Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]

Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]

Source link

NFL

Jacob Kupferman | Getty Images

The Miami Dolphins and the New York Jets face off in the National Football League’s first ever Black Friday game this week — but it’s not going to be the usual broadcast or cable offering. The game will stream exclusively on Amazon’s Prime Video.

The NFL’s decision to start a new Thanksgiving tradition with a streaming platform instead of a broadcast or cable channel is yet another indicator of trouble for linear, or traditional, TV, which has suffered from slumping ad revenue and customers cutting the cable cord.

The Black Friday matchup is an expansion of Amazon’s “Thursday Night Football” deal with the NFL, which has helped drive a 6% jump in NFL viewership since last year. And with the game streaming the day after Thanksgiving, Amazon could capture some of the holiday viewership, which broke records last year.

“I don’t make predictions on ratings,” Brian Rolapp, the NFL’s chief media and business officer, told CNBC’s Julia Boorstin this week. “But I think they’ll be good.” The Black Friday game kicks off at 3 p.m. ET.

Thanksgiving Day is already a football tradition, with the Detroit Lions and Dallas Cowboys headlining matchups through the years. Fox, CBS and NBC all will broadcast games on the holiday.

The NFL and Amazon hope the Black Friday game will become an annual tradition, executives said Tuesday at a media conference. In a push to drive Amazon e-commerce sales, the streaming broadcast will feature QR codes at the bottom of the screen that will link to some of Amazon’s Black Friday deals. Country music icon Garth Brooks will take the stage in an exclusive postgame concert.

Amazon’s 11-year “Thursday Night Football” deal and YouTube TV’s “NFL Sunday Ticket” package are just a few examples of live sports programming making the jump from cable to streaming. In October, Warner Bros. Discovery rolled out its Bleacher Report Sports Add-On Tier for the company’s flagship streaming platform Max, offering subscribers hundreds of live sports events.

ESPN’s pivot

ESPN has long ruled sports programming on traditional TV. But that could all change when the cable stalwart brings all its programming to streaming, in a planned direct-to-consumer release.

Yet even as the streaming trend picks up, sports programming is helping keep cable and traditional TV alive, for the moment.

Earlier this year, data firm Nielsen reported that traditional TV made up less than half of overall TV usage in July. But linear popped back in August and September. The jump was largely driven by the return of college and professional football, Nielsen said in a report released last month. ESPN also snagged the top 11 telecasts for the month of September, 10 of which were football-related.

ESPN has so far weathered the storm of the TV decline, capturing a “modest increase” in ad revenue in parent company Disney’s most recent quarterly report, even as overall TV revenue for the company fell.

Sports programming is holding the linear television industry together, according to Macquarie analyst Tim Nollen. And ESPN is a huge part of that.

But ESPN’s dominance in sports programming could pose a potentially fatal threat to linear TV. When ESPN unleashes its direct-to-consumer service, which would offer much more than its current ESPN+ app, it could be the push sports fans are waiting for to abandon the bundle altogether.

“When ESPN puts their DTC product online, depending on the pricing, it may create a critical mass of live sports outside of the bundle to accelerate cord cutting,” said UBS media and telecom analyst John Hodulik. “That’s what I think people are waiting for.”

Disney CEO Bob Iger told CNBC’s Boorstin on Nov. 8 that Disney will launch a direct-to-consumer ESPN flagship no later than 2025, putting the sports programming world on notice.

But not everyone is convinced that ESPN’s foray into streaming will do too much damage too quickly.

“When you look at the economics that ESPN gets from the pay TV bundle, they cannot just step away and pirouette to DTC and everything stays the same,” said sports media consultant and former Fox Sports executive Patrick Crakes. “There’s no DTC streaming product that scales like pay TV, even today, with pay TV in decline.”

The future looks more like a reimagined pay TV bundle, Crakes said, with streaming products included in the traditional economics of bundle. It’s reminiscent of the recent Disney-Charter agreement, in which Disney+ and ESPN+ are now included in some Spectrum cable packages.

But challenges could lie ahead for media companies that have not yet made the jump to bring their programming to the streaming world.

How vulnerable is Fox?

A FOX Sports TV camera operator during the week 5 NFL game between the Atlanta Falcons and the Carolina Panthers at Mercedes-Benz Stadium on October 11, 2020 in Atlanta, Georgia.

David J. Griffin | Icon Sportswire | Getty Images

The biggest loser of the slowing ad market will be Fox, Macquarie’s Nollen said. (Macquarie Group and its affiliates own a net long of 0.5% or more of the equity securities of Fox Corp.)

Other media companies, including NBCUniversal through its Peacock service, have pivoted in large part to streaming ventures, where ad revenue through those platforms can partially offset the slump in linear. The problem with Fox? It doesn’t have a streaming platform beyond its free, ad-supported service Tubi.

“Fox made the decision to double down on the bundle a few years ago and then they’ve done surprisingly well for it,” said Nollen. “But if cord-cutting accelerates and everyone picks up streaming sports elsewhere, I just don’t understand what Fox’s plan is.”

When asked for comment, Fox referenced a quote made by Fox Corp. CFO Steve Tomsic at the Bank of America media conference in September.

“I can see a world where the ESPNs of this world do go DTC, but I’m not sure how impactful that will be for us or the entire industry,” he said. “If there is the emergence of some sort of sports bundle that is across different network providers, then the first port of call is going to be Fox in terms of people wanting to aggregate our content with their service just given how strong our sports offering is.”

Disclosure: Comcast is the parent company of NBCUniversal and CNBC.

Tom Brady wants to buy part of the Raiders, but NFL owners are blocking the deal

Football legend Tom Brady wants back in the NFL.

After retiring at the end of last season, Brady is attempting to buy a minority stake in the Las Vegas Raiders franchise, but he’s hitting some roadblocks.

Brady is seeking to buy 10% of the Raiders for $175 million, which would imply a team valuation of $1.75 billion — a significant discount from what NFL teams have recently been sold for, according to a report from the Boston Globe. For example, the NFL’s Washington Commanders sold for $6 billion in 2023, and the Denver Broncos sold for $4.6 billion in 2022 to a Walmart

WMT,

heir.

It’s probable that the team, which is owned by businessman Mark Davis, would want to be associated with a top athlete like Brady. A number of high-profile athletes are minority owners in teams, including Formula One’s Lewis Hamilton and the Broncos, basketball star Dwayne Wade and the NBA’s Utah Jazz, and baseball legend Derek Jeter and the MLB’s Miami Marlins.

However, the other NFL owners have yet to approve Brady’s purchase, which was first reported to be happening back in May.

“We’re trying to work through,” Indianapolis Colts owner Jim Irsay said about the proposed deal. “The number just has to be a reasonable number for purchase price for Tom, is the only thing. If reasonable value says that 10% should be $525 million, you can’t pay $175 million.”

With NFL owners not set to meet again until Dec. 12, Brady’s potential ownership stake will be on hold until the end of the year.

Representatives for Brady, Davis and the NFL did not respond to MarketWatch’s request for comment.

See also: Michael Jordan is now worth $3 billion. Here’s what billionaire athletes have in common.

Davis and Brady do share common ownership of a team in another sport: the WNBA.

Davis owns the Las Vegas Aces, a WNBA team that Brady bought a minority stake in earlier this month. The Aces clinched their second consecutive WNBA championship on Wednesday over the New York Liberty. Brady and Davis were seen sitting together at one of the Aces games.

Las Vegas Raiders and Las Vegas Aces owner Mark Davis with Tom Brady at Game One of the 2023 WNBA playoffs.

Getty Images

The Raiders, a team that moved to Las Vegas from Oakland in 2020, is valued at $6.2 billion, according to Forbes estimates.

Brady, 46, retired as the NFL’s career leader in passing yards (89,214) and touchdowns (649). His $512 million fortune is made up of $332 million from his NFL checks over 23 seasons, with the rest coming from his off-field endeavors, including endorsements with Under Armour

UAA,

Ugg, Upper Deck and DraftKings

DKNG,

Brady also has a lucrative contract with Fox Sports to announce NFL games beginning in 2024. That deal is a 10-year contract worth up to $375 million, the largest in sports broadcasting history.

See also: Want to watch every NFL game this season? Here’s how much it will cost you.

NFL quarterback Trevor Lawrence has reached a settlement in a lawsuit involving FTX. This follows a trend of celebrities settling similar cases involving FTX promotions, including YouTubers Kevin Paffrath and Tom Nash.

As Sam Bankman-Fried readies himself for a trial defense in Manhattan next month, court documents reveal that three celebrity promoters associated with his unsuccessful FTX cryptocurrency exchange have chosen to reach a settlement in the case. The lawsuit relates to the sponsorship deals struck by the trio before the crypto exchange FTX went bankrupt the last year.

NFL team Jacksonville Jaguars’ quarterback Trevor Lawrence, along with YouTube influencers Kevin Paffrath and Tom Nash, have agreed to settle the case under undisclosed terms. The final court order, confirming the settlement and removing them from the case, is pending approval from US Judge K. Michael Moore.

Additionally, several other celebrities, including Shaquille O’Neal, Tom Brady, Gisele Bundchen, and Steph Curry, have faced legal action for promoting FTX. The lawyers leading the case against these celebrities have disclosed that they are currently involved in confidential discussions, and there is a high probability of further settlements with FTX in the near future, as per court documents.

Prior to FTX’s collapse, Trevor Lawrence had entered into a sponsorship agreement with Blockfolio, which was an FTX subsidiary, in 2021. As revealed in a filing related to the FTX lawsuit submitted to the US Bankruptcy Court on August 31, Lawrence received a sum of $205,555.35 from Blockfolio.

During that period, FTX’s then-COO, Sina Nader, emphasized that sponsorships involving Lawrence and other celebrities played a crucial role in breaking down societal barriers related to cryptocurrency, making it more widely accepted.

Lawrence himself had expressed his trust in Blockfolio as a long-term partner in the cryptocurrency space when the Blockfolio deal was announced.

Additionally, the recent court filing shows the dismissal of crypto influencer Ben “BitBoy” Armstrong from the case. Armstrong “has not served an answer or motion for summary judgment,” the filing says.

YouTuber Nash and Praffath’s Association with FTX

Initially, Tom Nash, an Australian citizen, did not respond to the lawsuit. As a result, attorney Jonathan Moskowitz sought permission from a federal judge to serve the lawsuit via a tweet.

Kevin Paffrath, another influencer boasting 1.88 million subscribers on his ‘Meet Kevin’ YouTube channel, publicly acknowledged his previous sponsorship by FTX in a video on November 17, 2022. He expressed regret about this association, describing it as a “scar”.

On March 16, following his inclusion in Jonathan Moskowitz’s class-action lawsuit, Paffrath released a second video in which he reiterated his attribution of the fraud to SBF. He vehemently dismissed any notion that influencers played a role in the losses resulting from FTX’s fraudulent activities, considering such claims “ludicrous”.

next

Blockchain News, Cryptocurrency News, News

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

You have successfully joined our subscriber list.

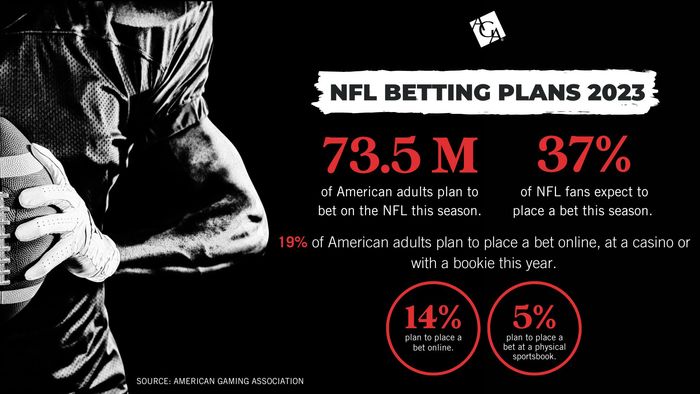

Over 70 million Americans plan to bet on the NFL this season, new survey says

Sports betting continues to expand across the U.S., setting up a potentially recording-breaking 2023 for the most wagered-on sport in America: football.

According to an American Gaming Association survey, 73.5 million American adults plan to bet on an NFL game this season.

What’s more, 37% of all NFL fans expect to place a bet on an NFL game this season, the AGA told MarketWatch.

The 73.5 million number comes from an online survey conducted by Morning Consult, on behalf of the American Gaming Association, between August 29 and 31. It got responses from 2,200 American adults, and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region, according to the AGA, which represents commercial and tribal casino operators, U.S.-licensed gaming suppliers, financial institutions and other key stakeholders in the gaming industry..

See also: DraftKings issues apology for 9/11-themed betting promotion

Before the 2022 season began, a similar survey found that 46 million people planned to bet on the NFL last season. One major reason for the year-over-year increase in wagering is that more states now offer legal sports betting.

As of September 2023, 35 U.S. states, plus Washington, D.C., offer some form of legalized sports betting, compared to this time last year when just 31 states, plus Washington, D.C., offered legal wagering, and in 2021 when 22 states did so.

That number could have been higher if California, the nation’s most populous state, voted to legalize sporting betting through a now-failed proposed ballot measure last fall.

A record-breaking 73 million Americans will bet on the NFL this season, survey says.

American Gaming Association

FanDuel CCO Mike Raffensperger told Yahoo Finance in a story published last week that “this will be the biggest NFL season for sports betting operators around the United States, bar none.”

“We are very excited at FanDuel. This is kind of Christmas, New Year’s, Fourth of July all wrapped into one” Raffensperger added. “There really is no week in the entire calendar year in terms of getting new customer trial onto a sportbook. There’s nothing quite like NFL kickoff.”

See also: Want to watch every NFL game without cable this season? Here’s how much it will cost you.

Since the Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) in 2018, it’s been up to individual states to create sports betting legislation, and not the federal government.

The NFL kicked off its regular season last week with a Thursday Night Football matchup between the defending champions Kansas City Chiefs and the Detroit Lions.

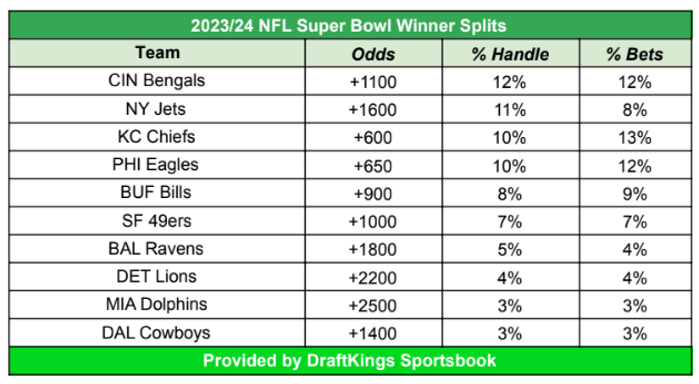

NFL bettors have a clear favorite team this season: the Cincinnati Bengals. The Bengals were the most-wagered-on NFL team to win this year’s Super Bowl on DraftKings in terms of total handle, aka the total money wagered, prior to the start of the season.

NFL bettors are loving the Bengals this year, making them the most popular team to bet on in 2023 before the season.

DraftKings

Read on: Top men’s tennis players to be guaranteed up to $300,000 a year in income in 2024

Sopa Images | Lightrocket | Getty Images

The kickoff to the NFL season is Thursday night, and Charter Communications doesn’t appear to be moving down the field in its negotiations with Disney.

Last week, Charter and Disney’s talks over contract fees spilled into the public when they were not able to reach an agreement and millions of consumers across the U.S. saw Disney-owned networks like ESPN and FX go dark.

On Thursday, Charter CEO Chris Winfrey said that “Disney will be who decides” what happens in the dispute.

“Sitting here today, if I had anything material to highlight I would, so that should tell you something on how we’re doing,” Winfrey said at the Goldman Sachs’ Communacopia and Technology conference, regarding the state of the negotiations as the beginning of the NFL season nears. He added both companies feel a sense of urgency to resolve this quickly.

Disney’s latest statement also indicated that the stalemate persists.

“It’s unfortunate that Charter decided to abandon their consumers by denying them access to our great programming,” Disney said Thursday. “The question for Charter is clear: Do you care about your subscribers and what they’re telling you they want — or not? Disney stands ready to resolve this dispute and do what’s in the best interest of Charter’s customers.”

Winfrey on Thursday said both Charter and Disney’s customers were caught in the crosshairs of this fight.

Disney added that Charter, one of the biggest pay TV providers in the U.S., has rejected multiple offers to extend negotiations before the blackout on Aug. 31.

Adding to the pressure is the kickoff of the NFL season — with ESPN’s first “Monday Night Football” game of the season occurring in a few days — as well as the U.S. Open and the beginning of college football season.

“Disney is the linchpin. ESPN is the linchpin,” Winfrey said Thursday of the cable bundle. “They have the opportunity to lead here and drive the industry. And if it works, it’s going to be because of them.”

Disney executives have said it’s a matter when, not if, ESPN is available as a direct-to-consumer streaming service outside of the bundle. Currently, ESPN+ offers its own exclusive content and games, with some overlaps from the TV network, such as some “Monday Night Football” broadcasts.

SportsCenter at ESPN Headquarters.

The Washington Post | The Washington Post | Getty Images

To bundle or not bundle sports?

Carriage fights and blackouts are not uncommon in the industry. But Charter’s proclamation about the pay TV model and push for programmers like Disney to make their streaming services available to cable customers at no additional cost has sent shock waves through an industry grappling with cord-cutting as streaming remains an unprofitable business.

A similar dispute has ensnared satellite-TV provider DirecTV and broadcast station owner Nexstar Media Group this summer. With many NFL games being offered, it could leave millions more consumers without access to the first games of the season.

But in a rare move, Winfrey and Charter executives held an investor call the day after Disney channels went dark for its customers. Executives said they pushed for a revamped deal with Disney that would see Charter’s Spectrum cable customers receive access to Disney’s ad-supported streaming services Disney+, ESPN+ and Hulu at no additional cost.

This seems to be the sticking point in negotiations. Charter said it was willing to pay the increase requested by Disney.

Winfrey said Thursday a big issue with content companies like Disney has been that they are focused on streaming “as if it’s a completely separate business” when much of companies’ cash flow stems from the traditional pay TV bundle.

Last week, Winfrey put the media industry on notice when he said the pay TV model is broken and needs to change in order to survive.

Disney has shot back, saying Charter refused to enter into a deal after it offered favorable terms, without elaborating on specifics. The company also added that its traditional TV networks and streaming services aren’t the same and therefore shouldn’t be offered for free to cable TV customers.

Live sports have continued to garner the highest ratings and are considered to be the glue holding the pay TV bundle together.

“If you had an environment where we no longer carry Disney content, which is becoming more and more of a potential reality, you have to say … what other additional sports content would you renew? At that point, there is very little,” Winfrey said Thursday.

With less sports content, he said, there would be a smaller base of cable customers but also a smaller package of mostly general entertainment content at a cheaper price. Charter could then sell separate streaming subscriptions to customers who still want sports content.

Charter already made a step in this direction earlier this summer when the company announced it would offer a cheaper, sports-lite bundle without regional sports networks.

Sports often drive up the cost of pay TV and streaming subscriptions due to the rights fees media companies pay the leagues and teams to carry games on-air. This has been a key theme in this year’s bankruptcy filing of Diamond Sports Group, the largest owner of regional sports networks.

Meanwhile, Disney has pushed for Charter’s customers to sign up for alternative internet-TV bundles like its own Hulu +Live TV, as well as competitors like Fubo or YouTube TV.

“Disney deeply values its relationship with its viewers and is hopeful Charter is ready to have more conversations that will restore access to its content to Spectrum customers as quickly as possible,” Disney said in a statement over the weekend. “However, if you are one of these frustrated customers, it can be infuriating to not be able to access the content you want.”

Since the dispute began last Thursday, Hulu + Live TV sign-ups are more than 60% higher than expected, a Disney Entertainment spokesperson said.

As more of Charter’s customers leave the bundle for alternative options, Winfrey said the incentive to get a deal done only lessens as the remaining customers likely won’t care to watch sports.

LeBron James of the Los Angeles Lakers at a game against the LA Clippers at ESPN Wide World Of Sports Complex on July 30, 2020 in Lake Buena Vista, Florida.

Mike Ehrmann | Getty Images

As Disney considers a strategic partner for ESPN, Chief Executive Officer Bob Iger and ESPN head Jimmy Pitaro have held early talks about bringing professional sports leagues on as minority investors, including the National Football League, National Basketball Association and Major League Baseball, according to people familiar with the matter.

ESPN has held preliminary discussions with the NFL, NBA and MLB about a variety of new partnerships and investment structures, the people said. In a statement, an NBA spokesperson said, “We have a longstanding relationship with Disney and look forward to continuing the discussions around the future of our partnership.”

Spokespeople for ESPN, the NFL and MLB declined to comment.

Talks with the NFL have occurred in conjunction with the league’s own desire for a company to take a stake in its media assets, including the NFL Network, NFL.com and RedZone, said the people, who asked not to be named because the talks have been private.

The NBA and Disney have broached many potential structures around a renewal of media rights, the people said. Disney and Warner Bros. Discovery have exclusive negotiating rights with the NBA until next year.

Iger said last week in an interview with CNBC’s David Faber that Disney is looking for a strategic partner for ESPN as it prepares to transition the sports network to streaming. He didn’t elaborate on what exactly that meant beyond saying a partner could bring additional value with distribution or content. He acknowledged selling a stake in the business was possible.

Disney owns 80% of ESPN. Hearst owns the other 20%.

“Our position in sports is very unique and we want to stay in that business,” Iger said to Faber. “We’re going to be open minded about looking for strategic partners that could either help us with distribution or content. I’m not going to get too detailed about it, but we’re bullish about sports as a media property.”

Theoretically, a jointly owned subscription streaming service among multiple leagues could eventually give consumers new packages of games and other innovative ways to take in content.

The move would be a logical one for Disney as it tries to move past the traditional cable subscriber model and underscores how badly the company wants to find a solution for the sports network as its linear subscribers decline. Still, ESPN ratings have climbed in recent years on major sporting events. There’s no better partner for sports content than the leagues, themselves.

Superficially, it may make less sense for the NBA, NFL and MLB which sign lucrative media rights deals with many media partners that fuel team revenue and player salaries with a range of media companies.

Professional sports leagues could face conflicts of interest if they take a minority stake in ESPN. Owning a stake in ESPN may irritate Disney’s competitors, such as Comcast‘s NBCUniversal, Fox, Amazon, Paramount Global and Apple, who help make the leagues billions of dollars by participating in bidding wars for sports rights. Taking an ownership stake in ESPN could give leagues the incentive to boost the value of that entity rather than striking deals with competitors.

There would also be hurdles for Disney. ESPN also employs hundreds of journalists that cover the major sports leagues. Selling an ownership stake to the leagues could cloud the perception of objectivity for ESPN’s reporting apparatus.

Still, the leagues are already business partners with ESPN. It’s possible ESPN could put measures in place to ensure reporters can continue to cover the leagues while minimizing conflicts, but it adds another layer of complexity to any deal.

A streaming-first ESPN

ESPN is trying to forge a new path as a digital-first, streaming entity. Disney realizes ESPN won’t be able to make money like it previously has in a traditional TV model.

Selling a minority stake in ESPN to the leagues could mitigate future rights payments, allowing Disney to better compete with the big balance sheets of Apple, Google and Amazon. It would also guarantee ESPN a steady flow of premium content from the leagues.

Until last quarter, Disney’s bundle of linear TV networks still had revenue growth because affiliate fee increases to pay-TV providers — largely driven by ESPN — made up for the millions of Americans who cancel cable each year. That trend finally ended last quarter, according to people familiar with the matter. Accelerating cancellations have now overwhelmed fee increases, and linear TV revenue outside of advertising has begun to decline.

“A lot has been said about renting [sports right] versus owning,” Iger said last week in his CNBC interview. “If you can rent it and continue to be profitable from renting, which we have been and we believe we will continue to be, then there’s value in staying in it. We have great relationships with Major League Baseball, and the National Hockey League, and various college conferences, and of course the NFL and the NBA. It’s not just about the live sports coverage of those leagues, those teams, it’s also about all of the shoulder programming it throws off on ESPN and what you can do with it in a streaming world.”

ESPN would like to morph itself into a streaming hub for all live sports. Management would like to launch a feature allowing ESPN.com or the ESPN app to funnel users to games no matter where they stream, CNBC reported earlier this year.

While striking a deal with professional sports leagues wouldn’t be easy, Disney appears to be pushing the envelope on its thinking to prepare for a streaming-dominated world that includes its full portfolio of sports rights.

“If [a partner] comes to the table with value, whether it’s content value, distribution value, whether it’s capital, whether it just helps derisk the business — that wouldn’t be the primary driver — but if they come to the table with value that enables ESPN to make a transition to a direct-to-consumer offering, we’re going to be very open minded about that,” Iger said.

WATCH: Disney CEO Bob Iger talks to CNBC’s David Faber about ESPN and its future