Bitcoin miner Bitdeer is reportedly in discussions with private credit firms to secure $100 million in funding to expand its mining capacity. It is believed that the cryptocurrency miner has engaged a financial adviser to assist with the negotiations. Negotiations Between Bitdeer and Lenders Continue The cryptocurrency mining firm Bitdeer Technologies Group is reportedly seeking […]

Bitcoin miner Bitdeer is reportedly in discussions with private credit firms to secure $100 million in funding to expand its mining capacity. It is believed that the cryptocurrency miner has engaged a financial adviser to assist with the negotiations. Negotiations Between Bitdeer and Lenders Continue The cryptocurrency mining firm Bitdeer Technologies Group is reportedly seeking […]

Source link

miner

Digihost Secures Hosting Deal for 4,640 S19 XPs With Leading Bitcoin Miner Manufacturer

Digihost Technology Inc., a blockchain technology and mining enterprise based in the U.S., revealed a significant augmentation of its bitcoin mining capabilities, courtesy of a multi-year hosting contract with a “leading” global provider of digital currency mining equipment. Digihost Expands Mining Fleet Under Newly Inked Multi-Year Hosting Deal Digihost (Nasdaq: DGHI; TSXV: DGHI) said the […]

Digihost Technology Inc., a blockchain technology and mining enterprise based in the U.S., revealed a significant augmentation of its bitcoin mining capabilities, courtesy of a multi-year hosting contract with a “leading” global provider of digital currency mining equipment. Digihost Expands Mining Fleet Under Newly Inked Multi-Year Hosting Deal Digihost (Nasdaq: DGHI; TSXV: DGHI) said the […]

Source link

Bitcoin miner Argo Blockchain sells Quebec site for $6.1 million amidst declining BTC production

Bitcoin miner Argo Blockchain sold one of its sites to repay debt amid its declining BTC production last month.

Argo sells site to repay debt

In a Mar. 5 statement, the miner explained that it sold its Mirabel Facility in Quebec for $6.1 million.

Following the sale, Argo allocated $4 million to settle debts owed to Galaxy Digital, effectively reducing its debt to approximately $14 million as of Feb. 29. This marks a significant 60% decrease from the initial Galaxy debt of $35 million.

Argo clarified that the remainder of the proceeds from the sale were utilized to settle the outstanding mortgage of the Mirabel Facility. Additionally, the company plans to relocate miners from the Mirabel site to its Baie Comeau facility in Quebec.

The Mirabel facility, boasting a power capacity of five megawatts (MW), will see its miners shifted to the Baie Comeau site, while older miners, representing 140 PH/s, will be liquidated.

Thomas Chippas, Argo CEO, said:

“We are able to exit the Mirabel Facility with a high multiple on its power capacity, and we also realize a premium on this real estate asset while maintaining a strong hashrate capacity of 2.7 EH/s.”

In 2021, Argo borrowed to expand its mining endeavors without selling its BTC holdings. However, due to the market downturn in 2022, Argo sold its Texas Helios mining site to Galaxy Digital for $65 million and secured a new $35 million from Galaxy to clear other outstanding loans.

BTC production declines

The miner revealed that its BTC production fell 21% in February to 92 BTC or 3.2 BTC per day due to a maintenance-related outage at the third-party-owned Cottonwood substation.

Besides that, Argo also explained that its production was negatively impacted by the BTC network’s rising mining difficulty. Last month, CryptoSlate reported that BTC’s mining difficulty hit a record high of more than 81 trillion.

As a result of these issues, the firm’s mining revenue for the month decreased by 15% month-on-month to $4.5 million. Argo holds around 14 BTC as of Feb. 29.

Bitcoin Miner Riot Acquires 31,500 ‘Next Generation’ M60S Mining Machines Worth $97.4 Million

Bitcoin miner Riot Platforms Inc. said it expects to take delivery as well as deploy 31,500 Whatsminer M60S miners worth $97.4 million by the end of July 2024. The addition of the new bitcoin mining machines is projected to increase the “self-mining” hashrate capacity of Riot’s Rockdale Facility to 15.1 EH/s. Replacement of Underperforming Miners […]

Bitcoin miner Riot Platforms Inc. said it expects to take delivery as well as deploy 31,500 Whatsminer M60S miners worth $97.4 million by the end of July 2024. The addition of the new bitcoin mining machines is projected to increase the “self-mining” hashrate capacity of Riot’s Rockdale Facility to 15.1 EH/s. Replacement of Underperforming Miners […]

Source link

Gold miner Polymetal looks to sell Russian operations for $3.69 billion amid nationalization fears

Gold miner Polymetal International on Monday said it had struck a deal to sell the entirety of its Russian mining business for $3.69 billion, with a view to fully exiting the Russian Federation due to the combined threats of Western sanctions and nationalization by Putin’s government.

If approved by shareholders, Polymetal will sell the business to Russian mining company JSC Mangazeya Plus, with a view to re-focusing its operations towards Kazakhstan where it currently runs two mines that account for around one-third of its total production.

The Anglo-Russian gold miner, which was founded in St Petersburg in 1998, said the sanctions-compliant agreement would see JSC Mangazeya Plus pay it $1.48 billion in cash and also agree to settle the Russian segment’s $2.21 billion debts.

Shares in Polymetal International fell 6% on Monday in Moscow, having lost 11% of their value over the past 12 months and 66% of their value since the start of the Russia’s invasion of Ukraine in early 2022.

In August 2023, the company abandoned its London listing and re-domiciled from Jersey to Kazakhstan’s capital Astana, with a view to avoiding Russia imposed rules that designated Jersey an “unfriendly jurisdiction” in response to Western sanctions.

Polymetal said it will let shareholders vote on the agreement at its upcoming annual general meeting on 7 March, as the company said the sell-off would help avoid risks including those posed by the operations being expropriated or nationalized by the Russian government.

In a statement, Polymetal said it believes a deal to sell its Russian operations “presents the most viable opportunity for the Group to restore shareholder value by removing or substantially mitigating critical political, legal, financial and operational risks.”

The striking of the deal marks the end of an arduous process faced by Polymetal in finding a sanctions-compliant buyer for its Russian operations, after it vowed to exit that country following the outbreak of war.

Polymetal’s push to divest from Russia was made more urgent by the U.S. Department of State’s decision to impose sanctions on its Russian subsidiary in May 2023, which blocked U.S. citizens from interacting with that unit.

The process of selling off its Russian assets has been more difficult due to stringent rules imposed by authorities in both Moscow and Washington on any company looking to exit Russia.

Polymetal said it had received confirmation from the U.S. Office of Foreign Assets Control (OFAC) that those involved in the sale to JSC Mangazeya would not be subject to sanctions, and made clear that any payment would be made via sanctions-compliant financial institutions.

JSC Mangazeya Plus is the mining subsidiary of the Mangazeya commodities conglomerate, which is controlled by Russian billionaire Sergey Yanchukov, who started his career as an oil trader in Ukraine.

If completed, the deal will see Polymetal retain its position as the second largest gold miner in Kazakhstan, in controlling two mines with an estimated 11.3 million ounces of gold.

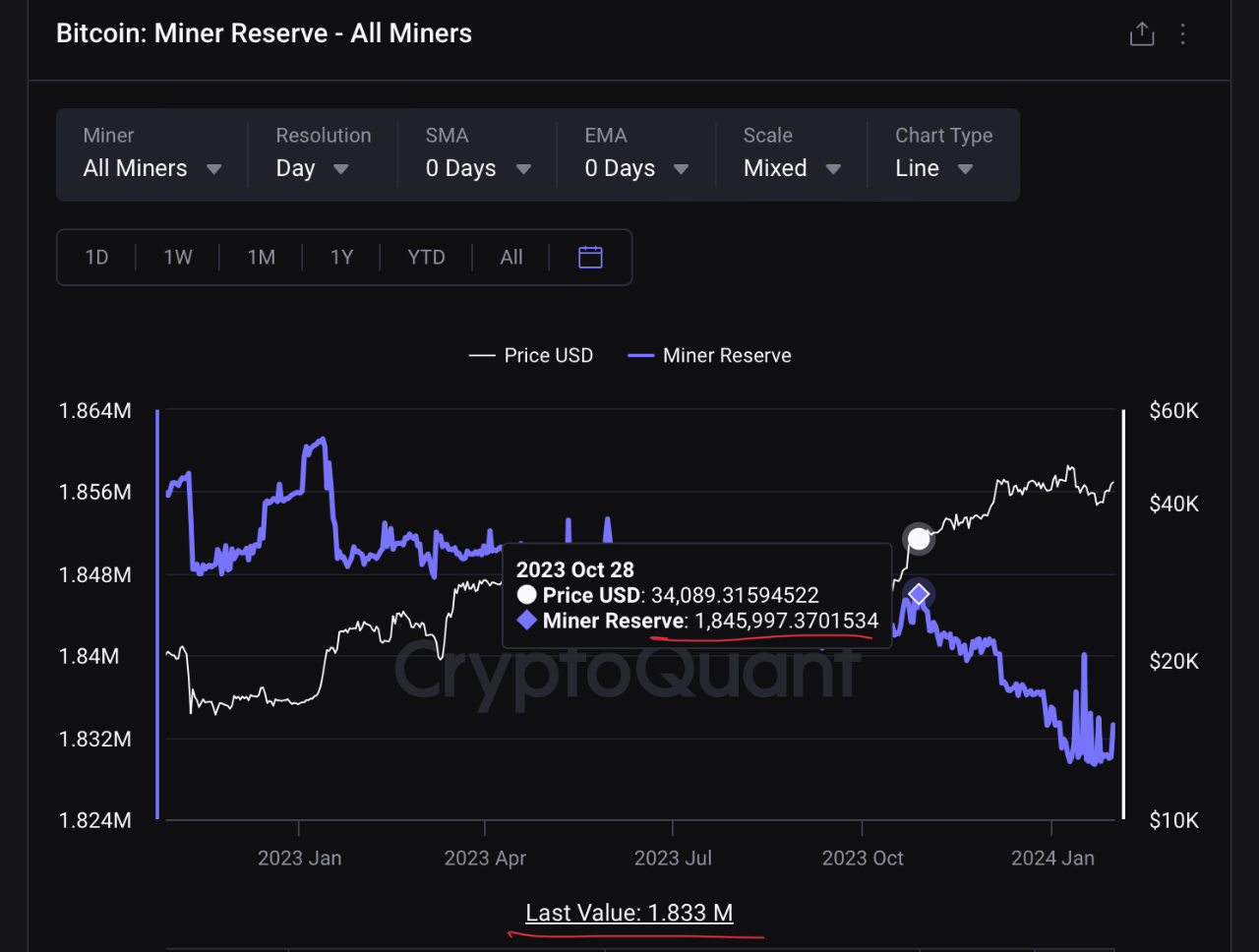

Bitcoin Miner Reserves Drop To June 2021 Levels, What This Means For Price

Bitcoin miner reserves can often be a tell for where the market could be headed next due to their large holdings. These reserves going up or down can pinpoint how miners are looking at the market, and a drop in their reserves can be bad for the BTC price.

Miners Reserves Drop By 14,000 BTC

Bitcoin miners, who are responsible for confirming transactions on the blockchain and keeping the network safe, seem to be turning toward selling rather than accumulating. According to a CryptoQuant report, these miner reserves have seen a notable drop since 2024 began.

Their holdings dropped by 14,000 BTC in less than two months, suggesting that these miners have been selling some of their stash. Going by an average price of $43,000 since January 2024, this means that Bitcoin miners have sold over $600 million worth of BTC so far. As a result of this, miner reserves are currently sitting at 1.8 million BTC, which is the lowest level since June 2021.

Bitcoin miners selling their coins are not new because they often need to sometimes sell to keep their operations running. The most notable costs include electricity, as well as mining machines. However, it does not change the fact that their selling can have an adverse effect on the price of BTC.

This time around, though, miners seem to be selling for an additional reason, which Matthew Sigel, who’s head of digital asset research at VanEck, has identified to be for purposes of bolstering their balance sheets.

Bitcoin Miners Getting Ready For The Halving

The next Bitcoin halving is expected to happen sometime in April 2024, and the block rewards are expected to fall to 3.125 BTC. Naturally, these miners are getting ready for this drop in rewards, as identified by Matthew Sigel.

“Miners have begun to sell more of their coins to bolster balance sheets and fund growth capex ahead of tougher times for margins when block rewards are halved in April. After the halving, scale will matter even more.”

Nevertheless, as selling has ramped up, so has buying as Spot Bitcoin ETF issuers scramble to accumulate BTC for their customers. According to this NewsbTC report, Spot Bitcoin ETF issuers now hold more than 657,000 BTC, worth more than $28 billion at current prices.

At the time of writing, the BTC price is trending at $42,933, after being beaten back from the $43,000 resistance. The crypto’s fluctuations at this level suggest that $43,000 is the target to beat if it is to continue its uptrend.

BTC price struggles below $43,000 | Source: BTCUSD on Tradingview.com

Featured image from Forbes India, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

On-chain data shows the Bitcoin miners have been selling recently, but this quant has argued that this selloff shouldn’t have much impact on the market.

Bitcoin Miner Reserve Has Registered A Decline Recently

In a CryptoQuant Quicktake post, an analyst discussed the latest selling pressure that the miners have been putting on the market. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin that the miners combined hold in their wallets right now.

This metric can naturally provide information about the collective behavior of these chain validators. Generally, the miners withdraw their coins from their reserve when they want to sell, so a decline in the indicator can potentially have bearish consequences for the asset.

A rise in the metric, on the other hand, may be bullish for the cryptocurrency’s price as it suggests the miners as a whole are in accumulation mode at the moment.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past year:

The value of the metric seems to have been heading down in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin miner reserve has been on its way down since October, implying that this cohort has withdrawn a net amount of BTC from their wallets during this period.

This latest selloff from the miners has recently been a topic in the community, with many speculating about the possible bearish impact arising from it. The quant has a different opinion on the matter, however.

“The sell-off of Bitcoin reserves by miners, as discussed on X and various portals, is unfounded,” explains the analyst. To back this claim, the quant has pointed out the exact numbers involved here.

Before this selling started, the miner reserve had a value of around 1,84,997 BTC. Following the decline that the indicator has witnessed since then, the miners now hold about 1,833,222 BTC.

This represents a decrease of 12,755 BTC, which, although substantial on its own, doesn’t seem too large in the grand scheme of things, especially considering the size of the miner reserve itself. “The minimal amount of bitcoin sold has negligible impact on the market,” notes the analyst.

The trend in the miner inflows and outflows over the past couple of months | Source: CryptoQuant

The above chart shows the data for the Bitcoin inflows and outflows being made by the miners. There have indeed been outflows taking place recently, which is why there has been talk of a selloff.

At the same time, the inflow transaction volume has also been at significant levels, making up for these outflows. This is the reason for the relatively small net decrease in the total miner reserve.

BTC Price

Bitcoin had recovered beyond the $43,000 mark earlier, but the asset has seen a setback during the past day as it has slipped back towards $42,500.

Looks like the price of the coin has retraced some of its recent recovery | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin miner balances hit 18-month low amid wallet reorganization signals

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Quick Take

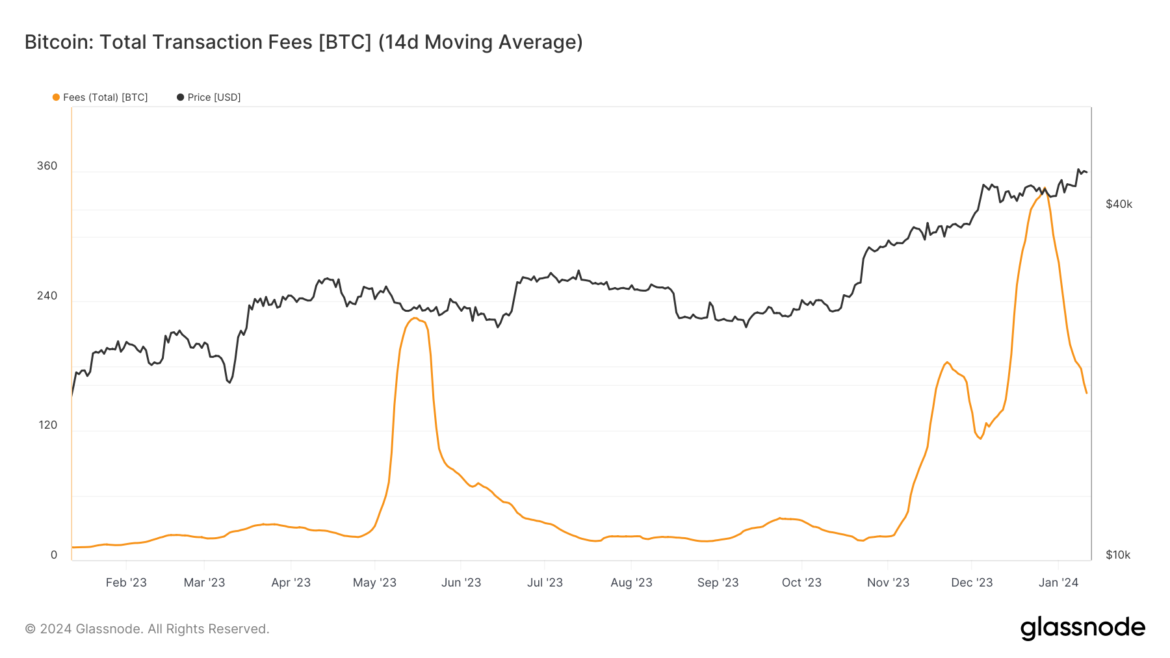

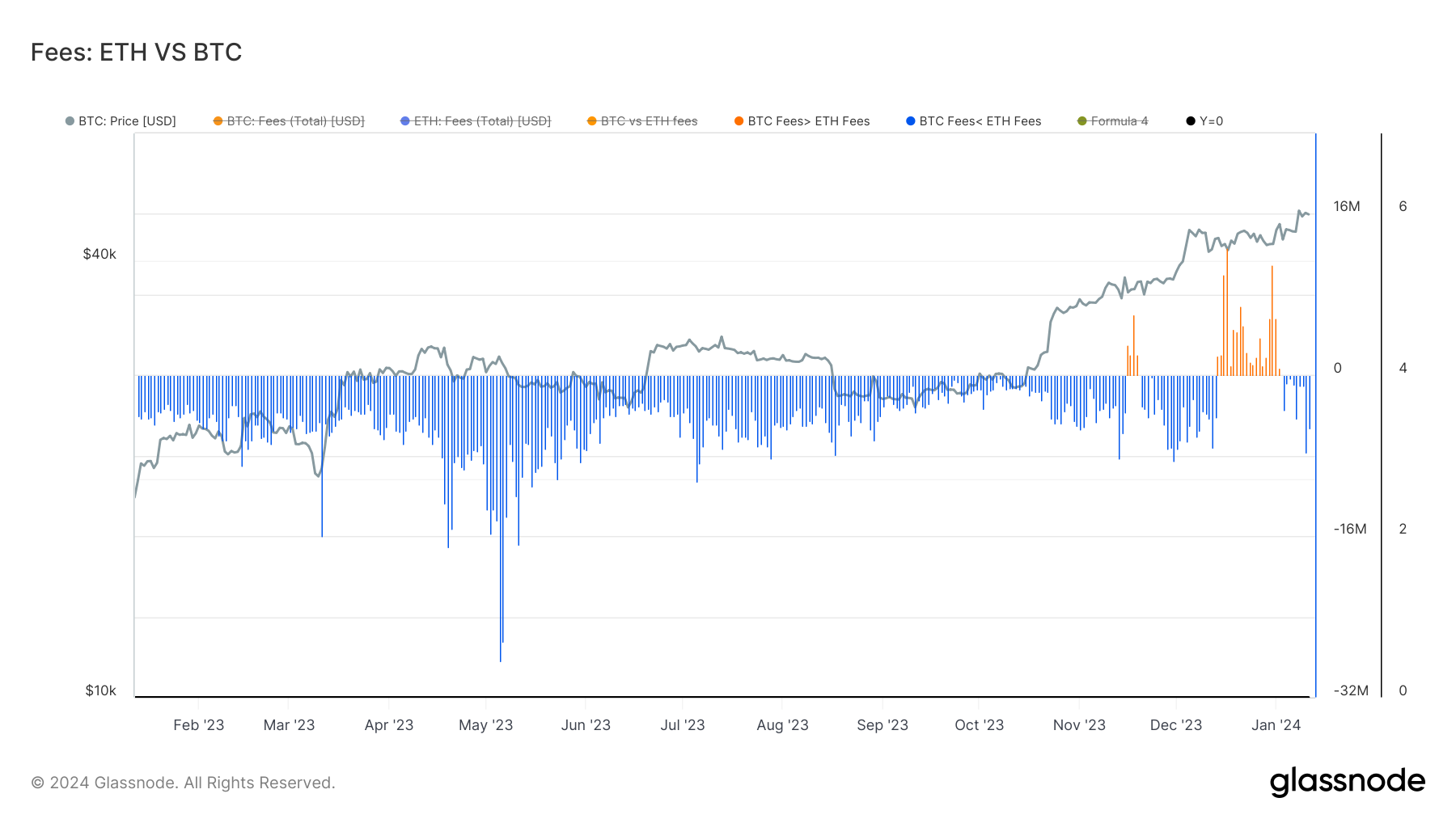

A marked shift in Bitcoin’s fee structure has become noticeable as the digital asset continues to fluctuate. Bitcoin’s fees have seen a significant decrease of 50% from the peak of its recent mini-bull run.

In numerical terms, by the end of Dec. 2023, the total amount paid to miners in fees stood at approximately $15 million, which has dwindled to around $7 million. This scenario suggests that we are in slightly uncharted territory, just above the zenith of the “inscription frenzy” observed in May 2023.

The proportion of miner revenue derived from fees, calculated as fees divided by the sum of fees and minted coins, currently sits at about 14%, a drop from its peak of 25%. While Bitcoin exhibits these changes, Ethereum’s fees have maintained a steadier course, consistently outpacing Bitcoin’s since Jan. 3.

These contrasting trends in fee structures highlight the unique dynamics between Bitcoin and Ethereum, further underlining the necessity for investors and miners to monitor and consider such factors closely in their strategic decision-making.

The post Bitcoin’s miner fee revenue plummets by 50% from recent highs appeared first on CryptoSlate.

Quick Take

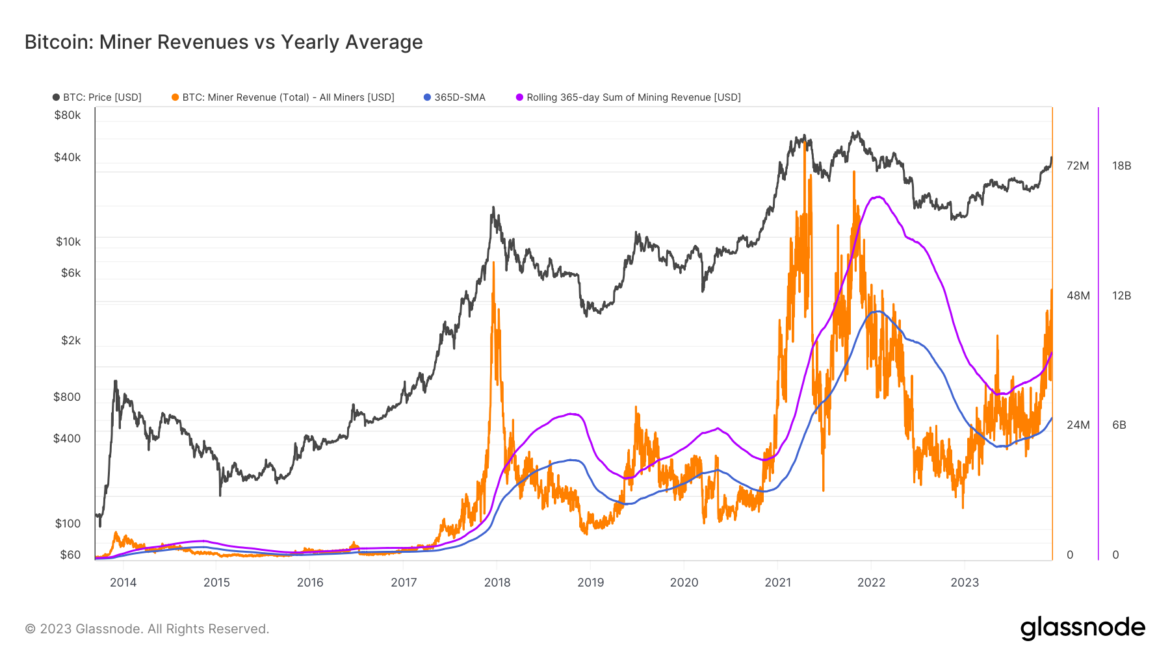

In a notable development in the Bitcoin mining arena, an uptick in miner fees was observed by CryptoSlate yesterday.

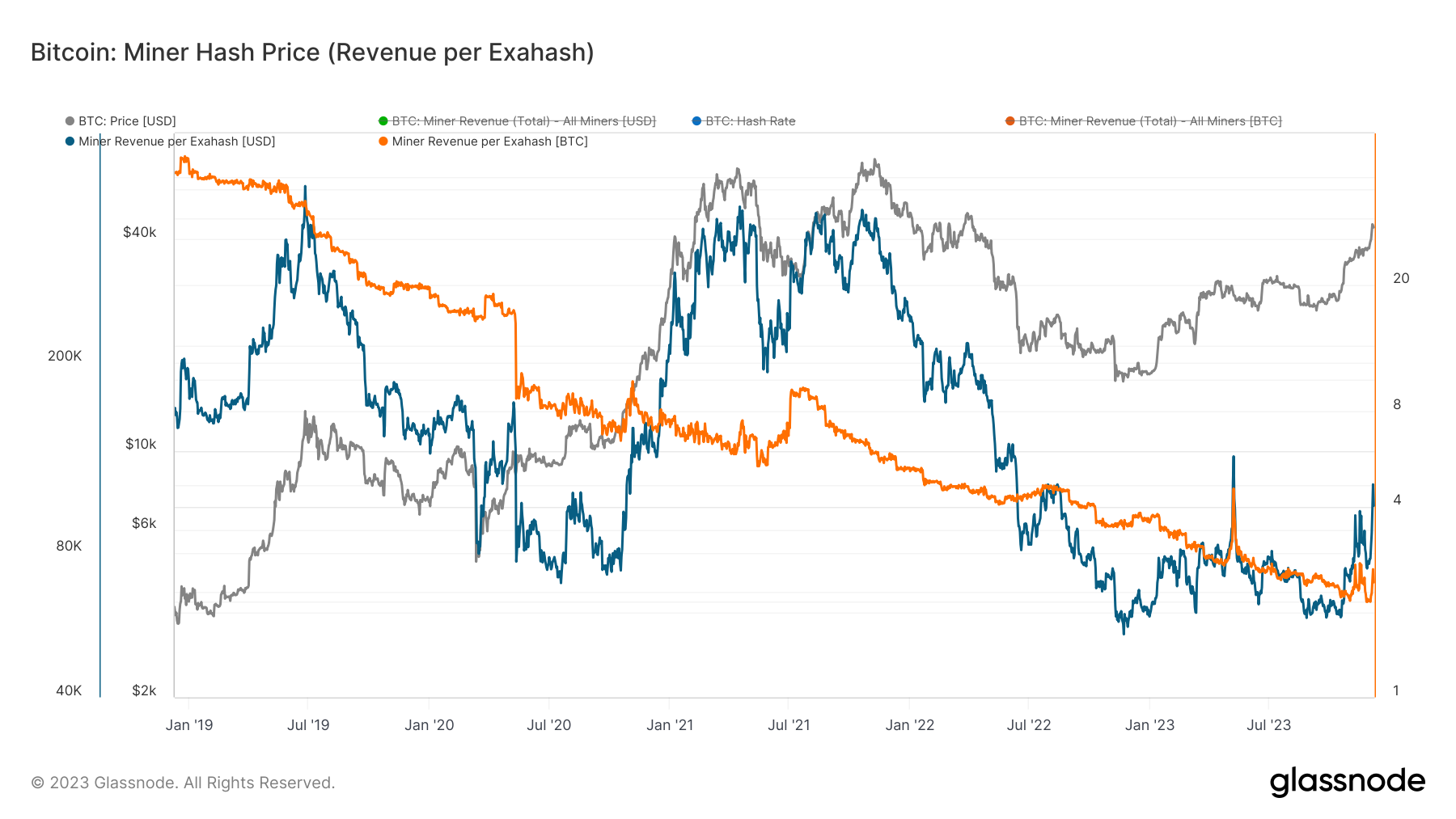

Miner revenue per Exahash, a metric applied to estimate the daily income of miners in relation to their network hash-power contribution, has experienced a significant surge. This metric, calculated by the ratio of total miner income (in USD or BTC) to the current hash rate, indicates the daily revenue per 1 EH/s of hash power a miner contributes to the network.

The long-term trend for miner revenue has generally been downward due to increasing difficulties for miners to remain profitable. In contrast to this trend, since October, there’s been a notable upsurge in hash price, pushing the miner revenue per exahash to one of the highest levels in 2023, standing at 2.53 Bitcoin or $111,000. This figure is only slightly below the May high, driven by the inscription craze.

A rolling 365-day sum of miner revenues is considered to assess the industry’s aggregate income. Most recently, the miner revenue peaked at around $50 million ( fees plus newly minted coins.), comfortably above the 365-day simple moving average. This metric, compared with the total daily USD revenue paid to Bitcoin miners, helps gauge daily volatility against the longer-term trend and informs the Puell Multiple oscillator.

During the initial stages of bull markets, it’s common to witness miner revenue soaring above the 365-day moving average of mining revenue, a phenomenon that has already begun to materialize.

The post Bitcoin miner revenue per exahash spikes, nearing yearly high appeared first on CryptoSlate.