Rent the Runway Inc. on Wednesday said it expected breakeven free cash flow this year, following cost cuts and signs of a revival in shoppers’ enthusiasm.

Source link

Milestone

ADA Price Ready To Soar As Cardano Network Hits New 88.6 Million Transaction Milestone

The Cardano (ADA) price looks set for a significant move to the upside. The network recently hit a new milestone in terms of transactions processed so far, in addition to other bullish fundamentals that could also contribute to the price surge.

Cardano Has Processed Over 88 Million Transactions

Data from Cardano’s latest weekly development report shows that the network has processed 88.6 million transactions to date. This is significant as sustained network activity can positively affect ADA’s price. Moreover, ADA has always been criticized as a “ghost chain,” this achievement dispels that notion and proves that people are actively using the network.

Source: Essential Cardano

Meanwhile, the report revealed that 1,353 projects are actively building on the network, which means the network will keep expanding as more users get onboarded through those projects. Additionally, Cardano’s Fund12 officially launches on April 26, with this decentralized and innovative incubator program set to usher in a new set of developers into the Cardano ecosystem.

That event also underlines Cardano’s potential to experience exponential network growth soon enough. It is also a testament to Cardano founder Charles Hoskison’s statement that the network is growing organically like Bitcoin, seeing as the team has continued to put in the work rather than solely depending on hype.

Considering these bullish developments, ADA’s price could be well primed for a significant move to the upside. This will provide a much-needed relief for ADA holders who have continued to worry about the crypto token’s lagging price action. ADA’s price had remained pretty tepid despite the broader crypto market recording massive price gains.

ADA Price Chart Says Otherwise

From a technical analysis perspective, the Cardano ecosystem is currently bearish. Technical analyst Alan Santana recently mentioned that further price declines are more feasible as ADA’s price has continued to lag. He revealed that ADA’s weekly chart is producing a “break below the EMA10 (Exponential Moving Average) with a very strong bearish candle as the RSI (Relative Strength Index) turns red. “

Santana also suggested that ADA’s price could drop to as low as $0.34 in a bid to establish support. Therefore, he stated that the “only wise decision is to remain bearish until the chart and market conditions change.” “Once support is found and established, we become bullish again,” the analyst added.

At the time of writing, ADA is trading at around $0.58, up in the last 24 hours according to data from CoinMarketCap.

ADA sees sharp drop to $0.58 | Source: ADAUSDT on Tradingview.com

Featured image from Biztech Africa, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Breakthroughs in the biotech industry sometimes come from relatively small drugmakers. Competing with the largest companies in significantly crowded areas, such as oncology, can be difficult. That’s why relatively unknown biotechs often opt to develop medicine where there are few (if any) approved therapies.

Madrigal Pharmaceuticals (MDGL -3.44%), a mid-cap biotech, has followed this blueprint. The company was recently awarded the first approval from the U.S. Food and Drug Administration (FDA) for a treatment for non-alcoholic steatohepatitis (NASH). Let’s look deeper at this important milestone and determine whether it makes Madrigal’s shares attractive.

Madrigal’s product boasts exciting sales potential

First, a primer on NASH. It is caused by a buildup of fat in the liver. As its name suggests, patients don’t owe it to excessive alcohol abuse, although the liver damage the illness causes is similar to that of heavy alcohol users. Instead, obesity and diabetes are thought to be some of the major risk factors. NASH can cause serious, life-threatening problems. That’s why the approval of Madrigal’s Rezdiffra to treat NASH is such a big deal.

The commercial opportunity looks attractive, too. Madrigal will go after 315,000 U.S. patients. Importantly, the FDA is not requiring a liver biopsy before prescription — a somewhat invasive procedure that likely would have limited the number of patients willing to take the medicine.

Rezdiffra will cost $47,400 per year although insurance will pick up most of the tab for most patients. The point, though, is that Rezdiffra’s potential vastly exceeds the $1 billion mark, so things are looking good for Madrigal Pharmaceuticals.

A few things to consider before buying

Rezdiffra is the only approved NASH medicine for now, but how long will that last? Analysts expect this area to rise rapidly in the coming years as more drugmakers join the fray. Several of the largest pharmaceutical companies in the world are on Madrigal’s trail. That includes Eli Lilly, Novo Nordisk, and Pfizer, just to name a few.

While earning the first approval might be an advantage to Madrigal, facing fierce competition from these larger companies with deeper pockets, stronger footprints and connections in the industry, and bigger sales teams won’t be easy. Will funding be an issue for Madrigal? The company conducted a secondary offering following Rezdiffra’s approval. The biotech expects gross proceeds of about $600 million from this move.

Before that, it ended 2023 with about $634 million in cash, equivalents, and marketable securities. So, the company should have in the neighborhood of $1 billion in cash after its latest round of financing. In my view, Madrigal Pharmaceuticals will no longer need to resort to dilutive forms of financing. It shouldn’t take too long for Rezdiffra to gain significant traction given its positive phase 3 results, convenient once-daily tablet dosing, and the fact that, for now, it is the only game in town for NASH patients who do not have to undergo a live biopsy to get access to the medicine.

Does all of this make Madrigal Pharmaceuticals stock a buy? On the one hand, the company displayed its innovative qualities, but it has no other products in development. Long-term biotech investors will want that to change with time; relying on a single medicine to drive growth over long periods is a somewhat dangerous, although not unprecedented, strategy. So, Madrigal Pharmaceuticals certainly boasts massive potential, although its overreliance on Rezdiffra is a risk.

In my view, somewhat aggressive investors should seriously consider initiating a position in the stock, whereas more conservative ones should look elsewhere.

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Cardano is yet to venture into the $0.8 price level this year, despite most cryptocurrencies breaking past old price levels. Although the blockchain has seen some exciting developments, the price action has been a little bit behind when compared to its peers. However, Cardano continues to give investors a glimmer of hope, as activity keeps soaring to new highs.

On-chain data shows that the active addresses on the Cardano network are spiking, with the monthly active count reaching its highest in the past year.

Monthly Cardano Active Addresses Hit One-Year High

Cardano’s active address count just hit a one-year high, signaling major network adoption and hinting at big things to come. According to data from Danogo, the active addresses in the past 30 days reached 596,915 on March 11, its highest since May 2023.

Interestingly, this number almost doubles the 279,000 active addresses recorded in September 2023, the lowest monthly active addresses in the past year.

Active addresses are one of the few metrics to look at when measuring the adoption rate of cryptocurrencies. Notably, various metrics have shown a surge in activity on the Cardano network and its ability to process a high number of transactions.

A further look at the chart data presented by Danogo shows that the monthly active addresses reversed to start a spike at the end of February after going on a free fall in January.

Data from Cardano Blockchain Insights tells a similar tale of increased activity, with the active daily addresses steadying above 50,000 since February 29. Active addresses in the past 24 hours were 66,970.

A similar activity metric from IntoTheBlock shows increased activity from Cardano whales. Its large transaction metric, which measures transactions greater than $100,000, puts the number of whale transactions at 6,810 in the past 24 hours and $73.86 billion in the past seven days. For comparison, Ethereum’s large transactions stand at $63.17 billion in the same time frame.

The supply in the top 1% has also shown a strong accumulation from whales, spiking by around 60 million ADA on March 10.

ADA To Reclaim $1?

Interestingly, ADA has more than tripled from a $0.24 price in the monthly active addresses low in September. At the time of writing, ADA is trading at $0.79, up by 42% in the past 30 days.

ADA has been rejected at $0.8 twice this month already, but it is now on its way to retesting the price level again. If the bulls can push ADA above $0.8, this could give the cryptocurrency free rein to reach $1 for the first time since April 2022. Overall, the overall crypto market continues to retain a bullish sentiment, which could push ADA above $1 this month.

ADA price at $0.78 | Source: ADAUSDT on Tradingview.com

Featured image from Binance Academy, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Stablecoin Sector Sees $3.26 Billion Growth Spurt; Tether Nears $100B Milestone, USDE Supply Swells by 374%

The stablecoin sector experienced a $3.26 billion expansion within the last eight days, climbing from $140.82 billion to $144.08 billion by Sunday, March 3, 2024. During February, increases in supply were observed in four of the top five stablecoins by market cap, with FDUSD’s supply growth leading amongst the five. Stablecoin Economy Rises 2.31% in […]

The stablecoin sector experienced a $3.26 billion expansion within the last eight days, climbing from $140.82 billion to $144.08 billion by Sunday, March 3, 2024. During February, increases in supply were observed in four of the top five stablecoins by market cap, with FDUSD’s supply growth leading amongst the five. Stablecoin Economy Rises 2.31% in […]

Source link

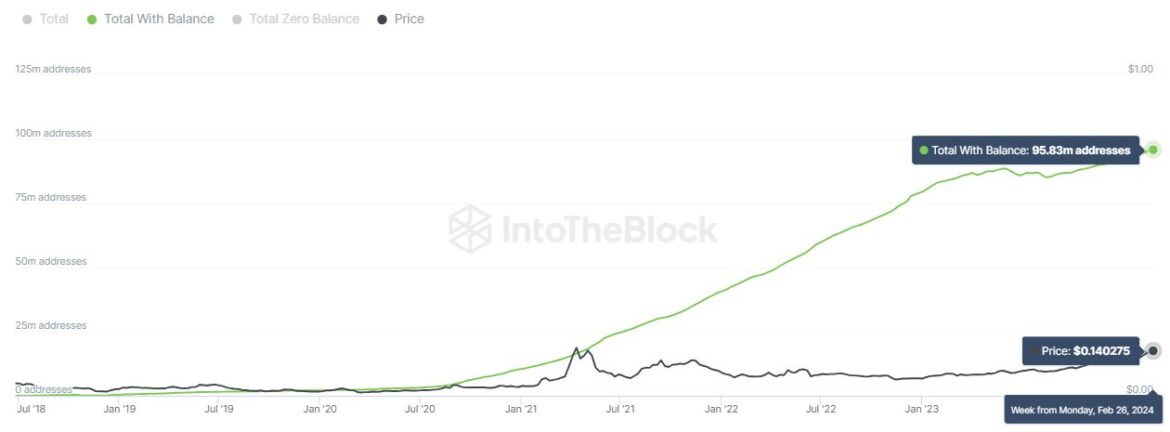

On-chain data shows the total number of addresses on the TRON network has exceeded the 95 million mark, a major milestone for the blockchain.

TRON Addresses Carrying A Balance Have Broken The 95 Million Mark

According to data from the market intelligence platform IntoTheBlock, TRON has far left behind other layer 1 networks like Cardano and Avalanche regarding its address growth.

Here, the analytics firm has used the total number of addresses on the blockchain carrying some non-zero balance to keep track of this network growth.

When these addresses with a balance go up, it means that either fresh investors are joining the network or old holders are returning. Either way, such a trend can be a positive sign for any cryptocurrency, as it suggests that some net adoption of the blockchain is going on.

On the other hand, a decline in the metric implies some investors have decided to clear out their wallets, a potential sign that they have decided to leave the network behind.

Now, here is a chart that shows the trend in the total addresses with a balance for TRON over the past few years:

The value of the metric seems to have been going up since a while now | Source: IntoTheBlock on X

As displayed in the above graph, the total number of TRON addresses with a balance has been rising for a while now and has recently hit a new record of more than 95 million.

“Quite an impressive number, considering other layer 1 networks like Cardano and Avalanche have fewer than 10 million addresses,” notes IntoTheBlock. “Layer 1” blockchains handle transactions and security independently, without being dependent on other networks.

Given the pace at which the TRON network has seen addresses open up, it would appear that users have been preferring the blockchain to some of the other layer 1 networks.

Now, what this adoption might imply for the price of TRX can be complicated. The chart shows that adoption has been up for the asset for years, but this hasn’t exactly translated into its price.

One thing that’s usually certain about adoption is that it provides a solid foundation for the network and is a good sign that the asset will be around in the long term.

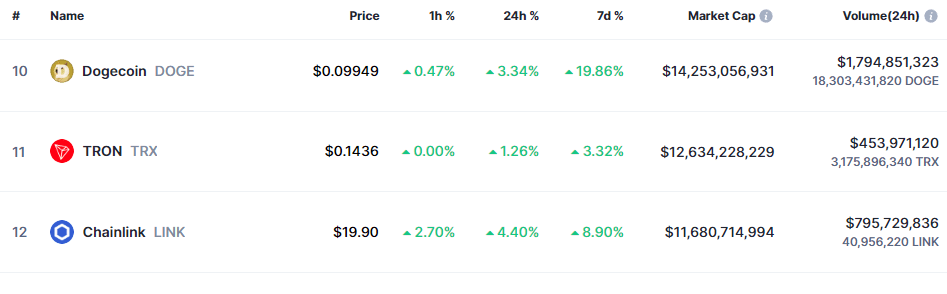

TRX Price

The cryptocurrency sector as a whole has been racing up recently, with Bitcoin leading the charge with its returns of 20% over the past week. TRON, however, has lagged behind the market, mustering only 3% profits in the same period.

The chart below shows that the coin is currently trading around the $0.14 level.

Looks like the price of the asset has been heading up in recent weeks | Source: TRXUSD on TradingView

Regarding the market cap, TRX is currently the eleventh-ranked cryptocurrency. However, if the coin continues to be weaker than its competitors, it might slip down the list, as Chainlink (LINK), the twelfth largest coin, is currently closing the gap with its stronger returns.

The market cap of the asset appears to be $12.6 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

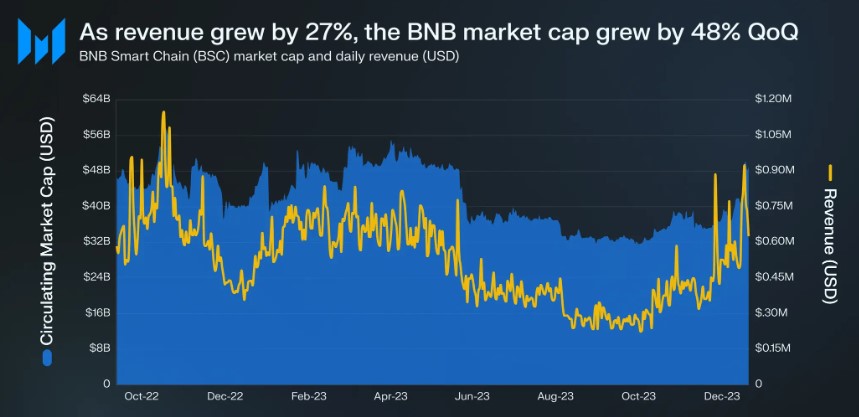

Binance Smart Chain (BSC) Market Cap Hits New Milestone, Registering 48% QoQ Surge

Binance Smart Chain (BSC) has demonstrated notable growth in key metrics during the fourth quarter (Q4) of 2023, as highlighted in a comprehensive report by Messari.

As the third-largest Layer-1 protocol by market capitalization, BSC experienced positive progress across its financial indicators, signaling a productive quarter for the blockchain ecosystem.

Binance Smart Chain Record-Breaking Transactions

The report reveals that BSC’s market capitalization witnessed a 48% quarter-over-quarter (QoQ) surge. This surge reflects renewed interest in BNB (Binance Coin), the native asset of BSC, following two consecutive quarters of decline.

Moreover, BSC’s revenue measured in USD experienced a significant QoQ growth of 27%. This revenue surge, amounting to over $39 million in Q4, indicates increased activity on the protocol and the implementation of various initiatives throughout the year.

Gas fees burned in BNB, a metric reflecting network activity, also saw a notable QoQ increase of 21%. The rising number of transactions and smart contract interactions contributed to increased gas fees burned, further reinforcing the Binance Smart Chain ecosystem.

In addition to financial metrics, BSC showcased impressive improvements in other areas. The number of active validators increased by 25% QoQ, highlighting growing trust and participation in securing the network. BSC’s commitment to decentralization was evident as the protocol experienced a 54% YoY increase in active validators.

According to Messari, throughout 2023, BSC demonstrated its ability to handle heightened activity while simultaneously reducing costs for users. Daily transactions on the network witnessed a 35% year-over-year (YoY) increase and a 30% QoQ surge, averaging around 4.6 million transactions per day in Q4.

These spikes in transaction volume were attributed to inscription-related activity, with BSC processing a record-breaking 32 million transactions on December 7, 2023.

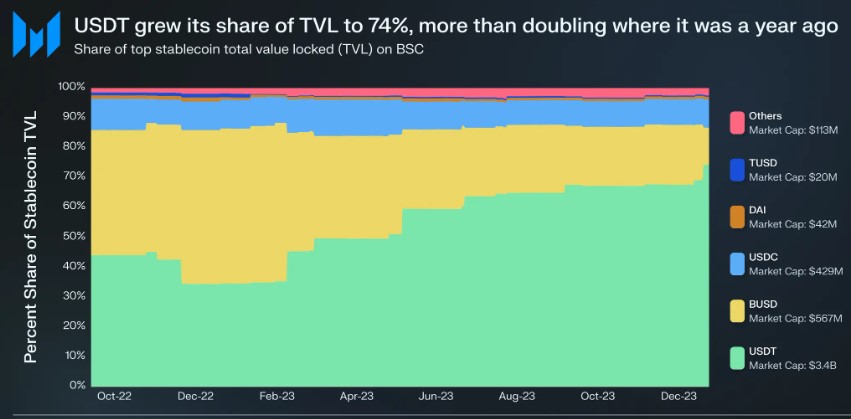

BSC’s DeFi Ecosystem Reaches $4.6 Billion TVL

Despite a decline in daily average active addresses and new unique addresses, primarily due to users exploring alternative chains like opBNB, BSC’s on-chain activity remained robust.

The protocol’s ecosystem of stablecoins, dominated by Tether’s USDT, reached a total value locked (TVL) of $4.6 billion in Q4, showcasing a 33% QoQ increase in Decentralized Finance (DeFi) TVL.

While Non-Fungible Token (NFT)- related metrics declined in Q4, Binance Smart Chain and Ethereum (ETH) witnessed a resurgence in activity toward the end of the quarter, indicating a potential upward trend in the next market cycle.

In addition to BSC’s growth, BNB also experienced notable price movements. After a sharp drop, BNB surged from $238 to reach the $338 level. However, it later retraced to $287 following a correction.

In the past 24 hours, BNB has recorded a growth of 3.7%, pushing its current trading price above $302.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

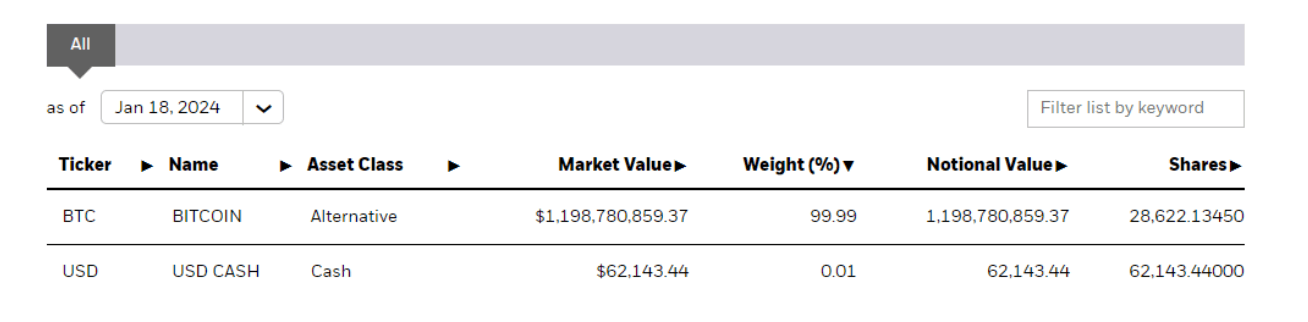

Blackrock bolsters Bitcoin ETF holdings to surpass $1.2 billion milestone

Quick Take

Blackrock has increased its Bitcoin holdings in its Exchange-Traded Fund (ETF) as the fund now retains an impressive count of 28,622 Bitcoin, with an addition of approximately 3,555 Bitcoin.

The Blackrock iShares Bitcoin ETF not only made headlines as the inaugural fund to surpass the $1 billion threshold but continued its upward trajectory to amass a notional value now standing at $1.2 billion.

The last update was on Jan. 16, when BlackRock added 8,705 BTC to the fund. Today’s update marks the lowest amount of Bitcoin added to the fund since launch day where 2,621 BTC were added.

The post Blackrock bolsters Bitcoin ETF holdings to surpass $1.2 billion milestone appeared first on CryptoSlate.

Solana Developer Ecosystem Hits Key Milestone, Fueling Potential 50% SOL Breakout from Its Price

In addition to the increasing developer activity on the Solana network, SOL has shown signs of recovery after a recent period of struggle.

The Solana blockchain network has achieved an important milestone with over 2,500 developers actively contributing to its open-source ecosystem on a monthly basis. This growth in developer numbers is a significant achievement for Solana, as it has made a focused effort to expand its community of builders.

Having a consistent group of developers is crucial for any layer-1 protocol that wants to succeed by launching decentralized applications to the public. The skills and dedication of these builders directly influence what can be accomplished on the network.

Despite being a relatively new blockchain that launched in March 2020, Solana has quickly established itself as the second-largest developer ecosystem in the blockchain industry, right after Ethereum. More than half of these developers have at least three years of programming experience, which indicates a high level of expertise in developing the network’s infrastructure and tools.

Solana has also made progress in retaining developers by improving their onboarding processes. Developer boot camps and educational resources provided by organizations like the Solana Foundation, SuperteamDAO, and mtnDAO have played a significant role in attracting builders to Solana. Over 50% of developers who joined Solana’s ecosystem in 2023 have remained active for at least three months, demonstrating the increasing retention rates within the network.

SOL Price Eyes Potential Breakout

In addition to the increasing developer activity on the Solana network, SOL has shown signs of recovery after a recent period of struggle. Despite the challenges, it has still managed to maintain a profit of over 30% in the last four weeks. In the current week alone, the coin has surged by 16%, going from $89 to $103 at the time of writing. This surge in activity may also contribute to the rising price, as investors anticipate further price growth with the emergence of more solutions built on Solana.

Renowned cryptocurrency analyst Ali suggests that Solana has a positive outlook that could potentially drive the price of SOL up by 50% if it can overcome a crucial resistance level. He highlights that Solana has formed a bullish pattern known as a bull flag on its hourly price chart. Bull flags typically indicate that the buyers are in control and the price may continue to rise, especially after a significant breakout.

On the hourly chart, #Solana is showing signs of forming a bull flag. A decisive close above the $110 resistance level could be the catalyst for a significant upward move!

If this pattern holds, we might see $SOL heading toward an ambitious target of $163. pic.twitter.com/dHNDnb9uNK

— Ali (@ali_charts) January 9, 2024

As per the analyst’s tweet, if Solana manages to break through the $110 resistance level, it could experience a substantial upward movement. Based on this pattern, the projected target for SOL is $163, aligning with the expected outcome of the bull flag.

With Solana developers actively working on the blockchain’s infrastructure and a renewed interest from users, analysts generally hold an optimistic view of SOL’s prospects in the short and long term. However, the token still faces challenges from macroeconomic factors and the risk of a decline if buyers are unable to sustain the price above important levels.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Shiba Inu’s Shibarium Hit Major Milestone Amid Rapid Network Recovery

The Shiba Inu Layer 2 Shibarium network is recovering once again after the festivities of the holidays have died down. This time around, the layer 2 network is celebrating a major milestone after a couple of months of impressive outperformance.

Shibarium Network Crosses 250 Million Transactions

The Shibarium network has now crossed a total of 250 million transactions that have been processed since it was launched last year. This latest milestone coincides with a significant recovery in the network’s daily transactions which had plunged at the start of the new year.

As NewsBTC reported on Thursday, the average daily transactions on the network had fallen around 50% from the 7 million average to 4 million. This decline would persist for at least two days, on January 2 and January 3, where an average of 4 million transactions were carried out.

Source: ShibariumScan

However, there has since been another jump in the number of transactions processed by the network. Currently, the daily transactions for Friday are sitting at 6.19 million at the time of writing. This translates to a 50% jump from the numbers recorded over the last few days.

The total number of blocks produced has also risen rapidly at this time as well. As the data shows, there are now over 2.84 million blocks produced on the Shibarium network. If the daily transactions on the Shiba Inu layer 2 network continue to rise, then the total number of blocks produced could cross 2.5 million before the month is over.

SHIB bulls losing control | Source: SHIBUSDT on Tradingview.com

Shiba Inu Burn Rate Mounts A Comeback

The transactions carried out on the Shibarium network are not the only thing making a comeback at this time. The Shiba Inu burn rate is also seeing a significant surge after being subject to a slow start to the year.

According to data from the burn tracking website Shibburn, there have been more than 4.2 million SHIB tokens burned in the last day. This figure translates to a 244% surge in the burn rate over this time, continuing the trend that was registered on Thursday.

The rise in the Shiba Inu burn rate shows that interest is not only localized to the Layer 2 network alone. But also, community members continue to work together in their bid to reduce the total circulating supply of the meme coin.

In the year 2023, the total number of SHIB tokens burned through this initiative has come out to more than 76 billion. However, this figure is minute compared to the over 400 trillion supply of the SHIB token, showing a need to ramp up burning.

Featured image from NewsBTC, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.