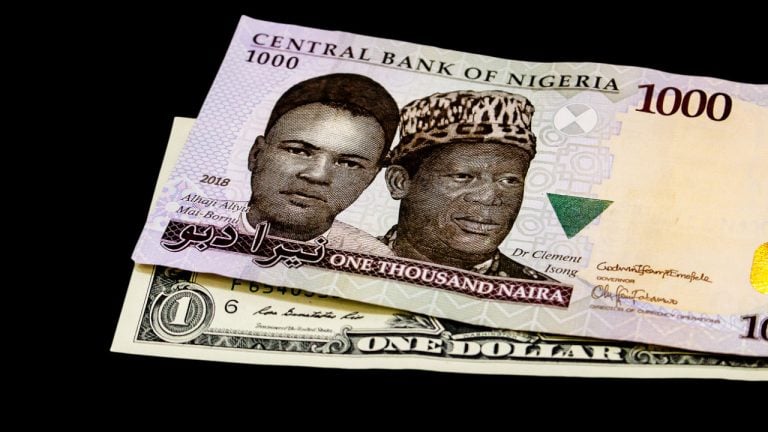

Bayo Onanuga, a special adviser to the Nigerian president, has leveled accusations against Binance, blaming it for exacerbating the local currency’s depreciation against major currencies. Onanuga called for immediate action against Binance, warning that its activities could potentially undermine the economy. Binance, however, has refuted these allegations, attributing the naira’s depreciation to “complex factors” that […]

Bayo Onanuga, a special adviser to the Nigerian president, has leveled accusations against Binance, blaming it for exacerbating the local currency’s depreciation against major currencies. Onanuga called for immediate action against Binance, warning that its activities could potentially undermine the economy. Binance, however, has refuted these allegations, attributing the naira’s depreciation to “complex factors” that […]

Source link

Nigerian

Nigerian Microfinance Bank Carbon Acquires Fintech Startup Vella Finance

Vella Finance, a Nigerian fintech startup, was recently bought by the microfinance bank Carbon. The acquisition of the fintech startup paves for Carbon to launch a new banking platform targeting Nigerian businesses. New Business to Leverage Artificial Intelligence The Nigerian microfinance bank, Carbon, has reportedly acquired the fintech firm Vella Finance for an undisclosed amount. […]

Vella Finance, a Nigerian fintech startup, was recently bought by the microfinance bank Carbon. The acquisition of the fintech startup paves for Carbon to launch a new banking platform targeting Nigerian businesses. New Business to Leverage Artificial Intelligence The Nigerian microfinance bank, Carbon, has reportedly acquired the fintech firm Vella Finance for an undisclosed amount. […]

Source link

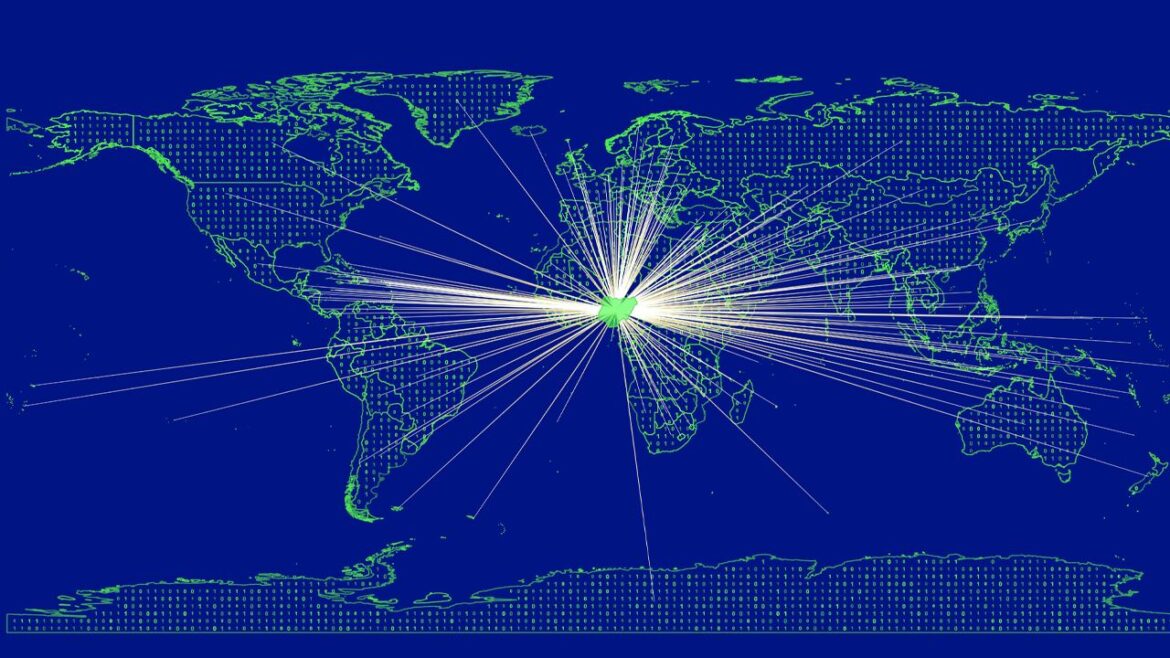

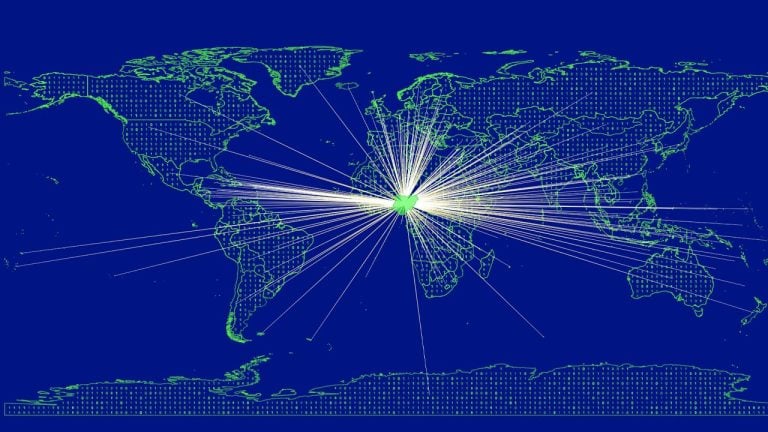

Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai

The Nigerian Securities and Exchange Commission (SEC) reiterated its warning that Binance’s operation within the country was illegal, according to a July 28 statement.

In its new notice, the regulator specifically mentioned Binance’s official website, stating that:

“The Commission again reiterates that the activities of Binance, and any such other platform through which the Company solicits investors is neither registered nor regulated by the Commission and its operations in Nigeria are therefore illegal.”

As of press time, Binance has yet to respond to CryptoSlate’s request for comment.

Despite the Nigerian SEC warning, Binance remains a top crypto platform in the African country. The exchange cemented itself as a market leader following FTX’s collapse, with its USDT/Naira trading pair approaching $500,000 in the last 24 hours, according to data on the platform.

Global Regulatory Concerns

Meanwhile, the warning is coming on the heels of Binance’s recent regulatory approval in Dubai after suffering multiple setbacks in Europe. Earlier today, on July 31, the exchange revealed that it became the first digital asset exchange to receive an Operational Minimum Viable Product (MVP) license within the region, allowing it to trade in the area.

After failing to get the appropriate regulatory approval, Binance has exited several European markets, including the Netherlands, Cyprus, Germany, and the U.K. The exchange’s spokesperson stated that the firm was focused on complying with the forthcoming Markets in Crypto Assets (MiCA) regulations to offer its services in Europe.

Binance Nigeria

Further, in June, the Nigerian SEC declared Binance Nigeria Limited’s operations illegal and urged the investing public to desist from using the platform.

Binance clarified that the Binance Nigeria firm mentioned by the Nigerian financial watchdog was unaffiliated with Binance.com, and CEO Changpeng ‘CZ’ Zhao stated that the exchange issued a cease and desist notice to the unaffiliated ‘scam’ entity. However, the new statement indicates that the Nigerian SEC has doubled down on its warning about Binance.

The post Nigerian SEC doubles down on Binance warning despite its recent approval in Dubai appeared first on CryptoSlate.

The president of the Stakeholders in Blockchain Technology Association of Nigeria (SIBAN), Obinna Iwunna, has commented on the implementation of the Finance Act, 2023, which was signed into law on May 28. According to Iwunna, the successful execution of the law will be challenging due to its premature introduction.

The act introduces a series of tax reforms aimed at modernizing the country’s fiscal framework. Among its provisions was the introduction of a 10% tax on gains from the disposal of digital assets, including cryptocurrencies.

In a Cointelegraph interview, Iwunna criticized implementing a 10% tax on cryptocurrencies in the current uncertain climate, likening it to putting the cart before the horse. He highlighted the ongoing issue with the Central Bank of Nigeria (CBN) instructing commercial banks not to facilitate financial transactions involving cryptocurrencies.

As commercial banks still cannot process cryptocurrency transactions, he questioned how taxing something not recognized or defined is possible, emphasizing the need for clarity and enabling infrastructure before imposing taxes. In support of this, Iwunna referenced how Nigeria’s National Information Technology Development Agency (NITDA) defined blockchain technology through a collaborative effort and formulation of a national policy.

Just read that very soon you all will start paying taxes on your crypto and Forex profits in Nigeria.

10% of your capital gains goes to government . What are we going to get in return?

— CryptoLord NE (@CryptoDefiLord) June 8, 2023

Iwunna stressed cryptocurrency involves security, currency and technology, overseen by the Nigerian Securities and Exchange Commission (SEC), the CBN and NITDA, respectively. Each entity has a specific role to play, but a comprehensive and unified understanding of cryptocurrency is crucial. Once a collective definition is established, policymakers can develop appropriate policies, regulations and taxation measures.

When asked if Nigerian crypto stakeholders have approached the SEC and CBN with their concerns, Iwunna confirmed that they have reached out and are currently awaiting a response. While some discussions have taken place, no definite decisions have been made.

Related: Binance sends cease and desist notice to fraudulent Nigerian entity

Acknowledging the government’s aim to broaden the tax base, Iwunna stated that it is important to ensure that taxation does not impede the growth of the cryptocurrency industry. Clarity is sought regarding the implications of taxation and its connection to the recognition of cryptocurrency and associated procedures.

According to Iwunna, the lack of consultation, as observed during the e-naira launch, may hinder the adoption of the tax laws. Had there been collaboration with the digital assets ecosystem, the e-naira could have seen rapid adoption by millions of Nigerians.

Magazine: Bitcoin in Senegal: Why is this African country using BTC?