Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Bitcoin’s mining difficulty has hit an unprecedented peak, marking the most significant jump of 2024. On Thursday, at the milestone of block 830,592, the network experienced its fourth adjustment this year with a sharp 8.24% uptick. Bitcoin Mining Difficulty Skyrockets, Setting New Records in 2024 Mining bitcoin (BTC) has become considerably more challenging, following an […]

Source link

Mining

Ethiopia’s Affordable Hydropower and Adoption of Crypto Mining Attracts Chinese Bitcoin Miners

The Ethiopian state electricity company has reportedly signed power supply agreements with 21 mainly Chinese bitcoin miners. The African country’s pursuit of foreign exchange has seemingly taken precedence over the concerns often raised by climate change advocates. Ethiopia Set to Become the Preferred Destination for Chinese Bitcoin Miners Ethiopia’s state power company has entered into […]

The Ethiopian state electricity company has reportedly signed power supply agreements with 21 mainly Chinese bitcoin miners. The African country’s pursuit of foreign exchange has seemingly taken precedence over the concerns often raised by climate change advocates. Ethiopia Set to Become the Preferred Destination for Chinese Bitcoin Miners Ethiopia’s state power company has entered into […]

Source link

Criminals Behind $2M School Theft Admit Guilt: Crypto Mining Scheme Uncovered

In recent developments, two California school district officials have admitted guilty to stealing up to $1.8 million and misappropriating electricity to finance and operate a clandestine crypto-mining operation.

The United States Department of Justice (DOJ) disclosed that Jeffrey Menge, former Assistant Superintendent and Chief Business Officer of Patterson Joint Unified School District, and Eric Drabert, the district’s IT Director, pleaded guilty to charges of theft concerning programs receiving federal funds.

Fraudulent Billing Scandal

According to the DOJ’s statement, Menge, as Assistant Superintendent, hired Drabert as the school district’s IT director around 2020.

Together, they orchestrated a series of illicit activities to siphon funds from the district. Menge reportedly utilized a Nevada-based company called CenCal Tech LLC, which he controlled, as a front for the crypto scheme.

The investigation revealed that to circumvent restrictions on conducting interested party transactions, Menge created a fictitious executive, “Frank Barnes,” to represent CenCal Tech.

Through this setup, it is alleged that Menge and Drabert executed fraudulent transactions worth over $1.2 million, involving practices such as double billing, overbilling, and billing for undelivered items.

Illicit Crypto Mining Operation Unveiled

Diversifying their criminal activities, Menge and Drabert went beyond financial embezzlement, according to the US Department of Justice.

The law enforcement agency stated that the individuals utilized “high-end graphics cards,” school district property, and electricity to establish and operate a crypto mining farm within the school district.

The illegally mined crypto assets were then redirected to wallets under their control. Additionally, Menge is alleged to have exploited school district-owned vehicles, acquiring a Chevy truck at a discounted price and selling it for personal profit while using a Ford Transit van as his vehicle.

The overall magnitude of the embezzlement was staggering. Menge misappropriated funds between $1 million and $1.5 million, while Drabert was found guilty of stealing between $250,000 and $300,000.

The DOJ revealed that the ill-gotten gains were used for “lavish” personal expenses. Menge indulged in remodeling his residence, purchasing luxury vehicles, including a Ferrari sports car, and funding other personal endeavors. Drabert, on the other hand, utilized stolen funds to renovate his vacation cabin and for various personal expenses.

The guilty pleas by Jeffrey Menge and Eric Drabert, former officials of Patterson Joint Unified School District, shed light on a shocking case of embezzlement and crypto mining fraud within the education system.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k

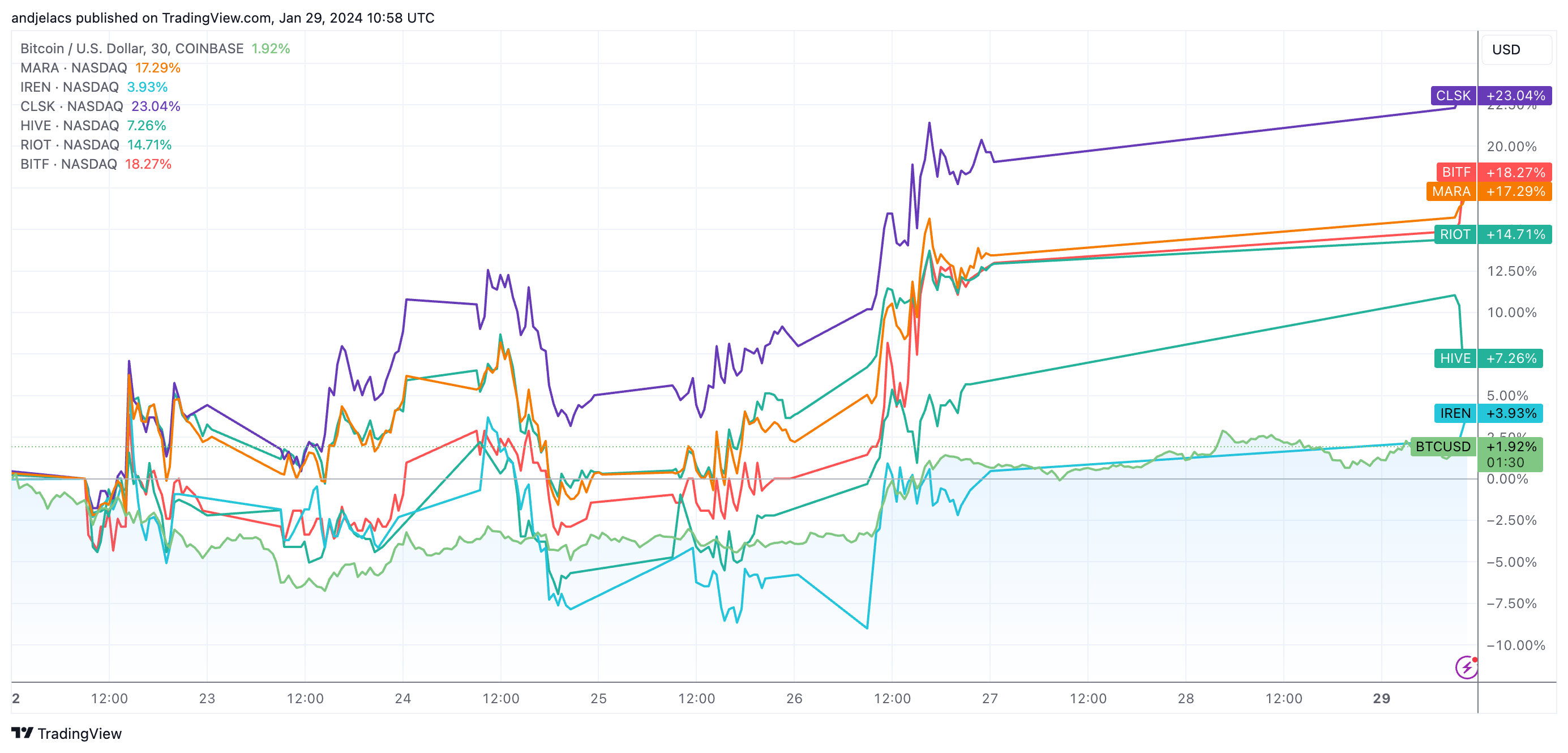

Bitcoin regained the psychologically important $40,000 level during the weekend after spending last week struggling to surpass $39,500. As of press time, it stands at just above $42,000, showing solid resilience at this level. This recovery positively affected the broader crypto market and the performance of public Bitcoin mining companies.

Despite being listed and traded on stock exchanges like Nasdaq, public Bitcoin mining companies are susceptible to changes in Bitcoin’s spot price and other developments in the crypto market. As most TradFi investors involved with the stocks see them as a proxy for trading and owning Bitcoin, increases in Bitcoin’s price automatically translate into increases in the stock value of these companies. Conversely, a decrease in the price of BTC leads to a reduction in revenues, adversely affecting their stock performance.

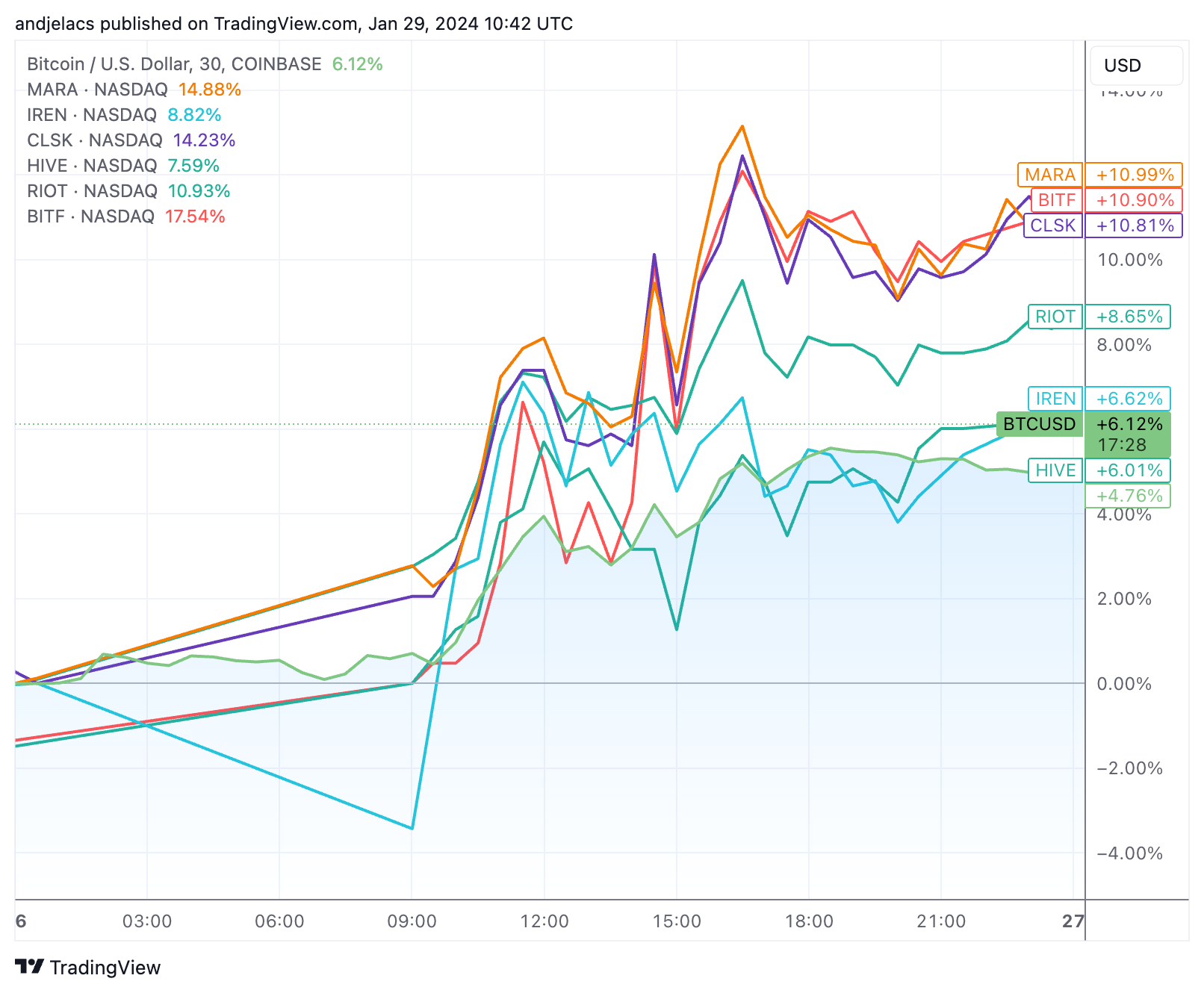

After experiencing a sharp slump in the first two weeks of January, public miners seem to have recovered most of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the pack with a 23% increase, with Bitfarms (BITF) close behind with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and 7.26%, respectively, with Iris Energy (IREN) posting the slightest growth of 3.93% during the period.

This upward trend was extremely pronounced on Friday, Jan. 26, when almost all of the mentioned stocks outperformed Bitcoin’s growth of 6.12%, with MARA, BITF, and CLSK all showing increases of over 10.80%.

On Jan. 29, as of press time, there has been a lack of response from Bitcoin mining stocks to Bitcoin’s price movement. This lag is due to the different trading hours between the crypto market, which operates 24/7, and traditional stock exchanges like Nasdaq, which operates only on weekdays and where most of the mining stocks are listed. This discrepancy often results in a delayed reaction in mining stock prices to Bitcoin’s weekend price movements. Given Bitcoin’s rise past $42,000 over the weekend, we could see further growth in mining stocks as the market opens on Jan. 29 and adjusts to the development in the coming week. Stocks such as RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, so far in pre-market trading.

The performance of these stocks also reflects the slightly increased miner revenue, which was volatile last week but showed an overall positive uptrend. According to data from Glassnode, the total daily USD revenue paid to miners fluctuated between $39 million and $47 million, following Bitcoin’s price volatility. Miner revenue is a critical benchmark for assessing the health and performance of mining stocks, and revenue increases are one of the most significant factors pushing stock prices up.

The post Despite ETF rotation fears, mining stocks recover as Bitcoin crosses $42k appeared first on CryptoSlate.

Bitcoin Mining Stocks Soar Past $3.5B in Volume, Surpassing Tech Giants

Marathon Digital’s spectacular performance aligns with the broader boom in the Bitcoin mining sector.

In an astonishing turn of events, Bitcoin (BTC) mining stocks experienced an unparalleled jump in trading volumes this week, outperforming some of the world’s greatest tech giants. Marathon Digital Holdings Inc (NASDAQ: MARA) and Riot Platforms Inc (NASDAQ: RIOT), two major players in the Bitcoin mining sector, collectively recorded a staggering $3.55 billion in trading volume on Monday, according to data from Yahoo Finance.

Marathon Digital Takes the Lead

Marathon Digital stole the spotlight by securing the position of the top-traded stock in the United States on Monday. With a trading volume of 112 million total shares, the Bitcoin miner surpassed well-known names such as Tesla Inc (NASDAQ: TSLA), Advanced Micro Devices, Inc (NASDAQ: AMD), Nvidia Corp (NASDAQ: NVDA), and Apple Inc (NASDAQ: AAPL) by a considerable margin. Even Tesla, the second most traded stock in the United States lagged behind with a daily trading volume of approximately 85 million shares.

Simultaneously, Grayscale’s Bitcoin Trust (GBTC) traded close to half a billion on the same day. Industry expert Eric Balchunas pointed out that this volume surpassed over 99% of the 3,000 current Exchange-Traded Funds (ETFs). Notably, Grayscale Investments, the firm behind GBTC, is seeking approval from the Securities and Exchange Commission (SEC) to convert this trust into a spot ETF.

As the market eagerly anticipates the potential approval of spot Bitcoin ETFs, Balchunas noted that GBTC is wielding a remarkable advantage, describing it as “bringing a (volume) gun to a knife fight.” He, however, emphasized that Grayscale’s 1.5% fee will act as a repellent to investors. As a reference, fees from BlackRock Inc (NYSE: BLK) are pegged at 0.30% with many wondering how Grayscale Investments will match up with this competition.

Bitcoin Mining Sector Boom

Marathon Digital’s spectacular performance aligns with the broader boom in the Bitcoin mining sector. On Monday, Core Scientific secured a $55 million equity investment, marking a successful emergence from its debt crisis.

The oversubscribed equity offering positions the company for relisting on the Nasdaq exchange after completing bankruptcy proceedings. Similarly, CleanSpark announced a strategic agreement that could see the acquisition of up to 160,000 miners by the end of 2024, further contributing to the sector’s upward trajectory.

Moreover, Marathon Digital recently disclosed that it mined a whopping 1,853 Bitcoin in December 2023. Marathon’s mining results from last month indicate that it increased production by 56% in just one month. In addition, the company’s production increased by 290% from December 2022 levels.

The extraordinary trading volumes witnessed by Bitcoin mining stocks on January 8 underscore the growing influence of the crypto mining industry. As Marathon Digital and other key players outpace established tech giants, the narrative around Bitcoin continues to evolve.

With the anticipation of spot Bitcoin ETF approvals and ongoing developments within the mining sector, the stage is set for further excitement and exploration of the dynamic intersection between traditional finance and the crypto space.

next

Market News, News, Stocks

You have successfully joined our subscriber list.

Court grants final approval for $225M Celsius mining company, steers clear of securities ruling

The United States Bankruptcy Court for the Southern District of New York approved the implementation of the “MiningCo Transaction” for Celsius and its affiliated debtors as part of the Chapter 11 bankruptcy proceedings on Dec. 27. This order, enacted by Chief Judge Martin Glenn, marks a critical juncture in the restructuring efforts of Celsius as all objections to the proposal were also overruled.

The court’s decision now paves the way for Celsius to proceed with the transaction aimed at stabilizing and restructuring the company’s operations with the formation of “a public company focused solely on bitcoin mining.” The MiningCo Transaction involves specific terms and conditions that are integral to the company’s restructuring plan. This includes the capitalization of the new entity (NewCo) with $225 million in fiat and the transfer of specific mining assets to NewCo, excluding the Core Rhodium, Mawson, and Luxor assets.

Furthermore, the court’s order approves modifications to the Management Agreement, setting the initial term to four years with certain conditions for extension or early termination. Notably, if NewCo’s mining capacity does not meet the specified Exahash Target of 23 EH/s within the initial three years, NewCo holds the right to terminate the agreement without an early termination fee, provided a six-month transition period is given.

The court also sanctioned the “Wind-Down Budget and Procedures,” crucial for the orderly execution of the plan. The Wind-Down budget outlines significant expenses, including administration fees, professional fees, and operating expenses, totaling approximately $70 million. These costs are instrumental in supporting the distribution of asset sales and the administration of the estate.

Additionally, the court addressed the issue of the Securities and Exchange Commission’s (SEC) rights in relation to crypto tokens. The order explicitly states that nothing in the court’s decision should be construed as a determination under federal securities laws regarding the status of crypto tokens or transactions involving them. This clause maintains the SEC’s authority to challenge transactions involving crypto tokens.

This approval signals a shift towards an orderly wind-down, a change from the original plan but aimed at better outcomes for creditors. The decision came after weighing various inputs, including objections and supportive statements, reflecting the court’s focus on a fair and legal resolution.

With this ruling, previous agreements on how unsecured claims would be handled are now void. The court has put in place new guidelines for winding down the company’s operations and managing creditor payouts.

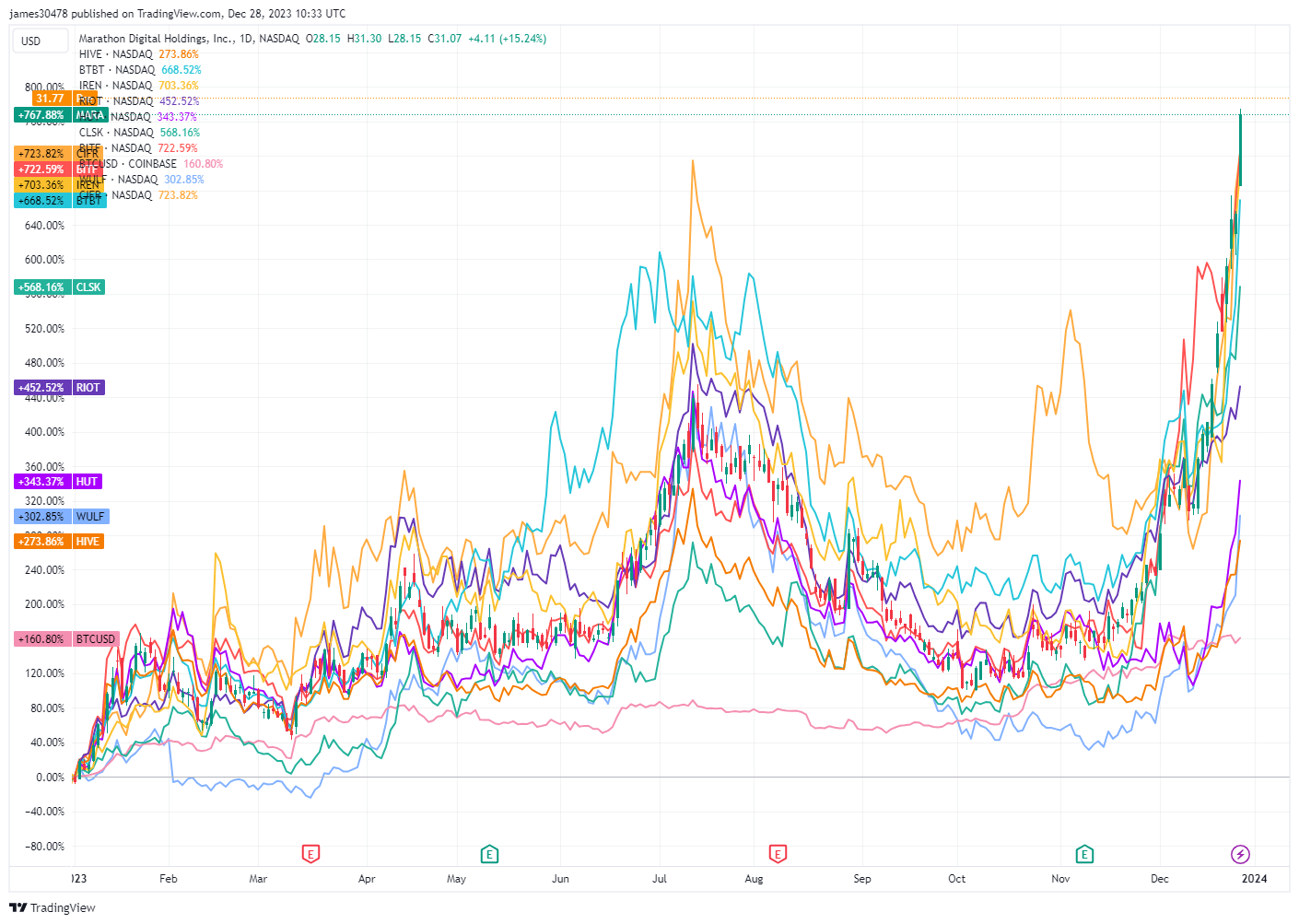

Quick Take

Bitcoin mining stocks have seen a remarkable performance in 2023, outpacing Bitcoin’s already impressive 160% YTD surge. Key mining players, including Hive and Marathon Digital Holdings, have recorded skyrocketing growth figures at an astonishing 274% and 767% YTD, respectively.

Data from Fintel points to an intriguing phenomenon – a significant percentage of short interest in these mining stocks, corroborated by analyst Mortensen Bach. This short interest has added momentum to their upward trajectory. CryptoSlate observed a divergence a few months prior between miners and Bitcoin’s price, a trend that has now caught up and exceeded the Bitcoin price.

| Mining Stock | Short Interest % |

|---|---|

| $HUT | 32.74% |

| $WULF | 22.58% |

| $MARA | 22.60% |

| $CIFR | 20% |

| $RIOT | 18.16% |

| $BTBT | 13.73% |

| $CLSK | 8.42% |

| $SDIG | 7.20% |

| $BITF | 6.51% |

| $HIVE | 5.25% |

| $IREN | 4.01% |

| $BTDR | 3.13% |

| $MSTR | 20.93% |

Source: Fintel

The Bitcoin mining proxy, WGMI, has surged 143% in the past three months, compared to Bitcoin’s 64% increase. The interplay of high short interest and rising prices on these mining stocks suggests a potential short squeeze scenario playing out. As prices continue to climb, shorts may be closing their positions, propelling prices upwards.

The post Bitcoin mining stocks dwarf Bitcoin’s gains amid short squeeze buzz appeared first on CryptoSlate.

Iris Energy to double hash rate in 2024 with $22M Bitmain T21 mining rig order

Renewable Bitcoin (BTC) mining firm Iris Energy is set to increase its total hash rate to 10 exahashes per second (EH/s) in 2024 by acquiring new Bitmain T21 mining rigs.

The company announced it had acquired an additional 1.6 EH/s of Bitmain T21 miners, set for delivery in the second quarter of 2024. The company currently has 5.6 EH/s of operational capacity as of December 2023.

The newest generation of Chinese manufacturer Bitmain’s mining hardware will also improve the efficiency of Iris’ operations from 29.5 joules per terahash (J/TH) to 24.8 J/TH. Iris invested $22.3 million in the latest order from Bitmain, pricing the hardware at $14 per terahash.

Related: Iris Energy to nearly triple hash rate with estimated 44,000 new BTC miners

Iris expects to bring 1.4EH/s of mining output by powering up a previous order of Bitmain S21 miners in the first quarter. It is also awaiting a different batch of Bitmain T21 miners, increasing its capacity by 1.3 EH/s.

The company also plans to build another 100 MW of data centers at the site, which is made possible by providing an additional 500 MW of power capacity that is already available to the operation.

While Iris has primarily been focused on Bitcoin mining, it has expanded its data center to service the growing demand for generative artificial intelligence computing. Iris invested $10 million in August to purchase 248 state-of-the-art Nvidia H100 GPUs, which are set to be delivered by the end of 2023.

The company currently operates data center facilities in different sites across North America, including Canal Flats, Mackenzie, Prince George in Canada’s British Columbia and its Childress site in Texas.

Magazine: Real AI & crypto use cases, No. 4: Fight AI fakes with blockchain

Ocean Mining defends accusations of censoring privacy-focused Bitcoin transactions by Samourai Wallet

Samourai Wallet, a Bitcoin mobile app wallet, accused Ocean Mining, a decentralized BTC mining pool, of censoring “privacy enhancing transactions” on the blockchain network in an extensive Dec. 7 thread on social media platform X (formerly Twitter).

However, Ocean Mining’s top executive retorted that a bug in Samurai’s system caused the problem.

The issue

The BTC wallet provider claimed that the mining pool enacted a policy of censoring Whirlpool Coinjoin transactions and BIP47 notification transactions from Dec. 6. The firm pointed fingers at Ocean Mining’s leadership, including CTO Luke Dashjr and lead investor Jack Dorsey, alleging ‘hostility’ towards its transactions.

According to Samourai, Dashjr’s claim that Whirlpool transactions are non-standard is “totally wrong and a lie” because it is imposing a 46-byte limit on the OP_RETURN function instead of the previous 80 bytes set in Bitcoin Core version 0.12. Samourai Wallet contends that this alteration effectively causes Ocean to exclude privacy-enhancing transactions.

The platform wrote:

“Ocean is choosing to pursue a very slippery slope in their decision to exclude privacy enhancing transactions…Unfortunately the action of Ocean deciding to censor privacy enhancing transactions is yet another example of the dilution of cypherpunk roots of the bitcoin project.”

In response, Dashjr countered that the issue was due to a bug in Samourai’s system.

Furthermore, the Ocean Mining CTO questioned why Samourai exceeded the 42-byte data carrier size. “What is this data even for? I’ve looked at trying to work around it, but can’t find any technical details,” Dashjr added.

However, he concluded that Samourai should fix the problem on their end since it’s reducing privacy.

Meanwhile, this is not the first time that Dashjr has been accused of trying to censor transactions on the BTC network. On Dec. 6, crypto community members likened his attempt to end Ordinals Inscription to censoring transactions on the blockchain network.

Crypto mining companies Hut 8 Mining Corp. and US Bitcoin Corp (USBTC) have combined operations in an all-stock merger of equals to form a new United States-domiciled entity named Hut 8 Corp (New Hut).

Canada-based Hut 8 announced the completion of the merger on Nov. 30, dubbed as the “largest mergers and acquisitions transaction” in crypto by New Hut CEO Jaime Leverton. Before the merger, Leverton served as CEO of Hut 8 for over three years.

After much anticipation… we’re thrilled to announce the completion of our merger of equals with USBTC! We are now officially operating as a U.S.-domiciled entity, Hut 8 Corp. with 825 MW of energy under management across 11 sites with self-mining, hosting, managed services, and… pic.twitter.com/yJ3uou326o

— Hut 8 (@Hut8Mining) November 30, 2023

The merger will result in the delisting of Hut 8 common stocks from the Toronto Stock Exchange and Nasdaq by or before Dec. 4. It will be replaced by New Hut common stocks under the ticker symbol “HUT.” Amid the delisting and relisting process, Hut8 shareholders received 0.2 of a share of New Hut common stock for every Hut 8 share held.

Asher Genoot, president of New Hut, revealed the company’s plan to ready itself for the upcoming Bitcoin (BTC) halving. By combining resources, “New Hut has access to approximately 825 MW [megawatts] of gross energy across six sites with self-mining, hosting, and managed service operations,” the announcement reads.

Hut8 received final clearance from the Supreme Court of British Columbia to merge with USBTC in September. However, the planning process began in February.

At the time, the merger was subject to court and regulatory approval by U.S. and Canadian authorities. Adding to the legal complexity, USBTC was undergoing “a legal dispute” with the City of Niagara Falls in New York against residents who had criticized the mining operations for their alleged noise pollution. The dispute was settled on April 7.

Related: Bitcoin mining firm Phoenix Group delays share listing

X (formerly Twitter) and Block co-founder Jack Dorsey recently took steps to promote the decentralization of Bitcoin mining operations.

Dorsey recently led a $6.2 million seed round for Mummolin, the parent company of the new decentralized Bitcoin mining pool Ocean, which is designed to provide more transparency into the mining process and enable miners to receive block rewards directly from Bitcoin rather than mining pools.

Magazine: Real AI & crypto use cases, No. 4: Fight AI fakes with blockchain

Update (Dec. 1 at 1:06 pm UTC): This article has been updated to clarify that Hut 8 shareholders received 0.2 of a share of New Hut common stock, rather than a complete share, for every one share of Hut 8 stock held.