“I have taken care of his first child from another marriage for 12 years.”

Source link

making

Many people are of the opinion that it’s perfectly fine to fall back on Social Security for retirement income. But that strategy could make your senior years a lot less enjoyable.

Social Security will only replace about 40% of your pre-retirement paycheck if you earn an average wage. And many seniors need a good 70% to 80% of their former income to live comfortably — hence the need for personal savings on top of those monthly benefits.

When it comes to saving for retirement, you have choices. Anyone with earned income is eligible to open and save in an IRA. But if your employer offers a 401(k) plan, you may be inclined to sign up and take advantage. If you’re going to do that, though, here are some steps you can take to help ensure that you’re making the most of that retirement plan.

Image source: Getty Images.

1. Snag your full employer match

Vanguard reports that 95% of its employer plans offer some type of matching incentive. If your 401(k) comes with a match, do your very best to snag it in full. Not only is that free money for your retirement, but it’s money you can invest at present to grow your balance further.

Let’s say you get $3,000 in employer matching dollars in your 401(k) this year. If your plan generates an average 8% yearly return over time, which is a bit below the stock market’s average return, that $3,000 will be worth over $44,000 in 35 years.

2. Aim to keep your fees low

One downside of saving for retirement in a 401(k) plan is that you’re generally limited to a bunch of different funds. IRAs, on the other hand, typically allow you to invest your savings in stocks. And that could be a far more cost-effective option.

Many of the funds you’ll commonly find in 401(k)s are notorious for charging costly fees — notably, mutual funds and target date funds. So if you’re going to invest your 401(k), consider going heavy on index funds. Because these funds are passively managed, they don’t tend to charge nearly the same fees (known as expense ratios) as their actively managed counterparts.

3. Consider a Roth

It’s not a given that your employer’s 401(k) will include a Roth savings feature. But if you do have access to a Roth 401(k), it could pay to forgo an up-front tax break on your contributions in exchange for the benefits involved.

Investment gains in a Roth 401(k) are yours to enjoy tax-free, whereas with a traditional 401(k), you’re paying taxes on gains eventually. So if you contribute $100,000 to a Roth 401(k) over time and your balance ends up being worth $500,000, you get to walk away with a $400,000 gain without the IRS getting a piece of it.

Plus, with a Roth 401(k), you set yourself up with tax-free withdrawals during retirement. That could ease a lot of the financial stress you might encounter once you shift into a lifestyle that has you living off savings, as opposed to earning money.

Also, don’t forget that as of this year, Roth 401(k)s no longer impose required minimum distributions. That gives you more say over how you manage your savings.

You don’t have to save for retirement in a 401(k), and that option may not even be on the table. But if it is, and you decide to sign up to your employer’s plan, make sure to claim your complete match every year. Choose your investments savvily to minimize your fees, and think seriously about putting your money in a Roth 401(k).

U.S. Money Supply Is Making History for the First Time Since the Great Depression, and It Implies a Big Move in Stocks Is on the Way

Over lengthy periods, it’s tough to outpace equities in the return column. Compared to gold, oil, housing, and Treasury bonds, the annualized return of stocks trumps them all over the long run.

However, the predictability of directional moves in the Dow Jones Industrial Average (DJINDICES: ^DJI), S&P 500 (SNPINDEX: ^GSPC), and Nasdaq Composite (NASDAQINDEX: ^IXIC) gets thrown out the window when the time frame is narrowed. Since the start of 2020, these three indexes have traded off bear and bull markets in successive years.

Even though forecasting directional moves for the major indexes can’t be done with 100% accuracy, it doesn’t stop investors from trying to gain an edge. This is where a very select group of economic data points and predictive indicators comes into play. Though Wall Street offers no short-term guarantees, a couple of data points and indicators do have exceptional track records of correlating with moves higher or lower in the broader market.

One such data point that speaks volumes at the moment is U.S. money supply.

U.S. money supply hasn’t done this since 1933

Among the five money supply measures, two receive the bulk of the attention from economists and investors: M1 and M2. M1 factors in all the cash and coins in circulation, as well as demand deposits in a checking account. Think of M1 as cash that’s easily accessible and can be spent in the blink of an eye.

Meanwhile, M2 takes into account everything in M1 and adds in savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000. M2 is still factoring in cash that consumers can spend, but it’s adding in capital that takes a bit more effort to get to. It’s this figure, M2, that is causing alarm in the investing world.

For well over a century, U.S. money supply has been rising with little interruption. Since a growing economy requires more cash and coins in circulation to complete transactions, rising money supply is something economists and investors tend to take for granted and assume is a given.

But on rare occasions, U.S. money supply contracts in a big way — and that’s historically portended bad news for the U.S. economy and stock market.

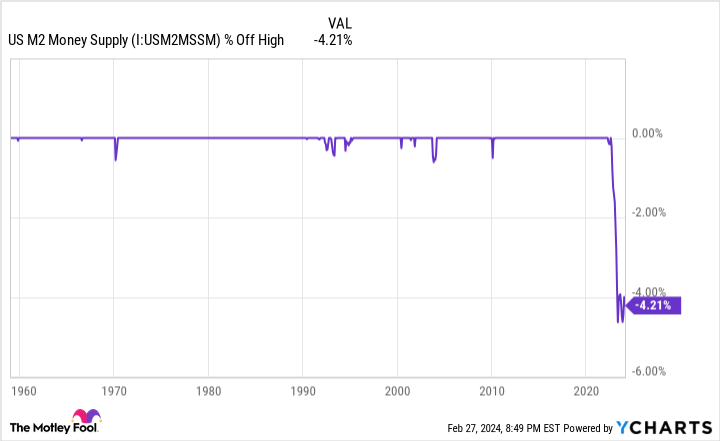

In July 2022, U.S. M2 money supply peaked at an all-time high of roughly $21.7 trillion. Based on the Feb. 27 data release from the Board of Governors of the Federal Reserve, M2 stood at $20.78 trillion, as of January 2024. All told, we’re looking at a year-over-year drop of 1.44% and an aggregate decline from the July 2022 peak of 4.21%. This is the first significant drop in M2 since the Great Depression.

The caveat to the decline since July 2022 is that M2 expanded at a truly historic pace during the COVID-19 pandemic. Fiscal stimulus increased M2 by a record 26% on a year-over-year basis. Thus, a case could be made that a 4.21% retracement is merely a reversion to the mean. Then again, history has been incredibly unforgiving when M2 money supply has fallen by at least 2% on a year-over-year basis.

According to research conducted by Reventure Consulting CEO Nick Gerli, which relied on data from the U.S. Census Bureau and the Federal Reserve, there have only been five instances, when back-tested to 1870, where M2 has declined by at least 2%: 1878, 1893, 1921, 1931-1933, and July 2022 through at least January 2024. The previous four instances all coincided with deflationary depressions and double-digit unemployment rates.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

If I can offer a ray of hope, two of the four previous incidences occurred prior to the creation of the nation’s central bank, and the other two date back more than nine decades. The Federal Reserve’s knowledge of monetary policy, and the fiscal tools available to the federal government, make it highly unlikely that a depression would materialize today.

On the flip side, declining money supply isn’t something that should be swept under the rug. If the core inflation rate remains above the Fed’s 2% long-term target and M2 continues to decline, there will be less discretionary income to go around.

Based on data from Bank of America Global Research, about two-thirds of the S&P 500’s max drawdowns occur after, not prior to, a U.S. recession being declared. In short, a persistent decline in M2 money supply could spell trouble for a currently red-hot stock market.

Following the money has been a problem for the past year

The worry for investors is that M2 represents just one money metric that looks to be working against the U.S. economy and stocks, as a whole. Another key money-based data point that’s cause for concern is commercial bank credit.

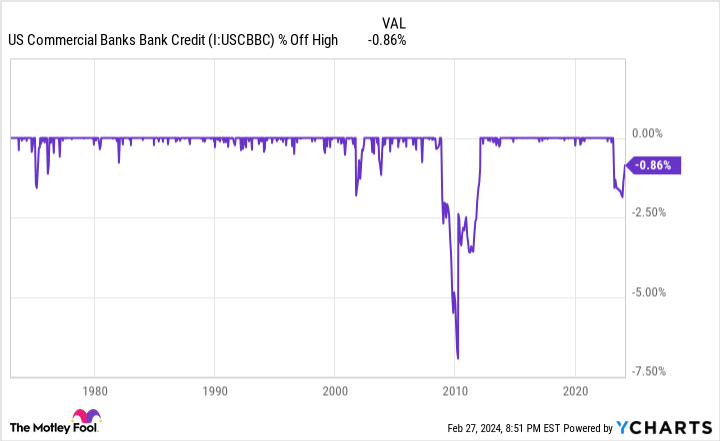

Commercial bank credit is reported by the Board of Governors of the Federal Reserve on a weekly basis and factors in all of the loans, leases, and securities held by U.S. commercial banks. Over the past 51 years, commercial bank credit has expanded from around $567 billion to roughly $17.44 trillion, as of the week ended Feb. 14, 2024.

Just as M2 rising over time makes complete sense, so does the regular expansion of commercial bank credit. As the U.S. economy grows, it’s only natural that consumers and businesses are going to increase their borrowing. Furthermore, commercial banks offset the cost of taking in deposits by lending.

Trouble arises when this steadily climbing metric heads decisively south.

Since data reporting began in January 1973, there have only been three instances where commercial bank credit has pulled back at least 2% from its all-time high:

-

In October 2001, during the dot-com bubble, commercial bank credit slipped a maximum of 2.09%.

-

In March 2010, shortly after the Great Recession, commercial bank credit troughed at a 6.94% decline.

-

In November 2023, commercial bank credit hit a peak drop of 2.07%.

While it is worth noting that commercial bank credit has begun climbing in recent weeks, the drop throughout 2023 pretty clearly shows that banks have tightened their lending standards. When lending institutions become pickier about how they lend their money, it’s not uncommon for businesses to pare back hiring, innovation, and acquisitions. Put another way, a notable decline in commercial bank credit can be a precursor to an economic downturn.

Although Wall Street and the economy aren’t intertwined, recessions tend to negatively impact corporate earnings, which in turn would be expected to send the Dow Jones, S&P 500, and Nasdaq Composite lower. For context, the S&P 500 lost around half of its value during the previous two sizable contractions in commercial bank credit.

History is actually a long-term investors’ best friend

Considering that the Dow Jones Industrial Average and S&P 500 have rocketed to record-closing highs in 2024, a prognostication of downside in the broader market probably isn’t what you want to hear. But just as history can, at times, serve as a short-term guide that portends downside in stocks, it’s often the greatest ally of patient investors.

As much as workers and investors might dislike recessions, the fact remains that they’re a normal and unavoidable part of the economic cycle. They’re also notoriously short-lived. Only three recessions of the 12 that have occurred since the end of World War II made it to the 12-month mark, and none of the remaining three lasted longer than 18 months. In other words, downturns in the U.S. economy are fleeting.

Compare this to periods of growth over the past 78 years and change. Though there are a couple of growth spurts that lasted around a year, most expansions were multiyear events. In fact, two periods of growth surpassed the 10-year mark.

This disparity between U.S. economic growth and contractions is seen in Wall Street’s major indexes. As an example, the S&P 500 has endured 40 separate double-digit percentage corrections since the start of 1950. However, each and every one of these downturns was eventually put in the back seat by a bull market rally. Despite never knowing precisely when these declines will occur, history has pretty conclusively shown that the major indexes will rise in value over time.

To add to the above, the analysts at Bespoke Investment Group put out a dataset in June 2023 that compared the average length of bear markets in the benchmark S&P 500 to bull markets since the start of the Great Depression in September 1929. While the average bull market has endured 1,011 calendar days, the 27 bear markets over the past 94 years have stuck around for an average of only 286 calendar days (about 9.5 months).

The final data set that overwhelmingly demonstrates the power of time and perspective for investors is updated annually by Crestmont Research.

The researchers at Crestmont analyzed the rolling 20-year total returns, including dividends, of the S&P 500 dating back to 1900. Even though the S&P didn’t come into existence until 1923, researchers were able to trace its components to other major indexes at the time, thereby allowing total returns data to be back-tested to the start of the 20th century. This left Crestmont with 105 rolling 20-year periods (1919-2023) to analyze.

What Crestmont’s dataset showed is that all 105 rolling 20-year periods produced a positive total return. Hypothetically speaking, as long as an investor purchased an S&P 500 tracking index since 1900 and held that position for 20 years, they made money, without fail, every time.

No matter what M2 money supply and commercial bank credit suggest will happen with stocks, long-term investors are perfectly positioned to succeed.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has nearly tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of February 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

U.S. Money Supply Is Making History for the First Time Since the Great Depression, and It Implies a Big Move in Stocks Is on the Way was originally published by The Motley Fool

Nvidia Is Making a Lot of Money Selling Artificial Intelligence (AI) Chips, but You May Be Surprised About How Much It Could Make From This Traditional Market

Nvidia (NASDAQ: NVDA) stock’s stunning rally since the beginning of 2023 was primarily driven by the rapid growth of the company’s data center business, which benefited from the booming demand for its artificial intelligence (AI) graphics cards.

In the company’s recently concluded fiscal year 2024 (which ended on Jan. 28), the data center business produced a record $47.5 billion in revenue, accounting for 79% of its top line. That was a massive increase of 217% from the year-ago period.

The data center business recorded a much stronger year-over-year increase of 409% in revenue to $18.4 billion in fiscal Q4, significantly outpacing the segment’s annual growth.

This suggests Nvidia’s data center business is still gaining momentum, which also explains why the company’s outlook for the current quarter was well ahead of consensus estimates. Nvidia expects revenue of $24 billion in the first quarter of fiscal 2025, which would be a 233% increase from the year-ago period.

Given that Nvidia relies on sales of chips that are being deployed in data centers for AI training and inference purposes, it can be easily concluded that this business segment can continue to be a major catalyst for the company.

However, investors shouldn’t ignore the progress Nvidia is making in its second-largest business segment — which was originally the company’s bread and butter before AI arrived — as it has the potential to supercharge the company’s already impressive growth.

Nvidia’s gaming business is set to jump significantly thanks to AI

Nvidia brought major innovation to personal computers (PCs) in 1999 when it introduced what it calls the world’s first graphics processing unit (GPU), an additional processor tacked on to a PC’s motherboard for running graphics-intensive workloads such as video games.

Nvidia’s GPU technology evolved over the years, and it is now being used in multiple industries ranging from automotive to digital twins to AI. But at the same time, the company continues to be a major player in the market for discrete PC graphics cards with a share of more than 80%. The good part is that this dominance is leading to robust financial gains for Nvidia.

The company generated $10.4 billion in revenue in fiscal 2024 from the gaming segment, an increase of 15% from the prior-year period. That’s a nice recovery considering that the gaming GPU market was not in great shape a year ago on account of poor PC sales and oversupply. However, Nvidia’s 56% year-over-year increase in gaming revenue in the fourth quarter of fiscal 2024 suggests that this market gained tremendous momentum.

One of the reasons why that’s happening is because of the recovery in the PC market. Market research firm Canalys estimates that PC sales could increase by 8% in 2024 following last year’s drop of 12.4%. AI is going to play a key role in this growth. According to IDC, AI-enabled PCs capable of running generative AI applications locally could gain solid traction from 2024 with shipments of 50 million units.

IDC predicts that annual shipments of such AI-enabled PCs could climb to an impressive 167 million units in 2027. Even then, this emerging niche will have a lot of room for growth as AI PCs are expected to account for 60% of overall PC shipments in 2027. For Nvidia, the adoption of AI PCs will unlock a massive growth opportunity, and the good part is that the company has already started capitalizing on this nascent market.

In its latest earnings release, Nvidia said that it enabled generative AI capabilities for an installed base of 100 million users who are using the RTX series of graphics cards.

Moreover, the company released new RTX 40 Super series graphics cards starting at $599 in January, which come equipped with generative AI capabilities. In a presentation in October 2023, Nvidia pointed out that 47% of its installed base of discrete GPU users were using RTX graphics cards. Meanwhile, only 20% of the installed base is using a graphics card more powerful than an RTX 3060, a chip that’s now more than three years old.

So, a big chunk of Nvidia’s user base can be expected to upgrade to its new, AI-capable GPUs as generative AI adoption gains steam. At the same time, the increase in the adoption of AI-enabled PCs suggests that there is a huge addressable opportunity for Nvidia to tap into.

Nvidia could make a lot of money in AI PCs

Annual shipments of AI-powered PCs could hit 167 million units in 2027, as per IDC. The researcher also points out that these PCs will be equipped with dedicated chips to run generative AI workloads. Nvidia’s latest RTX 40 series GPUs come with Tensor Cores to enable AI workloads. These Tensor Cores offer between 242 and 1,321 tera operations per second (TOPS) of performance.

This puts Nvidia’s RTX 40 series GPUs in the category of advanced AI chips, IDC said. It said AI PCs equipped with a dedicated chip that offers more than 60 TOPS of performance are categorized as advanced AI PCs.

Nvidia controls 80% of the AI GPU market. If the company can maintain that share in 2027, it could sell a whopping 133 million AI GPUs for PCs that year. If Nvidia can maintain an average selling price of even $400 per AI GPU, which is significantly lower than the $599 starting price for the RTX 40 Super Series, it can generate a whopping $53 billion in annual gaming revenue in 2027.

That would be more than 5 times Nvidia’s gaming revenue in the latest fiscal year, suggesting that the company could still enjoy solid growth in a market that propelled it into the limelight years ago and was its bread and butter for a long time. Throw in the potential growth the company could witness in the data center business over the next five years, and it won’t be surprising to see it sustain its red-hot stock market rally in the long run.

That’s why investors would do well to buy this semiconductor stock while it is available at an attractive 33 times forward earnings, which is almost in line with the Nasdaq-100 index’s forward earnings multiple of 31.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Is Making a Lot of Money Selling Artificial Intelligence (AI) Chips, but You May Be Surprised About How Much It Could Make From This Traditional Market was originally published by The Motley Fool

GoPro Is Known for Making Some of the Best Action Cameras in the World. But It Makes Almost $100 Million per Year From Something That You Might Not Expect.

For more than a decade, action cameras from GoPro (GPRO) have enjoyed a market-leading position among adrenaline seekers. Surfers, bikers, skiers, divers, and more all capture their adventures with these durable devices.

And then there are time-constrained individuals like me who aspire to such a lifestyle and own a GoPro camera that mostly just sits there. But it’s ready for me whenever I finally get around to surfing Diamond Head.

Sales for GoPro devices are still holding strong after all these years. In 2023, the company sold 3 million cameras, which was a 6% jump from camera sales in 2022.

Unfortunately, the camera hardware business has proved to be a challenging venture for GoPro. Despite the brand’s popularity and ongoing strong sales, the company fails to consistently earn a profit and create shareholder value.

Several years ago, GoPro launched a new business that was supposed to be a better opportunity than hardware sales. Adoption of this product has been strong and now brings in nearly $100 million in annual revenue. But unfortunately it hasn’t been a catalyst for the stock, as I’ll explain.

GoPro’s other near-nine-figure business

GoPro offers a subscription service that provides unlimited cloud storage of pictures and videos, certain discounts on merchandise, and access to editing software. The company ended the fourth quarter of 2023 with 2.5 million subscribers, which was a healthy 12% year-over-year increase.

Thanks to this growth, GoPro generated subscription-and-services revenue of $97 million in 2023. It generated $82 million in 2022.

Many investors believed that this other business from GoPro would boost growth and improve profit margins. However, the chart below shows that this hasn’t been the case. Revenue is almost flat over the past five years, and the company’s gross margin has gone down.

GPRO Gross Profit Margin data by YCharts

The explanation for this is fairly simple. While $100 million is a big number, GoPro had revenue of $1 billion for the whole business. Therefore, revenue from subscriptions and services doesn’t meaningfully impact the overall numbers.

Moreover, cloud revenue should be high-margin in theory. But with only 2.5 million subscribers, GoPro lacks scale. Therefore, it’s not getting a boost here.

GoPro promises to grow its opportunity again

In 2024, GoPro is expanding its market opportunity by moving into motorcycle helmets. In January, the company acquired tech-enhanced helmet maker Forcite for an undisclosed amount. Management believes that it can service half of this market it estimates at $6 billion.

I’m skeptical that a move such as this moves the needle for GoPro. While the multibillion-dollar target is big, management left room for doubt. Founder and CEO Nick Woodman said, “There will be some cannibalization because you’re right, there are many motorcyclists who buy a GoPro to attach it to their helmet.”

In other words, GoPro can’t expect motorcyclists to buy both a camera and tech-enabled helmet. They’ll buy one or the other. Therefore, it’s questionable how much this acquisition really grows its long-term opportunity.

What should investors do now?

I believe that GoPro will continue to struggle with growth and profitability in coming years, which is why this is a stock I would avoid today.

Part of GoPro’s struggles making a profit have resulted from difficulties in predicting consumer demand. Sometimes it has too much inventory that doesn’t get sold. The problem is that it frequently updates its product lineup. If old inventory doesn’t sell before new cameras come out, old cameras must be marked down, hurting profits.

In Q4, this problem surfaced yet again for GoPro, demonstrating that it’s not a thing of the past. Management had guided for Q4 revenue of $325 million but only generated revenue of $295 million — that’s a big miss. And the reason is that it sold fewer of its lower-tier priced cameras than expected.

Over the next two years, GoPro intends to launch more products at even more price points. But this introduces a higher level of complexity in predicting consumer demand. And if GoPro gets it wrong, it could actually exacerbate its problems with profitability even more.

My GoPro camera is well loved even if it doesn’t see as much action as I’d like it to. I believe many consumers feel the same about the brand. But when it comes to the stock, revenue growth and profits matter. I don’t see either metric sustainably trending in the right direction right now, which is why GoPro stock doesn’t seem like a stock worth buying today.

Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter

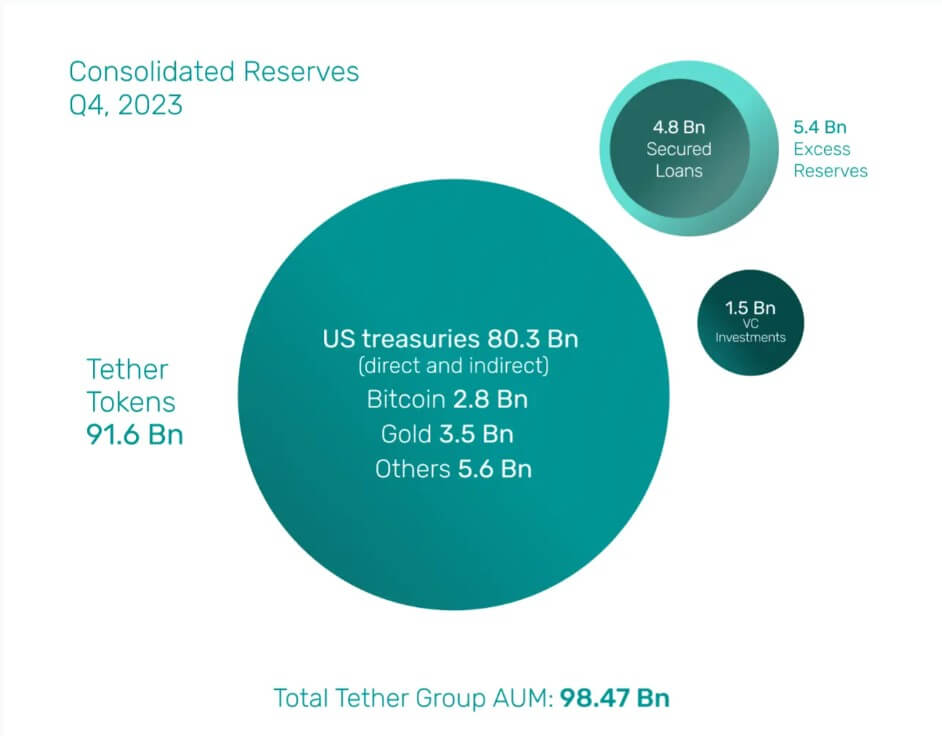

Goldman Sachs reported a profit of $2.01 billion in the last three months of the previous year, while Tether’s Q4 report revealed that its profits comprised $1 billion from U.S. Treasury bills and $1.85 billion from holdings in Gold and Bitcoin.

This remarkable performance can be attributed to the surge in the crypto market, driven by the enthusiasm surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. During this period, Bitcoin’s value skyrocketed to over $42,000 from around $27,000, coinciding with Tether’s USDT supply rising to nearly 92 billion from approximately 83 billion tokens.

Observers noted that the increased demand for Tether’s fiat-backed stablecoin signaled a growing interest from institutional investors entering the market. CryptoSlate’s data shows that Tether’s USDT supply has risen to $96.2 billion as of press time.

However, despite its impressive performance, Tether’s overall profit for the year was $6.2 billion, notably lower than Goldman Sachs’s earnings of $8.52 billion.

Meanwhile, Paolo Ardoino, Tether’s CEO, emphasized that these substantial profits emphasize the company’s financial strength throughout the year.

“The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength,” Ardoino said.

Goldman Sachs, a globally renowned investment banking firm, holds the status of the second-largest investment bank in the world by revenue and is recognized as a systemically important financial institution by the Financial Stability Board.

Over $5 billion in excess reserves

The substantial profit margin enabled Tether to bolster its excess reserves to $5.4 billion. Of this, $640 million was allocated to various project investments, including sustainable energy, Bitcoin mining, AI infrastructure, and P2P communications. Tether does not consider these investments part of its reserves.

“Our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future,” Ardoino explained.

BDO Italia, a prominent global accounting firm conducting Tether’s attestations, verified that the stablecoin’s excess reserves entirely covered its $4.8 billion in outstanding unsecured loans. Tether highlighted its achievement in eliminating the risk of secured loans from its token reserves.

As of December 31, 2023, Tether’s held assets were valued at $98.47 billion, with liabilities amounting to $91.59 billion.

Trump is now complaining that soaring stocks are ‘making rich people richer’ after bragging about the market’s gains while president

-

Donald Trump complained the stock market was enriching the wealthy after touting it while president.

-

President Biden marked this year’s stock rally by poking fun at Trump’s warnings of a crash.

-

Many Americans don’t personally own stocks, and the ultra rich benefit more from market gains.

Donald Trump views a booming stock market as a glorious achievement when he’s in office, but a symbol of mounting wealth inequality when he’s not.

“The stock market is making rich people richer,” the former US president who’s running for reelection next year said during a Nevada rally this week, according to Reuters. Trump frequently crowed about advances in stocks during his presidency but has changed his tune during President Biden’s time in office.

The major stock indices tumbled in 2022 but have rallied strongly this year. The benchmark S&P 500 is up 24% to a near-record level, the tech-heavy Nasdaq has surged 43%, and the Dow Jones Industrial Average has climbed 13% to an all-time high as well.

Biden celebrated the strong performance by posting a campaign ad on X last week. It started with a clip of Trump warning in 2020 that “if Biden wins, you’re gonna have a stock-market collapse the likes of which you’ve never had.” The video then cut to Biden smiling as cable news commentators hailed the stunning rally.

“Good one, Donald,” Biden wrote.

It’s worth noting that many Americans don’t personally own stocks, meaning they only benefit indirectly from market gains, for example if they boost their retirement accounts. Trump certainly isn’t wrong to say that rising stocks enrich the wealthy, either.

The world’s 10 richest people have gained an estimated $470 billion in cumulative net worth this year, lifting their combined fortunes to nearly $1.5 trillion, per the Bloomberg Billionaires Index. Their wealth has soared in large part because they own large stakes in public companies that have seen their stock prices soar this year.

For example, Warren Buffett’s shares of his company, Berkshire Hathaway, make up over 98% of the investor’s $119 billion net worth. Berkshire’s shares have climbed 15% this year, making Buffett $12 billion richer on paper despite his gifting of $5.5 billion of stock to philanthropic causes.

It’s not surprising to see Trump try to disparage the stock market when Biden is actively pointing to it as evidence of his successful presidency. It may not be a surprise either to see Trump return to his previous stance on stocks if he’s reelected.

Read the original article on Business Insider

The Airbus A380 made its first commercial flight in 2007. When it debuted, it overtook the long-reigning Boeing 747 as the world’s biggest passenger plane. It has four engines and is a full double-decker that can carry more than 800 people depending on an airline’s cabin layout.

The plane’s large number of seats was seen as key in helping to reduce the overcrowding of air traffic at several big airports, such as London’s Heathrow Airport, New York’s John F. Kennedy International Airport and Chicago’s O’Hare International Airport.

But orders for four-engine aircraft began to decline alongside the arrival of more fuel-friendly planes such as Airbus’ own A350 and Boeing’s 787 Dreamliner.

“What we’ve generally heard from airlines is that when you can fill an A380, the unit costs, as in the cost per seat, are very attractive,” said Mike Stengel of AeroDynamic Advisory. “But of course, you know, consistently filling 550 seats is far more difficult than consistently filling a 350-seat wide-body.”

The Europe-based Airbus announced an end to its A380 superjumbo program just 12 years after it first took to the skies.

During the Covid-19 pandemic, the A380 was one of the fleets most heavily affected by the near-halt to international long-haul travel, due to its size and operating cost. Many said it was the end for the superjumbos, but the A380 has been making a comeback, with several airlines pulling planes out of retirement.

Airbus says it expects the A380 to be flying for the next two decades, and it is still being operated by 10 airlines, including Emirates, Lufthansa, Etihad Airways and British Airways.

CNBC explores how the A380 became the biggest passenger plane in the world and what the future looks like for the massive jet. Watch the video to learn more.

There’s no one way of achieving success in the stock market and different strategies can be used to attain the basic goal: seeing big returns on an investment.

Talking of big returns achieved via divergent styles, then we can look at the techniques used by legendary investors such as Warren Buffett and Ken Griffin.

Both have had huge success but adhere to different tactics. Buffett made his reputation by favoring value investing, seeking out equities underappreciated at the time and then watching as the market catches up. Meanwhile, making good use of his love of mathematics, Griffin is a proponent of quantitative investment methods.

However, that does not mean that both paths do not cross at times. In fact, delving into both market sages’ portfolios, we find that they are both making some big bets on the same names.

So, we decided to check out 3 stocks held by both and see why they are such fans. By running these names via the TipRanks database, we can also get an idea for how Wall Street’s cadre of analysts see the future shaping up for these equities. Let’s check the details.

Snowflake Inc. (SNOW)

For our first Buffett/Griffin favorite, we’ll head to the tech sector, where we find Snowflake, a prominent data warehousing company known for revolutionizing the way organizations store, manage, and analyze their data in the cloud.

Snowflake offers a cloud-based data platform that provides businesses with a scalable and flexible solution for their data needs. The company’s key innovation lies in its architecture, which separates data storage from compute resources, allowing users to scale their data warehouses dynamically according to their specific requirements. This unique approach has made Snowflake a preferred choice for organizations looking to harness the power of data analytics without the complexities of traditional on-premises data warehouses.

Snowflake’s platform is designed to handle vast amounts of structured and semi-structured data, making it a versatile tool for data analytics, machine learning, and business intelligence applications and its usage has been growing at a fast pace. In the second quarter of fiscal 2024 (July quarter), revenue grew by 35.5% year-over-year to reach $674.02 million, while beating the consensus estimate by $11.74 million. Likewise, adj. EPS of $0.22 outpaced the forecast by $0.12.

While those results exceeded expectations, there have been concerns amongst some investors about growth slowing down. For Q3, the company guided for product revenue between $670 to $675 million, up 28% to 29% compared to the same period a year ago but decelerating sequentially, and the midpoint, below the analyst estimate of $674.9 million.

Meanwhile, Buffett has been heavily invested here for a while and currently owns 6,125,375 shares worth $923 million. As for Griffin, he bought the majority of his stack in Q2, and his 838,521 shares command a market value of more than $126 million.

HSBC analyst Stephen Bersey has no concerns around slowing growth, and claims Snowflake is set to be a prime beneficiary of AI’s rise.

“We believe that Snowflake has demonstrated impressive growth and operating leverage, and we think that the company will deliver turnover and EPS growth above peers for the foreseeable future,” the 5-star analyst said. “The company’s products present a strong value proposition, in our view, as they are focused on an important part of the enterprise technology stack, large dataset management and analysis.”

“Notably, we have embedded a tailwind to revenue into our estimates, driven by an increase in global investment spend on AI to capitalize on the recent breakthroughs in the vertical. We see Snowflake as one of the early beneficiaries to this increase in spending as the company’s product portfolio is focused on the critical component of AI, large datasets,” Bersey went on to add.

Conveying his confidence, Bersey’s Buy rating is backed by a $201 price target, suggesting SNOW shares will climb ~34% higher over the next 12 months. (To watch Bersey’s track record, click here)

Tech names like Snowflake have no trouble catch analyst reviews – and there are 25 such reviews on record for SNOW shares. They break down to 20 Buys and 5 Holds, for a Strong Buy consensus view. At $193.33, the average target implies gains of 28% could be in the cards for the coming year. (See Snowflake stock forecast)

DaVita Inc. (DVA)

We’ll turn now from tech to healthcare and look at DaVita, one of the largest providers of kidney care services in the United States, serving over 200,000 patients across more than 2,800 dialysis centers. The company also has several hundred others located in 10 countries.

DaVita is renowned for its patient-centric approach, focusing on delivering high-quality, personalized care to individuals suffering from chronic kidney disease and end-stage renal disease. The company offers a range of services, including in-center hemodialysis, peritoneal dialysis, home hemodialysis, and nutritional support, with the aim of improving patients’ quality of life and managing their condition effectively.

All that combined to deliver a Q2 report boasting beats both on the top-and bottom-line. Revenue of $3 billion represented a 2.4% year-over-year increase and beat Street expectations by $50 million. At the same time, adj. EPS of $1.94 came in ahead of the forecast, by $0.21.

Buffett remains long and strong here. He is the owner of 36,095,570 shares, which at the current price are worth $3.36 billion. Griffin’s holdings are more “modest,” with most purchased during Q2. His DVA holdings total 1,286,177 shares, amounting to $120 million.

It’s the prospect of growth ahead that UBS analyst Andrew Mok says justifies investors’ attention, even though that seems to go against the Street’s current rhetoric.

“We see inflecting treatment growth in 2Q-3Q ahead of accelerating growth in 2024+. Combined with better pricing and a lower cost structure (ESA savings, closed clinics), we see numerous tailwinds that support our Street-high earnings estimates and contrarian Buy rating. Further, our differentiated view that DVA will resume share repurchase in 4Q should serve as a positive catalyst and an accelerant to 2024 EPS not reflected in consensus estimates,” Mok opined.

That Buy rating goes alongside a Street-high $142 price target, making room for 12-month returns of 52%. (To watch Mok’s track record, click here)

As Mok notes above, his positive thesis is in contrast to others right now. With the 2 additional recent ratings being Holds, the stock manages to eke out a Moderate Buy consensus rating. Nevertheless, even the doubters see the shares as somewhat undervalued; the $123 average target implies shares will appreciate by 32% on the one-year horizon. (See DaVita stock forecast)

Charter Communications (CHTR)

For our final Buffett/Griffin-backed name, we’ll switch lanes again and turn to the telecom industry to check the details on the US’s second-largest cable operator. That’s the spiel behind Charter Communications, a company primarily known for its provision of cable television, high-speed internet, and telephone services to residential and business customers across the country.

Charter’s Spectrum brand extends its services to over 32 million customers across 41 states, leveraging a vast network that covers an impressive distance of over 750,000 miles with the extensive network infrastructure and advanced technology enabling the company to deliver a wide range of digital services, including high-definition television, on-demand video, and broadband internet with competitive speeds.

CHTR stock has enjoyed the spoils of 2023’s bull market, gaining 26.5% year-to-date, and that is despite missing expectations in its most recent quarterly readout. In Q2, revenue stayed roughly the same as in the year-ago period, showing a top-line of $13.66 billion, with the figure falling shy of expectations by $180 million. At the other end of the scale, EPS of $8.05 came in $0.05 below the Street’s forecast.

Positively, during the quarter, Charter purchased 1.1 million shares of its stock for approximately $378 million. Ken Griffin was also busy buying shares, almost tripling his holdings to 527,699. This holding is currently worth more than $228 million. Buffett made no changes to his stack, which remains substantial. He owns 3,828,941 CHTR shares, worth a massive $1.65 billion.

Wells Fargo analyst Steven Cahall is also a fan, laying out why he believes the stock represents a good investment opportunity.

“We think CHTR is the clearest expression of a new normal for Cable competition,” the analyst said. “It has a strong converged bundle with Spectrum One, stable net adds due to its expansion in rural and a more aggressive video posture with programmers. We’re comfortable with ~MSD % EBITDA growth, while capex should meaningfully step-down, beginning in 2026. This makes CHTR appealing as a levered cash return story, and we think it can maintain 8-9x EV/EBITDA.”

These comments underpin Cahall’s Overweight (i.e., Buy) rating on CHTR, while his $550 price target anticipates investors will be sitting on returns of 27% a year from now. (To watch Cahall’s track record, click here)

Overall, of the 15 analyst reviews submitted over the past 3 months, 7 join Cahall in the bull camp and with the addition of 6 Holds and 1 Sell, the analyst consensus rates the stock a Moderate Buy. Going by the $493.31 average target, the stock’s one-year upside potential stands at 14%. (See CHTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Making real-world blockchain solutions possible — Solana co-founder Raj Gokal

Raj Gokal, co-founder of blockchain protocol Solana and chief operations officer of Solana Labs, started his career in venture capital with a focus on high-growth tech business.

For seven years, Gokal focused on health tech, first with wearable sensors using Bluetooth Low Energy as a wireless protocol, then leading product management at Omada Health. He aimed to address the fractured, challenging United States healthcare system but “encountered challenges with health plans and regulators, leading me to recognize the industry’s persistent issues,” he told Cointelegraph.

After meeting Solana co-founder Anatoly Yakovenko and seeing his “vision to resolve scalability in crypto,” Gokal immersed himself in the crypto industry. “The journey has been rewarding over these past five years.”

Recently, Gokal sat down for an interview with Cointelegraph to discuss Web3, scalability, tokenization and more.

Cointelegraph: There has been a noted absence of substantial real-world use cases in the Web3 domain. This contributes to the perception that there’s no product-market fit for the industry. What are a few real-world use cases Web3 is currently prioritizing?

Raj Gokal: A real-world use case that comes to mind is decentralized physical infrastructure networks, or DEPIN. Developers often lead the way, as seen with projects like Helium, which established a decentralized 5G network with 1.5 million hotspots before transitioning to Solana. Similarly, Hivemapper launched its decentralized maps, utilizing a distributed global workforce equipped with dashcams. This is now an alternative to a centralized organization like Google deploying tens of thousands of cars that it owns to map the roads.

The Hivemapper network remapped 8% of the world’s roadways in just a few months, which is very much a real-world application of Web3 on Solana. These ventures showcase the viability and significance of leveraging low-cost, scalable blockchain technology to create innovative solutions. Developers across the world come together without any central authority and create successful business models with tangible value.

CT: Your ambition was to resolve scalability challenges within Web3. What architectural considerations are essential when building real-world solutions on layer-1 platforms?

RG: The benefits of parallelized transaction processing and validation are foundational, offering various advantages for developers and users. Solana pioneered these features, optimizing for speed with 400-millisecond block times and near-instant confirmations. We hear testimonials from users that a transaction was completed on Solana even before they could switch tabs. This fast, seamless experience builds trust and user satisfaction. Additionally, low transaction costs are crucial.

Compatibility and composability are essential, too, allowing various applications to work together. Decentralization is a linchpin, ensuring longevity and reliability. For instance, on Solana, we have close to 3,000 validators and the highest Nakamoto coefficient of 33 across all blockchains. While achieving these feats within a decentralized, high-performance network is challenging, it has been achieved through rigorous effort and innovation.

There are several such architectural decisions that make real-world solutions possible on blockchains. It is often not just one feature — it is the convergence of several architectural considerations that make it viable and scalable.

I also think blockchain networks must be battle-tested across multiple cycles. As ecosystems thrive through difficult market conditions, it provides developers, users and investors confidence that the network is here to stay.

CT: Let’s move on to Web3’s approach to mobile and payments. Solana has taken steps to introduce Solana Pay. You also recently launched the Saga phone. What are the motivations behind this, and how does it impact the broader mobile and payments landscape?

RG: The Solana Saga phone has shown that there is a huge opportunity for handset and operating system makers to create a sandbox where developers can build what they want with token incentives and without any restrictions on nonfungible tokens. Since the launch of the Saga, Apple and Google have eased their stance on digital assets in their application stores.

We have seen similar initiatives in the past, when Tesla created a new market for electric vehicles. It started with the Roadster, which initially only sold a few thousand cars. But over time, it has made it a more accessible mass-market product. We should see a similar trajectory for Web3-friendly mobile phones over the coming years, and Saga is just the beginning.

Solana Pay, on the other hand, operates at the crossroads of fostering a more accessible and open payments ecosystem. If you look at the Bitcoin white paper, the initial purpose of Bitcoin and the whole idea of digital money was to facilitate permissionless peer-to-peer online payments. That was the initial vision for cryptocurrencies.

By providing an alternative platform, Solana aims to influence these giants to adopt more user-centric and app-friendly frameworks. As for Solana Pay itself, it’s designed to enable any developer to integrate QR code-based payment features across various contexts, whether in point-of-sale systems, mobile apps or web-based services.

This has sparked initiatives like Decaf in over 30 countries, focusing on cross-border remittances. Sling, another Solana-powered platform, competes with Venmo on a global scale. Over the next few years, we can anticipate an upsurge in grassroots and enterprise-driven solutions that leverage crypto for payments.

CT: Let’s talk about real-world asset tokenization. While this area holds immense potential, it hasn’t fully taken off. What are the barriers preventing the widespread adoption of real-world asset tokenization, and how can these hurdles be overcome?

RG: Real-world asset tokenization indeed presents enormous opportunities, especially in sectors like real estate. Initiatives such as Parcl and Homebase are pioneering this space, though it requires time for adoption. For instance, Homebase is focused on individual properties that are tokenized and fractionalized so that you can get rental income that is globally accessible to anyone.

This space is about providing assets that people actually want and then making sure the narrative is good enough to win mindshare and convince users that real-world asset tokenizations are now something that’s possible. The idea looks sound on paper, but often, it takes time to execute, and we just need founders who are good at carrying the messaging for this space and have strong product skills. Success hinges on creating accessible, user-friendly, trustworthy platforms that offer real value to users, but also in delivering the narrative to the target users.

Over the next few years, the collective efforts of dedicated teams and the introduction of innovative platforms will likely drive increased adoption and establish a strong presence in the market.

CT: What strategies can mitigate risks associated with potential outages or technical difficulties within the Web3 ecosystem?

RG: Addressing liveness [i.e., the guarantee that a protocol can exchange messages between the network nodes, allowing them to reach a consensus] and reliability issues is essential to ensure seamless operations in real-world applications. The industry has learned from mistakes committed in the past and has actively implemented solutions to minimize outages. This will be critical for institutional adoption, as they will want to see reliable infrastructure before embracing this innovation at scale.

Networks like Solana have made significant strides in enhancing liveness and minimizing potential issues. Collaborative efforts between multiple validator clients, diverse solutions and continuous refinement of the ecosystem have led to increased stability and dependability. While the Web3 space is still evolving, the focus on these aspects will likely lead to even greater reliability over time.

CT: What would you define as a product-market fit for layer-1 protocols and the broader Web3 ecosystem? What would the user experience look like in your view?

RG: I think there are two stages of product-market fit. One is where founders and developers are able to either fund themselves or get funding to launch products that work toward end-user product market fit. And I believe we have achieved that level of product-market fit. Even in the depths of the bear market, you still see quality teams get funded, things are getting pushed forward, and new products are being launched.

Then, there is the second level, which is end-user product-market fit. And I would say that is a stage where the majority of the value that users are getting is not speculative from buying and holding assets but is from earning by contributing to networks, where the value is being shared back to the user. That’s why sectors like DEPIN, even though there are not 100 DEPIN examples, are happening. Users are using their hardware to earn money in crypto by supporting a network that adds real-world value to users. It’s exciting, and I’ll admit that it’s early.