In the first quarter of 2024, more than $336 million in digital assets were stolen from decentralized finance platforms across 61 incidents of hacking and fraud. During this period, criminals made off with digital assets valued at $144.48 million in two major hacking incidents. In contrast, centralized finance platforms reported no incidents of hacking or […]

In the first quarter of 2024, more than $336 million in digital assets were stolen from decentralized finance platforms across 61 incidents of hacking and fraud. During this period, criminals made off with digital assets valued at $144.48 million in two major hacking incidents. In contrast, centralized finance platforms reported no incidents of hacking or […]

Source link

Lose

Cryptocurrency traders constantly look for the next big project to yield significant profits. However, not all of their investments result in massive gains.

A recent report by Lookonchain revealed that a trader lost more than $1 million within three days.

When Buying High Doesn’t Result In Selling Higher

According to the blockchain research platform Lookonchain, a crypto trader lost 6,039 SOL over the last three days after FOMO-buying a memecoin. Per the report, the trader bought Slerf (SLERF) for 4,958 SOL, worth around $1 million.

The different transactions occurred when the price hovered between $0.8 and $1.4 on its launch day. A couple of hours later, the trader sold its SLERF tokens, losing 2,793 SOL after the token’s price plunged to the $0.4-$0.6 range, for a loss of $564,000.

This #FOMO buyer sold all $SLERF at a loss of 6,039 $SOL($1.15M) again.

Then he deposited all his $SOL to #Binance and may no longer trade #MEMEcoins. pic.twitter.com/RIJkDF103C

— Lookonchain (@lookonchain) March 21, 2024

Seemingly, the fear of missing out made the trader buy SLERF a second time when the price neared its all-time high (ATH) of $1.30. The address bought 3 million Slerf at $1.17, spending 19,133 SOL, worth around $3.152 million.

At the time, the pending question was whether the trader would profit from this second attempt or lose more money. As Lookonchain reported, the FOMO buyer sold all their SLERF tokens at a loss again, losing 6,039 SOL, worth $1.15 million.

The Slerf token, which has been all over the news for its dramatic launch, saw a significant price decrease of 52.39% from the ATH registered the day after launch. At writing time, SLERF is trading at $0.6351, an 18.4% decrease in the past 24 hours.

oh fuck#Slerf #Slerfthesloth #slerfsup $slerf pic.twitter.com/MZes6fVjHN

— Slerf (@Slerfsol) March 22, 2024

A second trader lost 3,731 SOL, worth $775,000, just one hour after buying 790,236 SLERF at its ATH price. The trader then doubled down on its bet and bought another 650,000 SLERF. Unluckily, the token’s price plummeted after both purchases.

Is The Crypto Presale Meta Hand In Hand With FOMO?

To paint an even bigger picture, another crypto trader lost money yesterday after buying a different ‘presale meta’ memecoin. Although the figures are more modest than the other two cases, this trader bought SMOLE and lost 371 SOL. Later, the address spent 2,549 SOL to buy SLERF.

This guy always buys high and sells low.

He lost money on $SMOLE twice in just 20 minutes, with a total loss of 371 $SOL($70K).

Then he spent all 2,549 $SOL($484K) to buy $SLERF. pic.twitter.com/oZlWkyKD8B

— Lookonchain (@lookonchain) March 21, 2024

SMOLE, despite only being out for one day, has already seen massive criticism and a 17.1% price drop. At writing time, the memecoin is changing hands at $0.0001499, a 70.39% decrease from its highest price of $0.0005086.

As this might suggest, FOMO seemingly drives memecoin traders’ decisions during this presale meta. The trend has seen hundreds of millions of dollars sent to memecoins, most of which report millions in losses for investors.

2024 is a #FOMO #YOLO kind of year

go for it ! pic.twitter.com/AT8iMZchdQ

— Crypto Damus (@AstroCryptoGuru) March 20, 2024

Despite experienced traders being able to profit from this trend, the current numbers hint at a considerable amount of traders losing massive figures while trying to catch the next memecoin to go “turbo parabolic,” even if it doesn’t have a long-term roadmap.

SOL is trading at $172.25 in the 1-day chart. Source: SOLUSDT on Trading.view.com

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Amazon’s stock could lose to Walgreens’ this year if the Dow jinx holds

The keepers of the Dow Jones Industrial Average have been very good at making sure the changes they make to the venerable stock-market barometer are seamless to investors, but nobody’s perfect.

How the 128-year old index

DJIA

is constructed is a secret closely guarded by S&P Dow Jones Indices. But some things, such as the influence each stock has, are known once changes are made.

There’s also the matter of the “Dow jinx,” which has seen new members tend to underperform the members they replaced.

The Dow is different than other market trackers, because the price is determined by dollar-amount changes in the components’ stocks. So stocks with higher prices — not companies with larger market capitalizations like those in the S&P 500 index

SPX

and the Nasdaq Composite Index

COMP

— have greater influence on the index’s price.

Rather than a weighting based on market cap, there is a “divisor,” or a number that a Dow stock’s price change is divided by to determine what effect that stock’s move has on the Dow.

As of Friday, that divisor was 0.15172752595384. That means that each $1 change in any of the Dow stocks moved the Dow’s price by 6.59 points.

On Monday, Walmart Inc.’s

WMT,

stock split will lower its price by two-thirds. And as of Friday’s close, the price of incoming Amazon.com Inc.’s stock

AMZN,

was roughly eight times the price of outgoing Walgreens Boots Alliance Inc.’s

WBA,

Also read: Why you can count on the Dow making changes in February

With those changes, the divisor increases slightly to 0.15265312230608, meaning the price changes of all the other Dow stocks will have a little less influence on the Dow’s price. For each $1 change, the Dow will now move by 6.55 points.

At Monday’s open, Amazon will be the third-largest company in the Dow by market cap, but will rank 17th out of 30 by price. A 1% change in Amazon’s stock would move the Dow by 11.5 points. But a 1% move in the Dow’s highest-priced stock, UnitedHealth Group Inc.’s

UNH,

which has about a quarter of Amazon’s market cap, would move the Dow by about 35.5 points.

The Dow keepers said the idea behind Monday’s change was to increase exposure to consumer retail, as well as other business areas. In effect, the keepers swapped a stock with a negative correlation to the market with one with a relatively high correlation.

For the past two years, the correlation coefficient between Walgreens’ stock and the Dow was negative 0.45, and between the stock and the S&P 500 it was negative 0.51.

Meanwhile, the correlation of Amazon’s stock with the Dow was 0.60 and with the S&P 500 it was 0.82.

S&P Dow Jones Indices also made a change to the Dow Jones Transportation Average

DJT,

by adding Uber Technologies Inc.’s stock

UBER,

while removing JetBlue Airways Corp.’s stock

JBLU,

Given that Friday’s closing price for Uber’s stock was about 12 times that of JetBlue’s, the Dow transports’ divisor increased to about 0.1673077 from 0.1627986.

Keep in mind that the Dow keepers aren’t trying to pick winners. Their mission is to match the market. And they’ve been pretty great at it over the long term. The Dow’s correlation with the S&P 500 was 0.93 over the past two years and was 0.99 over the past 10 years.

But for some unknown reason, a quirk of Dow changes has been that the performance of stocks that enter often get beat over the short term by those that leave.

It might seem inconceivable to some that Walgreens’ stock would outperform Amazon’s, which is one of the so-called Magnificent Seven group of tech stocks, but surely many thought the same when Apple Inc.’s

AAPL,

stock replaced AT&T Inc.’s

T,

In the year before Apple entered the Dow on March 19, 2015, the technology giant’s stock soared 71%, while telecom stalwart AT&T’s stock gained just 3.4%.

One year after the stocks were swapped, Apple’s had dropped by about 18% and AT&T’s had run up 16%.

Don’t miss: Buffett saved $460 million by waiting to swap AT&T for Apple

Meanwhile, over the past year, Amazon’s stock soared about 83%, while Walgreens shares plunged 40%.

Also read: R.I.P. the ‘Magnificent Seven,’ says analyst who coined the big-tech moniker. Here’s why.

Here’s how the stocks that entered the Dow and the stocks they replaced performed in the year after the last changes were made, on Aug. 31, 2020:

-

Salesforce Inc.’s stock

CRM,

-0.29%

fell 2.2% in the year after it entered the Dow, while the stock it replaced, Exxon Mobil Corp.’s

XOM,

-0.88% ,

soared 34%. -

Shares of Amgen Inc.

AMGN,

+1.40%

were down 11% a year after going in, while Pfizer Inc. shares

PFE,

+0.76%

were up 28% a year after getting booted. -

The jinx didn’t always hold, however, as Honeywell International Inc. shares

HON,

-0.09%

rose 38% in the year after entering the Dow, while RTX Corp.’s stock

RTX,

+0.54%

climbed 36% in the year after exiting.

It is often said that a car begins losing its value as soon as you drive it off the lot. The reasons why boil down to some Nobel Prize-winning insights about human behavior and some quirks of the automotive industry.

Everyone in the automotive industry keeps a close eye on depreciation: owners and buyers concerned about resale value, automakers calculating lease payments and of course, dealers.

The principles underlying it had been pretty stable for much of the auto industry’s century-long history.

But the Covid-19 pandemic turned the used car market upside down. Vehicle production was constrained, supply chains experienced severe shortages and there were fewer new cars on lots.

“The prices of used vehicles were actually increasing for about two years,” said Alex Yurchenko, chief data science officer at Black Book and Motor. “We’ve never seen anything like that for the market.”

The result: Cars are holding onto about 10% more of their value after three years than they were during the pandemic. Industry analysts say it is likely to stay that way.

Watch the video to learn more.

My mother is on food stamps and Medicaid, if she sells her house will she lose her benefits?

Dear Harry,

My mother has a home (value approximately $300,000) and no money in savings. She is using many state-funded benefits (food stamps, energy assistance, Medicaid) to supplement what her Social Security does not cover on a monthly basis. My brother and I are trying to determine if selling her home and moving her to a smaller, less expensive home would help but we realize that once the house sells she may lose some or all of these benefits because she would then have money in the bank. Is the right thing to do to move her home in our names (but then we would have to pay capital gains once it sells) or to a trust before selling it so that it is out of her name? She won’t be able to survive without these state benefits, regardless of an increase in her savings.

Dear reader,

Your mother is subject to the miserliness of public benefits in our country. Many programs are only available for individuals who keep their savings below $2,000, a threshold that has not changed since 1984.

There are a lot of factors for your mother to consider in deciding whether to sell her home or to transfer it or some of the proceeds of its sale to you and your brother or into trust.

First, you are right. If the house is transferred to you and your brother and then you sell it, you will have to pay taxes on any capital gain. If your mother keeps the house and sells it herself, she can exclude the first $250,000 of gain from taxation. So, it probably does not make sense to transfer the house to you and your brother if the plan is to sell it.

Second, there are other possible drawbacks to such a transfer. The house or the proceeds of its sale would be subject to claim if either you or your brother were sued and potentially if you entered divorce proceedings. Further, your mother would lose some autonomy since she would be dependent on you for her home and possible access to her cash.

Third, such a transfer could make your mother ineligible for benefits for a period of time. To make things complicated, each program has its own rules, and sometimes the rules differ depending on the circumstances. For instance, some state Medicaid programs do not impose a transfer penalty as long as a beneficiary is living in the community but do if they move to a nursing home.

Fourth, a trust may make sense, but the typical trust used to protect homes must be irrevocable and it must bar distributions to the person creating it. So, if your mother transferred her home to a trust and then it was exchanged for a less expensive house, she would not have access to cash that would be generated. This is an argument for transferring the house or the excess proceeds directly to you and your brother to hold for your mother despite the drawbacks described above.

Finally, if your mother is disabled she may be eligible for one of two “safe harbor” trusts that permit her to shelter assets and still benefit from them. For one of these trusts, she must be under age 65. The other, a so-called (d)(4)(C) or “pooled disability” trusts, she may be eligible after age 65, but that depends on state options. As you can see, these issues are very complicated and the best plan depends on a mixture of your mother’s situation, the specific benefits she receives, and how various laws are applied in your state.

To determine the best approach it makes sense to consult with a local elder law attorney.

Harry S. Margolis practices elder law, estate and special needs planning at Margolis Bloom & D’Agostino in Boston and Wellesley, Mass., and is the founder of ElderLawAnswers.com. He is author of The Baby Boomers Guide to Trusts: Your All-Purpose Estate Planning Tool and answers consumer questions about estate planning issues at www.AskHarry.info.

Biden would lose in matchup vs. Trump, according to CNBC survey; Israel funding has strong support

U.S. President Joe Biden attends a meeting with Israeli Prime Minister Benjamin Netanyahu (not pictured), as he visits Israel amid the ongoing conflict between Israel and Hamas, in Tel Aviv, Israel, October 18, 2023.

Evelyn Hockstein | Reuters

The American public, in the wake of the Hamas terrorist attacks on Israel, believes the government should support Israelis over Palestinians and strongly back U.S. military funding for Israel. But a significant share want the U.S. to be evenhanded in the conflict.

The CNBC All-America Economic Survey also finds support for President Joe Biden at nearly all-time lows and that he would lose by 4 points to former President Donald Trump in a head-to-head race.

According to the survey, 39% of the public believe the U.S. government should favor Israelis over Palestinians in their conflict, compared with 34% after the 2014 Gaza war. Meanwhile 36% believe the U.S. should treat both the same, compared with 53% in 2014. Nineteen percent are undecided, up from 9% in 2014, suggesting the situation remains fluid and actions by either side could still move public opinion. (The prior results come from an NBC News survey in August 2014 conducted one month after the Gaza war.)

Meanwhile, 74% of the public believe it is either somewhat or very important for the U.S. government to fund military aid to Israel. That compares with 72% who say it’s important to fund securing the border with Mexico and foreign humanitarian aid. A smaller, but still solid 61% majority respond that it’s important to fund military aid to Ukraine compared with 52% who support military and economic aid to Taiwan.

The survey of 1,001 Americans across the country was conducted Oct. 11-15 and has a margin of error of +/-3.1%.

Falling Biden support

Meanwhile, a combination of negative views on the economy and geopolitical tensions looks to be eroding support for President Biden. Americans’ overall approval rating for the president fell to 37% with 58% disapproving. It’s the highest disapproval and second-lowest approval rating of Biden’s presidency.

Biden’s 32% approval rating on the economy is the lowest of his presidency, while the 63% economic disapproval rating is the second lowest.

Even while Biden moved quickly to publicly support Israel and provide additional aid, the public is giving the president poor marks for this handling of foreign policy. Just 31% approve and 60% disapprove.

A part of Biden’s problem looks to come from within his own party. Just 66% of Democrats support his handling of foreign policy and 74% back his handling of the economy, compared with 81% overall approval by Democrats.

“You don’t get sub 40 approval ratings without losing large chunks of your base. And that’s what’s happening here,” said Micah Roberts, partner at Public Opinion Strategies, the Republican pollster for the survey. He called the data “distressing numbers for a president facing reelection.”

Jay Campbell, partner at Hart Research Associates, the Democratic pollster for the survey, said the numbers among young people, Black people and Latinos “are very troubling” for Biden. They have been among the hardest hit economically and “you start to think that maybe they’ve run out of patience, and it’s starting to show through in their decreasing regard for the president,” Campbell said.

Losing by 4 points to Trump

About the only “bright” spot for the president is that Trump bests him by just 4 percentage points in a head-to-head match up, 46-42 with 12% undecided. Both pollsters said that, given Biden’s poor numbers, Trump’s lead would likely be larger if not for widespread reservations about the former president himself. Yet, some of the data in the poll suggests that both independents and undecided voters would break for Trump.

The survey finds the support for Israelis over Palestinians is driven by Republicans, with 57% saying the government should favor Israelis, compared with just 29% of Democrats and 27% of independents. By contrast, 44% of Democrats and 47% of independents want the government to treat both sides the same.

Comparing the polls in 2014 and today shows that Americans 35 and older are more likely now than in 2014 to say the U.S. should favor Israelis with substantial growth in support from seniors. Among 18- to 34-year-olds, 46% say both should be treated the same, the most of any age group, and 11% say the U.S. government should favor Palestinians, up from 2% in 2014.

“There’s a real generational split on this question,” Campbell said. “Younger Democrats have increased their sympathies on both sides of the ledger to a certain degree, whereas Democrats over age 50 are really much more in support of Israel than Palestinians at this point in time.”

When it comes to what is important for the government to fund, Republicans and independents give the most support to securing the border with Mexico followed by military funding for Israel. Democrats prioritize military funding for Ukraine, followed by foreign humanitarian aid.

Click here for the full survey

Don’t miss these CNBC PRO stories:

Correction: Biden’s 63% economic disapproval rating is the second lowest. An earlier version mischaracterized the figure.

Binance users in Hong Kong lose $450K in wave of fraud texts: HK police

Hong Kong’s police force has raised the alarm after 11 Hong Kong-based Binance customers were targeted in a wave of phishing scams sent through text messages.

Hong Kong police warned users of the scam in an Oct. 9 post to its Facebook page dubbed “CyberDefender.”

“Recently, fraudsters posing as Binance sent text messages claiming that users must click the link in the message to verify their identity details before a deadline, otherwise their account would be deactivated.”

Beware of scammers. Stay #SAFU! pic.twitter.com/XZMDMKkBJf

— CZ Binance (@cz_binance) October 9, 2023

Police said that once users clicked the link and supposedly “verified” their personal details, hackers were then able to gain full access to their Binance accounts, where they proceeded to steal all of the assets contained within the users’ wallets.

According to the post, the phishing scheme has seen 11 Hong Kong-based Binance customers report combined losses of more than $446,000 (3.5 million Hong Kong dollars) in the last two weeks.

The police have asked any users who believe that they’ve received a potentially fraudulent message to log the suspicious messages on the “fraud prevention” section of its official website.

Additionally, the police displayed a link to a newly published list of verified virtual asset trading platforms, provided by the Hong Kong Securities and Futures Commission (SFC).

Currently, only two cryptocurrency exchanges — HashKey and OSL — are fully licensed for retail investment purposes in Hong Kong.

Related: Hong Kong police, regulator form crypto task force as JPEX saga unfolds

Established in May, CyberDefender is a project launched by the Cyber Security and Technology Crime Bureau of the Hong Kong Police Force, aimed at increasing local citizen’s awareness of online security risks.

Hong Kong police unveil ‘CyberDefender’ metaverse platform to combat rising digital crimes. https://t.co/xyqa0iWQxf

— Cointelegraph (@Cointelegraph) May 28, 2023

Meanwhile, Hong Kong crypto investors have been hit hard by scams and fraudulent activity in recent weeks, with the recent JPEX crypto exchange scandal ballooning to an estimated $180 million in losses and more than 2,300 Hong Kong-based investors filing complaints with local police.

JPEX was an unlicensed cryptocurrency exchange that allegedly lured in Hong Kong residents with flashy advertising and “suspiciously” high returns on its lending products. The exchange ratcheted up fees on withdrawals from its platform on Sept. 15, rendering funds inaccessible to its users.

Following the scandal, which has been described as the largest financial fraud ever to hit Hong Kong, the SFC announced that it would publish a list of both fully licensed and “suspicious” crypto platforms in a bid to combat potential fraud.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis

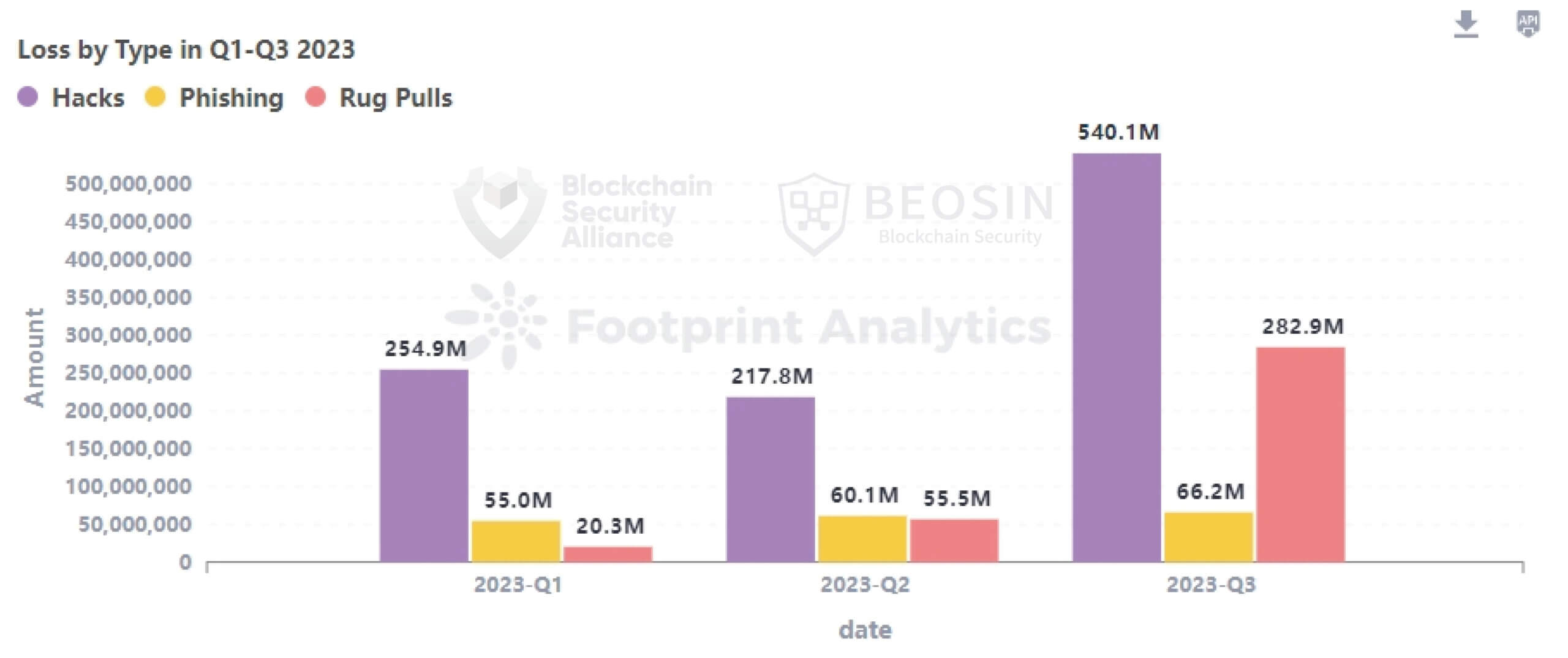

Crypto projects lost nearly $889 million to hacks, phishing scams, and rug pulls during the third quarter, blockchain security firm Beosin revealed in its Global Web3 Security Report.

According to the report, crypto investors lost $282.96 million to rug pulls across 81 incidents, while phishing schemes generated $66.15 million in ill-gotten gains during the same quarter.

The biggest hit came from hacks where 43 crypto projects suffered security breaches that led to the loss of $540.16 million. During the period, CryptoSlate reported notable hacks of different crypto projects, including the $200 million hack of Mixin Network, the $73 million exploit of Curve Finance, and the $8 million HTX lost to a hot wallet compromise.

This marks a significant upsurge compared to the cumulative losses of the first half of the year, totaling $330 million during the first quarter and a slight increase to $333 million by the year’s second quarter.

The report was published in collaboration with other members of the blockchain alliance, including Footprint Analytics and SUSS NiFT.

Malicious players keep targeting DeFi projects.

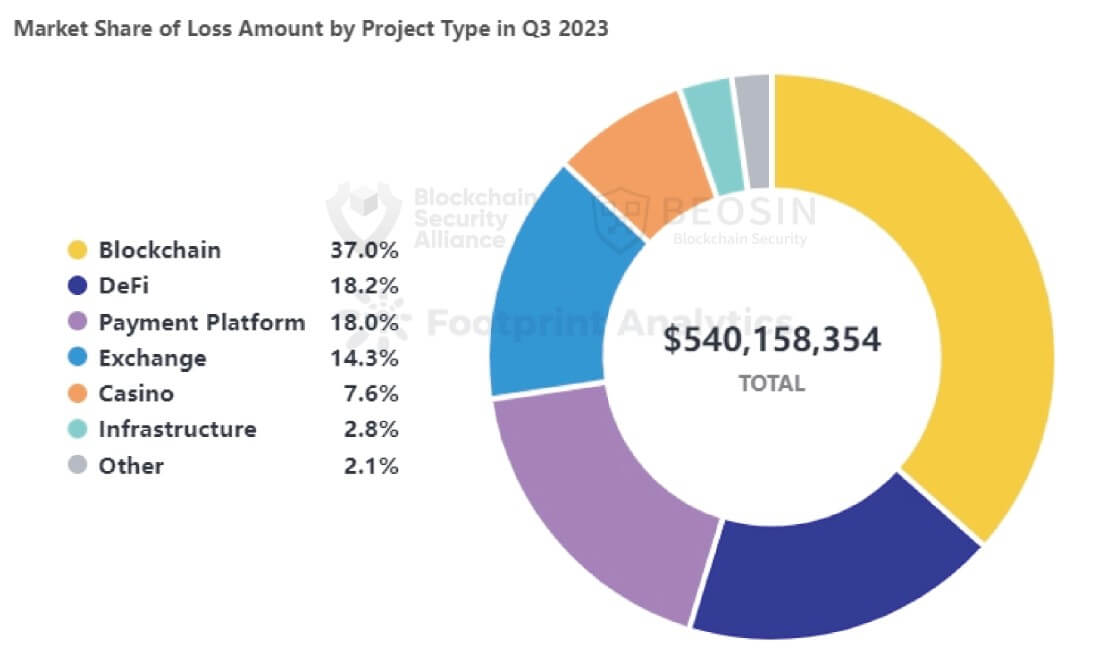

Beosin revealed that decentralized finance (DeFi) projects suffered the most hacks during the period, with around 67% of the breaches targeting platforms in the sector. However, it’s essential to note that other sectors, such as blockchains, payment platforms, exchanges, casinos, and infrastructure, also suffered hacking incidents during the period.

Despite malicious players’ penchant for targeting DeFi projects, public blockchains recorded the highest monetary loss because of the $200 million breach of Mixin Network. This single breach accounts for 37% of the total losses for the quarter and is the most significant crypto loss of this year.

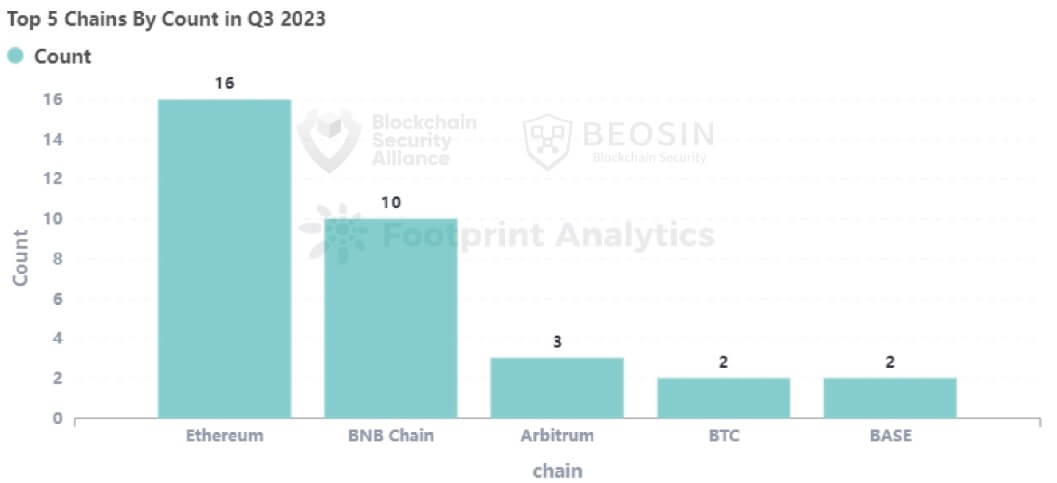

Meanwhile, Beosin wrote that the Ethereum blockchain suffered the most losses and incidents during the period. It said:

“Ranked by number of attacks, the top 5 chains with the most security incidents were: Ethereum (16 times), BNB Chain (10 times), Arbitrum (3 times), BTC (2 times), and Base (2 times).”

Most exploits were preventable

Interestingly, nearly half of the attacked projects (46.5%) had not undergone any security audits. Beosin added that 14 (63.6%) of the 22 projects attacked due to contract vulnerabilities had never been audited.

This highlights that many of these exploits could have been prevented had projects taken the necessary precautions to conduct audits and address vulnerabilities.

Regrettably, only 10% of the stolen funds were successfully recovered, leaving a substantial sum of approximately $800 million unaccounted for, underscoring the challenges of retrieving stolen crypto assets.

Miami Mayor Denis Suarez, who’s running for president of the United States, took a shot at his Republican counterpart in the presidential race, Florida Governor Ron DeSantis.

Emphasizing his own support for crypto, Suarez said about DeSantis: “You gotta go beyond just saying that the central bank digital currencies are bad. Everybody agrees on that. That’s a very easy position.”

That incident tells a lot about the role crypto could have in the upcoming presidential race, but it says even more about DeSantis, who, until recently, was the most prominent “crypto candidate” in the field.

Now the politician faces harsh competition from other, vocally pro-crypto candidates, and his chances to become president or even win the Republican primaries are rapidly declining.

How DeSantis became a crypto darling

The Florida governor has been vocally supporting crypto since as early as 2021, when he proposed to allow businesses to pay state fees with cryptocurrencies in the 2022–2023 budgetary year.

Even then, he had to compete with Suarez, who has been accepting his paychecks entirely in Bitcoin (BTC), while Miami under his mayorship became home to the “largest-ever” Bitcoin event and even got its own digital currency. In 2023, DeSantis began talking about crypto more often and his presidential ambitions. This March, he even dedicated a press conference to the potential project of an American central bank digital currency (CBDC).

Standing at a podium bearing the phrase “Big Brother’s Digital Dollar,” the politician urged Florida lawmakers and their “like-minded” counterparts to preventively prohibit the introduction of the digital dollar in their states. A CBDC is all about surveilling Americans and controlling their behavior, DeSantis added.

No CBDC in Florida https://t.co/p9pwSTmrlN

— Ron DeSantis (@GovRonDeSantis) March 20, 2023

Later, he continued to criticize the CBDC and its potential issuer, the United States Federal Reserve, on Twitter (now called X).

In May, DeSantis signed a bill restricting the use of CBDCs, including foreign ones, in the state. Once again, he emphasized the difference between CBDCs and private digital currencies: “I think they want to crowd out and eliminate other types of digital assets like cryptocurrency because they can’t control that, so they don’t like that.”

Later, DeSantis promised to lobby for the same prohibition if he becomes the president of the United States.

DeSantis vowed not only to ban CBDCs forever but to end President Joe Biden’s “war on Bitcoin and cryptocurrency” should he succeed him in the White House. However, he didn’t refer to any specific policies of the Biden administration, preferring to concentrate his attention on the Federal Reserve.

Recent: Making real-world blockchain solutions possible — Solana co-founder Raj Gokal

Back in May, when the list of candidates for the presidency was much shorter, DeSantis seemed to many to be the logical choice for Republicans in general and the crypto community in particular.

Of course, he wasn’t the perfect candidate for every innovation enthusiast, given his disdain for progressive social policies.

DeSantis gained fame as a fighter against sanctuary cities, LGBTQ+ rights, gun control and the Affordable Care Act. But for a while, those could have been seen at least as a realistic compromise, signifying the partisan divide over crypto.

However, in the last few months, everything has changed.

Presidential candidacy unravels

Epithets about DeSantis, like “circling the drain” and “falling apart,” started to appear in the media in the middle of July. By the end of last month, his campaign had to cut almost a third of its staff to stay afloat.

DeSantis still remains the second Republican candidate after former President Donald Trump, according to polls. However, if at the beginning of July he was a clear second choice for 35% of Republican voters, by the middle of August, this rating plummeted to 23%.

The pundits agree DeSantis failed at his strategy of becoming a “Trump-not-Trump” candidate, engaging aggressively in the same cultural wars but with a promise of electability in the midst of criminal investigations of the former president’s alleged behavior.

As it soon became clear, DeSantis failed to attract the loyal base of Trump’s conservative voters, who still believe in their candidate, while at the same time scaring away more moderate Republicans, who hope to cast their votes for someone not obsessed with a struggle for schools’ curricula.

DeSantis engaged in a feud with Trump, claiming that the latter failed to fulfill his presidential promises during his term, even with regard to building his notorious wall with Mexico. In response, Trump called his fellow Republican “Rondesanctimonious” and advised him to get a “personality transplant.”

“When he tries to be as visceral as Trump, he just comes off as weird,” sums up David Bateman, a political scientist at Cornell.

Alternative candidates

The good news is that even if DeSantis fails, he’s not the only pro-crypto candidate.

The Democrats have Robert Kennedy Jr., who publicly confessed to buying 2 BTC for each of his children. He also announced that he would begin accepting campaign donations in Bitcoin and make the currency exempt from capital gains taxes if elected president.

Kennedy even promised to back the U.S. dollar with Bitcoin in the event of his victory. But for all that, in late July, just 9% of Democrats had a favorable opinion of Kennedy, with words like “crazy,” “dangerous,” “insane,” “nutjob,” “conspiracy” and “crackpot” among the most popular to describe the candidate.

Perhaps still far from the obvious favorite, the youngest-ever Republican presidential candidate, Vivek Ramaswamy, managed to raise the level of favorable opinions about him from 16% in April to 27.2% in August and stands third in the polls after Trump and DeSantis.

The candidate, called “very promising” by entrepreneur Elon Musk, pushed for a stronger crypto industry in the U.S. and also accepts BTC for campaign donations, even offering nonfungible tokens (NFTs) to qualifying donors.

One obvious problem is that Ramaswamy demonstrates no less eccentricity than Kennedy, comparing Massachusetts Representative Ayanna Pressley to the Ku Klux Klan’s grand wizard (Pressley is Black) and rapping Eminem’s songs at events. The rapper has since asked Ramaswamy to stop.

“Speaking about Governor DeSantis, I think it will be surprising to some that, by some polling, he may have been the winner or a winner of a recent debate,” Martin Dobelle, co-founder and CEO of Engage — a platform for crypto donations to political campaigns — told Cointelegraph.

Indeed, according to polls conducted in the aftermath of the Republican candidates’ first debate, 29% of debate viewers considered DeSantis to be the best performer of the evening.

However, 26% of respondents named Ramaswamy as the champion of the debate. It should be noted that Donald Trump was absent from the debate.

Nevertheless, Dobelle doesn’t think that one person should be considered a “crypto candidate,” nor should a single party be named the pro-crypto party.

“Dragging financial technology into this polarized political climate is not going to be a constructive strategy,” he said. “Rather than putting its chips behind one candidate, party or another, crypto should be building bridges and meeting people where they are in terms of where and how to start conversations about policy.”

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

Dave Weisberger, CEO of algorithmic trading platform CoinRoutes, believes that it’s not just candidates who can influence crypto regulation. He told Cointelegraph, “Even with the current Biden administration’s open hostility towards digital assets, they might change policy if the pollsters tell them to do so.”

Perhaps the major intrigue that remains is Donald Trump’s crypto card for 2024. A vocal Bitcoin critic during his presidential term, the politician was recently revealed to possess over $2.8 million in an Ethereum wallet, in addition to over $4.8 million from licensing fees tied to NFT collections using his image.

How can I give $600K to my kids and ensure they don’t lose it if they divorce?

Dear Quentin,

My three siblings and I inherited a house on a beautiful island from our parents that is worth about $2 million. It is mostly used in the summer. I’m 72, I live abroad, and I don’t get there much. I find the maintenance costs and the joint decision making burdensome, as lovely as the place is. My two children, 41 and 35, are not keen to inherit this property, which could end up being split far too many ways. So I am negotiating with my siblings to buy me out. It would leave me with an inheritance of around $667,000.

I don’t need the money. I have a good pension and my own property, so I would like to use these proceeds to set my children on the property ladder, in effect transmitting to them a portion of their future inheritance when they most need it. They are both renters but are keen to buy, and they are both married or partnered.

My question is how to protect myself and them. If my spouse dies before me, I would want to move back to the U.S., near one child or the other, and this might require a top-up of capital — or else my children might have to provide me with a spare room or two. In addition, I would like to ensure that they could keep this gift for themselves in the event of divorce, without my being too obvious and nasty about it. Is there a co-purchase scenario — or two, since I want to treat them equally — that would make sense?

The Father

Related: Trusts are useful for almost everything in estate planning

Dear Father,

If there is a 50/50 chance that you will return to the U.S., think twice before giving all $667,000 away to your children. Once you’ve given it away, it’s gone for good.

First, the financials. The current estate-tax exemption — the amount of money on which you won’t owe federal estate tax when you die — is now $12.9 million for individuals, up from $12.06 million in 2022. That exemption is $25.84 million for couples, up from $24.12 million the previous year. However, those rates will sunset at the end of 2025. Without congressional action, those exemptions will return to where they were before the 2018 Tax Cuts and Jobs Act, meaning they will be reduced by about half.

An inheritance received by one person in a marriage is generally considered separate property, as is real estate owned by one spouse prior to a marriage. But that can change. Here’s Scenario No. 1: You make a gift of money to your unmarried child, who buys a home before getting married, but your child’s partner contributes to a renovation of the property, thus turning it from separate property into community property. And Scenario No. 2: You give money to your married child, who decides to put it in a joint bank account, thereby making it a shared asset.

You could, as you suggest, purchase property with your children. There are several kinds of co-ownership agreements. Joint tenancy with the right of survivorship means that if one person died, the other owner or owners would inherit their share and the property would not go through probate. With tenants in common, on the other hand, if one of your children died before you, their share would go through probate and be distributed among their heirs. Such decisions should be made with the assistance of a good estate-planning lawyer.

There are measures you can take to keep this money in the sole hands of your children, but there is only so much you can do once you hand it over. Setting up a revocable trust for your children would allow you to dictate how the money is spent and who can access it, and would also keep it out of reach of their respective partners — should that be their wish, too. An irrevocable trust, used if your estate exceeds the lifetime exemption, is more often used by the ultrawealthy (exhibit A: the British royal family) and, from what you say, that does not apply to you.

Remember to review your last will and testament and the rules of any family trusts every five years. There may come a time where you grow close to your children’s partners and wish to include them in your will, when you want to set up trusts for their children. Fair warning: Management of such trusts does not usually come cheap.

Ultimately, there is only so much control you can have over your children — and the money you give them. If you want more control, keep all or a portion of it. And never give away your entire kingdom.

“Ultimately, there is only so much control you can have over your children — and the money you give them,” the Moneyist writes.

MarketWatch illustration

Readers write to me with all sorts of dilemmas.

By emailing your questions, you agree to have them published anonymously on MarketWatch. By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

The Moneyist regrets he cannot reply to questions individually.

More from Quentin Fottrell:

I gave my daughter $5,000 for her divorce, but she lashed out when I refused to give her more. When will enough be enough?

‘He wanted nothing to do with me’: I discovered my biological father through Ancestry.com. Am I entitled to a share of his estate?

‘I grew up dirt-poor’: I am 43 and have $2.5 million in stocks and an IRA. Can I retire early?