The past week has not been favorable for the majority of cryptocurrency assets, with only four specific digital currencies recording gains. This week, ONDO appreciated by 13.2%, TON increased by 11.3%, PENDLE grew by 6%, and LEO saw a slight uptick of 0.5%. Market Update: A Tough Week for Crypto With Few Standouts The landscape […]

The past week has not been favorable for the majority of cryptocurrency assets, with only four specific digital currencies recording gains. This week, ONDO appreciated by 13.2%, TON increased by 11.3%, PENDLE grew by 6%, and LEO saw a slight uptick of 0.5%. Market Update: A Tough Week for Crypto With Few Standouts The landscape […]

Source link

lows

Treasury yields end at roughly three-week lows after new U.S. economic data

U.S. government debt rallied on Friday after a mixed batch of U.S. economic data, giving 2- and 10-year yields their biggest weekly declines in at least a month.

What happened

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

fell 11.3 basis points to 4.531%, from 4.644% on Thursday. The yield declined 15.6 basis points for the week, the biggest weekly decline since the period that ended Jan. 12. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

dropped 7.1 basis points to 4.180%, from 4.251% on Thursday. It finished 7.8 basis points lower for the week, the biggest weekly decline since the period that ended Feb. 2. - Friday’s levels were the lowest for the 2- and 10-year yields since Feb. 12, based on 3 p.m. Eastern time figures from Dow Jones Market Data.

-

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

fell 4.9 basis points to 4.326%, from 4.375% on Thursday. Friday’s level was the lowest since Feb. 7. The yield declined 5.3 basis points this week.

What drove markets

Friday’s U.S. economic-data releases brought a pair of mixed reports on manufacturing.

The Institute for Supply Management’s manufacturing index showed that activity contracted in February for a 16th straight month. But the final reading of S&P Global’s manufacturing purchasing managers’ index inched up to 52.2 in February versus an initial reading of 51.5, signaling a quicker pace of improvement in that sector.

Separately, consumer sentiment moved sideways in February, slipping from levels seen in January but holding on to gains from over the past three months, according to the University of Michigan. And construction spending fell in January for the first time since December 2022.

Treasury yields had ended February with their biggest monthly gains since 2023, following a series of data that pointed to continued persistent inflation. On Thursday, the Fed’s preferred inflation measure, the PCE price index, was in line with expectations for January, but still hot.

Read: ‘The Fed will not cut rates this year,’ says Wall Street economist

Fool.com contributor Parkev Tatevosian evaluates Lucid (LCID 27.17%) and its prospects to determine if long-term investors should buy the stock today.

*Stock prices used were the afternoon prices of Jan. 26, 2024. The video was published on Jan. 28, 2024.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

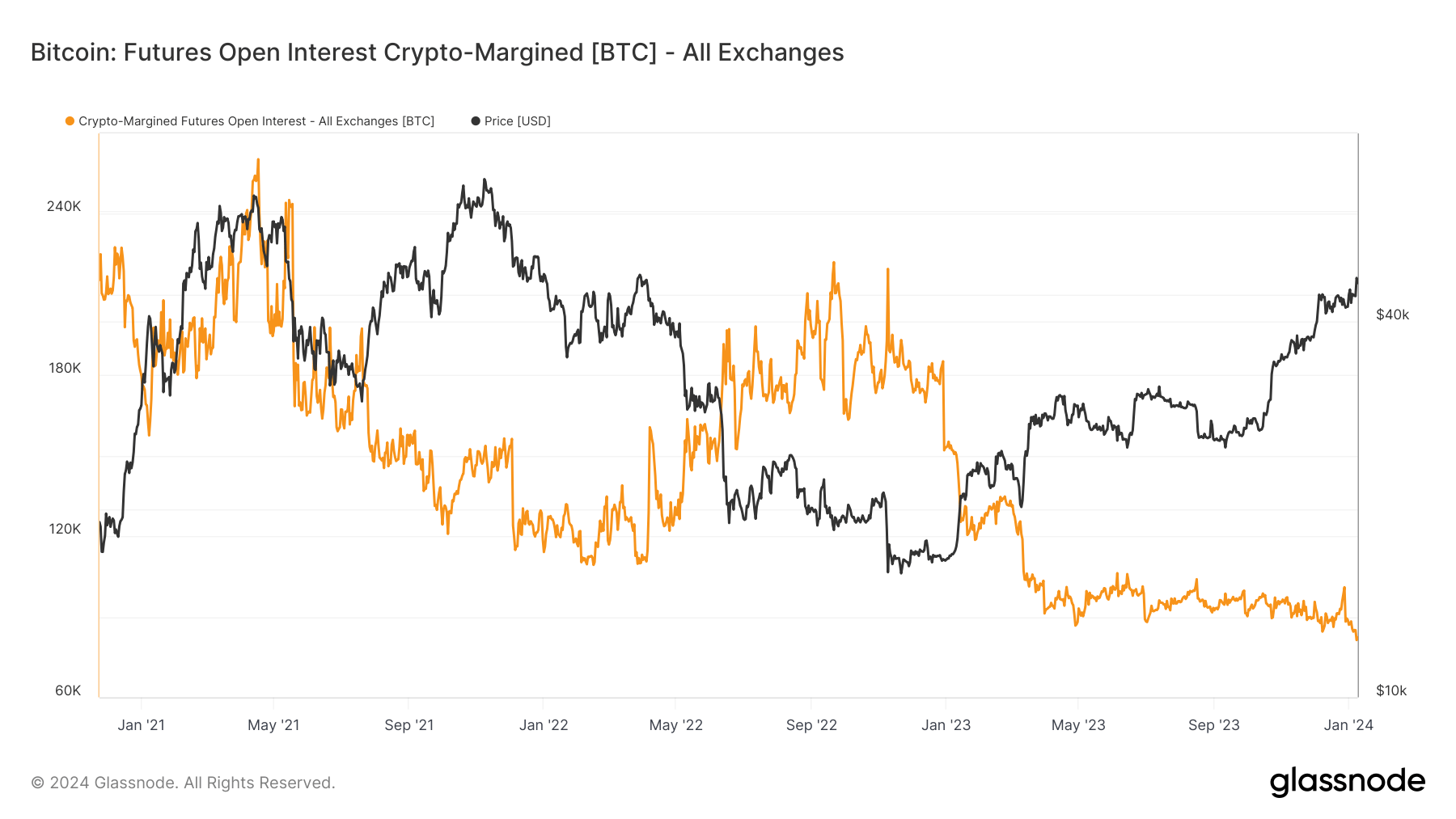

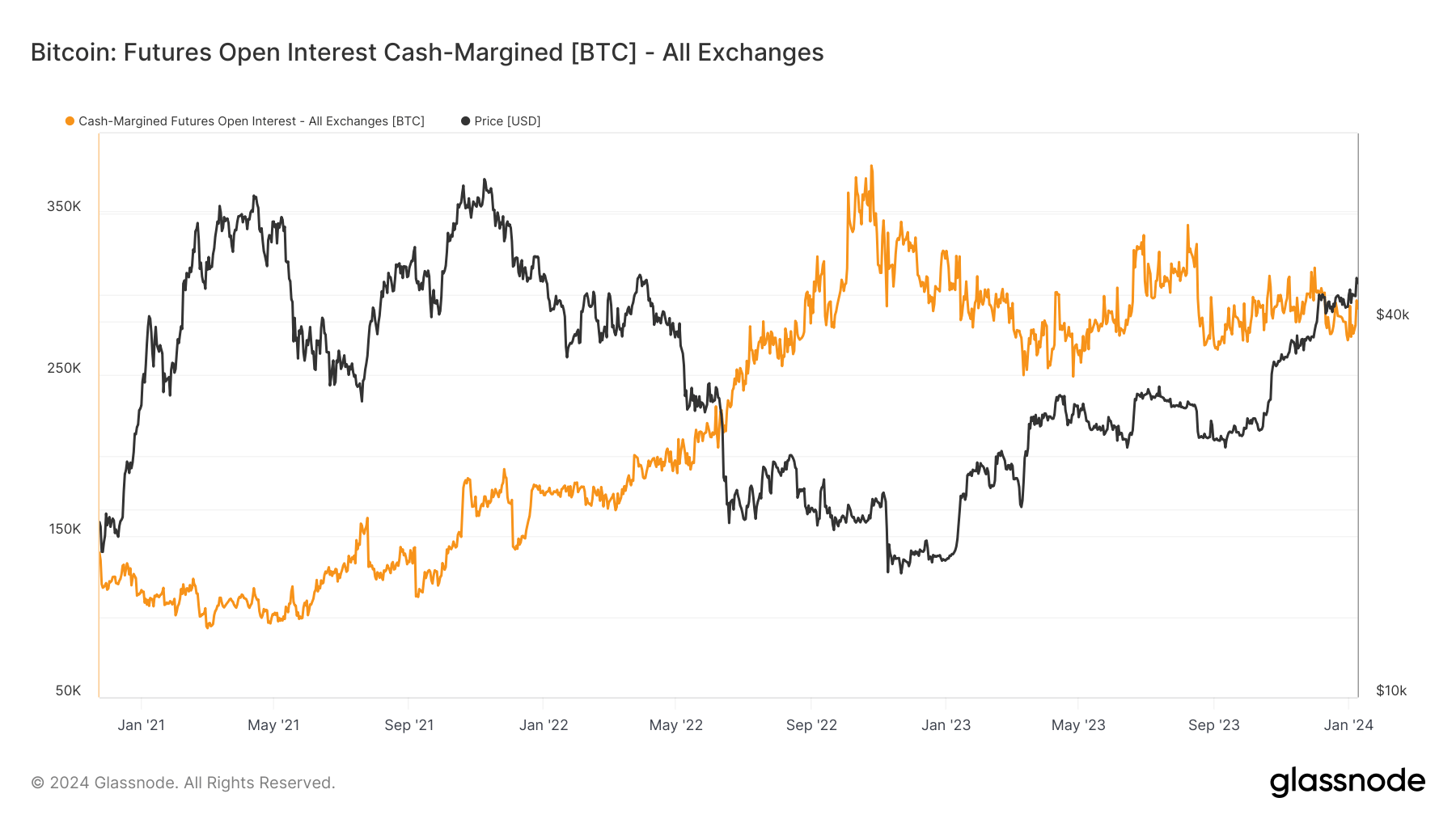

Bitcoin futures margined in BTC hit historic lows as cash options prevail

Quick Take

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX’s holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin’s shift from volatile futures to more stable cash margins could signal reduced market volatility.

The post Bitcoin futures margined in BTC hit historic lows as cash options prevail appeared first on CryptoSlate.

Dr. Martens shares plunge to all-time lows as shoemaker cuts guidance on weak U.S. sales

Shares in Dr. Martens PLC plunged to all-time lows on Thursday after the British shoemaker cut its guidance and reported a 57% drop in its first-half profits following a sharp slowdown in its U.S. business driven by caution around the state of the American economy.

The FTSE 250 shoe seller, which is best known for its iconic AirWair boots, reported a 5% drop in firm-wide revenue to £395.8 million, following a 22% drop in sales to U.S. wholesalers due to “widespread macro-economic caution.”

Shares in Dr. Martens

DOCS,

fell 23% on Thursday with stock in the company having lost 56% of its value over the past year and 88% of its value since its initial public offering in January 2021.

The Northamptonshire shoemaker said sales to its wholesale customers worldwide – which account for half of its total revenues – fell 17% year-on-year, to £199.4 million, primarily due to the 22% drop in its U.S. wholesale division.

The drop in wholesale revenues offset slightly higher sales across its retail and e-commerce divisions, which were bolstered by increased revenues from Dr. Martens’ European/Middle Eastern and Asia-Pacific businesses, even as U.S. sales across both its retail and e-commerce arms fell.

The higher EMEA and APAC sales saw revenues from Dr. Martens’ retail business increase 15%, to £104.7 million, and sales from the shoemaker’s e-commerce segment increased 3%, to £91.7 million.

These increases, however, failed to offset the plunge in Dr. Martens’ U.S. business, as sales from the company’s Americas arm plunged 18%, to £147.7 million.

Looking ahead, Dr. Martens warned it now expects “that it will take longer to see a material improvement in USA performance than initially anticipated,” despite encouraging signs of an uptick in consumer spending over the Black Friday weekend.

The British firm, in turn, withdrew its guidance for the financial year 2025, as it also warned that it now expects firm-wide revenues to “decline by high single-digit percentage year-on-year” in 2024, leading to earnings “moderately below the bottom end of the range of consensus expectations,” where the sellside consensus was for EBITDA between £223.7 million and £240 million.

In July, Sky News reported activist investor Sparta Capital, which was started by former Elliott fund manager Franck Tuil, had started building a stake in Dr. Martens.

2 Magnificent Dividend Stocks Trading Near 52-Week Lows to Buy Now and Hold at Least a Decade

Shares of Johnson & Johnson (JNJ -0.30%), Altria Group (MO -0.10%), and stocks in general recently received a boost from the Federal Reserve, which appears unmotivated to raise interest rates in the near term. Despite the recent lift, these magnificent dividend stocks are still way down over the past year

At their beaten-down prices, these stocks offer above-average yields and that isn’t all they have in common. Both of these high-yield stocks are underpinned by excellent businesses that appear poised to steadily deliver a growing portion of their profits to patient investors.

Image source: Getty Images.

Here’s why you could regret not taking advantage of their beaten-down prices.

Johnson & Johnson

If you’re like most Americans, you know a few people who’ve had a knee replacement, but you probably don’t realize how many of those new knees were sold by DePuy Synthes, a Johnson & Johnson subsidiary. The company recently reported that medical technology sales that rose 10% year over year to $7.5 billion in the third quarter.

Once a hospital trains its surgeons to use a Johnson & Johnson product, retraining them to use a competitor’s is a huge expense that administrators would rather avoid. In addition to switching costs that benefit its medtech segment, Johnson & Johnson’s pharmaceutical segment gets all kinds of pricing power from patent-protected market exclusivity. For example, sales of Darzalex, a multiple myeloma treatment that first earned approval from the U.S. Food and Drug Administration (FDA) in 2015, are on pace to reach $10 billion this year.

At recent prices, shares of J&J offer a 3.1% yield, which is much better than wht most dividend payers offer. The average dividend-paying stock in the Dow Jones Industrial Average offers a yield of just 2.1% at the moment.

Earlier this year, Johnson & Johnson spun its consumer-goods segment off into a new company named Kenvue. Now that it’s focused on medical technology and pharmaceuticals, faster-than-usual growth could follow. Management expects more than $10 per share in adjusted earnings this year, but its dividend payout is set at just $4.76 per share annually.

With plenty of wiggle room to make payout increases in the near term and advantages that could help earnings grow all the way through the decade ahead, this stock is a screaming buy.

Altria Group

If you aren’t concerned about your portfolio’s ESG rating, consider Altria Group (MO -0.10%). Shares of the company that markets Marlboro brand cigarettes in the U.S. offer a huge 9.6% dividend yield at recent prices.

Huge dividend yields usually mean there’s concern about the underlying business’s ability to grow earnings. Steadily declining cigarette sales are why investors are nervous about Altria Group, but they probably shouldn’t be. The company has raised its dividend payout 58 times over the past 54 years.

I’ve listened to investors complain about smoking’s declining popularity for decades, but this complaint ignores how easy it is to raise prices on packs of Marlboros. In the third quarter, Altria estimates that domestic cigarette industry volume decreased by 8% year over year. But Altria reported third-quarter revenue net of excise taxes that decreased just 2.5% year over year, thanks to price increases and rising sales of non-combustible products.

Marketing regulations make it impossible to develop new cigarette brands, so we can reasonably expect price increases to offset declining volume for at least another decade. Altria is also taking steps to ensure customers who give up combustible cigarettes keep using its nicotine-delivery products. In June, Altria completed a $2.75 billion acquisition of NJOY Holdings, which is the only company with FDA authorization to market a line of pod-based e-vapor products.

Declining cigarette volumes didn’t stop Altria Group from more than doubling its dividend payout over the past decade. Despite the rapid raises, it needed less than 80% of the free cash flow it generated over the past year to meet its dividend commitment. Buying some shares now to hold for at least 10 years looks like the right move.

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends Johnson & Johnson and Kenvue. The Motley Fool has a disclosure policy.

2 Exceptional Dividend Stocks Near 52-Week Lows. Are They Bargains Now?

This hasn’t been a sensational year for the dividend stocks already in investors’ portfolios, but you could hardly pick a better time to be a buyer. The risk-free returns institutional investors can receive from long-term Treasuries have risen to levels we haven’t seen since before the global financial crisis kicked off about 15 years ago.

The ongoing flight to safety has reduced demand for reliable, dividend-paying stocks to a lower level than many investors can remember. While higher interest rates are wreaking havoc on stock prices, they won’t unravel the competitive advantages that allow these companies to consistently outperform.

Image source: Getty Images.

In addition to the general lack of demand for dividend payers, both of these companies have issues of their own that have driven their stock prices down near 52-week lows. Let’s take a closer look to see if they’re bargains with a good chance to deliver heaps of passive income or just cheap.

Johnson & Johnson

Johnson & Johnson (JNJ -0.11%) has raised its dividend payout for 61 consecutive years, but a wonderfully reliable track record hasn’t stopped its stock price from falling in 2023. At recent prices, shares of J&J have slid about 12% from a peak they set in July and offer a 3.1% yield.

Over the past 10 years, J&J has been able to raise its dividend payout by 80% thanks mostly to growing contributions from its medical technology and biopharmaceutical businesses. Earlier this year, the company spun off its consumer-health business into a new outfit named Kenvue.

J&J’s remaining operating segments are still diverse enough to stave off nearly any disruption. For example, its medtech segment sells a lot of replacement knees and robot-assisted systems that help surgeons install them. While COVID-related lockdowns were keeping patients out of surgical centers, J&J’s pharma segment filled in the gap with blockbuster sales of its COVID-19 vaccine.

J&J’s vaccine sales fell off a cliff this year, but its medtech segment has come roaring back. Now that the company can focus on medtech and pharmaceuticals, dividend growth could accelerate in the years ahead.

At recent prices, the stock trades for 11.3 times trailing-12-month earnings. That’s a bargain price for a dividend grower you can rely on.

British American Tobacco

Other than being near 52-week lows, British American Tobacco (BTI -0.23%) and J&J don’t have much in common. While healthcare needs keep rising, demand for cigarettes is declining steadily.

This tobacco giant’s stock is trading at an incredibly low valuation of just 6.4 times trailing-12-month earnings because cigarette sales are falling even faster than anticipated. In the first half of 2023, cigarette volumes fell 5.7% year over year.

With help from price hikes, British American Tobacco reported total combustible-product sales that rose 0.2% year over year at constant currency. Sales of the company’s non-combustible products rose 15.3% year over year, but this segment is responsible for less than one-fifth of total revenue.

Declining cigarette volumes are disappointing, but this company has enduring pricing power that can continue to make up the difference. British American Tobacco owns popular brands, like Newport, American Spirit, and Camel, the youngest of which is already over 40 years old. Heavy advertising restrictions that went into effect after these brands established themselves make it impossible for upstarts to build new brands that can compete.

British American Tobacco’s payout has risen 18.2% since it began issuing a quarterly dividend in 2018. It probably won’t be the fastest-growing dividend in your portfolio, but there’s a good chance the 9.4% yield it offers at recent prices can keep moving in a positive direction. Put it together and this stock looks like a bargain now that’s hard to pass up.

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Johnson & Johnson and recommends the following options: long January 2024 $40 calls on British American Tobacco P.l.c. and short January 2024 $40 puts on British American Tobacco P.l.c. The Motley Fool has a disclosure policy.

Venture funding for crypto hits lows last seen in 2020 due to SBF trial fallout

Global venture capital (VC) investments in the cryptocurrency sector are down 63% during the third quarter, marking the lowest level of funding since 2020, Bloomberg News reported, citing PitchBook research.

A mere $2 billion was poured into the sector, contrasting sharply with the enthusiasm seen in previous industry peaks, based on data provided by PitchBook.

VC Retreat from Crypto Investments

The decline coincides with the ongoing legal tumult involving FTX co-founder Sam Bankman-Fried (SBF) and his alleged mismanagement of the cryptocurrency exchange, which received hundreds of millions in venture funding.

Once the driving force behind the meteoric rise of the crypto industry, venture capitalists are now retreating in the face of increasing scrutiny due to their association with the beleaguered FTX platform.

Robert Le, a seasoned analyst at PitchBook, said:

“We aren’t seeing the big deals anymore. That’s one of the drivers of the decline – deals are smaller.”

Le further delved into the predicaments now facing companies that once thrived during the crypto bull market, such as FTX, OpenSea, and Yuga Labs.

With VCs stepping back, these companies might have no choice but to cut costs, lay off employees, or, in dire circumstances, face acquisition at slashed valuations.

He added:

“If they’re not able to raise a round, even a down round, they’re either going to go out of business or get acquired at a valuation that’s much, much lower.”

While early-stage crypto companies still see some investment deals, many established tech investors have vacated the scene entirely. Adding complexity to the situation is the continued ripple effects of the FTX scandal.

FTX fallout on VCs

Prominent VCs, such as the renowned Sequoia Capital, once backed FTX with relatively substantial investments, which it had to write off when the exchange went under.

FTX and its trading division, Alameda Research, were prolific investors in their own right before legal challenges clouded their horizons. Their vast investment portfolio boasted industry heavyweights like Circle, Paxos, Aptos Labs, and Anchorage Digital.

As FTX and Alameda navigate bankruptcy proceedings, their equity stakes in various startups have become crucial lifelines. The buzz surrounding a prospective funding round for AI startup Anthropic, an FTX investment, offers a silver lining for FTX’s creditors, holding out the promise of recouping losses through potential equity sales.

However, the U.S. Department of Justice (DOJ) is opposing SBF’s attempt to present the current value of investments, like AI startup Anthropic, in court. Prosecutors argue this is irrelevant and could mislead the jury.

Meanwhile, the prospect of a broad liquidation sale looms large, which, if executed hastily, could further drive down the valuations of crypto startups. Le accentuated this concern, stating:

“Because FTX and Alameda have such a huge portfolio, it could further depress valuations in this space.”

The global crypto investment community now waits with bated breath, keeping a keen eye on developments surrounding the FTX saga and its possible ramifications on the sector’s future.

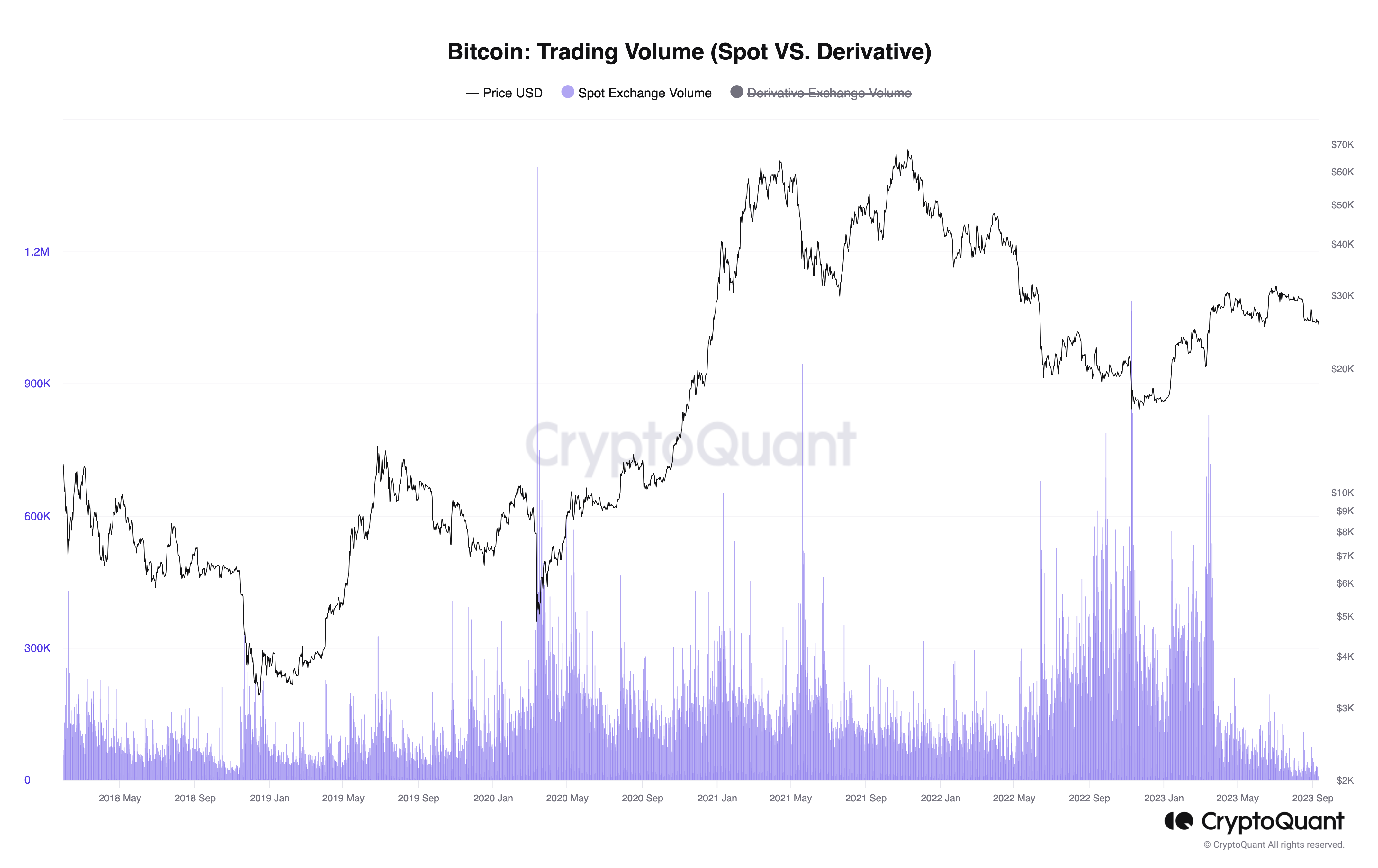

Bitcoin exchange volume tracks 5-year lows as Fed inspires BTC hodling

Bitcoin (BTC) exchanges have seen trading volume collapse as traders deal with constant macroeconomic uncertainty.

According to new research from on-chain analytics platform CryptoQuant published on Sept. 25, daily BTC volumes are at lows rarely seen since 2018.

Fed keeps Bitcoin investors wary of “possible recession”

Bitcoin price action has stayed in a familiar range for several months, and as time goes by, interest in transacting appears to be fading.

CryptoQuant data, which tracks activity on both spot and derivatives exchanges, highlights the extent to which volumes have decreased since BTC/USD entered its current range in March.

The past week saw between 8,000 and 15,000 daily spot exchange transactions — a fraction of the standard March daily tally, which exceeded 600,000.

For contributing analyst Caue Oliveira, a principal force behind the phenomenon is the macroeconomic climate.

“One of the main reasons cited is the growing fear regarding the macroeconomic scenario,” he wrote in part of the commentary accompanying the data.

“The actions of the United States Central Bank perpetuate a constant feeling of uncertainty, leaving investors waiting for a possible recession.”

Oliveira referenced current economic policy in the U.S., where the Federal Reserve has flitted between interest rate hikes and pauses in 2023 while keeping overall conditions tight.

Continuing, he noted that Bitcoin hodlers have chosen to keep hold of BTC capital as a result.

“Instead of seeking quick profits through short-term trading, more and more people are viewing bitcoin and other cryptocurrencies as a long-term investment,” he concluded.

“They are more interested in holding their coins, believing in their future value, than selling at the first sign of profit.”

Little food for BTC price bulls

As Cointelegraph reported, times have become tough for Bitcoin speculators in recent weeks.

Related: Bitcoin price fights for $26K as US dollar strength hits 10-month high

Short-term holders — entities holding BTC for 155 days at most — now hold almost their funds at an unrealized loss, with their cost basis higher than the current spot price.

In further research this week, fellow CryptoQuant contributor Yonsei_dent concluded that the cost basis of various Bitcoin newcomers would act as “strong resistance.”

“Excluding investors who have been holding for the long term since 1.5 years (12m) + HODLers, investors who entered the market over the past year are believed to have a stronger tendency to buy and sell in the short term,” he warned.

An accompanying chart showed unspent translation output (UTXO) numbers split by age band, forming resistance and support levels.

External interest in BTC exposure, meanwhile, also remains distinctly absent. Google Trends data shows the lowest interest in “Bitcoin” as a search term since October 2020.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

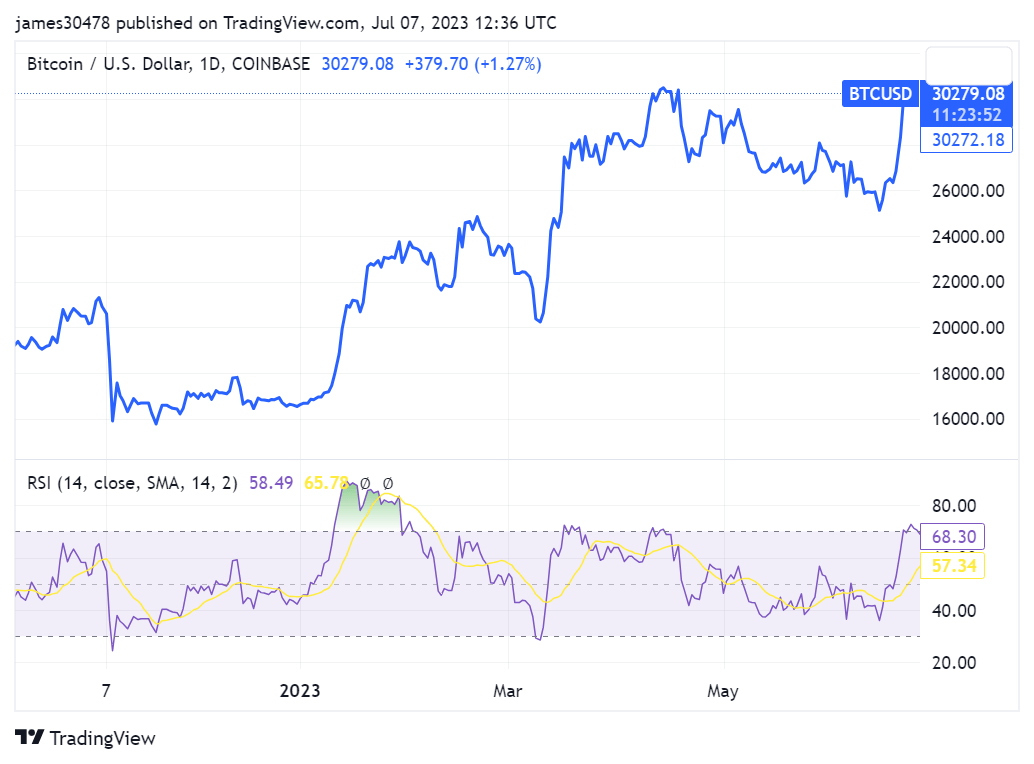

Quick Take

Data from Zerohedge on U.S. data

- June nonfarm payrolls 209K, Exp. 230K, Last 339K

- Unemployment rate 3.6 %, Exp. 3.6%, Last 3.7%

- Average hourly earnings 0.4%, Exp. 0.3%, Last 0.4%

- Average weekly hours all workers 34.4, Exp. 34.3, Last 34.3

- Bitcoin up 1.3%, $30,300

The post Unemployment rate stays at historic lows, Bitcoin jumps 1.5% appeared first on CryptoSlate.