According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

According to the latest figures, Microstrategy’s investment in bitcoin has doubled, showing a 116% increase after the cryptocurrency’s value experienced a significant rise this past week. The company, specializing in business intelligence, has acquired a total of 193,000 bitcoins at an expenditure of $6.122 billion, with the current market value of their holdings soaring to […]

Source link

MicroStrategys

MicroStrategy’s stock sinks after plan to offer convertible debt to buy bitcoin

Shares of MicroStrategy Inc. slumped Tuesday, as the business-analytics software company and bitcoin play’s plan to offer convertible debt gave investors a reason to take a breather following the stock’s recent sprint to a 24-year high.

Also weighing on MicroStrategy’s stock

MSTR,

bitcoin dropped 1.5%, after rallying into record territory earlier in the session. That followed a 34% run-up in bitcoin

BTCUSD,

over the previous six sessions.

MicroStrategy said late Monday that the $600 million in senior notes due 2030 it plans to offer can be converted into shares of common stock, cash or a combination of both.

The notes will be part of a private offering, in which only people believed to be “qualified institutional buyers” can participate.

“MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes,” the company stated.

The stock sank 10.5% in morning trading, after closing Monday at the highest price since March 17, 2000. That puts the stock in danger of suffering its biggest one-day selloff since it tumbled 19.6% on Nov. 9, 2022.

The pullback comes after the stock rocketed 94.1% amid a six-day win streak, which was the longest win streak in four months and the biggest six-day gain in three years.

Read: MicroStrategy stock rises 24% — tops $1,300 for first time in 24 years as bitcoin soars.

MicroStrategy’s market capitalization ballooned by about $11 billion over the past six days, to $22.6 billion at Monday’s close.

The company said in its annual report filed in February that as of Dec. 31, it had $2.21 billion in debt.

S&P Global Ratings rates MicroStrategy’s credit at CCC+, which is seven-notches deep into speculative grade, or “junk,” territory.

The company said the interest rate, conversion price and other items related to the latest debt offering will be determined when it prices, which is still unknown.

MicroStrategy’s stock has hiked up 89%, while bitcoin has climbed 59.5%, the SPDR S&P Software & Services ETF

XSW

has slipped 0.9% and the S&P 500 index

SPX

has gained 6.6%.

Microstrategy’s Bitcoin Investment Flourishes, Valued at Nearly $10 Billion

Based on the latest available data, the Nasdaq-traded Microstrategy possesses 190,000 bitcoins, acquired at a cost of $5.96 billion. Presently, the value of the company’s bitcoin holdings has swelled to $9.88 billion. This marks a 66% increase in the firm’s bitcoin portfolio, a stark contrast to its performance just eight months earlier. From Decline to […]

Based on the latest available data, the Nasdaq-traded Microstrategy possesses 190,000 bitcoins, acquired at a cost of $5.96 billion. Presently, the value of the company’s bitcoin holdings has swelled to $9.88 billion. This marks a 66% increase in the firm’s bitcoin portfolio, a stark contrast to its performance just eight months earlier. From Decline to […]

Source link

MicroStrategy’s leverage scenarios show potential for astronomical returns on Bitcoin investments

Quick Take

In its Q4 earnings report, MicroStrategy disclosed its substantial Bitcoin investment in Q4 2023 of $1.25 billion, which is now worth a staggering $8 billion. The firm holds 190,000 BTC in its corporate treasury.

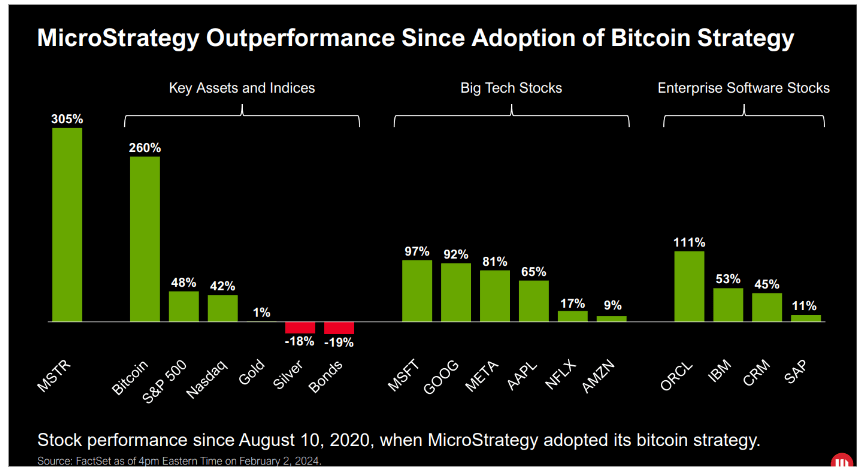

MicroStrategy’s Q4 2023 Earnings Presentation shows that this strategic decision has paid dividends, as its stock has surged by 305% since it started investing in Bitcoin in August 2020. For comparison, Bitcoin itself saw an increase of 260% during the same period, while more traditional assets lagged behind, with the S&P 500 and gold only increasing by 48% and 1%, respectively, according to MicroStrategy data.

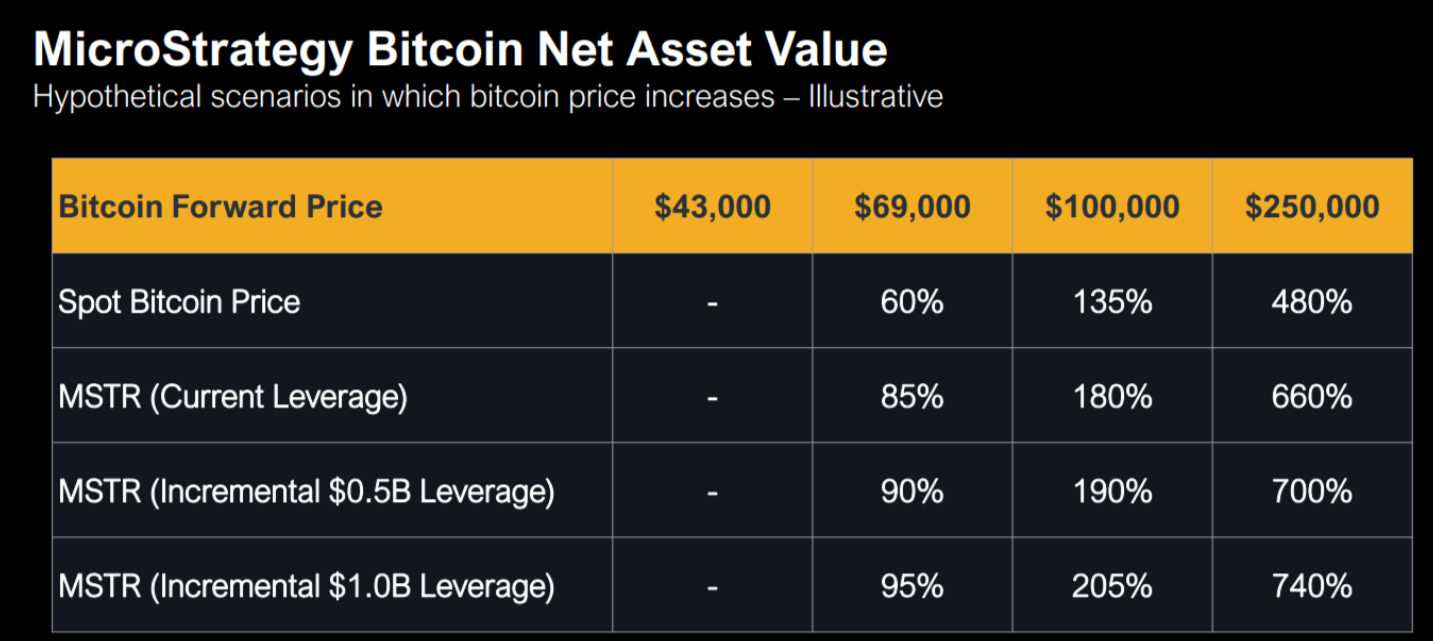

Furthermore, MicroStrategy presented hypothetical scenarios in the earnings presentation based on their net asset value, calculated as their Bitcoin holdings market value minus total outstanding debt.

These scenarios considered varying Bitcoin spot prices and the effect of adding leverage. For instance, if Bitcoin’s price rose from $43,000 to $69,000, this would result in a 60% increase, scaling up to a 135% increase if Bitcoin hit $100k and a whopping 480% surge if Bitcoin reached $250k, MicroStrategy data shows.

As MicroStrategy reported, adding the company’s existing leverage would further enhance returns, potentially by 85% at a Bitcoin price of $69,000 and up to 660% if Bitcoin soared to $250k. An additional scenario illustrated how a further $0.5B of leverage could substantially augment these returns.

The post MicroStrategy’s leverage scenarios show potential for astronomical returns on Bitcoin investments appeared first on CryptoSlate.

MicroStrategy’s Michael Saylor Calls Bitcoin An Institutional-Grade Asset Destined For $1 Million

Microstrategy’s Executive Chairman and Co-founder, Michael Saylor, is one who always uses every opportunity to heap praises on the flagship cryptocurrency Bitcoin. Once again, he didn’t disappoint, as BTC was the center of discussion in his latest media appearance.

Bitcoin Going To $1 Million

In an interview with CNBC, Michael Saylor stated that Bitcoin is going to $1 million if it isn’t going to “zero.” He noted that the “big question” in relation to BTC’s potential was whether or not the digital asset was legitimate. According to him, if Bitcoin is a “legitimate institutional asset,” then everybody is “under-allocated” to it.

His comment about Bitcoin possibly hitting $1 million seems to stem from his belief that Bitcoin as an asset is still untapped, as he expects many institutional players to get in on the crypto token. He noted how 99.9% of the world’s capital is currently tied to other global assets like bonds, real estate, stocks, and precious metals. However, expects that to change soon enough.

That change, he believes, will stem from education about digital assets. From that, Saylor says more and more people will realize that they ought to be allocating more and more of their capital to digital assets. Interestingly, he labeled BTC as a “digital transformation of capital,” alluding to its disruptive nature.

These institutional players could well be allocating more of their capital to BTC as early as 2024. The new rule by the Financial Accounting Standards Board (FASB) recently opened the door for firms to include cryptocurrencies like Bitcoin on their balance sheet. As such, we could see other tech firms adopt Microstrategy’s “Bitcoin Strategy.”

BTC price reclaims $43,000 | Source: BTCUSD on Tradingview.com

BTC Is Going Foward In 2024

Saylor also discussed several macro factors that he considers bullish for Bitcoin going into the new year. These factors include the potential approval of a Spot Bitcoin ETF, the loosening of monetary policies, and wider BTC adoption in countries suffering from inflation.

He also alluded to the BTC Halving event, which he believes is also bullish for the Bitcoin ecosystem. All these factors form a “confluence of very bullish milestones,” which Saylor projects are going to happen over the next six months.

Saylor will undoubtedly be fulfilled when his company’s Bitcoin strategy has panned out as Microstarategy is currently in profit with its Bitcoin acquisitions. The company’s stocks are also flying high as it recently hit a 2-year high, thanks in part to its BTC exposure.

At the time of writing, BTC is currently trading at around $43,000, up over 4% in the last 24 hours according to data from CoinMarketCap.

Featured image from Yahoo Finance, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.