South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

Source link

listing

Bitcoin Cash (BCH) has registered a sharp 15% rally in the past 24 hours after plans of a futures listing on Coinbase have surfaced for the asset.

Coinbase Plans To Launch Bitcoin Cash Futures Product On 1 April

As an X user has pointed out, the cryptocurrency exchange Coinbase appears to have filed certifications with the Commodity Futures Trading Commission (CFTC) to list futures products for three coins on its platform: Bitcoin Cash (BCH), Dogecoin (DOGE), and Litecoin (LTC).

Coinbase Derivatives LLC quietly filed certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash.

They filed them on March 7 and surprisingly nobody seemed to notice.

Futures are set to start trading on April 1 if there are no objections from… pic.twitter.com/DYbWjuS6G2

— Summers (@SummersThings) March 20, 2024

As per the CFTC filing, all of these products were certified on March 7, and they are set to go live on trading on the first of the month.

The BCH, LTC, and DOGE futures contracts were all certified earlier in the month | Source: CFTC

Interestingly, all three of these digital assets happen to be based on the original cryptocurrency: Bitcoin. Bloomberg analyst James Seyffart has hinted that this may be why Coinbase has chosen them.

This is interesting… wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures’. These all forked from Bitcoin so “these are securities” claims would be hard to make after spot #Bitcoin ETF approvals. Might be why Coinbase chose them🤔

— James Seyffart (@JSeyff) March 20, 2024

Unlike LTC and DOGE, which are based initially on BTC’s code, BCH is a direct fork of the cryptocurrency made to fulfill BTC’s original purpose as a fast and cheap form of currency that may be used for regular purposes (hence the name).

The filling made by Coinbase on Bitcoin Cash reads:

The market position of Bitcoin Cash reflects its role as an alternative to Bitcoin that prioritizes transaction efficiency. While it has not matched Bitcoin in terms of market capitalization or price, Bitcoin Cash has established itself as a significant player in the cryptocurrency space, with a dedicated user base and ecosystem.

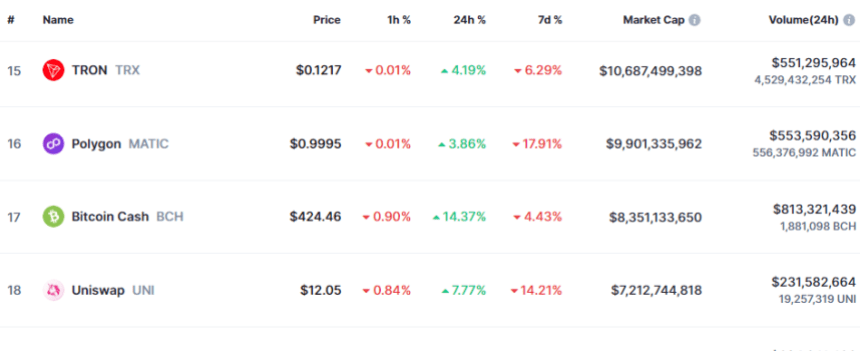

BCH Has Enjoyed A 14% Surge During The Last 24 Hours

The cryptocurrency sector has been up in the past day, but two coins in particular have stood out among the top 20 assets by market cap: Bitcoin Cash and Dogecoin.

Both of these have managed more than 14% returns in this period, notably outperforming their peers. Bitcoin itself has only been able to put together a rally of about 6%.

Given that the Coinbase filling has been making the rounds in this window, it would appear likely that it was at least partially responsible for the extraordinary surges of these coins.

Even though Litecoin is also planned to see its futures contract launch on the same day as the other two, its price performance has been more or less in line with the rest of the market with its profits sitting at just 4%.

Following the sharp rally, Bitcoin Cash has now arrived at the $424 level. The chart below shows how the cryptocurrency’s trajectory has looked in the last few days.

Looks like price of the asset has shot up over the past day | Source: BCHUSD on TradingView

Regarding the market cap, Bitcoin Cash is currently the 17th largest asset. While there is some distance to Polygon (MATIC) in 16th place, LTC may be able to catch it if it can keep up this rally.

The BCH market cap seems to be $8.3 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Binance just announced the listing of Dogwifhat (WIF), the Solana-based coin climbing up in the memecoins ranking. The price of the dog-themed coin positively reacted to the announcement news and reached a new all-time high.

WIF Now Trading On Binance

Today, Binance announced the highly anticipated listing of Dogwifhat. WIF has been experiencing a crazy bull run the past few weeks that has catapulted the coin even higher after the memecoin frenzy that started over the weekend.

The hat stays on, on #Binance$WIF will be live for trading at 14:00 UTC.

🐕 🧢

— Binance (@binance) March 5, 2024

The largest crypto exchange revealed that the listing and open trading of the supported Spot Trading Pairs would occur today at 14:00 (UTC). Additionally, withdrawals will be available on March 6 at 14:00 (UTC).

According to the announcement, the new Spot Trading Pairs available on Binance are WIF/BTC, WIF/USDT, WIF/FDUSD, and WIF/TRY.

The exchange warned users about the “higher than normal risk” of WIF’s price volatility. Due to its relatively new token status, it suggested that investors do their research before deciding to trade the token.

Moreover, Binance announced that the Seed Tag will be applied to WIF. This tag labels the coin as an “innovative project that might exhibit higher volatility and risks than other listed tokens.”

As a result of the Seed Tag, users will need to pass the corresponding quizzes every 90 days on the Binance Spot and Binance Margin platforms to gain trading access to WIF. The quizzes, as the Binance support page reads, are set up to ensure the user’s awareness of the risks of a token before trading it.

The Hat Stays On

Dogwifhat has gone on a “turbo parabolic” rally since late February. This rally has gained the dog-themed coin traditional media acknowledgment.

Recently, a Bloomberg host name dropped WIF, alongside PEPE, when discussing whether the “era of the memecoin is back” on live TV.

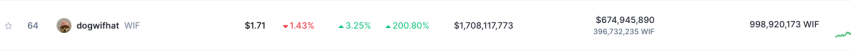

Undoubtedly, WIF’s performance has been notable after the memecoin market pullback from a few weeks ago, when WIF was experiencing a 30% price decrease in the 7-day timeframe.

At the time, Dogwifhat was the 196th largest cryptocurrency by market cap, according to CoinGecko data. After investors wore several hats, the memecoin climbed to 64th in two weeks.

Dogwifhat ranks 64th among all cryptocurrencies. Source: CoinMarketCap

Following the announcement, WIF’s price of $1.51 skyrocketed to a new all-time high of $1.90. This price increase represented a 25.8% surge in an hour.

Consequentially, the market activity for the dog-themed coin increased 81.17% in the last 24 hours, with a trading volume of $657.2 million, according to CoinMarketCap Data.

At the time of writing, Dogwifhat has seen an 8.2% price drop from its new ATH mark in the past hour. With a market capitalization of $1.7 billion, 2.2% down from the day prior, WIF is the fifth largest memecoin by this metric. The current price of $1.74 still represents a 2% gain in a 24-hour timeframe.

WIF is trading at $1.7 in the hourly chart. Source: WIFUSDT on TradingView.com

Featured image from X.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Revolut to launch new crypto exchange amidst reports of listing Solana’s BONK memecoin

UK-based digital bank Revolut is preparing to introduce more extensive crypto exchange services, according to a report from Coindesk on Feb. 16.

That report cites an email to a UK customer describing a “new crypto exchange, built with advanced traders in mind.” The email also promises that the exchange will feature “deeper analytical tools and lower fees” than Revolut’s main app.

Reportedly, the fees are set between 0% and 0.09%, and limit orders will not include a cost. It is unclear whether those rates apply to upcoming or current services, as those numbers appear to describe Revolut’s contemporary maker and taker fees.

Another page suggests that Revolut charges a single fixed fee for crypto conversions between 0.99% and 1.99%, depending on the plan.

The latest development marks growth in Revolut’s crypto services following earlier reductions. Revolut reduced UK business access to crypto services in December 2023 and suspended US access to crypto services in August 2023 due to regulatory developments in both jurisdictions.

Revolut may list Solana’s BONK memecoin

There is also speculation that Revolut will list Solana-based memecoin BONK as part of a partnership, which will involve running a $1.2 million “learn and earn” campaign.

The news is supported by a recent proposal by the BONK community that describes a partnership with “one of the biggest European fintech” firms without naming Revolut specifically. However, the proposal also describes the partner firm serving 38 million customers in over 50 countries, which applies to Revolut.

It is unclear whether the expected BONK partnership will extend to Revolut’s current crypto services or is restricted to its upcoming advanced exchange.

BONK saw a significant surge in value in December 2023, setting a new all-time high. However, the memecoin has lost most of the gains since and is now down 62% from its ATH on Dec. 15.

BONK has been criticized for its highly centralized supply and the lack of a whitepaper. Nevertheless, it has gained listings on popular exchanges such as Binance and Coinbase.

The post Revolut to launch new crypto exchange amidst reports of listing Solana’s BONK memecoin appeared first on CryptoSlate.

Wall Street Veteran Explains Why Shares Could Surge 2000% Before Public Listing

Pro-XRP Wall Street financial analyst Linda Jones recently shared her thoughts on a potential Ripple Initial Public Offering (IPO). Specifically, she elaborated on her belief that the crypto firm was currently undervalued and how the company’s stocks could still rise before it went public.

Why Ripple’s Stock Could Be Worth 20 Times Its Current Price

Linda Jones used Coinbase’s IPO as a mirror to explain why Ripple’s stock could be worth 20 times its current valuation. She noted that Coinbase was valued at $86 billion when it initially went public, and its stocks traded for as high as $429 during that period. If Ripple were to follow a similar path, then its stock price would be worth more than the $35, which it is currently valued at by private equity platform Linqto, Jones claimed.

Interestingly, the analyst factored in Ripple’s escrowed XRP holdings while trying to estimate how much the crypto firm could eventually be valued. According to her, Ripple could be valued as high as $107 billion if those escrowed funds (said to be worth $21 billion) are added to the $86 billion (if Ripple were to be valued similarly to Coinbase).

Going by Jones’ analysis, Ripple having a valuation of $107 billion means that the company’s stocks could trade at $600 on the first day of being publicly listed. The analyst then went on to lay out a possible scenario where Ripple is valued at more than $107 billion, the amount under consideration.

XRP price at $0.5 | Source: XRPUSD On Tradingview.com

How Ripple Could End Up Being Worth Half A Trillion

Linda Jones also mentioned that Ripple could end up being worth half a trillion if the SEC’s case against Ripple were to end soon and XRP rises back to its all-time high (ATH). If the latter happens, Ripple’s escrowed XRP holdings will be worth around $150 billion. That could ultimately increase Ripple’s value to about $500 billion, the analyst claims.

Jones believes that Ripple being valued at $500 billion during the IPO isn’t farfetched, considering that there are companies that are already valued at up to a trillion. She further compared Ripple to the likes of Apple, Microsoft, and Nvidia, suggesting that the crypto firm could match up to these blue chip companies.

The financial analyst’s belief in Ripple’s potential is why she boldly claims that purchasing Ripple’s stock now is a great investment, as it will only go “up” from here. She also predicts that there could be a new record for a company at its valuation, and Ripple could be that company.

Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Kaspa, a relatively recent entrant to the cryptocurrency market, has emerged as one of the top performers this weekend, experiencing a remarkable surge in value. This surge aligns with a broader trend, as the entire market capitalization of the crypto market has grown by over 5%, underscoring a substantial increase in overall value.

In the past week alone, Kaspa’s price has soared significantly, contributing to its standout performance in the dynamic cryptocurrency landscape.

The value of Kaspa (KAS) surged last week after it was added to the Coinbase Global platform, hitting a record high. This is frequently linked to the “Coinbase effect,” which gives the listed commodity a sense of legitimacy.

Also, following the announcement of possible expansion in the Bitcoin cloud mining phenomenon, the altcoin saw a sharp increase. In the next days, there will also be updates on KAS’s integration with the OKX wallet and a $1 million airdrop.

The sentiment gained steam when one of the biggest cryptocurrency exchanges in the world, Binance, declared that it would launch Kaspa for perpetual trading, Friday, drawing interest from investors.

The token’s price climbed by 15% in just one day as a result of this statement, while trading volume increased by 80% between Thursday and Friday. With better order execution and lively buyer-seller interaction, the increased activity indicates that the market is reacting favorably to the listing.

Source: Coingecko

At the time of writing, KAS was trading at $0.135, up nearly 6% in the last 24 hours, and commanding a solid 55% rally in the last seven days, data from crypto price aggregator Coingecko shows.

KAS market cap currently at $2.8 billion. Chart: TradingView.com

As November commenced, there was a notable positive turn of events as the price successfully breached the upper boundary, signaling a potential shift in market dynamics.

Subsequently, the Kaspa coin witnessed substantial price movement, attaining a fresh annual peak. However, it encountered resistance and was turned away at the $0.09732 mark, leading to a correction with a decline exceeding 10% in value.

KAS seven-day price action. Source: Coingecko

Despite this setback, Kaspa’s price regained traction, surpassing resistance levels and steadily appreciating. In more recent developments, the price confronted rejection at $0.137, setting the stage for an imminent retest of this level, the outcome of which remains uncertain.

On average, the price of a newly listed coin on the Coinbase exchange tends to increase by over 80% within the first five days of its listing. Notably, Kaspa has had a growth of more than 60% since reaching a low of $0.0800 on November 13.

The act of becoming publicly listed on the top cryptocurrency exchange in terms of trading volume is indicative of establishing credibility and authenticity.

Even while metrics like the Relative Strength Index (RSI) indicate that Kaspa might be overbought, upside is still possible. Long-term investors may have an opportunity if KAS can break above $0.140 and achieve a new range high of $0.148, according to market observers.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pixabay

Upland secures $7M funding aiming at AI metaverse expansion and Spark token exchange listing

The web3 Metaverse “super app,” Upland, has extended its Series A funding, successfully securing an additional $7 million.

According to Upland, this latest investment round, which includes EOS Network Ventures as a new investor, brings the firm’s total funding to $25 million.

Riding a wave of increasing user engagement and steadily growing virtual property ownership, Upland seems poised to double down on the resurgence of metaverse hype. The app has registered over 3 million accounts on the EOS blockchain, with almost 300,000 virtual property owners, while continuously launching and enhancing features, including a new car racing app, in-game racing features, and a third-party developer platform.

The newly acquired funds aim to propel Upland’s mission to construct the world’s most expansive digital open economy and advance its innovation roadmap, such as introducing novel features and platform components utilizing AI.

Furthermore, the funding will bolster the company’s initiative to make its utility token, Spark, tradeable outside the Upland platform on Ethereum through a Token Tradability Event, marking its debut on external exchanges.

Last year, Upland raised $18 million last year, channeling funds to broaden its global footprint, develop new features, form strategic brand partnerships, and accelerate user acquisition. This move aligns with “Upland’s ability to offer a captivating web2 experience that seamlessly abstracts away the intricacies of blockchain technology while delivering the advantages of true asset ownership,” as EOS Network Ventures’ director, Yves La Rose, explained.

Upland is creating an immersive web experience mapped to the real world through its metaverse. The platform offers various activities for players and creators alike, including virtual property trading, world-building, and competitive car racing. Moreover, it allows entrepreneurs to operate virtual shops powered by UPX, Upland’s native currency, and Spark, a utility token that fuels value creation by its highly engaged community.

Upland is available from the App Store or Google Play. The recent announcement of plans to make Spark tradable on exchanges (converted to “Sparklet” on Ethereum) and the publication of a white paper, approved by an 87% majority of the community, can also be found on the Upland website.

Should we wait for the tenants to leave before listing our New York City rental?

Dear Big Move,

My husband and I own a home in New York City. We’d like to sell it, but we have to give the current tenants until about the end of the month to move. The home is located in Staten Island. It’s a single-family, fully-detached home with a small fenced-in yard.

Our question is this: What should we do first? Should we put it on the market now, and tell the real-estate agent about the tenants’ need for a few months, or wait until about a month before they have to leave and put it up for sale then?

We’ve never sold a house before, and I’m not sure what the best course of action should be.

Confused

‘The Big Move’ is a MarketWatch column looking at the ins and outs of real estate, from navigating the search for a new home to applying for a mortgage.

Do you have a question about buying or selling a home? Do you want to know where your next move should be? Email Aarthi Swaminathan at TheBigMove@marketwatch.com.

Dear Confused,

It depends on how quickly you want to sell the home. Yes, you can sell the home with the tenants in it. But if you are not in a rush, you could wait until their lease is up and clear it out first, then sell.

But it sounds like you’re keen to explore the idea of putting the home on the market as soon as possible, so here are a few major points you need to consider.

First, you need to make sure that you’ve provided them with adequate notice to terminate the lease. If it’s a month-to-month tenancy, they have 30 days or more to vacate the home, depending on how long they’ve lived there, according to New York City regulations.

Then, talk to a real-estate agent about selling the property. Present all of the facts such as how long the tenants have lived there, how much rent they’re paying, when their lease ends (or when they have agreed to vacate the home), or if they are keen to stay at the unit under new owners. They’ll be able to help you anticipate any unexpected issues when it comes to selling the home.

Third, you’ll have to decide with the real-estate agent if it’s worth vacating the home and having it staged for showings, have it empty, or show it with tenants at home. It may be logistically easiest to show the home without the tenants in it, and it may be worth the home being staged.

Should you ‘stage’ your home?

“It depends on the current state of the home, it can be good for prospective buyers to see a furnished versus an unfurnished home to get a sense of proportion with furniture,” Adjina Dekidjiev, a real-estate broker at Coldwell Banker Warburg, told MarketWatch, “but if the home is too cluttered they should wait.”

But “if the home shows well, it’s fine to show with as much notice as possible to ensure that tenants have time to clean up and declutter,” Dekidjiev added. “There’s a clause in most leases that allows for owners to begin marketing and showing the home.”

Assess the home and see if it’s worth showing it to prospective buyers as-is. You don’t want a messy home to hurt your chances at selling, or have the bidders put in a lowball offer because they can’t imagine themselves living there in style.

The bottom line: If you’re selling your Staten Island rental, you can put it on the market now with the agent being aware of the tenant situation, if the home is presentable and appealing with them living in it.

By emailing your questions, you agree to having them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Tech worker goes viral after listing all past and current salaries on LinkedIn—but experts warn that may work against you

As salary transparency becomes more widespread it’s increasingly easy to measure up how your wage compares to similar roles on the market. In theory, the practice can help close the gap that women, people of color and other minorities often experience, as pay inequalities become public.

But one worker has taken matters into her own hands: Charlotte Chaze, founder of Break Into Tech, recently posted the salaries of all of her previous jobs to her LinkedIn profile.

The 32-year-old tech worker said on her TikTok channel that she added the salary for each job—from $28,000 to be a research assistant, to $158,000 as a senior analytics manager for AT&T—to “do her part to make salary transparency happen”.

Her LinkedIn profile went viral, thanks in part to this tweet which has been viewed over 4 million times, with people conflicted on whether Chaze’s candor is a smart or foolish idea.

As her own boss, Chaze felt she had both freedom and responsibility to post her salary information but according to Rameez Kaleem, the founder and managing director at 3R Strategy, she’s part of a growing trend.

He told Fortune that a number of clients at his remuneration consultancy have experienced employees sharing their salaries online “because they feel that they’re underpaid in their current job”.

“Other people are putting their salary on LinkedIn to reduce the risk of time-wasting, poorly paid recruitment opportunities,” Kaleem says. “They’re making their current salaries public to say, ‘This is what I currently earn. If you’re going to make me an offer, it has to be higher than this, otherwise, I just won’t bother.’”

Is posting your salary counterintuitive?

By disclosing what you’re currently on, Zahra Amiry, Omnicom Media Group’s associate director of talent attraction cautions that you could be sabotaging your chances of substantially increasing your salary in the future.

“By effectively saying, ‘Don’t approach me for a role, which is less than this’ you’re capping yourself,” she explains because hiring managers will most likely look at this information and form their job offer based on your current salary.

It means that those who are already being paid below market value for their role, risk being lowballed.

“All this does is transfer the inequity and discrimination from one company to the next,” Kaleem echoes, while adding that it’s especially risky for those who don’t know the current market value of their role or are transitioning into another industry that pays much higher.

“They may think they’re being paid well when they’re actually far below the market median for that position,” he adds. “Publishing your salary with this in mind can demonstrate to employers that you’re happy to sit at the lower end of a salary range.”

Meanwhile, even those who know they’re being underpaid lose their ability to negotiate when they’ve put all their cards on the table.

Risk of damaging relations with your current employer

Although it’s perfectly legal to do so, publishing your salary while you’re still employed can cause unnecessary internal friction and impact how you’re perceived by management.

Really, most modern businesses are slowly trying to reduce pay inequalities and are introducing measures like salary banding to do so.

“It takes a long time to get there,” Amiry says, adding that some team members may experience a pay adjustment sooner than others. “You don’t know what your peers are earning, so you’ll be displaying some pretty significant discrepancies potentially which could cause tension.”

Not only could outing your salary put a strain on the relationship you hold with your peers and your boss (who has to deal with the fallout), but Kaleem warns that it risks damaging the reputation of your company, which certainly won’t land well.

“As a result, it could definitely ruin future progression opportunities with that employer,” he says.

The first port of call, if you are frustrated with your pay, is to speak with your line manager and HR department.

But if you feel like all avenues have been exhausted, rather than sharing your individual pay publicly, you could consider using anonymous salary-sharing websites, such as Glassdoor, to voice your frustrations without exposing yourself to potential backlash.

Alternatively, if poor pay is a company-wide issue, you could rally together your peers in protest. “If you have a large group of people that are part of this movement, it can force organizations to rethink their strategy.”

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home

Fourth Paradigm Receives Hong Kong IPO Green Light from Chinese Regulator after Fourth Attempt at Public Listing

Following acceptance by the CSRC, Fourth Paradigm should proceed with launching its IPO in the Hong Kong market.

Chinese artificial intelligence (AI) company Fourth Paradigm Technology has completed the process required for an initial public offering (IPO) in Hong Kong. The company has now received a regulatory green light from the China Securities Regulatory Commission (CSRC).

Fourth Paradigm is one of only a few companies to receive the green light from the CSRC this year after the Commission instituted new rules for offshore listings. Introduced in February, the rules became effective from March 31 and provided clarity for companies interested in overseas IPOs. As of June 15, the CSRC had received filings for offshore IPOs from 14 companies and was reportedly waiting for 38 others.

According to the new rules, Fourth Paradigm and other companies looking for foreign IPOs must file with the CSRC first. In addition, each of these companies must receive approval from other regulators. These regulators are now involved in the VIE (variable interest entity) process Chinese companies use to list overseas. Agencies that could potentially be involved in the process include the National Development and Reform Commission and the Cyberspace Administration of China (CAC).

Fourth Paradigm’s IPO nod dissolves some uncertainty surrounding adherence to the new rules and the difficulty of listing abroad. Upon announcing the new rules, the CSRC said that any firm in violation could pay a fine of up to 10 million yuan, about $1.5 million. This fine also applies to any persons or companies who share wrong information.

China’s Crackdown on Foreign IPOs

China has always been particular about offshore listings, although they were much easier. Even before adopting the rules, the CAC – China’s cybersecurity regulator – requires firms holding personal data of at least 1 million users to apply for a cybersecurity review before an offshore IPO.

This was why the CAC slammed transport company Didi with a $1.19 billion fine last year. Didi reportedly did not complete a cybersecurity review before listing on the New York Stock Exchange (NYSE). The CAC also fined Didi founder Cheng Wei and president Jean Liu, 1 million yuan each.

Fourth Paradigm Filed for the Hong Kong IPO in March

The current attempt at an IPO is Fourth Paradigm’s fourth after previous ones failed. Founded in 2014, Fourth Paradigm filed for an IPO in August 2021 and in February 2022, with both attempts expiring for unidentified reasons. The startup filed the fourth attempt in March, only a few days before the third attempt – filed last September – was to expire.

Fourth Paradigm was sanctioned by the US and placed on the Commerce Department’s Entity List in March. Companies on this list need a license to buy or access specific goods, services, or technologies. Following its addition to the list, Fourth Paradigm allayed public fears. The company clarified that the inclusion “should not have a material impact on the business or operations of the group”. Fourth Paradigm company also said none of its suppliers, customers, or investors, have withdrawn their commitments to the company.

next

Business News, IPO News, Market News, News

Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify crypto stories to the bare basics so that anyone anywhere can understand without too much background knowledge.

When he’s not neck-deep in crypto stories, Tolu enjoys music, loves to sing and is an avid movie lover.

You have successfully joined our subscriber list.