Ripple’s chief legal officer has urged the U.S. Securities and Exchange Commission (SEC) to own up to its multiple missteps in enforcement actions against the crypto industry. He referenced court rulings that criticized the SEC for “gross abuse of power,” lack of “faithful allegiance to the law,” and being “arbitrary and capricious.” Ripple’s Legal Chief […]

Ripple’s chief legal officer has urged the U.S. Securities and Exchange Commission (SEC) to own up to its multiple missteps in enforcement actions against the crypto industry. He referenced court rulings that criticized the SEC for “gross abuse of power,” lack of “faithful allegiance to the law,” and being “arbitrary and capricious.” Ripple’s Legal Chief […]

Source link

Mistakes

If you’re newly retired in 2024, or if you’re planning to leave the workforce for good this year, you’ll want to be sure you’re on a solid financial path so you won’t have to spend the rest of your retirement worrying about money.

To make certain you have the funds you need for your future, there are three major errors you need to avoid. Here’s what they are.

Image source: Getty Images.

1. Not making a budget

When you retire, your life is going to change in important ways. You’re going to be relying on new sources of income such as Social Security and distributions from your 401(k). You may also be spending more on some things, like travel, and less on others, like work clothes or your commute to your job.

You need to make sure you have enough income coming in to cover all your costs, which means you need a budget.

It’s best to make one as soon as you retire, or even before, so you can figure out all your expenditures and make sure your income will cover them. After all, you don’t want to get halfway through the year and find you’ve already spent all you can afford to take out of your retirement accounts — but still have tons of expenses left.

You can use a simple spreadsheet or an app to make your budget, but the important thing is that you make one so you know where your money is going and confirm you have enough of it.

2. Not being strategic about when to claim Social Security

As a new retiree, Social Security will be an important income source. If you haven’t claimed it yet, you’ll want to be strategic about when you do — not taking time to consider this choice carefully could be a huge mistake.

You could claim benefits right at your full retirement age to get your standard benefit, or you could file for benefits before that to get smaller monthly checks but more total payments. You could also delay claiming benefits so your monthly payment amount would continue to increase until you turn 70.

If you expect you’ll live a long time or you have a lower-earning spouse who’s likely to rely on survivor benefits, a late claim may make strategic sense, as you could end up with more lifetime benefits. If you are concerned about your health and your spouse won’t be relying on your survivor benefits after you’re gone, you may want to claim early so you can start receiving money.

The important thing is to understand how your age when you claim benefits affects your income and make an informed choice about what claiming age is best for you.

If you have already claimed Social Security benefits, this may not be a concern — although if it has been less than 12 months since you started them, you could always rescind your claim if you decide you made the wrong choice. You’d have to pay back any money you already received, but this would allow you to delay the start of your benefits and increase your future check if you want to do so.

3. Withdrawing money without setting a safe withdrawal rate

Finally, taking money out of your retirement accounts without deciding on a safe withdrawal rate is an error you can’t afford. You don’t want to take too much money out too quickly and find yourself draining your account dry.

You can use the 4% rule as a good rule of thumb, withdrawing 4% from your account in the first year of retirement and then taking out more each year to keep pace with inflation. While there’s some concern that your money won’t always last if you use this approach — due to longer life expectancies and lower projected returns compared to when the rule was created — many experts still advise it as a simple approach to figuring out how much to withdraw.

The most important thing, though, is having some system to ensure you won’t leave yourself with too little to live on in late retirement.

By avoiding these three mistakes, you can hopefully ensure your retirement goes well and that you have plenty of money to enjoy your later years.

We can all relate to the frustration of trying to remove a stripped screw, but, for Mike Massimino, one particular mangled screw was higher stakes than your typical DIY headache.

In 2009, the then-astronaut was in space, floating next to the body of the Hubble Space Telescope and struggling to remove one of the screws that fastened a handrail to one of the telescope’s instrument panels.

Massimino…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

These are the biggest money mistakes we make in our 20s, 30s and 40s

Financial literacy peaks at age 54, according to a 2022 study. That’s around the time you’ve gained enough knowledge and experience to make sound money decisions — and before your cognitive ability might start to ebb.

“As we get older, we seem to rely more on past experience, rules of thumb, and intuitive knowledge about which products and strategies are better,” said Rafal Chomik, an economist in Australia who led the study.

If people in their mid-50s tend to make smart financial moves, where does that leave younger generations?

Advisers often educate clients at different stages of life to avoid money mistakes. While those in their 50s usually demonstrate optimal prudence in navigating investments and savings, advisers keep busy helping others — from twentysomethings to mid-career professionals — avoid costly financial blunders:

Navigate your 20s

Perhaps the biggest blunder for young earners is spending too much and saving too little. They may also lack the long-term perspective that encourages long-range planning.

“The mistake is not establishing the saving habit early, and not appreciating the power of compounding” over time, said Mark Kravietz, a certified financial planner in Melville, N.Y.

Similarly, it’s common for young workers to delay enrolling in an employer-sponsored retirement plan. Not participating from the get-go comes with a steep long-term cost.

“ Better to prioritize debt with the highest interest rate, which can result in paying less interest over the long run. ”

People in their 20s process incoming information quickly. But their high level of fluid intelligence can work against them. Cursory research into a consumer trend or hot sector of the stock market can spur them to make rash investments. Such impulsive moves might backfire.

“It’s important to resist the hype,” Kravietz said. “Don’t chase fads or try to make fast money” by timing the market.

Many young adults with student debt juggle multiple loans. Eager to chip away at their debt, they fall into the trap of choosing the wrong loan to tackle first, says Megan Kowalski, an adviser in Boca Raton, Fla.

Rather than pay off the highest-interest rate loan first (so-called avalanche debt), they mistakenly focus on the smallest loan (a.k.a. snowball debt). It’s better to prioritize debt with the highest interest rate, which can result in paying less interest over the long run.

Navigate your 30s

“ Resist the temptation to lower your 401(k) contribution to boost your take-home pay. ”

By your 30s, insurance grows in importance. You want to protect what you have — now and in the future. But many people in this age group neglect their insurance needs. Or they misunderstand which coverages matter most.

“If you have a life partner and kids, get the proper life insurance while in your 30s,” Kravietz said.

It’s easy to get caught up in your career and assume you can put off life insurance. But even low odds of your untimely death doesn’t mean you can ignore the risk of leaving your loved ones without a cash cushion.

Another common blunder involves disability insurance. If your employer offers short-term disability insurance as an employee perk, you may think you’re all set.

However, the real risk is how you’d earn income if you suffer a serious and lasting illness or injury. Don’t confuse short-term disability insurance (which might cover you for as long as one year) with long-term disability coverage that pays benefits for many years.

Assuming you were wise enough to enroll in your employer-sponsored retirement plan from the outset, don’t slough off in your 30s. Resist the temptation to lower your 401(k) contribution to boost your take-home pay.

“You want to give till it hurts,” Kravietz said. “Keep putting money away” in your 401(k) or other tax-advantaged plan until you feel a sting. Weigh the minor pain you feel now against the major relief of having a much bigger nest egg decades from now.

Navigate your 40s

“ ‘The 40s are often the most expensive in anyone’s life. Life is getting more complicated.’”

For Kravietz, the 40s represent a decade of heavy spending pressures. Mid-career professionals face a mortgage and mounting tuition bills for their children.

“The 40s are often the most expensive in anyone’s life,” he said. “Life is getting more complicated.”

As a result, it’s easy to overlook seemingly minor financial matters like updating beneficiaries on your 401(k) plan or completing all the appropriate estate documents such as a will.

“People in their 40s sometimes fail to update beneficiaries,” Kravietz said. For example, a new marriage might mean changing the beneficiary from a prior partner or current parent to the new spouse.

It’s also easy to get complacent about your investments, especially if you’re the conservative type who favors a set-it-and-forget-it strategy. Instead, think in terms of tax optimization.

“In your 40s, you want to take advantage of what the government gives you,” Kravietz said. “If you have a lot of money in a bank money market account and you’re in a top tax bracket, shifting some of that money into municipal bonds can make sense” depending on your state of residence and other factors.

If you’re saving for a child’s college tuition using a 529 plan — and you have parents who also want to chip in — work together to strategize. Don’t make assumptions about how much (or how little) your parents might contribute to your kid’s education.

“Rather than assume you’ll have to pay a certain amount for educational expenses, coordinate between generations of parents and grandparents” on how much they intend to give, Kowalski said. “That way, you’re not duplicating efforts and you won’t put extra funds in a 529 plan.”

More: 7 more ways to save that you may not have considered

Also read: ‘We live a rather lavish lifestyle’: My wife and I are 33, live in New York City and earn $270,000. Can we retire at 55?

Millions of seniors today get a monthly benefit from Social Security. And chances are, you’re looking forward to receiving your share of that pot given that you pay into the program on a regular basis.

But it’s important to get a solid handle on Social Security well ahead of retirement and in the years leading up to it. And so to that end, it’s best to avoid these Social Security mistakes at all costs.

Image source: Getty Images.

Continue reading

U.S. executive order on China shows it’s learning from Russia mistakes

The White House has announced a ban on some U.S. investment in China in sensitive technologies such as computer chips in the latest ratcheting up of Washington’s disassociation from Beijing amid perceived national security risks.

Drew Angerer | Getty Images News | Getty Images

LONDON — U.S. moves to de-risk from China with a new investment ban suggest that Western allies may be learning from national security failings in Russia, according to analysts.

The White House on Wednesday announced a ban on some U.S. investment in China in sensitive technologies such as computer chips, in the latest ratcheting up of Washington’s disassociation from Beijing amid perceived national security risks.

Analysts said the U.S. was making such moves with an eye on rising tensions over Taiwan, given that the potential fallout from a conflict between China and Taiwan would be “unimaginable.”

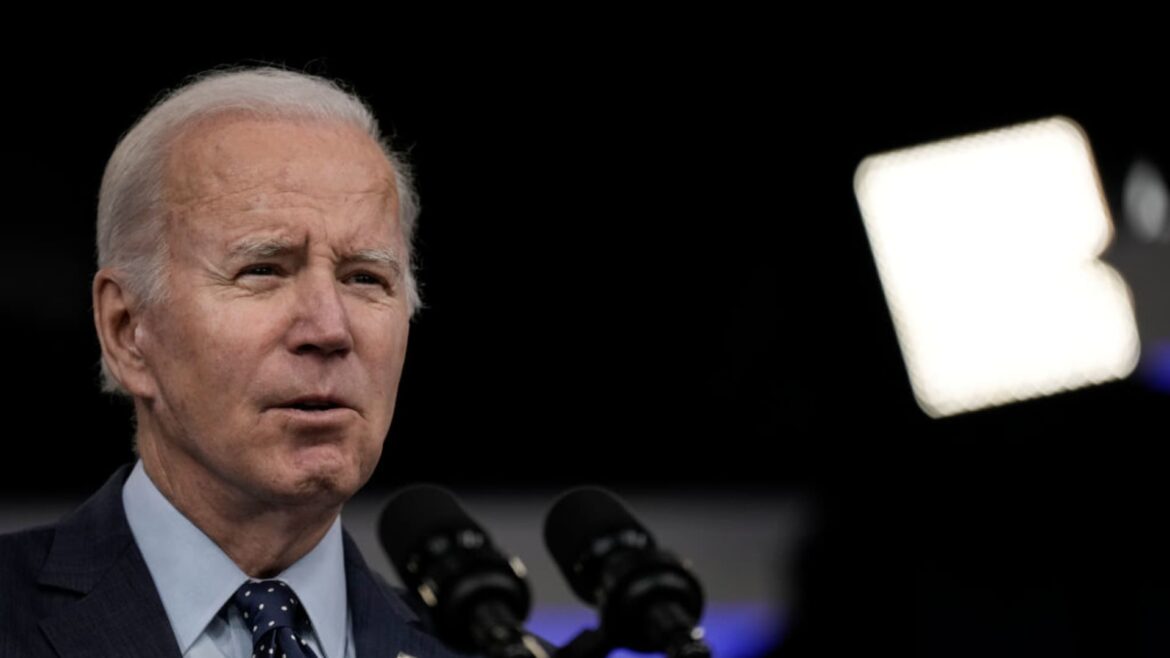

U.S. President Joe Biden said the executive order, which will come into effect next year, aims to ensure that China’s military does not benefit from American technology and funding, particularly in sectors that “counter United States and allied capabilities.”

Such moves have sometimes been referred to as a “decoupling” of the world’s two largest economies, though the U.S. has preferred the term “de-risking.”

Beijing hit back at the announcement Thursday, with the Foreign Ministry saying it was “resolutely opposed” to what it dubbed the U.S.’ “blatant economic coercion and technological bullying.” China’s ambassador to Washington has previously warned that Beijing would retaliate against such measures.

These preemptive ideas about decoupling … that’s all done with a view to potential conflicts.

Olena Yurchenko

advisor at the Economic Security Council of Ukraine

“These preemptive ideas about decoupling — taking the manufacturing and the manufacturing facilities from China to India etc. — that’s all done with a view to potential conflicts, so that when it erupts, let’s say in Taiwan, it’s not so excruciating to impose some restrictions,” said Olena Yurchenko, advisor at the Economic Security Council of Ukraine. Yurchenko, who spoke to CNBC ahead of the Wednesday announcement, dubbed the scale of the risks regarding Taiwan as “unimaginable.”

Taiwan has been governed independently of China since the end of a civil war in 1949, but Beijing views the island as part of its territory.

The dispute over Taiwan is a global flashpoint, with most in the West considering it a self-governing nation. Beijing, meanwhile, has called for “reunification” with Taiwan, last year describing its status in a white paper as an “unalterable” part of China.

Prominent China hawk Kyle Bass, who said he had consulted military experts, told CNBC Tuesday that he believes Chinese President Xi Jinping could launch an attack on Taiwan as early as next year. He cited Beijing’s recent ratcheting up of its military drills around the Taiwan Strait. CNBC could not independently verify his assertions.

The Chinese government did not immediately respond to CNBC’s request for comment on Bass’ assertions. However, it has previously said the issue with Taiwan is an internal affair and its military exercises are in response to repeated meetings between Taiwan’s president and U.S. representatives — a red line for Beijing.

Learning lessons from Russia

The U.S. has been forthright in its aims to de-risk from China, with the Biden administration ramping up measures over the past several months amid growing global tensions following Russia’s full-scale invasion of Ukraine.

The Economic Security Council of Ukraine’s Yurchenko, whose work closely follows geopolitics and international relations, said the timing of the two events was no coincidence.

“This is kind of a long-term lesson the Western governments try to learn from what they’ve seen in Russia,” she said.

Western allies have slapped unprecedented sanctions on Russia in response to its ongoing war. Still, CNBC analysis shows that Moscow is able to circumvent sanctions by relying on intermediary countries to help it import Western goods, including advanced technologies for its military equipment.

Elina Ribakova, senior fellow at the Peterson Institute for International Economics, said that China was watching the West’s approach to Russia closely. China has been cited as the primary intermediary supplying Western tech to Russia’s military.

“If we’re not effective with Russia, if China is the one playing the key role in helping Russia circumvent these export controls, then how can we possibly think that we’ll be effective against China if something were to happen with Taiwan?” Ribakova said.

The Chinese government did not respond to a request for comment on Ribakova’s and Yurchenko’s statements.

Western sanctions against Moscow keep coming, almost 1½ years after Russian forces crossed Ukraine’s borders.

The U.K. on Tuesday announced new sanctions on a range of foreign businesses accused of supplying Russian forces with weapons and components for use against Ukraine.

This follows the European Union’s introduction in June of a new package of sanctions, which includes an anti-circumvention tool to restrict the “sale, supply, transfer or export” of specified sanctioned goods and technology to certain third countries acting as intermediaries for Russia.

Asked last month whether the sanctions might send a message of potential repercussions from any possible future conflicts, including between China and Taiwan, European Commission spokesperson Daniel Ferrie told CNBC he could not comment or speculate on the future.

Reducing ties with China

As the world’s second-largest economy, China’s contributions to — and its role within — international relations and global markets are widely recognized as far exceeding those of Russia, prompting heightened caution from the West.

The European Union has thus far been more ambivalent than the U.S. in its approach to China. The British government, for its part, said Wednesday that it was considering whether to follow the U.S. as it continues to assess “potential national security risks attached to some investments.”

We need to be more firm. I’m not saying immediately decouple and walk away, although I think that’s what will happen.

Kyle Bass

founder and chief investment officer at Hayman Capital Management

However, Bass said that Western allies’ current approach of a “slow decoupling” could be misguided, leaving governments to “improvise” quickly if a conflict involving Taiwan broke out.

“We need to be more firm. I’m not saying immediately decouple and walk away, although I think that’s what will happen,” he added.

Speaking to CNBC’s “Street Signs” on Tuesday, before Biden signed the executive order, Bass, who is founder and chief investment officer at Hayman Capital Management, supported the prospect of new guidelines around U.S. investment in Chinese tech.

“We should have very strict outbound restrictions on surveillance companies, on genomics companies, on any companies that deal with Chinese military building their aircraft carriers, their war machines, their ships, their tanks,” he said.

Americans reveal their No. 1 financial regret, but advisers say they hear these horrible mistakes the most

If you’re like most Americans, you are probably regretting some of your financial decisions.

But first, the good news: Making money mistakes is not the end of one’s journey to financial freedom, Emmanuel K. Eliason, president and CEO of Eliason Wealth Management based in Centennial, Colo., told MarketWatch. It’s more like a detour to the final destination, he said.

In fact, financial advisers said that having regrets — or making mistakes — is normal. “This is what life is,” said Erika Safran, financial planner and founder of Safran Wealth Advisors based in New York City. “Just because it didn’t work out, doesn’t mean it wasn’t worth pursuing.”

Now for the bad news: Nearly 75% of Americans say they have some sort of financial regrets, according to a survey released Wednesday from Bankrate. Only one in five Americans said they didn’t have any financial regret at all.

“Nearly 75% of Americans say they have at least one financial regret.”

Of those asked by Bankrate, 21% said not starting to save for retirement early enough is their top financial regret. That was followed by taking on too much credit-card debt (15%); not saving enough for emergency expenses (14%); taking on too much student-loan debt (5%); and not saving enough for their children’s education (3%). A significant number of respondents — 18% — said they didn’t know what their biggest financial regret was, or that it was something else not listed above.

“Despite rising debt levels and higher interest rates, regrets over lack of savings continue to outpace regrets related to debt,” Bankrate chief financial analyst Greg McBride said in a statement. The power of compounding interest rates has the potential to “magnify regrets” about foregone savings over time, he added.

Here are three of people’s biggest financial regrets, as identified by financial advisers.

1. Not saving early enough for retirement

Most financial advisers said their clients’ most common regret is not starting to save for retirement early enough. “I tell them that it is never too late, but they must start now,” said Angela Dorsey, founder and financial planner of Dorsey Wealth Management based in Torrance, Calif.

For many, the reason may be not knowing when or how to start saving for retirement — especially for those not making a lot of money to start with, said Josh St. Laurent, founder and CEO of Wealth In Yourself based in South Lake Tahoe, Calif. The stigma surrounding financial literacy education or lack thereof is powerful, he added.

For those who just entered the workforce, Dorsey stresses the importance of “saving even just a small amount” in a 401(k) from each paycheck. If the annual return is at 6.5%, every dollar put in a 401(k) in your 20s becomes $17 by the time the person retires, McBride said.

The “I should have saved more” excuse is “a catch-all to cover several ill-advised, regrettable decisions,” said Jim White, a financial adviser at Great Oak Wealth Management, which has offices in Pennsylvania.

And people withdrawing from a 401(k) before reaching the age of 59½ are “savings killers,” he added. Pulling money out early can incur a 10% penalty fee. So keep that in mind before deciding to pull from your 401(k) to purchase your dream home, White added.

2. Making black-and-white money decisions

People are most likely to make mistakes when they make “binary” or black-and-white decisions about money — that they want to go all-in or all-out, said Scott A. Bishop, partner and managing director at Presidio Wealth Partners in Houston. This is especially true when it comes to buying and selling stocks, he said. When people try to time the stock market, they often have FOMO (fear of missing out).

Instead of going all-in for a specific investment and selling everything, take another look at your allocation and rebalance the portfolio for less risk, he said.

“In my experience when someone goes ‘all to cash’, they get out late,” Bishop said. And the end result? “They sell low and buy high, exactly the opposite of what you want to make money in the markets.

3. Signing a loan on behalf of a friend

Of course, financial advisers make mistakes too. Not doing proper due diligence before signing a rental lease on behalf of a friend is one of the biggest financial regrets of Eliason, the Colorado-based financial planner, said. He did just that, but did not do enough research into his friend’s financial behavior. The “friend” eventually disappeared in the middle of the lease, and Eliason was left to pick up the tab.

People should be extra mindful about signing a loan — whether it’s a student loan or a personal loan — on behalf of friends or loved ones, Eliason said. Before taking the risk, consider the worst-case scenario and, if that happened, how that would impact your finances.

Questions Eliason recommends asking before cosigning a loan: What’s your employment history? What’s your credit score? Do you have any other outstanding loans?

In the end, taking a little time before making a big decision could be the difference between having big financial regrets — or not. “I should have been more vigilant and done a proper check instead of simply leading with my heart and emotion out of misplaced compassion without financial wisdom,” Eliason said.

Emotion and finance, after all, too often go hand-in-hand.

What’s a financial mistake you’ve made or regret you had in the past? We’d like to hear from you. Tell us at readerstories@marketwatch.com and a reporter might get in touch.

Related:

‘She’s currently waiting tables on nights and weekends’: My sister asked me to cosign her $11,000 student loan. Do I say yes?

Is Meta Repeating OpenAI’s Mistakes? Mark Zuckerberg Doesn’t Think So

Meta Platforms (META -2.73%) recently announced that it will make its new large language model (LLM) for artificial intelligence (AI) freely available as open-source software. It’s a move that contrasts with strategic shifts that generative-AI leader OpenAI has made for its own hugely popular ChatGPT service.

While OpenAI previously made its LLM software available on an open-source basis, the company ultimately decided that the approach wasn’t a good idea. Meta’s move to offer Llama 2 as freely available and customizable software might close off some sales opportunities and create some additional downsides, but CEO Mark Zuckerberg believes it’s ultimately the right move for the company. Here’s why.

Meta aims to shake up the AI space

In a post published on Meta’s Facebook platform, Zuckerberg outlined details about the launch of his company’s new large language model and the decision to make the software freely available for most commercial users. Here’s what he said on the significance of making Llama 2 open source:

Open source drives innovation because it enables many more developers to build with new technology. It also improves safety and security because when software is open, more people can scrutinize it to identify and fix potential issues. I believe it would unlock more progress if the ecosystem were more open, which is why we’re open-sourcing Llama 2.

While the core service won’t generate any direct revenue for Meta, the company may be able to sell additional support and add-on services. Making the software open source will also potentially curb growth opportunities for its biggest rivals in the AI space.

Rather than pay for commercial LLM software, many potential users may opt to use Meta’s free offering. This could lay foundations for the company to generate valuable data that can be used to train increasingly advanced artificial-intelligence models.

The launch of Llama 2 also represents an expansion of Meta’s existing partnership with Microsoft. The social media giant has chosen Microsoft’s Azure cloud infrastructure service as the preferred partner for its new, open-source large language model. The software has already been made available on Microsoft’s Azure cloud infrastructure service, and it will also be available on Amazon‘s AWS, Hugging Face, and other providers.

While Meta competes with a wide range of players in the tech space, its focus on the digital advertising market means that Alphabet is one of its biggest rivals. Apple is another company of concerned. Because Alphabet and Apple own the leading operating systems for mobile platforms, decisions they make can have a large impact on Meta’s business.

By offering Llama 2 as open-source software, Meta may be able to head off some of Alphabet’s and Apple’s moves in the AI space. But OpenAI believes that making advanced LLMs freely available for use and customization also opens doors for potential misuse.

Is OpenAI right about the dangers of open source?

OpenAI actually started as a company focused on providing open-source AI software. While the company’s name hasn’t changed, its approach to software access and customization has. The artificial intelligence specialist has pivoted away from making code and information about data training available, and it believes that trying the open-source approach was a mistake.

While OpenAI has cited competitive reasons as the primary rationale for ditching the open-source approach, top executives at the company have also cited safety concerns as a motivating factor for shifting to a closed model.

In particular, Open AI’s chief scientist and co-founder Ilya Sutskever has warned about the potential for abuse as AI models become more advanced. Sutskever believes that it will eventually be very easy for bad actors to use artificial intelligence applications to cause harm — and that making access to the inner workings of AI software less readily available could help avert damaging outcomes.

While it remains to be seen whether Llama 2 will be abused by bad actors, it’s clear why Zuckerberg and Meta have a different take on the competitive aspects of open source. As a massive social networking technology company that also has business and potential growth drivers in a wide range of other categories, Meta isn’t as dependent on directly monetizing its LLMs.

By bringing more users into its own AI ecosystem, Meta strengthens its ability to compete with ChatGPT, Bard, and other leading offerings in the space. Additionally, Llama 2’s open-source status comes with a bit of a catch — at least for some of Meta’s biggest competitors. The company has stipulated that potential licensees with more than 700 million monthly active users must receive special permission to use the software.

Therefore, while remaining open source clearly wasn’t the right move for OpenAI, it could wind up paying off for Meta Platforms.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon.com, Apple, Meta Platforms, and Microsoft. The Motley Fool has a disclosure policy.