In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

Source link

Market

Digital Renaissance: Global Market of Artification Brings Rubens and Rembrandt Artworks to Global Blockchain Show

PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

PRESS RELEASE. Dubai, April 12, 2024: The Global Blockchain Show is pleased to announce Global Market of Artification (GMA) as its diamond sponsor at the upcoming two-day conference, set to take place at the Grand Hyatt, Dubai. Artworks by renowned masters like Rubens and Rembrandt will be featured at the event. With the inclusion of […]

Source link

Bitcoin is now hovering around the $70,000 threshold after a notable recovery it witnessed a few days ago. Due to the recent momentum, crypto enthusiasts are becoming less pessimistic about the digital asset’s growth prior to the halving event. With the fast approaching much-anticipated Bitcoin Halving, Rekt Capital, a well-recognized cryptocurrency analyst and aficionado, has offered his market insights mapping out three distinct stages of the event for investors.

3 Distinct Aspects Of The Bitcoin Halving

Rekt Capital’s analysis delves into Bitcoin‘s movement before and after the halving takes place, which is expected to happen this month. In the seven days leading up to the occurrence, the crypto analyst underscored three stages to observe for a successful outcome.

These three phases include the final pre-halving retrace, the re-accumulation phase, and the parabolic uptrend phase. Emphasizing on the first aspect, Rekt Capital noted that the pre-halving retrace is documented in the books and has already manifested.

During this period, Bitcoin experienced an 18% pullback compared to 2016 and 2020’s retracement of 38% and 19%, respectively. The expert believes that the concluded pre-halving Retrace was the last chance to purchase a deal during the pre-halving phase.

Following the conclusion of the retrace, Rekt Capital has confirmed the development has laid the groundwork for the Re-accumulation range. It is important to note that the aforementioned range occurs a few weeks ahead of the halving, and it ends with a breakout from it a few weeks later.

Specifically, the period could last for several weeks and up to 150 days or five months. Given the manifestation of the range, sideways movement through the halving and beyond is the major purpose of BTC.

Thus, the analyst has stressed the need to be patient around this phase, as many investors get frustrated, bored, and disappointed here because their Bitcoin investments lack significant returns. As a result, they lose confidence and get shaken out of the market before the event.

BTC’s Post-Halving Rally Might Mirror Previous Trend

As for the parabolic uptrend, Rekt Capital claims the phase will begin when Bitcoin breaks out from the re-accumulation range. He further stated that the price of BTC tends to grow more quickly and enters a parabolic upsurge during this stage.

According to the expert, this area has typically lasted about a year or a little more, particularly around 385 days in the past. However, with the possible accelerated cycle that is currently in development, the period could be halved within this bull market cycle.

Rekt Capital’s key perspectives came amidst Bitcoin demonstrating strength to revisit its current all-time high of $73,000. BTC has managed to amass gains of more than 6% in the past few days.

It recovered to the $70,000 level after plunging as low as $67,000 on Wednesday and is getting close to $71,000. At the time of writing, BTC was trading at $70,854, indicating over 6% increase in the past week.

Its market capitalization is up by 1% and its trading volume has plummeted by more than 21% over the past day. Given the current trend in the coin market, BTC could be in a position to see even bigger gains in the months to come.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Costco is selling lots of gold; should you be buying? How this gold rush impacts the market

Costco’s decision to sell precious metals has brought it golden buzz.

A Wells Fargo report stated that the bank’s analysts believe that the warehouse retail giant is selling between $100 million to $200 million in gold per month.

Wells Fargo suggested that the precious metal offering was a way to add value to the company’s brand noting that “it’s a very low-profit business at best.”

“We view the addition of gold/silver as a smart move for Costco, as it only reinforces its value position,” the report said.

The buzz around Costco’s offering has led to increased interest in investing in the metal, according to Zachary Scott, general manager of Wilshire Coin in Santa Monica, Calif. Scott said that he is seeing customers who are “less than typical” brought in after seeing gold being sold by “a trusted company.”

“It’s bringing in new buyers and interest, though not in massive amounts, who have seen the articles around Costco selling gold,” Scott said.

How much gold is Costco selling?

Using the estimates from the Wells Fargo report and an approximate price of $2,000 Costco sells between 50,000 and 100,000 ounces of gold per month.

USA TODAY reached out to Costco to inquire about the volume of gold it has sold and did not receive a response.

Gold prices since Costco started selling

After Costco introduced the 1 oz. gold bars to its website last October the spot price of the metal held steady around $2,000 until an upswing that started in February.

The metal made a run at the start of March that stabilized around the $2,175 mark in the middle of the month. Gold is experiencing another breakout that started at the end of March and has continued.

The spot price of the metal was $2,341.35 as of 9 a.m. ET Thursday, April 11.

Should someone buy gold?

Whether it’s a good time to buy gold depends on various factors, including your investment goals, risk tolerance and time horizon, the broader economic outlook, and forecasts about the gold market.

Historically, many people view gold as a hedge against inflation and currency fluctuations. Others see it as a store of value during economic downturns. At the same time, some may find diversifying a portfolio of stocks and bonds useful, given its low correlation to both assets.

“If you look at gold’s performance historically, it’s the kind of asset that should perform well through uncertainty, as it has done in five out of the last seven recessions,” said Joseph Cavatoni, chief market strategist for North America at the World Gold Council. “For people looking for a store of value and a portfolio diversifier, gold has a strong track record of delivering those qualities.”

Contributing: Tony Dong and Farran Powel USA TODAY Blueprint

This article originally appeared on USA TODAY: Costco gold sales increase interest in metal but doesn’t move market

South Korea’s Crypto Market Continues to Defy Global Trends With Premium Prices

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

Bitcoin NFT Market Thrives, Franklin Templeton Remains Bullish, Binance Ends Support

Franklin Templeton’s digital assets division has released a note to its investors introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in activity within the Bitcoin ecosystem.

The asset manager attributes this increased momentum to various factors, including the emergence of Bitcoin (BTC) NFTs called Ordinals, the development of new fungible standards like BRC-20 and Runes, the growth of Bitcoin Layer 2 (L2s) solutions, and the expansion of decentralized finance (DeFi) applications built on the Bitcoin network.

Bitcoin Ordinals Shine

According to the Bitcoin ETF issuer’s report, activity in the Bitcoin NFT space is gaining momentum. In particular, Ordinals have seen a significant increase in trading volume over the past few months.

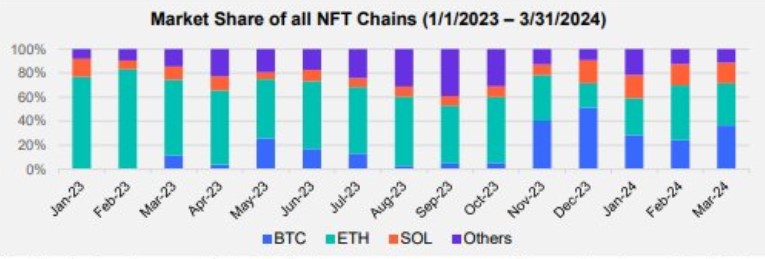

This growth is evident in Bitcoin’s dominance in terms of trading volume, which surpassed Ethereum (ETH) in December 2023, as shown in the accompanying chart.

In addition, several collections of Bitcoin Ordinals are emerging as dominant players in the NFT market, both in terms of trading volume and market capitalization.

These collections include NodeMonkes, Runestone, and Bitcoin Puppets, which have an aggregate market cap of $353 million, $339 million, and $168 million, respectively. They are the most notable collections.

In terms of trading volume over the past 30 days, the report shows that these three collections recorded trading volumes of $81 million, $85 million, and $38 million, respectively, over the past month.

The asset manager further claimed that what distinguishes BTC Ordinals from NFTs on other blockchains, such as Ethereum or Solana, is that they contain raw data recorded directly on the Bitcoin blockchain. This feature contributes to the attractiveness and growing popularity of Bitcoin Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market, was one of the issuers that launched a spot BTC ETF in the United States earlier this year. Its ETF, which trades under the ticker name “EZBC,” has seen total inflows of 281.8 million since its January 11 launch, according to BitMEX research data as of April 3.

Despite its zero-fee structure, Franklin Templeton’s ETF has seen a significant difference in flows compared to the leading players in the newly approved ETF market, such as Blackrock (IBIT) and Fidelity (FBTC), which have seen flows of over 14 billion and 7.7 billion, respectively.

Binance To Discontinue Support For BTC NFTs

In a recent blog post, crypto exchange Binance announced it would discontinue support for Bitcoin-based NFTs on its marketplace. Less than a year after their introduction, Binance will no longer facilitate airdrops, benefits, or utilities associated with BTC NFTs, citing a need to streamline its product offerings in the NFT space.

Binance states that users who own Bitcoin NFTs are advised to withdraw them from the Binance NFT marketplace via the Bitcoin network before May 18, 2024.

Effective April 18, 2024, users can no longer purchase, deposit, bid, or list NFTs via the BTC network on the Binance NFT Marketplace. Any existing listing orders affected by this change will be automatically canceled simultaneously.

Currently, BTC is trading at $68,300, up a modest 3% in the last 24 hours. It is approaching the significant milestone of $70,000, a level the cryptocurrency has struggled to maintain several times.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Expert Releases List Of Top 10 Altcoins To Buy For Maximum Profit In The Bull Market

Crypto expert Michaël van de Poppe has repeatedly stated that altcoins are still greatly undervalued heading into this bull run. Now, he has published a list of altcoins that he believes can provide investors with maximum returns.

Chainlink Is Top Of The List

In an X (formerly Twitter) post, Van de Poppe listed Chainlink (LINK) as the number one altcoin he believes has so much potential. He explained that Chainlink’s valuation is currently at a cycle low and has dropped by 40% since its recent peak. As such, this decline presents a “massive opportunity” since LINK is still likely to make more moves to the upside.

The second altcoin that Van de Poppe listed is Celestia (TIA). He noted that TIA is a relatively new project and would likely be a “massive gainer” in this market cycle. Considering that TIA is currently down 61% from its recent peak, the crypto expert claims this is a “giant opportunity” for those interested in investing in the token.

The third token on Van de Poppe’s list is Arbiturm (ARB). The crypto expert alluded to the massive ARB token unlock in March, which caused a lot of selling pressure. He also suggested that this is probably one of the reasons its valuation has dropped by 60% in the past month. However, he is bullish on Arbitrum as he considers the network a “strong Layer 2 Rollup system” and believes the ARB token could be one of the strongest gainers in this cycle.

Polkadot (DOT) is the next altcoin Van de Poppe mentioned. The analyst claims DOT’s valuation is still at a cycle low, which has opened up a “large opportunity” to invest in it. ATOM (Cosmos) is another altcoin that the crypto expert believes is still greatly undervalued and could provide significant returns for investors.

Other Altcoins On The List

Van de Poppe mentioned DYDX (DYDX) as another altcoin with great potential. He revealed that the crypto token is reaching a cycle-low level in the Bitcoin pair. He expects the token to make a significant move to the upside once it is done consolidating. The crypto expert also listed WooNetwork (WOO) as another DeFi token that is greatly undervalued.

Meanwhile, SEI (SEI), like TIA, is another relatively new project he believes will likely outperform other major crypto tokens in this upcoming cycle. He also acknowledged that newer coins also have the potential to enjoy more gains than tokens that have been around for a while.

Skale Network (SKL) and Covalent (CQT) completed Van de Poppe’s list of ten altcoins that he believes are undervalued and could do well in this bull run.

Total market cap trending at $2.4 trillion | Source: Crypto Total Market Cap on Tradingview.com

Featured image from Coinpedia, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow

Quick Take

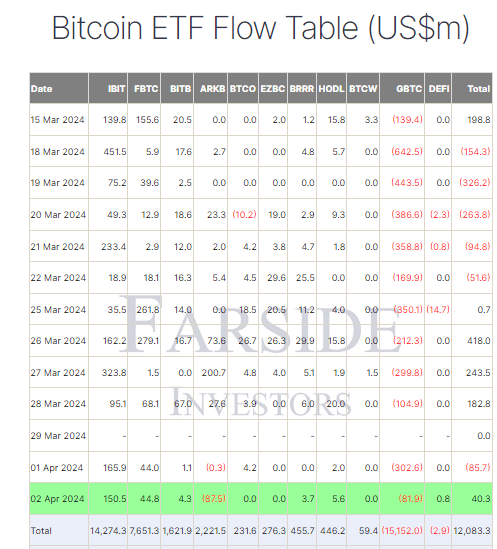

Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 2 experienced a moderate net inflow of $40.3 million, according to Farside data. Particularly noteworthy is the Grayscale Bitcoin Trust (GBTC), which saw a relatively smaller outflow of $81.9 million, signaling a significant slowdown from previous outflows. GBTC has now totaled $15,152.0 billion in net outflows.

Farside data reports that the ARK ETF (ARKB) recorded its largest single-day outflow of $87.5 million, yet it has accumulated total inflows of $2,221.5 billion. On the other hand, BlackRock’s (IBIT) Bitcoin ETF attracted a healthy inflow of $150.5 million, boosting its total net inflow to an impressive $14,274.3 billion. In a positive turn, the Hashdex Bitcoin ETF (DEFI) saw its first net inflow since Feb. 21 of $0.8 million, reducing its total outflows to just $2.9 million.

According to Farside data, cumulative net inflows across all Bitcoin ETFs now stand at $12,083.3 billion.

The post Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow appeared first on CryptoSlate.