Ripple’s chief legal officer has urged the U.S. Securities and Exchange Commission (SEC) to own up to its multiple missteps in enforcement actions against the crypto industry. He referenced court rulings that criticized the SEC for “gross abuse of power,” lack of “faithful allegiance to the law,” and being “arbitrary and capricious.” Ripple’s Legal Chief […]

Ripple’s chief legal officer has urged the U.S. Securities and Exchange Commission (SEC) to own up to its multiple missteps in enforcement actions against the crypto industry. He referenced court rulings that criticized the SEC for “gross abuse of power,” lack of “faithful allegiance to the law,” and being “arbitrary and capricious.” Ripple’s Legal Chief […]

Source link

legal

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Montenegro’s Supreme Court stalls Do Kwon’s extradition amid legal tussle

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Donald Trump is due to be handed a $3.5bn (£2.8bn) payday as the Republican presidential contender faces a looming deadline to pay a huge legal bill, after his social media company passed the final obstacle to a Wall Street listing.

On Friday, shareholders in Digital World Acquisition Corp, a listed cash shell, voted to approve a merger with Trump Media & Technology Group (TMTG), the company behind Mr Trump’s social network Truth Social.

It means TMTG will join the Nasdaq exchange as early as next week. Mr Trump will own a majority of the combined company with a stake worth around $3.5bn.

Mr Trump has until Monday to pay a $454m bond to a New York civil fraud case and authorities could seize his assets if he does not pay. He must pay the bond as he seeks to appeal a ruling that he fraudulently inflated the value of his assets.

While he would not be able to sell his shares for six months, the merger of TMTG and Digital World may buttress Mr Trump’s finances.

The merger had faced late hurdles amid uncertainty over whether Arc Global Investments, Digital World’s largest shareholder, would support the deal. But Digital World secured enough support in a shareholder meeting on Friday.

Shares in Digital World have surged by 145pc this year, a phenomenon believed to be in part due to Mr Trump’s voters buying up the shares as a show of support.

TMTG and Digital World secured regulatory approval to go ahead with the deal last month, opening the door to the long-delayed merger.

Truth Social, announced by Mr Trump in 2021 after he left office, is similar to Twitter, from which the former president was banned after the January 6 Capitol Hill riots.

It allows users to send out short messages, reply and “re-truth” other people’s posts. Mr Trump typically posts several times a day on the service, despite his ban from Twitter being rescinded.

TMTG lost $49m in the first nine months of 2023, while revenue rose from $237,000 in the first nine months of 2022 to $3.4m.

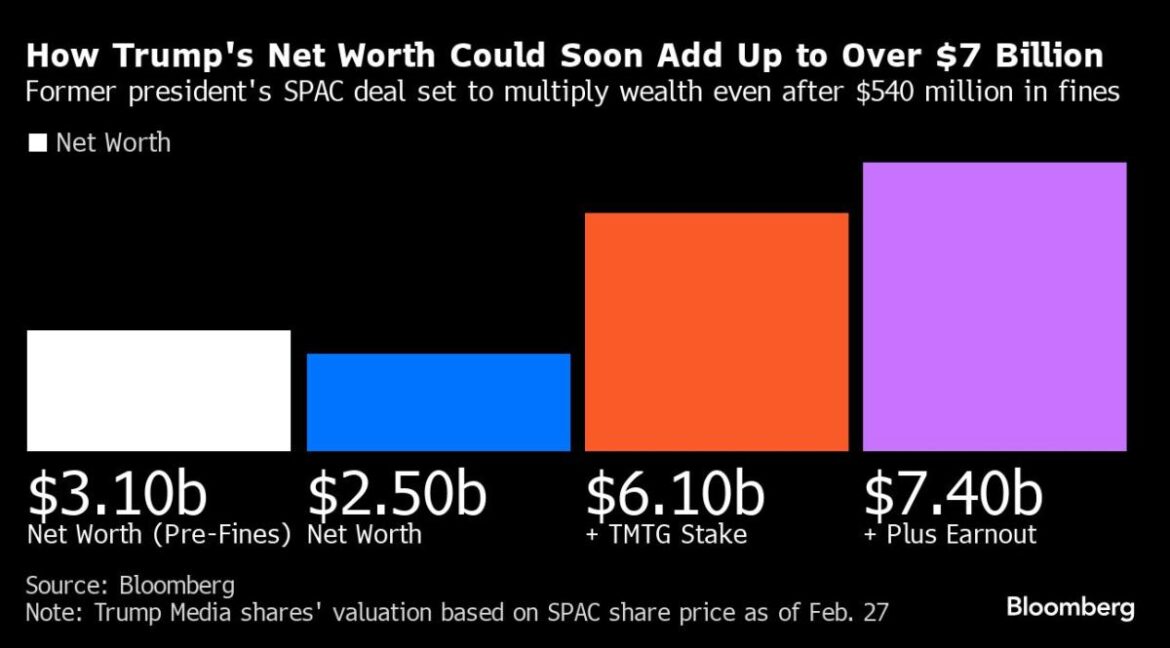

(Bloomberg) — On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

Most Read from Bloomberg

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus. In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month. If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion. Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth. But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

“He needs the money but he can’t sell too much at once without risking tanking the stock,” said Usha Rodrigues, a professor at the University of Georgia School of Law. “Once the lockup is expired, he could use the shares as collateral for loans in order to access cash without selling the shares.”

And it’s unlikely a bank would lend him a large sum of money against the locked-up shares, according to industry watchers like University of Florida finance professor Jay Ritter.

Read More: Trump’s $540 Million Court Loss Tests His ‘King of Debt’ Claim

Representatives for DWAC, Trump Media and the Trump Organization didn’t immediately respond to requests for comment.

Even the so-called earnout would more than cover it. After the deal closes, if the stock trades above $17.50 for 20 of 30 days, Trump Media holders would be entitled to receive as many as an additional 40 million shares filings show — with the majority earmarked for Trump.

A more troubling question for Trump is whether shareholders will keep the faith for more than five months after the merger is complete. As recently as April, Trump assigned the company a $5 million to $25 million value in a financial disclosure filed with the Federal Election Commission, a fraction of its valuation in the SPAC deal terms as well as in the market.

Read More: Trump Fuels Meme-Like Rallies in Stocks Tied to 2024 Bid

The business has struggled, with Trump Media losing $49 million in the nine months through September while generating just $3.4 million in revenue, according to regulatory filings. As such, the company has warned that it may run out of cash without the merger, filings show.

Trump Media “hasn’t been able to turn the corner and it’s not clear how the company is going to succeed in monetizing its business,” said Ritter.

The deal’s anticipated completion is a feat in itself after more than two years of starts and stops. Skeptics questioned whether Trump Media’s merger could clear a litany of shareholder votes, as well as investigations from the Justice Department and the SEC.

After the completion and during the lockup, the share price – and Trump’s potential windfall – will hinge on how successful he is politically, industry watchers agree. Trump Media has been aiming to “rival the liberal media consortium” and fight against big tech companies like Meta Platforms Inc., Netflix Inc., and Elon Musk’s X.

Shareholders may even choose to hold onto their shares in the hope that because of Trump Media’s alignment with his campaign message, Trump would have a strong incentive not to add Truth Social to the long list of ventures he’s endorsed, then exited from.

“The majority of people who are buying and holding this thing are Trump supporters, “ Tuttle said. “I don’t think it’d be smart for him to entirely blow out of his position and leave them holding the bag.”

–With assistance from Tom Maloney.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Satoshi Correspondence Revealed by Witnesses in Legal Clash Against Craig Wright

In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

Source link

My in-laws asked me to relinquish any claim to $100,000 they gave us as a down payment for our house — on the day we closed. Is that legal?

Dear Quentin,

My husband and I purchased a house together in New York about a year ago. We’ve been married 14 years. His parents gave us $100,000 toward the house, which was deposited in a joint bank account, one that I don’t have access to.

About a week later, my in-laws had me sign a document stating that the funds were considered “separate property” and that I wouldn’t claim any of those funds in case of a divorce. I signed this document on the day of the closing with their family lawyer, who was also the notary.

Does this document have legal standing in case of a divorce in New York state? Would this be considered signing under duress given that it happened on closing day, or a conflict of interest given that the family lawyer represented all of us?

Confused and Curious

Related: My Tinder match asked if I ‘rent or own’ my apartment. Is it gauche to ask financial questions before a first date?

“You have three questions to ask yourself: the legal and financial questions and the moral one.”

MarketWatch illustration

Dear Confused,

There is a lot of uncertainty in your letter about what happened on the day you signed this postnuptial agreement — and how you felt about signing it. The most revealing and yet confusing word you use is when you say your in-laws “had” you sign. It appears that you did so voluntarily and exercised your free will, but also that you felt pressure to do so. An attorney should walk you through the events of that day. But you do not say that you were forced to sign or did so under duress.

However, there are other aspects to this scenario that should be considered if you consult your own attorney — one who represents you exclusively. You say you were given no time to think it over. According to the New York City Bar: “If either you or your spouse uses pressure to get the postnuptial agreement signed or does not give the other enough time to consider the postnuptial agreement, the court may not enforce the postnuptial agreement.”

It adds: “The postnuptial agreement takes the control over your property and assets away from the state and places it in the hands of you and your spouse. A postnuptial is valid and can be enforced as long as it protects both you and your spouse and it was entered into with a full and fair disclosure of all assets by both you and your spouse. The agreement must also be executed and acknowledged with the full formality required for a property deed to be recorded.”

You say $100,000 was deposited into a joint account. I assume you mean it was one held by your in-laws and your husband, and your postnuptial agreement deals with this $100,000 as a separate gift before it was used as a down payment. (An aside: This strikes me as bizarre behavior, given that you are both buying a home — I assume you will both be on the deed as well as the mortgage — and you have been married for 14 years.)

Marital property versus separate property

“In order for an agreement waiving your right to marital property to be valid and enforceable under New York law — in this case the apparent postnuptial agreement at issue — it would have to be (i) in writing, (ii) subscribed by you and your husband and (iii) acknowledged or proven in the manner required to entitle a deed to be recorded,” says Ory Apelboim, partner in the Matrimonial & Family Law Practice Group at Blank Rome.

And if these conditions were met? “Then other issues might come into play,” he says. “New York has a strong public policy favoring individuals deciding their own interests through contracts. However, an agreement between spouses may be invalidated if the party challenging the agreement demonstrates that it was the product of fraud, duress or other inequitable conduct, or if the terms are unconscionable or the product of overreaching.”

The fact that you had no counsel and that it could be considered manifestly unfair could also play in your favor. “There could be an inference of overreaching by your husband, which he would be required to rebut,” Apelboim adds. “Additional considerations are the existence of a fiduciary relationship between you and your husband and the fact that postnuptial agreements are contracts which require consideration that is a benefit to each party.”

You have three questions to ask yourself: the legal and financial questions and the moral one. Do you have a legal basis to challenge the postnuptial agreement? Do you believe challenging your husband for half of this down payment ($50,000) would be worth it in the event you divorced? Or is this a matter of principle — you should have been given more time to consider your options, especially given that you have been married for 14 years?

If you do decide to contest this agreement, do it because you would not have signed under any other circumstances. How would you have responded if your in-laws had given you time to think this over? It seems like a big ask by your in-laws after 14 years of marriage. I could better understand their rationale if they had asked you to sign a prenuptial agreement. If you genuinely believe this is unfair, and you signed this contract under duress, ask an attorney for an opinion.

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter.

Check out the Moneyist private Facebook group, where we look for answers to life’s thorniest money issues. Post your questions, tell me what you want to know more about, or weigh in on the latest Moneyist columns.

The Moneyist regrets he cannot reply to questions individually.

Previous columns by Quentin Fottrell:

I asked my elderly father to quitclaim his home so I can refinance it — and take out a $200,000 annuity for my sister and me. Is this a good idea?

My partner is against us getting married. I’m not on the deed to his home, but he has a revocable trust. What could go wrong?

I want my son to inherit my $1.2 million house. Should I leave it to my second husband in my will? He promised to pass it on.

Tornado Cash developers to receive funding from new legal defense DAO

An activist group launched a legal defense fund for accused Tornado Cash developers Alexey Pertsev and Roman Storm on Jan. 22.

Roman Storm endorsed the fundraiser, stating:

“2024 is the year that will define the rest of my life. Honestly, I’m scared. But also hopeful that this community cares with a passion. Please donate towards my legal defense.”

The DAO was also announced by Ameen Soleimani, who is associated with various Ethereum and cryptocurrency projects. Soleimani wrote:

” … Roman & Alexey are fighting for all of us. The outcomes of these trials will have far reaching consequences for ETH devs & users, especially those working on privacy tools.”

The fund is organized by a group called Free Pertsev & Storm. The group stated that the fundraiser will run from Jan. 22 to Feb. 22 and noted that the defendants’ legal fees would range between $90,000 and $100,000 per month. It added that the “upcoming months will be crucial in shaping their defense strategy.”

Donations are possible through three fundraising platforms. As of 11:00 p.m. UTC on Jan. 22, Free Pertsev & Storm’s fundraiser page on JuiceBoxDAO had attracted 23 ETH ($53,300) through 78 donations.

Additionally, the group’s GoFundMe fundraiser raised $14,745 through cash donations. Another website at WeWantJusticeDAO.org appears to be accepting donations as well, though it does not report the raised amount publicly.

The U.S. is taking action against coin mixers

The U.S. initially took action against Tornado Cash in August 2022 as the Treasury blacklisted various on-chain crypto addresses linked to the service.

About one year later, the U.S. Department of Justice (DOJ) began to pursue charges against the platform’s developers. The agency charged Storm over his role in developing the coin mixer Tornado Cash in August 2023, alleging conspiracy charges around money laundering, sanctions violations, and the operation of an unlicensed money-transmitting business. The DOJ simultaneously charged another individual, Roman Semenov, who remains at large.

Alexey Pertsev was arrested in the Netherlands in August 2022, facing similar money laundering charges. He does not currently face charges in the U.S. but has been designated by the Treasury for his role in Tornado Cash.

U.S. authorities maintain that Tornado Cash and other coin mixers are used in money laundering and by cybercrime groups, including North Korea’s Lazarus Group. Crypto community members have largely countered this and asserted that coin mixers have legitimate privacy applications for general users.

Incidentally, the DeFi Education Fund submitted a comment opposing a federal proposal to treat coinmixers as a special money laundering concern.

Brad Garlinghouse, the CEO of Ripple, expressed his views on the aftermath of their legal battle with the US Securities and Exchange Commission (SEC).

Ripple CEO Insights On The SEC’s Stand In The Legal Battle

The Ripple CEO spoke about the case between the crypto company and the SEC in an interview at the 2023 DC Tech Week. Garlinghouse highlighted the SEC’s several setbacks since the case started.

According to the CEO, “the SEC has lost on everything that matters” when he was asked if the case is “done and dusted.” He further highlighted that the case’s conclusion rests on the SEC’s decision to pursue an appeal or not.

Nonetheless, Garlinghouse asserted that whether or not the SEC files an appeal on the case, which seems over for the regulator. This is due to the SEC’s “losing about three times to the crypto firm.”

In addition, the CEO also brought up the SEC’s losses in the Grayscale case. In a court ruling, a trial judge declared the agency was behaving “arbitrarily and capriciously” towards Grayscales’s Spot Bitcoin ETF application.

Notably, this legal wording suggests intentional and unreasonable activities done carelessly, ignoring relevant circumstances, facts, and other parties’ rights. With this incident, Garlinghouse emphasized that the SEC should reevaluate its course toward cryptocurrency regulation. The CEO stated:

I mean this is damning language from a federal judge to the SEC. At some point when you keep trying the same thing and having the same outcome, you need to change your approach. I hope the SEC’s change will be magical.

Nonetheless, Garlinghouse noted that the SEC losses will be amplified if they decide to take the appeal process higher.

Furthermore, Garlinghouse “reaffirmed” that Ripple stands prepared to pursue the matter further with the US Supreme Court should the situation demand it. Given that the Supreme Court has typically ruled against regulators, he firmly believes that the SEC would fail in the Supreme Court.

Regulatory Framework For the Cryptocurrency Industry

The Ripple CEO also spoke about the ambiguous regulatory framework for the cryptocurrency industry in the United States. According to Garlinghouse, other nations are increasing their market influence by implementing open rules and luring capital into the industry. On the other hand, the US continues to view cryptocurrencies with “skepticism.”

Garlinghouse conveyed that the US lacks a conducive regulatory framework. This causes the United States to “forfeit” its prospective position as a leader in the cryptocurrency space. So far, the Ripple CEO believes the US will create a crypto-friendly legal environment in the next ten years.

Feature image from iShock, chart by Tradingview.com

Founder who suffered eye damage at Bored Ape Yacht Club event sends ‘formal legal notice’ to Yuga Labs

A founder who attended Yuga Labs’ recent Ape Fest in Hong Kong has sent legal notice to the company after suffering eye damage related to the event.

Asif Kamal, founder of the art-tech and NFT company Artfi, said that he fell ill to a “widespread eye infection outbreak” during the Bored Apes Yacht Club-themed event, which was held in Hong Kong between Nov. 3 and Nov. 5. In the hours following the event, several attendees reported eye pain, skin irritation, and other maladies associated with overexposure to UV light.

He also said that he was hospitalized after returning to Dubai after two days and added that the infection gradually spread to the skin on his face.

Kamal and ArtFi said in a press release:

“To ensure such an incident never repeats itself, Asif Kamal and his legal team have taken swift action by sending a formal legal notice to Yuga Labs, the organizers of the event. Mr. Kamal is dedicated to seeking justice for those who suffered and safeguarding the rights of the affected individuals.”

Kamal otherwise expressed concern and condemnation regarding Yuga Labs’ apparent failed security measures, as well as sympathy for other victims.

Condition is not infectious

Most other reports attribute the widespread eye condition to UV exposure from improper lighting. Several other attendees reported eye pain, vision problems, and burnt skin following the event.

In a petition on Change.org, Kamal similarly suggested that his condition was caused by exposure to UV radiation but maintained that this resulted in an infection.

Yuga Labs has acknowledged those reports. In a statement to Variety, the firm said that it was aware of “some attendees” reporting the above conditions (apart from infection). The company added that it was “distressed” by those reports and said that it was working with festival vendors and contractors to determine the cause of the incident.

In another statement to Verge, Yuga Labs said that 15 individuals, or less than 1% of the 2,250 people in attendance, had contacted it about the matter.