The termination of the project led to a significant drop in Trekki NFT floor prices and sparked frustration among NFT holders and enthusiasts.

Former US President and Republican Presidential Candidate Donald Trump has hinted at the possibility of launching a new NFT collection, following the success of his previous ones.

In an interview with Bloomberg Businessweek, Trump highlighted the strong demand from his supporters for more digital assets. This demand could influence his decision to release a new collection. He stated:

“We had one year to sell it out and it sold out in one day. The whole thing sold out: 45,000 of the cards. And I did it three times [and] I’m going to do another one, because the people want me to do another one.”

Over the past few years, Trump has launched three NFT collections, generating both success and criticism from the community.

His first NFT collection, launched in December 2022, received much acclaim but experienced significant value losses, similar to his Series 2 collection launched in April 2023 and the Mugshot edition in December 2023.

These projects have also faced broader complaints. Early reports suggested that the company controlling the project reserved several NFTS for the team. It was also alleged that many card designs plagiarized stock images from popular websites like Amazon.

Meanwhile, Trump mentioned that his involvement in NFTs changed his views about the crypto industry. He said:

“I did things like NFTs and, you know, stuff. And I noticed that 80% of the money was paid in crypto. It was incredible…The thing I really noticed was everything was paid in—I would say almost all of it was paid in crypto, in this new currency. And it opened my eyes.”

Reports from last year indicate that Trump has earned around $5 million from his NFT collections.

Trump explained that his pro-crypto stance aims to position the US as a leader in the industry.

He believes the industry is young and here to stay, making government intervention essential. He emphasized the importance of not letting another country take the lead.

Trump said:

“If we don’t do it, China is going to pick it up and China’s going to have it—or somebody else, but most likely China. China’s very much into it. Also, it’s not going away. It’s amazing.”

Franklin Templeton’s digital assets division has released a note to its investors introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in activity within the Bitcoin ecosystem.

The asset manager attributes this increased momentum to various factors, including the emergence of Bitcoin (BTC) NFTs called Ordinals, the development of new fungible standards like BRC-20 and Runes, the growth of Bitcoin Layer 2 (L2s) solutions, and the expansion of decentralized finance (DeFi) applications built on the Bitcoin network.

According to the Bitcoin ETF issuer’s report, activity in the Bitcoin NFT space is gaining momentum. In particular, Ordinals have seen a significant increase in trading volume over the past few months.

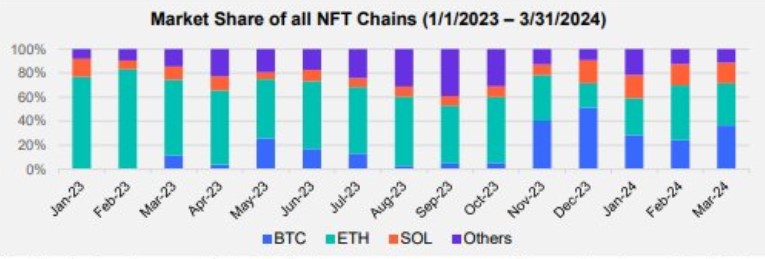

This growth is evident in Bitcoin’s dominance in terms of trading volume, which surpassed Ethereum (ETH) in December 2023, as shown in the accompanying chart.

In addition, several collections of Bitcoin Ordinals are emerging as dominant players in the NFT market, both in terms of trading volume and market capitalization.

These collections include NodeMonkes, Runestone, and Bitcoin Puppets, which have an aggregate market cap of $353 million, $339 million, and $168 million, respectively. They are the most notable collections.

In terms of trading volume over the past 30 days, the report shows that these three collections recorded trading volumes of $81 million, $85 million, and $38 million, respectively, over the past month.

The asset manager further claimed that what distinguishes BTC Ordinals from NFTs on other blockchains, such as Ethereum or Solana, is that they contain raw data recorded directly on the Bitcoin blockchain. This feature contributes to the attractiveness and growing popularity of Bitcoin Ordinals, as evidenced by market cap and trading volume figures.

Franklin Templeton, known for its involvement in the ETF market, was one of the issuers that launched a spot BTC ETF in the United States earlier this year. Its ETF, which trades under the ticker name “EZBC,” has seen total inflows of 281.8 million since its January 11 launch, according to BitMEX research data as of April 3.

Despite its zero-fee structure, Franklin Templeton’s ETF has seen a significant difference in flows compared to the leading players in the newly approved ETF market, such as Blackrock (IBIT) and Fidelity (FBTC), which have seen flows of over 14 billion and 7.7 billion, respectively.

In a recent blog post, crypto exchange Binance announced it would discontinue support for Bitcoin-based NFTs on its marketplace. Less than a year after their introduction, Binance will no longer facilitate airdrops, benefits, or utilities associated with BTC NFTs, citing a need to streamline its product offerings in the NFT space.

Binance states that users who own Bitcoin NFTs are advised to withdraw them from the Binance NFT marketplace via the Bitcoin network before May 18, 2024.

Effective April 18, 2024, users can no longer purchase, deposit, bid, or list NFTs via the BTC network on the Binance NFT Marketplace. Any existing listing orders affected by this change will be automatically canceled simultaneously.

Currently, BTC is trading at $68,300, up a modest 3% in the last 24 hours. It is approaching the significant milestone of $70,000, a level the cryptocurrency has struggled to maintain several times.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

In a recent announcement by Binance on April 4, 2024, the firm disclosed its decision to halt support for Bitcoin-based Ordinal non-fungible token (NFT) collectibles within its NFT marketplace. The directive from Binance calls for users of its NFT marketplace to withdraw their Ordinal inscriptions by May 18, 2024. Binance NFT Marketplace to End Ordinal […]

Source link

Crypto exchange Binance said its non-fungible token (NFT) marketplace will discontinue support for Bitcoin NFTs by April 18, per an April 4 statement.

According to the exchange:

“Starting from 2024-04-18 06:00 (UTC), users will no longer be able to buy, deposit, bid on, or list NFTs on the Binance NFT Marketplace via the Bitcoin network. All impacted listing orders will be automatically canceled at 2024-04-18 06:00 (UTC).”

It added that its platform would stop supporting airdrops, benefits, or other utilities associated with the NFTs by April 10.

Notably, this decision is coming less than a year after the platform enabled support for these digital assets.

Binance explained that its decision was part of “ongoing efforts to streamline product offerings” in its NFT marketplace.

The firm did not comment on whether trading volumes or user demand affected its decision to end those services.

The exchange launched the NFT marketplace in 2021 amid the crypto market boom. While the marketplace enjoyed early successes due to its association with the exchange and football superstar Cristiano Ronaldo, the platform has struggled for considerable adoption compared to rivals like Blur.

Besides that, Binance is navigating regulatory issues across several jurisdictions, including the United States, where it agreed to pay a record fine of more than $4 billion and stop operating within the country.

These regulatory upheavals have prompted a rethink of the exchange’s operating style and the appointment of a seven-member board of directors led by Gabriel Abed, the former ambassador of Barbados to the UAE.

Bitcoin-based NFTs have grown remarkably during the past year, fueled by the rising fascination with Ordinals.

Asset management firm Franklin Templeton pointed out that the innovations within Bitcoin’s ecosystem were primarily fueled by “Bitcoin NFTs, known as Ordinals, new fungible token standards such as BRC-20 and Runes, Bitcoin Layer 2s, and other Bitcoin DeFi primitives.”

Notably, data from CryptoSlam shows that Bitcoin’s NFT sales amounted to $6.37 million within the past 24 hours, marking the second-highest figure in the industry.

This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

Source link

Starbucks has said it will discontinue its Odyssey non-fungible token beta program and members “have until March 25, 2024, to complete any remaining journeys.” Starbucks stated on its FAQ page that it will keep its NFT community in mind and is working to find a place for its members to connect in the future. Starbucks […]

Starbucks has said it will discontinue its Odyssey non-fungible token beta program and members “have until March 25, 2024, to complete any remaining journeys.” Starbucks stated on its FAQ page that it will keep its NFT community in mind and is working to find a place for its members to connect in the future. Starbucks […]

Source link

Sales of Non-fungible tokens (NFTs) have witnessed a notable uptick this past week, climbing 11.62% to hit $442.02 million over the previous seven days. The most significant transaction was the sale of the ‘Alien’ Cryptopunk #3,100, donning a headband, for $16 million, with Bitcoin-based NFTs claiming the lead in sales volume across 22 different blockchains. […]

Sales of Non-fungible tokens (NFTs) have witnessed a notable uptick this past week, climbing 11.62% to hit $442.02 million over the previous seven days. The most significant transaction was the sale of the ‘Alien’ Cryptopunk #3,100, donning a headband, for $16 million, with Bitcoin-based NFTs claiming the lead in sales volume across 22 different blockchains. […]

Source link

As the value of cryptocurrencies has risen, the non-fungible token (NFT) market has experienced a 35.14% increase in sales compared to the preceding week. This marks the third consecutive week of sales growth in the NFT sector, with NFTs based on Bitcoin leading the charge throughout this period. NFT Sales Surge Past $412 Million in […]

As the value of cryptocurrencies has risen, the non-fungible token (NFT) market has experienced a 35.14% increase in sales compared to the preceding week. This marks the third consecutive week of sales growth in the NFT sector, with NFTs based on Bitcoin leading the charge throughout this period. NFT Sales Surge Past $412 Million in […]

Source link

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Based on the most recent international standings and weekly figures, sales of non-fungible tokens (NFTs) have surged by 17.66% in the past week, amassing slightly more than $306 million in sales. This uptick marks a jump from last week’s 16.8% rise in NFT sales, with the leading blockchains in terms of volume — Ethereum and […]

Source link