The adult-use ballot question could potentially allow cannabis sales in the third-largest U.S. state, with a population of more than 22 million people.

Source link

November

These defense stocks may fare best whether Biden or Trump wins in November

Assuming the major parties’ nominees for the November U.S. presidential election will be Joe Biden and Donald Trump, it is anybody’s guess who will be elected, but it can be useful for investors to consider which stock sectors or industries might fare best if one or the other were to win a second term in the White House.

Joseph Adinolfi looked earlier this week at how various stock sectors performed during the first Trump presidency and, based on a report from Sevens Report Research, looked ahead at a potential second Trump term.

One of the industry groups whose stocks Tom Essaye, publisher of Sevens Report Research, said he would expect to perform well during a second Trump term is defense.

Read: Trump’s return to the White House could benefit these stock-market sectors — while undercutting others

Of course, regardless of who wins the November election, U.S. defense contractors may benefit from the depletion of hardware and munitions resulting from U.S. and other NATO countries’ support for Ukraine’s defense against Russia’s invasion, along with renewed efforts to bolster the conventional defenses of Western European countries.

Screening U.S. defense stocks

So with the stage set for what might be a strong multiyear period for U.S. defense contractors, we began a screen with the 35 stocks held by the $5.9 billion iShares U.S. Aerospace and Defense exchange-traded fund

ITA.

This is a broad stock-market category that goes beyond companies making military or aeronautical hardware.

Then we added the five aerospace and defense stocks, as categorized by FactSet, that are in the S&P Composite 1500 Index

XX:SP1500

but aren’t in the ITA portfolio, for an initial list of 40 U.S. stocks. The S&P Composite 1500 is made up of the S&P 500

SPX,

the S&P MidCap 400

MID

and the S&P MidCap 600.

Then we narrowed the screen to include only companies that are covered by at least five analysts polled by FactSet and whose 2023 revenue (or estimated revenue) totaled at least $1 billion.

That leaves a list of 27 stocks.

Expected sales growth

Some companies have fiscal years that don’t match the calendar, so the estimates driving this screen are based on FactSet’s adjusted estimates for calendar years.

Here are the 10 aerospace and defense companies on our list that are expected to show the highest compound annual growth rates for sales from 2023 through 2025, based on consensus estimates among analysts polled by FactSet. Expected weighted sales CAGR for the S&P 500 and the S&P 500 aerospace and defense industry group are at the bottom of the table.

| Company | Ticker | Two-year estimated sales CAGR through 2025 | Estimated 2023 sales | Estimated 2024 sales | Estimated 2025 sales |

| Axon Enterprise Inc. |

AXON, |

22.1% | $1,561 | $1,924 | $2,331 |

| Spirit AeroSystems Holdings Inc. Class A |

SPR, |

19.6% | $6,048 | $7,484 | $8,653 |

| Heico Corp. |

HEI, |

15.8% | $3,112 | $3,890 | $4,173 |

| Heico Corp. Class A |

HEI.A, |

15.8% | $3,112 | $3,890 | $4,173 |

| Boeing Co. |

BA, |

13.2% | $77,745 | $89,788 | $99,658 |

| TransDigm Group Inc. |

TDG, |

12.1% | $6,864 | $7,911 | $8,624 |

| Hexcel Corp. |

HXL, |

11.5% | $1,789 | $1,987 | $2,223 |

| Kratos Defense & Security Solutions Inc. |

KTOS, |

10.3% | $1,035 | $1,135 | $1,261 |

| AAR Corp. |

AIR, |

9.8% | $2,138 | $2,390 | $2,588 |

| Howmet Aerospace Inc. |

HWM, |

8.2% | $6,640 | $7,142 | $7,778 |

| Woodward Inc. |

WWD, |

7.7% | $2,995 | $3,289 | $3,471 |

| S&P 500 | SPX | 5.3% | |||

| S&P 500 Aerospace and Defense | 7.3% | ||||

| Source: FactSet | |||||

There are actually 11 stocks on the list, because two common share classes of Heico Corp.

HEI,

HEI.A,

are held within the ITA portfolio. According to Heico’s annual 10-K filing with the Securities and Exchange Commission for 2023 (page 103), the two share classes are identical, except that the Class A shares have one-tenth the voting rights of the regular common shares.

Ratings summary for the best expected revenue growers

Leaving those 11 stocks in the same order, here’s a summary of ratings and price targets among analysts polled by FactSet:

| Company | Ticker | Share buy ratings | Share neutral ratings | Share sell ratings | Feb. 27 price | Consensus price target | Implied 12-month upside potential |

| Axon Enterprise Inc. |

AXON, |

85% | 15% | 0% | $271.82 | $306.13 | 13% |

| Spirit AeroSystems Holdings Inc. Class A |

SPR, |

48% | 52% | 0% | $29.17 | $34.22 | 17% |

| Heico Corp. |

HEI, |

72% | 14% | 14% | $193.52 | $208.29 | 8% |

| Heico Corp. Class A |

HEI.A, |

72% | 14% | 14% | $155.04 | $208.29 | 34% |

| Boeing Co. |

BA, |

67% | 30% | 3% | $201.40 | $261.73 | 30% |

| TransDigm Group Inc. |

TDG, |

64% | 32% | 4% | $1,174.22 | $1,235.80 | 5% |

| Hexcel Corp. |

HXL, |

38% | 52% | 10% | $75.57 | $77.83 | 3% |

| Kratos Defense & Security Solutions Inc. |

KTOS, |

73% | 27% | 0% | $18.68 | $21.91 | 17% |

| AAR Corp. |

AIR, |

100% | 0% | 0% | $64.99 | $81.25 | 25% |

| Howmet Aerospace Inc. |

HWM, |

80% | 10% | 10% | $65.97 | $68.80 | 4% |

| Woodward Inc. |

WWD, |

33% | 67% | 0% | $137.67 | $156.70 | 14% |

| Source: FactSet | |||||||

Analysts’ favorite defense stocks

Going back to our original pared list of 27 aerospace and defense stocks, here are the nine rated buy or the equivalent by at least 75% of analysts polled by FactSet. These are sorted by how much analysts expect the stocks to rise the over the next year:

| Company | Ticker | Share buy ratings | Feb. 27 price | Consensus price target | Implied 12-month upside potential | Two-year estimated sales CAGR through 2025 |

| V2X Inc. |

VVX, |

83% | $37.83 | $59.50 | 57% | 4.4% |

| Triumph Group Inc. |

TGI, |

86% | $14.60 | $20.75 | 42% | 6.0% |

| AAR Corp. |

AIR, |

100% | $64.99 | $81.25 | 25% | 10.0% |

| Teledyne Technologies Inc. |

TDY, |

90% | $424.90 | $500.55 | 18% | 4.6% |

| Axon Enterprise Inc. |

AXON, |

85% | $271.82 | $306.13 | 13% | 22.2% |

| Curtiss-Wright Corp. |

CW, |

86% | $236.03 | $254.20 | 8% | 5.4% |

| Howmet Aerospace Inc. |

HWM, |

80% | $65.97 | $68.80 | 4% | 8.2% |

| Leonardo DRS Inc. |

DRS, |

83% | $22.93 | $23.83 | 4% | 6.9% |

| BWX Technologies Inc. |

BWXT, |

75% | $89.28 | $86.63 | -3% | 5.2% |

| Source: FactSet | ||||||

Before buying any individual security, you should do your own research to form your own opinion about a company’s ability to be competitive. One way to start that process is by clicking on the tickers for more information about each company.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Don’t miss: Want your stock picks to beat index funds? Look at companies with one key metric.

As Donald Trump made his victory speech after Iowa’s caucuses, the front-runner in the 2024 Republican presidential primary couldn’t resist taking a shot at electric vehicles while praising a supporter from Missouri.

That supporter “comes all the way from Missouri, which isn’t that far. You can’t drive an electric car that far, though,” the former president said Monday night, drawing laughs from his audience in Des Moines.

It’s the type of criticism of EVs that Trump has offered often during his 2024 White House campaign, breaking sharply with President Joe Biden’s approach. The Democratic incumbent has made support for EVs

DRIV

KARS

a key part of his speeches and his economic policies, saying the car industry’s future “is electric, and there’s no turning back.”

From the archives (September 2023): Trump attacks Biden over EVs as he makes pitch to auto workers

So the result of the 2024 presidential race, which looks increasingly likely to be a Biden-Trump rematch, is expected to have an outsize impact on the Biden administration’s incentives and regulations that aim to boost adoption of EVs. The election has been described as a “referendum” on EVs by analysts at Beacon Policy Advisers, even as they acknowledge the issue won’t drive voters as much as top-tier topics such as inflation or abortion rights.

“It’s not necessarily what people are going to be voting on, but the future of EVs is nevertheless very election-dependent on what happens in 2024,” Beacon analyst Maxwell Shulman said.

There are expectations that widely used tax credits that can take as much as $7,500 off the cost of a new EV will be targeted by Trump or any Republican president — especially if the GOP keeps its grip on the U.S. House of Representatives and takes control of the Senate. The credits already have been pared back as of Jan. 1, with some car models losing out due to new anti-China rules for battery materials. They could be reduced further after the 2024 elections, as even Democratic-run chambers of Congress might support closing a “leasing loophole.”

Washington will have to decide in 2025 how much of the Republican tax overhaul of 2017 should be extended vs. being allowed to expire. If Republicans are in control of the White House and both chambers of Congress, they’re likely to look during that process at the EV credits, established by Biden’s Inflation Reduction Act, according to Beacon’s Shulman.

“If you’re going to do tax cuts, you need the revenue offset from somewhere, and what’s better than the marquee legislative package that your opponents passed the prior term?” he said.

Related: As Biden touts his Inflation Reduction Act, analysts size up how Trump might repeal it

Courtney Rosenberger Gelman, managing director of policy research at Strategas Securities, said the EV tax credits are “the most at risk” part of the Inflation Reduction Act, if Republicans score wins in the 2024 elections. She said she thinks it’s going too far to say this fall’s voting in the U.S. looks like a referendum on EVs, but it does have the potential to have an impact on the growing industry.

Democratic control of one chamber of Congress probably would prevent a full rollback of the EV tax credit, but there still could be changes, according to Gelman. “Even with Democrats, because of how bipartisan going after China is,” there could be additional sourcing requirements, she said. And with “continuously building populist momentum on both sides of the aisle, things like the leasing loophole could be targeted,” she said.

That loophole refers to how it’s possible to get $7,500 off any EV at any price if it’s leased, with no limits on the driver’s income level. For buying rather than leasing, the subsidy comes with more rules, such as an income cap of $150,000 for individual tax filers buying new vehicles, as well as North American sourcing.

Beyond the EV tax credit, Beacon’s Shulman expects a Republican administration would aim to roll back Biden regulations such as a proposed tailpipe-emissions rule that’s intended to push all-electric options to making up as many as two out of every three new passenger vehicles sold in the U.S. by 2032.

The GOP-run House passed a bill in December on that exact issue, with Republican lawmakers describing Biden’s rule as an EV mandate, but it’s not expected to find any traction this year in the Democratic-controlled Senate.

Forecasts for the EV industry’s growth would have to be reduced if such regulations were nixed in 2025, because it’s not only carrots, or subsidies, that would go away, “but also because the sticks forcing industry in that way are sort of getting removed as well,” Shulman said.

Companies ‘can’t make a long-term investment plan’

The share of U.S. car sales that are EVs is likely to be 8% in 2024, up from 6.9% in the first 11 months of 2023, according to Jessica Caldwell, head of insights at Edmunds. She describes the market for the vehicles as experiencing a “wake-up call” after earlier projections proved too optimistic, with some of the struggles coming from elevated interest rates for car loans.

Losing the $7,500 EV tax credit would be a hit to the industry, especially as buyers now are no longer as likely to be early adopters, she said. “It definitely would affect it, just because if we are going to more of a mass-market consumer, that person has a lower income level than an early adopter, generally speaking.”

Related: Hertz cites weak demand, high damage costs in decision to downsize EV fleet

Car makers and their allies have indicated they’re tracking the political risks. The CEO of Chrysler and Fiat parent Stellantis

STLA,

Carlos Tavares, recently told Automobilwoche that the U.S. elections are important, and his company may have to change its strategy “if political and public opinion tends toward fewer EVs.” In a similar vein, executives from General Motors

GM,

and Nissan

7201,

told the Financial Times that eliminating incentives would hurt EV sales.

“What I worry about the most on behalf of American business is just the lack of certainty,” said the U.S. Chamber of Commerce’s president, Suzanne Clark, during a news conference last week when she was asked about repealing parts of the Inflation Reduction Act.

“This every two or four years having a big guardrail-to-guardrail shift means we’re seeing companies say, ‘I don’t know how to invest in the United States. I can’t make a long-term investment plan.’ “

Related: Both Trump and Biden ‘threatening for the markets’, says Ray Dalio

Voters show big partisan divide on EVs

While there’s a war of words over EVs between Biden and Trump, there also appears to be a partisan divide over these products between rank-and-file Democrats and Republicans.

Some 71% of GOP voters say they would not buy an EV, according to a Gallup poll conducted last year. Among Democrats, only 17% feel that way. Among independent voters, it’s 38%.

To be sure, Gallup has noted that Americans aren’t the best forecasters of what they’ll end up buying, as nearly a quarter of respondents to a 2000 survey said they would never buy a cellphone. What’s more, while an E&E News tally last year showed that members of Congress with EVs are overwhelmingly Democrats, GOP Rep. Thomas Massie of Kentucky has said he was the first U.S. lawmaker to have a Tesla

TSLA,

on Capitol Hill, as he got one of Elon Musk’s products a decade ago.

Still, what gives with the party split on EVs?

“I think it comes down to partisan viewpoints on energy

XLE

generally, where Republicans are generally more pro–fossil fuel

RB00,

and Democrats have been generally viewed as anti-drilling, anti-oil

CL00,

anti-coal,” said Gelman at Strategas.

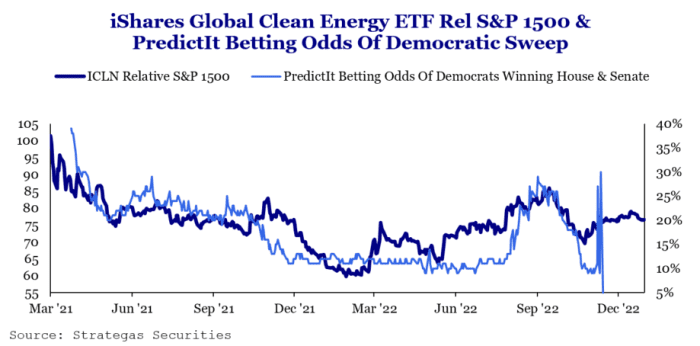

Green-energy stocks

ICLN

could end up tracking Democratic prospects in the 2024 elections, according to Gelman.

“You’re going to see EVs and other renewable-energy names potentially trading off of the odds of Republicans vs. Democrats doing well in the election,” she said. She noted that her shop found that type of relationship ahead of the 2022 midterm elections, as shown in the chart above.

Now read: Want to buy a new car? You should probably be making $100,000 a year.

Cathie Wood and Ark Invest Bought $107 Million of This 1 Brilliant Stock Since November. Should You Follow Suit?

Following the trades of large firms can be a smart investing strategy. Not that anyone should blindly follow, but seeing where they think the market could move can provide insights into what you should be doing.

Many people have done this with Warren Buffett’s trades at Berkshire Hathaway for years, but they only reveal their trades once every quarter in a 13F document. Cathie Wood and Ark Invest don’t follow those same guidelines; they post their daily trades on their website. This allows us to see what they’re doing in real time, and they’ve recently made some big moves in The Trade Desk (TTD -3.86%) stock.

Growth expectations sank the stock

Since Nov. 10, Ark Invest (in its various funds) has purchased 1.42 million shares of The Trade Desk. At today’s prices, that’s worth about $107 million. So, what happened around Nov. 10 that triggered Ark’s buying spree? The Trade Desk’s earnings report was released on the evening of the Nov. 9.

Investors didn’t like what they heard from The Trade Desk, so they promptly sent the stock down by 17%. But what was so bad in this report?

At face value, everything seemed normal: Revenue was up by 25% year over year to $493 million, and net income rose from $16 million to $39 million. Customer retention also remained over 95%, marking nine years straight of strong retention.

But the problem investors had with the quarter was its guidance for the fourth quarter. Management only guided for $580 million in revenue, indicating 18% growth. Besides one quarter in 2020, this would mark the slowest The Trade Desk has grown in its existence. As for The Trade Desk’s preferred profitability measure — adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) — it’s only expected to grow 10%. This is a problem because investors see a massive market opportunity in front of The Trade Desk, and it hasn’t reached max profitability yet.

However, Wood and her team at Ark Invest believe this is just a single quarter of slowdown, plus management may be sandbagging projections. These are both real possibilities, and with the massive buy-side advertising market coming online as more TV viewers switch to streaming, The Trade Desk should be fine over the long term.

But should you follow their lead and load up on The Trade Desk?

The Trade Desk stock is still expensive

Since the third-quarter results caused a sell-off, The Trade Desk stock has quickly marched back to where it was before the report and is only down about a percent from its pre-earnings figure. So, the screaming deal that Ark got right after the earnings report is no longer available.

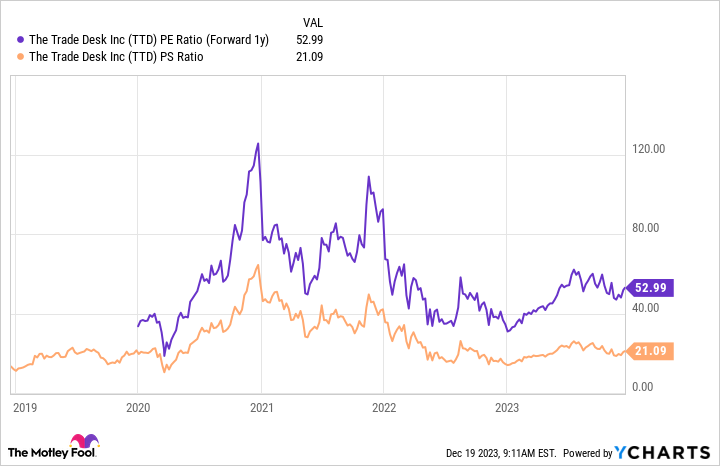

With The Trade Desk trading at some expensive valuations, it also may be smart to hold off for a bit.

TTD P/E Ratio (Forward 1 year) data by YCharts.

When a company’s revenue growth dips below its price-to-sales (P/S) ratio, it should be an immediate red flag. Ideally, its growth would be two to three times its P/S valuation, but growing slower than its P/S valuation is a cause for concern.

When earnings are considered, The Trade Desk trades at 53 times 2024 earnings, which isn’t cheap but isn’t terrible considering its huge market opportunity.

So what should investors do?

If you’re already a The Trade Desk shareholder, I don’t think now is a smart time to add to your position. However, if you don’t own shares, The Trade Desk is a phenomenal company in a quickly evolving industry. Establishing a full position now isn’t smart, but picking up a small bit so it’s in your portfolio to monitor is a wise strategy. That way, if it dips again, you’ll be easily alerted when it’s time to increase your position sizing.

The Trade Desk may have been a great deal a month ago, but right now, it’s very expensive.

Keithen Drury has positions in The Trade Desk. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.

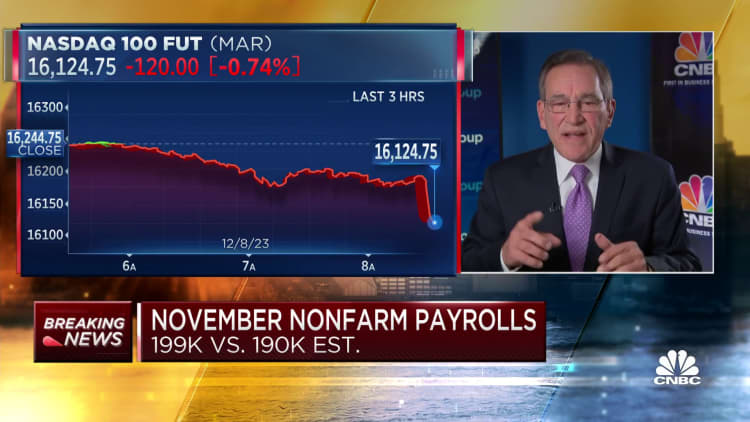

The U.S. job market once again surprised to the upside in November, as strong growth in health care and a few other sectors helped the economy add nearly 200,000 jobs and push the unemployment rate down.

Health care and social assistance added more than 93,000 jobs for the month, making it the top category for job growth, according to the U.S. Bureau of Labor Statistics. Government jobs grew by 49,000, while leisure and hospitality added 40,000 jobs.

The job gains for health care and social assistance rise to 99,000 when including private education, as some economists do.

Much of the labor market story over the past two years has been tied to the economic rebound from the Covid-19 pandemic, but the health-care growth appears to be part of a longer-term trend.

“We’re back to 2019 in some ways. If prior to the pandemic, you would have said, ‘Hey, health care’s going to be one of the largest sources of hiring in late 2023,’ no one would have been surprised by that, I think. There are very long-term structural tailwinds here,” Nick Bunker, director of economic research at Indeed Hiring Lab, told CNBC.

Bunker also pointed out that health care is less sensitive to higher interest rates or other cyclical factors that affect the U.S. labor market.

Another key part of the jobs growth story in November was returning strike workers.

Manufacturing employment rose by 28,000, helped by the 30,000 jobs gained in motor vehicles and parts as the United Auto Workers strike ended. The information sector was also bolstered by the addition of 17,000 jobs from the motion picture and sound recording industries, as Hollywood production restarts after the actors’ strike was resolved.

Retail trade was an outlier area to the downside, losing more than 38,000 jobs. The sector is roughly flat year over year in terms of total jobs, according to the Labor Department.

“I’m not spooked by it right now. … If you look at the nonseasonally adjusted gains for that sector, it’s roughly in line with what we saw last year. So maybe the seasonal adjustments need to catch up or change. I think we’ve seen this with a variety of data,” Bunker said.

Don’t miss these stories from CNBC PRO:

Private sector job creation slowed further in November and wages showed their smallest growth in more than two years, payrolls processing firm ADP reported Wednesday.

Companies added just 103,000 workers for the month, slightly below the downwardly revised 106,000 in October and missing the 128,000 Dow Jones estimate.

Along with the modest job growth came a 5.6% increase in annual pay, which ADP said was the smallest gain since September 2021. Job-changers saw wage increases of 8.3%, making the premium for switching positions the lowest since ADP began tracking the data three years ago.

After leading job creation for most of the period since Covid hit in early 2020, leisure and hospitality recorded a loss of 7,000 jobs for the month. Trade, transportation and utilities saw an increase of 55,000 positions, while education and health services added 44,000 and other services contributed 15,000.

Services-related industries provided all the job gains for the month, as goods-producers saw a net loss of 14,000 due to declines of 15,000 in manufacturing, despite the settlement in the United Auto Workers strikes, and 4,000 in construction. Recent layoffs in Silicon Valley and on Wall Street also did not show up in the data, as both sectors posted gains on the month.

“Restaurants and hotels were the biggest job creators during the post-pandemic recovery,” said ADP’s chief economist, Nela Richardson. “But that boost is behind us, and the return to trend in leisure and hospitality suggests the economy as a whole will see more moderate hiring and wage growth in 2024.”

Companies with between 50 and 499 employees led job creation, with an addition of 68,000. Small businesses contributed just 6,000.

The ADP report comes two days before the more widely watched nonfarm payrolls count from the Labor Department. The two reports can differ widely, though the numbers for private payrolls were close in October as the Labor Department reported growth of 99,000, just 7,000 below the revised ADP tally.

Including government jobs, nonfarm payrolls increased 150,000 in October and are expected to show growth of 190,000 in November, according to Dow Jones.

Another sign that the labor market is loosening came Tuesday, when the Labor Department reported that job openings declined to 8.73 million in October, the lowest level since March 2021.

Don’t miss these stories from CNBC PRO:

Correction: Annual pay increased 5.6%, which ADP said was the smallest gain since September 2021. An earlier version misstated the month. The Labor Department reported private payroll growth of 99,000 for October, just 7,000 below the revised ADP tally. An earlier version misstated a figure.

When most people consider investing in tech stocks, buying high-yield dividend payers is usually not high on the list of criteria. That’s because tech stocks tend to be volatile, fast-growing (and often yet-to-be-profitable) companies. The businesses underlying most dividend stocks typically have a more stable, steadily growing profile. They also generate ample cash flows to support their payouts.

But on occasion, investors do come across the occasional tech stock that pays you well for the privilege of owning it and has price appreciation potential as well. Here are three high-yield tech stocks worth considering right now.

1. Texas Instruments: A semiconductor giant positioned for a rebound

With its stock down around 10% over the past year and a dividend yielding 3.4% annually as of this writing, semiconductor giant Texas Instruments (TXN -1.36%) is a fantastic bet for yield-hungry investors anticipating a rebound. In fact, Texas Instruments’ stock price rebound may already be underway. Despite briefly falling to a fresh 52-week low late last month after the company posted disappointing quarterly results, shares have bounced back nicely in recent weeks as traders seemingly bet the worst could be over.

Indeed, Texas Instruments’ third-quarter report left plenty to be desired; Revenue fell 14% year over year to $4.53 billion — hurt by broad weakness in the industrial sector — while net income declined 26% to just over $1.7 billion, or $1.85 per share. Guidance for the current fourth quarter calls for roughly similar year-over-year declines.

At the same time, however, Texas Instruments remains solidly cash-flow positive, generating operating cash flow of more than $1.9 billion and free cash flow of $442 million last quarter. And the company just increased its quarterly cash dividend by 5% to $1.30 per share, marking its 20th straight year of consecutive dividend increases, starting with its Nov. 14 payout.

Noting the chip industry is incredibly cyclical by nature, Texas Instruments plans to continue investing around $5 billion per year toward new chip-fabrication plants through 2026 to meet projected demand as the sector inevitably rebounds.

During their third-quarter conference call, Texas Instruments’ head of investor relations, Dave Pahl even mused: “[T]he best time to be preparing for the upturn is before it shows up. So that’s what we’ve been busy doing, and we think we’re in a great position to support the next upturn and to continue to gain share.”

For patient investors willing to buy now and collect that dividend in the meantime, I think Texas Instruments stock remains a bargain today.

2. Qualcomm: A compelling AI play

Share prices of fellow chip titan Qualcomm (QCOM -1.92%) are up around 8% over the past year, helped by a recent bounce on the heels of its own seemingly disappointing quarterly update on Nov. 1. Qualcomm’s fiscal fourth-quarter revenue (for the period ended Sept. 24) similarly declined 24% year over year, hurt by a cyclical downturn in consumer electronics sales since the pandemic, while adjusted (non-GAAP) net income per share plunged 35%.

Yet Qualcomm CEO Christiano Amon insisted during the quarterly call that the company remains “pleased with [its] roadmap and product execution, which position us well across our businesses.”

Indeed, Qualcomm’s products continue to find their way into the world’s most popular devices. The company recently extended its supply agreement with Apple in September to provide its Snapdragon 5G Modem-RF Systems for new iPhones through 2026, for example. And at their recent Snapdragon Summit, management detailed new products that should position Qualcomm at the center of enabling smartphones to run next-generation on-device generative AI solutions.

With a dividend yielding 2.5% annually as of this writing — and assuming Qualcomm remains well positioned to capitalize on an impending cyclical rebound in smartphone sales — I think Qualcomm stock offers an excellent balance between a juicy dividend and potential continued share-price appreciation.

3. Corning: A historically high 4% yield

Finally, specialty-glass maker Corning (GLW -0.64%) boasts an incredible 4% annual dividend payout — a percentage yield only previously surpassed once in company history, when it hit 4.6% during Corning’s post-pandemic lows in March 2020.

Corning has similarly endured cyclically low demand for its products in recent quarters. Core sales in the third quarter of 2023 fell 6% year over year to $3.46 billion, and net income declined 12% to $386 million, or $0.45 per share.

But Corning has wisely embraced the latest downturn to focus on improving profitability and cash flows. Core gross margin expanded by 90 basis points year over year last quarter to 37%, thanks to favorable pricing initiatives and productivity gains, while free cash flow nearly doubled over the same period to $466 million.

“Our markets continue to reflect demand below trend lines, but our sales will recover, and we will return to growth,” explained Corning Chairman and CEO Wendell Weeks.

Best of all, when Corning’s markets eventually recover, Corning will emerge even stronger by serving its customers using existing manufacturing capacity with improved pricing and lower costs.

In the end, as its markets recover and its share price follows suit, I fear Corning’s historically high dividend won’t be available for much longer.

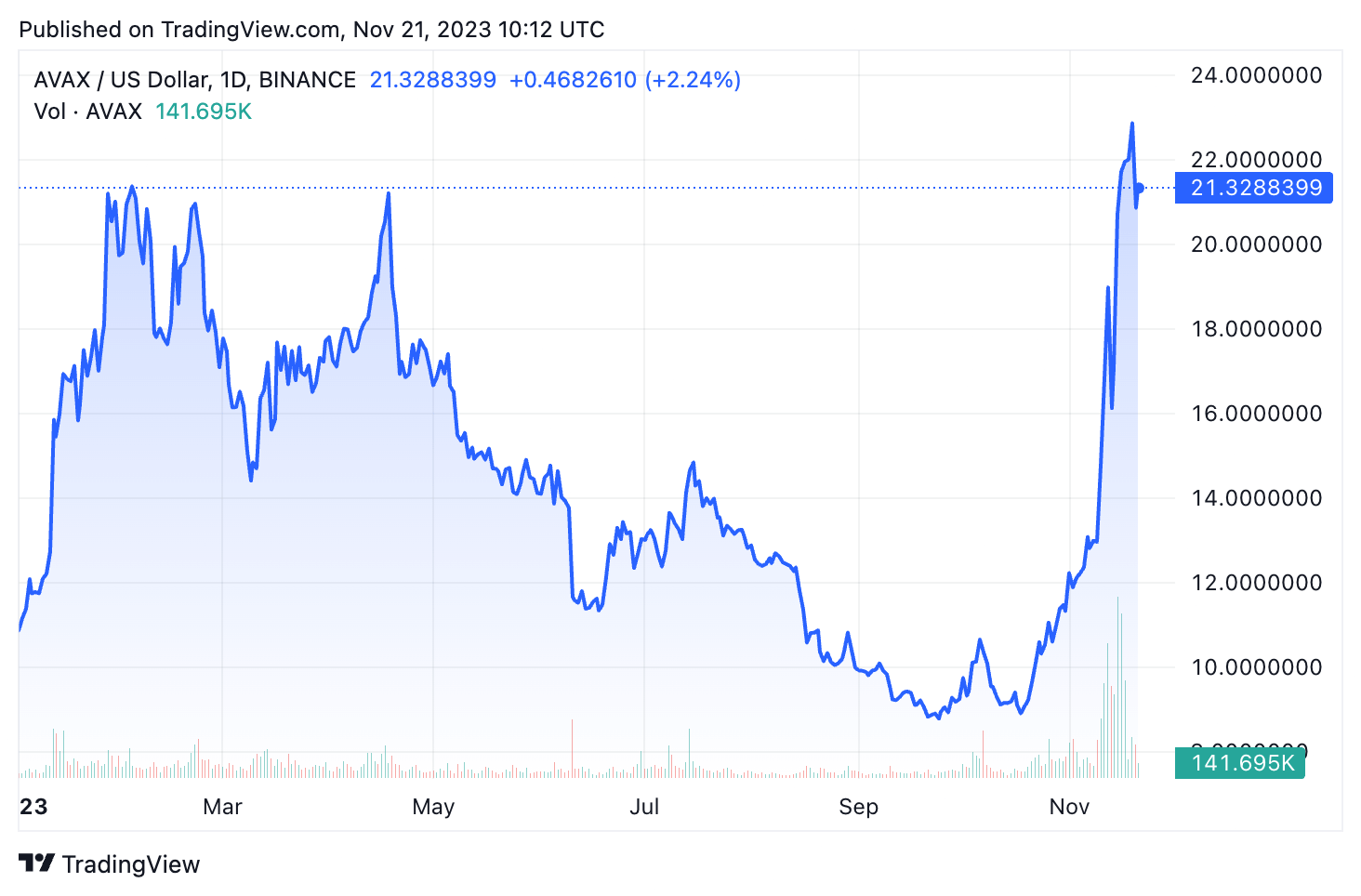

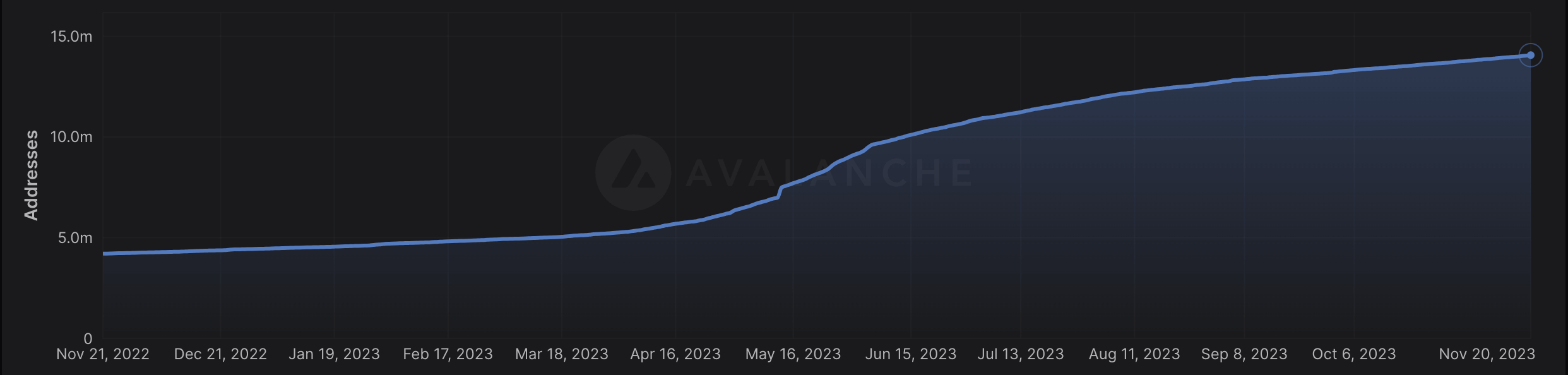

Avalanche has seen a significant increase in its market value this year. The token has grown substantially with impressive monthly, year-to-date (YTD), and yearly gains. AVAX’s price has surged by over 103% in the last 30 days alone, with a notable 77% increase over the past year.

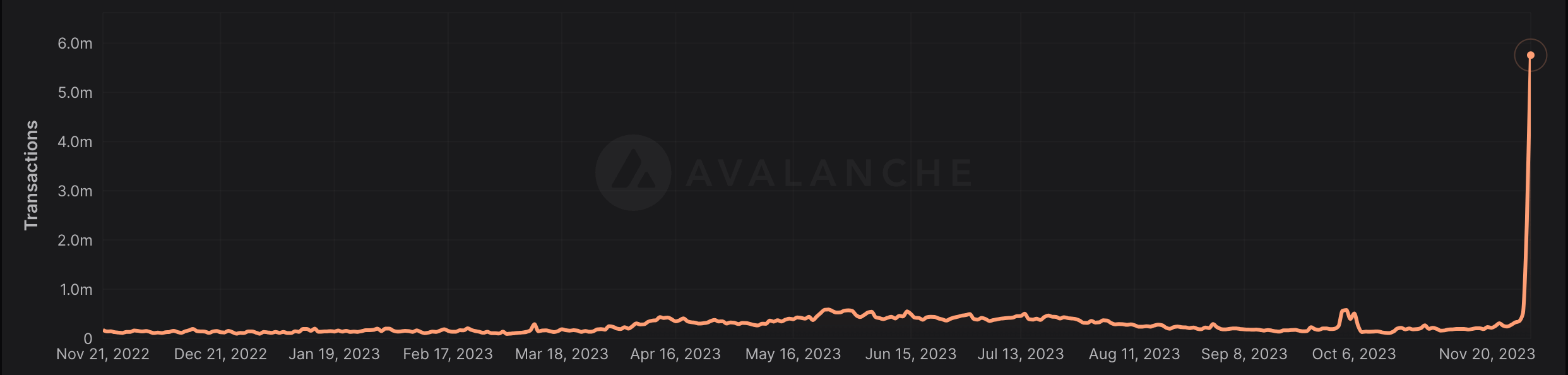

This price growth was accompanied by an even higher increase in usage and activity on the Avalanche network. The network experienced an unprecedented surge in daily transactions in November, a key indicator of network utilization and user engagement. From Nov. 1 to Nov. 20, daily transactions skyrocketed from 183,107 to 5,750,000, marking a 3,040% increase. This surge points to a growing interest and trust in the Avalanche platform among users and investors.

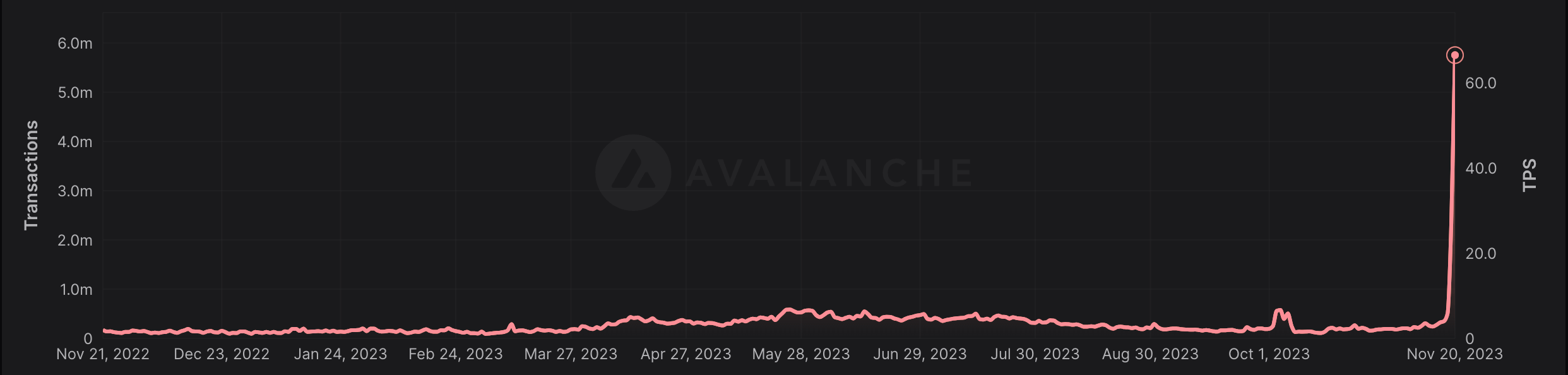

Alongside the rise in transaction count, there was a significant increase in the number of transactions per second (TPS) the network processed. This metric is a crucial gauge of a blockchain’s efficiency and scalability. The average TPS on Avalanche jumped from 2.24 on Nov. 1 to a peak of 66.61 on Nov. 20. This represents a remarkable ability of the network to handle increased throughput, showcasing its potential to support a high volume of transactions efficiently.

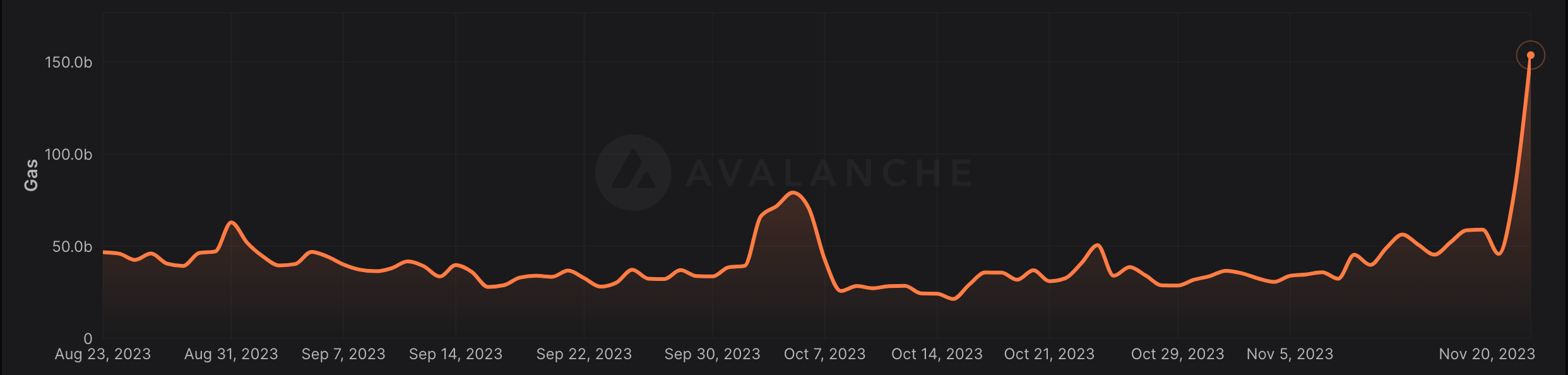

Another vital aspect to consider is gas usage, a measure of the computational effort required to execute operations on the network. Gas is essential to understand, as it reflects the network’s demand and the complexity of processing transactions. From Nov. 1 to 20, the gas used on Avalanche escalated significantly, from 36.7 million to 153.79 million, the second-highest level in the past year. This rise indicates not only increased activity but also possibly more complex transactions taking place on the network.

In addition to the surging transaction metrics, the total number of addresses on Avalanche also saw a noteworthy increase. This growth in addresses is indicative of the network’s expanding user base and adoption rate. The data shows a growth from 13.56 million addresses on Nov. 1 to 14.06 million on Nov. 20.

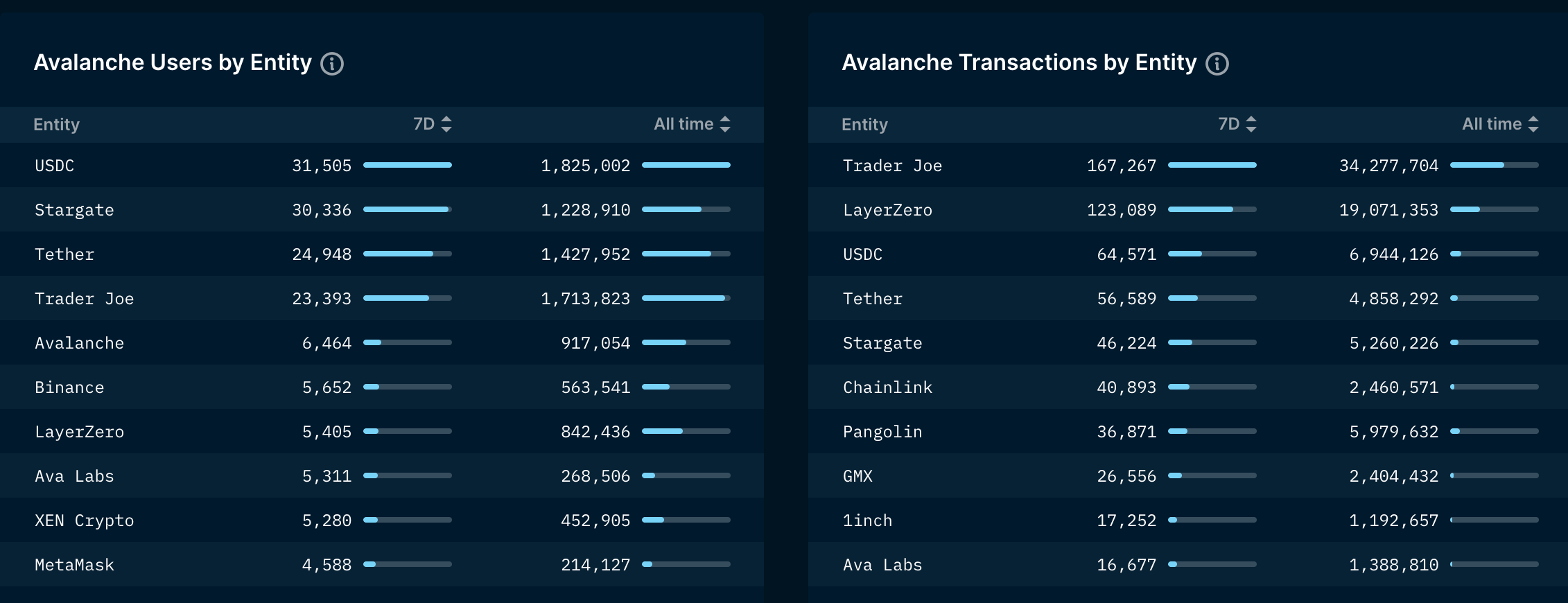

Focusing on specific entities within the Avalanche ecosystem, certain protocols have experienced heightened user interaction and transaction volume. For instance, USDC and Trader Joe have seen the highest number of users and transactions. Such entities play a pivotal role in the ecosystem, offering services ranging from stablecoin transactions to decentralized trading.

These developments and the surge in on-chain activity correlate with recent advancements and initiatives in the AVAX ecosystem. Strategic partnerships, technological enhancements, and expansions across various sectors likely drive this surge.

The post Transactions on Avalanche surge by 3,040% in November appeared first on CryptoSlate.

S&P 500, Nasdaq eke out 3rd day of gains, but November rally hits speed bump

U.S. stocks closed mostly higher Thursday, but with the powerful November rally that carried the S&P 500 to its highest level in two months hitting a speed bump.

Investors also focused on earnings from big-box retailers and a batch of weaker economic data.

How stocks traded

-

The Dow Jones Industrial Average

DJIA

shed 45.74 points, or 0.1%, to end at 34,945.47, snapping a 4-day win streak. -

The S&P 500

SPX

gained 5.36 points, or 0.1%, closing at 4,508.24, after earlier flipping between small gains and losses. -

Nasdaq Composite

COMP

climbed 9.84 points, or 0.1%, finishing at 14,113.67.

The S&P 500 closed at its highest level since Sept. 1 on Thursday, while it was the Nasdaq’s highest finish since Aug. 1, according to Dow Jones Market Data.

What drove markets

Investors largely took a breather on Thursday to digest weaker economic data and a rally that has carried the Nasdaq nearly 10% higher since the beginning of November.

The bullish tone allowed the tech-heavy Nasdaq index to exit correction territory earlier in the week. The S&P 500 has been knocking on the door of an exit too, but needs to close at 4,529.11 or higher to officially mark a rebound of at least 10% from its recent low.

Peter Cardillo, chief market economist at Spartan Capital, said it was unsurprising that stocks would struggle for momentum, given the recent strong rally, in a phone interview. “Today, we also had a slew of macro news, which most of it was basically negative in terms of economic activity but good for the Fed, in that the economy is slowing, exactly what it wants it to do.”

A raft of earnings from major retailers were another focus, including from Walmart

WMT,

Macy’s

M,

and Williams-Sonoma

WSM,

Shares of Walmart fell 8.1%, pulling down on the Dow, following comments from Doug McMillon, Walmart’s chief executive, indicating that he expects to see a U.S. deflation trend in the coming months.

See: Walmart’s shareholders may have anticipated today’s selloff — if they’d been watching its bonds

Poorly received results from Cisco Systems

CSCO,

saw the networking company’s stock drop 9.8% on Thursday, making it another leading Dow decliner.

A broader rally in unloved corners of the market also paused, including for the small-cap Russell 2000 index,

RUT

which fell 1.5% Thursday.

“Everyone’s taking a breath from the almost frantic buying pace we’ve seen over the past week,” JJ Kinahan, chief executive of IG North America, which owns Tastytrade, told MarketWatch.

Investors also heard Thursday from U.S. central bankers, with Fed governor Lisa Cook saying that inflation can keep declining without a sharp spike in unemployment, but warning that a “soft landing” for the U.S. economy “is not assured.” Cleveland Fed President Loretta Mester said easing monetary policy “is just not part of the conversation right now,” in an interview with CNBC.

Recent signs of cooling inflation, rising layoffs and slowing job creation helped bolster expectations that the Fed may have delivered its last interest-rate hike of the cycle in July.

Stocks struggled for direction, even though the 10-year Treasury yield

BX:TMUBMUSD10Y

retreated to 4.444%, down 9.1 basis points on the day. Yields, which move inversely to bond prices, have fallen from a 16-year high of about 5%, reached last month.

In economic data, weekly jobless-claims data released Thursday showed the number of Americans applying for unemployment benefits jumped to a three-month high, the latest sign of a cooling labor market.

In other economic news, the Philadelphia Fed said Thursday that its gauge of regional business activity improved slightly to negative 5.9 in November from negative 9 in the prior month. A Fed report on industrial production showed a drop of 0.6% in October, larger than economists had expected. Investors also digested the latest release from the home-builder sentiment index, which declined to 34 from 40 in November.

Companies in focus

-

Amazon.com Inc.

AMZN,

-0.26%

shares shed 0.3% after the company detailed plans to launch online vehicle sales next year, starting with Hyundai Motor Co.

005380,

-0.38%

brands. CarMax Inc.

KMX,

-5.56%

and Carvana Co.

CVNA,

-5.27%

shares fell 5.6% and 5.3%, respectively. - Shares of Macy’s were 5.7% higher after the department-store chain reported a surprise third-quarter profit that beat expectations.

-

U.S.-listed shares of Alibaba Group

BABA,

-9.14%

fell 9.1% after the company posted solid earnings but issued a warning about the impact of U.S. export controls.

Jamie Chisholm contributed.

Investing in companies that are developing world-changing technologies can lead to life-changing returns. Here we’ll look at a company involved in artificial intelligence (AI) software, and another business making a splash in the electric car market that could deliver tremendous returns over the long term.

1. Palantir Technologies

Palantir Technologies (PLTR -0.90%) is a leading software developer that helps organizations analyze massive amounts of data to make better decisions. The stock tripled from last year’s lows, but the recent acceleration in revenue and profits could bode well for investors in 2024.

Like many other tech companies, Palantir experienced slower revenue growth earlier this year amid macroeconomic headwinds. What seemed to be holding the stock back more than anything else was weak profitability. But in early May the stock took off after Palantir said it expected to be profitable each quarter through the end of the year, and it hasn’t looked back.

Revenue accelerated in Q3, up 17% year over year. Palantir is getting faster at converting new customers, and it nearly tripled the number of users on its artificial intelligence platform. It’s also delivering this growth while still dealing with uncertainty in the economy, but it also expects accelerating growth from its U.S. government business, which is a catalyst.

The growing demand for its software platforms is causing profits to explode, with net income up 157% over the previous quarter. The strong momentum in customer demand could further push profits up and cause the stock to head higher in 2024 and beyond.

2. Rivian Automotive

Rivian Automotive (RIVN -4.93%) is a leading electric car maker that is experiencing exponential growth. While it offers two truck models for the consumer market, its claim to fame is supplying thousands of commercial delivery vans for Amazon. The stock is down, as investors remain skeptical about whether the company can profitably grow revenue over the long term. But there are good reasons to believe it will, which could lead to explosive gains over the next few years.

Rivian’s quarterly vehicle production has scaled quickly, growing from 1,003 in 2021 to 16,304 in the recent quarter. Revenue is growing along with production increases, but the company also reported a massive loss from operations of $1.4 billion on just $1.3 billion of revenue in the third quarter.

Nonetheless, management is making strides to bring costs down. Losses narrowed from over $1.7 billion in the year-ago quarter, as gross profit per unit increased each quarter this year. Management expects new technologies to reduce production costs even further.

A major growth catalyst is the recent announcement that Rivian will sell its commercial vans to other companies beyond Amazon. This is great news, but it’s also worth noting that the e-commerce giant is the company’s largest shareholder, with a stake worth $3.8 billion at the end of Q3. Amazon’s investment is a significant vote of confidence in the future value of Rivian’s business. It could succeed in becoming one of the top electric car makers in the world, and that could potentially lead to massive gains to shareholders in the years to come.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Ballard has positions in Amazon and Rivian Automotive. The Motley Fool has positions in and recommends Amazon and Palantir Technologies. The Motley Fool has a disclosure policy.