The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

Massive

Quick Take

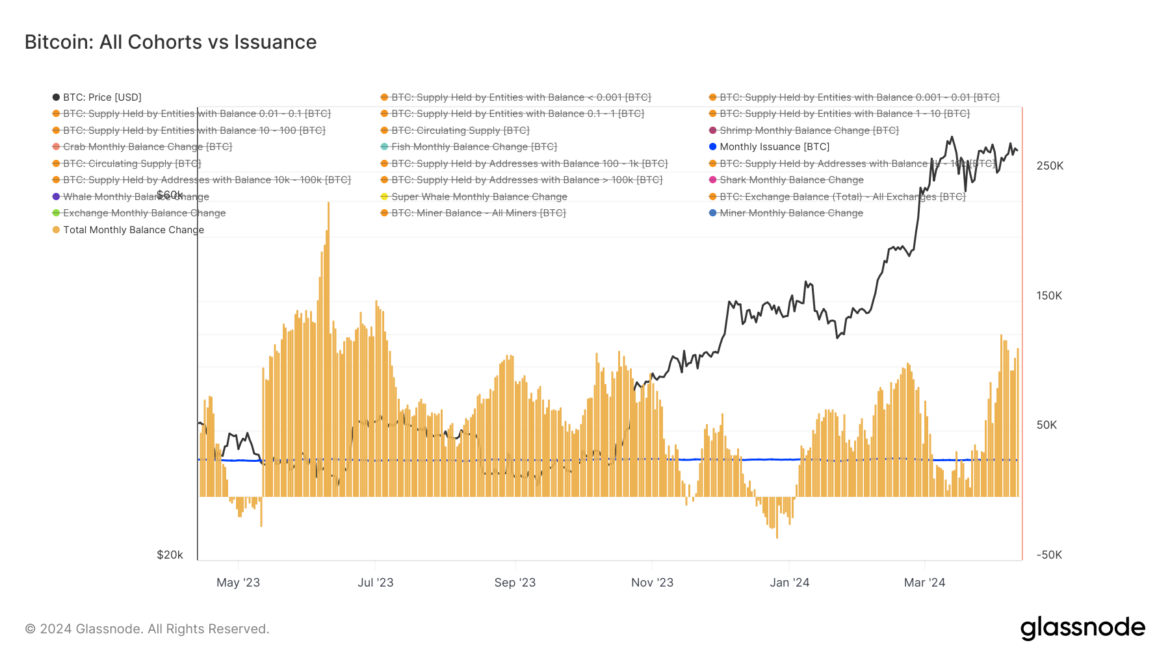

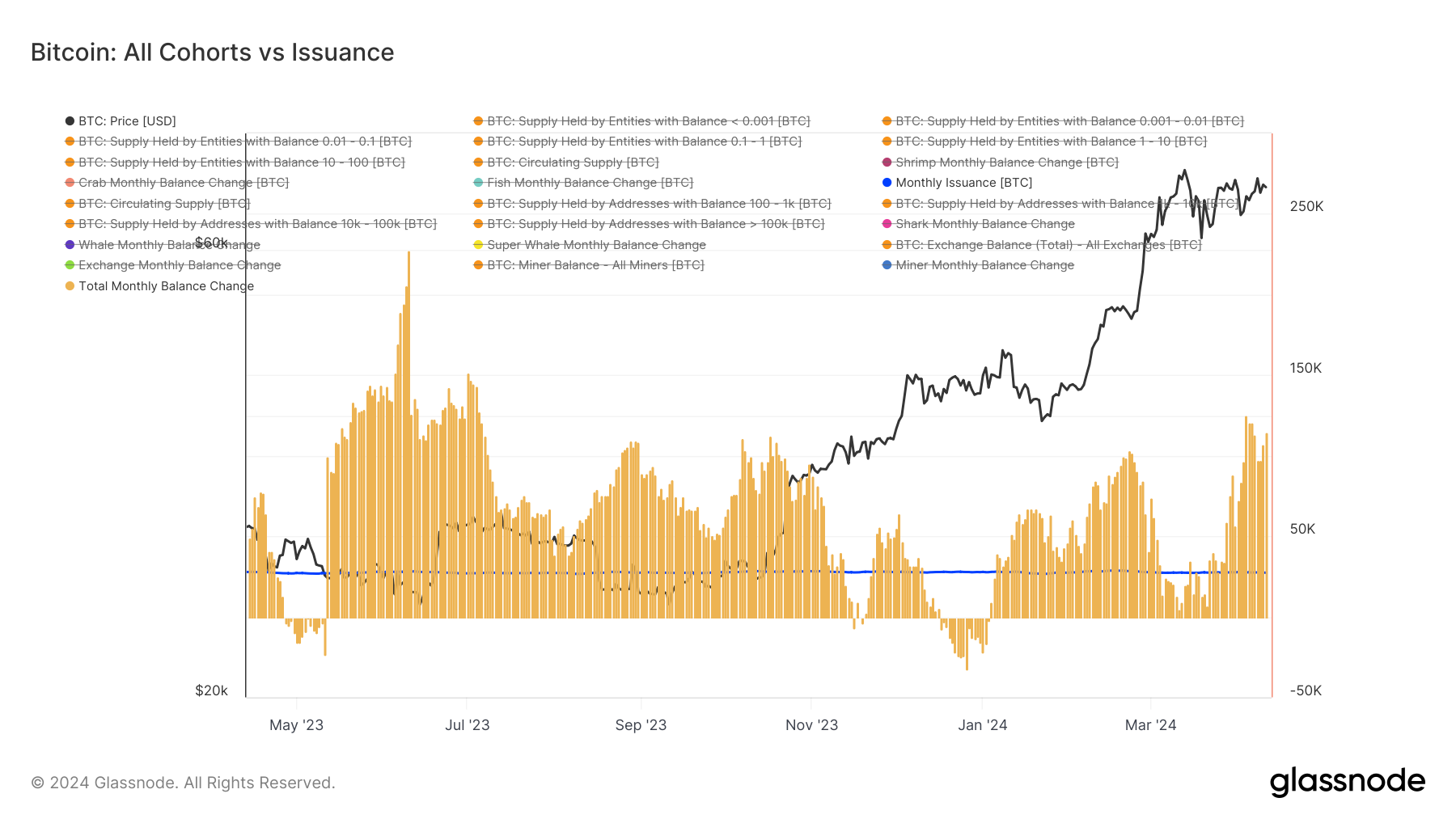

The aggregate accumulation by various Bitcoin cohorts, ranging from shrimps (holding less than one BTC) to super whales (10,000+ BTC), has surpassed the monthly issuance, painting a bullish picture for the future of BTC.

We are rapidly approaching the next Bitcoin (BTC) halving, with the event now just days away. Currently, around 900 BTC are mined daily, amounting to approximately 27,000 BTC per month. Amid this data, Glassnode reveals an astonishing accumulation of 115,000 BTC over the past 30 days, marking one of the most bullish periods in a year.

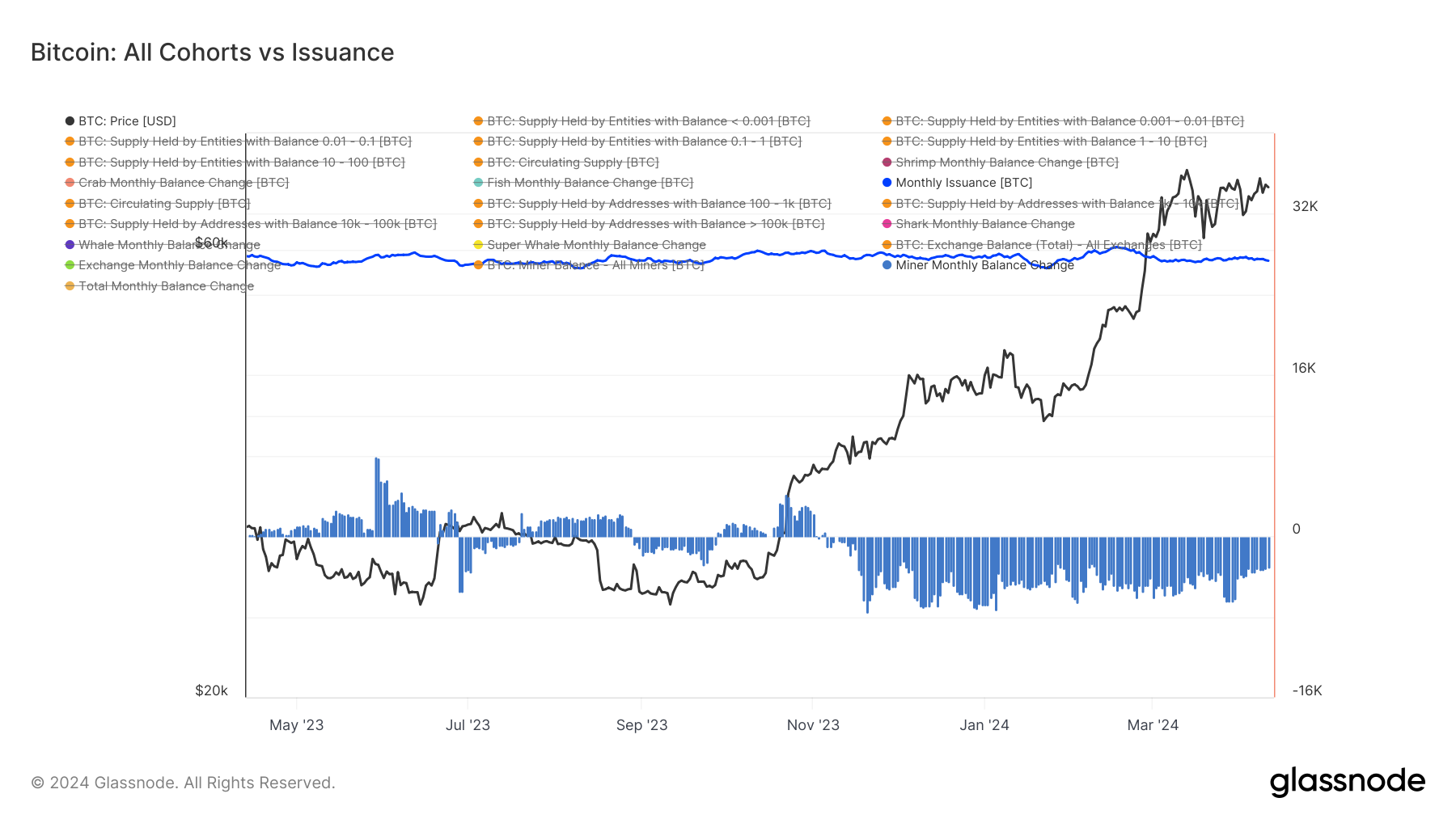

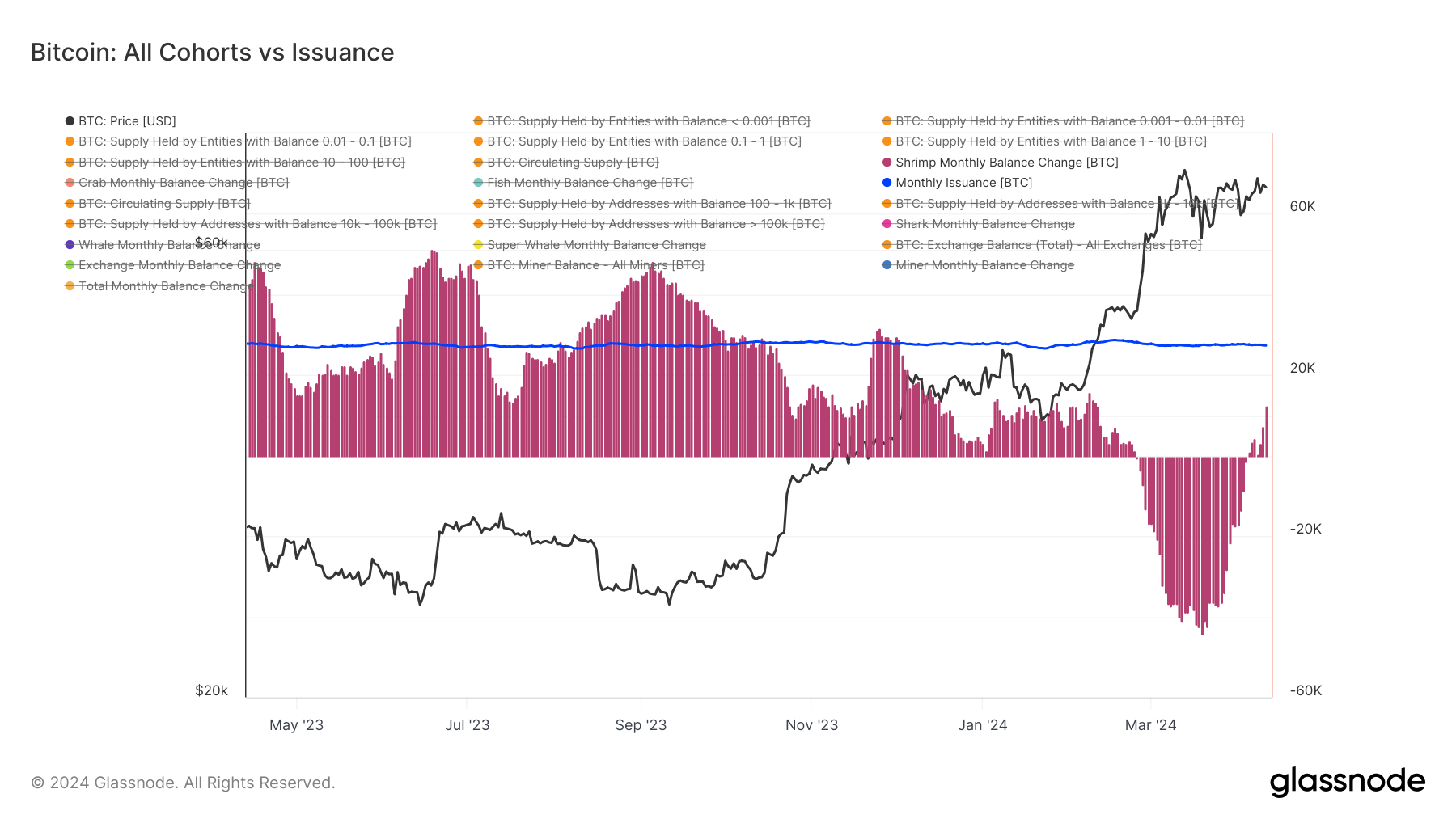

Interestingly, while miners have been continuously distributing since the end of 2023, shrimps are now accumulating for the first time since February, with a strong accumulation of roughly 12,500 BTC over the past 30 days.

As the halving looms closer, the monthly issuance is set to be cut in half to 13,500 BTC. This reduction in supply, coupled with the increasing demand outpacing the monthly issuance, sets the stage for an exciting Q2.

The post Bitcoin’s looming halving event prompts massive accumulation appeared first on CryptoSlate.

Crypto Experts Predict Massive Price Surge For XRP Price, Is $20 Possible?

Crypto experts continue to be bullish on the XRP price despite the poor performance that the altcoin has exhibited in recent times. Some of these experts see the cryptocurrency’s price rising higher from its current level, with one analyst expecting XRP to rise as high as $20 in the coming bull market.

XRP Price On The Verge Of Breakout

One of the crypto experts that has shown incredibly bullish sentiment toward the XRP price is Matthew Dixon, the CEO of crypto rating platform, Evai. Dixon took to X (formerly Twitter) to share with the crypto community that the XRP trading volume had been seeing positive headwinds in recent times.

At the time, the Evai chart shared by the the crypto CEO showed that XRP had recorded an approximately 42% increase in its daily trading volume to cross $2.1 billion. Using this increase in trading volume, Dixon believes that it shows the rising interest in the altcoin.

Naturally, increased interest often translates to increased demand, which can be bullish for a cryptocurrency’s price. This was the thought shared by the Evai CEO who believed the surge in trading volume and interest meant that the XRP price was on the verge of a breakout.

However, this does not seem to be the case, at least in the short term, since the XRP price continues to trend around the same level since Dixon first made the post. It is hovering around $0.61 at the time of this writing, with a0.96% gain in the last 24 hours.

Can Price Get To $20?

Predictions for the XRP price going into the next bull market have had a wide variety, from very conservative to very ambitious. For many, though, the expectation is that the XRP price will rise very quickly as regulatory clarity from the Ripple vs SEC case is fast approaching.

Crypto analyst Armando Patoja takes the ambitious route with his own prediction, forecasting an over 3,000% price increase for XRP. According to Patoja, the predictions that put XRP’s future price at $5 severely underestimate the ability of the altcoin.

On his own, the crypto analyst believes that the XRP price has the potential to rise even further to reach between $10 to $20. Patoja posits that saying XRP will reach just $5 is like expecting Bitcoin to top out at $1,000 in 2015.

There people saying #XRP will reach $5 are significantly underestimating.

This is similar to predicting #Bitcoin would cap at $1,000 in 2015. XRP is on a trajectory akin to Bitcoin’s in 2015, with a rapidly growing network effect.$XRP prediction: $10-$20. Thoughts?

— Armando Pantoja (@_TallGuyTycoon) April 6, 2024

Despite the growing XRP community, it is no doubt that Patoja’s prediction has been received with a grain of salt. One community member responded to the post saying XRP could not possibly rise that high because major projects who were building on the XRP Ledger have been abandoning it for other chains because it is a dead chain. Due to the lack of builders, they do not believe that XRP has the steam to run that high.

XRP trading at $0.61 | Source: XRPUSDT on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

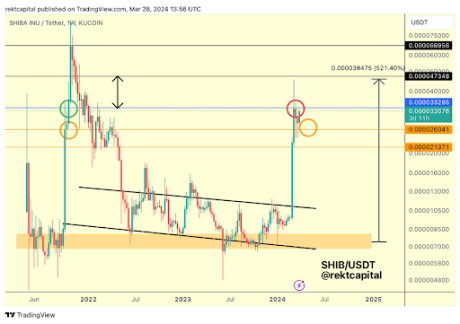

Crypto expert Rekt Capital has suggested that Shiba Inu (SHIB) could follow a similar trajectory to its move back in 2021. If so, this sets up the crypto token for a parabolic move that could see it hit its all-time high (ATH) and even surpass it.

2024 Shiba Inu To Mirror 2021 Action

Rekt Capital mentioned in an X (formerly Twitter) post that SHIB’s retest was successful and that history was repeating itself. According to him, SHIB needs to break above the $0.000033285 price range to begin its uptrend continuation. In a previous post, the crypto analyst raised the possibility of SHIB’s price action mirroring the one from 2021.

He noted how SHIB came close to that price range but couldn’t break this resistance level. This was the same thing in late 2021, as Shiba Inu didn’t break that resistance level on the first attempt. That forced the meme coin to retest the $0.000026041 price level as a new support before confirming further upside.

Source: X

This time, Shiba Inu also retested that $0.000026041 price level during its recent price dip, which was partly caused by a wave of profit-taking. The meme coin showed great resolve and somehow managed to hold above that level, and it has since made a good recovery.

Now, it needs to break above the $0.000033285 price range to confirm that history is repeating itself and that a price surge to the one in 2021 is on the horizon. 2021 was SHIB’s breakout year when it enjoyed a mouth-watering gain of 46,000,000% on its way to an ATH of $0.00008845 in October 2021.

Analysts Optimistic About Shiba Inu’s Future Trajectory

Rekt Capital isn’t the only one optimistic about SHIB’s future trajectory. Crypto analyst and trader Xanrox recently predicted that SHIB could rise to $0.00008854 by July, representing a new ATH for the meme coin. Interestingly, that looks to be only the starting point for the meme coin, as other analysts have predicted that SHIB could shed another zero.

One of them is crypto investor and analyst Oscar Ramos, who expressed his bullish sentiment about the meme coin when he predicted it could rise to $0.0001. Technical analyst Javon Marks also echoed similar sentiments when he suggested that SHIB could rise to as high as $0.0001553.

Meanwhile, crypto analyst Ali Martinez once suggested that SHIB’s price gain in 2021 could be nothing compared to what lies ahead for the meme coin. Specifically, Martinez predicted that Shiba Inu could see a historic 122,000% price surge to $0.011.

At the time of writing, SHIB is trading around $0.00003116, up over 3% in the last 24 hours according to data from CoinMarketCap.

SHIB price at $0.00003 | Source: SHIBUSDT on Tradingview.com

Featured image from Coinpedia, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In this video, I will cover the recent updates regarding Palantir (NYSE: PLTR).

*Stock prices used were from the trading day of March 28, 2024. The video was published on March 29, 2024.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Neil Rozenbaum has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy. Neil is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

Massive News for Palantir Stock Investors was originally published by The Motley Fool

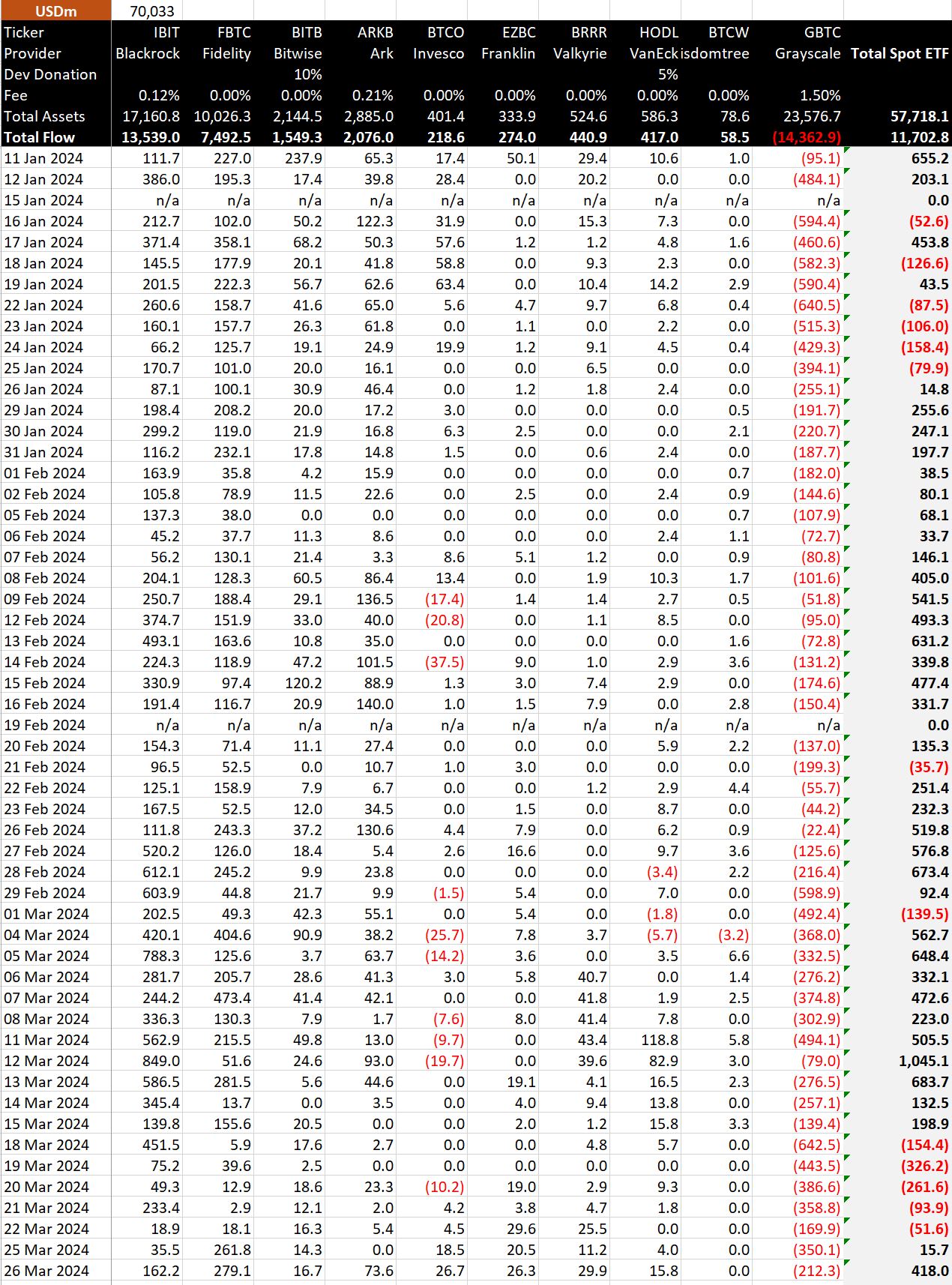

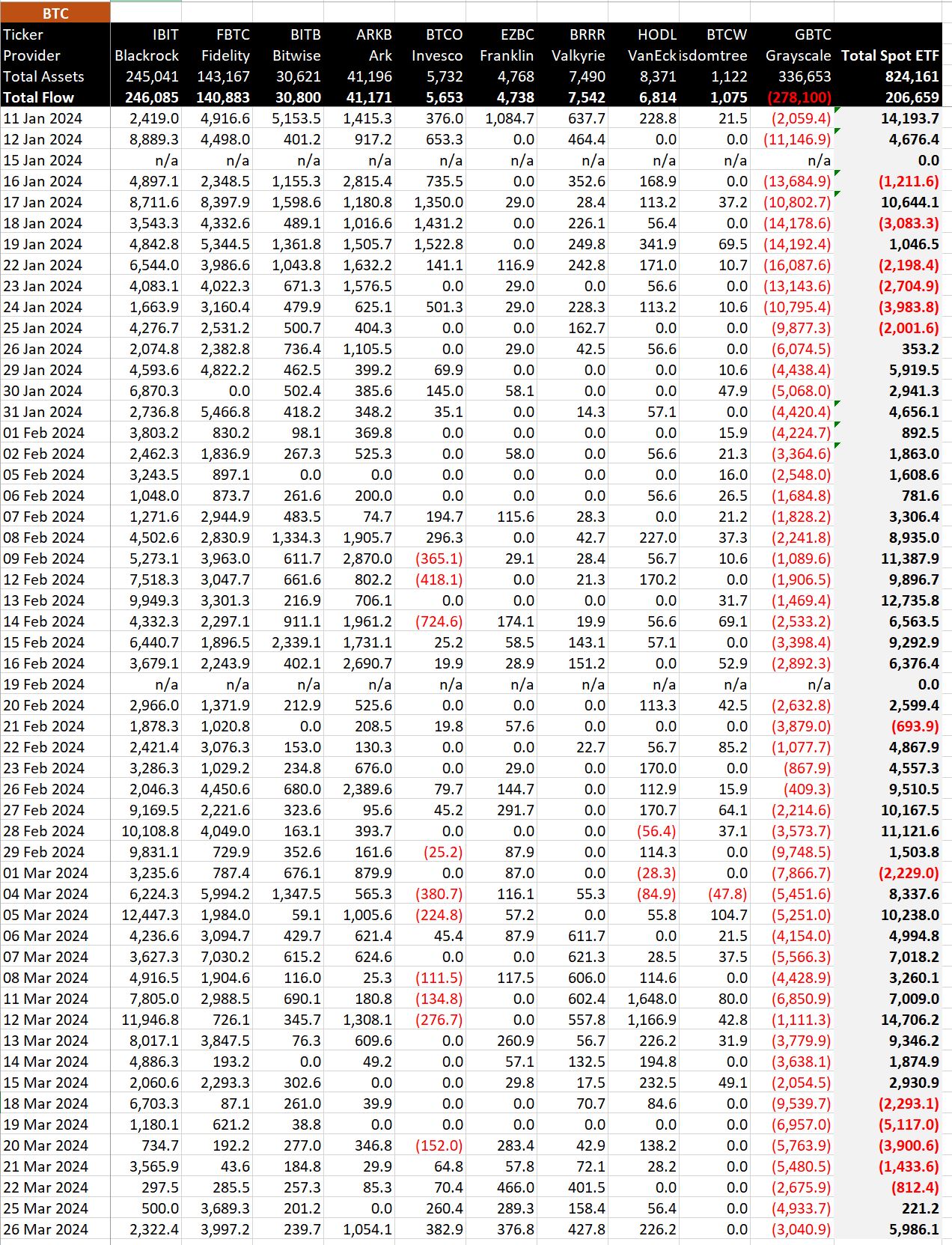

Quick Take

BitMEX’s recent data highlights a substantial inflow in Bitcoin (BTC) Exchange-Traded Funds (ETFs), showcasing their most significant day of inflows since March 13, with a total of $418.0 million, equivalent to 5,986.1 BTC. Notably, Fidelity’s FBTC ETF led the surge with an exceptional $279.1 million in net inflows, equivalent to 3,997.2 BTC, maintaining its strong sequence of consecutive inflow days. This increase has elevated their total net inflows to an impressive $7,492.5 billion, translating to 140,883 BTC.

BitMEX’s data reveals that BlackRock’s IBIT also experienced a solid inflow of $162.2 million, equal to 2,322.4 BTC, marking its best performance since March 21. This contribution boosted their total net inflows to $13,539 billion, corresponding to 246,085 BTC. Conversely, GBTC faced substantial outflows amounting to $212.3 million, or 3,040.9 BTC, leading to a cumulative net outflow of $14,362.9 billion and a net loss of 278,100 BTC.

Following five outflow data, the Bitcoin ETF sector continues a robust influx, with total net inflows reaching $11,702.8 billion, equivalent to a significant 206,659 BTC this year.

The post Fidelity and BlackRock ETFs lead massive Bitcoin inflow day appeared first on CryptoSlate.

Massive Bitcoin Shift: $6B Moved as 5th Largest BTC Wallet Reactivates After Years of Dormancy

This week, blockchain observers noticed that the “37X” wallet, once holding the title of the fifth-largest bitcoin wallet, was activated for the first time since 2019. This significant move involved the transfer of 94,504.03 bitcoin into three distinct addresses. One of these recipient wallets has now risen to become the sixth-largest bitcoin holder, showcasing a […]

This week, blockchain observers noticed that the “37X” wallet, once holding the title of the fifth-largest bitcoin wallet, was activated for the first time since 2019. This significant move involved the transfer of 94,504.03 bitcoin into three distinct addresses. One of these recipient wallets has now risen to become the sixth-largest bitcoin holder, showcasing a […]

Source link

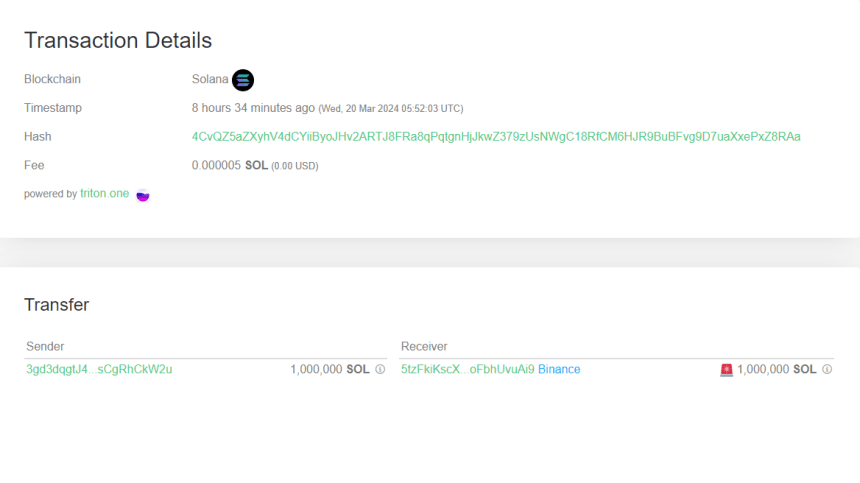

Solana Whale Makes Massive 1,000,000 SOL Deposit To Binance, Bearish Sign?

On-chain data shows a Solana whale has just moved a massive SOL stack to Binance, which could prove to be bearish for the asset’s price.

Solana Whale Has Deposited 1 Million SOL To Binance Today

According to data from the cryptocurrency transaction tracker service Whale Alert, several large SOL transactions have occurred on the blockchain during the past day.

More specifically, six massive transfers have been spotted on the network. Out of these, two transactions were gigantic, with tokens worth $362 million and $498 million involved.

These extraordinary transfers, though, were both between unknown wallets. Addresses like these are those unattached to any known centralized exchange, so they are usually the users’ personal, self-custodial wallets.

Due to this, transfers between unknown wallets are generally hard to say anything about. Often, they can be as simple as the investor moving to a fresh wallet, which is naturally of no particular consequence for the wider market.

The other four whale transactions from the past day, however, did involve central entities on one end, so speculation around them can have a bit more ground to stand on.

Out of these four, one transaction in particular stands out. In this move, a whale shifted 1 million SOL on the network, worth more than $166 million at the transfer time. Below are some additional details regarding this transfer.

Looks like this massive move only required a negligible fee of 0.000005 SOL to go through | Source: Whale Alert

As is visible, the receiver in the case of this transaction was a wallet affiliated with the cryptocurrency exchange Binance, implying that the whale transferred coins from their address to the platform.

Such transactions are known as exchange inflows. Users make these transfers when they want to use one of the exchange services, which can include selling.

As such, exchange inflows may sometimes be bearish for the cryptocurrency. In particular, massive inflows made by the whales can exert some visible fluctuations on the market.

Just like this huge SOL transfer, the other three transactions mentioned before were also exchange inflows. They were significantly smaller in scale, though, with their average value being $33.2 million.

Two of these transactions also went to Binance, while the third (and the latest) headed to Coinbase. Interestingly, the address pairs in these two Binance transfers were the same, hinting that the same whale may have been responsible for them.

With the four exchange inflows, Solana, worth $265.6 million, has now found its way to exchanges. This is clearly a notable amount, so it may impact the asset’s price.

There is no guarantee, however, that any of the whales involved made these transactions for selling; it’s possible that they made the moves for some other purpose that’s not directly relevant to the market.

Although Solana has been sliding off over the past few days, the possibility of these whales deciding to exit certainly exists.

SOL Price

Following the recent drawdown Solana has seen, the asset’s price has come down to the $174 level.

The price of the asset appears to have gone through some drawdown recently | Source: SOLUSD on TradingView

Featured image from Rod Long on Unsplash.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Rogue trader crashes Bitcoin to $8900 on BitMEX in massive sell-off event

BitMEX is investigating an unusual activity involving “a user selling large orders” on its Bitcoin spot market.

Yesterday, several market observers identified a rogue seller who unloaded more than 400 BTC on the BitMEX exchange. This action resulted in the flagship digital asset crashing by 87% to as low as $8900 on the platform yesterday before correcting to the actual price.

BitMEX clarified that the event did not impact its derivative markets or index price. It added:

“This does not affect any of our derivative markets, nor the index price for our popular XBT derivatives contracts. The trading platform is operating as normal and all funds are safe.”

BTC faces further declines

Meanwhile, Bitcoin price faced further challenges today, dropping to around $63,000 in Asian trading hours after crashing by more than 6%. This decline was part of a broader market downturn that erased over $600 million from crypto futures traders.

Amid Bitcoin’s struggles, other major cryptocurrencies also suffered losses. Ethereum, Solana, BNB, Cardano, and Avalanche experienced more than 5% declines.

Some analysts see this dip as typical market behavior preceding the upcoming halving event. Crypto analyst Michaël van de Poppe observed a pattern mirroring previous halvings and suggested that Bitcoin price tends to peak about five weeks before the halving, which is then followed by a consolidation period and potential altcoin activity.

The eagerly awaited BTC halving event is set to occur on April 20, with fewer than 5,000 blocks remaining until the big day.

Price speculators lose $623 million.

The recent market downturn inflicted substantial losses on 240,000 crypto traders, tallying a staggering $623 million in just 24 hours.

According to Coinglass data, long traders bore the brunt of the losses, accounting for $516 million, while their short counterparts were liquidated for a modest $107 million.

Across assets, Bitcoin traders experienced liquidations of more than $150 million, followed by Ethereum traders with $106 million in losses.

The most significant liquidation order registered was a $12 million long position on Bitcoin, executed via the OKX crypto exchange.

The post Rogue trader crashes Bitcoin to $8900 on BitMEX in massive sell-off event appeared first on CryptoSlate.

Is Ripple Behind The XRP Price Crash? Massive Selling Spree Sparks Concern

Ripple’s occasional sale of XRP tokens has always been pinpointed as one reason for XRP’s tepid price action. Once again, the crypto firm’s recent offloading of a significant amount of XRP has raised concerns about its negative effect on the crypto token.

Ripple Offloads 240 Million XRP

On-chain data shows that Ripple transferred a total of 240 million XRP tokens to an unknown address in two separate transactions. The first transaction occurred on March 5, when it sent 100 million XRP to the address in question. Then, on March 13, the Ripple wallet again transferred 140 million XRP to this address.

These transactions have raised eyebrows, and members of the XRP community are contemplating whether these sales might have been the reason XRP’s price crashed recently. Notably, the crypto token rose to as high as $0.74 on March 11 before seeing a sharp correction.

It is worth mentioning that XRP’s price crashed on March 5, the day the first transaction was carried out. Data from CoinMarketCap shows that the crypto token, which was trading as high as $0.65 on the day, dropped to as low as $0.55 on the same day. However, it remains uncertain whether or not Ripple’s action was directly responsible for this price dip.

Meanwhile, XRP’s price was pretty stable on the day the second transaction occurred, although it was still declining from its weekly high of $0.7, recorded on March 11. The impact of Ripple’s XRP sales on the market continues to be heavily debated among those in the XRP community.

Pro-XRP crypto YouTuber Jerry Hall previously claimed that Ripple was suppressing XRP’s price with its monthly sales. However, there has also been a report that Ripple’s sale doesn’t impact prices on crypto exchanges.

If Not Ripple, Then Who?

Ripple’s price action defies logic, especially considering that the token’s fundamentals and technical analysis suggest it is well primed for a parabolic move. That is why talks about possible market manipulation continue to persist. It is also understandable that all fingers instantly point to Ripple since they are the largest XRP holders.

However, if Ripple is indeed not responsible for XRP’s stagnant price action, then there needs to be another explanation for why XRP has continued to underperform. Although the crypto token has continued to rank in the top 10 largest crypto tokens by market cap, it is worth mentioning that it is one of few tokens that has a negative year-to-date (YTD) gain.

At the time of writing, XRP is trading at around $0.61, up in the last 24 hours according to data from CoinMarketCap.

Token price at $0.6 | Source: XRPUSDT on Tradingview.com

Featured image from BitIRA, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.