Popular onchain analyst Willy Woo has predicted a potential bitcoin price surge to $650,000 at the bull market’s peak. His prediction hinges on spot bitcoin exchange-traded fund (ETF) investors fully deploying their assets based on recommendations from asset managers. “These are very conservative numbers. Bitcoin will beat gold cap when ETFs have completed their role,” […]

Popular onchain analyst Willy Woo has predicted a potential bitcoin price surge to $650,000 at the bull market’s peak. His prediction hinges on spot bitcoin exchange-traded fund (ETF) investors fully deploying their assets based on recommendations from asset managers. “These are very conservative numbers. Bitcoin will beat gold cap when ETFs have completed their role,” […]

Source link

manager

(Bloomberg) — A Fidelity International money manager has sold the vast majority of US Treasuries from funds he oversees on expectations the world’s biggest economy still has room to expand.

Most Read from Bloomberg

Singapore-based George Efstathopoulos, who helps manage about $3 billion of income and growth strategies at Fidelity, sold the bulk of his 10-year and 30-year Treasuries holdings in December. He is now turning to assets that typically do well in times of good economic growth to boost returns.

“We don’t expect sort of a recession anymore,” said Efstathopoulos. “The probability of no landing is still small, but it’s been increasing. If that increases much more, potentially we will not be talking about Fed cuts anymore” in 2024.

Efstathopoulos is among those cooling on Treasuries as the US economy’s resilience forces investors to rethink bets on interest-rate cuts. Some are going a step further, speculating the Federal Reserve’s next move may even be a hike, after the recent strong inflation and jobs reports.

Traders are now pricing under four quarter-point interest-rate cuts in 2024, down from wagers for 150 basis points of cuts this year starting March. Bonds are reflecting the swing in sentiment, with 10-year US yields advancing more than 40 basis points since the start of the year to 4.3%, as comments from Fed officials also reinforce expectations of higher-for-longer rates.

Fed Vice Chair Philip Jefferson warned on Thursday about the dangers of easing too much in response to easing price pressures, while Fed Minneapolis President Neel Kashkari said “we still have some work to do” on inflation.

Efstathopoulos sold Treasuries as concern over US growth faded. The asset is typically less attractive amid elevated borrowing costs, and when prices reflect the Fed’s median forecast of three quarter point interest-rate cuts this year.

He also sold bonds from other developed markets, including gilts and bunds, while leaving some exposure to inflation-linked US government debt and an idiosyncratic position in Austrian bonds.

The US economy is showing “more signs of re-acceleration than it is of slowing down,” Efstathopoulos said, adding that “I wouldn’t be surprised in a couple of quarters down the road we end up seeing sort of manufacturing PMI in a more expansion sort of territory” in developed markets.

Data on Thursday reinforced his view as US jobless claims dropped to the lowest level in a month, underscoring the strength of the economy.

Some funds such as Jupiter Asset Management are taking a different view, opting to load up on Treasuries while seeing risks of an eventual hard landing after the Fed’s most aggressive tightening cycle in decades.

Prefers Stocks

Efstathopoulos helps oversee a number of strategies, including a global multi-asset growth and income fund that gained 5% in the year to Jan. 31, according to a company factsheet.

In comparison, the Bloomberg Global-Aggregate Total Return Index of worldwide investment-grade bonds rose about 0.9% in the same period. The fund had dropped 2.31% over a three year period, the factsheet showed.

Efstathopoulos took profit on a top money-making bullish India equities trade last month as prices soared, rotating instead to US mid-cap and Greek stocks. He also likes Japanese banks.

The strategy is now more positive on stocks but “very underweight duration,” he said, referring to a measure that typically reflects the sensitivity of a bond portfolio to changes in interest rates.

“We’ve gone through a massive disinflation period and growth seems to be OK, and the labor market seems to be OK,” he said. “If this is where we land, this is a great place.”

(Updates with Fed comments in sixth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

This fund manager stopped worrying about economics. He’s outperforming the market.

A change in strategy has helped transform the GoodHaven Fund from a long-term underperformer into an outperformer since the end of 2019. The fund follows a concentrated-value approach and now has a four-star rating (out of five) in Morningstar’s Large Blend fund category.

Larry Pitkowsky, managing partner of GoodHaven Capital Management, based in Millburn, N.J., explained how this was achieved in an interview with MarketWatch.

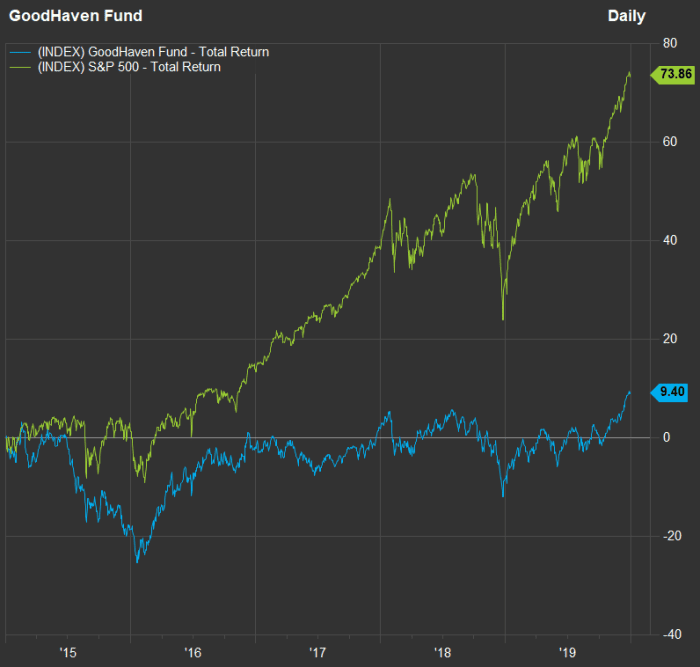

To begin, take a look at how the GoodHaven Fund performed, with dividends and capital-gains distributions reinvested, over a five-year period through 2019, compared with the S&P 500:

For five years through 2019, the GoodHaven Fund returned only 9.4%, while the S&P 500 returned 73.9%.

FactSet

Late in 2019, Pitkowsky led a series of changes in how the fund operated, including paying less attention to macroeconomic factors, moving on more quickly if investments aren’t working out well and holding on to successful companies longer, to avoid selling too early. He cited Microsoft Corp.

MSFT,

as an example of a stock he had parted ways with too early, and said an example of an industry and macro-based investment play that didn’t go well was a group of energy and materials stocks that were crushed when commodity prices dropped from mid-2014 and 2015 through early 2016.

“We like to own high return-on-capital companies” with good trajectories for growth, Pitkowsky said, “before everyone else has figured it out.”

He added: “We try to avoid structurally challenged businesses that might be statistically cheap.”

Now take a look at how the fund has performed against the S&P 500

SPX

since the end of 2019:

The GoodHaven Fund has outperformed the S&P 500 since changing its investment-selection process late in 2019.

FactSet

Narrowing further to a three-year chart through Feb. 6 sheds more light on the seesaw performance of the broad stock market, with an 18.1% decline for the S&P 500 in 2022 followed by a 26.3% return in 2023.

The GoodHaven Fund has had a smoother ride during the stock market’s up-and-down cycle over the past two years, leading to a much higher three-year return than that of the S&P 500.

FactSet

Fund holdings and comments about companies

GoodHaven Capital Management has about $340 million in assets under management, including separate client accounts and about $230 million in the fund.

As of Nov. 30, the fund’s portfolio was 29% in cash and short-term investments, in part because of an influx of new money from investors but also because Pitkowsky wants to keep money readily available to make purchases at attractive prices and to meet any redemption requests from the fund’s shareholders. At times the fund’s level of cash and short-term investments has been much lower.

Here are the fund’s top 10 stockholdings as of Nov. 30, making up 52% of its portfolio:

| Stock | Ticker | % of fund | Forward P/E |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

11.2% | 22.0 |

| Alphabet Inc. Class C |

GOOG, |

7.0% | 21.1 |

| Builders FirstSource Inc. |

BLDR, |

6.6% | 14.6 |

| Bank of America Corp. |

BAC, |

5.4% | 10.3 |

| Devon Energy Corp. |

DVN, |

4.4% | 7.6 |

| Jefferies Financial Group Inc. |

JEF, |

4.2% | 11.1 |

| Exor N.V. |

EXO, |

4.2% | 7.6 |

| Lennar Corp. Class B |

LEN.B, |

3.5% | 9.6 |

| Progressive Corp. |

PGR, |

2.8% | 21.0 |

| KKR & Co. |

KKR, |

2.8% | 18.5 |

| Sources: GoodHaven Capital Management, FactSet | |||

Click on the tickers for more about each company, fund or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

The table includes forward price-to-earnings ratios for the stocks, based on Tuesday’s closing price and consensus earnings-per-share estimates for the next 12 months among analysts polled by FactSet. For comparison, the S&P 500 trades at a weighted forward P/E of 20.2.

Two “big wins” Pitkowsky cited when discussing the GoodHaven Fund’s recent outperformance were Builders FirstSource Inc.

BLDR,

and the Class B shares of Lennar Corp.

LEN.B,

a home builder that is trading at a low P/E, along with its entire industry group. We listed P/E ratios for 17 home builders in October, when most of them were very low. At that time, the S&P Composite 1500 Homebuilding subindustry group was trading at a weighted forward P/E of 7.6. The group now trades at a forward P/E of 10.2.

Pitkowsky believes both Builders FirstSource and Lennar have “plenty of growth ahead of them” and said he was also pleased that both companies have low levels of debt. “The big builders have become much better businesses,” he said.

Something else to consider is that Pitkowsky holds Lennar’s Class B shares, which trade at a forward P/E of 9.6 — a discount to the valuation of the company’s Class A shares

LEN,

which trade at a forward P/E of 10.3.

Lennar’s Class B shares have 10 times the voting rights as the Class A shares, but they trade at a lower P/E, probably because they are less liquid and are not included in the S&P 500, Pitkowsky said. “When we began to research [Lennar], we saw the super-voting shares traded at around a 20% discount to the non-super-voting shares,” he said, adding that the fund has benefited as the valuation gap has narrowed.

Another big winner for the fund has been Bank of America Corp., which Pitkowsky said was his largest purchase during the 12-month period that ended Nov. 30. Bank of America now trades at a forward P/E of 10.3, compared with a five-year average of 11.1 and a 10-year average of 11.3.

“[Bank of America’s] return on equity is a depressed 11%+,” he wrote in the November letter to GoodHaven Fund shareholders. But he likes the stock’s risk/reward potential for several reasons, including “recurring earnings from the nonbanking businesses.”

While lamenting what he now knows was an early sale of Microsoft shares, Pitkowky points to Alphabet Inc.

GOOGL,

GOOG,

as a strong holding he has stuck with since 2011.

Alphabet trades at the lowest P/E among the 10 largest companies in the S&P 500.

Pitkowsky said he remained comfortable with Alphabet as a large holding, in part because the company has become “more focused over the past year or two on re-engineering the cost base.” He added that the stock’s valuation “does not seem demanding” relative to Alphabet’s further growth potential.

Don’t miss: Is Meta now a value stock?

Small-cap stocks can help investors diversify from the S&P 500, which is heavily weighted to the largest U.S. tech players. Investors may imagine small-caps as up-and-coming companies focused on increasing their sales and taking market share from rivals, or ones facing binary events, such as drug trials, that can set up windfall profits.

But Bill Hench, the head of small-cap investing at First Eagle Investments, takes a value approach, looking for companies that need to be fixed.

“We look to get a dollar of assets for less than a dollar,” he said during an interview.

A small-cap veteran

Hench is the head of the Small Cap team at First Eagle Investments in New York and portfolio manager of the $1.7 billion First Eagle Small Cap Opportunity Fund FESCX. He has been following a value strategy since 2002 when he was working at Royce Investment Partners. He and his team joined First Eagle in April 2021 — the same month that the First Eagle Small Cap Opportunity Fund was established.

From that date, the fund’s institutional shares were down 1% through Friday, net of expenses, which was in line with the performance of the Russell 2000 Value Index

,

but ahead of the 10% decline for the full Russell 2000

.

Needless to say, this period hasn’t been a good one for small-caps. Since the First Eagle Small Cap Opportunity Fund is less than three years old it doesn’t yet have a Morningstar rating.

Brett Arends: These small-cap managers’ stock picks crushed the indexes last year — again. Here’s what they’re buying now.

But Hench had a solid long-term performance record at Royce — the Royce Opportunity Fund RYPNX, which he co-managed, had a 15-year return of 296% through March 2021, compared with returns of 191% for the Russell 2000 Value Index and 256% for the full Russell 2000.

Identifying bargains

Hench takes a broad approach, typically holding shares of between 180 and 300 companies. He and his team typically identify companies whose shares are trading low to book value or revenue not because the companies are little-known in the market, but “because something is wrong.”

“We look for companies that experience difficulties in the short term, which is normal. Sometimes it is their mistakes, sometimes it is the economy,” he said.

Hench doesn’t consider companies’ price-to-earnings valuations when making initial purchase decisions because the companies aren’t as profitable as he believes they can become.

“We look for cheap and a reason they will get back to normal,” he said.

He also believes the word “quality” is overused in the investment community. “The term may be used when an investor overpays,” he said. The idea is that you might be willing to pay a high price for stability, but you also might take advantage of lower prices, because for most companies “things are not always great all the time.”

Looking back to the early phase of the COVID-19 pandemic, Hench said: “You had traditional growth stocks selling at similar valuations to value stocks. Back then, you were able to buy things like Dunkin’ Donuts or Texas Roadhouse

TXRH,

which were typically in value funds at low multiples and they got back to where they had typically sold, which is where we exited.”

Hench said about a third of the companies in the portfolio are maturing and have been held for about a year and a half because they are improving as he expected. Another third “have just made the turn, with fundamentals getting better or the economy at their backs,” and the remaining third includes companies “in the thick of it,” or improving as the worst of their problems have abated.

“Everything in the portfolio goes in there because there is something wrong, something not working,” he said. “If we think they have a good shot at fixing it, we will take a position. Then we do maintenance, to make sure of the progress we want” he said. As he gains more confidence in a company’s progress, he will add to a position. He will sell it if the expected improvement isn’t taking place. Once a company is far enough through the cycle of improvement for the shares to have reached what Hench believes to be their fair value, he will sell.

“These things take time to work out,” especially if one of the companies he invests in has a new management team, he said.

A current fixer-upper

Rob Kosowsky, an associate portfolio manager on Hench’s team provided an example of a holding that can still be considered a fixer-upper because of operational problems: Stericycle Inc.

SRCL.

Stericycle’s main business is the collection and disposal of hazardous waste from hospitals and other medical facilities. It also provides document shredding services.

Kosowsky said Stericycle was formerly “a Wall Street darling” as it acquired hundreds of smaller competitors from 2000 through 2015. While this “classic roll-up” built a large revenue stream, it caused the company’s profit margins to tumble “because it had never been fully integrated.”

Cindy Miller became Stericycle’s CEO in 2019, following a 30-year career at United Parcel Service. Since then, she has been leveraging her logistics background “to simplify the business and improve margins,” Kosowsky said.

Since the acquisitions hadn’t been fully integrated, “there was an outdated and incohesive enterprise resource planning system,” he said. This meant that while trying to route trucking fleets across the U.S. and in 16 other countries, management had difficulty getting real-time information to improve efficiency and pricing. Once the new ERP system is in place, management can act quickly to improve efficiency, and company salespeople will have an easier time understanding Stericycle’s full business relationship with each corporate customer.

Another leftover from Stericycle’s acquisitions is the confusing array of about 150 different standard container sizes for the collection of hazardous medical waste, according to Kosowsky. The company plans to trim this number to about 20.

He also said Miller’s decision to make some divestitures had helped Stericycle pay down debt.

Kosowsky said Stericycle was still in “a risky state.” But he expects steady improvement to the company’s profit margin over coming years.

Three holdings that have improved their financial performance

Hench named three holdings of the fund that had already turned the corner with operational improvements.

-

AAR Corp.

AIR

provides various services to government and commercial aircraft operators, including fleet management, parts, inventory and repair, and also provides various containers and shelters for use during military and humanitarian deployments. Needless to say, the company suffered during the COVID-19 pandemic, and even though air travel has recovered, Hench still sees a runway for continuing improvement. There is a global shortage of new airplanes, with rising demand. This means the air fleet is getting older, which is wonderful for a company in the aircraft maintenance repair and overhaul business. “Although it has moved up a lot, AIR is still a prominent part of our portfolio,” Hench said. -

HealthStream Inc.

HSTM

provides outsourced training, certification and related regulatory services to the healthcare industry. “They provide software that allows you to go online and take a test, [access] training manuals or get certified online, or keep track of tasks at work, Hench said. He added that the stock trades at a lower valuation than many other SaaS (software as a service) companies. He said it was unusual for a value fund to hold shares of a growth-stage company, but that a valuation of 2.25 times estimated annual sales made this stock appear “really cheap.” He described HealthStream as a scalable business that would not require major capital investment to continue growing quickly. -

Chuy’s Holdings Inc.

CHUY

runs a chain of more than 100 Tex-Mex restaurants from its base in Austin, Texas. The company is opening 10 to 14 new locations each year, Hench said. Chuy’s is not a franchise operation — it owns all of its restaurants. Hench said the company’s senior management is directly involved with the opening of each new restaurant, that “the food is really good,” and that “they are particular about what they serve, how they serve and cleanliness.” At a forward price-to-earnings valuation of 16.5 (based on consensus earnings estimates among analysts polled by FactSet), Hench said this stock could be placed in the “growth at a reasonable price” category. But he believes that P/E ratio could move up as the company keeps growing.

Top holdings

Here are the top holdings of the First Eagle Small Cap Opportunity as of Nov. 30:

| Company | Ticker | % of the First Eagle Small Cap Opportunities Fund |

| Air Lease Corp. Class A | AL | 0.83% |

| Goodyear Tire & Rubber Co. | GT | 0.81% |

| Chefs’ Warehouse, Inc. | CHEF | 0.81% |

| Tenet Healthcare Corp. | THC | 0.81% |

| AAR Corp. | AIR | 0.80% |

| Louisiana-Pacific Corp. | LPX | 0.80% |

| Stewart Information Services Corp. | STC | 0.80% |

| QuidelOrtho Corp. | QDEL | 0.79% |

| Alaska Air Group Inc. | ALK | 0.76% |

| Herc Holdings Inc. | HRI | 0.74% |

| Source: First Eagle Investments | ||

Click on the tickers for more about each company.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: Why Microsoft’s stock is a better investment than Apple’s

To uphold the token’s value, stablecoin issuers often reserve cash or liquid assets. Amid rising interest rates, DWS is poised to manage the reserves for the new stablecoin.

Deutsche Bank’s DWS Group, along with Dutch market maker Flow Traders Ltd. and crypto fund manager Galaxy Digital Holdings Ltd, is set to establish a new entity named AllUnity. The primary objective of AllUnity is also to issue a euro-denominated stablecoin, aiming to foster wider acceptance of tokenized assets in mainstream finance.

The company, headquartered in Frankfurt and led by Alexander Höptner, former BitMex CEO, plans to apply for an e-money license with Germany’s financial watchdog, BaFin, with the ambition to launch the stablecoin within the next 18 months.

Drawing on their collective expertise in both traditional and crypto markets, the consortium aims to create a successful stablecoin tailored for institutions, corporates, and private users. DWS, majority-owned by Deutsche Bank, oversees assets totaling €860 billion ($927 billion), while Flow Traders, active in the crypto space since 2017, traded assets worth €2.8 trillion ($3 trillion) in the first half of the year.

For the Euro stablecoin launch, the DWS Group has partnered with Galaxy Digital. Galaxy Digital, led by renowned investor Michael Novogratz, offers a range of services, including crypto trading, asset management, and mining. Speaking on the development, Höptner further said:

“You need to have the stability, the trust, the connection and market power to make stablecoins really viable and usable. This partnership is pretty unique because it combines the trustworthiness of a big asset manager, that of a highly successful market maker and of a leading innovator in the crypto sector.”

Growing Focus on Euro-Backed Stablecoin

In a strategic move, Deutsche Bank’s DWS Group, Flow Traders, and Galaxy Digital plan to create AllUnity, a Frankfurt-based company, to issue a euro-denominated stablecoin. The collaboration reflects a growing trend among major institutions entering the stablecoin market, catering to crypto’s widely traded tokens often pegged one-to-one with traditional assets like the dollar.

To uphold the stability of the token, issuers of stablecoins usually reserve a certain amount in cash or liquid assets, like US government securities. With the current upward trend in interest rates, this model has proven to be a profitable venture for stablecoin issuers. The intention is for DWS to oversee the reserves of the planned stablecoin, as stated by Höptner.

Stablecoins, known for their low volatility, appeal to traders and businesses for various use cases, including swift cross-border transactions and facilitating digital payments. While the stablecoin market has reached $130 billion, the dominance of dollar-backed tokens, notably Tether’s USDT, is evident. Besides, Euro stablecoins have seen lower demand, with monthly trading volumes averaging $90 million compared to $600 billion for USD stablecoins.

Societe Generale’s crypto asset subsidiary recently introduced its euro-denominated stablecoin, EUR CoinVertible, on the Bitstamp crypto exchange. The European Union’s new cryptoasset regime provides a regulatory framework, potentially driving greater adoption of euro-denominated tokens. AllUnity plans to launch in Q1 2024, contingent on regulatory approvals and obtaining a full e-money license.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Mark Spitznagel, the Universa Investments founder and chief investment officer whose firm is advised by Black Swan author Nassim Nicholas Taleb, said the stock market is likely to surge — then turn drastically when the Federal Reserve starts cutting interest rates.

Most Read from Bloomberg

“That’s when things are going to get really awful,” Spitznagel said in an interview this week in New York.

Spitznagel is extending his concerns about the market’s reliance on Fed support through more than a decade of low interest rates and its bond-buying program, which it’s now in the process of trying to reverse. Earlier this year, he told investors we’re living in “the greatest tinderbox-timebomb in financial history,” even worse than the late 1920s run-up to the Great Depression.

“This is my own crazy theory: I think our rates are going to go back to zero as well. I mean, a lot of people would think I’m nuts,” said Spitznagel, 52. “But remember when a credit bubble pops, remember what a deflationary event that is. It’s like taking a giant pile of cash and lighting it on fire.”

Universa, based in Miami, is a tail-risk fund, which means it’s designed to protect investors when markets turn south. Tail-fund managers are inclined to warn against the next blowup, touting their strategies to clients as an insurance policy against extreme moves in financial markets. Spitznagel’s greatest payouts to investors come during extreme market crashes, such as the pandemic-spurred one in March 2020.

He said this week that he believes the Fed will have a hard time with its quantitative-tightening efforts, and that the central bank may even have to start easing once again.

“I think they’re gonna have to come back with vengeance, I really do,” he said.

The Fed’s balance sheet, which had roughly $9 trillion in assets at its peak in 2022, has declined to less than $7.9 trillion. That’s still some $3.7 trillion more than where they stood at the beginning of 2020, before the Covid-19 pandemic spurred the central bank to support markets even more drastically.

Spitznagel said he believes the Fed will need to reaffirm its support because he sees a recession as likely. Yet the market will continue to rise before tumbling because “the Fed just paused — that’s a good start right there — and people are positioned in a way like we’re about to crash,” he said.

“We’re probably deferring a recession to next year, and the yield curve has spent some time being uninverted,” Spitznagel said. “Put all those things together and we’re going vertical. But the sentiment is very, very negative.”

The S&P 500 has been on a week-and-a-half rally, held up in particular by dovish signals of late from Federal Reserve policymakers. While borrowing costs in the US have risen to a 22-year high, yields have begun to subside recently.

Spitznagel said the lagged effects of such high rates have yet to be fully realized throughout the economy, and future cuts will reflect the inability of borrowers to stomach higher borrowing costs after saddling themselves with debt.

“We’re likely now in a brief Goldilocks zone, and no one expects it — more squeeze-up and blow-off in risk assets, which I’ve been writing and saying for a year,” he said. “Then Papa Bear shows up, and it will be too late to react.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

Investors should ‘be patient’ with beaten-down bank sector, buy-side fund manager says

The clouds over bank stocks aren’t expected to clear anytime soon, fund manager Dave Ellison said, but some names remain attractive based on valuation.

Depending on whether you’re optimistic or unenthusiastic about the sector, the outlook for bank stocks remains mixed.

In a moribund environment for banks with the collapse of Silicon Valley…

Global bond rout looks ‘tremendously dangerous’ for stocks, hedge fund manager warns

An intensifying bond rout is piling pressure on the global economy and creating a “tremendously dangerous” outlook for equities, the chief investment officer of Livermore Partners hedge fund said Friday.

A new era of higher interest rates has caused bond yields to surge, hampering returns for investors and flipping on its head the status quo of the past decade-and-a-half, David Neuhauser told CNBC. Bond yields move inversely to prices.

Asked how worrying that landscape was for equities, he said: “I think it’s tremendously dangerous at this point.”

“We’re in this world of risk where, for almost 15 years, you had a bond market that was in a bull market, and you had rates negative for several years,” Neuhauser told “Squawk Box Europe.”

“That dynamic fed throughout the global economy, where housing prices were affordable, autos were affordable, and people were subjected to an environment and a lifestyle which had much lower interest rates.”

That environment has shifted as central banks have pushed ahead with rate hikes to tackle higher inflation. That, in turn, has pushed bond yields higher and sapped money from government budgets by raising borrowing costs.

In the U.S. Treasury market — a crucial component of the global financial system — bond yields have surged to highs not seen since the onset of the global financial crisis. In Germany, Europe’s largest economy, yields have hit their highest level since the 2011 euro zone debt crisis. And in Japan, where interest rates are still below 0%, yields have risen to 2013 highs.

“I think that is going to cause a lot of pain moving forward in terms of the economy,” Neuhauser said.

Bond bears ‘back from the dead’

Those fiscal imbalances are giving “a lot of ammunition to the bond bears,” the hedge fund manager added, with interest rates likely to remain higher for longer.

“What you’re seeing now with the bond market is, you know, bond vigilantes are back in vogue, back from the 80s, back from the dead, and I think they’re leading the market today,” Neuhauser said.

Neuhauser’s statement echoes similar comments earlier this week from UBS Asset Management’s head of global sovereign and currency, Kevin Zhao, who said “the bond vigilante is coming back.”

NEW YORK, NY – FEBRUARY 27: Traders work on the floor of the New York Stock Exchange on February 27, 2020 in New York City. With concerns growing about how the coronavirus might affect the economy, stocks fell for the fourth straight day. The Dow Jones Industrial Average lost almost 1200 points on Thursday. (Photo by Scott Heins/Getty Images)

Scott Heins | Getty Images News | Getty Images

Central banks have been keen to stress that interest rates are unlikely to start falling any time soon. The European Central Bank reiterated the point Thursday, holding rates steady at a record high of 4%, while the U.S. Federal Reserve is expected to hold at 5.25%-5.50% next week.

Neuhauser said these higher rates will weigh heavily on consumers and corporates.

“I think that’s going to cause a lot of pressure on the credit markets, it’s going to cause a lot of pressure on the consumer going forward,” he said.

Corporates, too, are set to come under pressure from high debt and refinancing costs, Neuhauser said.

“Ultimately that will lead to the downtrend of the economy and also it’s going to hurt the stock market and you’re starting to see that today,” he added.

Opinion: Stock market’s decline is just beginning, this top fund manager says

If August’s stock-market weakness has you concerned, brace yourself because it’s going to get a lot worse.

That’s the outlook of Eli Salzmann, who manages the Neuberger Berman Large Cap Value Fund NPRTX. While most investors have migrated to the “soft landing” and “no landing” camps, Salzmann holds steadfast to his belief that a recession is on the way.

Why should you care what he thinks? Because where most mutual fund managers have a tough time beating the U.S. market, Salzmann’s $12.6 billion fund outperforms nicely over the past three- and 10 years, according to Morningstar Direct.

Much of that long-term outperformance comes from out-of-consensus forecasts about macro trends — like the one behind his current cautionary stance.

“The economy is heading south in the next six to nine months,” he told me in a recent interview. “Make sure your portfolio is very defensive and protects on the downside, because the downside isn’t going to be pretty.”

If you are looking for defensive names to consider, here’s how Salzmann is positioned for what he expects will play out.

Top holdings include “steady Eddie” consumer staples names including Procter & Gamble

PG,

PepsiCo

PEP,

Philip Morris International

PM

and beverage and snack giant Mondelez International

MDLZ.

The fund also has substantial positions in utilities including Duke Energy

DUK,

Sempra

SRE

and Exelon

EXC,

and mature healthcare giants Johnson & Johnson

JNJ,

Merck

MRK

and Pfizer

PFE.

Salzmann recently had 18.8% of the fund’s portfolio in consumer defensive names, compared to 8.6% for large-cap value funds overall, according to Morningstar Direct.

Likewise, the fund manager is underweighting cyclical sectors like banks, technology, and consumer discretionary companies in the portfolio. For example, he has 2.6% of his fund in tech vs. 12.5% for large cap value overall, Morningstar reports.

This defensive posture has decidedly hurt the fund so far this year — when the crowd moved into cyclical sectors as worries about recession eased. Salzmann’s fund trails both the Morningstar large-cap value category and Morningstar U.S. large-cap value index. But he’s not throwing in the towel.

“Do we think it is time to cave in and go with everyone else? No. We are staying where we are,” Eli Salzmann says. “There are times when you want to bet against consensus, and now is one of those times. We think being defensive is absolutely the right move.”

Salzmann’s cautious economic outlook and defensive posture are based on three core concepts that reformed bears largely abandoned this year.

1. Monetary policy takes around 18 months to impact the economy — and it’s about to hit: Since the Federal Reserve raised rates aggressively in the first part of 2022, that means the U.S. central bank’s policy change is only now going to start hitting the economy. “At some point past September, leading indicators will have tough time,” Salzmann says. Likewise, tighter monetary policy takes about 24 months to hurt company earnings. He adds: “At some point later this year or next year you will see companies miss earnings in a big way.”

The important wrinkle here is that investors consistently forget about this time lag, and shrug off a dramatic monetary policy change. “When the economy did not slow in a substantial way towards the end of last year everybody said it’s time to go back in the water. Guess what. The sharks are still there.”

“ ‘What happened with the banking sector was simply the appetizer.’”

— Eli Salzmann

For example, Salzmann expects more trouble in the U.S. banking sector, in part because of exposure to commercial real estate loans. But he expects problems beyond that, as the aggressive Fed rate policy inevitably “breaks” something.

“What happened with the banking sector was simply the appetizer. Other issues will come up,” Salzmann says. He doesn’t offer predictions about what the Fed will “break” next. Fair enough, because past Fed policy moves show the breakage happens in unexpected places — like Orange County, Calif. in the mid-1990s, or Lehman Brothers during the Great Financial Crisis.

2. The inverted yield curve continues to predict a recession: A lot of investors have written this forecast off, because the yield curve has been so wrong for so long. It has been inverted for 11 months. “People on Wall Street are saying the saying yield curve does not matter. I have heard this rhetoric before, but it has a 100% success rate,” he says. “100% of the time when the yield curve has been inverted for this length of time there is a recession.”

3. Inflation will be higher for longer: “We are not going back to 2% or below on a sustained basis. We think inflation will be in the 3% to 4% range,” Salzmann says. He cites the decline in globalization, which removes the downward pressure on U.S. prices exerted by lower production costs in China and India. If he’s right, both the U.S. economy and cyclical stocks will face challenges because the Fed will have to maintain its anti-inflation campaign.

The bottom line: Despite rosy metrics out there like the Atlanta Fed GDPNow expected 5% third quarter growth, Salzmann thinks we are moving into the late stage of the cycle where the economy moves towards a recession — and when defensive names outperform.

Salzmann has benefited from contrarian calls in the past, albeit in the opposite direction — or towards cyclical names and away from defensives. In both 2016 and the first half 2020 he went long cyclicals at a time when other investors moved to defensive names because of worries about global recession.

Stock-picking tactics

Making the right contrarian macro calls is only part of the challenge for portfolio managers. They also have to be in the right stocks to benefit from their calls. Salzmann shares two tactics he says contribute to his fund’s success.

1. Favor sectors where capacity is scarce because they have been deprived of capital: The capacity shortage means surviving companies in the space can enjoy higher profit margins because they have fewer competitors.

Here, Salzmann cites basic materials, where he owns an array of mining companies including Newmont

NEM,

Rio Tinto

RTNTF,

Wheaton Precious Metals

WPM,

Franco-Nevada

FNV,

Freeport-McMoRan

FCX

), Mosaic

MOS

and Barrick Gold

GOLD.

Around 9% of the fund’s portfolio recently was in such basic-materials stocks, compared to 3.6% for large cap value funds overall, Morningstar says.

Energy is the other sector where capacity is scarce because of underinvestment. Global oil investment was 40% lower last year than in 2014, says Goldman Sachs analyst Bruce Callum — part of an underinvestment trend that has gone on for years. In energy, Salzmann’s fund has taken big positions in Exxon Mobil

XOM

and Chevron

CVX.

2. Favor companies that look cheap against normalized earnings: Many stock investors take the easy way out and value stocks against Wall Street consensus earnings forecasts. It’s better to do the legwork and recognize when earnings are temporarily suppressed — and about to bound back to normal. This helps you find the really cheap stocks with better potential. “We look for companies with below-normal returns that have catalysts over the next 12 to 18 months,” Salzmann says.

Consider Procter & Gamble as a mini-case study. Financial databases typical show the stock has a forward price-earnings multiple of about 24. That does not look cheap. But those consensus earnings estimates are too low, Salzmann says. The company has been investing in new product development and automation. “So, earnings are below normal,” he adds.

Investors will see a boost in earnings due to market-share gains and profit margin improvement linked to productivity gains because of these investments, Salzmann says. Incorporating these anticipated earnings gains, Procter & Gamble trades at 19 times Salzmann’s expected normalized earnings, which are considerably higher than consensus earnings expectations. “On the surface, Procter & Gamble does not look that cheap,” he says. “But it is cheaper than it looks because earnings are well below normal.”

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned FCX and XOM. Brush has suggested PM, JNJ, PFE, FCX, MOS, XOM and CVX and in his stock newsletter, Brush Up on Stocks. Follow him on X (formerly Twitter) @mbrushstocks

More: Rising yields put S&P 500 on pace for biggest monthly loss of 2023 as investors brace for Fed Chair Powell’s Jackson Hole speech

Also read: Will August’sstock-market stumble turn into a rout? Here’s what to watch, says Fundstrat’s Tom Lee.

Tokenized asset firm Securitize continues expanding investor access to private market alternative assets by acquiring the cryptocurrency fund manager Onramp Invest, which has over $40 billion in assets under management (AUM).

Securitize is planning to simplify the access of registered investment advisers (RIA) to private equity, private credit and secondary asset classes with the acquisition of Onramp.

A spokesperson for Securitize declined to disclose the acquisition’s costs to Cointelegraph. At the time of the transaction, Securitize had 150 employees, while Onramp’s headcount is 18 people, the representative noted.

The acquisition brings more than $40 billion in combined assets, which the Onramp platform handles for a community of RIAs across the United States. Onramp’s customer base features some prominent firms in the crypto industry, including asset managers WisdomTree and Valkyrie Invest, exchange-traded fund provider Global X, and crypto media outlet Coindesk — among others.

As a result of the acquisition, RIAs can offer their clients investments in alternative asset classes like private equity, private credit and real estate via Onramp Invest’s dashboard. According to the announcement, Securitize will increase and diversify the investments available to RIAs by giving them direct access to its alternative investment portfolio.

“Onramp already offered RIAs easy access to digital assets, so it is a very natural extension to offer them tokenized alternative assets to complement their portfolios,” Securitize CEO Carlos Domingo said, adding:

“Most wealth is generated in private market alternative assets, and bringing Securitize and Onramp together enables registered investment advisers to give their clients access to that wealth generation.”

The latest acquisition builds on a previous partnership between Securitize and Onramp, announced in March 2023. The partnership was focused on distributed access to tokenized private equity funds from investment firms like Hamilton Lane. At the time, Onramp’s platform had RIA firms with a combined AUM of over $35 billion.

Related: ‘XRP is not a security. Period’ — Crypto lawyers on Ripple’s case amid SEC appeal

The news comes soon after Securitize started tokenizing equity in the Spanish real estate investment trust Mancipi Partners in June. The firm expects to launch secondary trading on the Avalanche blockchain in September.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Big Questions: Did the NSA create Bitcoin?