Citigroup analysts predict gold will reach $3,000 within six to 18 months, with more buyers piling in amid Fed rate cut hopes and geopolitical tensions.

Source link

months

World App, the first native Worldcoin (WLD) wallet, has reached the milestone of 10 million users in less than 12 months from its launch. As the first wallet compatible with World ID, the World App significantly contributes to providing accessible, self-custodial wallet services worldwide.

The team launched the World App in May 2023, quickly gaining momentum with 4 million downloads by November. Now, the app serves users across more than 160 countries, with 2 million engaging daily and facilitating over 70 million transactions.

The growth has firmly positioned the app among the top self-custodial wallets globally, showcasing its capacity with an average of 7.1 transactions per second.

Tiago Sada, Head of Product at TFH, shared excitement about the milestone, focusing on its tangible impact. He said:

“Reaching this milestone demonstrates the potential of making the fundamental technologies of Ethereum accessible and user-friendly. The World App represents our dedication to simplicity and functionality in the crypto domain.”

The World App aims to simplify crypto interactions by focusing on the essential functions of Worldcoin and Ethereum. It enables users to authenticate their identity with World ID, execute global transactions without fees, engage in crypto token swaps, and access Worldcoin Grants in many areas.

The app accommodates a broad user base, supports most mobile devices, provides gasless transactions, and offers 24/7 support in over 10 languages.

Remco Bloemen, head of blockchain at the Worldcoin Foundation, praised World App’s success as an entry point for further adoption and innovation within the Worldcoin ecosystem. He added that he looks forward to the development of more wallets to suit varying user preferences, reflecting the Worldcoin community’s goal for greater decentralization and accessibility.

A notable instance of the app’s impact comes from Kenya, where a World App user purchased a goat using Worldcoin. The story garnered attention and support from the crypto community, leading to donations that allowed the user to acquire additional livestock.

Sada said:

“Such stories vividly illustrate the life-changing potential of cryptocurrency. Our vision is to enable similar empowering experiences on a global scale.”

With the World App now serving over 10 million users, TFH continues to illustrate the broad possibilities of crypto in enhancing global economic engagement.

The development comes amid a backdrop of regulatory concerns regarding Worldcoin’s biometric data collection practices in several countries, including Kenya.

Worldcoin recently made a lot of its code open-source in an effort to be more transparent about its data collection. The project has also undergone a security audit and received praised from industry magnates.

Mentioned in this article

Latest Alpha Market Report

From days to months: How Bitcoin holder behavior predicts price peaks

Quick Take

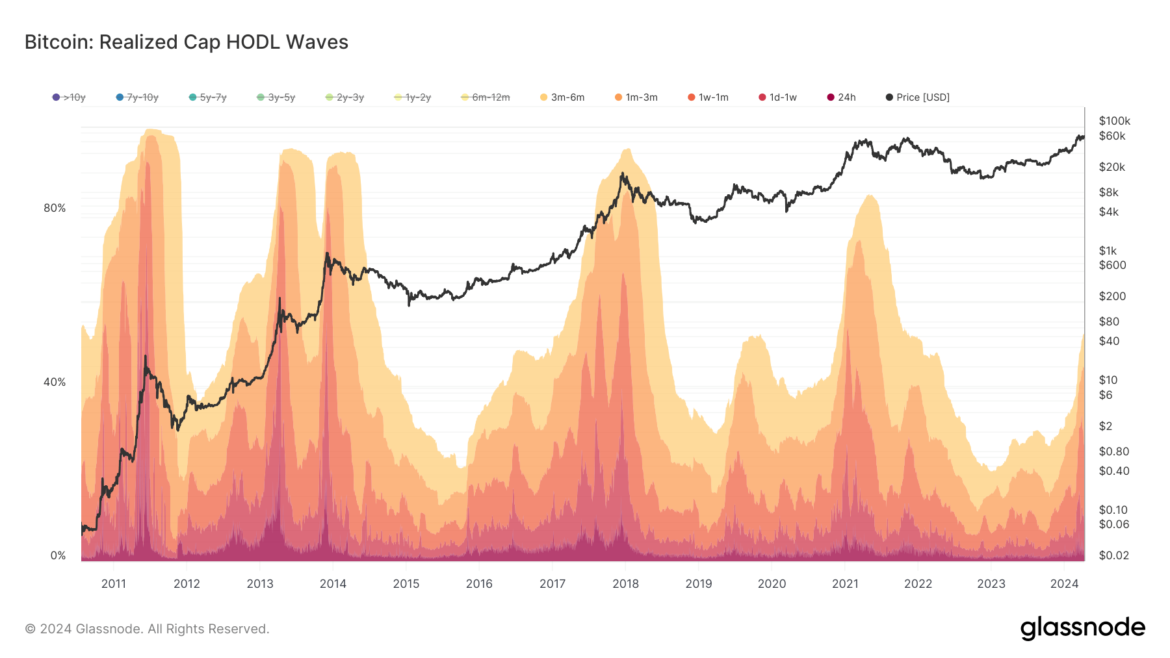

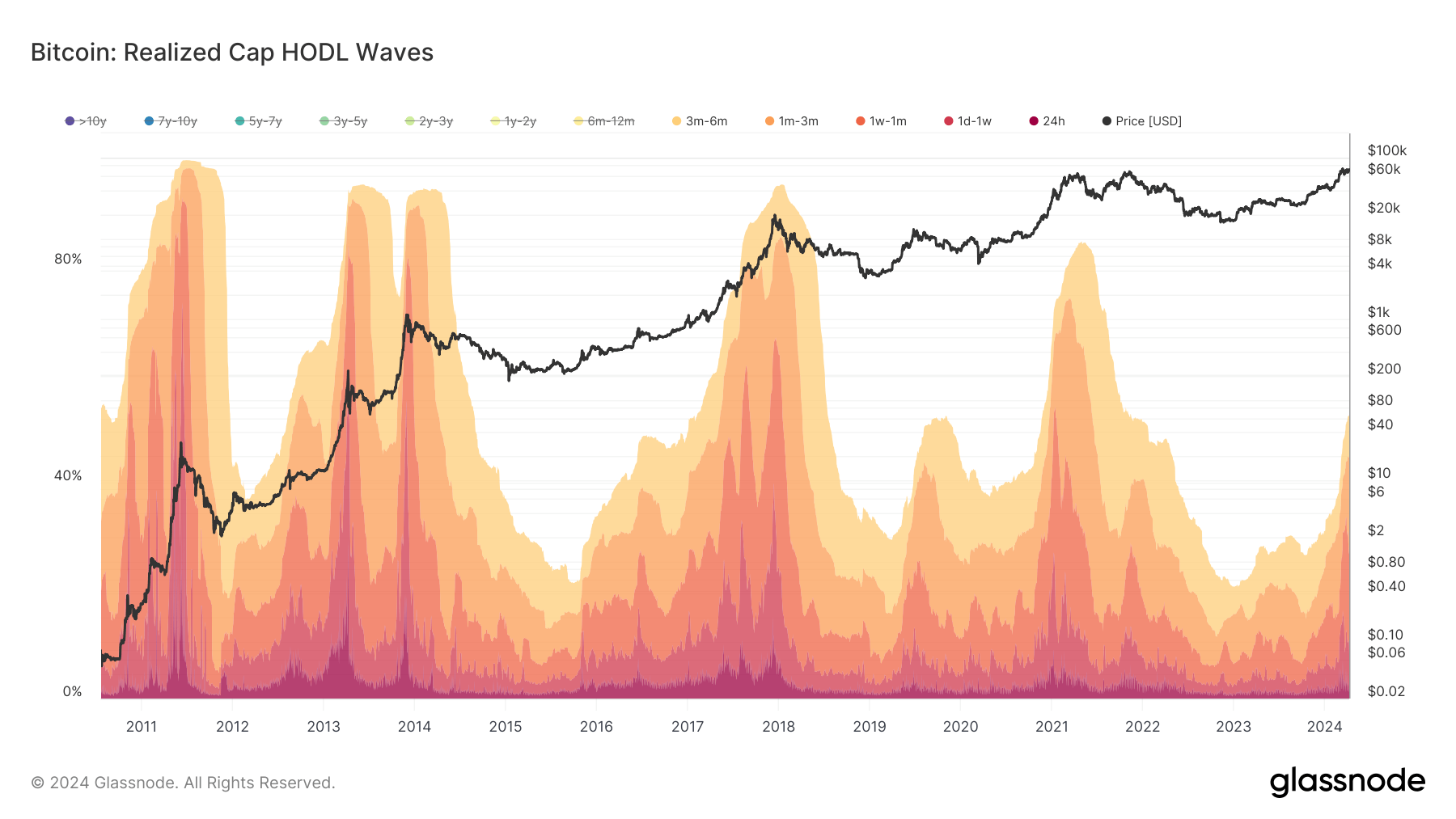

Bitcoin’s price cycles are often influenced by the behavior of short-term holders (STHs), defined as investors who have held the digital asset for less than 155 days. According to Glassnode data, during market peaks, STHs typically possess 80% or more of the Bitcoin supply, with the prevailing cohort transitioning from shorter to longer holding periods in each subsequent cycle.

Data from Glassnode shows that at the peak in 2011, STHs commanded 96% of the supply, primarily comprising holders of one-day to one-week durations. By the 2013 peak, 90% of the supply was held by STHs, predominantly those holding for one-day to one-week periods. Moving to the 2017 peak, STHs still dominated over 90% of the supply, but the principal cohort shifted to one-week to one-month holders, indicating a slightly maturing market.

In March 2021, at the peak, 85% of the supply was held by STHs, with the predominant group being holders of one-month to three-month durations, according to Glassnode.

Currently, with Bitcoin hovering near all-time highs, STHs control 54% of the supply, which suggests potential for further growth. The gradual transition in dominant STH groups from shorter to longer durations implies an evolving market maturity.

The post From days to months: How Bitcoin holder behavior predicts price peaks appeared first on CryptoSlate.

Crypto Expert Reveals What To Expect For Bitcoin, Dogecoin, And XRP In 12-16 Months

Crypto expert Ash Crypto has outlined his price predictions for several crypto tokens, including Bitcoin (BTC), Dogecoin (DOGE), and XRP, heading into this bull run. He also suggested that these price levels could be attained in the next 12 to 16 months.

How High Will Bitcoin, Dogecoin, And XRP Rise?

Ash Crypto predicted in an X (formerly Twitter) that BTC would rise between $100,000 and $250,000 by 2025. This prediction aligns with those made by other notable crypto analysts. One of them is Skybridge Capital CEO Anthony Scaramucci, who predicted in January that Bitcoin would rise to $170,000 18 months after the Bitcoin Halving.

Source: X

Meanwhile, some other crypto analysts will argue that Bitcoin hitting $100,000 could even happen this year rather than 2025. This includes Tom Dunleavy, the Chief Investment Officer (CIO) at MV Capital, who claims that Bitcoin will rise to $100,000 by the end of this year. Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, also predicted that Bitcoin would rise to as high as $150,000 this year.

Regarding his price target for DOGE, Ash Crypto predicted that the meme coin would rise to $1 in the next 12 to 16 months. This prediction is also a common sentiment shared by several other crypto analysts and members of the crypto community. Specifically, crypto analyst DonAlt once mentioned that “it isn’t too unlikely for Dogecoin to go to $1,” while crypto analyst Altcoin Sherpa stated that DOGE could do “something silly like go to $1 this cycle eventually.”

Ash Crypto also shared his price target for XRP, stating that the crypto token could rise between $3 and $5. This price prediction, however, seems conservative, considering other predictions that crypto analysts have made for the XRP token.

Crypto analyst CrediBULL Crypto recently mentioned that XRP could rise to as high as $20 in this market cycle. Meanwhile, Crypto analyst Egrag Crypto has repeatedly stated that XRP hitting $27 is possible.

Undervalued Altcoins Make The List

Crypto expert Michaël van de Poppe recently included Chainlink (LINK), Celestia (TIA), and Polkadot (DOT) in a list of ten crypto tokens he believes are undervalued. Interestingly, these three altcoins also made their way into Ash Crypto’s list of coins, for which he outlined price targets.

For LINK, Ash Crypto predicted that the crypto token could rise to between $250 and $500 by next year. LINK’s rise to such levels would undoubtedly be massive, considering it currently trades at around $17. Ash Crypto also predicted a parabolic surge in TIA and DOT’s prices, as he believes they could rise to as high as $150 and $120, respectively.

DOGE price rises above $0.2 resistance | Source: DOGEUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

DAO Treasuries See Over $20 Billion Growth in 4 Months Amid Crypto Market Boom

Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Source link

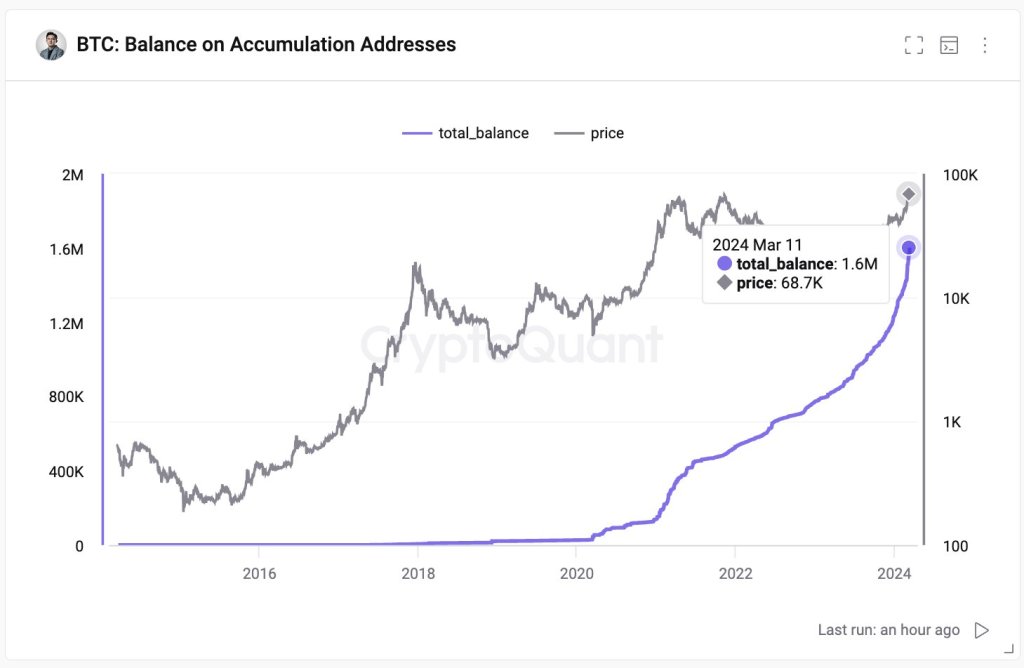

Ki Young Ju, the founder of CryptoQuant, a crypto analytics platform, predicts a severe Bitcoin “sell-side liquidity crisis” in the next six months. In this event, the founder thinks that not only will prices erupt to new levels, surpassing expectations, but the crisis will likely lead to a market disruption.

Bitcoin Records New All-Time Highs

Bitcoin is trading at around new all-time highs following sharp price gains on March 11. The coin roared to print new all-time highs of $72,800 before cooling off to spot levels.

Even though the upside momentum has waned as prices move horizontally when writing, the uptrend remains. Accordingly, more traders expect BTC to ease above yesterday’s highs as bulls target seven digits at $100,000. If bulls break above this psychological number, technical and fundamental analysts say it will be a crucial inflection point for Bitcoin.

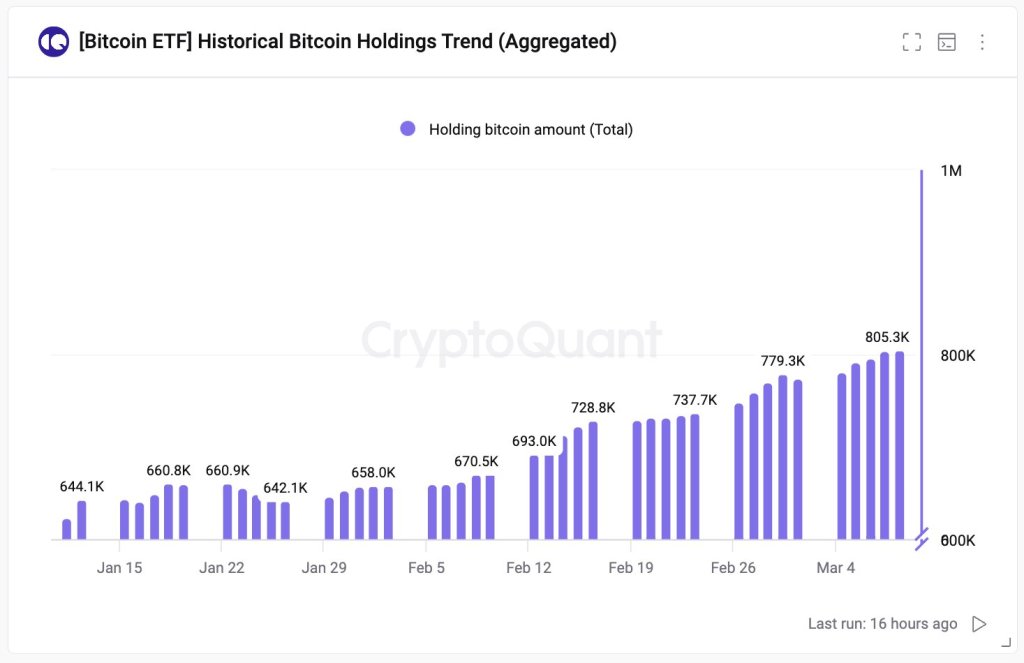

The founder expects Bitcoin prices to explode in the next six months primarily because of two factors. The first, Ju notes, is the massive influx of demand from institutions via spot Bitcoin exchange-traded funds (ETFs). So far, analysts have linked the current upswing in Bitcoin to institutional demand.

Last week, Ju observed a net inflow of over 30,000 BTC. This means that institutions are taking away more coins from circulation at an unprecedented level, contributing to scarcity. Institutions and wealthy individuals can gain exposure to BTC through spot ETFs without necessarily owning it directly.

Beyond this, the concern lies in the limited number of coins held across centralized exchanges and known entities, especially miners. The founder estimates that exchanges and miners own roughly 3 million BTC. Ju explains in the post that entities in the United States hold 1.5 million BTC.

BTC Scarcity Crisis Expected

The founder notes that rising demand from spot ETFs and a constrained supply will create a “sell-side liquidity crisis” within six months. This scenario could lead to a situation where there aren’t enough sellers to meet the high buyer demand, further lifting prices to fresh levels.

The Bitcoin network will slash miner rewards by half in April from the current 6.125 BTC. Because of this, BTC’s emissions will drop, meaning only small amounts of coins will be released into circulation, further worsening the situation.

As such, if the current level of demand remains and institutions continue to double down, the expected scarcity crisis may likely cause a major disruption in the market, benefiting coin holders.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

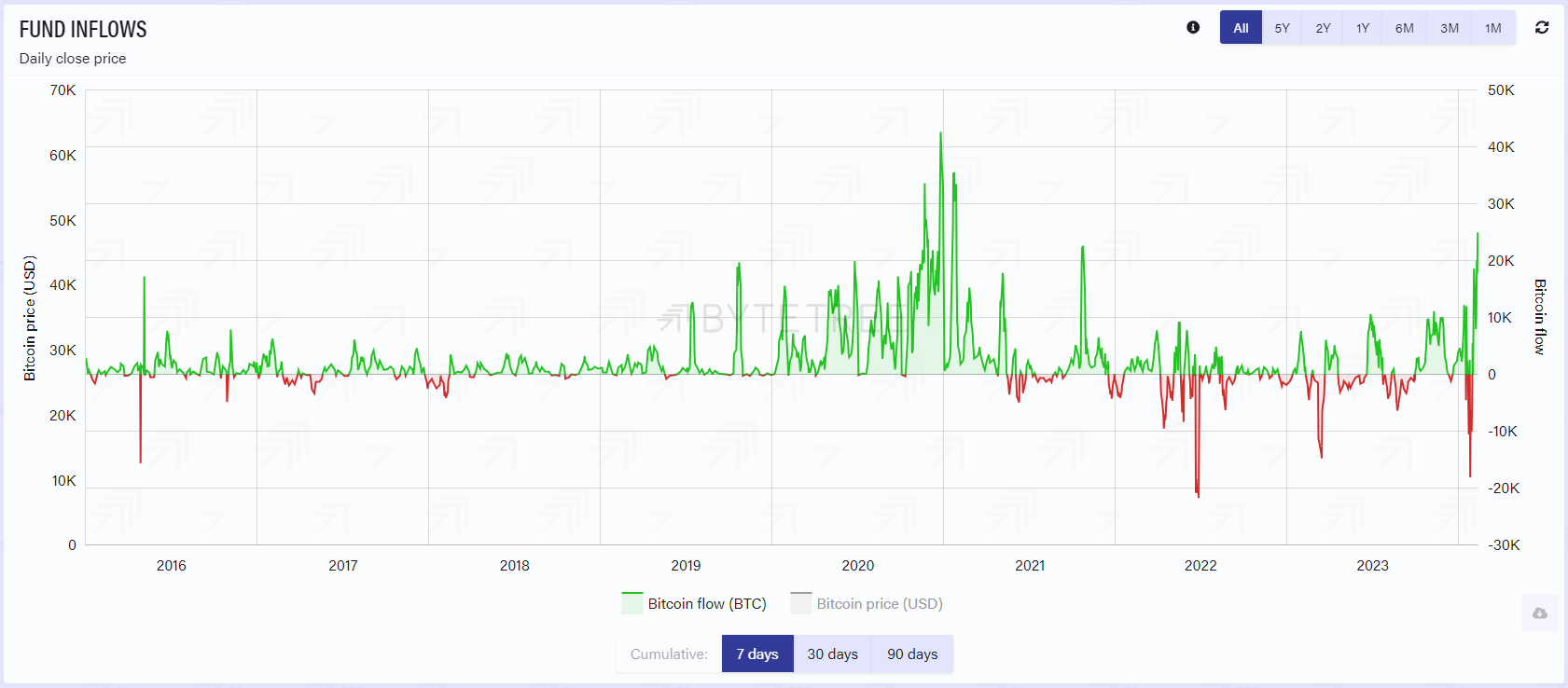

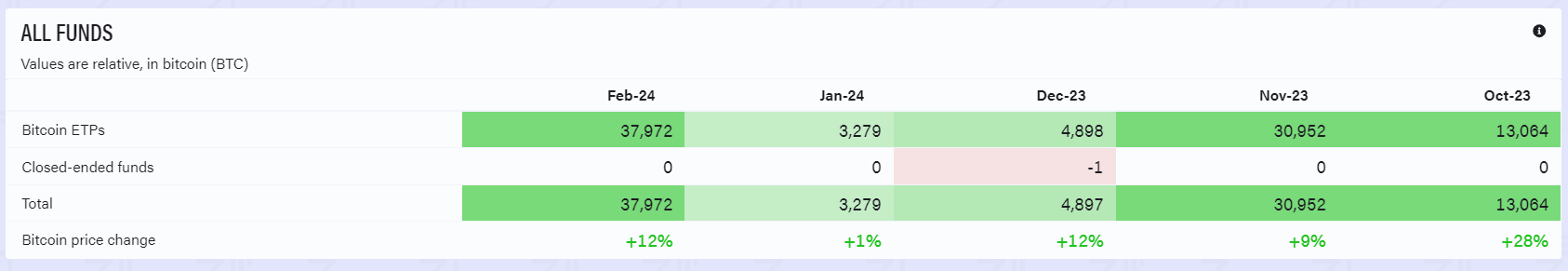

February’s Bitcoin ETP net inflows close to total of previous three months

Quick Take

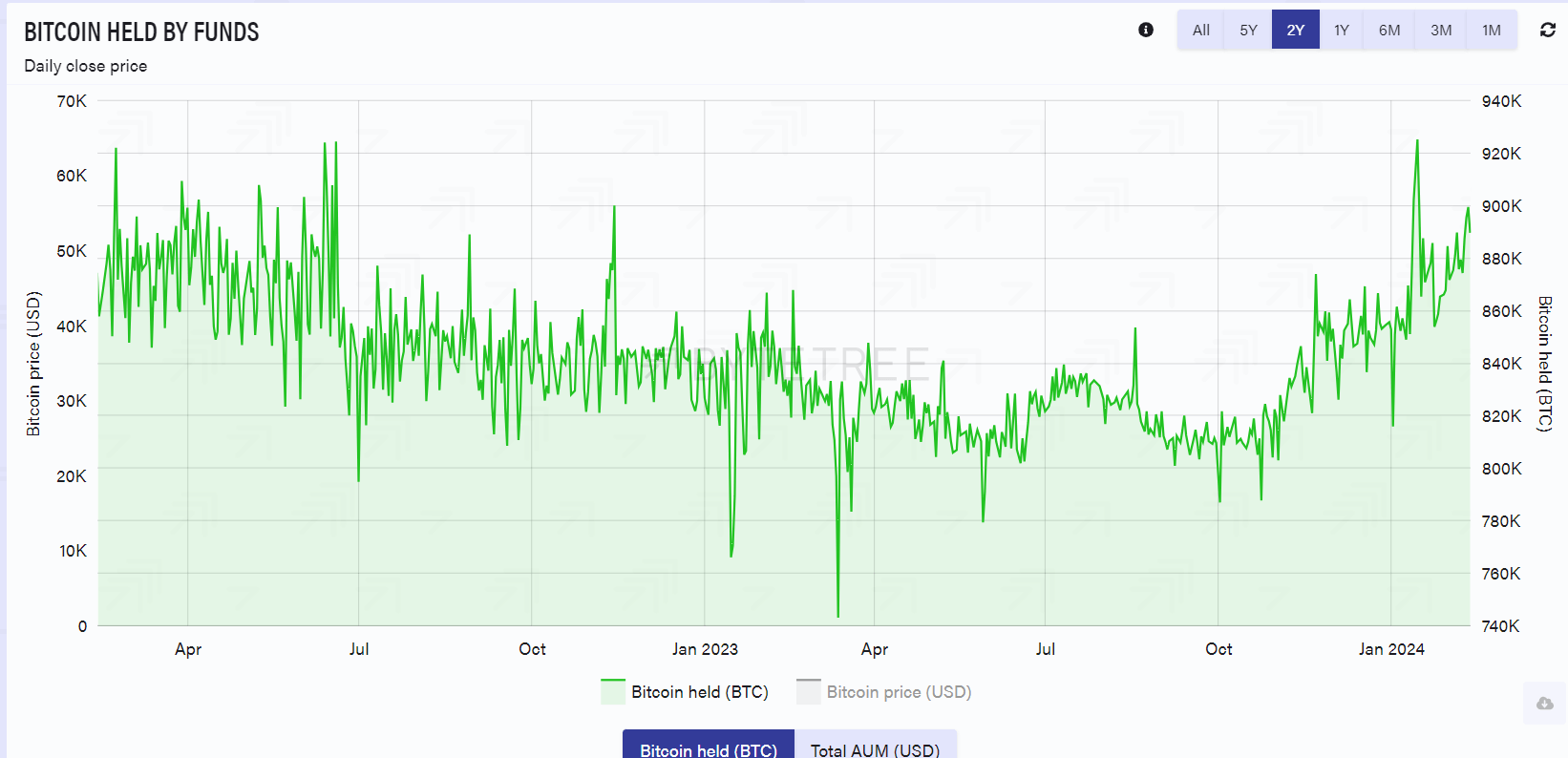

ByteTree has reported a massive influx in the global allocation of Bitcoin among exchange-traded products (ETPs) since October 2023, adding roughly 100,000 BTC.

According to ByteTree data, approximately 890,000 BTC are currently held in varying ETPs worldwide, which is about 4.56% of the circulating supply of Bitcoin. Interestingly, the start of 2024 has seen an increase of about 80,000 BTC in the ETP space, primarily attributed to US-based Bitcoin ETFs.

Within the last seven days alone, global Bitcoin ETPs underwent an influx of roughly 25,000 BTC, marking the most significant weekly increase since the early part of 2021.

February alone contributed an impressive 38,000 BTC net inflow into ETPs, roughly equal to the combined flow for November, December, and January.

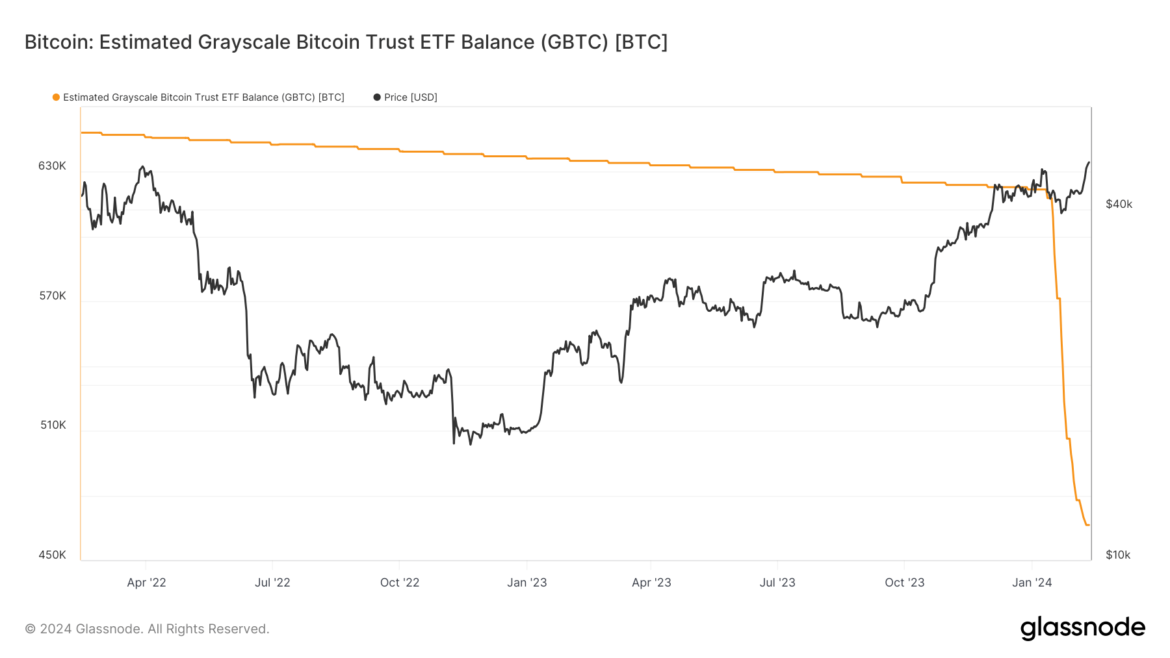

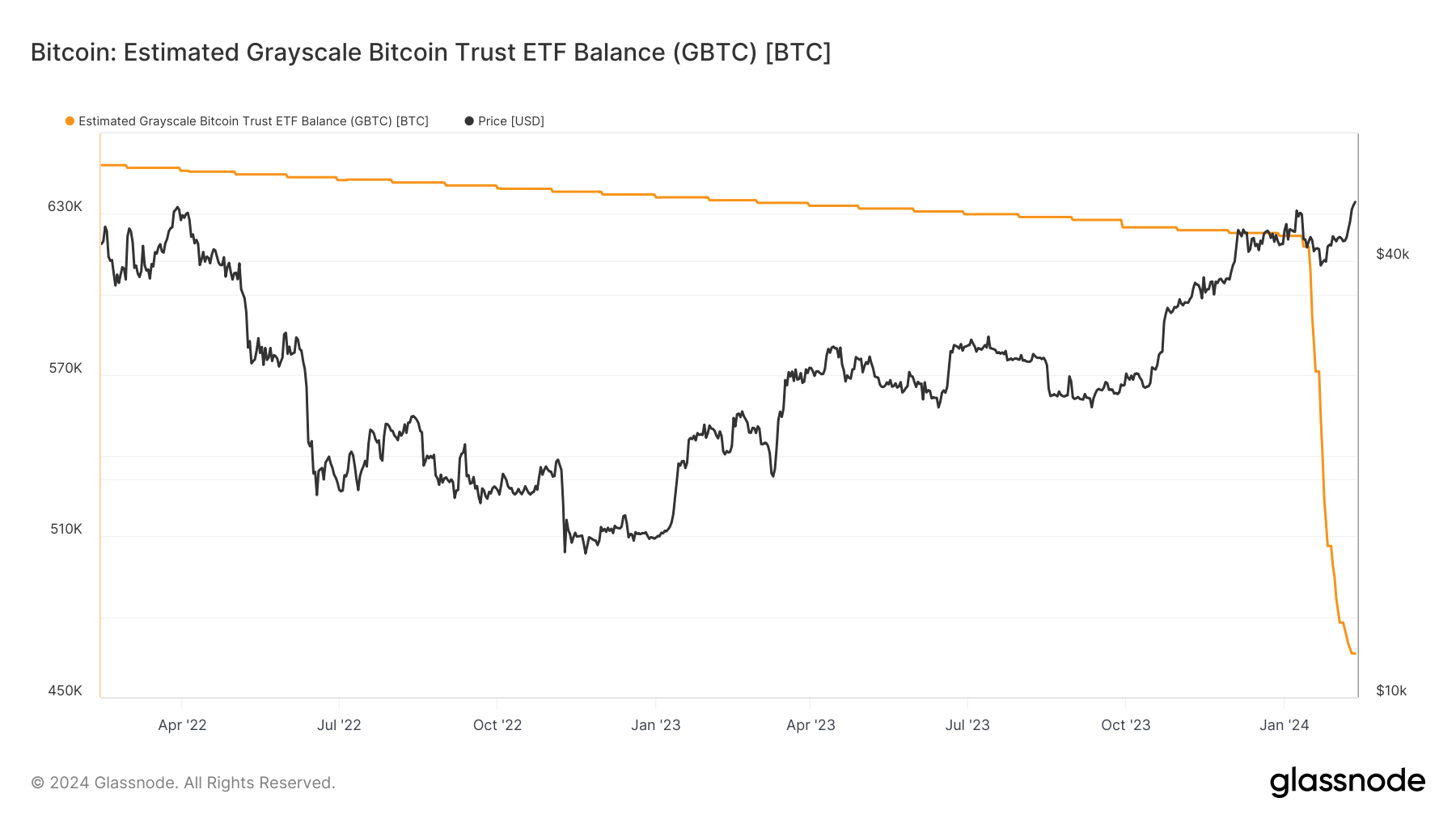

Glassnode data reports that Grayscale Bitcoin Trust (GBTC) currently holds approximately 466,000 Bitcoin, a significant 30% decline from its peak holdings of about 622,000 Bitcoin before Bitcoin ETFs began trading.

The post February’s Bitcoin ETP net inflows close to total of previous three months appeared first on CryptoSlate.

If BlackRock continues 6k BTC daily buys we get a supply crunch within 18 months, here’s why

Building on CryptoSlate’s recent analysis of the competing Bitcoin inflows and outflows between BlackRock and Grayscale, I extrapolated the data even further to see just how long BlackRock could sustain its current average Bitcoin accumulation.

At a high level, BlackRock’s entry through Bitcoin ETFs is a substantial moment for Bitcoin’s reputation in the United States. Along with the other ‘Newborn Nine‘ ETFs, BlackRock’s endorsement is likely to decrease the liquid and very liquid supplies as more investors gain access to Bitcoin as a long-term investment. Further, it will increase investor confidence for those unfamiliar with blockchain and enhance the credibility of Bitcoin as an asset class, thereby affecting its liquidity and volatility profiles.

Before I go any further, I want to add a very clear disclaimer here. The analysis below is a hypothetical look at possible accumulation levels from spot Bitcoin ETFs. I have used the debut inflows for BlackRock as the yardstick. There is no guarantee these levels will persist, and if they did, it would very likely result in an increase in the price of Bitcoin. The demand for Bitcoin is unlikely to remain consistent at any price, so assuming the same BTC inflows over a prolonged period is improbable.

That said, looking at the numbers from a purely theoretical standpoint does reveal some extremely headline-worthy data points, which can then be used alongside other analyses to identify if and when a supply crunch is on the horizon for Bitcoin.

The longer these new ETFs continue to acquire Bitcoin at these elevated levels, the better for long-term HODLers and laser eyes.

In my opinion, now, more than ever, HODLing Bitcoin has a real purpose. The fewer Bitcoins available for purchase inside ETFs, the closer we come to a MOASS (Mother Of All Supply Squeezes) where Bitcoin moons, not because shorts have to cover, but because institutions have to buy Bitcoin on the open market like the rest of the world.

Liquidity in Bitcoin and BlackRock’s immediate impact.

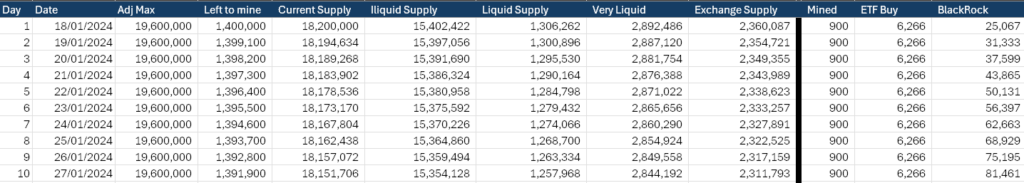

Since the debut of spot Bitcoin ETFs in the US last week, BlackRock has acquired an average of 6,266 BTC daily for a cumulative total of 25,067 BTC as of press time. The total acquired by the Newborn Nine over just four trading days is now at 70,000 BTC ($2.9 Billion.) When we include Grayscale, the total Bitcoin under management is 660,540 BTC ($27.6 billion.)

To understand the analysis, I’ll first outline the buckets used, as defined by Glassnode data.

“The liquidity of an entity is defined as the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

More info on calculating L can be found on Glassnode’s blog.

- Current Supply: The total number of bitcoins that have been mined and are currently in circulation.

- Illiquid Supply: Bitcoins held in wallets without significant movement, suggesting a long-term investment strategy.

- Liquid Supply: Bitcoins that are actively traded or spent, indicating higher market activity.

- Very Liquid Supply: This category represents bitcoins that are not just traded but are readily available for trading on exchanges within a short timeframe.

- Exchange Supply: Bitcoins held in exchange wallets, ready to be traded or sold.

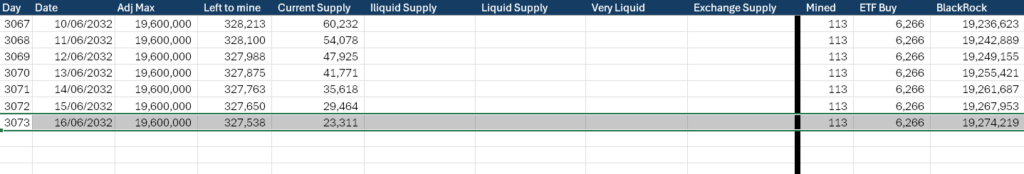

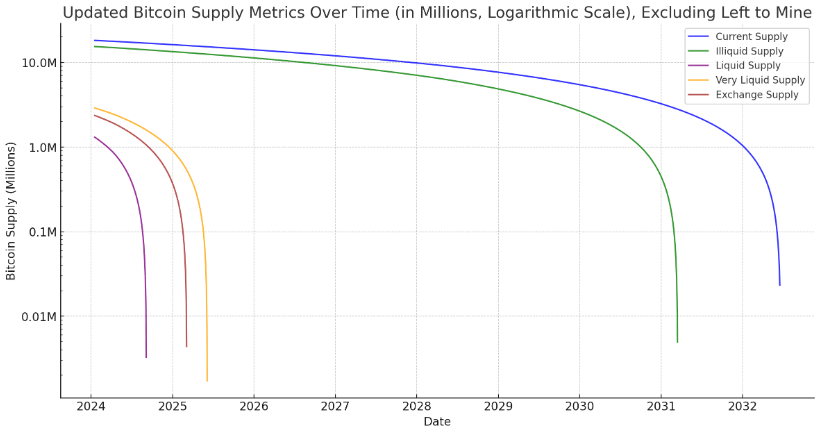

The chart below shows the different liquidity cohorts for Bitcoin across time. The illiquid supply is by far the largest sector. However, interestingly, the highly liquid portion is greater than the liquid portion, indicating a dichotomy among investors. Bitcoin holders are either hodlers or traders, with very few on the fence about whether to hold or transact with Bitcoin.

Now we understand the liquidity situation, let’s look at how the different cohorts stack up. The official max supply of Bitcoin is 21,000,000 coins. The current circulating supply is 19,600,000. According to Glassnode, the total amount of lost coins is roughly 1,400,000; this includes Satoshi’s coins, among others. There are other higher estimates of lost coins; however, given that this number has remained relatively consistent since 2012, I think it is the most reliable number.

Interestingly, this means that when we remove the lost coins from the maximum supply, we end up with the same number as the current circulating supply. While this is purely coincidental for this exact moment in time, it gives an idea of how it will feel when all the coins have been mined, at least in terms of market liquidity. Of course, after all coins are mined, the lack of block rewards for miners will add another aspect to the mix I won’t get into right now. I will say that I believe fees will be more than enough to continue to secure the network given the current direction Bitcoin is heading in.

| Metric | Value |

|---|---|

| Max Supply | 21,000,000 |

| Current Supply | 19,600,000 |

| Adj. Max Supply | 19,600,000 |

| Adj. Current Supply | 18,200,000 |

| Illiquid Supply | 15,402,422 |

| Liquid Supply | 1,306,262 |

| Very Liquid Supply | 2,892,486 |

| Exchange Balance | 2,360,087 |

The current supply can also be adjusted to remove lost coins. The three main cohorts to analyze are the liquidity levels, as explained below, and the balance of Bitcoin on crypto exchanges. The total liquid and very liquid coins amount to just 4,198,748 BTC ($175 billion,) which accounts for around 21% of the $815 billion Bitcoin market cap.

What if BlackRock keeps buying up all the Bitcoin?

Now, for the fun part that you are all reading for What if BlackRock inflows were to continue at the level seen during its debut? While some have bemoaned the launch of spot Bitcoin ETFs as a failure, and Bitcoin’s price has even dropped to $0.0413 million from its recent high of nearly $49,000, I think they will surely end up with the ‘egg on their face,’ as we say in the UK. Here’s why!

Currently, 900 new Bitcoins are mined daily, and this will drop to 450 BTC around April 18, 2024. Additionally, as I said previously, BlackRock is acquiring around 6,266 BTC daily. If BlackRock were to attempt to buy directly from miners, this would lead to a net deficit of 5,266 BTC.

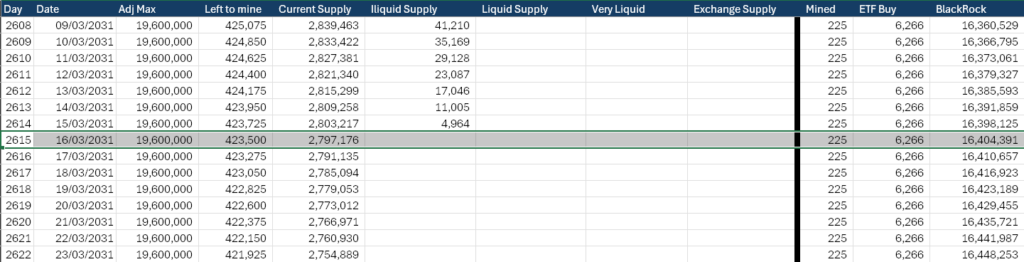

So, it needs to get Bitcoin from somewhere else. So far, the Coinbase OTC desks have had sufficient liquidity to soak up the requirement. However, this cannot last forever; there is no endless liquidity. The table below shows what would happen if BlackRock bought from each cohort with miner participation.

At its current rate, over the next 10 days, BlackRock would achieve around 81,481 BTC with little to no significant impact on any cohort. So, the launch is a failure?

I don’t think so.

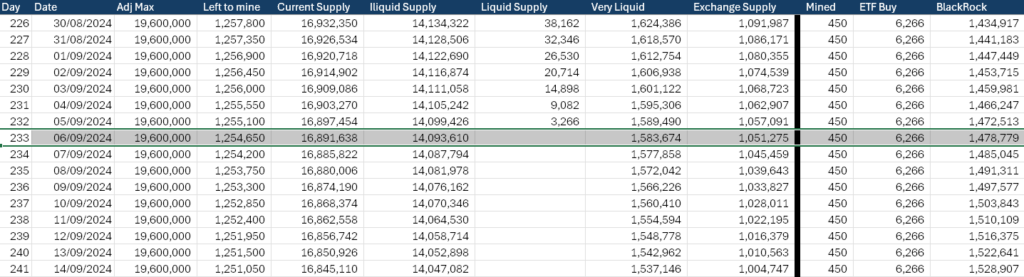

If we extend this down to Sept. 6, 2024, and BlackRock is only buying from the liquid supply, with miners adding to this cohort and reducing the impact, the entire cohort would be absorbed.

Let’s carry on.

To keep it nice and clear, each table going forward will be under the following hypothetical scenario.

What if BlackRock bought exclusively from this cohort at the rate it has during the first four days and newly mined Bitcoin was also included, thus reducing the impact of BlackRock’s buying?

By March 3, 2025, the Bitcoin held on exchanges would be gone, and BlackRock would have 2.6 million BTC.

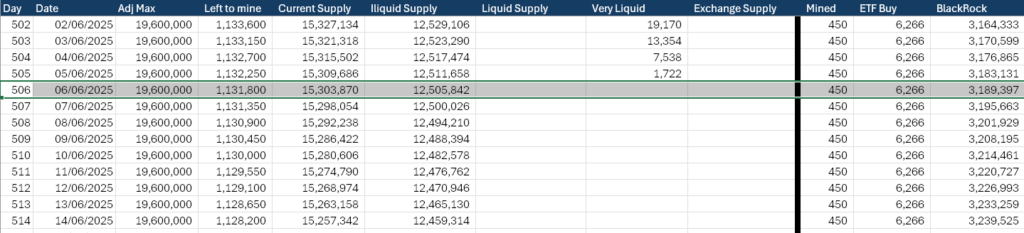

The ‘very liquid’ cohort would be absorbed by June 6, 2025. This group is probably the most easily accessible for BlackRock to find liquidity, and it is still just 18 months away.

In just eight years, by 2032, BlackRock’s Bitcoin holding would be worth $686 billion by today’s standards and consist of 16,404,391 BTC. This would require it to have found a way to buy all of the Bitcoin from the ‘illiquid’ supply and give it around 79% of all Bitcoin in circulation under management.

Finally, in just 3,073 short days, on June 16, 2032, BlackRock would have bought all of the Bitcoin in circulation and finally have to stop its 6,266 BTC per day purchase. Going forward, there would only be 113 BTC available each day from newly mined Bitcoin, of which there would be 327,538 BTC left to mine.

Of course, few of the above scenarios are going to happen. BlackRock is unlikely to be able to sustain these levels of inflows in Bitcoin terms without Bitcoin’s price either falling significantly or demand increasing along with price.

For example, 6,266 BTC is worth $262 million at $0.04184 million per Bitcoin. At $0.2 million per Bitcoin, this amount becomes $1.25 billion daily. Conversely, at $0.01, it is only $62.6 million.

So unless Bitcoin stays around $0.04 million for the next eight years, BlackRock is able to convince investors to buy its ETF at the same pace, and it can find HODLers willing to sell, we aren’t going to see BlackRock take custody of all the Bitcoin.

However, we can now start to see what sort of an impact consistent Bitcoin ETF inflows can have on different parts of the supply. Personally, my Bitcoin is illiquid and remains that way. I see the benefits of spot Bitcoin ETFs, and I also see the supply crunch that’s coming in some shape or form. Definitely not today, probably not this quarter, but after that…

CryptoSlate will continue to dig into the numbers and nerd out on chain for you, so if you enjoyed this exploration into Bitcoin supply, please let us know on our X account @cryptoslate or reach out to me directly @akibablade. Also, shout out to Samson Mow for the ‘M’ notation for Bitcoin!