological descendant to receive a step-up in basis,” says S. Michelle Jann, director of wealth planning at Goelzer Wealth Management. “The property in question must be included as a part of the decedent’s estate. Qualifying for the step-up in basis doesn’t have anything to do with the relationship of the individual.”

You would need to be named either in the will, or in a revocable trust, or via a transfer-on-death deed to inherit the property, Jann adds. If you inherited the property via one of these methods, you would receive the step-up in basis.

“If no one has been named as the legal heir and the home is going through probate, then the stepson may not be determined to be the legal heir during the probate process,” she added. “If the probate courts have to decide, they will follow the laws of intestate succession which would follow blood lines and probably not include the stepson. The individual or individuals chosen by the probate court would receive a step-up in basis.”

As an aside, there are wrinkles to the step-up rule for married couples, depending on where they live. For example, if you owned the house jointly with your second husband, he would receive a step-up in basis, but likely only on half of the value of the house, Jann says. However, if you lived in a community-property state, he would receive a full step-up in basis.

This all assumes that you predecease your husband. It’s actually more likely that your husband will die before you. Between 25% and 50% of men outlive women, according to this global study spanning 200 years published in BMJ Open, a peer-reviewed open-access medical journal. Indeed, women tend to outlive men by five to six years, Scientific American reports.

Create an estate plan that is rock solid, one that needs no room for maneuver.

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Post your questions, tell me what you want to know more about, or weigh in on the latest Moneyist columns.

The Moneyist regrets he cannot reply to questions individually.

Previous columns by Quentin Fottrell:

My parents want to pay off my $200,000 mortgage, and move into my rental. They say I’ll owe my sister $100,000. Is this fair?

‘I hate the 9-to-5 grind’: I want more time with my newborn son. Should I give up my job and dip into my six-figure trust fund?

Tang Tan, the Apple Inc. executive who headed product design for the iPhone and Apple Watch, is leaving amid a shake-up of the division responsible for the company’s most critical product lines, according to a Bloomberg report.

Tan reports to John Ternus, senior vice president of hardware engineering, and the division is reshuffling duties to handle the transition.

Earlier this week, Bloomberg reported that Steve Hotelling, who worked on key technologies like the iPhone’s multitouch screen, Touch ID, and Face ID, is retiring from Apple.

Shares of Apple

AAPL,

are up 0.7% in trading Friday. Apple had no comment on the departures.

I don’t want to leave my financially irresponsible daughter my house. Is that unreasonable?

Dear Quentin,

I am at my wit’s end and hope someone can recommend ways to help my daughter’s unwillingness to manage her money. When I am gone her chances are slim to none. I am a senior citizen and I’ve had cancer four times in the last three years, so I don’t know how much longer I have.

I already told her I’d…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

Two more Binance.US executives leave the company as mass exodus continues

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Leave a legacy: Use planned giving to control wealth now and give to charity after you’re gone

For those with philanthropic interests, charitable giving can be beneficial to the charity and to you as the donor. In today’s tenuous world, everywhere we turn in our country, a fire, flood, landslide or other disaster is leaving families homeless. Youth are avoiding higher education because of the cost. Disease is breaking apart families. Houses of worship are facing financial straits. Needs seem endless.

Making contributions everywhere is impossible, but did you know that with a planned giving strategy you can donate beyond your lifetime to causes that matter most to you?

People who want to give to charity but fear running out of money have options. If you are resisting giving now because you worry about needing cash, planned giving is a way to act on your interests. Planned giving can fulfill your wishes after your death while potentially receiving benefits during your lifetime — and you can still leave money to family or friends.

What if you do not feel you have the cash to donate, even post-death? You are not alone — 93% of American wealth is held in noncash assets. These types of assets include retirement investments, real estate, life insurance and privately held stock.

With some well-informed planning, however, these assets can be donated to a charity, while possibly generating additional income, receiving an income tax deduction, avoiding capital-gains taxes and saving on estate taxes.

Also see: Do you want to preserve your land? Cut taxes, not trees with conservation-based estate planning.

First, understand your options

“Planned giving should be a thoughtful process that allows someone to ponder their philanthropic passions, while considering the needs of loved ones,” said David Chadwick, a member of the gift planning team at the University of Colorado.

A variety of planned giving strategies exist, such as designating a charity through a bequest in your will or as a beneficiary to a retirement account, a life insurance policy, a charitable trust or a gift annuity.

You will likely read and hear a lot about more complex structures such as charitable gift annuities (CGA), charitable remainder unitrusts and annuity trusts (CRUT and CRAT), charitable lead annuity trusts (CLAT), among others, but do not get lost in the acronyms. The specific planned giving vehicle can be determined once you have decided on your goals. The bottom line is knowing you can give in many diverse forms and ways.

Plus: I want to give over $600,000 to my adult children. How do I ensure they don’t lose that money in the event they divorce?

Second, be realistic about giving

Cash is not “king” when it comes to supporting worthy causes. Stocks, mutual funds, real estate and retirement assets are also commonly accepted donations. Other more complex assets like life insurance and closely held business interests can be donated as well, even post-life.

With a broad range of your assets available to donate to charity, review what your expected financial needs are today and until the anticipated end of life. What income do you need annually? Are you preparing to sell a privately held business and would benefit from a tax deduction and avoidance of capital gains? Do you have a highly appreciated stock? Are you willing to part with real estate but not its income?

Once you have answers to these questions along with the details of your financial life, the potential assets and vehicles for gifting will become clear. You always get to decide what and when to give with planned giving.

Third, work with qualified experts

Your lawyer and tax professional can offer solutions and options that best serve your tax situation and assets.

“Donors with philanthropic intent can benefit at both the income and the estate-tax level,” Chadwick said. “Some of the most effective giving is made with highly appreciated assets if those assets are not needed.”

One man told his lawyer he wanted his home to go to a housing charity. He showed his estate plan to his certified financial planner, who read it carefully. That charitable point was nowhere in the plan documents. When shown the discrepancy, the lawyer responded that “his executor could take care of that” and “it is easier this way.” The gentleman got a new lawyer.

A good lawyer follows your wishes and offers perspective, but you have to read the documents before you sign them. Verify what you are signing.

Also on MarketWatch: ‘My family is dealing with a significant shock’: My father secretly married his caregiver, who is 40 years his junior. She’ll inherit $80 million. What can we do?

Fourth, involve charities you choose

Being transparent with your plan will allow you to work with the charity’s staff to fully understand that your wishes and the charity’s needs can be met.

“Non-cash assets like a limited liability company or some other closely held business interest may feel like the right thing to give, but Chadwick said, “charities usually have guidelines and policies detailing what can be accepted based on the resources and expertise available to evaluate and manage the proposed gifts.”

Ruth Henry, the senior philanthropic adviser at Vermont Community Foundation, adds, “Plus, the donor wants to be sure the organization can fulfill their intentions.”

A charity may be restricted in how it distributes the money flowing through its doors. You want to be sure your charitable mission is possible. In addition, charities may have pre-existing strategies to improve upon your ideas.

Henry encourages working with a philanthropic adviser whose expertise can ease the way in planning for your bequest. This more holistic approach allows you to work with an expert and develop an estate plan that will benefit a range of the causes you wish to benefit.

The flexibility this approach offers includes the ease of changing charities over time and your adviser’s knowledge of the industry and charitable tools to meet your needs.

Don’t miss: I’m retiring at 65 with $2 million, an $850,000 home and $3,500 a month in Social Security. Should I follow the 4% rule if I don’t want to leave an inheritance?

Finally, tell your heirs about your plan

Your philanthropic interests and plans should not be a surprise to family after your death. They need to know why you decided to do this and what the overall process is. Otherwise, if they want to challenge the bequest they can, tying up your assets and reducing the charity’s financial benefit. Numerous donors’ families have been known to challenge bequests after death. Even if you think, “This will never happen to my family,” have this conversation before finalizing any bequest or other planned giving structure.

Donating post-death through one’s estate plan accomplishes three basic goals:

- Keeps money in your control during your lifetime.

- Allows your assets to benefit a charity of your choice at your death.

- Creates a vehicle to save estate taxes for your heirs.

Planned giving is a beneficial way to leave a positive legacy. Giving wisely and strategically is not difficult but does require thought, time and professional assistance. With the right commitment, your donation will benefit others long after you have passed from this world. If you plan now.

C.D. Moriarty, CFP, is a Vermont-based financial speaker, writer and coach. She can be found at MoneyPeace.com.

This article is reprinted by permission from NextAvenue.org, ©2023 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

I will leave my daughter my house, but she doesn’t want to take over my $250,000 mortgage. Should she rent the house, or just sell it?

Dear MarketWatch,

My daughter has a similar issue that this lady is facing, whose mother left her the family home.

I will be leaving my daughter my house in my will. But she has a physical disability that affects her head and ability to work full-time, so her income is limited.

She lives in an apartment close to her work and doesn’t want to move into my house.

My house is worth $450,000, with a loan balance of $248,000, which I had recently refinanced to a 3.35% mortgage rate.

My suggestion to her is to lease the house when it ends up in her hands. She can get about $2,800 in income, and since the mortgage is just under $1,600 a month, that gives her additional income. And if she does this, that extra money would almost fully pay her rent.

Her other option is to sell, and take approximately $200,000 out of the house.

So my question is, should she sell or should she lease?

Trying My Best

‘The Big Move’ is a MarketWatch column looking at the ins and outs of real estate, from navigating the search for a new home to applying for a mortgage.

Do you have a question about buying or selling a home? Do you want to know where your next move should be? Email Aarthi Swaminathan at TheBigMove@marketwatch.com.

Dear Trying,

Ask her to lease this house if you predecease her. Do not recommend that she sell it just yet.

But start working with her now so she can find her feet as a landlord, if and/or when that happens. Together you can see the best ways to find tenants, how to set up rent payments, and how to care and maintain the home.

If she’s not able to take on this responsibility, you can research a property-management company that can help you at a cost. A property-management company typically takes about 8% to 12% of the monthly rate as a fee.

I love that she has a little bit of money left over from the rent if she leases. That will boost her income, give her more financial stability, and help her to put money money aside for an emergency.

Many people in America who are renting dream of owning their own home, so you have helped to set her up for a successful and secure retirement. Plus, that 3.35% mortgage interest rate was a catch. She would be lucky to see that again soon.

I don’t know what medical issues she has, and what other financial needs she may have in the medium- to long-term, but if there’s no immediate and pressing need to draw on that $200,000, why go down that route?

I truly appreciate how much you have done — and what you are leaving behind — for your daughter. It is kind of you to give your daughter a financial leg-up by willing your home to her.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Company, the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Should we wait for the tenants to leave before listing our New York City rental?

Dear Big Move,

My husband and I own a home in New York City. We’d like to sell it, but we have to give the current tenants until about the end of the month to move. The home is located in Staten Island. It’s a single-family, fully-detached home with a small fenced-in yard.

Our question is this: What should we do first? Should we put it on the market now, and tell the real-estate agent about the tenants’ need for a few months, or wait until about a month before they have to leave and put it up for sale then?

We’ve never sold a house before, and I’m not sure what the best course of action should be.

Confused

‘The Big Move’ is a MarketWatch column looking at the ins and outs of real estate, from navigating the search for a new home to applying for a mortgage.

Do you have a question about buying or selling a home? Do you want to know where your next move should be? Email Aarthi Swaminathan at TheBigMove@marketwatch.com.

Dear Confused,

It depends on how quickly you want to sell the home. Yes, you can sell the home with the tenants in it. But if you are not in a rush, you could wait until their lease is up and clear it out first, then sell.

But it sounds like you’re keen to explore the idea of putting the home on the market as soon as possible, so here are a few major points you need to consider.

First, you need to make sure that you’ve provided them with adequate notice to terminate the lease. If it’s a month-to-month tenancy, they have 30 days or more to vacate the home, depending on how long they’ve lived there, according to New York City regulations.

Then, talk to a real-estate agent about selling the property. Present all of the facts such as how long the tenants have lived there, how much rent they’re paying, when their lease ends (or when they have agreed to vacate the home), or if they are keen to stay at the unit under new owners. They’ll be able to help you anticipate any unexpected issues when it comes to selling the home.

Third, you’ll have to decide with the real-estate agent if it’s worth vacating the home and having it staged for showings, have it empty, or show it with tenants at home. It may be logistically easiest to show the home without the tenants in it, and it may be worth the home being staged.

Should you ‘stage’ your home?

“It depends on the current state of the home, it can be good for prospective buyers to see a furnished versus an unfurnished home to get a sense of proportion with furniture,” Adjina Dekidjiev, a real-estate broker at Coldwell Banker Warburg, told MarketWatch, “but if the home is too cluttered they should wait.”

But “if the home shows well, it’s fine to show with as much notice as possible to ensure that tenants have time to clean up and declutter,” Dekidjiev added. “There’s a clause in most leases that allows for owners to begin marketing and showing the home.”

Assess the home and see if it’s worth showing it to prospective buyers as-is. You don’t want a messy home to hurt your chances at selling, or have the bidders put in a lowball offer because they can’t imagine themselves living there in style.

The bottom line: If you’re selling your Staten Island rental, you can put it on the market now with the agent being aware of the tenant situation, if the home is presentable and appealing with them living in it.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Want to Leave Assets to Heirs? IRS Rule Change Should Have You Rethinking Your Irrevocable Trust

Managing your taxes can be one of the most complex aspects of estate planning and a new IRS rule change continues that trend. The rule, published at the end of March, changes how the step-up in basis applies to assets held in an irrevocable trust. If you need help interpreting the IRS rule change or setting up your estate, consider speaking with a financial advisor.

What Is a Step-Up in Basis?

When someone inherits an asset with unrealized capital gains, the basis of the asset resets or “steps up,” to the current fair market value, wiping out any tax liability for the previously unrealized capital gains.

For example, if you purchased stock for $100,000 more than a year ago and sold it now for $250,000, you would pay capital gains tax on the $150,000 profit above the original basis of $100,000. If you inherit that stock, however, your new basis steps up to $250,000 and you’ll pay tax only if you sell the stock for more than that amount.

To protect their assets, many people place them in an irrevocable trust, which means they lose all ownership rights to the assets. Instead, the trust becomes the owner of the assets for the benefit of the trust’s beneficiaries.

How IRS Rule Change Impacts Irrevocable Trusts

Previously, the IRS granted the step-up in basis for assets in an irrevocable trust but the new ruling – Rev. Rul. 2023-2 – changes that. Unless the assets are included in the taxable estate of the original owner (or “grantor”), the basis doesn’t reset. To get the step-up in basis, the assets in the irrevocable trust now must be included in the taxable estate at the time of the grantor’s death.

That’s the bad news.

The good news is that because of the $12.92 million per-person exclusion in 2023 ($25.84 million for married couples), few estates in the United States pay even a portion of the estate tax.

In 2021, 6,158 estates were required to file estate tax returns, with just 2,584 of them (42%) paying any tax at all. By including the irrevocable trust assets in the taxable estate, heirs who are the beneficiaries of the trust will dodge the tax hit and receive the step-up in basis. However, that situation could change for some people in 2026 when the estate tax exemption limit reverts to the 2017 amount of $5 million, adjusted for inflation.

Why would someone be using an irrevocable trust? A typical reason is to remove assets from your ownership in order to qualify for Medicaid nursing home assistance. A parent could place a home worth $500,000 into the trust, qualify for Medicaid but, by including the home in their taxable estate, then pass the property on to their children tax-free at a basis of $500,000.

Bottom Line

Anyone using an irrevocable trust should be reviewing their estate plan to make sure it complies with the updated IRS rule and preserve the step-up in basis for assets that the trust will pass on to their heirs. Building a sufficient estate plan is also something that most people should try to have in place in order to limit issues for their family down the road.

Financial Planning Tips

-

A financial advisor can help you make sense of important rule changes so your financial plan stays on track. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Life insurance can play a vital role in the financial planning process so that your loved ones are protected in the event that something happens to you. SmartAsset has a life insurance tool specifically designed to help you determine how much coverage you need.

Photo credit: ©iStock.com/shapecharge, ©iStock.com/kate_sept2004

The post Want to Leave Assets to Heirs? IRS Rule Change Should Have You Rethinking Your Irrevocable Trust appeared first on SmartReads CMS – SmartAsset.