El Salvador continues its daily bitcoin purchases, aiming to keep buying until the cryptocurrency becomes too expensive. The top 10 bitcoin mining rigs of 2024 show significant profit margins due to recent value increases. Blackrock, has submitted a form to the SEC for the initiation of a tokenized investment fund called “BUIDL.” “Rich Dad Poor […]

El Salvador continues its daily bitcoin purchases, aiming to keep buying until the cryptocurrency becomes too expensive. The top 10 bitcoin mining rigs of 2024 show significant profit margins due to recent value increases. Blackrock, has submitted a form to the SEC for the initiation of a tokenized investment fund called “BUIDL.” “Rich Dad Poor […]

Source link

Mining

Greenpeace’s Anti-Bitcoin “Mining for Power” Report Receives Fierce Backlash on X

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

“Mining for Power,” an anti-Bitcoin report by Greenpeace USA that explains the links between the bitcoin mining industry and fossil fuel companies, has faced a backlash in social media due to its inaccurate portraits of the mining activity. Using community notes, social network users detailed the report contained “many factual errors,” including outdated information. Greenpeace […]

Source link

Top 10 Bitcoin Mining Rigs of 2024: Leading the Charge in Crypto Earnings

Over the past month, the valuation of bitcoin has seen a notable increase, leading to significantly enhanced profits for today’s most sophisticated application-specific integrated circuit (ASIC) bitcoin mining devices. As of March 16, 2024, the top ten ASIC miners focused on the SHA256 consensus algorithm are generating daily earnings ranging from $10 to $21, assuming […]

Over the past month, the valuation of bitcoin has seen a notable increase, leading to significantly enhanced profits for today’s most sophisticated application-specific integrated circuit (ASIC) bitcoin mining devices. As of March 16, 2024, the top ten ASIC miners focused on the SHA256 consensus algorithm are generating daily earnings ranging from $10 to $21, assuming […]

Source link

The winds of change are blowing through the Bitcoin landscape. On March 14th, 2024, the network witnessed a monumental shift – mining difficulty skyrocketed to a record-breaking 84 trillion hashes. This unprecedented challenge coincides with another significant event on the horizon: the Bitcoin halving slated for April.

According to BTC.com, the rate has risen by nearly 5.80% since the previous modification. The mining hashrate for the original coin has also peaked, indicating that more people are now participating in the mining process. At present, the value stands at 617 EH/s.

Source: BTC.com

Bitcoin Mining: The Difficulty Dilemma

Mining Bitcoin is no easy feat. Miners compete to solve complex cryptographic puzzles, and the difficulty of these puzzles adjusts based on the overall network hash rate. As more miners join the network, the difficulty increases to ensure a steady block production rate (roughly 1 block every 10 minutes).

This recent surge in difficulty signifies an influx of new miners, likely drawn by Bitcoin’s recent price rally that saw it peak at a staggering $73,800 on the same day.

The Halving Effect

The upcoming halving event in April throws another variable into the equation. Every four years, the block reward for miners – the amount of Bitcoin earned for successfully mining a block – is cut in half.

This economic policy is a cornerstone of Bitcoin’s design, aiming to control inflation and maintain scarcity over time. The last halving in May 2020 witnessed a significant price increase in the following months, and many analysts believe the upcoming halving will follow suit.

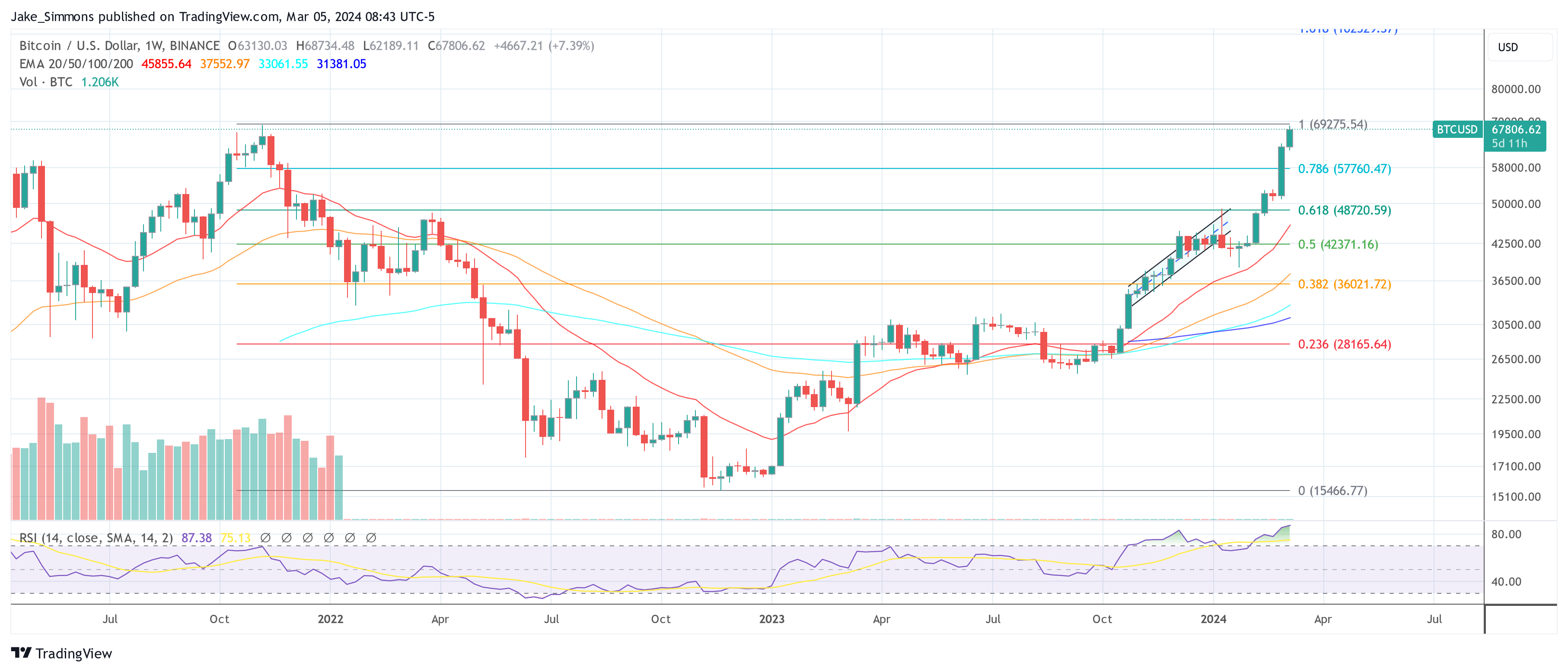

BTCUSD weakens today and trades at $68,178: TradingView.com

Here’s the logic: with the supply of new Bitcoins being halved, the existing ones become relatively more scarce, potentially driving the price up due to increased demand.

A Balancing Act For Miners

Despite the rising difficulty, the potential for Bitcoin’s price to appreciate after the halving could incentivize miners to weather the storm. This economic incentive is bolstered by the recent spike in mining rewards, which reached nearly $79 million

This suggests that even with the increased difficulty, miners are still reaping substantial profits due to the high Bitcoin price. However, the long-term sustainability of this model is debatable.

As difficulty continues to climb, the energy consumption required for mining will also rise. It raises concerns about the environmental impact of Bitcoin mining, especially considering the reliance on non-renewable energy sources in some regions.

Beyond The Headlines

The narrative surrounding Bitcoin’s recent surge often focuses on its price and the upcoming halving. However, there are crucial underlying factors to consider.

The ever-increasing mining difficulty raises questions about the long-term viability of proof-of-work, Bitcoin’s current consensus mechanism. Alternative, more energy-efficient mechanisms are being explored, but their widespread adoption remains uncertain.

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Mining Hits Record Difficulty as Countdown to 2024 Halving Begins

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

On Thursday, Bitcoin’s network difficulty escalated by 5.79% at block height 834,624, signaling the year’s fourth rising adjustment. The mining difficulty now stands at an unprecedented peak of 83.95 trillion, with the forthcoming adjustment anticipated around March 27, 2024. Bitcoin Difficulty Jumps 5.79% Mining Bitcoin has reached unprecedented levels of difficulty, peaking at 83.95 trillion […]

Source link

Nasdaq-Listed Bitcoin Mining Companies Bounce Back From Recent Downturn

Following a dynamic period of activity in the crypto market on Friday, stocks of publicly traded mining companies have recovered from their recent decline. In the last five days, Marathon Digital Holdings’ stock fell over 15%, yet on Friday, it experienced a 7.71% increase in value against the U.S. dollar. Several other leading mining corporations […]

Following a dynamic period of activity in the crypto market on Friday, stocks of publicly traded mining companies have recovered from their recent decline. In the last five days, Marathon Digital Holdings’ stock fell over 15%, yet on Friday, it experienced a 7.71% increase in value against the U.S. dollar. Several other leading mining corporations […]

Source link

In a series of statements made on X (formerly Twitter), Marc van der Chijs, the CEO of the publicly traded Bitcoin mining firm Hut 8, shared an optimistic outlook on the future of Bitcoin, suggesting that the cryptocurrency may be on the brink of a ‘supercycle.’ “I think I have never been more bullish about Bitcoin than I am right now,” he remarked, pointing to the cryptocurrency’s recent performance and the absence of widespread hype as a prelude to what he terms a ‘supercycle.’

Understanding the concept of a ‘supercycle’ is crucial to grasping van der Chijs’ perspective. Unlike regular market cycles that see periodic rises and falls, a supercycle in the Bitcoin domain refers to an extended period of bullish growth over several years. This phase is characterized by a substantial increase in adoption, demand, and price, often leading to far-reaching economic implications.

In essence, a supercycle marks a paradigm shift where the asset’s value escalates dramatically, supported by a continuous inflow of investment and a growing consensus about its long-term viability. To come to this conclusion, Van der Chijs’ prediction hinges on several observations and trends within the Bitcoin sector.

Why A Bitcoin Supercycle Could Be Possible

First, he notes a significant shift towards Bitcoin ETFs by funds, including yesterday’s landmark announcement from Blackrock’s Strategic Income Opportunities Fund. This movement signifies a robust institutional interest that could feed a constant stream of investment into Bitcoin, setting the stage for a supercycle.

“This will be a constant flow of new money into the ETFs. […] The flows into the ETF are getting bigger, not smaller,” van der Chijs remarked. With financial advisors poised to recommend Bitcoin ETFs to clients following a regulatory settling period, van der Chijs sees a torrent of new capital on the horizon. This anticipation is not unfounded, considering the groundbreaking success of the Bitcoin ETF launch, which he cites as “the most successful ETF launch ever.”

Corporate strategies around Bitcoin also play a pivotal role in van der Chijs’ supercycle theory. He points to Microstrategy’s aggressive leverage-based Bitcoin purchases as a harbinger of a trend where companies increasingly view Bitcoin not just as an investment, but as a fundamental aspect of their financial strategy. This shift, according to van der Chijs, could prompt other CEOs to follow suit, further accelerating Bitcoin’s ascendancy.

Moreover, a critical mass of financial advisors is on the brink of recommending Bitcoin ETFs to clients, pending the expiration of regulatory and due diligence waiting periods. This opens the gates for substantial new investments from a segment traditionally cautious about direct cryptocurrency investments. “They can’t sell the ETF during the first 90 working days (internal regulations mostly because of DD), although they are fast tracking it for this ETF,” van der Chijs stated.

FOMO And A Self-Fulfilling Prophecy

The speculation around unidentified large-scale Bitcoin acquisitions adds another layer to the supercycle narrative. Van der Chijs alludes to the intrigue surrounding a wallet that has been steadily accumulating Bitcoin, hinting at the involvement of a billionaire possibly akin to Jeff Bezos. “Since November 2023 a wallet has been adding on average about 100 BTC per day, the wallet now contains over 50,000 BTC,” he states, pointing to the potential for influential figures to catalyze broader market movements.

Another argument is potential purchases by nation-states. Although nation-state involvement in Bitcoin has been minimal, with El Salvador being a notable example, any increase in such activities could trigger a domino effect. The participation of nation-states in the Bitcoin market could significantly elevate Bitcoin’s status as a sovereign asset class.

Next, the retail sector remains largely on the sidelines in the current cycle, but van der Chijs anticipates a surge in retail interest following new all-time highs and increased media coverage. This could initiate a FOMO cycle, drawing more investment from traditional asset classes into Bitcoin.

Last, van der Chijs mentions the concept of a self-fulfilling prophecy: As Bitcoin continues to rise without significant dips due to constant new money inflow, more people and institutions will entertain the concept of a supercycle. This, in turn, could lead to increased capital allocation to Bitcoin, making the supercycle more likely.

Macroeconomic Implications Of A Supercycle

Van der Chijs’ theory also touches on the potential macroeconomic implications of a Bitcoin supercycle, predicting a significant shift in wealth and power structures. The redistribution of wealth could see Bitcoin at the center of a new economic order, with traditional asset classes potentially losing ground.

In conclusion, Marc van der Chijs outlines a compelling case for a forthcoming Bitcoin supercycle, supported by a confluence of institutional, corporate, speculative, and retail trends. He acknowledged the speculative nature of his prediction, “Right now I think there is a chance of maybe 10% that this will happen and that chance is (very slowly) going up.”

However, the implications could be massive. “[I]t will change the existing world order. It will suck money out of the stock and bond markets, out of gold and other commodities, and even out of real estate (global housing prices could collapse). This will lead to BTC prices that we can’t even imagine today, potentially millions of dollars per BTC.”

At press time, BTC traded at $67,806.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Texas Blockchain Council challenges controversial Bitcoin mining energy survey

In the recent SlateCast episode, Texas Blockchain Council Chairman President Lee Bratcher discussed the controversial emergency survey recently issued by the Energy Information Administration (EIA) regarding Bitcoin mining energy usage. As Bratcher explained:

“[The EIA] created this farce of an emergency and rushed it through without the notice and comment period.”

He elaborated that the survey asked for proprietary information and failed to follow proper procedures, leading to a lawsuit from the Texas Blockchain Council.

Political Pressure Behind the Scenes

According to Bratcher, it was evident that Senator Elizabeth Warren heavily influenced the EIA’s decision to issue this Bitcoin mining survey. Warren had explicitly asked the Secretary of Energy to survey Bitcoin energy use and clarified that she expected data to be collected before the next briefing.

With this context, Bratcher believes the EIA faced undue and inappropriate political pressure that led it to skirt proper procedures and fairness, ultimately necessitating the lawsuit from the Texas Blockchain Council.

Though Warren may have had reasonable intentions around understanding Bitcoin’s climate impact, Bratcher argues her demands failed to acknowledge benefits and placed disproportionate scrutiny on Bitcoin miners.

Future Renewable Energy Usage

Bratcher does not believe Bitcoin mining will ever rely completely 100% on renewables but expects a future mix incorporating stranded or wasted gases. He points to projects already redirecting natural gas that would otherwise be flared into generators that power Bitcoin mining. This reuse provides environmental benefits compared to releasing unused gas.

Though likely not enough to fully power Bitcoin mining, these stranded energy sources, paired with growth in solar, wind, and other renewables, can significantly reduce the carbon footprint of mining while still leveraging fossil fuels when available.

Bratcher paints an optimistic view that with the right policies, much of Bitcoin’s energy could one day come from renewables and waste gas.

Bitcoin Mining in Texas

When asked about the benefits Texas offers Bitcoin mining companies, Bratcher emphasized:

“It’s really around our energy only marketplace…you’re able to create a power trading strategy that’s probably more important than your operating strategy, or at least have equal importance and, and that’s why Texas is the best place in the world to open up a business or mine Bitcoin specifically.”

He did warn new mining companies that “this is an extremely competitive industry, and people get wrecked, especially if you’re trying to jump in without experienced operators.”

Ideal Resolution with the EIA

Now that the EIA has rescinded the original emergency Bitcoin survey, Bratcher hopes they will take the opportunity to craft a fair and thorough data center survey. This would ideally ask standardized questions across industries about energy consumption, allowing equitable comparison and performance benchmarking.

Importantly, Bratcher stresses that the Texas Blockchain Council welcomes sharing energy usage information as long as proprietary or sensitive details are protected. He advocates that miner contributions to grid stability should be accounted for. An improved survey could enable miners to showcase their energy resilience and grid benefits.

Bratcher seeks collaborative transparency, not combative obscurity, to resolve the survey controversy. He added:

“We’re happy to share energy consumption information, and we’re happy to share. It’d be great if they ask a question about our performance on the grid, and we could give them some data about how we’re doing.”

The full SlateCast episode provides an in-depth look at the Bitcoin mining industry in Texas and the policy issues surrounding it. Bratcher makes a strong case for the benefits Bitcoin mining can provide while also acknowledging fair concerns.

With Bitcoin poised to remain a growing industry, debates like these will likely continue around its energy usage and impact on grids. Watch the full podcast below:

NEW PODCAST 🎙️ Texas Blockchain Council challenges controversial #Bitcoin mining energy survey

Featuring @lee_bratcher from @TXblockchain_ with co-hosts @akibablade and @NateWhitehill pic.twitter.com/k6kJqYALLW

— CryptoSlate (@CryptoSlate) February 29, 2024

Bitcoin Miner Riot Acquires 31,500 ‘Next Generation’ M60S Mining Machines Worth $97.4 Million

Bitcoin miner Riot Platforms Inc. said it expects to take delivery as well as deploy 31,500 Whatsminer M60S miners worth $97.4 million by the end of July 2024. The addition of the new bitcoin mining machines is projected to increase the “self-mining” hashrate capacity of Riot’s Rockdale Facility to 15.1 EH/s. Replacement of Underperforming Miners […]

Bitcoin miner Riot Platforms Inc. said it expects to take delivery as well as deploy 31,500 Whatsminer M60S miners worth $97.4 million by the end of July 2024. The addition of the new bitcoin mining machines is projected to increase the “self-mining” hashrate capacity of Riot’s Rockdale Facility to 15.1 EH/s. Replacement of Underperforming Miners […]

Source link

The new frontier in Bitcoin mining: Stranded energy utilization and open hash power markets

In the latest episode of SlateCast, CryptoSlate’s Liam “Akiba” Wright and CEO Nate Whitehill welcomed Ryan Condron, CEO of Titan Mining and the creator of Lumerin Protocol, to discuss the current state of Bitcoin mining and the potential for hash power to become a valuable asset in the future.

How Titan Lightning streamlines the experience of mining

Titan Lightning, a new integration with the Lumerin hash power marketplace, aims to streamline the mining experience for users. As Condron explained, traditional mining setups often involved significant friction for newcomers:

“Previously, [new miners] had to set up an account with a mining pool, plug in the credentials — it was hard to onboard through that.”

Titan Lightning solves this by allowing users to simply provide a Lightning address when purchasing hash power through the Lumerin marketplace. The hash power then streams directly to the Titan Lightning pool, which pays users out in real-time on a “pay per share” basis.

Condron highlighted the powerful feeling of “purchasing hash power, which is essentially Bitcoin over time, and then you start receiving the stream of sats directly into your wallet.” This seamless integration removes barriers to entry, providing an instant and intuitive mining experience where users can see their rewards hit their Lightning wallet almost immediately after purchase.

Condron further explained:

“You can take a mining facility and put the hash power up for sale to the highest bidder. It’s an open market around hash power on a global decentralized anonymous scale.”

Why decentralizing hash power democratizes the Bitcoin network

Decentralizing hash power is crucial for maintaining the democratic nature of the Bitcoin network. As institutional investors and large mining pools increasingly dominate Bitcoin’s hash rate, there is a risk of centralization that could undermine the foundational principles of the network.

By enabling a global, decentralized marketplace for hash power like Lumerin, individual miners and smaller players can access and contribute computing resources without going through a centralized mining pool. This promotes a more evenly distributed hash rate and decision-making power over which transactions are included in blocks. Condron emphasized:

“Hash power needs to be accessible to everyone on earth if the Bitcoin network is going to stay democratized.”

A truly decentralized network, where no single entity controls a majority of the hash power, aligns with Bitcoin’s vision of monetary sovereignty for all participants. Initiatives focused on democratizing access to hash power are vital for upholding this ideal.

While acknowledging the potential for governments to regulate mining pools and on-ramps, Condron highlighted the need for a balanced approach:

“Governments really don’t like it when you mess with their money supply,” he said. “They’re going to look to regulate the ownership and control the transaction processing and interiors of the system.”

The future of Bitcoin mining: Embracing stranded energy

The future of Bitcoin mining lies in harnessing stranded energy resources worldwide. Many developing nations have abundant renewable energy potential that is underutilized due to infrastructure challenges or lack of local energy demand. Bitcoin mining presents an opportunity to monetize this stranded energy.

As Condron explained:

“With the advent of Bitcoin mining, you have miners coming in and actually government sponsoring mining build-out now because they realize that they can use up the electricity from these large production facilities to mine Bitcoin.”

Miners can establish operations near remote renewable energy sites, utilizing excess power that would otherwise be wasted. This facilitates Bitcoin’s sustainable growth and can drive economic development by bringing investment, jobs, and supplemental power to local communities with abundant but stranded energy resources.

The discussion with Ryan Condron offered insightful perspectives on the evolving landscape of Bitcoin mining and hash power. As the network grows, the democratization of hash power and the utilization of stranded energy resources will play pivotal roles in shaping the future of Bitcoin mining.

Watch the full podcast here.